Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Analysis Consumer Buying Behavior of Branded and Non Branded Jewellery

Caricato da

Chandan SrivastavaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Analysis Consumer Buying Behavior of Branded and Non Branded Jewellery

Caricato da

Chandan SrivastavaCopyright:

Formati disponibili

Presented by-

Chandan Srivastava

Avinashi Soni

Ashish Srivastava

Ashutosh Pratap Singh

Mahavir Kumar Gautam

TABLE OF CONTENTS

S.no | Particulars | Page no.|

1. | Introduction | 3 |

2. | Objectives | 4 |

3. | Difference between branded & non-branded | 5 |

4. | Branded Jewellery| 6-11 |

5. | Non Branded Jewellery | 12-13 |

6. | Analysis | 14 -19|

7 | Factors | 20|

8 |Conclusion |21-22|

INTRODUCTION

As India makes rapid progress in the retail arena, the

Indian Jewellery market is undergoing a gradual

metamorphosis from unorganized to organized formats.

Jewellery retailing is moving from a Storehouse of

value to a Precious fashion accessory.

Consumers are more quality conscious than ever

before.

The jewellery market is one of the largest consumer

sectors in the country- larger than telecom,

automobiles, and apparel and perhaps second only to

the foods sector.

OBJECTIVES

To study and understand the buying behavior of consumers for

branded and non branded jewellery

To find the difference b/w perceptions, opinion and behavior of

branded and non- branded jewellery buyers.

To have an idea about parameters consumer consider while

buying jewellery

To know the knowledge level of customers regarding the

jewellery brands available in the market

Difference between Branded and

Non-Branded Jewellery

BRANDED | NON-BRANDED |

Name & reputation gives a confidence to the consumer | Customer can

tailor make jewellery according to their preferences |

It comes with a written lifetime guarantee, considering the emotional

quotient of the consumer | No written lifetime guarantee, trust is

purely based on consumer |

Excellent quality, good selling policies and backup services for

jewellery | Minimum efforts in packaging, finishing, sales & low

advertising |

Has a more contemporary stylish and classic outlook, which easily

segments itself among the traditional ones. | Is usually bulky &

traditional |

Available at multiple outlets | Available only in traditional jewellery

outlets |

BRANDED JEWELLERY

Name & reputation gives a confidence to the consumer

It comes with a written lifetime guarantee, considering

the emotional quotient of the consumer

Excellent quality, good selling policies and backup

services for jewellery

Has a more contemporary stylish and classic outlook,

which easily segments itself among the traditional

ones.

Available at multiple outlets

BRANDED JEWELLERS

Nakshatra

Tiffany

Cartiers

Gili

Tanishq

Ddamas

Gitanjali Jewels

NON-BRANDED JEWELLERY

Customer can tailor make jewellery according to their

preferences

No written lifetime guarantee, trust is purely based on

consumer

Minimum efforts in packaging, finishing, sales & low

advertising

Is usually bulky & traditional

Available only in traditional jewellery outlets

Analysis

Gold Jewellery Market in India

Before the liberalization of the Indian economy in 1991, only the

Minerals and Metals Trading Corporation of India (MMTC) and the

State Bank of India (SBI) were allowed to import gold. The abolition of

the Gold Control Act in 1992, allowed large export houses to import gold

freely Exporters in export processing zones were allowed to sell 10

percent of their produce in the domestic market. In 1993, gold and

diamond mining were opened up for private investors and foreign

investors were allowed to own half the equity in mining ventures. In

1997, overseas banks and bullion suppliers were also allowed to import

gold into India. These measures led to the entry of foreign players like

DeBeers, Tiffany and Cartiers into the Indian market. In the 1990s, the

number of retail jewellery outlets in India increased greatly due to the

abolition of the Gold Control Act.

This led to a highly fragmented and unorganized jewellery market with an estimated

100,000 workshops supplying over 350,000 retailers, mostly family-owned, single

shop operations. In 2001, India had the highest demand for gold in the world; 855

tons were consumed a year, 95% of which was used for jewellery. The bulk of the

jewellery purchased in India was designed in the traditional Indian style. Jewellery

was fabricated mainly in 18, 22 and 24-carat gold. As Hallmarking was not very

common in India, under-carat age was prevalent. According to a survey done by the

Bureau of Indian Standards (BIS), most gold jewellery advertised in India as 22-carat

was of a lesser quality. Over 80% of the jewelers sold gold jewellery ranging from 13.5

carats to 18 carats as22-carat gold jewellery. The late 1990s saw a number of branded

jewellery players entering the Indian market. Titan sold gold jewellery under the

brand name Tanishq, while Gitanjali Jewels, a Mumbai-based jewellery exporter, sold

18-carat gold jewellery under the brand name Gili. Gitanjali Jewels also started selling

24-carat gold jewellery in association with a Thai company, Pranda. Su-Raj (India)

Ltd. launched its collection of diamond and 22 -carat gold jewellery in 1997.The

Mumbai-based group, Beautiful, which marketed the Tiffany range of products in

India, launched its own range of studded 18-carat jewellery, Dagina. Cartiers entered

India in 1997 in a franchise agreement with Ravissant. Other players who entered the

Indian branded gold jewellery market during the 1990s and 2000-01 included

Intergold Gem Ltd., Oyzterbay, Carbon and Tribhovandas Bhimji Zaveri (TBZ).

Gold Jewellery Becomes Fashion Accessory

Till the early 1990s, the average Indian bought jewellery for investment

rather than for adornment. Jewellery made of 18-karat gold was not favored

as it was considered a poor investment. Confidence in the local jeweler was

the hallmark of the gold jewellery trade in India. A jeweler or goldsmith in

a local area had a fixed and loyal clientele. The buyer had implicit faith in

his jeweler. Additionally, the local jeweler catered to the local taste for

traditional jewellery. However, since the late 1990s, there was a shift in

consumer tastes: women were increasingly opting for fashionable and

lightweight jewellery instead of traditional chunky jewellery. There was a

rise in demand for lightweight jewellery, especially from consumers in the

16 to25 age group, who regarded jewellery as an accessory and not an

investment. The new millennium witnessed a definite change in consumer

preferences. According to Samrat Zaveri, CEO of Trend Smith, "Research

shows that the Indian jewellery sector is in the transition phase with

consumers' desire for possession of jewellery for its aesthetic appeal and

not as a form of investment."

In October 2002, Trendsmith conducted a survey to understand the

shifting need, motivations and aspirations of consumers in the

jewellery market, and to identify new trends and opportunities. The

research study arrived at the following conclusions:

The Indian market was witnessing an accelerated shift from

viewing jewellery as an investment to regarding it as aesthetically

appealing ornaments. The focus had shifted from content to

design.

The younger generation was looking at trendy, contemporary

jewellery and clearly avoiding heavy, traditional gold jewellery.

The consumer wanted a wider selection at a single convenient

location and expected an international shopping experience.

The Indian consumer was willing to experiment with new

designs.

Brand appeal

Branded jewellery has found a niche for itself in the tough Indian

market, and its increasing growth rates show that before long it will

corner a significant share of the jewellery market. With the retail

industry in India burgeoning, several companies have made inroads

into the traditional jewellery industry, selling the product that was

never really "marketed" in "brand" new ways. So much so that branded

jewellery is the new mantra in the market, having rapidly acquired a

niche over the past few years. Some of the companies have even cleverly

played on Indian customs and tradition to advertise and establish their

brands. Jewellery is now marketed for every occasion; even Valentine's

Day calls for "a special something [diamond] for a special someone". In

spite of pessimism about the marketability of branded jewellery in a

country rooted in buying ornaments from the traditional goldsmith, 30

brands were launched in 2004.

Factors That Guide Consumer While

Purchasing Jewellery

Factors (%)

Design (85)

Price (92)

Purity (87)

Image (65)

Variety (67)

Display (5)

Promotion and Offers (10)

Service (2)

Family and Friends (12)

0

10

20

30

40

50

60

70

80

90

100

2

5

10

12

65

67

85

87

92

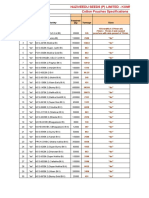

Indian Jewellery Industry

Size Rs 1.3 lakh crore

Diamond jewellery Rs 70,000 crore

No of jewellers 300,000

No of branded players (with multiple stores)

15-20

Branded market share 12-15%

Growth rate for branded 30%

Online jewellery market Rs 200-250 crore

15%

85%

Branded Jewellery

Non Branded Jewellery

Market Share Of Branded And Non Branded Jewellery

In India

Conclusion

The jewellery market in India is changing rapidly and the buying

behavior of people is changing accordingly.

The results show that the price of gold plays an important role in the

purchasing procedure. The rising prices of gold are one of the main

factors that affect the purchase for a middle class family. On the

contrary, it is not a problem for the business class; they are indifferent

in buying jewellery irrespective of the prices, designs and the brand.

The consumers buying behavior shows a shift from content to design

in jewellery i.e. fashionable jewellery is the rage nowadays and

acquires a status symbol in their minds. Branded jewellery players will

continue to face lot of competition from local jewelers.

People also look for the convenience while visiting the store and this is

the reason why some people today also visit non-branded jewellery

shops for making purchases as they easily approachable, reliable,

prices are negotiable and also they have a long term relationship with

them.

The dissertation will help to study the consumer preference over branded and non-

branded jewellery. The main objectives of the study were to compare between Branded and

Non-Branded Jewellery, to know Consumer perception towards Jewellery, to know the

Major Players of Jewellery industry, to have an idea about parameters consumer consider

while buying Jewellery, to have knowledge about demographic segments, to know the

Marketing strategies used by various jewellery brands. India is growing at a very fast pace

and jewellery sector is one which is registered to achieve 65% international market by 2010.

The jewellery sector is largely unorganized in India but is changing into organized business

because of many major and influential players entering into the market and have started

organizing the market and focusing all segments of customers such as Tanishq by TATA

and Gili by Gitanjli jewellers etc. The branded jewellery sectors is only 2-3% of the total

jewellery market in India but most of the brands have been able to make a mark on

consumers with their highly satisfying marketing strategies. The local jewellers or the

unbranded jewellers do not provide any guarantee of the purity and quality but brands

such as Tanishq introduced karometer in their outlets which help the consumer to test the

purity of the jewellery. As jewellery sector is changing, consumer is also changing today

they are more aware, have greater disposable income and want to be more secure. That is

why when given a preference between branded and non- branded jewellery most

respondents choose branded jewellery. The booming economy along with the rapid

increase in income levels is estimated to further accelerate the growth of this industry.

According to a KPMG study, Indias growing importance in the global jewellery market is

only expected to increase in the future with total estimated jewellery sales of US$ 21 billion

by 2010 and US$ 37 billion.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Customer Satisfaction Towards McDonald'sDocumento50 pagineCustomer Satisfaction Towards McDonald'sChandan Srivastava67% (3)

- Marketing Strategies of ToyotaDocumento53 pagineMarketing Strategies of ToyotaChandan Srivastava100% (1)

- History of Nike, Inc.: Brs BeginningsDocumento38 pagineHistory of Nike, Inc.: Brs BeginningsChandan SrivastavaNessuna valutazione finora

- SWOT Analysis of Voot 2Documento7 pagineSWOT Analysis of Voot 2Chandan SrivastavaNessuna valutazione finora

- SWOT Analysis of Voot 2Documento7 pagineSWOT Analysis of Voot 2Chandan SrivastavaNessuna valutazione finora

- Brand Positioning of Nike in Lucknow CityDocumento33 pagineBrand Positioning of Nike in Lucknow CityChandan Srivastava100% (1)

- Customer Satisfaction Towards Raymonds Fashion WearDocumento39 pagineCustomer Satisfaction Towards Raymonds Fashion WearChandan SrivastavaNessuna valutazione finora

- E-Bike Repairer PrateekDocumento34 pagineE-Bike Repairer PrateekChandan SrivastavaNessuna valutazione finora

- Inflation and Its Impact On Indian EconomyDocumento75 pagineInflation and Its Impact On Indian EconomyChandan Srivastava100% (1)

- A Study On Customer Satisfaction Towards OLA Cab Services in LucknowDocumento35 pagineA Study On Customer Satisfaction Towards OLA Cab Services in LucknowChandan SrivastavaNessuna valutazione finora

- "Convertable Shoes": Mini Project Report IDocumento35 pagine"Convertable Shoes": Mini Project Report IChandan SrivastavaNessuna valutazione finora

- A Study On Performance Appraisal System at BYJU's in Lucknow CityDocumento44 pagineA Study On Performance Appraisal System at BYJU's in Lucknow CityChandan SrivastavaNessuna valutazione finora

- E Ambulance 1Documento45 pagineE Ambulance 1Chandan Srivastava100% (1)

- Indoor Garden Lamp With Room FreshenerDocumento33 pagineIndoor Garden Lamp With Room FreshenerChandan Srivastava100% (3)

- Environment Friendly Products Made of Bamboo For Daily Household UsageDocumento43 pagineEnvironment Friendly Products Made of Bamboo For Daily Household UsageChandan SrivastavaNessuna valutazione finora

- Inventory Control HDocumento45 pagineInventory Control HChandan SrivastavaNessuna valutazione finora

- Home Made Food Delivery AppDocumento43 pagineHome Made Food Delivery AppChandan SrivastavaNessuna valutazione finora

- PumaDocumento20 paginePumaChandan Srivastava100% (1)

- ReebokDocumento12 pagineReebokChandan SrivastavaNessuna valutazione finora

- Doorbell Cum Visitor Indicator - Sensing Is Life 1Documento35 pagineDoorbell Cum Visitor Indicator - Sensing Is Life 1Chandan Srivastava60% (5)

- XiaomiDocumento8 pagineXiaomiChandan SrivastavaNessuna valutazione finora

- Fingerprint Based Atm SystemDocumento27 pagineFingerprint Based Atm SystemChandan SrivastavaNessuna valutazione finora

- Versace ShoesDocumento4 pagineVersace ShoesChandan SrivastavaNessuna valutazione finora

- "Customised Footwear": Mini Project ReportDocumento36 pagine"Customised Footwear": Mini Project ReportChandan Srivastava100% (1)

- SamsungDocumento23 pagineSamsungChandan SrivastavaNessuna valutazione finora

- Sun NXT: Available For Android and Ios Devices, Smart Tvs and Other DevicesDocumento2 pagineSun NXT: Available For Android and Ios Devices, Smart Tvs and Other DevicesChandan SrivastavaNessuna valutazione finora

- One PlusDocumento8 pagineOne PlusChandan SrivastavaNessuna valutazione finora

- C. & J. ClarkDocumento13 pagineC. & J. ClarkChandan SrivastavaNessuna valutazione finora

- MX Player 3Documento2 pagineMX Player 3Chandan SrivastavaNessuna valutazione finora

- Hoichoi 8Documento2 pagineHoichoi 8Chandan SrivastavaNessuna valutazione finora

- Task 2 - The Nature of Linguistics and LanguageDocumento8 pagineTask 2 - The Nature of Linguistics and LanguageValentina Cardenas VilleroNessuna valutazione finora

- Sportex 2017Documento108 pagineSportex 2017AleksaE77100% (1)

- What A Wonderful WorldDocumento2 pagineWhat A Wonderful WorldDraganaNessuna valutazione finora

- Earnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisDocumento2 pagineEarnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisSelina González HerreraNessuna valutazione finora

- DODGER: Book Club GuideDocumento2 pagineDODGER: Book Club GuideEpicReadsNessuna valutazione finora

- Indiabix PDFDocumento273 pagineIndiabix PDFMehedi Hasan ShuvoNessuna valutazione finora

- RulesDocumento508 pagineRulesGiovanni MonteiroNessuna valutazione finora

- E-Governance Horizon Report 2007 PDFDocumento240 pagineE-Governance Horizon Report 2007 PDFtouhedurNessuna valutazione finora

- Did Angels Have WingsDocumento14 pagineDid Angels Have WingsArnaldo Esteves HofileñaNessuna valutazione finora

- Cotton Pouches SpecificationsDocumento2 pagineCotton Pouches SpecificationspunnareddytNessuna valutazione finora

- Tateni Home Care ServicesDocumento2 pagineTateni Home Care ServicesAlejandro CardonaNessuna valutazione finora

- Accountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesDocumento10 pagineAccountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesJEROME ORILLOSANessuna valutazione finora

- How To Use The ActionDocumento3 pagineHow To Use The Actioncizgiaz cizgiNessuna valutazione finora

- Acitve and Passive VoiceDocumento3 pagineAcitve and Passive VoiceRave LegoNessuna valutazione finora

- The Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Documento3 pagineThe Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Astry Iswara Kelana CitraNessuna valutazione finora

- Saln 1994 FormDocumento3 pagineSaln 1994 FormJulius RarioNessuna valutazione finora

- Harper 2001Documento6 pagineHarper 2001Elena GologanNessuna valutazione finora

- Powerpoints 4 4up8Documento9 paginePowerpoints 4 4up8Ali KalyarNessuna valutazione finora

- January Payslip 2023.pdf - 1-2Documento1 paginaJanuary Payslip 2023.pdf - 1-2Arbaz KhanNessuna valutazione finora

- Robot 190 & 1110 Op - ManualsDocumento112 pagineRobot 190 & 1110 Op - ManualsSergeyNessuna valutazione finora

- Bakery Management SynopsisDocumento13 pagineBakery Management SynopsisSHiVaM KRNessuna valutazione finora

- Grade 10 Science - 2Documento5 pagineGrade 10 Science - 2Nenia Claire Mondarte CruzNessuna valutazione finora

- COSL Brochure 2023Documento18 pagineCOSL Brochure 2023DaniloNessuna valutazione finora

- Pre-Boarding Announcement Skill Focus: ListeningDocumento5 paginePre-Boarding Announcement Skill Focus: ListeningJony SPdNessuna valutazione finora

- Agitha Diva Winampi - Childhood MemoriesDocumento2 pagineAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNessuna valutazione finora

- Corrugated Board Bonding Defect VisualizDocumento33 pagineCorrugated Board Bonding Defect VisualizVijaykumarNessuna valutazione finora

- James Ellroy PerfidiaDocumento4 pagineJames Ellroy PerfidiaMichelly Cristina SilvaNessuna valutazione finora

- Rotation and Revolution of EarthDocumento4 pagineRotation and Revolution of EarthRamu ArunachalamNessuna valutazione finora

- PEDIA OPD RubricsDocumento11 paginePEDIA OPD RubricsKylle AlimosaNessuna valutazione finora

- Soal Pas Myob Kelas Xii GanjilDocumento4 pagineSoal Pas Myob Kelas Xii GanjilLank BpNessuna valutazione finora