Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ryanair 2

Caricato da

Saurav DashDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ryanair 2

Caricato da

Saurav DashCopyright:

Formati disponibili

Ryanair (A) & (B)

Key Take-Aways

Haas School of Business

University of California,

Berkeley

How can we anticipate competitors moves?

Ryanair vs Aer Lingus / BA

Will these players retaliate against Ryanair? If so, how?

Given the assumption of retaliation, should Ryanair enter? If

so, how?

How can we anticipate competitors moves?

Game Theory

Identify structure of the game that is being played

In static setting, predicts limited competitive response of AL /

BA to Ryanairs entry---but its a close call

With targeted response, retaliation starts to look attractive

With non-pecuniary incentives, retaliation starts to look attractive

Competitor analysis

Develop model of pecuniary and non-pecuniary incentives,

views of the game, etc. based on Competitor response

profile

Competitor analysis

Competitor analysis can be helpful in anticipating

competitor moves

A competitor profile includes an assessment of a competitors

strengths and weaknesses, its strategic intent, and its

behavioral predispositions

Competitor analysis is inherently qualitative

Complements quantitative analyses

Competitor analysis (II)

Questions to ask:

What are the goals of my competitor?

May be different from pure greed (profit maximization)

What is the strategy of my competitor?

Do the prior strategic actions (or statements) of the competitor suggest a

direction that the competitor now might take?

What are the resources and capabilities of my competitor?

Does the competitor have a particular set of strengths or weaknesses

that might make some of its reactions more or less likely to succeed?

What assumptions is the competitor making about the

business?

Competitors may hold a set of assumptions about the industry that lead it

to make systematically different choices from the ones that you would

make, were you in their shoes

A Framework for Competitor Analysis

Source: Michael E. Porter, Competitive Strategy, p. 49

What the Competitor Is Doing

and Can Do

What Drives the Competitor

Future Goals

At all levels of management

and in multiple dimensions

Current Strategy

How the business is

currently competing

Capabilities

Both strengths

and weaknesses

Assumptions

Held about itself

and the industry

Competitors Response Profile

Is the competitor satisfied with

its current position?

What likely moves or strategy

shifts will the competitor make?

Where is the competitor

vulnerable?

What will provoke the greatest

and most effective retaliation by

the competitor?

Competitor profile of British Airways (1986)

Goals

Successful flotation /

privatization

Key step for Thatchers program

Focus on near term profitability

Resources and Capabilities

Government interest

Heathrow

Extensive network

Reputation for safe, reliable

service; improving reputation for

customer service

(neg) still operationally inefficient

(neg) needs capex to upgrade

intl fleet

Strategy

Differentiation in service: The

worlds favorite airline

Focus on business class

customers

Assumptions

Competition is coming to Europe

BA will benefit from airline de-

regulation in Europe given

extensive international

experience

What does this tell us about how BA is likely to respond?

Competitor profile of Aer Lingus (1986)

Goals

Safety, efficiency, reliability, and

profitability

Promote national interests

Resources and Capabilities

Government backing

Reputation & reliability among

Irish

Established operations in EU,

Boston, NY

Shannon airfield

Technical skills that other airlines

need

(neg) inefficient

(neg) needs capex

Strategy

Break even on air services and

profit from diversification

Provide service levels

comparable to flag carriers

Assumptions

Airline service is a public good

government will pay

One true way to run an airline

Airlines cooperate

Gentlemanly competition

What does this tell us about how AL is likely to respond?

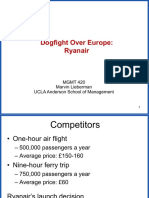

Ryanairs 1986 entry strategy

Initial success

100% load factor on Dublin-London Route

AL & BA dropped restricted fares to I95 vs. Ryanairs I95

unrestricted fare: a rather mild reaction

Positive press managers believed they had a winning strategy

Expansion

27 routes; 5 jets by 1991

rapidly increasing customer volumes

strategy: driven by customer service

Aer Lingus responds

matches prices, increases capacity on routes served by Ryanair

Problems with Ryanairs 1986 entry strategy

Limited cost advantage

in high fixed cost, low marginal cost industries competition is

intense for incremental customers

even though Ryanair may have had a cost advantage, AL was willing to

produce below average costs (but above marginal costs) to pay off fixed

costs

AL had deeper pockets and other sources of profit

No service advantage

first rate customer service no difference from BA or AL

potential disadvantages

flying into Luton rather than Gatwick or Heathrow

flying turboprops rather than jets

A me-too strategy

In the words of Porter, Ryanair attempted to compete

on operational effectiveness without making any

explicit tradeoffs

we tried to be all things to all people Kevin Osborne, CFO,

Ryanair (B) case

Not differentiated and not enough of a cost advantage

to profit from the restructuring of the industry that they

began

Comparison to Dells Entry

Compaq was very strong in retail. A new marketing

an distribution strategy was something new, however.

--- Michael Dell

Dells entry:

Not head-to-head with established players

Achieved significant variable cost advantage (7 versus 65

days inventory)

Stealth strategy --- direct channel undervalued by

established players

Ryanair rising from the ashes

OLeary, 29, appointed Deputy CEO

No one else was left to take the position

Focus on cost reduction & cash generation

Drop loss-making routes

No in-flight amenities

Renegotiated labor contracts to pay based on productivity

Emphasized duty-free sales

Become 1/3 of flight attendant compensation

Sell advertisements on seat-backs

Goal: become a low-cost, low-fare airline

Senior managers visit Herb Kelleher at Southwest

Even more frugal than Southwest

No free snacks or drinks

Not even peanuts!

No air bridges linking plans with airport terminals

All boarding via metal stairs

No frequent flier program

Average fare falls to I42 / passenger

Average cost ~ I25

In 1999, OLeary claimed marginal cost was - I2

Ryanairs Route Map Today

http://www.ryanair.com/site/EN/dests.php?flash=yes

Relative Efficiency of Major Airlines

Employees

(approx)

Revenue per

employee (est)

Market Value of

Equity

Ryanair 2,302 Euro 450,000 $6.7 Billion

Southwest 31,011 $210,570 $11.3 Billion

Continental 38,255 $254,607 $855 Million

Delta 69,150 $217,919 $566 Million

Strategy or being on the right side of history i.e., luck?

Potrebbero piacerti anche

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityDa EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNessuna valutazione finora

- Jet AirwaysDocumento11 pagineJet AirwaysAnonymous tgYyno0w6Nessuna valutazione finora

- RyanairDocumento8 pagineRyanairAkshay GargNessuna valutazione finora

- Ryanair Case Analysis Group 03 Mm01 r1Documento24 pagineRyanair Case Analysis Group 03 Mm01 r1cksharma68Nessuna valutazione finora

- Analysis of Ryanair's Competitive Advantages - 2009Documento22 pagineAnalysis of Ryanair's Competitive Advantages - 2009spinster4Nessuna valutazione finora

- Presentation 1Documento18 paginePresentation 1Athar Shafi50% (2)

- MKT - Group 7 - Ryanair - Case AnalysisDocumento4 pagineMKT - Group 7 - Ryanair - Case AnalysisSwetha PinisettiNessuna valutazione finora

- Dogfight Over EuropeDocumento41 pagineDogfight Over EuropeAndrew NeuberNessuna valutazione finora

- Competitive AdvantageDocumento31 pagineCompetitive AdvantageSohrab Ali ChoudharyNessuna valutazione finora

- 2014-05-07 - Cinema Operator Industry Report May 2014 PDFDocumento27 pagine2014-05-07 - Cinema Operator Industry Report May 2014 PDFAnonymous 45z6m4eE7p100% (1)

- Case Study On RyanairDocumento3 pagineCase Study On RyanairMohd AfhsarNessuna valutazione finora

- Marketing Assingment: Dominion Motors & Controls Case StudyDocumento4 pagineMarketing Assingment: Dominion Motors & Controls Case StudyParas JatanaNessuna valutazione finora

- Dogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KDocumento7 pagineDogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KViswas10000% (1)

- Marketing Failed ProductDocumento3 pagineMarketing Failed ProducthmganatraNessuna valutazione finora

- Ryanair AnalysisDocumento6 pagineRyanair AnalysisAlexmaster92Nessuna valutazione finora

- Adolph Coors in The Brewing IndustryDocumento2 pagineAdolph Coors in The Brewing Industrysamadabbas00275% (4)

- Dogfight Over EuropeDocumento3 pagineDogfight Over Europesourav goyalNessuna valutazione finora

- Nucleon, Inc.: June 28th, 2019 - Group 5 - Bishwadeep - Gulshan - Mitali - RaghaviDocumento12 pagineNucleon, Inc.: June 28th, 2019 - Group 5 - Bishwadeep - Gulshan - Mitali - RaghaviGulshan DhananiNessuna valutazione finora

- The Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatDocumento5 pagineThe Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatAninda DuttaNessuna valutazione finora

- Industrial Organization How Is The U.S. American Fast Food Industry StructuredDocumento10 pagineIndustrial Organization How Is The U.S. American Fast Food Industry StructuredLaura SchulzNessuna valutazione finora

- SouthWest AirlinesDocumento15 pagineSouthWest AirlinesKaushal RaiNessuna valutazione finora

- Deere & Company Industrial Equipment Operations: Group 6Documento7 pagineDeere & Company Industrial Equipment Operations: Group 6SiddharthSaraswatNessuna valutazione finora

- Dms - Group 4 - La Maison SimonsDocumento8 pagineDms - Group 4 - La Maison SimonsGupta VishuNessuna valutazione finora

- CASE26 SouthwestDocumento12 pagineCASE26 SouthwestAdmar J. Junior100% (2)

- BMW PPT FinalDocumento27 pagineBMW PPT FinalSambit RoyNessuna valutazione finora

- Case AnalysisDocumento12 pagineCase AnalysisBeverly Goh50% (2)

- Southwest Airlines - HR InitiativesDocumento7 pagineSouthwest Airlines - HR InitiativesKaran TripathiNessuna valutazione finora

- Logan - Case Wirteup - FinalDocumento6 pagineLogan - Case Wirteup - FinalchandranveNessuna valutazione finora

- Daimler - ChryslerDocumento18 pagineDaimler - ChryslerAnika VarkeyNessuna valutazione finora

- Ryan Air CaseDocumento4 pagineRyan Air Casedfglbld0% (1)

- Jetblue'S Decision To Add E190 To Its Fleet. Agree?: Advantages DisadvantagesDocumento1 paginaJetblue'S Decision To Add E190 To Its Fleet. Agree?: Advantages DisadvantagesAkhil Goutham KotiniNessuna valutazione finora

- Haier Q1Documento3 pagineHaier Q1Chandan Bharambe100% (1)

- Amazon Vase Competitive StrategyDocumento1 paginaAmazon Vase Competitive StrategyAdityaNessuna valutazione finora

- Case Analysis - Hutchison WhampoaDocumento11 pagineCase Analysis - Hutchison WhampoaUtsav DubeyNessuna valutazione finora

- Virgin Mobile Pricing and Launch in UsaDocumento5 pagineVirgin Mobile Pricing and Launch in UsaHiamanshu SinghNessuna valutazione finora

- 6 Chosen Competitive Strategy-UpdatedDocumento46 pagine6 Chosen Competitive Strategy-UpdatedAmmarah KhanNessuna valutazione finora

- NITC Transcripts Form PDFDocumento2 pagineNITC Transcripts Form PDFSheri Abhishek ReddyNessuna valutazione finora

- Ducati Marketing Case StudyDocumento12 pagineDucati Marketing Case StudyGokul ChhabraNessuna valutazione finora

- Ryanair Case StudyDocumento14 pagineRyanair Case StudyLolsi SanturdzhiyanNessuna valutazione finora

- American AirlinesDocumento3 pagineAmerican AirlinesSushma Chitradurga SrinivasNessuna valutazione finora

- The Failure of Amazon in Chinese Market and Prediction For Emerging MarketDocumento11 pagineThe Failure of Amazon in Chinese Market and Prediction For Emerging MarketDo Thu Huong50% (2)

- American Airlines Value PricingDocumento19 pagineAmerican Airlines Value PricingPedro José ZapataNessuna valutazione finora

- Group 04-IndiaMart IPO Case AnalysisDocumento23 pagineGroup 04-IndiaMart IPO Case AnalysisakshayNessuna valutazione finora

- WeikingDocumento11 pagineWeikingVamsi GunturuNessuna valutazione finora

- Jetblue Airways 609046-PDF-ENG - Case StudyDocumento9 pagineJetblue Airways 609046-PDF-ENG - Case StudyvikramNessuna valutazione finora

- Foxy Originals Case StudyDocumento7 pagineFoxy Originals Case StudyJoshua NyabindaNessuna valutazione finora

- Fisher Price CaseDocumento6 pagineFisher Price CasegulrukhhinaNessuna valutazione finora

- 02 Kitty-Hawk Case NotesDocumento2 pagine02 Kitty-Hawk Case NotesGary Putra RizaldyNessuna valutazione finora

- The One-World Airline AllianceDocumento4 pagineThe One-World Airline AllianceAthena Hdz GuerraNessuna valutazione finora

- TDC Case FinalDocumento3 pagineTDC Case Finalbjefferson21Nessuna valutazione finora

- Ryanair StrategyDocumento18 pagineRyanair StrategyRitu RajNessuna valutazione finora

- Case Analysis..Go GlobalDocumento4 pagineCase Analysis..Go Globalशशांक पाण्डे0% (1)

- Ryanair Case Study AnalysisDocumento5 pagineRyanair Case Study Analysisbinzidd00767% (3)

- Taking FlyhtDocumento6 pagineTaking FlyhtAmandeep AroraNessuna valutazione finora

- Ryan Air FinalDocumento32 pagineRyan Air FinalBir Bahadur Singh100% (1)

- Case External Analysis The Us Airline IndustryDocumento2 pagineCase External Analysis The Us Airline IndustryPenujakIPJB0% (1)

- Apple Case Study Competitive StrategyDocumento2 pagineApple Case Study Competitive StrategyNaman HegdeNessuna valutazione finora

- Dell Case Analysis DraftDocumento18 pagineDell Case Analysis DraftAnil TripathiNessuna valutazione finora

- Ryanair 2Documento16 pagineRyanair 2Sid AryanNessuna valutazione finora

- Ryanair (A) & (B) : Key Take-Aways Haas School of Business University of California, BerkeleyDocumento16 pagineRyanair (A) & (B) : Key Take-Aways Haas School of Business University of California, BerkeleyAndrew NeuberNessuna valutazione finora

- MRSUTRIALQ1G08Documento2 pagineMRSUTRIALQ1G08Saurav DashNessuna valutazione finora

- Size of The Industry-The Total Banking Sector Assets Have Reached USD 1.8 Trillion in FYDocumento4 pagineSize of The Industry-The Total Banking Sector Assets Have Reached USD 1.8 Trillion in FYSaurav DashNessuna valutazione finora

- Team Radicals Abhishek Jain Himanshu Mehta: Triveni Group Case ChallengeDocumento10 pagineTeam Radicals Abhishek Jain Himanshu Mehta: Triveni Group Case ChallengeSaurav DashNessuna valutazione finora

- Thermal Performance of Sg10 Boiler: Prepared By: Ashutosh Kumar Singh (Ax2616) 3 Year, Chemical EngineeringDocumento34 pagineThermal Performance of Sg10 Boiler: Prepared By: Ashutosh Kumar Singh (Ax2616) 3 Year, Chemical EngineeringSaurav DashNessuna valutazione finora

- BT10CHE065Documento1 paginaBT10CHE065Saurav DashNessuna valutazione finora

- SKI Report2008 - 50 2Documento46 pagineSKI Report2008 - 50 2nada safitriNessuna valutazione finora

- Cambridge IGCSE: BIOLOGY 0610/31Documento20 pagineCambridge IGCSE: BIOLOGY 0610/31Balachandran PalaniandyNessuna valutazione finora

- Chapter 2-EER and Relational Database SchemaDocumento146 pagineChapter 2-EER and Relational Database Schemagirmay tadeseNessuna valutazione finora

- Activity 2Documento2 pagineActivity 2cesar jimenezNessuna valutazione finora

- (Applied Logic Series 15) Didier Dubois, Henri Prade, Erich Peter Klement (Auth.), Didier Dubois, Henri Prade, Erich Peter Klement (Eds.) - Fuzzy Sets, Logics and Reasoning About Knowledge-Springer NeDocumento420 pagine(Applied Logic Series 15) Didier Dubois, Henri Prade, Erich Peter Klement (Auth.), Didier Dubois, Henri Prade, Erich Peter Klement (Eds.) - Fuzzy Sets, Logics and Reasoning About Knowledge-Springer NeAdrian HagiuNessuna valutazione finora

- 10 Chapter 3Documento29 pagine10 Chapter 3felefel100% (1)

- Project Dayan PrathaDocumento29 pagineProject Dayan PrathaSHREYA KUMARINessuna valutazione finora

- Dubai TalesDocumento16 pagineDubai Talesbooksarabia100% (2)

- Read Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallDocumento1 paginaRead Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallKJRNessuna valutazione finora

- Contoh Pidato Bahasa Inggris Dan Terjemahannya Untuk SMPDocumento15 pagineContoh Pidato Bahasa Inggris Dan Terjemahannya Untuk SMPAli Husein SiregarNessuna valutazione finora

- Mee2006 QaDocumento80 pagineMee2006 QaJames Stallins Jr.100% (1)

- Medical Surgical Nursing Nclex Questions 5Documento18 pagineMedical Surgical Nursing Nclex Questions 5dee_day_8Nessuna valutazione finora

- Awakening The Journalism Skills of High School StudentsDocumento3 pagineAwakening The Journalism Skills of High School StudentsMaricel BernalNessuna valutazione finora

- Presente Progresive TenseDocumento21 paginePresente Progresive TenseAriana ChanganaquiNessuna valutazione finora

- Occupant Response To Vehicular VibrationDocumento16 pagineOccupant Response To Vehicular VibrationAishhwarya Priya100% (1)

- Tutor InvoiceDocumento13 pagineTutor InvoiceAbdullah NHNessuna valutazione finora

- Verbal Reasoning TestDocumento3 pagineVerbal Reasoning TesttagawoNessuna valutazione finora

- Exposicion Verbos y AdverbiosDocumento37 pagineExposicion Verbos y AdverbiosmonicaNessuna valutazione finora

- National Formulary of Unani Medicine Part Ia-O PDFDocumento336 pagineNational Formulary of Unani Medicine Part Ia-O PDFMuhammad Sharif Janjua0% (1)

- Hydrozirconation - Final 0Documento11 pagineHydrozirconation - Final 0David Tritono Di BallastrossNessuna valutazione finora

- Literature Review LichenDocumento7 pagineLiterature Review LichenNur Fazrina CGNessuna valutazione finora

- Berms For Stablizing Earth Retaining Structures: Youssef Gomaa Youssef Morsi B.SC., Civil EngineeringDocumento212 pagineBerms For Stablizing Earth Retaining Structures: Youssef Gomaa Youssef Morsi B.SC., Civil EngineeringChan KNessuna valutazione finora

- ch09 (POM)Documento35 paginech09 (POM)jayvee cahambingNessuna valutazione finora

- Read Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFDocumento2 pagineRead Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFSonali Kadam100% (1)

- MGMT 400-Strategic Business Management-Adnan ZahidDocumento5 pagineMGMT 400-Strategic Business Management-Adnan ZahidWaleed AhmadNessuna valutazione finora

- Tfa Essay RubricDocumento1 paginaTfa Essay Rubricapi-448269753Nessuna valutazione finora

- DLL Template MathDocumento3 pagineDLL Template MathVash Mc GregorNessuna valutazione finora

- A Guide To FractionsDocumento18 pagineA Guide To FractionsAnnelyanne RufinoNessuna valutazione finora

- What Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsDocumento149 pagineWhat Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsCometa Halley100% (1)

- Q4-ABM-Business Ethics-12-Week-1Documento4 pagineQ4-ABM-Business Ethics-12-Week-1Kim Vpsae0% (1)