Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

282120417

Caricato da

Ashwin Ramesh0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni18 paginegood

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentogood

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni18 pagine282120417

Caricato da

Ashwin Rameshgood

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 18

What are non performing assets:

Non performing assets means a credit facility in

respect of which the interest or installment has

remained due for a specific period.

The credit facility given by the bank ceases to

generate income for bank is termed as non

performing asset.

The RBI has issued guidelines for provision for loss

on advances or credit facilities by the banks .

Classification of Non performing assets:

Substandard assets:

The amount of advance which is not exceeding

18 months is considered as substandard assets.

The security available to the bank is

inadequate.

The bank will suffer loss if the deficiencies are

not corrected immediately.

Doubtful assets:

The amount of advance which is due for period

exceeding 18 months is considered as doubtful

assets.

This type of asset is considered as weak as its

collection is improbable.

For this purpose the unsecured and secured

portions are to be considered.

Loss assets:

The amount of advance which is

identified by the bank but which is not

yet written off.

The bank must write off the loss assets

even though there is remote possibility of

recovery of certain amount.

Fund based:

Term loan:

The bank advances a lump sum amount for a

certain period at an agreed rate of interest.

The entire amount is credited to the borrower.

The interest is charged for the full amount of

loan.

Term loan may be medium term or long term.

Short Term And Medium Term:

Banks provide short term credit to the banks.

They have also started providing medium term

loans to the business.

The loan once repaid in full cannot be drawn

again by the borrower unless the bank sanctions a

fresh loan.

The short term and medium term loans are

granted for meeting the working capital

requirements.

Short term and medium term loans are granted

from a period of one year to five years.

Long term loans:

Long term loans vary from a period of five years to

twenty five years.

The rate of interest is higher on such loans.

There is a certain loan agreement Which protects the

interest of the loan and binds the company(Borrower).

Cash credit:

It is an arrangement by which the borrower is allowed

to borrow up to a certain limit.

It is an arrangement for long term and medium term

and the borrower need not draw the sanctioned

amount at once.

He can draw the loan amount as and when required.

Cash credit is a running account to which deposits and

withdrawals can be made.

Interest is charged only on the amount drawn.

The arrangement for loans can be made

against the goods.

It is a more favorable form of loan.

Export Import financing:

Every business requires finance

Export finance refers to the finance of the

goods from the home country to the importers

port.

The export financing begins as soon as an

export order is received an d accepted.

The importer sometimes purchases the goods on payment of cash in

advance.

On many occasions payments are made on shipment of goods.

Thus the importer needs finance for importing goods.

Export finance means the credit required by the exporters for

financing their export transactions from the time of getting export

order to the time of full realization of payment from the importer.

Importers also need finance for making payments for their

imports.

Rural financing:

Agriculture is the back bone of the Indian

economy.

Being the largest industry, it provides

employment to the total workforce of the

country.

The financial requirements of the farmers is

known rural credit.

Rural credit can be classified into three

categories on the basis of time.

Short term credit is required for the purpose of

seeds,fertilizers,pesticides,fodder of live stock,

payment to labourers,marketing of agricultural

products.

The period of this credit is less than 15 months.

Medium term loans are generally used for the purpose

of purchasing cattle,equipments,repairs and

reconstruction.

The period of such credit ranges from 15 months to 5

years.

Long term loans are provided for improvement of

land, digging of tube wells, repayment of old debts.

The period of this loan is more than 5 years.

Rural credit needs of the farmer can be classified into

productive and nonproductive

Productive needs are

seeds,fertilizers,equipments,livestock,repairs,pay

ments.

At the time of floods,draughts,crops are

destroyed and the farmers need to take loan

for their consumption.

Farmers also require loan for marriages,

festivals etc.

Bank guarantee:

A Bank guarantee is defined under section 126 of the Indian

contract act 1872 as A contract to perform the promise or

discharge the liability of the third person on case of default.

The person who gives the guarantee is called the surety.

The person in respect of whose default the guarantee is given

is called the principal debtor.

The person to whom the guarantee is given is called the

creditor.

The bank extends guarantee on behalf of their clients.

The following are the different types of guarantees a

bank is required to issue.

Financial guarantees:

The bank guarantees its customers credit worthiness.

The financial guarantees are typically issued for the

following purposes.

In lieu of retention money, tender deposit.

Issue to the government department for releasing

disputed claim.

Performance guarantee:

The bank guarantees obligations that relate to

the technical,managerial,administrative

experience capacity of the customer.

Performance guarantees cover the following:

For performance of machinery.

For satisfied performance of projects for a

specified period.

Shipping guarantee:

A bank is requested to issue a shipping

guarantee.

This is issued only on behalf of very

respectable customers and against 100%

margin.

the shipping company agrees to deliver the

goods against the production of bank

guarantee.

Potrebbero piacerti anche

- Data CompatibilityDocumento1 paginaData CompatibilityAshwin RameshNessuna valutazione finora

- FDI Is ImportantDocumento3 pagineFDI Is ImportantAshwin RameshNessuna valutazione finora

- Data CompatibilityDocumento1 paginaData CompatibilityAshwin RameshNessuna valutazione finora

- CRM AshishDocumento3 pagineCRM AshishAshwin RameshNessuna valutazione finora

- SM7 Ch01 IntroductionDocumento23 pagineSM7 Ch01 IntroductioncatyamatNessuna valutazione finora

- E Guys These R D Case Stdies of RM For SDocumento1 paginaE Guys These R D Case Stdies of RM For SAshwin RameshNessuna valutazione finora

- E Guys These R D Case Stdies of RM For SDocumento1 paginaE Guys These R D Case Stdies of RM For SAshwin RameshNessuna valutazione finora

- CCCC CCCDocumento1 paginaCCCC CCCAshwin RameshNessuna valutazione finora

- CCCC CCCDocumento1 paginaCCCC CCCAshwin RameshNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

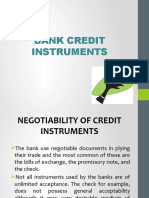

- Bank Credit Instruments-Fm122Documento27 pagineBank Credit Instruments-Fm122Jade Solante Cervantes100% (1)

- Negotiable Instruments - Meaning, Types & UsesDocumento3 pagineNegotiable Instruments - Meaning, Types & UsesQuishNessuna valutazione finora

- Building an Islamic Venture Capital ModelDocumento12 pagineBuilding an Islamic Venture Capital ModelNader MehdawiNessuna valutazione finora

- CF Chapter 4Documento25 pagineCF Chapter 4ASHWIN MOHANTYNessuna valutazione finora

- Chap 009Documento19 pagineChap 009van tinh khucNessuna valutazione finora

- 09304079.pdf New Foreign PDFDocumento44 pagine09304079.pdf New Foreign PDFJannatul FerdousNessuna valutazione finora

- NHC Invites Bids for Housing ConstructionDocumento2 pagineNHC Invites Bids for Housing ConstructionGladys Bernabe de VeraNessuna valutazione finora

- Mozambique Travel Guide - Getting to Vilanculos & General InfoDocumento3 pagineMozambique Travel Guide - Getting to Vilanculos & General InfocharleneNessuna valutazione finora

- Global Insurance+ Review 2012 and Outlook 2013 14Documento36 pagineGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraNessuna valutazione finora

- UnclaimedProperty2014 - Glenburn, Levant, Kenduskeag, Corinth MaineDocumento10 pagineUnclaimedProperty2014 - Glenburn, Levant, Kenduskeag, Corinth MaineMaineHouseGOP2Nessuna valutazione finora

- Configuration of SAP Special GLDocumento20 pagineConfiguration of SAP Special GLAtulWalvekar100% (3)

- Baglihar Hep Stage-I: Annual Revenue Requirement (ARR) Tariff Petition FY 2009-10 FY 2010-11Documento48 pagineBaglihar Hep Stage-I: Annual Revenue Requirement (ARR) Tariff Petition FY 2009-10 FY 2010-11najonwayNessuna valutazione finora

- Karwa Letter 5Documento19 pagineKarwa Letter 5Samyak DahaleNessuna valutazione finora

- G.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportDocumento79 pagineG.H. Patel Post Graduate Institute of Business Management: Summer Internship Training Project ReportBoricha AjayNessuna valutazione finora

- Visa NetDocumento22 pagineVisa NetPahul WaliaNessuna valutazione finora

- OSP#16078878Documento6 pagineOSP#16078878Guhanadh PadarthyNessuna valutazione finora

- Bank Financing Proposal for Brick Factory ExpansionDocumento11 pagineBank Financing Proposal for Brick Factory ExpansionSudhakaar ShakyaNessuna valutazione finora

- HuiDocumento5 pagineHuiShiv SinghNessuna valutazione finora

- Description: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Documento3 pagineDescription: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Suvaid KcNessuna valutazione finora

- The Prons and Cons of Internet and World Wide WebDocumento6 pagineThe Prons and Cons of Internet and World Wide WebMohamad Razali RamdzanNessuna valutazione finora

- BPI Capital Audited Financial StatementsDocumento66 pagineBPI Capital Audited Financial StatementsGes Glai-em BayabordaNessuna valutazione finora

- Medfield Pharmaceuticals' Valuation and Strategic OptionsDocumento9 pagineMedfield Pharmaceuticals' Valuation and Strategic OptionsvATSALANessuna valutazione finora

- Extra Problems For Test 1Documento4 pagineExtra Problems For Test 1night_98036Nessuna valutazione finora

- IBPS Clerk Main 2016 Capsule by AffairscloudDocumento91 pagineIBPS Clerk Main 2016 Capsule by AffairscloudMadhu SekharNessuna valutazione finora

- Philippine Financial SystemDocumento35 paginePhilippine Financial SystemGrace DimayugaNessuna valutazione finora

- Indian Money Market 2019: An OverviewDocumento50 pagineIndian Money Market 2019: An OverviewRavi Sahani100% (1)

- Customer Relationship Management (CRM) in Banks: Pooja GargDocumento29 pagineCustomer Relationship Management (CRM) in Banks: Pooja GargManish SinghNessuna valutazione finora

- Comparative Financial Analysis of SBI and HDFC BankDocumento85 pagineComparative Financial Analysis of SBI and HDFC Bankshshant kashyap50% (4)

- Neemyl KitDocumento3 pagineNeemyl KitBhupendra Pratap SinghNessuna valutazione finora

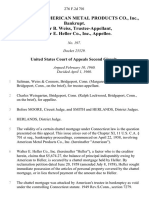

- In The Matter of AMERICAN METAL PRODUCTS CO., Inc., Bankrupt. Arthur B. Weiss, Trustee-Appellant, Walter E. Heller Co., Inc., AppelleeDocumento6 pagineIn The Matter of AMERICAN METAL PRODUCTS CO., Inc., Bankrupt. Arthur B. Weiss, Trustee-Appellant, Walter E. Heller Co., Inc., AppelleeScribd Government DocsNessuna valutazione finora