Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Law of Agency

Caricato da

Abid Ahasan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

94 visualizzazioni42 pagineThis document provides an overview of the key concepts in agency law, bailment, indemnity, and guarantee. It defines agency as a relationship that arises when one person acts on behalf of another. It outlines the duties and rights of agents and principals. Bailment is defined as the delivery of goods by one person to another for a specific purpose. Indemnity involves one party promising to compensate another for losses incurred, while guarantee involves a third party promising to fulfill another's debt or obligation if they default. The document compares and contrasts indemnity and guarantee.

Descrizione originale:

law of agency

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document provides an overview of the key concepts in agency law, bailment, indemnity, and guarantee. It defines agency as a relationship that arises when one person acts on behalf of another. It outlines the duties and rights of agents and principals. Bailment is defined as the delivery of goods by one person to another for a specific purpose. Indemnity involves one party promising to compensate another for losses incurred, while guarantee involves a third party promising to fulfill another's debt or obligation if they default. The document compares and contrasts indemnity and guarantee.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

94 visualizzazioni42 pagineLaw of Agency

Caricato da

Abid AhasanThis document provides an overview of the key concepts in agency law, bailment, indemnity, and guarantee. It defines agency as a relationship that arises when one person acts on behalf of another. It outlines the duties and rights of agents and principals. Bailment is defined as the delivery of goods by one person to another for a specific purpose. Indemnity involves one party promising to compensate another for losses incurred, while guarantee involves a third party promising to fulfill another's debt or obligation if they default. The document compares and contrasts indemnity and guarantee.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 42

Presentation on Law of Agency

and Bailment, I ndemnity and

Guarantee

Sk. Nazibul Islam

Faculty Member,BIBM

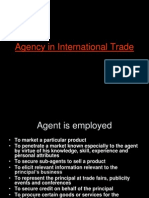

Agency

An agency relationship arises when one

person(the agent) acts for the benefit of and

under the direction of another(the principal)

Agency relationship is usually formed by

contract.

Agent & Principal

An agent is a person employed to do any

act for another or to represent another in

dealings with third persons.-Sec.182

The person for whom such act is done or

who is represented is called the principal.

P appoints X to buy 100 bales of cotton on

his behalf. P is the principal and X is his

Agent.

The relationship between P and X is called

Agency.

Power of Attorney

An agent may be appointed by the principal,

executing a written and stamped document.

Such a document is called Power of

Attorney.

There are two kinds of power of attorney:

General and Special.

A general power is one by which the agent

is given an authority to do certain

objectives, e.g., managing an estate or a

business.

A special or particular power may be

appointed by which an agent is authorized

to do a specific thing e.g., selling some

goods.

Enforcement and consequences of

Agents contracts

The function of an agent is to bring about

contractual relations between the principal

and third parties.

Usually agents are appointed with specific

instructions and authorized to act within the

scope of their instructions.

Acts of the agent within the scope of the

instructions bind the principal as if he has

done them himself.

There is a legal maxim regarding agency

He who does through another does by

himself.

The act of an agent is the act of the

principal.

Contracts entered into through an agent,

and obligations arising from acts done by an

agent, may be enforced in the same manner

and will have the same legal consequences,

as if the contracts had been entered into and

the acts done by the principal in person.-

Sec.226.

Who can appoint an Agent?

Any person who is of the age of majority

according to the law to which he is subject,

and who is of sound mind, may employ an

agent.-Sec.183.

Who may be an Agent?

Any person may be an agent, even a minor. A

minor acting as an agent can bind the principal to

third parties.

But a minor is not himself liable to his principal.-

Sec.184.

Joint Principals: Several principals can jointly

appoint one agent. The agent can act in respect of

those affairs in which all the co-principals are

jointly interested.

Classes of Agents

Broker

Factor

A Commission Agent

Auctioneer

A Del credere Agent i.e. (Risk taker)

General Agent and Particular Agent

Broker brings buyer and sellers into

contract with one another against

commission.

Factor is a mercantile agent who kept

goods for sale and has got

discretionary power to enter into

contract of sale with third party.

Commission Agent is one who secures

buyers for a sell of goods in return for

a commission.A commission agent

may have possession over the goods or

not.

An Auctioneer is one who is authorized to sell

goods of his principal by auction. He has a

particular lien on the goods for his remuneration.

He has the goods in his possession and can sue the

buyer in his own name for the purchase price.

An auctioneer acts in a double capacity. Up to the

moment of sale he is the agent of the seller. After

the sale he is the agent of the buyer. An auctioneer

has implied authority to sell the goods without any

restriction.

A Del Credere Agent is one who for

extra remuneration guarantees the

performance of the contract by the

other party, if the party fails to perform

as per agreement then Del credere must

pay compensation to the principal.

General Agent represents the principal

in all matters concerning a particular

business. Factors and commission

agents are usually general agents.

Particular Agent who is appointed for

a specific purpose e.g., to sell a

particular article or time.

Agency Creation

Agency by express agreement

Agency by implied agreement

Express Agency

An agency that occurs when a principal and

an agent expressly agree to enter into an

agency agreement with each other.

Exclusive agency contract

Power of attorney

Express agency contracts can be either oral

or written unless the Statute of Frauds

stipulates that they must be written.

I mplied Agency

An agency that occurs when a principal and an

agent do not expressly create an agency.

The agency is implied from the conduct of the

parties.

The extent of the agents authority is determined

from the particular facts and circumstances of the

particular situation.

Incidental authority

Agency by Ratification

An agency that occurs when:

1. A person misrepresents himself or herself

as anothers agent when in fact he or she

is not, and

2. The purported principal ratifies (accepts)

the unauthorized act.

Agents Duties to Principal

Conduct the business according to the

direction of the principal

To carry out business with reasonable care

and skill.

Render proper accounts.

Communicate with principal and seeking

instruction.

Refund the benefit for illegal transaction on

principals own account.

Agents Duties to Principal (cont.)

To pay sums received for principal.

Protection of the interest at the death or

insanity of the principal.

Supply information to the principal.

Rights of Agent

Enforcement of rights

Right to receive remuneration

Agent not entitled to remuneration for

business misconducted

Agents lien

Right of stoppage of goods in transit

Right to receive damage for negligence or

inefficiency of principal.

Termination of Agency

Termination of Agency by the act of the

parties

Mutual agreement

Revocation of agents authority by principal

Renounce of authority by agent

Termination of Agency by the Operation of Law:

By performance of the contract

By lapse of time

By death of any party

By insanity of any party

By insolvency of any party

By supervening impossibility

Bailment

Bailment is the delivery of goods from one

person to another for some purpose with a

contract, when the purpose is accomplished

goods will be returned.

Characteristics or Requisites of

Bailment

Contract

Delivery of goods

Purpose

Ownership

Possession

Return

Moveable goods

Other elements of contract

Duties of the Bailor

To disclose faults in goods bailed

Payment of expenses in gratuitous bailment

To receive back the goods

Rights of Bailee

Right to know the fault of bailed goods

Right to get damage & expenses

Bailees lien

Types of Bailment

Gratuitous Bailment:A gratuitous bailment is

one in which neither the bailor, nor the bailee is

entitled to any remuneration, e.g., loan of an

article gratis; safe custody without charge, etc.

Bailment of Reward:A bailment for reward is

one where either the bailor or the bailee is entitled

to remuneration, e.g., a motor car let out for hire;

goods given to a carrier for carriage at a price;

articles given to a person for being repaired for a

remuneration; pawn etc.

Duties of the Bailee

To take reasonable care of the bailed goods

Return of bailed goods

Not unauthorized use of bailed goods

Not mixture the bailed goods with bailors

own goods

Return of accretion to the goods bailed

Guarantee

Guarantee is a promise normally given by a

third person to the lender for the present or

future debt of the borrower.

Person who gives the guarantee is called

surety or guarantor.To whom guarantee is

given is called beneficiary.

Types of Guarantee

Performance guarantee

Letter of credit

Shipping guarantee

Custom & Excise guarantee

Essential Features of Guarantee

Guarantors liability is secondary

Guarantee may be either written or oral

Guarantee may be Specific or Continuing

Party must be competent to give guarantee

Minor cannot give guarantee

Guarantee must be supported by lawful

consideration

A guarantee obtained under misrepresentation,

fraud and undue influence is void able.

Discharge of Surety

Death of the surety

Discharge on variation of terms

Discharge by the performance of the debtor

Discharge by notice of revocation

I ndemnity

Indemnity is defined as a contract by which

one party promises to save the other from

loss caused to him.The person who makes

such promise is called indemnifier and the

other person is called the beneficiary.

Banks and letters of I ndemnity

Loss of term deposit receipt

Issue of duplicate draft

Loss of Travelers Cheque

Loss of safe custody receipt

Loss of gift cheque

Distinction Between Guarantee & I ndemnity

1.Number of parties: In case of guarantee there

are three parties- the principal debtor, the creditor

and the surety. A contract of guarantee requires

the concurrence of the three parties. In case of

indemnity there are only two parties- indemnified

and indemnifier.

2.Number of contracts: In case of guarantee

there are two contracts, one between the principal

debtor and the creditor and the second between the

surety and the creditor. On the other hand, in a

contract of indemnity, there is only one contract

between the indemnifier and the beneficiary.

3.Request: In a contract of guarantee, the guarantor

undertakes his obligation at the request, express or implied,

of the principal debtor; no such request is necessary in

respect of an indemnity.

4.Nature of liability: In a contract of guarantee the

liability of the principal debtor is primary and that of

surety is secondary. The person giving an indemnity is

primarily and independently liable.

5.Purpose of contracts: A contract of guarantee is to

provide necessary security to the creditor against the loan

but a contract of indemnity is made for reimbursement of

loss.

6.Right of parties: The surety has the right to

recover from the principal debtor the amount paid

by him under the contract of guarantee, the

indemnifier cannot claim reimbursement from

anybody else.

7.Nature of risk: The surety agrees to discharge

the existing liability of the principal debtor. So it

is a subsisting risk. The indemnifier promises to

save the indemnified against risk of loss

happening in future. So it is a contingent risk.

Thank You

Potrebbero piacerti anche

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsDa EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsValutazione: 5 su 5 stelle5/5 (1)

- Law of AgencyDocumento42 pagineLaw of AgencyArefin SajibNessuna valutazione finora

- Business LawDocumento26 pagineBusiness LawHavish ChandraNessuna valutazione finora

- IndemnityDocumento35 pagineIndemnityRaselAhmedNessuna valutazione finora

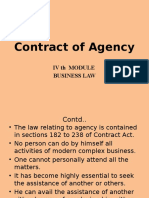

- Unit 1 Contract of AgencyDocumento46 pagineUnit 1 Contract of AgencyDeborahNessuna valutazione finora

- Special Contracts: Basic Elements of Law Relating To Agency, Guarantee and PledgeDocumento15 pagineSpecial Contracts: Basic Elements of Law Relating To Agency, Guarantee and Pledgesayush91Nessuna valutazione finora

- Agency in International Trade 1Documento14 pagineAgency in International Trade 1Parvathy KottolNessuna valutazione finora

- Nov 14. Chapter 13 - AgencyDocumento5 pagineNov 14. Chapter 13 - Agencyzachiechan3Nessuna valutazione finora

- LAB Combined Till 7Documento274 pagineLAB Combined Till 7Vivek MishraNessuna valutazione finora

- Day 1Documento34 pagineDay 1Vivek MishraNessuna valutazione finora

- Module IV Contract of AgencyDocumento30 pagineModule IV Contract of AgencyAnish IyerNessuna valutazione finora

- Commercial Law - Lecture 3Documento26 pagineCommercial Law - Lecture 3Zale EzekielNessuna valutazione finora

- Essential Elements of AgencyDocumento20 pagineEssential Elements of AgencyMichelle Gozon100% (3)

- Contract of AgencyDocumento20 pagineContract of AgencyRajat Sharma100% (1)

- L3 - Law of AgencyDocumento17 pagineL3 - Law of AgencyaseliNessuna valutazione finora

- Lecture No. 4 Agency: Meaning of Agency Definition of "Agent"Documento42 pagineLecture No. 4 Agency: Meaning of Agency Definition of "Agent"AlviNessuna valutazione finora

- SM V Contract of AgencyDocumento47 pagineSM V Contract of AgencyUtkarshNessuna valutazione finora

- DEFINITION (Sec 182) : The Person For Whom Such Act Is Done, or Who Is Represented, Is Called PrincipalDocumento36 pagineDEFINITION (Sec 182) : The Person For Whom Such Act Is Done, or Who Is Represented, Is Called PrincipalUtkarsh SethiNessuna valutazione finora

- Law of AgencyDocumento51 pagineLaw of AgencybulihNessuna valutazione finora

- Agent, Agency & Agreement: By: Ahsan Naeem Lone Anaa Rafique M.Zubair Nasir Sobia Sarwar Urooj ZawwarDocumento17 pagineAgent, Agency & Agreement: By: Ahsan Naeem Lone Anaa Rafique M.Zubair Nasir Sobia Sarwar Urooj ZawwarahsanloneNessuna valutazione finora

- Contract of AgencyDocumento36 pagineContract of AgencysuhaniNessuna valutazione finora

- AGENCYDocumento86 pagineAGENCYKarla Mari Orduña GabatNessuna valutazione finora

- Unit 3 B.Law BBA 4th SemDocumento30 pagineUnit 3 B.Law BBA 4th Semnischal bhattaraiNessuna valutazione finora

- Session 11 - 22092021Documento83 pagineSession 11 - 22092021skkaviya sethilrajakirthikaNessuna valutazione finora

- Law of Indemnity, Guarantee, Bailment & PledgeDocumento34 pagineLaw of Indemnity, Guarantee, Bailment & Pledgemansisharma8301Nessuna valutazione finora

- The Law of Agency & Elements of The Law of E-CommerceDocumento76 pagineThe Law of Agency & Elements of The Law of E-CommerceKatrina EustaceNessuna valutazione finora

- Session 31 - 03112021Documento79 pagineSession 31 - 03112021skkaviya sethilrajakirthikaNessuna valutazione finora

- Contract of IndemnityDocumento21 pagineContract of IndemnitysaadRaulNessuna valutazione finora

- HW 20501Documento17 pagineHW 20501Harshita AndaniNessuna valutazione finora

- BBA170-FPD-5-2018-1.pptLAW OF AGENCYDocumento59 pagineBBA170-FPD-5-2018-1.pptLAW OF AGENCYdanielNessuna valutazione finora

- Business Law Chapter 5Documento34 pagineBusiness Law Chapter 5ماياأمال100% (1)

- Busniess LawDocumento14 pagineBusniess LawPROGRAM MANAGERNessuna valutazione finora

- The Law of Agency and Elements of The Law of Electronic CommerceDocumento76 pagineThe Law of Agency and Elements of The Law of Electronic CommerceShirdah AgisteNessuna valutazione finora

- Law of Agency: By: Ishfaque RahujoDocumento23 pagineLaw of Agency: By: Ishfaque RahujoSoomal JamaliNessuna valutazione finora

- Contract of AgencyDocumento6 pagineContract of AgencyPallabi PattanayakNessuna valutazione finora

- SECURITIES Mode of Charging SecuritiesDocumento32 pagineSECURITIES Mode of Charging SecuritiesMohammad Shahnewaz HossainNessuna valutazione finora

- Law of Agency in Malaysia (Lecture 14) (Autosaved)Documento25 pagineLaw of Agency in Malaysia (Lecture 14) (Autosaved)Kenneth Wen Xuan TiongNessuna valutazione finora

- Law of Agency 2Documento18 pagineLaw of Agency 2Senelwa AnayaNessuna valutazione finora

- Contract of AgencyDocumento90 pagineContract of AgencyAadhitya NarayananNessuna valutazione finora

- 6contract of AgencyDocumento21 pagine6contract of AgencyHardik Singh BawejaNessuna valutazione finora

- Legal Environment of Business: Law of Agency and BailmentDocumento6 pagineLegal Environment of Business: Law of Agency and BailmentDM YazdaniNessuna valutazione finora

- Week 9 LAW501 Agency LawDocumento25 pagineWeek 9 LAW501 Agency LawUshra KhanNessuna valutazione finora

- AGENCYDocumento154 pagineAGENCYAdityaSharmaNessuna valutazione finora

- Agency ReportDocumento12 pagineAgency ReportNo NoNessuna valutazione finora

- Theme 2 - Law of SecurityDocumento11 pagineTheme 2 - Law of Securityu22619942Nessuna valutazione finora

- Sessions 01 - 02 Special ContractsDocumento22 pagineSessions 01 - 02 Special ContractsRohit DuttaNessuna valutazione finora

- Group 2 Presentation - Law of SuretyDocumento91 pagineGroup 2 Presentation - Law of SuretyROMEO CHIJENANessuna valutazione finora

- 02 Means of Insurance For Payment - FiduciaryDocumento20 pagine02 Means of Insurance For Payment - FiduciaryPierpaolo LinardiNessuna valutazione finora

- Special ContractDocumento22 pagineSpecial Contractbas 2minNessuna valutazione finora

- Bailment and PledgeDocumento14 pagineBailment and PledgeAkhil Ranjan TarafderNessuna valutazione finora

- Special Contracts 2023Documento13 pagineSpecial Contracts 2023SAMYUKKTHHA S (RA2252001040009)Nessuna valutazione finora

- Unit 1 - Part 2Documento29 pagineUnit 1 - Part 2sourabhdangarhNessuna valutazione finora

- Agency Part 1 Lecture SlidesDocumento14 pagineAgency Part 1 Lecture SlidesSiphesihle Shange100% (1)

- Law of AgencyDocumento11 pagineLaw of Agencyprabharun18Nessuna valutazione finora

- LAB NotesDocumento13 pagineLAB Notessamal.arabinda25Nessuna valutazione finora

- Authority of AgentDocumento26 pagineAuthority of AgentirfafNessuna valutazione finora

- Contract of Agency and Contract Part - 2Documento22 pagineContract of Agency and Contract Part - 2Chirag GoyalNessuna valutazione finora

- The 250 Questions Everyone Should Ask about Buying ForeclosuresDa EverandThe 250 Questions Everyone Should Ask about Buying ForeclosuresNessuna valutazione finora

- Life, Accident and Health Insurance in the United StatesDa EverandLife, Accident and Health Insurance in the United StatesValutazione: 5 su 5 stelle5/5 (1)

- Timetech CompanyDocumento62 pagineTimetech CompanyAbid AhasanNessuna valutazione finora

- Business Plan On BagasseDocumento64 pagineBusiness Plan On BagasseAbid Ahasan100% (8)

- Negotiable Instruments ActDocumento55 pagineNegotiable Instruments ActAbid Ahasan100% (1)

- The Power of TQM: Analysis of Its Effects On Profitability, Productivity and Customer SatisfactionDocumento15 pagineThe Power of TQM: Analysis of Its Effects On Profitability, Productivity and Customer SatisfactionAbid Ahasan100% (1)

- Milking The PoorDocumento15 pagineMilking The PoorAbid AhasanNessuna valutazione finora

- Time Value of MoneyDocumento19 pagineTime Value of MoneyAbid AhasanNessuna valutazione finora

- AUTOMOTIVE FINANCE CORPORATION v. ABERDEEN AUTO SALES, INC. Et Al - Document No. 28Documento9 pagineAUTOMOTIVE FINANCE CORPORATION v. ABERDEEN AUTO SALES, INC. Et Al - Document No. 28Justia.comNessuna valutazione finora

- Garcia v. Scientology: Defendants Bench MemorandumDocumento25 pagineGarcia v. Scientology: Defendants Bench MemorandumTony OrtegaNessuna valutazione finora

- Installation Instructions, Instructions D'installation, Instrucciones de Instalación, Instruções de Instalação, Istruzioni Di InstallazioneDocumento60 pagineInstallation Instructions, Instructions D'installation, Instrucciones de Instalación, Instruções de Instalação, Istruzioni Di InstallazioneDavidNessuna valutazione finora

- 043 - Philippine Products Company V Primateria (1965) (Miguel, V)Documento2 pagine043 - Philippine Products Company V Primateria (1965) (Miguel, V)VM MIGNessuna valutazione finora

- PPRA Rules SummaryDocumento5 paginePPRA Rules Summaryjawad zain67% (3)

- B R F I0Documento19 pagineB R F I0Bhavya ShrivastavaNessuna valutazione finora

- Executive Summary: A. IntroductionDocumento7 pagineExecutive Summary: A. IntroductionJoy AcostaNessuna valutazione finora

- Reviewer Conflicts of LawDocumento74 pagineReviewer Conflicts of LawSheena ValenzuelaNessuna valutazione finora

- Commercial ReviewerDocumento39 pagineCommercial ReviewerDavid Sibbaluca MaulasNessuna valutazione finora

- Recovery Scheduli NG - AS Appli ED I N Engi Neeri NG, Procurement, AND Constructi ONDocumento5 pagineRecovery Scheduli NG - AS Appli ED I N Engi Neeri NG, Procurement, AND Constructi ONAejaz AhmedNessuna valutazione finora

- T Hub PH II RFP PDFDocumento35 pagineT Hub PH II RFP PDFkumaresh tNessuna valutazione finora

- Quiz 6Documento4 pagineQuiz 6Jan NiñoNessuna valutazione finora

- Quotation For Civil, Plumbing, Electical Work 2022Documento6 pagineQuotation For Civil, Plumbing, Electical Work 2022M PraveenNessuna valutazione finora

- UntitledDocumento4 pagineUntitledOjasvinee SharmaNessuna valutazione finora

- Breach of International Contract Under CisgDocumento15 pagineBreach of International Contract Under CisgArasan ArasanNessuna valutazione finora

- Consequence of Breach of ContractDocumento5 pagineConsequence of Breach of ContractPhyoe Myat100% (1)

- 05 Pantaleon V American Express International, Inc.Documento34 pagine05 Pantaleon V American Express International, Inc.Mark Anthony Javellana SicadNessuna valutazione finora

- Enlistment Rule 2021Documento46 pagineEnlistment Rule 2021Karan AgrawalNessuna valutazione finora

- Hildebrant LawsuitDocumento14 pagineHildebrant LawsuitDan MonkNessuna valutazione finora

- Legal Issues and Ethical IssuesDocumento28 pagineLegal Issues and Ethical IssuesVelmurugan RajarathinamNessuna valutazione finora

- 3.5 Reasonable Causal Connection: Smart Communications Vs Astorga, 542 SCRA 434, Jan. 27, 2008Documento103 pagine3.5 Reasonable Causal Connection: Smart Communications Vs Astorga, 542 SCRA 434, Jan. 27, 2008pokeball001Nessuna valutazione finora

- S3 Lecture 2 - Laws On ContractsDocumento7 pagineS3 Lecture 2 - Laws On ContractsSamantha Joy AngelesNessuna valutazione finora

- Procore Project Setup ProceduresDocumento25 pagineProcore Project Setup ProceduresMaximo YanezNessuna valutazione finora

- Motorized Contract (DELIVERYDocumento3 pagineMotorized Contract (DELIVERYScribdTranslationsNessuna valutazione finora

- SYLLABUS Business Orgsanization Law ABM BDocumento2 pagineSYLLABUS Business Orgsanization Law ABM BMarceliano Monato IIINessuna valutazione finora

- Fundamentals of MPMM PM Methodology SoftwareDocumento275 pagineFundamentals of MPMM PM Methodology SoftwareJulio Fuster BragadoNessuna valutazione finora

- Atswa Examinations New Syllabus PDFDocumento63 pagineAtswa Examinations New Syllabus PDFEgede DavidNessuna valutazione finora

- 2000 2010+PIL+Related+QuestionsDocumento13 pagine2000 2010+PIL+Related+Questionsdodong123Nessuna valutazione finora

- 4 CORPO Case Digest #4Documento39 pagine4 CORPO Case Digest #4Miko TabandaNessuna valutazione finora

- Report RA 9184Documento54 pagineReport RA 9184JannahSalazarNessuna valutazione finora