Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Finance - Chapter 6

Caricato da

Chuck AikenDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Finance - Chapter 6

Caricato da

Chuck AikenCopyright:

Formati disponibili

6-1

6-2

Key Concepts and Skills

Know the important bond features and

bond types

Understand:

Bond values and why they fluctuate

Bond ratings and what they mean

The impact of inflation on interest rates

The term structure of interest rates and

the shape of the yield curve

determinants of bond yields

6-3

Chapter Outline

6.1 Bonds and Bond Valuation

6.2 More on Bond Features

6.3 Bond Ratings

6.4 Some Different Types of Bonds

6.5 Bond Markets

6.6 Inflation and Interest Rates

6.7 Determinants of Bond Yields

6-4

Bond Definitions

Bond

Debt contract

Normally a interest-only loan

Par value (face value) ~ $1,000 (repaid at end)

Coupon payment = (interest payment on bond)

Coupon rate = (annual coupon / face value)

Maturity date = (time until face value repaid)

Yield to maturity = (market interest rate required on bond)

6-5

Key Features of a Bond

Par value:

Face amount

Re-paid at maturity

Assume $1,000 for corporate bonds

Coupon interest rate:

Stated interest rate

Usually = YTM at issue

YTM = Yield to Maturity

Multiply by par value to get coupon payment

Bond Calculations

6-6

Coupon Payment = Coupon Rate Par Value

Coupon Rate = Coupon Payment / Par Value

Par Value = Coupon Payment / Coupon Rate

CP = CR * PRV

CR =

CP

PRV

PRV =

CP

CR

6-7

Key Features of a Bond

Maturity:

Years until bond must be repaid

Yield to maturity (YTM):

The market required rate of return for bonds of

similar risk and maturity

The discount rate used to value a bond

Return if bond held to maturity

Usually = coupon rate at issue

Quoted as an APR

6-8

Bond Value

Bond Value = PV(coupons) + PV(par)

Bond Value = PV(annuity) + PV(lump sum)

Remember:

As interest rates increase present values

decrease ( r PV )

As interest rates increase, bond prices

decrease and vice versa

6-9

The Bond-Pricing Equation

t

t

YTM) (1

F

YTM

YTM) (1

1

1-

C Value Bond

+

+

(

(

(

(

+

=

PV(Annuity)

PV(lump sum)

C = Coupon payment; F = Face value

Return

to Quiz

What is the relationship between bond prices and yields?

6-10

Spreadsheet Formulas

=FV(Rate,Nper,Pmt,PV,0/1)

=PV(Rate,Nper,Pmt,FV,0/1)

=RATE(Nper,Pmt,PV,FV,0/1)

=NPER(Rate,Pmt,PV,FV,0/1)

=PMT(Rate,Nper,PV,FV,0/1)

Inside parens: (RATE,NPER,PMT,PV,FV,0/1)

0/1 Ordinary annuity = 0 (default)

Annuity Due = 1 (must be entered)

6-11

Pricing Specific Bonds in Excel

=PRICE(Settlement,Maturity,Rate,Yld,Redemption,

Frequency,Basis)

=YIELD(Settlement,Maturity,Rate,Pr,Redemption,

Frequency,Basis)

Settlement = actual date as a serial number; date

settled after security issued.

Maturity = actual date as a serial number; maturity date

of bond.

Redemption and Pr(ice) = % of par value

Rate (coupon) and Yld = annual rates as decimals

Frequency = # of coupons per year

Basis = day count convention (enter 2 for ACT/360)

Basis: Type of day count basis to use.

6-12

Bond Cash Flows

6-13

What is the present value of the face (par) value?

What is the present value of the annual coupon payments?

What is the total bond value?

Using Excel: =PV(0.08, 10, 80, 0, 0) = 536.81

Using Excel: =PV(0.08, 10, 0, 1000, 0) = 463.19

TV = PV Par + PV Coupons = 463.19 + 536.81 = 1,000

6-14

NOTE: Coupon Rate and

Market Rate are Equal

6-15

The amount lost due to rising rates.

6-16

The amount gained due to falling rates.

6-17

Valuing a New Bond with Annual

Coupons Issued at Market

Coupon rate = 10%

Annual coupons

Par = $1,000

Maturity = 5 years

YTM = 10%

5

5

10 1

1000

10 0

10 1

1

1

100

) . (

.

) . (

+

(

(

(

(

(

= B

Using the formula:

B = PV(annuity) + PV(lump sum)

B = 379.08 + 620.92 = 1000

Using Excel: =PV(0.10, 5, 100, 1000, 0) = $1000

Note: When YTM = Coupon rate Price = Par Value

6-18

Valuing a Discount Bond with

Annual Coupons

Coupon rate = 10%

Annual coupons

Par = $1,000

Maturity = 5 years

YTM = 11%

5

5

) 11 . 1 (

1000

11 . 0

) 11 . 1 (

1

1

100 B +

(

(

(

(

=

Using the formula:

B = PV(annuity) + PV(lump sum)

B = 369.59 + 593.45 = 963.04

Note: When YTM > Coupon rate Price < Par = Discount Bond

Using Excel: =PV(0.11, 5, 100, 1000, 0) = $963.04

6-19

Valuing a Premium Bond with

Annual Coupons

Coupon rate = 10%

Annual coupons

Par = $1,000

Maturity = 20 years

YTM = 8%

20

20

) 08 . 1 (

1000

08 . 0

) 08 . 1 (

1

1

100 +

(

(

(

(

= B

Using the formula:

B = PV(annuity) + PV(lump sum)

B = 981.81 + 214.55 = 1196.36

Note: When YTM < Coupon rate Price > Par = Premium Bond

Using Excel: =PV(0.08, 20, 100, 1000, 0) = $1,196.36

6-20

Graphical Relationship Between Price

and Yield-to-maturity

600

700

800

900

1000

1100

1200

1300

1400

1500

0% 2% 4% 6% 8% 10% 12% 14%

B

o

n

d

P

r

i

c

e

Yield-to-maturity

What is par value of the bond and what is the coupon rate?

6-21

Bond Prices:

Relationship Between Coupon and Yield

Coupon rate = YTM Price = Par

Coupon rate < YTM Price < Par

Discount bond Why?

Because the bond pays less than the market rate of interest.

Coupon rate > YTM Price > Par

Premium bond Why?

Because the bond pays more than the market rate of interest.

6-22

M

Premium

1,000

Discount

30 25 20 15 10 5 0

CR>YTM

CR<YTM

YTM

= Coupon Rate (CR)

Bond Value ($) vs Years

remaining to Maturity

6-23

The Bond-Pricing Equation

Adjusted for Semi-annual Coupons

2t

2t

YTM/2) (1

F

YTM/2

YTM/2) (1

1

- 1

2

C

Value Bond

+

+

(

(

(

(

+

=

C = Annual coupon payment C/2 = Semi-annual coupon

YTM = Annual YTM (as an APR) YTM/2 = Semi-annual YTM

t = Years to maturity 2t = Number of 6-month

periods to maturity

6-24

Semiannual Bonds

Example 6.1

Coupon rate = 14% - Semiannual

YTM = 16% (APR)

Maturity = 7 years

Number of coupon payments? (t)

14 = 2 x 7 years

Semiannual coupon payment? (C)

$70 = (14% x Face Value)/2

Semiannual yield? (YTM)

8% = 16%/2

6-25

Example 6.1

Semiannual coupon = $70

Semiannual YTM = 8%

Periods to maturity = 14

Bond value =

70[1 1/(1.08)

14

] / .08 +

1000 / (1.08)

14

= 917.56

t

t

YTM) (1

F

YTM

YTM) (1

1

1-

C Value Bond

+

+

(

(

(

(

+

=

14

14

) 08 . 1 (

1000

08 . 0

) 08 . 1 (

1

1

70 +

(

(

(

(

= B

Using Excel: =PV(0.08, 14, 70, 1000, 0)

Bond Prices: 3

2-26

Using Excel: =PV(0.08, 9, 60, 1000, 0) = $875.06

Using Excel: =10*PRICE(settlement,maturity,0.06,0.08,100,1) = $875.06

Bond Yields: 4

2-27

Using Excel: =RATE(9,70,-1038.5,1000,0) = 6.42%

Using Excel: =YIELD(settlement,maturity,0.7,103.85,100,1) = 6.42%

Coupon Rates: 5

2-28

Using Excel: =PMT(0.075,12,-963,1000,0) = $70.22

7.022% .

,

.

= = = = 07022 0

000 1

22 70

PRV

CP

CR

Using Excel: =RATE(12,70.22,-963,1000,0) = 7.50%

6-29

Interest Rate Risk

Price Risk

Change in price due to changes in interest

rates

Long-term bonds have more price risk than

short-term bonds

Low coupon rate bonds have more price

risk than high coupon rate bonds

Bonds with a higher coupon has a larger cash flow early in its life,

so its value is less sensitive to changes in the discount rate.

6-30

Interest Rate Risk

Reinvestment Rate Risk

Uncertainty concerning rates at which cash

flows coupons can be reinvested at same rate

Short-term bonds have more reinvestment rate

risk than long-term bonds

High coupon rate bonds have more

reinvestment rate risk than low coupon rate

bonds

6-31

Figure 6.2

The longer the time to maturity, the greater

the interest rate risk; ceteris paribus. Small

changes in interest rates can lead to large

changes in the bonds value.

6-32

Computing Yield-to-Maturity YTM

Yield-to-maturity (YTM) = the market

required rate of return implied by the

current bond price

With a financial calculator or Excel,

Enter ,, /, . and 0

Remember the sign convention

/ and 0 need to have the same sign (+)

. the opposite sign (-)

6-33

YTM with Annual Coupons

Consider a bond with a 10% annual

coupon rate, 15 years to maturity and a

par value of $1000. The current price is

$928.09.

Will the yield be more or less than 10%?

Using Excel: =RATE(15, 100, -928.09, 1000, 0) = 11% = YTM

6-34

YTM with Semiannual Coupons

Suppose a bond with a 10% coupon rate

and semiannual coupons, has a face value

of $1000, 20 years to maturity and is

selling for $1,197.93.

Is the YTM more or less than 10%?

The bond is trading at a premium, YTM < CR

What is the semiannual coupon payment?

CP = 10% * $1,000 = $100 / 2 = $50

How many periods are there?

T*2 = 20 * 2 = 40

6-35

YTM with Semiannual Coupons

Suppose a bond with a 10% coupon rate and

semiannual coupons, has a face value of $1,000,

20 years to maturity and is selling for $1,197.93.

NOTE: Solving a semi-annual payer

for YTM results in a 6-month YTM.

Excel will solve what you enter.

Using Excel: =RATE(40, 50, -1197.93, 1000, 0) = 4%

4% or YTM * 2 = 8% YTM

Using Excel: =RATE(40, 50, -1197.93, 1000, 0)*2 = 8%

6-36

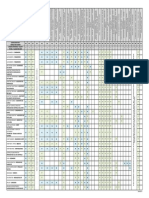

Table 6.1

6-37

Debt versus Equity

Debt

Not an ownership interest

No voting rights

Interest is tax-deductible

(issuer, sometimes by holder)

Creditors have legal recourse

if interest or principal

payments are missed

Debt can result in higher

returns to the firm (tax

benefits to debt), but

Excess debt can lead to

financial distress and

bankruptcy

Equity

Ownership interest

Common stockholders

vote to elect the board of

directors and on other

issues

Dividends are not tax

deductible (by firm or

stockholder)

Dividends are not a

liability of the firm until

declared. Stockholders

have no legal recourse if

dividends are not declared

Equity holders are paid

after debt holders, but not

required

An all-equity firm cannot

go bankrupt

6-38

The Bond Indenture

Deed of Trust

Contract between issuing company and

bondholders includes:

Basic terms of the bonds

Total amount of bonds issued

Secured versus Unsecured

Sinking fund provisions

Call provisions

Deferred call

Call premium

Details of protective covenants

Return

to Quiz

6-39

6-40

Bond Classifications

Registered vs. Bearer Bonds

Registered: company records ownership, payments made to

and information sent to owner.

Bearer: Issued without record of owner name, payments made

to holder after receipt of detachable coupon. May be difficult to

recover if lost or stolen, bondholders cannot be notified of

important event.

Security

Collateral: secured by financial securities (bonds and stocks)

Mortgage: secured by real property, normally land or buildings

Debentures: unsecured

Notes: unsecured debt with original maturity less than 10 years

6-41

Bond Classifications

Seniority

Senior versus Junior, Subordinated

Debt cannot be subordinated to equity.

Repayment

Can be repaid at maturity, or sinking fund

established to retire or repurchase bonds

Call Provision

Repurchase or call part or all of bond issue

at a specific price prior to maturity, usually at

a premium, the call may be deferred and the

bondholder protected during the prohibition

period.

6-42

Bond Classifications

Protective Covenants

Indenture provision that limit certain actions

that might be taken during the term of the

loan, usually to protect the lender.

Negative Covenants: Thou Shalt Not

Limit amount of dividends to prescribed formula

No pledging of any assets to other lenders

No merger with another firm

No issuance of additional long-term debt

Positive Covenants: Thou Shalt

Maintain working capital at or above a certain level

Furnish financial statements to lender

Maintain collateral in good condition

6-43

Bond Characteristics and

Required Returns

Coupon rate

](risk characteristics of the bond when issued)

Usually yield at issue

Which bonds will have the higher coupon,

all else equal?

Secured debt versus a debenture

Subordinated debenture versus senior debt

A bond with a sinking fund versus one without

Sinking funds can retire a portion of the debt or call some bonds

A callable bond versus a non-callable bond

6-44

Bond Ratings

Bond ratings are concerned only with the

possibility of default.

Bond ratings do not address interest rate risk,

the risk of a change in the value (i.e. price) of a

bond resulting from a change in interest rates.

The price of a highly rated bond can still be quite

volatile given interest rate risk.

Return

to Quiz

6-45

Investment-grade bonds are bonds rated at least BBB by S&P or Baa by

Moodys.

A bonds credit rating can change as the issuers financial strength improves

or deteriorates.

Credit ratings are important because defaults really do occur, and if they do,

investors can lose heavily.

6-46

6-47

Bond Ratings Investment Quality

High Grade

Moodys Aaa and S&P AAA capacity to pay is

extremely strong

Moodys Aa and S&P AA capacity to pay is very

strong

Medium Grade

Moodys A and S&P A capacity to pay is strong,

but more susceptible to changes in circumstances

Moodys Baa and S&P BBB capacity to pay is

adequate, adverse conditions will have more

impact on the firms ability to pay

Return

to Quiz

6-48

Bond Ratings - Speculative

Low Grade

Moodys Ba, B, Caa and Ca

S&P BB, B, CCC, CC

Considered speculative with respect to capacity

to pay. The B ratings are the lowest degree

of speculation.

Very Low Grade

Moodys C and S&P C income bonds with no

interest being paid

Moodys D and S&P D in default with

principal and interest in arrears

6-49

6-50

Government Bonds

Treasury Securities = Federal government debt

Treasury Bills (T-bills)

Pure discount bonds

Original maturity of one year or less

Treasury notes

Coupon debt

Original maturity between one and ten years

Treasury bonds

Coupon debt

Original maturity greater than ten years

Exempt from state but not federal taxation.

6-51

Government Bonds

Municipal Securities

Debt of state and local governments

Varying degrees of default risk, rated similar to

corporate debt

Interest received is tax-exempt at the federal

level

Interest usually exempt from state tax in

issuing state

Yields usually lower than treasury or corporate

bonds since advantage of not being taxed.

6-52

Example 6.4

A taxable bond has a yield of 8% and a

municipal bond has a yield of 6%

If you are in a 40% tax bracket, which bond do you prefer?

What is the after tax return on a taxable bond?

8%(1 - .4) = 4.8%

The after-tax return on the corporate bond is 4.8%, compared to a 6%

return on the municipal

At what tax rate would you be indifferent between the two

bonds?

8%(1 T) = 6%

T = 25%

At what municipal yield would you be indifferent to a taxable

bond?

8%(1-0.40)=M

M=4.8

6-53

Zero Coupon Bonds

Make no periodic interest payments (coupon rate = 0%)

Entire yield-to-maturity comes from the difference

between the purchase price and the par value (capital

gains)

Cannot sell for more than par value

Sometimes called zeroes, or deep discount bonds

Treasury Bills and U.S. Savings bonds are good

examples of zeroes

Zero Coupon Bond Interest

EIN Company issues a $1,000 face value, five-year zero

coupon bond. What should the bond sell for at issue, assuming

a 14 percent yield to maturity using semiannual periods?

6-54

Using Excel: =PV(0.07, 10, 0, 1000, 0) = $508.35

What is the amount of interest paid over the life of the bond?

$1000 - $508.35 = $491.65

What is the annual interest deduction calculated on a

straight-line basis?

$491.65 / 5 = $98.33

NOTE: The issuer of a zero must deduct interest every year even though no interest is actually paid. Also,

the owner must pay taxes on interest accrued every year even though no interest is received. Current tax

law requires interest to be determined by amortizing the loan as opposed to straight line.

Zero Coupon Implicit Bond Interest

6-55

6-56

Floating Rate Bonds

Coupon rate floats depending on some index

value

Examples adjustable rate mortgages and

inflation-linked Treasuries (TIPS)

Less price risk with floating rate bonds

Coupon floats, so is less likely to differ

substantially from the yield-to-maturity

Coupons may have a collar the rate

cannot go above a specified ceiling or

below a specified floor

6-57

Other Bond Types

Income bonds

Coupon dependent on company income

Convertible bonds

Convertible to shares of stock

Put bonds

Holder forces issues to buy back at stated price, the

reverse of a call provision

Many types of provisions can be added to a bond

Important to recognize how these provisions affect

required returns

Who does the provision benefit?

6-58

Bond Markets

Primarily over-the-counter transactions with

dealers connected electronically

Extremely large number of bond issues

(compared to equity), but generally low daily

volume in single issues and little transparency

Getting up-to-date prices difficult, particularly

on small company or municipal issues

Treasury securities are an exception

What is the largest securities market in the

world?

U.S. Treasury Market not the NYSE.

6-59

Work the Web Example

Bond information is available online

One good site:

http://cxa.marketwatch.com/finra/BondCenter

Click on the web surfer to go to the site

Use Quick Bond Search to observe the

yields for various bond types, and the

shape of the yield curve.

6-60

Bond Yields: 7

2-61

Using Excel: =RATE(26, 34.50, -940, 1000, 0) = 3.82%

3.82% or YTM * 2 = 7.64% YTM

Using Excel: =2*RATE(21, 34.50, -945, 1000, 0) = 7.64%

Coupon Rates: 8

2-62

Using Excel: =PMT(0.042, 21, -945, 1000, 0) = $38.01

$38.01*2 = $76.02; $76.02 / $1,000 = 7.60%

Bond Yields: 19

2-63

Using Excel: =2*RATE(40, 39, -1125, 1000, 0) = 6.66%

6-64

Treasury Quotations

6-65

Treasury Quotations

Highlighted quote in Figure 6.3

5/15/2030 6.250 150.7188 150.7500 .8906 2.713

When does the bond mature?

What is the coupon rate on the bond?

What is the bid price? What does this mean?

May 15, 2030

6.25% per year on semiannual basis, $62.50/2 = $31.25 on a $1,000

face value bond

Bid amount dealer offers to buy from you, 150.7188% (i.e.,

1.507188) of the par or face value, therefore the bid is $1,570.188 =

(1, 000 * 1.507188)

6-66

Treasury Quotations

Highlighted quote in Figure 6.3

5/15/2030 6.250 150.7188 150.7500 .8906 2.713

What is the ask price? What does this mean?

How much did the price change from the previous day?

What is the YTM based on Ask price and why?

Ask amount dealer is willing to sell to you, 150.7500% of the par or

face value (i.e., 1.507500), therefore the ask is = $1,507.50 = ($1,000

* 1.507500)

Asked price up by 0.890% from the previous day

Asked yield is 2.713%, lower than coupon rate since this is a premium

bond and sells for more than the face value.

6-67

Treasury Quotations

Highlighted quote in Figure 6.3

5/15/2030 6.250 150.7188 150.7500 .8906 2.713

What is bid-ask spread, what does this represent?

Ask Bid = $1,507.500 - $1,507.188 - = $0.312 and represents the

dealers profit.

6-68

Quoted Price vs. Invoice Price

Quoted bond prices = clean price

Net of accrued interest

Invoice Price = dirty or full price

Price actually paid

Includes accrued interest

Accrued Interest

Interest earned since last coupon payment is

owed to bond seller at time of sale

The Bellwether Bond

6-69

The very last

bond, usually

quoted on the

evening news as

to the direction of

long-term interest

rates. If bond

yield went up

(down), bond

price went down

(up). This is

known as the

bellwether bond.

6-70

Inflation and Interest Rates

Real rate of interest

=Change in purchasing power

Nominal rate of interest

= Quoted rate of interest,

= Change in purchasing power and inflation

The ex ante nominal rate of interest

includes our desired real rate of return

plus an adjustment for expected inflation

6-71

The Fisher Effect

The Fisher Effect defines the relationship between real rates, nominal rates

and inflation

(1 + R) = (1 + r)(1 + h)

R = nominal rate (Quoted rate)

r = real rate

h = expected inflation rate

R = r + h + rh

= real + inflation + compounding

Approximation: R = r + h

only if r or h not high

Return

to Quiz

rh h r R

rh h r R

rh h r R

h r R

+ + =

+ + + =

+ + + = +

+ + = +

1 1

1 1

1 1 1 ) )( ( ) (

6-72

The Fisher Effect

The Fisher Effect defines the relationship between real rates, nominal rates

and inflation

(1 + R) = (1 + r)(1 + h)

R = nominal rate (Quoted rate)

r = real rate

h = expected inflation rate

Return

to Quiz

h

h R

r

h r h R

rh r h R

rh h r R

rh h r R

rh h r R

h r R

+

=

+ =

+ =

+ + =

+ + + =

+ + + = +

+ + = +

1

1

1 1

1 1

1 1 1

) (

) )( ( ) (

1

1

1

1

1

1

1 1 1

+

+

=

+

+

= +

+ + = +

h

R

r

h

R

r

h r R ) )( ( ) (

6-73

The Fisher Effect

The Fisher Effect defines the relationship between real rates, nominal rates

and inflation

(1 + R) = (1 + r)(1 + h)

R = nominal rate (Quoted rate)

r = real rate

h = expected inflation rate

Return

to Quiz

r

r R

h

r R r h

r R rh h

rh h r R

rh h r R

rh h r R

h r R

+

=

= +

= +

+ + =

+ + + =

+ + + = +

+ + = +

1

1

1 1

1 1

1 1 1

) (

) )( ( ) (

1

1

1

1

1

1

1 1 1

+

+

=

+

+

= +

+ + = +

r

R

h

r

R

h

h r R ) )( ( ) (

6-74

Calculating The Fisher Effect

If the nominal interest rate is 15.50% and the

inflation rate is 5%, what is the real rate?

(1 + R) = (1 + r)(1 + h)

(1 + 0.1550) = (1+ r)(1 + 0.05)

(1 + r) = 1.1550 / 1.05 = 1.10

r = 1.10 1 = 0.10 or 10%

Return

to Quiz

10 0

05 1

105 0

05 0 1

05 0 155 0

1

.

.

.

.

. .

=

=

+

=

+

=

r

r

h

h R

r

10 0 1 10 1

1

05 0 1

155 0 1

1

1

1

. .

.

.

= =

+

+

=

+

+

=

r

r

h

R

r

6-75

Example 6.6

If we require a 10% real return and we

expect inflation to be 8%, what is the

nominal rate?

R = (1.1)(1.08) 1 = .188 = 18.8%

Approximation: R = 10% + 8% = 18%

Because the real return and expected inflation are

relatively high, there is significant difference between

the actual Fisher Effect and the approximation.

Calculating Real Rates of Return: 9

2-76

% . .

.

.

.

) . (

) . (

) (

) (

) (

) (

) (

) )( (

) )( ( ) (

46 2 0246 0

1 0246 1 1

016 1

041 1

1

016 0 1

041 0 1

1

1

1

1

1

1

1 1 1

1 1 1

= =

= =

+

+

=

+

+

=

+

+

= +

+ + =

+ + = +

r

r

h

R

r

h

R

r

h r R

h r R

% . .

.

.

.

. .

) (

) )( (

) )( ( ) (

46 2 0246 0

016 1

025 0

016 0 1

016 0 041 0

1

1

1 1

1 1 1

1 1 1

= =

=

+

=

+

=

= +

= +

+ + =

+ + + =

+ + =

+ + = +

r

r

h

h R

r

h R h r

h R rh r

rh h r R

rh h r R

h r R

h r R

% . .

.

.

.

.

.

. ) ( .

) . )( ( ) . (

) )( ( ) (

46 2 0246 0

1 0246 1 1

016 1

041 1

016 1

041 1

1

016 1 1 041 1

016 0 1 1 041 0 1

1 1 1

= =

= =

= +

+ +

+ + = +

+ + = +

r

r

r

r

r

h r R

% . .

. .

: ion Approximat

5 2 025 0

016 0 041 0

= =

+ =

+ =

r

r

h r R

Inflation and Nominal Returns: 10

2-77

% . .

.

. ) . )( . (

) . )( . (

) )( ( ) (

30 6 06295 0

1 06295 1

06295 1 034 1 028 1 1

034 0 1 028 0 1 1

1 1 1

= =

=

= = +

+ + = +

+ + = +

R

R

R

R

h r R

% . .

. .

) . * . ( . .

) )( (

) )( ( ) (

3 6 062952 0

000952 0 062 0

034 0 028 0 034 0 028 0

1 1

1 1 1

1 1 1

= =

+ =

+ + =

+ + =

+ + + =

+ + =

+ + = +

R

R

R

rh h r R

rh h r R

h r R

h r R

Nominal and Real Returns: 11

2-78

% . .

.

.

.

) ( . .

) )( . ( ) . (

) )( ( ) (

64 3 03636 0

1 03636 1

10 1

14 1

1

1 10 1 14 1

1 10 0 1 14 0 1

1 1 1

= =

=

= +

+ =

+ + = +

+ + = +

h

h

h

h

h

h r R

% . .

.

) . (

) . (

) . (

) . (

) (

) (

) (

) )( ( ) (

64 3 03636 0

1 03636 1 1

10 1

14 1

1

10 0 1

14 0 1

1

1

1

1 1 1

= =

= =

+

+

=

+

+

= +

+ + = +

h

h

h

r

R

h

h r R

% . .

.

.

.

. .

) (

) )( (

) )( ( ) (

64 3 03636 0

10 1

04 0

10 0 1

10 0 14 0

1

1

1 1

1 1 1

1 1 1

= =

=

+

=

+

=

= +

= +

+ + =

+ + + =

+ + =

+ + = +

h

h

r

r R

h

r R r h

r R rh h

rh h r R

rh h r R

h r R

h r R

% .

. .

: ion Approximat

4 04 0

10 0 14 0

= =

+ =

+ =

h

h

h r R

6-79

Term Structure of Interest Rates

Term structure: The relationship between

time to maturity and yields, all else equal

(Ceteris Paribus):

The effect of default risk, different coupons,

etc. has been removed.

Shape of term structure determined by:

Real Rate of Interest

Inflation Premium

Interest Rate Risk Premium

Increases with maturity length

Return

to Quiz

6-80

Term Structure of Interest Rates

Yield curve: Graphical representation of

the term structure

Normal = upward-sloping L/T > S/T

Inverted = downward-sloping L/T < S/T

Return

to Quiz

6-81

Figure 6.5 A Upward-Sloping

Yield Curve

RISING

CONSTANT

RISING

Inflation Premium higher in long than short run.

6-82

Figure 6.5 B Downward-

Sloping Yield Curve

FALLING

CONSTANT

RISING

Inflation Premium higher in short than long run.

6-83

Figure 6.6 Treasury Yield Curve

Based on data

in Figure 6.3

6-84

6-85

Factors Affecting Required Return

Default risk premium bond ratings

Taxability premium municipal versus taxable

Liquidity premium bonds that have more

frequent trading will generally have lower

required returns

Maturity premium longer term bonds will tend

to have higher required returns.

Anything else that affects the risk of the cash flows to

the bondholders will affect the required returns

Return

to Quiz

Interest Rate Risk: 17

2-86

Using Excel: =PV(0.04, 20, 20, 1000, 0) = $728.19

Using Excel: =PV(0.05, 20, 20, 1000, 0) = $626.13

% .

.

.

.

. .

% 02 14

19 728

06 102

19 728

19 728 13 626

=

= AJ

BOND J

BOND S

Using Excel: =PV(0.04, 20, 70, 1000, 0) = $1,407.71

Using Excel: =PV(0.05, 20, 70, 1000, 0) = $1,249.24

% .

. ,

.

. ,

. , . ,

% 26 11

71 407 1

47 158

71 407 1

71 407 1 24 249 1

=

= AS

The lower the coupon rate,

the greater the price

sensitivity of the bond to

changes in interest rates.

6-87

Quick Quiz

How do you find the value of a bond and why

do bond prices change? (Slide 6.8)

What is a bond indenture and what are some

of the important features? (Slide 6.30)

What are bond ratings and why are they

important? (Slide 6.33)

How does inflation affect interest rates?

(Slide 6.48)

What is the term structure of interest rates?

(Slide 6.50)

What factors determine the required return on

bonds? (Slide 6.54)

End of Chapter Questions to Review

Question Topic

1 Interpreting Bond Yields

2 Interpreting Bond Yields

3 Bond Prices

4 Bond Yields

5 Coupon Rates

6 Bond Prices

7 Bond Yields

8 Coupon Rates

9 Calculating Real Rates of Return

10 Inflation and Nominal Returns

11 Nominal and Real Returns

5-88

End of Chapter Questions to Review

Question Topic

12 Nominal versus Real Returns

13 Using Treasury Quotes

17 Interest Rate Risk

18 Bond Yields

19 Bond Yields

5-89

6-90

Chapter 6

END

6-91

Previous Treasury Quotations

Highlighted quote in Figure 6.3

2020 Feb 15 8.5 145.12 145.15 +64 3.4730

When does the bond mature?

What is the coupon rate on the bond?

What is the bid price? What does this mean?

February 15, 2020

8.5% per year on semiannual basis, $85/2 = $42.50 on a $1,000 face

value bond

Bid amount dealer offers to buy from you, quoted in 32nds, 145 and

12/32 % of par = 145.375% (i.e., 1.45375) of the face value, therefore

the bid is $1,453.75 = (1, 000 * 1.45375)

Treasury prices were

previously quoted in

32nds.

6-92

Previous Treasury Quotations

Highlighted quote in Figure 6.3

2020 Feb 15 8.5 145.12 145.15 +64 3.4730

What is the ask price? What does this mean?

How much did the price change from the previous day?

What is the YTM based on Ask price and why?

Ask amount dealer is willing to sell to you, quoted in 32nds, 145 and

15/32 % of par cent = 145.46875 % (i.e., 1.4546875) of the face

value, therefore the ask is = $1,454.69 = ($1,000 * 1.4546875)

+64/32 of 1 percent or 2 percent; a tick size = 1/32

Asked yield is 3.4730%, lower than coupon rate since this is a

premium bond and sells for more than the face value.

Treasury prices were previously

quoted in 32nds.

6-93

Previous Treasury Quotations

Highlighted quote in Figure 6.3

2020 Feb 15 8.5 145.12 145.15 +64 3.4730

What is bid-ask spread, what does this represent?

Ask Bid = $1,454.69 - 1,453.75 - = $0.94 and represents the

dealers profit.

Treasury prices were previously

quoted in 32nds.

Potrebbero piacerti anche

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryDa EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNessuna valutazione finora

- Principles of Business Finance: Lecture 6: Interest Rates and Bond ValuationDocumento28 paginePrinciples of Business Finance: Lecture 6: Interest Rates and Bond ValuationAmandaNessuna valutazione finora

- Household Balance Sheet Q2 2009Documento6 pagineHousehold Balance Sheet Q2 2009DvNetNessuna valutazione finora

- Basics of Bond Mathematics: Sankarshan BasuDocumento68 pagineBasics of Bond Mathematics: Sankarshan BasuUdit GuptaNessuna valutazione finora

- Important Banking GK PDFDocumento26 pagineImportant Banking GK PDFPriya BanothNessuna valutazione finora

- LeverageDocumento38 pagineLeverageAnant MauryaNessuna valutazione finora

- Dimensions of Cash Flow Management: Prof. N. C. KarDocumento74 pagineDimensions of Cash Flow Management: Prof. N. C. KarAshokNessuna valutazione finora

- ICE CDS White PaperDocumento21 pagineICE CDS White PaperRajat SharmaNessuna valutazione finora

- Instruments For Financing Working CapitalDocumento6 pagineInstruments For Financing Working CapitalPra SonNessuna valutazione finora

- Banking FinanceDocumento9 pagineBanking FinanceAstik TripathiNessuna valutazione finora

- Rfi On Transparency 2022 (6.27.22)Documento5 pagineRfi On Transparency 2022 (6.27.22)Carlos100% (1)

- General Principles of Credit Analysis: - IntroductionDocumento17 pagineGeneral Principles of Credit Analysis: - IntroductionTamanna TuliNessuna valutazione finora

- How Much Should You InvestDocumento3 pagineHow Much Should You InvestKurian PunnooseNessuna valutazione finora

- Foreign Exchange Activities of Merchantile Bank LTDDocumento160 pagineForeign Exchange Activities of Merchantile Bank LTDtanvirNessuna valutazione finora

- Deed of SurrenderDocumento10 pagineDeed of SurrenderGhanshyam mishraNessuna valutazione finora

- July 2, 2014 Leave A CommentDocumento3 pagineJuly 2, 2014 Leave A CommentMaryann BarberanNessuna valutazione finora

- Debt InstrumentsDocumento14 pagineDebt InstrumentsAnubhav GoelNessuna valutazione finora

- Tax Money Not PeopleDocumento1 paginaTax Money Not PeopleAnonymous snSfklbI8pNessuna valutazione finora

- Multiloop Timing ProtocolDocumento12 pagineMultiloop Timing Protocolgi1980Nessuna valutazione finora

- 1 1 BondsDocumento10 pagine1 1 BondsyukiyurikiNessuna valutazione finora

- Issuing SecuritiesDocumento6 pagineIssuing SecuritiesKomal ShujaatNessuna valutazione finora

- Loans WebquestDocumento4 pagineLoans Webquestapi-288888809Nessuna valutazione finora

- Assignment Retail BankingDocumento3 pagineAssignment Retail BankingSNEHA MARIYAM VARGHESE SIM 16-18Nessuna valutazione finora

- Question Bank 2019 With AnswersDocumento373 pagineQuestion Bank 2019 With AnswersAkhil MadavanNessuna valutazione finora

- Tutorial 020Documento5 pagineTutorial 020Jason HenryNessuna valutazione finora

- Compilation of Guidelines For Redress of Public Grievances - Naresh KadyanDocumento290 pagineCompilation of Guidelines For Redress of Public Grievances - Naresh KadyanNaresh KadyanNessuna valutazione finora

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocumento2 pagineProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNessuna valutazione finora

- Tender Document: Bharat Sanchar Nigam Ltd. (BSNL)Documento32 pagineTender Document: Bharat Sanchar Nigam Ltd. (BSNL)engg.satyaNessuna valutazione finora

- Bank of America HELOC Short Sale PackageDocumento7 pagineBank of America HELOC Short Sale PackagekwillsonNessuna valutazione finora

- Money: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofDocumento50 pagineMoney: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofChetan Ganesh RautNessuna valutazione finora

- CSC CproDocumento1 paginaCSC Cproactuarial_researcherNessuna valutazione finora

- A Private Investor's Guide To GiltsDocumento36 pagineA Private Investor's Guide To GiltsFuzzy_Wood_PersonNessuna valutazione finora

- Banking OriginsDocumento2 pagineBanking OriginsEugene S. Globe IIINessuna valutazione finora

- FAR 1 NotesDocumento7 pagineFAR 1 NotesDavEriKevNessuna valutazione finora

- Tutorial 030Documento8 pagineTutorial 030Jason HenryNessuna valutazione finora

- Circular 2012-007 Fall Protection Devices and Lifeboat Release SystemsDocumento3 pagineCircular 2012-007 Fall Protection Devices and Lifeboat Release SystemsViorel AndreiNessuna valutazione finora

- An Introduction To Investment TheoryDocumento7 pagineAn Introduction To Investment Theorynazeer8384100% (1)

- Tender Document Eluru R.R. Peta ParkDocumento31 pagineTender Document Eluru R.R. Peta Parkeluru corporationNessuna valutazione finora

- USPS OIG Management Advisory - Benchmarking Mail Distribution To CarriersDocumento15 pagineUSPS OIG Management Advisory - Benchmarking Mail Distribution To CarriersbsheehanNessuna valutazione finora

- Document PDFDocumento63 pagineDocument PDFVijay HemwaniNessuna valutazione finora

- BondDocumento22 pagineBondBRAINSTORM Haroon RasheedNessuna valutazione finora

- Nysylc Entrepreneurship Guide - Web VersionDocumento122 pagineNysylc Entrepreneurship Guide - Web VersionAngy RiveraNessuna valutazione finora

- General Banking of National Bank LimitedDocumento52 pagineGeneral Banking of National Bank LimitedBishal IslamNessuna valutazione finora

- Form 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Documento22 pagineForm 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Sakan PoolsawatkitikoolNessuna valutazione finora

- FORM 10-Q: General Instructions A. Rule As To Use of Form 1O-QDocumento7 pagineFORM 10-Q: General Instructions A. Rule As To Use of Form 1O-QhighfinanceNessuna valutazione finora

- DSTBoMGuhT9rFhxxnIFCbfB 1354528090573Documento3 pagineDSTBoMGuhT9rFhxxnIFCbfB 1354528090573Kavitha RajendranNessuna valutazione finora

- Life InsuranceDocumento26 pagineLife Insurancevivek kant100% (1)

- Types of Mutual Funds: 1. Based On Asset ClassDocumento5 pagineTypes of Mutual Funds: 1. Based On Asset ClassVishal DudejaNessuna valutazione finora

- CH 1Documento17 pagineCH 1kiran shahzadiNessuna valutazione finora

- The Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsDocumento4 pagineThe Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsBaqi-Khaliq BeyNessuna valutazione finora

- Balance Sheet Management - BFMDocumento4 pagineBalance Sheet Management - BFMakvgauravNessuna valutazione finora

- Bond ValuationDocumento7 pagineBond ValuationrabiaNessuna valutazione finora

- Banking MaterialDocumento87 pagineBanking Materialmuttu&moonNessuna valutazione finora

- 2011 01 06 - DR 3Documento1 pagina2011 01 06 - DR 3Zach EdwardsNessuna valutazione finora

- Chapter 6 - Bond Valuation and Interest RatesDocumento36 pagineChapter 6 - Bond Valuation and Interest RatesAmeer B. BalochNessuna valutazione finora

- LN06Brooks671956 02 LN06Documento61 pagineLN06Brooks671956 02 LN06nightdazeNessuna valutazione finora

- Financial Management - Bonds 2014Documento34 pagineFinancial Management - Bonds 2014Joe ChungNessuna valutazione finora

- Macaulay DurationDocumento63 pagineMacaulay Durationthulasie_600628881Nessuna valutazione finora

- Bonds, Stock and Their Valuation: Presented By: Irwan Rizki Basir Neela Osman YuningsihDocumento68 pagineBonds, Stock and Their Valuation: Presented By: Irwan Rizki Basir Neela Osman YuningsihnensirsNessuna valutazione finora

- Fixed IncomeDocumento36 pagineFixed IncomeAnkit ShahNessuna valutazione finora

- Purification of Dilactide by Melt CrystallizationDocumento4 paginePurification of Dilactide by Melt CrystallizationRaj SolankiNessuna valutazione finora

- AWS Compete CustomerDocumento33 pagineAWS Compete CustomerSergeyNessuna valutazione finora

- Team 6 - Journal Article - FinalDocumento8 pagineTeam 6 - Journal Article - FinalAngela Christine DensingNessuna valutazione finora

- ISSA2013Ed CabinStores v100 Часть10Documento2 pagineISSA2013Ed CabinStores v100 Часть10AlexanderNessuna valutazione finora

- Java Edition Data Values - Official Minecraft WikiDocumento140 pagineJava Edition Data Values - Official Minecraft WikiCristian Rene SuárezNessuna valutazione finora

- Jordan CVDocumento2 pagineJordan CVJordan Ryan SomnerNessuna valutazione finora

- Mini Project A-9-1Documento12 pagineMini Project A-9-1santhoshrao19Nessuna valutazione finora

- International Business ManagementDocumento3 pagineInternational Business Managementkalaiselvi_velusamyNessuna valutazione finora

- RseDocumento60 pagineRseH S Vishwanath ShastryNessuna valutazione finora

- Dash8 200 300 Electrical PDFDocumento35 pagineDash8 200 300 Electrical PDFCarina Ramo LakaNessuna valutazione finora

- Assignment 4 Job Order Costing - ACTG321 - Cost Accounting and Cost ManagementDocumento3 pagineAssignment 4 Job Order Costing - ACTG321 - Cost Accounting and Cost ManagementGenithon PanisalesNessuna valutazione finora

- Carbonate Platform MateriDocumento8 pagineCarbonate Platform MateriNisaNessuna valutazione finora

- LP MAPEH 10 1st Quarter Printing Final.Documento29 pagineLP MAPEH 10 1st Quarter Printing Final.tatineeesamonteNessuna valutazione finora

- Xii Mathematics CH 01 Question BankDocumento10 pagineXii Mathematics CH 01 Question BankBUNNY GOUDNessuna valutazione finora

- Visual Inspection ReportDocumento45 pagineVisual Inspection ReportKhoirul AnamNessuna valutazione finora

- Hydrogen Production by Steam ReformingDocumento10 pagineHydrogen Production by Steam ReformingramiarenasNessuna valutazione finora

- Manual TV Hyundai HYLED3239iNTMDocumento40 pagineManual TV Hyundai HYLED3239iNTMReinaldo TorresNessuna valutazione finora

- General Characteristics of Phonemes: Aspects of Speech SoundsDocumento8 pagineGeneral Characteristics of Phonemes: Aspects of Speech SoundsElina EkimovaNessuna valutazione finora

- H.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeDocumento108 pagineH.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeeswariNessuna valutazione finora

- Preliminary Examination The Contemporary WorldDocumento2 paginePreliminary Examination The Contemporary WorldJane M100% (1)

- NCDC-2 Physical Health Inventory Form A4Documento6 pagineNCDC-2 Physical Health Inventory Form A4knock medinaNessuna valutazione finora

- PixiiDocumento3 paginePixiiFoxNessuna valutazione finora

- Note Hand-Soldering eDocumento8 pagineNote Hand-Soldering emicpreampNessuna valutazione finora

- Market EquilibriumDocumento36 pagineMarket EquilibriumLiraOhNessuna valutazione finora

- NZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDocumento2 pagineNZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDumarronNessuna valutazione finora

- Offshore Training Matriz Matriz de Treinamentos OffshoreDocumento2 pagineOffshore Training Matriz Matriz de Treinamentos OffshorecamiladiasmanoelNessuna valutazione finora

- Sweat Equity SharesDocumento8 pagineSweat Equity SharesPratik RankaNessuna valutazione finora

- Review and Basic Principles of PreservationDocumento43 pagineReview and Basic Principles of PreservationKarl Marlou Bantaculo100% (1)

- Medical Equipment Quality Assurance For Healthcare FacilitiesDocumento5 pagineMedical Equipment Quality Assurance For Healthcare FacilitiesJorge LopezNessuna valutazione finora

- Pepperberg Notes On The Learning ApproachDocumento3 paginePepperberg Notes On The Learning ApproachCristina GherardiNessuna valutazione finora