Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Hertz Corporation Case Study Analysis

Caricato da

Rahul AgarwalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Hertz Corporation Case Study Analysis

Caricato da

Rahul AgarwalCopyright:

Formati disponibili

13.12.

2007

Case Study:

The Hertz Corporation

Presentation: Mariano Mateos, Ricardo Velilla, Elias Vlker

Casestudy: The Hertz Corporation 13.12.2007 2

The Bid for Hertz

Casestudy: The Hertz Corporation 13.12.2007 3

Agenda

Deal Structure

How to create value

Hertz Company Overview

Financial Engineering

Conclusion

Casestudy: The Hertz Corporation 13.12.2007 4

Intro

Ford Motor

Company

CD&R

Other PE

firms

Hertz

Corporation

Casestudy: The Hertz Corporation 13.12.2007 5

Hertz business areas

Hertz

RAC

HERC

USA Europe

Region

Off/On-airports

1,77 million cars

$17 bln market

revenues

180 largest

airports

Off/On-airports

12% share of the

market

$10 bln market

revenues

The third largest

company

$1,2 bln revenue

The fourth

largest company

$152 mln

revenue

Casestudy: The Hertz Corporation 13.12.2007 6

Agenda

Deal Structure

How to create value

Hertz Company Overview

Financial Engineering

Conclusion

Casestudy: The Hertz Corporation 13.12.2007 7

Clayton, Dubilier & Rice Inc.

Private equity investment firm

founded in 1978

Investments in 39 US and

European businesses

Specialized in acquiring

under-managed divisions

Has obtained a higher and

steady return on investment

The case of Hertz

Casestudy: The Hertz Corporation 13.12.2007 8

First Stage: Uninteresting Bid

YEAR 2002

CD&R began studying the

rental car business (RAC).

Early in its investigation, CD&R

studied Budget and Alamo.

Hertz Much more attractive.

Ford dismissed the proposal as

uninteresting and unfeasible.

CD&R financing challenge

Securitizing Hertzs rental fleet

in cooperation with Lehman

Brothers and Deutsche Bank

New proposals.

YEAR 2003

CD&R convinced that Hertzs

capital structure was inefficient.

New visit to Ford The deal

could be indeed financed.

Hertz was non-strategic to Ford.

Ford executives remained

unconvinced as well as Hertzs

CEO.

Casestudy: The Hertz Corporation 13.12.2007 9

Second Stage: Ford sells

YEAR 2005

Early 2005 Ford core US auto business was in trouble.

Monetizing Hertz One step to improve Ford balance sheet.

Ford advisors recommended two tracks:

IPO Filed in June

Sale of the business Proposal and preliminary bids by

July

Ford made confidential financing and operating information.

Hertz executives Informational meetings with potential buyers.

After a month of due diligence, CD&R identified several specific

opportunities for improving operations.

Casestudy: The Hertz Corporation 13.12.2007 10

Improving Hertz Operations

HERTZ

US RAC On-airport

Operating Expenses

US RAC Off-airport

strategy

European OpEx &

SG&A

US RAC Fleet Costs

US RAC Non-Fleet

CapEx

HERC ROIC

Casestudy: The Hertz Corporation 13.12.2007 11

Agenda

Deal Structure

How to create value

Hertz Company Overview

Financial Engineering

Conclusion

Casestudy: The Hertz Corporation 13.12.2007 12

Key Questions of Deal Structure

1. Can fleet be used as a source of

debt capacity?

2. Can ABS financing be used for

a levered buy out?

3. How can lenders be serviced

and protected?

Casestudy: The Hertz Corporation 13.12.2007 13

Proposed Corporate Structure

The Hertz

Corporation

Domestic

Subsidiaries

HERC

Hertz Vehicle

Financing

Hertz

International

OpCo

OpCo owns rest of Hertzs assets

Conducts all rental transactions with

customers

Leases fleet from FleetCo and

provides equity for FleetCo

FleetCo

Bankruptcy remote special purpose

entities provide optimized

securitization for asset backed debt

financing

Leasing rates from OpCo cover

debt payments

Casestudy: The Hertz Corporation 13.12.2007 14

Agenda

Deal Structure

How to create value

Hertz Company Overview

Financial Engineering

Conclusion

Casestudy: The Hertz Corporation 13.12.2007 15

Goals of new capital structure

Hertz should be able to survive a severe business

downturn without need to restructure or default

Stability

Hertz should be able to exploit future growth

opportunities without having to refinance

Liquidity

Capital structure should enable Hertz to make large

car purchases and manage fluctuations in the rental

activity

Flexibility

Funds should be obtained at significantly lower cost

than current capital

Lower

Costs

1

4

3

2

Casestudy: The Hertz Corporation 13.12.2007 16

The Layer Cake

FleetCo (in m$)

Cash 526, 4

US Fleet ABS

Internat. Fleet ABS

5.256,7

1.972,4

Total FleetCo Debt 7.229,1

Fleet Enhancement Cars

Fleet Enhancement LC

Fleet Enhancement Cash

200

115,1

1.346,9

Total FleetCo Equity 1662,0

OpCo (in m$)

Sponsor Equity 2295,0

Total OpCo Equity 2295,0

ABL Facility 396

Term Loan B

Senior Unsecured Notes

1.850

2.250

Total OpCo Debt 5.296,0

Senior Sub Notes

Existing Debt

800

0

Total Capitalization: 16,482,1 m$

Casestudy: The Hertz Corporation 13.12.2007 17

Advantages

New capital structure highly leverages Hertz

Long term debt agreements ensure stability

Not all debt was drawn immediately, so

liquidity and flexibility was ensured

Capital Cost are lowered through extensive

use of asset backed facilities

Casestudy: The Hertz Corporation 13.12.2007 18

Calculation of Capital Cost

1. FleetCo

Amount Interest in %

Debt

US Fleet ABS 5256,7 L+60 4,94%

International Fleet ABS 1972,4 L+100 5,34%

Equity

Total Equity 1662 15,83%

WACC (FleetCo) 6,24%

2. OpCo

Amount Interest in %

Debt

ABL Facility 396 L+250 6,84%

Term Loan B 1850 L+300 7,34%

Senior Unsecured Loan 2250 9,50%

Senior Sub Notes 800 10,75%

Equity

Sponsor's Equity 2295 15,83%

WACC (OpCo) 9,66%

3. Hertz Total

Amount Interest in %

Debt

Total Debt 12525,1

Equity

Total Equity 3957

WACC (Hertz) 0,07817571 7,82%

4. Assumptions

Beta 1,5

Risk Free Rate 4,34%

Market Return 12%

Tax Rate 20%

Casestudy: The Hertz Corporation 13.12.2007 19

Agenda

Deal Structure

How to create value

Hertz Company Overview

Financial Engineering

Conclusion

Casestudy: The Hertz Corporation 13.12.2007 20

The Question

Both PE-groups bid around $5,4 bln for Hertz

Ford asks for a revised bid

CD&R are considering whether $5,6 bln are

still a fair price...

Casestudy: The Hertz Corporation 13.12.2007 21

Original Valuation

This is what their valuation might have looked

like...

Free Cash Flow & NPV Calculation based on CD&R Information

2005 2006 2007 2008 2009 2010

Corporate EBITDA 1.019,0 1.254,8 1.323,7 1.396,1 1.472,3 1.552,6

Net Non-Fleet CapEx 0,0 50,7 14,6 15,2 15,9 16,6

Delta NWC 14,8 59,0 17,2 18,1 19,1 20,1

Delta Others 2,0 7,1 2,1 2,2 2,3 2,4

FCFF 1.006,3 1.152,2 1.293,9 1.364,9 1.439,7 1.518,3

Cost of Equity 7,82% 7,82% 7,82% 7,82% 7,82% 7,82%

Discount factor 100% 92,7% 86,0% 79,8% 74,0% 68,6%

Discounted FCFF 0 1068,7 1113,1 1089,0 1065,4 1042,1

NPV 5.378

Casestudy: The Hertz Corporation 13.12.2007 22

What are the value drivers?

CD&R already pushed capital structure and leverage

to the limit

Significantly lower WACC is very unrealistic

Lower

WACC

CD&R included conservative cost cutting projections

Still quite some leeway for further improvements

Most realistic value driver

Less

Costs

Projections already include revenue growth forecast

No rational reason for Hertz to outperform the market

Revenue growth above market highly speculative

More

Revenues

RAC and equipment rental are businesses with short

cash cycles

Thus timing of cash flows is no lever for value

Timing of

Cash

Flows

Casestudy: The Hertz Corporation 13.12.2007 23

Improving Hertz Operations

HERTZ

US RAC On-airport

Operating Expenses

US RAC Off-airport

strategy

European OpEx &

SG&A

US RAC Fleet Costs

US RAC Non-Fleet

CapEx

HERC ROIC

Casestudy: The Hertz Corporation 13.12.2007 24

Further savings potential

1. Further Savings Potential

2006 2007 2008 2009 2010

Priced in 243,0 243,0 243,0 243,0 243,0

On-Airport OpEx 75,0 75,0 75,0 75,0 75,0

Off-Airport 58,0 58,0 58,0 58,0 58,0

Europe 33,0 33,0 33,0 33,0 33,0

Non-Fleet CapEx 57,0 57,0 57,0 57,0 57,0

HERC 20,0 20,0 20,0 20,0 20,0

Projected 411,5 411,5 411,5 411,5 411,5

On-Airport OpEx 89,7 89,7 89,7 89,7 89,7

Off-Airport 100,0 100,0 100,0 100,0 100,0

Europe 100,0 100,0 100,0 100,0 100,0

Non-Fleet CapEx 90,0 90,0 90,0 90,0 90,0

HERC 31,8 31,8 31,8 31,8 31,8

Mean 327,2 327,2 327,2 327,2 327,2

(Projected-Priced) 168,5 168,5 168,5 168,5 168,5

(Projected-Mean) 84,2 84,2 84,2 84,2 84,2

Casestudy: The Hertz Corporation 13.12.2007 25

Modified valuation

By including higher cost savings into the

projections, we arrive at a valuation that is

$278 mln higher...

Free Cash Flow & NPV Calculation with higher projected savings

2005 2006 2007 2008 2009 2010

Corporate EBITDA 1.019,0 1.322,6 1.395,7 1.472,8 1.553,9 1.639,5

Net Non-Fleet CapEx 0,0 61,9 14,8 15,4 16,0 16,7

Delta NWC 14,8 75,9 18,3 19,3 20,3 21,4

Delta Others 2,0 9,1 2,2 2,3 2,4 2,6

FCFF 1.006,3 1.193,8 1.364,9 1.440,4 1.520,0 1.604,0

Cost of Equity 7,82% 7,82% 7,82% 7,82% 7,82% 7,82%

Discount factor 100% 92,7% 86,0% 79,8% 74,0% 68,6%

Discounted FCFF 0 1107,3 1174,1 1149,3 1124,9 1100,9

NPV 5.656

Casestudy: The Hertz Corporation 13.12.2007 26

Conclusion

We think...

...that a valuation of $5,6 bln can be justified

...CD&R should go ahead with the deal

History proves us right...

Casestudy: The Hertz Corporation 13.12.2007 27

Thank you for your

attention!

Any questions?

Potrebbero piacerti anche

- Case Study Hertz Corporation 130430125238 Phpapp01Documento23 pagineCase Study Hertz Corporation 130430125238 Phpapp01rbhatter007100% (1)

- Leveraged Buyout TargetDocumento6 pagineLeveraged Buyout TargetBryard Conhuay InfantesNessuna valutazione finora

- HertzDocumento2 pagineHertzChhavi AnandNessuna valutazione finora

- Hertz A + BDocumento11 pagineHertz A + BLinus Vallman Johansson100% (1)

- Case Study Hertz CorporationDocumento27 pagineCase Study Hertz CorporationEliasVoelker60% (5)

- Case Study Hertz CorporationDocumento27 pagineCase Study Hertz CorporationprajeshguptaNessuna valutazione finora

- Hertz LBODocumento5 pagineHertz LBOhichambentouhami100% (1)

- Hertz LBO target characteristics analysisDocumento3 pagineHertz LBO target characteristics analysisjen1861233% (6)

- HertzDocumento6 pagineHertzArpit KhuranaNessuna valutazione finora

- Hertz IPO CaseDocumento6 pagineHertz IPO CaseHamid S. Parwani100% (1)

- Hertz LBO Bid Offers 27% Returns in 5 YearsDocumento5 pagineHertz LBO Bid Offers 27% Returns in 5 Yearsrishabh jainNessuna valutazione finora

- CASE Exhibits - HertzDocumento15 pagineCASE Exhibits - HertzSeemaNessuna valutazione finora

- BerkshireDocumento30 pagineBerkshireNimra Masood100% (3)

- Carter LBODocumento1 paginaCarter LBOEddie KruleNessuna valutazione finora

- WilliamsDocumento20 pagineWilliamsUmesh GuptaNessuna valutazione finora

- Burton Sensors Case Study 1Documento10 pagineBurton Sensors Case Study 1anish mahtoNessuna valutazione finora

- HertzDocumento4 pagineHertzChristos DozesNessuna valutazione finora

- Bidding For Hertz Group 6Documento15 pagineBidding For Hertz Group 6Anurag Sharma0% (3)

- Berkshire - IntroDocumento2 pagineBerkshire - IntroRohith ThatchanNessuna valutazione finora

- Corp Finance HBS Case Study: Williams 2002Documento6 pagineCorp Finance HBS Case Study: Williams 2002Tang Lei100% (1)

- Landmark Facility Solutions - SunilDocumento4 pagineLandmark Facility Solutions - SunilPawan Mishra67% (3)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocumento12 pagineBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNessuna valutazione finora

- Southland Case StudyDocumento7 pagineSouthland Case StudyRama Renspandy100% (2)

- MACR Assignment - 4 General Mills’ Acquisition of Pillsbury from Diageo PLCDocumento6 pagineMACR Assignment - 4 General Mills’ Acquisition of Pillsbury from Diageo PLCArpit Goyal100% (2)

- Hertz LBO Questions for Potential BuyersDocumento1 paginaHertz LBO Questions for Potential BuyerskiubiuNessuna valutazione finora

- Group 4 Williams SFMDocumento7 pagineGroup 4 Williams SFMthisissick100% (3)

- M&a Assignment - Syndicate C FINALDocumento8 pagineM&a Assignment - Syndicate C FINALNikhil ReddyNessuna valutazione finora

- Hertz Write UpDocumento5 pagineHertz Write UpAnna Lin100% (1)

- Williams Seeks $900M Financing to Address Liquidity CrisisDocumento4 pagineWilliams Seeks $900M Financing to Address Liquidity CrisisAnirudh SurendranNessuna valutazione finora

- Midland Case CalculationsDocumento24 pagineMidland Case CalculationsSharry_xxx60% (5)

- Case Analysis - Compania de Telefonos de ChileDocumento4 pagineCase Analysis - Compania de Telefonos de ChileSubrata BasakNessuna valutazione finora

- Group 6 M&A MellonBNY Case PDFDocumento8 pagineGroup 6 M&A MellonBNY Case PDFPrachi Khaitan67% (3)

- Lex Service PLCDocumento11 pagineLex Service PLCArup Dey0% (1)

- Corporate Finance - PresentationDocumento14 pagineCorporate Finance - Presentationguruprasadkudva83% (6)

- Allen Lane Case Write UpDocumento2 pagineAllen Lane Case Write UpAndrew Choi100% (1)

- General Mills Pillsbury Case - MACRDocumento7 pagineGeneral Mills Pillsbury Case - MACRNikita GulguleNessuna valutazione finora

- Marriott Case WACC AnalysisDocumento3 pagineMarriott Case WACC AnalysisNaman SharmaNessuna valutazione finora

- Berkshire's Bid for Carter's - Industry Fit and Quantitative AnalysisDocumento2 pagineBerkshire's Bid for Carter's - Industry Fit and Quantitative AnalysisAlex TovNessuna valutazione finora

- Caso HertzDocumento32 pagineCaso HertzJORGE PUENTESNessuna valutazione finora

- Valuing Capital Investment ProjectsDocumento13 pagineValuing Capital Investment ProjectsSiddhesh MahadikNessuna valutazione finora

- USX Corporation proposes targeted stock structure to appease activist investorDocumento24 pagineUSX Corporation proposes targeted stock structure to appease activist investorolegipod50530% (1)

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocumento12 pagineBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- John Whitehead's Early Career and Navy ServiceDocumento20 pagineJohn Whitehead's Early Career and Navy ServiceJimNessuna valutazione finora

- Koito Case Questions 2,3,4Documento2 pagineKoito Case Questions 2,3,4Simo RajyNessuna valutazione finora

- Marriott Cost of Capital Analysis for Lodging DivisionDocumento3 pagineMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoNessuna valutazione finora

- Carter's LBO CaseDocumento3 pagineCarter's LBO CaseNoah57% (7)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Documento3 pagineSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNessuna valutazione finora

- General Mills' acquisition of Pillsbury from DiageoDocumento4 pagineGeneral Mills' acquisition of Pillsbury from DiageoDigraj Mahanta100% (1)

- Session 10 Simulation Questions PDFDocumento6 pagineSession 10 Simulation Questions PDFVAIBHAV WADHWA0% (1)

- Structure of Case Study Invest Policy Hewlett Foundation.Documento4 pagineStructure of Case Study Invest Policy Hewlett Foundation.SulaimanAl-SulaimaniNessuna valutazione finora

- Assignment 5Documento10 pagineAssignment 5MatthewLiuNessuna valutazione finora

- Case Study 1: FX Risk Hedging at EADSDocumento10 pagineCase Study 1: FX Risk Hedging at EADSSaraQureshiNessuna valutazione finora

- Case 4 Hertz - Key Sources of Extra Value and Bid AmountDocumento4 pagineCase 4 Hertz - Key Sources of Extra Value and Bid AmountДмитрий КолесниковNessuna valutazione finora

- VCPE: Should CD&R Bid $5.6B for HertzDocumento3 pagineVCPE: Should CD&R Bid $5.6B for HertzAbhishek VermaNessuna valutazione finora

- MiniCase02 Ch04Documento2 pagineMiniCase02 Ch04MAR0% (1)

- ProjectDocumento7 pagineProjectfarhat514Nessuna valutazione finora

- Project Evaluation and Financing Key DriversDocumento58 pagineProject Evaluation and Financing Key DriversabhishekatupesNessuna valutazione finora

- HERTZ - Memo Group 4Documento9 pagineHERTZ - Memo Group 4uygh gNessuna valutazione finora

- GTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)Documento136 pagineGTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)jrweber912Nessuna valutazione finora

- CIT Aircraft Leasing Industry OverviewDocumento42 pagineCIT Aircraft Leasing Industry Overviewjamesbrentsmith50% (2)

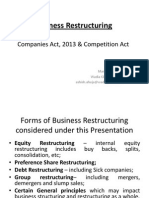

- Companies Act 2013Documento15 pagineCompanies Act 2013Rahul AgarwalNessuna valutazione finora

- Case Study CCI11Documento11 pagineCase Study CCI11Jennifer Bello AraquelNessuna valutazione finora

- Crash Course Company ValuationDocumento35 pagineCrash Course Company ValuationfarukhgulzarNessuna valutazione finora

- Guide To Common Writing ErrorsDocumento3 pagineGuide To Common Writing ErrorsRahul AgarwalNessuna valutazione finora

- Coal IndiaDocumento14 pagineCoal IndiaRahul AgarwalNessuna valutazione finora

- Case Study CCI11Documento11 pagineCase Study CCI11Jennifer Bello AraquelNessuna valutazione finora

- Hillier Model 3Documento19 pagineHillier Model 3kavyaambekarNessuna valutazione finora

- The Black-Litterman ModelDocumento111 pagineThe Black-Litterman ModelalfredkalelNessuna valutazione finora

- FrancescoDocumento16 pagineFrancescoRahul AgarwalNessuna valutazione finora

- Bac Cmo PrimerDocumento39 pagineBac Cmo Primerjms1999Nessuna valutazione finora

- Financial Markets and Institutions, 9e: Chapter 15 The Foreign Exchange MarketDocumento26 pagineFinancial Markets and Institutions, 9e: Chapter 15 The Foreign Exchange MarketDương Thanh HuyềnNessuna valutazione finora

- Share BuybackDocumento3 pagineShare Buybackurcrazy_mateNessuna valutazione finora

- LEHMAN BROTHERS Bond PricesDocumento22 pagineLEHMAN BROTHERS Bond PricesSouthey CapitalNessuna valutazione finora

- On Investment Banking ProjectDocumento26 pagineOn Investment Banking ProjectChiranjiv Karkera100% (1)

- Presentation Silicon Valley Bank Credit Suisse FiascosDocumento37 paginePresentation Silicon Valley Bank Credit Suisse Fiascosdebadrita senguptaNessuna valutazione finora

- Annual General Meeting PresentationDocumento23 pagineAnnual General Meeting Presentationtanvi virmaniNessuna valutazione finora

- Study foreign exchange marketsDocumento9 pagineStudy foreign exchange marketsjagrutiNessuna valutazione finora

- Risk and ReturnDocumento43 pagineRisk and ReturnAbubakar OthmanNessuna valutazione finora

- Mutual FundDocumento50 pagineMutual FundOmkar SutarNessuna valutazione finora

- Chapter 4 Measuring Financial PerformanceDocumento4 pagineChapter 4 Measuring Financial Performanceabdiqani abdulaahi100% (1)

- Inter-Paper-8-RTPs, MTPs and Past PapersDocumento249 pagineInter-Paper-8-RTPs, MTPs and Past PapersKarthik100% (1)

- fM-Cost of CapitalDocumento46 paginefM-Cost of CapitalParamjit Sharma100% (8)

- Singapore As A Regional Financial Centre: Denis HewDocumento26 pagineSingapore As A Regional Financial Centre: Denis HewSanthiya MogenNessuna valutazione finora

- Private Equity: Submitted By, Mangesh NilveDocumento20 paginePrivate Equity: Submitted By, Mangesh Nilvenilvemangesh67% (3)

- New Issue MarketDocumento31 pagineNew Issue MarketAashish AnandNessuna valutazione finora

- 2012 Part 2 FRM Practice Exam - v1213Documento35 pagine2012 Part 2 FRM Practice Exam - v1213NikNessuna valutazione finora

- The Basic Structure of U.S. Financial MarketsDocumento10 pagineThe Basic Structure of U.S. Financial MarketsRocaya SaripNessuna valutazione finora

- Assignment#04Documento10 pagineAssignment#04irfanhaidersewagNessuna valutazione finora

- ICICI Bank - India's Leading Private Sector BankDocumento18 pagineICICI Bank - India's Leading Private Sector Bankvenkatesh RNessuna valutazione finora

- Understanding Bonds and DebenturesDocumento16 pagineUnderstanding Bonds and Debenturesbishal bothraNessuna valutazione finora

- EMI StrategyDocumento2 pagineEMI Strategyveda sai kiranmayee rasagna somaraju AP22322130023Nessuna valutazione finora

- WSGR Entrepreneurs Report Summer 2008Documento16 pagineWSGR Entrepreneurs Report Summer 2008YokumNessuna valutazione finora

- Support & Resistance GuideDocumento3 pagineSupport & Resistance GuidesribabuNessuna valutazione finora

- Trading Support and Resistance Levels V 3 PDF 20240112 185657 0000Documento14 pagineTrading Support and Resistance Levels V 3 PDF 20240112 185657 0000akxi2468Nessuna valutazione finora

- 57 NBFC CompaniesDocumento1.480 pagine57 NBFC CompaniesDhawan Sandeep100% (2)

- Assignment For Week 10 - 2022Documento7 pagineAssignment For Week 10 - 2022Rajveer deepNessuna valutazione finora

- Capital Asset Pricing ModelDocumento6 pagineCapital Asset Pricing ModelkelvinramosNessuna valutazione finora

- Basics of Valuation: Unit Two-6 HoursDocumento12 pagineBasics of Valuation: Unit Two-6 HoursAjay ShahNessuna valutazione finora

- Market Kaleidoscope PDFDocumento3 pagineMarket Kaleidoscope PDFDurga PrasadNessuna valutazione finora