Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bullwhip

Caricato da

wuryaningDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bullwhip

Caricato da

wuryaningCopyright:

Formati disponibili

The Bullwhip Effect

P&G

Procter & Gamble (P&G) examined order patterns

for Pampers.

Its sales at retail stores were fluctuating, but the variability

was not excessive.

For the distributors' orders, P&G was surprised by the

greater degree of variability.

When they looked at P&G's orders of materials to their

suppliers, such as 3M, the swings were even greater.

While babies consumed diapers at a steady rate, the

demand order variability in the supply chain was

amplified as we move up the supply chain. P&G

called this phenomenon the "bullwhip" effect.

Bullwhip

As we move further away from the

end-customer in the supply chain,

1. Distortion in demand information,

2. Increase in variance of orders

Information Coordination: The

Bullwhip Effect

Consumer Sales at Retailer

0

100

200

300

400

500

600

700

800

900

1000

1

3

5

7

9

1

1

1

3

1

5

1

7

1

9

2

1

2

3

2

5

2

7

2

9

3

1

3

3

3

5

3

7

3

9

4

1

C

o

n

s

u

m

e

r

d

e

m

a

n

d

Retailer's Orders to Wholesaler

0

100

200

300

400

500

600

700

800

900

1000

1

3

5

7

9

1

1

1

3

1

5

1

7

1

9

2

1

2

3

2

5

2

7

2

9

3

1

3

3

3

5

3

7

3

9

4

1

R

e

t

a

i

l

e

r

O

r

d

e

r

Wholesaler's Orders to Manufacturer

0

100

200

300

400

500

600

700

800

900

1000

1

3

5

7

9

1

1

1

3

1

5

1

7

1

9

2

1

2

3

2

5

2

7

2

9

3

1

3

3

3

5

3

7

3

9

4

1

W

h

o

l

e

s

a

l

e

r

O

r

d

e

r

Manufacturer's Orders with Supplier

0

100

200

300

400

500

600

700

800

900

1000

1

4

7

1

0

1

3

1

6

1

9

2

2

2

5

2

8

3

1

3

4

3

7

4

0

M

a

n

u

f

a

c

t

u

r

e

r

O

r

d

e

r

Causes of the Bullwhip

Effect

Best illustration of the bullwhip effect is "beer game."

Participants play the roles of customers, retailers, wholesalers,

and suppliers of a popular brand of beer.

They cannot communicate with each other and must make

order decisions based only on orders from the next downstream

player.

The ordering patterns share a common, recurring theme: the

variability of an upstream site is always greater than

those of the downstream site, a simple, yet powerful

illustration of the bullwhip effect.

the bullwhip effect is a consequence of the players' rational

behavior within the supply chains infrastructure.

Customer

Retailer

Manufact.

Supplier

Distributor

So What?

When a supply chain is plagued with a

bullwhip effect and demand information

is distorted,

It results in

excessive inventory

poor product forecasts

insufficient or excessive capacities

poor customer service

Uncertain and costly production

high costs for corrections (expedited shipments

and overtime)

General Techniques for Over-

coming the Bullwhip Effect

Electronic linkages

Information sharing

Better forecasts

Real-time updates

Lower costs of procurement

More frequent deliveries

Use of cheap electronic procurement

Consolidation of loads through 3rd party logistics

Stable prices

Eg, Everyday Low Pricing (EDLP)

Four major causes of the

bullwhip effect:

1. Demand forecast updating

2. Order batching

3. Price fluctuation

4. Rationing and shortage

gaming

1. Demand Forecast

Updating

Companies in a supply chain usually do their own

product forecasting

Forecasting is often based on the order history from

the company's immediate customers.

When a downstream operation places an order,

the upstream manager processes that information as a

signal about future product demand.

readjusts his/her demand forecasts and, in turn,

the orders with the upstream suppliers

The order sent to the supplier reflects

the amount needed to replenish the stocks to

meet the requirements of future demands,

as well as the necessary safety stocks.

With long lead times, it is not uncommon to have

weeks of safety stocks.

The result is that the fluctuations in the order

quantities to suppliers over time can be much greater

than the fluctuations in the demand data

2. Order Batching

In a supply chain, each company places

orders with an upstream organization using

some inventory monitoring or control.

Demands come in, depleting inventory, but the

company may not immediately place an

order with its supplier.

It often batches or accumulates demands before

issuing an order.

There are two forms of order batching:

economies of ordering and transport

push ordering

High Cost of Order Processing

Companies may order weekly, biweekly,

or even monthly.

the time and cost of processing an

order. P&G estimates customer ordering

to cost $35 - $75 to process.

Many manufacturers place purchase orders

with suppliers when they run their material

requirements planning (MRP) systems.

MRP systems are often run monthly.

slow-moving items may be ordered infrequently

Economics of Transportation

There are substantial differences

between full truckload (FTL) and

less-than-truckload (LTL) rates,

strong incentive to fill a truckload

when ordering from a supplier.

Full truckload could be a month or

more product

Salespeople are measured

quarterly or annually

Sales people fill sales quotas by

"borrowing" ahead.

Sign orders prematurely

company experiences regular surges in

demand.

orders "pushed" on it from customers

3. Price Fluctuation

forward buy constituted 80

percent of transactions between

manufacturers and distributors in

the grocery industry

due to attractive price.

Resulted in $75 billion to $100 billion

of inventory

Promotions

Manufacturers and distributors periodically

have special promotions and trade deals like

price discounts, quantity discounts, coupons,

rebates, etc.

The result is that customers buy in bigger

quantities that do not reflect their

immediate needs and stock up for the

future.

Results of Promotions

Factories run overtime at certain times and are

idle at others.

Companies pile huge inventories to anticipate big

demand swings.

With a surge in shipments, they may pay premium

freight rates.

Damage also increases due to larger-than-normal

volumes and stocking inventories for long periods.

Problems are self imposed

4. Rationing and Shortage

Gaming

When demand exceeds supply,

manufacturers may ration its product to

customers.

One method: allocates amounts amount in

proportion to the amount ordered.

For example, if the total supply is only 50 percent of the

total demand, all customers receive 50 percent of what

they order.

Knowing that, customers may exaggerate

their real needs.

If and when demand cools, orders will suddenly

be cancelled

How to

Counteract the

Bullwhip Effect

1. Avoid Multiple Demand

Forecast Updates

make downstream demand data available to the

upstream sites. Both sites can update their forecasts

with the same raw data.

IBM, HP, and Apple require sell-through data on

withdrawn stocks from their resellers' central

warehouse.

Not as complete as point-of-sale (POS) store data.

Electronic Data Interchange

(EDI)

Supply chain partners use electronic data

interchange (EDI) to share data.

In the consumer products industry, EDI is growing

in 1990, 20 percent of orders by retailers transmitted via

EDI.

In 1992, 40 percent and,

in 1995, nearly 60 percent.

The increasing use of EDI

facilitate information transmission

sharing among chain members

Now moving to the internet

Vendor-managed inventory (VMI) or

Continuous replenishment program (CRP)

Manufacturer or wholesaler has access to the demand and

inventory information at retailing sites (either POS or retail

warehouses)

Updates forecasts and resupplies the retail sites.

Retailers become a passive partners in supply chain.

Inventory reductions of up to 25 percent are common.

Many companies such as Campbell Soup, M&M/Mars,

Nestle, Quaker Oats, Nabisco, P&G, and Scott Paper use CRP

with some or most of their customers. P&G uses VMI in its

diaper supply chain, starting with its supplier, 3M, and

its customer, Wal-Mart.

Consumer direct" program

Apple Computer has a "consumer

direct" program

sells directly to consumers without

going through the reseller

Allows Apple to see directly the

demand patterns.

Dell does the same.

2. Break Order Batches

Devise strategies that lead to

smaller batches

more frequent resupply

Lower cost of ordering

EDI can reduce the cost of the paperwork in

generating an order.

Using EDI, Nabisco perform paperless, computer-assisted

ordering (CAO) and customers order more frequently.

McKesson uses EDI to lower the transaction costs from

orders by drugstores and other retailers.

P&G has introduced standardized ordering terms

across all business units to simplify the process and

dramatically cut the number of invoices.

General Electric is electronically matching buyers

and suppliers.

A paper purchase order that typically cost $50 to process is

now $5.

Transportation alternatives

Differences in the costs of full truckloads and

less-than- truckloads are great

Improvements in order efficiency are wasted due to the full-

truckload constraint.

Now some manufacturers induce their distributors to

order assortments of different products. Hence

a truckload may contain different products from the

same manufacturer instead of a full load of the same

product.

P&G has given discounts to distributors that are willing to

order mixed-SKU loads of any of its products.

Third-party logistics

Consolidate loads from multiple

suppliers located near each other

a company can realize full truckload

economies without the batches coming

from the same supplier.

3. Stabilize Prices

Reduce the frequency and the level of

wholesale price discounting.

The manufacturer can reduce the incentives

for retail forward buying by establishing a

uniform wholesale pricing policy.

P&G, Kraft, and Pillsbury have moved to an

everyday low price (EDLP) or value

pricing strategy

4. Eliminate Gaming in

Shortage Situations

Instead of allocating products based on

orders, allocate in proportion to past

sales.

Customers then have no incentive to

exaggerate their orders.

General Motors uses this method of

allocation in cases of short supply.

Potrebbero piacerti anche

- Subway SCMDocumento28 pagineSubway SCMzakuan7960% (5)

- The Shopping Revolution, Updated and Expanded Edition: How Retailers Succeed in an Era of Endless Disruption Accelerated by COVID-19Da EverandThe Shopping Revolution, Updated and Expanded Edition: How Retailers Succeed in an Era of Endless Disruption Accelerated by COVID-19Nessuna valutazione finora

- Acquisition (Pagtamo) Meaning-Making (Pag-Unawa) Transfer (Paglilipat)Documento2 pagineAcquisition (Pagtamo) Meaning-Making (Pag-Unawa) Transfer (Paglilipat)MAY BEVERLY MORALES100% (8)

- Barilla Spa Case FinalDocumento6 pagineBarilla Spa Case FinalRohitHarikrishnanNessuna valutazione finora

- Discussion Questions Solution Supply Chain ManagementDocumento4 pagineDiscussion Questions Solution Supply Chain Managementprince185100% (3)

- Discussion QuestionsDocumento60 pagineDiscussion QuestionsUmar Gondal100% (1)

- All The Wrong MovesDocumento13 pagineAll The Wrong Movesabhishek2006100% (1)

- Bullwhip Effect Cause RemedyDocumento2 pagineBullwhip Effect Cause Remedyurmahi69100% (1)

- Bull Whip EffectDocumento5 pagineBull Whip EffectNandhini RamanathanNessuna valutazione finora

- Fundamental of Logistics and Supply Chain ManagementDocumento8 pagineFundamental of Logistics and Supply Chain ManagementAparajith ShankarNessuna valutazione finora

- Notes - Bullwhip EffectDocumento4 pagineNotes - Bullwhip Effectmohitegaurv87100% (1)

- Bullwhip EffectDocumento5 pagineBullwhip EffectWeynshet TeklleNessuna valutazione finora

- Bullwhip EffectDocumento4 pagineBullwhip Effectiimt mgmtNessuna valutazione finora

- Below Mentioned Are The Supply Chain Strategies To Tame Bullwhip Effect: 1. Avoidance of Multiple Demand ForecastDocumento4 pagineBelow Mentioned Are The Supply Chain Strategies To Tame Bullwhip Effect: 1. Avoidance of Multiple Demand ForecastNavlika DuttaNessuna valutazione finora

- Bull Whip Effect ASsignmentDocumento5 pagineBull Whip Effect ASsignmentSajjad HanifNessuna valutazione finora

- Bullwhip EffectDocumento14 pagineBullwhip EffectPunitBeri100% (2)

- SCPM Assignment 1Documento11 pagineSCPM Assignment 1AnandhNessuna valutazione finora

- Unit 4Documento3 pagineUnit 4akash agarwalNessuna valutazione finora

- Bullwhip Effect: Logistics and Supply Chain ManagementDocumento13 pagineBullwhip Effect: Logistics and Supply Chain ManagementPooja PatilNessuna valutazione finora

- The Bullwhip Effect in HPs Supply ChainDocumento9 pagineThe Bullwhip Effect in HPs Supply ChainGhastLayer - Timelapse CommandsNessuna valutazione finora

- SCM Bullwhip EffectDocumento21 pagineSCM Bullwhip EffectvksdsatmNessuna valutazione finora

- Soft Computing and The Bullwhip Effect : Christer Carlsson and Robert FullérDocumento26 pagineSoft Computing and The Bullwhip Effect : Christer Carlsson and Robert FullérKksksk IsjsjNessuna valutazione finora

- The Bullwhip EffectDocumento14 pagineThe Bullwhip Effectankitaagarwal66Nessuna valutazione finora

- Bullwhip Effect in Supply Chain: Solution Suggested/available Leveraging On ICTDocumento13 pagineBullwhip Effect in Supply Chain: Solution Suggested/available Leveraging On ICTali_awaisNessuna valutazione finora

- The Bullwhip Effect in HPs Supply ChainDocumento9 pagineThe Bullwhip Effect in HPs Supply Chainsoulhudson100% (1)

- Analysis On Causes and Countermeasures of Bullwhip Effect: 2016 GCMMDocumento6 pagineAnalysis On Causes and Countermeasures of Bullwhip Effect: 2016 GCMMVanya IvanovaNessuna valutazione finora

- Critically Analyze The Bullwhip Effect (Autosaved) (361) (2305843009214657425)Documento11 pagineCritically Analyze The Bullwhip Effect (Autosaved) (361) (2305843009214657425)Christiane SylvaNessuna valutazione finora

- Caselets SCM - AnishDocumento13 pagineCaselets SCM - AnishAnish MathewNessuna valutazione finora

- What Is Bullwhip Effect?Documento2 pagineWhat Is Bullwhip Effect?Muddaser NawazNessuna valutazione finora

- Homework 1Documento2 pagineHomework 1Vlada KozintcevaNessuna valutazione finora

- 17-Supply Chain StrategyDocumento37 pagine17-Supply Chain Strategymanali VaidyaNessuna valutazione finora

- The Bullwhip Effect: Presented by Rajesh.K Sudarsan.SDocumento28 pagineThe Bullwhip Effect: Presented by Rajesh.K Sudarsan.SRajesh KasettyNessuna valutazione finora

- The Bullwhip EffectDocumento4 pagineThe Bullwhip Effectkumar_chandan85Nessuna valutazione finora

- 2 Bullwhip EffectDocumento26 pagine2 Bullwhip Effectkanika019Nessuna valutazione finora

- Bull-Whip Mitigation StrategieDocumento3 pagineBull-Whip Mitigation StrategieHariSharanPanjwaniNessuna valutazione finora

- Chopra and Meindl-Chapter 10Documento4 pagineChopra and Meindl-Chapter 10Abc AnalysisNessuna valutazione finora

- RepDocumento21 pagineRepMuhammad AshfaqNessuna valutazione finora

- QUESTION 5 - FinalDocumento6 pagineQUESTION 5 - FinalfdoloNessuna valutazione finora

- The Bullwhip Effect in Supply ChainDocumento6 pagineThe Bullwhip Effect in Supply ChainJOSE FRANCISCO SALAZAR MORALESNessuna valutazione finora

- Barilla SpaDocumento11 pagineBarilla Spavariapratik100% (1)

- MGT236 Power Point, Chapter04Documento21 pagineMGT236 Power Point, Chapter04Faisal KhanNessuna valutazione finora

- The BullWhip EffectDocumento4 pagineThe BullWhip EffectnaabbasiNessuna valutazione finora

- UNIT V Bull Whip EffectDocumento3 pagineUNIT V Bull Whip EffectMuchaelNessuna valutazione finora

- Bullwhip EffectDocumento8 pagineBullwhip Effectsatu20Nessuna valutazione finora

- Operarions AssignmentDocumento2 pagineOperarions AssignmentDiya JosephNessuna valutazione finora

- FinalAssignmentDocumento5 pagineFinalAssignmentAB BANessuna valutazione finora

- Supply ChainDocumento7 pagineSupply ChainBRIJESH VORANessuna valutazione finora

- Module IV Supply ChainDocumento38 pagineModule IV Supply Chain221910306046 Sai Pavan ThotaNessuna valutazione finora

- Coordination in Supply ChainDocumento8 pagineCoordination in Supply ChainWaqqar ChaudhryNessuna valutazione finora

- Bull WhipDocumento35 pagineBull WhipJanmejai BhargavaNessuna valutazione finora

- Bullwhip Effect: Uncertainty CausedDocumento25 pagineBullwhip Effect: Uncertainty Causedmohit0503100% (1)

- Explain in Depth The So Called Bullwhip Effect', Including Its Causes and Consequences. (20 Marks)Documento4 pagineExplain in Depth The So Called Bullwhip Effect', Including Its Causes and Consequences. (20 Marks)Tasher GondweNessuna valutazione finora

- No. Title Pages: Executive Summary 2 Why The Bullwhip Effect Is So Bad For Supply Chains and Companies 5Documento15 pagineNo. Title Pages: Executive Summary 2 Why The Bullwhip Effect Is So Bad For Supply Chains and Companies 5zakuan79Nessuna valutazione finora

- Consumption Driven ReplenishmentDocumento4 pagineConsumption Driven Replenishmentsappz3545448Nessuna valutazione finora

- Bull-Whip Effect: A Critical Analysis ofDocumento15 pagineBull-Whip Effect: A Critical Analysis ofHarsh ShahNessuna valutazione finora

- Creating PDFDocumento54 pagineCreating PDFselvainNessuna valutazione finora

- Supply Chain Management Sessions 11 - 21Documento38 pagineSupply Chain Management Sessions 11 - 21Shobhit TripathiNessuna valutazione finora

- Dynamics of Supply Chain: Understanding The "Bullwhip Effect"Documento30 pagineDynamics of Supply Chain: Understanding The "Bullwhip Effect"amitmathuramitNessuna valutazione finora

- Value Nets (Review and Analysis of Bovet and Martha's Book)Da EverandValue Nets (Review and Analysis of Bovet and Martha's Book)Nessuna valutazione finora

- Basic ProbabilityDocumento53 pagineBasic ProbabilityGhada SheashaNessuna valutazione finora

- 6.hydraulic Pressure SpesificationDocumento3 pagine6.hydraulic Pressure SpesificationTLK ChannelNessuna valutazione finora

- Etap - Relay CoordinationDocumento311 pagineEtap - Relay CoordinationManohar Potnuru100% (1)

- (H-EP) Expanded Perlite: Low Temperature and Cryogenic InsulationDocumento2 pagine(H-EP) Expanded Perlite: Low Temperature and Cryogenic InsulationKamesh KalgiNessuna valutazione finora

- Global Edge Interview ExperienceDocumento2 pagineGlobal Edge Interview Experienceshafi hasmaniNessuna valutazione finora

- Dilg-Mbcrpp Isf Q2 2023Documento2 pagineDilg-Mbcrpp Isf Q2 2023Mallari GabrielNessuna valutazione finora

- Ice Plant TrainerDocumento1 paginaIce Plant TrainerVirender RanaNessuna valutazione finora

- Dism Repair Tools PDFDocumento21 pagineDism Repair Tools PDFprashant4455Nessuna valutazione finora

- The Dilemma of The Last FilipinoDocumento12 pagineThe Dilemma of The Last FilipinoEunice Delos SantosNessuna valutazione finora

- Banumathy.D Updated Profile 1Documento7 pagineBanumathy.D Updated Profile 1engineeringwatchNessuna valutazione finora

- Eminence Deltalite II 2515Documento1 paginaEminence Deltalite II 2515Suto BandNessuna valutazione finora

- Case Study On Green MarketingDocumento7 pagineCase Study On Green MarketingAnonymous WucWqwNessuna valutazione finora

- Chapter 5 - Decision Making and LoopingDocumento94 pagineChapter 5 - Decision Making and LoopingAcapSuiNessuna valutazione finora

- Cummins ECM Reference NotesDocumento11 pagineCummins ECM Reference NotesjuanNessuna valutazione finora

- Agile Project ManagementDocumento109 pagineAgile Project ManagementSundar Varadarajan100% (1)

- BX Tuner ManualDocumento4 pagineBX Tuner ManualdanielthemanNessuna valutazione finora

- CRMDocumento15 pagineCRMPradeep ChintadaNessuna valutazione finora

- The Scientist PDFDocumento68 pagineThe Scientist PDFPetcu Adrian100% (1)

- Physics 23 Fall 1993 Lab 2 - Adiabatic Processes: PV NRTDocumento13 paginePhysics 23 Fall 1993 Lab 2 - Adiabatic Processes: PV NRTvipul ch v v n s sNessuna valutazione finora

- Yuli's PPT FloralDocumento28 pagineYuli's PPT FloralYuli MyeshaNessuna valutazione finora

- Plotting in MatlabDocumento7 paginePlotting in Matlabpride3351Nessuna valutazione finora

- NTSE MAT Chattisgarh Paper 2011 PDFDocumento14 pagineNTSE MAT Chattisgarh Paper 2011 PDFKareena GuptaNessuna valutazione finora

- Normas ISO TelecomunicacionesDocumento38 pagineNormas ISO Telecomunicacionesjolao AlmeidaNessuna valutazione finora

- Current Volt Meter Ina219Documento40 pagineCurrent Volt Meter Ina219sas999333Nessuna valutazione finora

- Overboard Dump ValveDocumento3 pagineOverboard Dump ValveekabudiartiNessuna valutazione finora

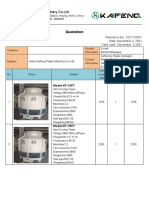

- KAIFENG Quotation For 150T Cooling TowerDocumento13 pagineKAIFENG Quotation For 150T Cooling TowerEslam A. FahmyNessuna valutazione finora

- Revised Runway Length Discussion (20171206) - 201712211212022318Documento3 pagineRevised Runway Length Discussion (20171206) - 201712211212022318Ilham RaffiNessuna valutazione finora

- TIA Workshop ITBDocumento48 pagineTIA Workshop ITBFirman Suhendra100% (1)