Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Objective: Issues Being Faced Type of Financing Required Construction Industry Financials

Caricato da

Gurjot Singh Osahan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

36 visualizzazioni2 paginesector report

Titolo originale

Construction

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentosector report

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

36 visualizzazioni2 pagineObjective: Issues Being Faced Type of Financing Required Construction Industry Financials

Caricato da

Gurjot Singh Osahansector report

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Objective

Financing in Construction Industry

Balanced Scorecard As-Is Analysis Competitive Analysis Opportunity Analysis Practical Implications

Issues Being Faced

Lenders do not understand dynamics of construction

sector

Lack of adequate safeguarding for the banks about the

credibility of the Industry

Banks have better options to lend money to sectors

having assured returns.

State Governments do not make funds available after

they approve the projects

BOT funding issues

Type of Financing Required

Working capital requirements

Capital requirements for

modernization of equipment and/or

expansion of industry

Project specific bridge loans

Loans for BOT projects

Equity for BOT and real estate

project

Short Term

Sources: Team Analysis ,India Rating and Research

Enhancing flow of finance through

grading of construction companies

Construction industry-specific lending

norms

Setting up of a Mortgage Refinance

Company

Letter of Credit for contractors

Single Window Clearance

Sector Specific innovative financial

instrument can be launched.

Access to international finance market

to generate funds

Long Term

National Investment Board

Credit Enhancement

Developing long term Bonds Market

Policy Initiatives

Financial:

o Implement uniform stamp duty across the

states

Regulatory:

Allow banks and domestic FIs to provide

credit enhancement for the infrastructure

bonds

Develop regulatory framework for multi-asset

CDOs

Securitization

Currency & Derivatives Market Development

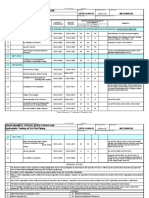

Construction Industry Financials

Item FY10 FY11 FY12 FY13 PFY14

Receivable Days 105 105 116 123 129

Inventory/WIP Days 71 75 73 64 71

Leverage 2.83 3.15 3.14 3.84 4.81

Interest Coverage 3.92 3.41 2.69 2.15 1.7

EBITDA Margins 11.47 11.86 11.94 10.79 10.2

2950.0

1573

426

262

220

85

35

349

Total

Sepnding

Budgetary

Support

Commercial

banks

Equity and

FDI

NBFCs Insurance/

Pension

Funds

ECB Investment

Funding

Gap

Construction Sector Financing 2013-

23(Projected)

Financing Funding USDbn

Objective

Construction employs an estimated 35 million people

second only to agriculture

Infrastructure account for an estimated 49% of demand

for construction in India.

Real Estate and housing account for a 42% while

Industrial projects account for an estimated 9%.

Order booking is stagnant at 2.5x-3.5x

Industry expects a growth rate of 7-8% per annum over

the next 10 years.

The forward and backward multiplier impact of the

construction industry is significant.

Highly unorganized sector with over 95 per cent of the

enterprises employ less than 200 persons.

Construction Sector

Balanced Scorecard As-Is Analysis Competitive Analysis Opportunity Analysis Practical Implications

Growth Drivers

Real estate

construction segment

forecast 13.6% CAGR

for 2012-16

Infrastructure target

for 12

th

five year plan

is 1 trillion dollars

Focus on affordable

housing projects by

government.

0

1

2

3

4

5

6

7

8

0

50

100

150

200

250

300

350

400

2

0

1

2

2

0

1

3

e

2

0

1

4

P

2

0

1

5

P

2

0

1

6

P

2

0

1

7

P

2

0

1

8

P

2

0

1

9

P

2

0

2

0

P

2

0

2

1

P

2

0

2

2

P

2

0

2

3

P

Construction

Value in USDbn

Growth Rate

1028

162

119

166

83

498

Total Loss in GDP Tendering Non Financing Subotimal Design

and Engineering

Procurement Construction

practices

Projected GDP loss(2023) due to current inefficencies in system

Loss GDP USDbn

Source: Team Analysis:Mckenzie:Building

Potrebbero piacerti anche

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryDa EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNessuna valutazione finora

- Empirical Analysis of Working Capital Management: Presentation OnDocumento18 pagineEmpirical Analysis of Working Capital Management: Presentation OnsumitkjhamNessuna valutazione finora

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportDa EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNessuna valutazione finora

- State Financial InstituteDocumento19 pagineState Financial InstituteSom TapareNessuna valutazione finora

- Project FinanceDocumento21 pagineProject Financesuperandroid21Nessuna valutazione finora

- IDFC Indian Infrastructure - ChallengesDocumento18 pagineIDFC Indian Infrastructure - ChallengesSudarshan SubhashNessuna valutazione finora

- 50 Rupy Bhej DioDocumento67 pagine50 Rupy Bhej Dioyaboya1485Nessuna valutazione finora

- 3283 Meeting 4 Competitiveness (I)Documento44 pagine3283 Meeting 4 Competitiveness (I)Choi ChoiNessuna valutazione finora

- Infrastructure FinancingDocumento36 pagineInfrastructure FinancingSunaina KhoslaNessuna valutazione finora

- Royal 001Documento16 pagineRoyal 001Vandana PandeyNessuna valutazione finora

- Innovations and Constraints in Financing Infrastructure ProjectsDocumento27 pagineInnovations and Constraints in Financing Infrastructure ProjectsabishekmittalNessuna valutazione finora

- Financial Analysis of Real Estate SectorDocumento10 pagineFinancial Analysis of Real Estate SectorHanita WadhwaniNessuna valutazione finora

- Corporat Bond Market RK v11Documento11 pagineCorporat Bond Market RK v11SpUnky RohitNessuna valutazione finora

- Summer Internship ProjectDocumento32 pagineSummer Internship ProjectNaina JageshaNessuna valutazione finora

- Outlook For Indian Construction Industry Till 2020Documento7 pagineOutlook For Indian Construction Industry Till 2020Priyashri MishraNessuna valutazione finora

- Project FinanceDocumento21 pagineProject FinanceSagar GajjarNessuna valutazione finora

- 2 - Project Financing in IndiaDocumento20 pagine2 - Project Financing in IndiaSarath Menon100% (1)

- Construction Industry: Prepared by Nguyen Thien Luat - Credit Department - Chailease International Leasing Co., LTDDocumento29 pagineConstruction Industry: Prepared by Nguyen Thien Luat - Credit Department - Chailease International Leasing Co., LTDNGỌC100% (1)

- Financing Infrastructure ProjectsDocumento32 pagineFinancing Infrastructure ProjectsDhananjay MallyaNessuna valutazione finora

- Schemes: - The Industries Act 1951 - Msmed Act 2006 - Competition Act 2002 - GST, IBC - MAKE IN INDIA, PLI, Start Up India, DTI Scheme - Sez, Nimz, Tech Parks, Mega ParksDocumento20 pagineSchemes: - The Industries Act 1951 - Msmed Act 2006 - Competition Act 2002 - GST, IBC - MAKE IN INDIA, PLI, Start Up India, DTI Scheme - Sez, Nimz, Tech Parks, Mega Parksswaroopa sapdhareNessuna valutazione finora

- Construction Comprehensive PackDocumento122 pagineConstruction Comprehensive PackvasajithaNessuna valutazione finora

- External Commercial BorrowingsDocumento10 pagineExternal Commercial BorrowingsSairam EaswaranNessuna valutazione finora

- Me Real-Estate GCC Construction PPT 13Documento36 pagineMe Real-Estate GCC Construction PPT 13rami1964Nessuna valutazione finora

- Equtiy Research ProjectDocumento33 pagineEqutiy Research Projectshantanu_malviya_1Nessuna valutazione finora

- Project Feasibility StudyDocumento27 pagineProject Feasibility StudyharshaNessuna valutazione finora

- Debt Investor Presentation PDFDocumento64 pagineDebt Investor Presentation PDFkukadiyajignesh007Nessuna valutazione finora

- Infrastructure Development in India Using External Commercial BorrowingDocumento35 pagineInfrastructure Development in India Using External Commercial Borrowingamitnpatel1Nessuna valutazione finora

- External Commercial Borrowings (Ecbs) : Eligible Borrowers Amount and MaturityDocumento19 pagineExternal Commercial Borrowings (Ecbs) : Eligible Borrowers Amount and MaturityNilesh NarayananNessuna valutazione finora

- Working Capital ManagementDocumento18 pagineWorking Capital Managementaman.4uNessuna valutazione finora

- Indian Real Estate SectorDocumento8 pagineIndian Real Estate SectorSumit VrmaNessuna valutazione finora

- Topic 5 - Sources of Project FinancingDocumento14 pagineTopic 5 - Sources of Project FinancingSandeepa KaurNessuna valutazione finora

- DAC Draft Business PlanDocumento5 pagineDAC Draft Business PlanYonatanNessuna valutazione finora

- UNIT 1 NewDocumento50 pagineUNIT 1 NewP K JainNessuna valutazione finora

- India's Industrial Sector - Role of MSMEsDocumento14 pagineIndia's Industrial Sector - Role of MSMEsBiswajit PrustyNessuna valutazione finora

- Swot AnalysisDocumento4 pagineSwot AnalysisYogesh Patil100% (1)

- ME Module 5Documento54 pagineME Module 5Sash Dhoni7Nessuna valutazione finora

- Employment 2Documento20 pagineEmployment 2mehakdadwalNessuna valutazione finora

- Chapter-15 Financial ManagementDocumento30 pagineChapter-15 Financial ManagementSAINessuna valutazione finora

- ICICI Global Expansion StrategyDocumento15 pagineICICI Global Expansion Strategyaravind90100% (2)

- Construction: Project ManagementDocumento61 pagineConstruction: Project ManagementAbbas AliNessuna valutazione finora

- Project Report On Project AppraisalDocumento22 pagineProject Report On Project Appraisalwake_up_sid09Nessuna valutazione finora

- 00 - End Term CombinedDocumento409 pagine00 - End Term Combinedrishabh tyagiNessuna valutazione finora

- Capstone Presentation - Carolina LamartineDocumento24 pagineCapstone Presentation - Carolina LamartineCarolinaNessuna valutazione finora

- Infrastructure Finance: One Crore Ten CroreDocumento38 pagineInfrastructure Finance: One Crore Ten Croreprashant456Nessuna valutazione finora

- Niesbud 12 SEP 2015: State Bank of India Consultancy Services Cell Local Head Office, New DelhiDocumento30 pagineNiesbud 12 SEP 2015: State Bank of India Consultancy Services Cell Local Head Office, New DelhipeeyushbcihmctNessuna valutazione finora

- Bond MarketDocumento11 pagineBond MarketAjinkya NikamNessuna valutazione finora

- Study of ICICI Home LoansDocumento107 pagineStudy of ICICI Home LoansMukesh AwasthiNessuna valutazione finora

- Real Estate of India During RecessionDocumento24 pagineReal Estate of India During RecessionVikas SharmaNessuna valutazione finora

- Arnab Basu - Bridging Funding Gap - NBFC in InfraDocumento9 pagineArnab Basu - Bridging Funding Gap - NBFC in Infravinee89Nessuna valutazione finora

- Indian Service SectorDocumento21 pagineIndian Service SectorCharuta Jagtap TekawadeNessuna valutazione finora

- NBCC IPO Analysis ReportDocumento5 pagineNBCC IPO Analysis Reportketu999Nessuna valutazione finora

- Iifcl, Idfc, SbiDocumento105 pagineIifcl, Idfc, SbiDipanjan ChakrabartiNessuna valutazione finora

- Indian Eco Opport ThreatsDocumento32 pagineIndian Eco Opport ThreatsAnkit KhadloyaNessuna valutazione finora

- EPC Industry in IndiaDocumento54 pagineEPC Industry in IndiaHarsh Kedia100% (1)

- Credit Apprisal Method-FDocumento16 pagineCredit Apprisal Method-FRishabh JainNessuna valutazione finora

- Merge Rs & Acqui Siti OnsDocumento68 pagineMerge Rs & Acqui Siti OnsVisakan KandaswamyNessuna valutazione finora

- Chapter - 1Documento63 pagineChapter - 1Abhijeet DasNessuna valutazione finora

- Paran: Done by Harish Kumar - 33021 Jagan Raj-33022 Jayamathangi - 33023 Jegan M-33024 Jyotsna-33025Documento19 pagineParan: Done by Harish Kumar - 33021 Jagan Raj-33022 Jayamathangi - 33023 Jegan M-33024 Jyotsna-33025Harish KumarNessuna valutazione finora

- SME Financing (2007 Format)Documento48 pagineSME Financing (2007 Format)Sirsanath BanerjeeNessuna valutazione finora

- NIP Task Force ReportDocumento3 pagineNIP Task Force ReportChetan MitraNessuna valutazione finora

- HRCA SteelDocumento30 pagineHRCA SteelShankar PranavNessuna valutazione finora

- RTP 102 Polypropylene (PP) Glass Fiber: Product Data Sheet & General Processing ConditionsDocumento1 paginaRTP 102 Polypropylene (PP) Glass Fiber: Product Data Sheet & General Processing ConditionsarmandoNessuna valutazione finora

- Pump Shaft DeflectionDocumento3 paginePump Shaft DeflectionMine RHNessuna valutazione finora

- Module 4 Construction ContractsDocumento47 pagineModule 4 Construction ContractsNiki DimaanoNessuna valutazione finora

- LUS-HSE-MA1-400-001.05 - Lusail HSE Fire Management System Framework PDFDocumento18 pagineLUS-HSE-MA1-400-001.05 - Lusail HSE Fire Management System Framework PDFJaijeev PaliNessuna valutazione finora

- Sprinkler CalculationDocumento14 pagineSprinkler CalculationJMVNessuna valutazione finora

- Tender For Construction of Reinforced Concrete Trapezoidal Drain in Palm Loop PDFDocumento37 pagineTender For Construction of Reinforced Concrete Trapezoidal Drain in Palm Loop PDFabdirahmanNessuna valutazione finora

- 4935-w0 Standard For Purchase of Full-Encirclement Welded Split SleevesDocumento3 pagine4935-w0 Standard For Purchase of Full-Encirclement Welded Split SleevesLorenaNessuna valutazione finora

- Thrust Bearing OrientationDocumento1 paginaThrust Bearing Orientationmbueno1180Nessuna valutazione finora

- Layher Allround - Description and Technical SpecificationDocumento3 pagineLayher Allround - Description and Technical SpecificationYogesh WadhwaNessuna valutazione finora

- Fire Sprinkler Systems#Documento8 pagineFire Sprinkler Systems#aimiza50% (2)

- Reinhardt 1982Documento48 pagineReinhardt 1982Tugce CeranNessuna valutazione finora

- Materials For LumbungDocumento7 pagineMaterials For LumbungIssnadewi Paramitha WiryaNessuna valutazione finora

- Arch.: Delugan Meissl Associated Architects, Vienna, AustriaDocumento11 pagineArch.: Delugan Meissl Associated Architects, Vienna, AustriaRadu MihaiNessuna valutazione finora

- Saudi Aramco Typical Inspection Plan Hydrostatic Testing of On-Plot PipingDocumento10 pagineSaudi Aramco Typical Inspection Plan Hydrostatic Testing of On-Plot PipingAhdal NoushadNessuna valutazione finora

- 5 (1) .Recent IRC Codes On Waste Plastic, Warm - SK NirmalDocumento33 pagine5 (1) .Recent IRC Codes On Waste Plastic, Warm - SK NirmalSoni JitubhaiNessuna valutazione finora

- Otari D.P.: NAME OF WORK - Proposed ConstructionDocumento3 pagineOtari D.P.: NAME OF WORK - Proposed ConstructionDattaraj OtariNessuna valutazione finora

- Bituthene 3000-3000 HCDocumento2 pagineBituthene 3000-3000 HCRm1262Nessuna valutazione finora

- BS en 14576-2005Documento15 pagineBS en 14576-2005bdr85Nessuna valutazione finora

- Florida Heat PumpDocumento12 pagineFlorida Heat PumpGhiban ConstantinNessuna valutazione finora

- Full Overlay European Concealed Hinges Model Description Opening HDocumento2 pagineFull Overlay European Concealed Hinges Model Description Opening HMel TorresNessuna valutazione finora

- Calculation Sheet Boiler Control BuildingDocumento35 pagineCalculation Sheet Boiler Control BuildingKhamal Rachmanda AdamNessuna valutazione finora

- Fixotec Technical CatalogueDocumento71 pagineFixotec Technical CatalogueSaqib AliNessuna valutazione finora

- Carbon Steel Bolts, Studs, and Threaded Rod 60 000 PSI Tensile StrengthDocumento6 pagineCarbon Steel Bolts, Studs, and Threaded Rod 60 000 PSI Tensile StrengthPlinio LavinasNessuna valutazione finora

- SampleDocumento118 pagineSampleJanine NazaireNessuna valutazione finora

- RULE7-8 ProblemAnalysis PDFDocumento109 pagineRULE7-8 ProblemAnalysis PDFMhae Torres100% (1)

- Characteristics and Application of PolymersDocumento18 pagineCharacteristics and Application of PolymersQaz ZaqNessuna valutazione finora

- Unit 12 (REINFORCED CONCRETE COLUMNS)Documento30 pagineUnit 12 (REINFORCED CONCRETE COLUMNS)Zara Nabilah100% (4)

- TDS Weberfloor 535 FDDocumento3 pagineTDS Weberfloor 535 FDmanikandan4strlNessuna valutazione finora

- ER&MS Sept 2017Documento419 pagineER&MS Sept 2017omer tanrioverNessuna valutazione finora