Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FKP Indonesia-India Investment Cooperation

Caricato da

Teddy LesmanaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FKP Indonesia-India Investment Cooperation

Caricato da

Teddy LesmanaCopyright:

Formati disponibili

INDONESIA-INDIA

INVESTMENT COOPERATION:

PROSPECTS AND

CHALLENGES

Teddy Lesmana

Economic Research Center

The Indonesian Institute of Sciences

Forum Kajian Pembangunan

Media Center - LIPI, Gedung Sasana Widya Sarwono lantai 1, Jl

Jenderal Gatot Soebroto 10, Jakarta Selatan 12710

Outline

Introduction

India Investment Opportunities

Indonesia Investment

Opportunities

Challenges

Recommendation.

Introduction

The economy of India is the tenth-largest in the

world by nominal GDP and the third-

largest by purchasing power parity (PPP).

The country is one of the G-20 major economies, a

member of BRICS and a developing economy that

is among the top 20 global traders according to

the WTO.

Indonesia is also classified as G-20 and the tenth-

largest by purchasing power parity (PPP).

Given the economic description above, India and

Indonesia have potential economic opportunities to

co-operate in investment.

Key features of Indias

attractiveness

India was the fourth-largest recipient of FDI in terms of projects started in 2012, and in

terms of value, it accounted for 5.5% of global FDI. Although the number of jobs declined

slightly in 2012 (due to a drop in industrial projects) India still accounts for 9.4% of jobs

created by FDI around the world.

Investors across the world recognize Indias FDI potential. Between 2007 and 2012, the

US invested the most in India, with 30.2% of projects, followed by Japan with 10.4%.

Seven of the top 10 investors in India during 2007-12 were from Western Europe, led by

the UK and followed by Germany and France. India's pool of business partners is growing,

with a striking 123.3% rise in the number of projects from the Middle East in 2012, mostly

in financial services. Southeast Asian countries are also expanding their investment in the

country, with projects mainly originating from Singapore, Malaysia and Thailand.

Actual FDI performance and our survey results both show that metropolitan cities, such as

Mumbai, Bengaluru, the National Capital Region (NCR), Chennai and Pune, remain key

attractions. On the other hand, there is a significant awareness gap about tier-II and tier-III

Indian cities, which also offer opportunities for investment. Forty-three percent of

respondents could not think of any city other than the main metropolitan areas. Among

those who responded, Ahmedabad was the preferred choice in emerging cities, followed

by Jaipur, Chandigarh, Coimbatore and Surat.

Source: http://www.ey.com/in/en/issues/business-environment/ey-india-attractiveness-survey

Indias trade with Indonesia (US$

Millions)

Why Indonesia Matters

A polity transformed within a generation,

Indonesia is now playing a role commensurate

with its status as the fourth largest country, a

nation with the largest Muslim population, a

thriving democracy strategically located in the

Indian Ocean and Indo-Pacific region. It is a

country that seeks to lead the ASEAN without

dominating it, demonstrating an instinct for a

balanced relationship with other Asia-Pacific

powers such as the US, China, India, Japan,

Australia and South Korea.

Indonesias Economy in Brief

Growth in gross domestic product (GDP) moderated to

5.8% in 2013 from an average of 6.3% over the previous

3 years.

Growth in fixed investment slowed to 4.7% in 2013 after

strong increases of about 9% annually in 2010-2012.

Private consumption remained robust in 2013,

expanding by 5.3% and contributing half of the growth in

GDP on the expenditure side.

Government consumption grew by 4.9%, which signaled

some improvement in budget execution.

Selected Indonesia Economic

Indicator

Source: Asian Development Outlook (ADO) 2014; ADB estimates.

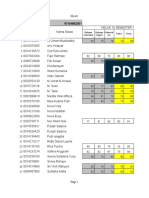

Selected Economic Indicators (%) - Indonesia 2014 2015

GDP Growth 5.7 6.0

Inflation 5.7 4.8

Current Account Balance (share of GDP) -2.9 -2.0

Indonesia Investment Priority

Sectors

The Government of Indonesia sets its investment

priority sectors every five years. Under the 2010-

2014 National Mid-Term Development Plan, the

priority sectors are:

lnfrastructure/Transportation

Oil, and Gas

Power

Mining

Telecommunications

Manufacturing and Agriculture

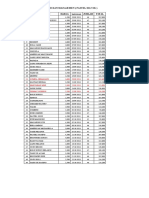

Potential Projects by sectors

No Sector /Sub-sector Quantity Project Cost

(C$ Billion)

1 Air Transportation 7 1.52

2 Land Transportation 2 0.27

3 Marine Transportation 12 2.83

4 Railways 9 9.33

5 Toll Road 35 26.23

6 Water Resources - -

7 Water Supply 24 1.81

8 Solid Waste and Sanitation 6 0.27

9 Telecommunication - -

10 Power 5 3.95

11 Oil and Gas - -

Total 100 46.21

The Government of Indonesia is consistently sustaining the

momentum of Public Private Partnership (PPP) development

in order to accelerate the provision of infrastructure. The

following projects summary are adopted from The PPP Book

2013, which is primarily intended to inform potential

investors, lenders and contractors about the opportunities

available in Indonesia to become a private partner in a PPP

Project. The PPP Book is therefore the presentation of PPP

opportunities in Indonesia to the world.

The PPP Book now consists of 27 projects, arranged in three

categories: potential, prospective, and ready for offer PPPs.

In this 2013 edition there are 14 prospective projects and 13

potential projects. To date, 21 projects listed in previous

books have already gone to tender.

Public-Private Partnership

Projects

Challenges in Investment

(India)

Political Challenge: The support of the political structure has to be

there towards the investing countries abroad. This can be worked

out when foreign investors put forward their persuasion

for increasing FDI capital in various sectors like banking, and

insurance.

Federal Challenge: Very important among the major challenges

facing larger FDI, is the need to speed up the implementation of

policies, rules, and regulations. The vital part is to keep

the implementation of policies in all the states of India at par.

Resource challenge: India is known to have huge amounts of

resources. There is manpower and significant availability of fixed

and working capital. At the same time, there are some

underexploited or unexploited resources.

Equity challenge: India is definitely developing in a much faster

pace now than before but in spite of that it can be identified that

developments have taken place unevenly.

Challenges in Investment

(Indonesia)

Indonesia is faced by the less developed of

infrastructure. Road, electricity supply, harbor, and any

other infrastructures, which support the economy

activities.

Harmonization of national and regional implementation.

Investment procedure is still long enough compared to

countries.

Insufficient supply of energy required for industrial

activities.

Regulations that impede investment climate.

The distribution of investment is still concentrated in

Java and less optimal implementation of technology

transfer.

Prospects

India-Indonesia Comprehensive Economic

Cooperation Arrangement (India-Indonesia

CECA)

The Indian government is keen to step up

investment in Indonesia, especially in the food,

automotive, manufacturing and infrastructure

Indonesia is keen on attracting Indian

investments in manufacturing and value added

processing than just in exploitation of its

natural resources.

Prospects

In a partial-equilibrium framework, the projection-

estimates of Indias exports to Indonesia are in the

range of US$. 1.7 billion - US$ 7.8 billion by the year

2020. The estimates of exports from Indonesia to India

would be in the range of US$ 3.4 billion - US$ 9.7 billion

by 2020.

Welfare gains of the proposed CECA on trade in goods

have been estimated using a multi-sector computable

general equilibrium (CGE) model. According to which,

the welfare gains accruing to India could be to the tune

of 1.0 percent of GDP and to Indonesia to the extent of

1.4 percent of GDP under the scenario of full tariff

liberalization along with setting in place the trade

facilitating infrastructure.

Source:

Report of the Joint Study Group on the Feasibility of India-Indonesia Comprehensive Economic

Cooperation Agreement (CECA)

Conclusion and

Recommendation

In the economic domain, Indias trade deficit with Indonesia is

the tenth largest it has with any country. Indonesian

investment in India still remains very low, while Indian imports

from Indonesia still focus mainly on extractive industries like

coal and palm oil.

Tourism is limited because there are still no direct flights

between the two countries. While a joint study

group recommended that India and Indonesia negotiate a

Comprehensive Economic Cooperation Agreement as early

as September 2009, leaders are still at the exploratory stages

of negotiations four years later.

As both existing and new ideas are implemented over the

next few years, close attention will have to be paid to not just

boosting the level of bilateral trade and investment, but also

resolving issues regarding the distribution and content of

these flows.

Conclusion and

Recommendation

Improve government procedures and the ease of doing

business. Better governance will reduce transaction costs,

helping a wide range of activities, including growth in exports.

Setting up infrastructure and connectivity between two countries.

Technological transfer and mutual investment cooperation.

Setting up bilateral Trade Negotiations Committee (TNC).

Commencing negotiations on trade in goods, trade in services,

investment and other

areas of cooperation as a single undertaking by TNC with a

view to establishing a

Comprehensive Economic Cooperation Agreement (CECA).

Conclusion and

Recommendation

Thank You

Potrebbero piacerti anche

- Fdi in India Research PaperDocumento8 pagineFdi in India Research Paperfvj892xr100% (1)

- Data 2Documento3 pagineData 2Manishaa NazarethNessuna valutazione finora

- The Role of Foreign Direct Investment (FDI) in India-An OverviewDocumento10 pagineThe Role of Foreign Direct Investment (FDI) in India-An OverviewLikesh Kumar MNNessuna valutazione finora

- Accenture Emerging Market Entry Candidates IndonesiaDocumento16 pagineAccenture Emerging Market Entry Candidates Indonesiatsr123321Nessuna valutazione finora

- PPP Book 2013Documento119 paginePPP Book 2013tommysupapto56Nessuna valutazione finora

- 07 - Kadek Sri Mirah Yusita Putri - MICROECONOMICS-1Documento10 pagine07 - Kadek Sri Mirah Yusita Putri - MICROECONOMICS-115Kadek Sri Mirah Yusita PutriNessuna valutazione finora

- Gjbmitv4n1 03Documento8 pagineGjbmitv4n1 03satish kumar jhaNessuna valutazione finora

- FDI - Driving The Future of IndiaDocumento4 pagineFDI - Driving The Future of IndiaHusain AttariNessuna valutazione finora

- SECTORWISEINFLOWOFFOREIGNDIRECTINVESTMENTININDIA1Documento9 pagineSECTORWISEINFLOWOFFOREIGNDIRECTINVESTMENTININDIA1Aditi KulkarniNessuna valutazione finora

- Risk Analysis of Infrastructure Projects PDFDocumento27 pagineRisk Analysis of Infrastructure Projects PDFMayank K JainNessuna valutazione finora

- Research Paper On Foreign Direct Investment in IndiaDocumento7 pagineResearch Paper On Foreign Direct Investment in IndiaafnjowzlseoabxNessuna valutazione finora

- Prof M R Jain12 PDFDocumento7 pagineProf M R Jain12 PDFNIKHIL KUMAR AGRAWALNessuna valutazione finora

- Advantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Documento10 pagineAdvantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Anonymous 9XYG68vqNessuna valutazione finora

- Fdi in India Literature ReviewDocumento5 pagineFdi in India Literature Reviewgvyns594100% (1)

- Viva Project FileDocumento25 pagineViva Project FileGyany KiddaNessuna valutazione finora

- Dr. Ram Manohar Lohiya National Law University, Lucknow: ACADEMIC SESSION: 2014 - 2015Documento10 pagineDr. Ram Manohar Lohiya National Law University, Lucknow: ACADEMIC SESSION: 2014 - 2015Abhishek PratapNessuna valutazione finora

- Global BusinessDocumento12 pagineGlobal BusinessanzilintNessuna valutazione finora

- Econ PTDocumento15 pagineEcon PTLebron JamesNessuna valutazione finora

- 10 DK Jha CGDocumento4 pagine10 DK Jha CGdkrirayNessuna valutazione finora

- Overview of The Economy and Debt in IndonesiaDocumento3 pagineOverview of The Economy and Debt in Indonesiairfan sururiNessuna valutazione finora

- Trends and Patterns of Fdi in IndiaDocumento10 pagineTrends and Patterns of Fdi in IndiaSakshi GuptaNessuna valutazione finora

- Top Seven Changes in India's Business EnvironmentDocumento12 pagineTop Seven Changes in India's Business Environmentamitsingla19Nessuna valutazione finora

- SudarshanKashyap IB Assignmnt 2 ArticleDocumento2 pagineSudarshanKashyap IB Assignmnt 2 ArticleSudarshan KashyapNessuna valutazione finora

- New FdiDocumento6 pagineNew FdiBhanu TejaNessuna valutazione finora

- It and ItesDocumento4 pagineIt and ItesPrathamesh DeoNessuna valutazione finora

- Impact of Foreign Direct Investment On Indian EconomyDocumento8 pagineImpact of Foreign Direct Investment On Indian Economysatyendra raiNessuna valutazione finora

- Shsconf IcsnewDocumento10 pagineShsconf IcsnewSam RasydNessuna valutazione finora

- India Infrastructure InvestmentDocumento5 pagineIndia Infrastructure Investmentneha_64Nessuna valutazione finora

- Fdi in IndiaDocumento8 pagineFdi in IndiamoniluckNessuna valutazione finora

- FAQ On InvestmentDocumento80 pagineFAQ On InvestmentIrka PlayingNessuna valutazione finora

- Ipo 1Documento13 pagineIpo 1Prakash TripurariNessuna valutazione finora

- FDI in India-AssignmentDocumento2 pagineFDI in India-AssignmentrknanduriNessuna valutazione finora

- Project On Foreign Direct Investment in Hotel and TourismDocumento15 pagineProject On Foreign Direct Investment in Hotel and Tourismsweetsayliupale81085Nessuna valutazione finora

- Foreign Direct Investment in India-Its Pros and ConsDocumento30 pagineForeign Direct Investment in India-Its Pros and ConskiranshingoteNessuna valutazione finora

- Impact of FdiDocumento41 pagineImpact of FdiBarunNessuna valutazione finora

- Fdi Research Paper in IndiaDocumento4 pagineFdi Research Paper in Indiaafeaynwqz100% (1)

- A Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediDocumento9 pagineA Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediananyaNessuna valutazione finora

- Project 1Documento20 pagineProject 1pandurang parkarNessuna valutazione finora

- Summer Training Report - RitikaDocumento69 pagineSummer Training Report - Ritikaritika_honey2377% (30)

- IIPC NY BrochureDocumento2 pagineIIPC NY BrochureArita SoenarjonoNessuna valutazione finora

- Impact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDocumento5 pagineImpact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDylan WilcoxNessuna valutazione finora

- Foreign Direct Investment in IndiaDocumento6 pagineForeign Direct Investment in IndiaIOSRjournalNessuna valutazione finora

- Risk Assessment in Bop ProjectsDocumento22 pagineRisk Assessment in Bop ProjectsHarishNessuna valutazione finora

- Economics Project: Foreign Direct Investment in IndiaDocumento26 pagineEconomics Project: Foreign Direct Investment in IndiaMranal MeshramNessuna valutazione finora

- Impact of FDI On Indian Economy: Term Paper On Financial SystemDocumento19 pagineImpact of FDI On Indian Economy: Term Paper On Financial SystempintuNessuna valutazione finora

- 5Documento15 pagine5balwantNessuna valutazione finora

- Research Paper Fdi IndiaDocumento6 pagineResearch Paper Fdi Indialuwahudujos3100% (1)

- A Study About Foreign Direct Investment in IndonesiaDocumento3 pagineA Study About Foreign Direct Investment in IndonesiaInternational Organization of Scientific Research (IOSR)Nessuna valutazione finora

- Fdi in India Phd. ThesisDocumento5 pagineFdi in India Phd. Thesisdianawalkermilwaukee100% (1)

- FDI and Impact On Indian EconomyDocumento8 pagineFDI and Impact On Indian EconomyOm PrakashNessuna valutazione finora

- Winning Together Investment Opportunities and Synergies For The Us and IndiaDocumento56 pagineWinning Together Investment Opportunities and Synergies For The Us and IndiaNavin JollyNessuna valutazione finora

- Nurfatin Najiha Fazal MohamedDocumento9 pagineNurfatin Najiha Fazal MohamedFatin Najiha FazalNessuna valutazione finora

- Accenture High Performance in Infrastructure and Construction OptDocumento16 pagineAccenture High Performance in Infrastructure and Construction OptPreetham SamuelNessuna valutazione finora

- Assignment Of: Security Analysis and Portfolio ManagementDocumento3 pagineAssignment Of: Security Analysis and Portfolio ManagementArpandeep KaurNessuna valutazione finora

- Final Essay U7596796 JoeDocumento5 pagineFinal Essay U7596796 JoeRobert JoeNessuna valutazione finora

- International Journal of Management (Ijm) : ©iaemeDocumento13 pagineInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationNessuna valutazione finora

- An Empirical Study On Fdi Inflows in Indian It and Ites SectorDocumento8 pagineAn Empirical Study On Fdi Inflows in Indian It and Ites SectorTJPRC PublicationsNessuna valutazione finora

- Green Infrastructure Investment Opportunities: Thailand 2021 ReportDa EverandGreen Infrastructure Investment Opportunities: Thailand 2021 ReportNessuna valutazione finora

- Warisan Budaya Indonesia Dan Remaja ModernDocumento2 pagineWarisan Budaya Indonesia Dan Remaja ModernRikza StarrNessuna valutazione finora

- Data Staff BaruDocumento15 pagineData Staff BaruGianLucky BuffonNessuna valutazione finora

- PENGARUH KUBADAYAAN ASING TERHADAP KEBUDAYAAN INDONESIA PADA KALANGAN REMAJA - Id.enDocumento14 paginePENGARUH KUBADAYAAN ASING TERHADAP KEBUDAYAAN INDONESIA PADA KALANGAN REMAJA - Id.enUmamNessuna valutazione finora

- Nilai Pdss Ptkain Ipa 2019Documento12 pagineNilai Pdss Ptkain Ipa 2019maslidarNessuna valutazione finora

- Critical Review of Journal Article in BilingualismDocumento5 pagineCritical Review of Journal Article in BilingualismadiunderzzNessuna valutazione finora

- Contoh Slip Gaji Karyawan Format Ms ExcelDocumento2 pagineContoh Slip Gaji Karyawan Format Ms ExcelBahari Prabowo Aji100% (1)

- Balinese Homestays Chapter 2Documento11 pagineBalinese Homestays Chapter 2Asykur HidayatNessuna valutazione finora

- Agreed Minutes of The 3rd Meeting of Imt-Gt Wghrd-FinalDocumento6 pagineAgreed Minutes of The 3rd Meeting of Imt-Gt Wghrd-FinalralkoestNessuna valutazione finora

- HVS - Indonesia Hotel Watch - Indonesia Overview PDFDocumento9 pagineHVS - Indonesia Hotel Watch - Indonesia Overview PDFHarimurti WijNessuna valutazione finora

- Form Kontrol Tahap 1 Termin 1Documento48 pagineForm Kontrol Tahap 1 Termin 1NUNIK CELLNessuna valutazione finora

- Biography Ir SOEKARNODocumento2 pagineBiography Ir SOEKARNOFatta Syam100% (2)

- PESTEL Analysis of IndonesiaDocumento13 paginePESTEL Analysis of IndonesiaZia Baig0% (1)

- Bika Ambon of Indonesia History Culture and Its Cont PDFDocumento6 pagineBika Ambon of Indonesia History Culture and Its Cont PDFmarthaNessuna valutazione finora

- Diversity and Management of Phytophthora in Southeast AsiaDocumento101 pagineDiversity and Management of Phytophthora in Southeast AsiaMinh Thu TranNessuna valutazione finora

- LaprakDocumento9 pagineLaprakmuhammad ihzaul wafiNessuna valutazione finora

- Menu Snack Dokter Dan Manajemen (Pastel Ma'Cik) : NO. Nama Kue Harga Jumlah TotalDocumento1 paginaMenu Snack Dokter Dan Manajemen (Pastel Ma'Cik) : NO. Nama Kue Harga Jumlah TotalGIZITHAMRIN CILEUNGSINessuna valutazione finora

- Airport Sector in IndonesiaDocumento40 pagineAirport Sector in IndonesiaRully MediantoNessuna valutazione finora

- Lembar Soal: K-13 B07 BIG UtamaDocumento10 pagineLembar Soal: K-13 B07 BIG UtamaVivi DwiNessuna valutazione finora

- AssignmentDocumento2 pagineAssignmentBaihaqi FiazinNessuna valutazione finora

- Urgensi Revisi Uu No 6 Tahun 2014 Tentang DesaDocumento22 pagineUrgensi Revisi Uu No 6 Tahun 2014 Tentang Desafery firmansyahNessuna valutazione finora

- ANNOUNCEMENTDocumento4 pagineANNOUNCEMENTWidodo Eko DadunNessuna valutazione finora

- 2019 Indonesia Salary GuideDocumento32 pagine2019 Indonesia Salary Guideiman100% (1)

- Paper 6 ICRMB Sri Rahayu Hijrah Hati Page 32Documento78 paginePaper 6 ICRMB Sri Rahayu Hijrah Hati Page 32Sri Rahayu Hijrah HatiNessuna valutazione finora

- PWC Indonesia-Oil-And-Gas-Guide-2016 PDFDocumento172 paginePWC Indonesia-Oil-And-Gas-Guide-2016 PDFberiawiekeNessuna valutazione finora

- Icoc 2023 ProgramDocumento54 pagineIcoc 2023 ProgramRose SosialNessuna valutazione finora

- Jadwal Dinas 7 Juli 2019Documento5 pagineJadwal Dinas 7 Juli 2019Taurus D'VirizNessuna valutazione finora

- JAKARTA - by by ANDRE VLTCHEK PDFDocumento23 pagineJAKARTA - by by ANDRE VLTCHEK PDFRany FuadNessuna valutazione finora

- PearlDocumento54 paginePearldennycaNessuna valutazione finora

- TOTAL MABA 2021.1 FINAL UPLOAD PKBJJ OkeDocumento125 pagineTOTAL MABA 2021.1 FINAL UPLOAD PKBJJ OkeNihayah El HusnyNessuna valutazione finora

- Sidalih A.3 Kpu Luwu Lamasi Timur Pompengan Pantai Tps 001 SD 003Documento40 pagineSidalih A.3 Kpu Luwu Lamasi Timur Pompengan Pantai Tps 001 SD 003AXHO AXhoNessuna valutazione finora