Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/Irwin

Caricato da

Sobia NasreenTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/Irwin

Caricato da

Sobia NasreenCopyright:

Formati disponibili

The McGraw-Hill Companies, Inc.

, 2005

McGraw-Hill/Irwin

3-1

THE ACCOUNTING

CYCLE: CAPTURING

ECONOMIC EVENTS

Chapter

3

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-2

The Ledger

The entire group of

accounts is kept

together in an

accounting record

called a ledger.

Cash

Accounts

Payable

Capital

Stock

Accounts are

individual records

showing increases

and decreases.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-3

The Use of Accounts

Increases are

recorded on one

side of the T-

account, and

decreases are

recorded on the

other side.

Left

or

Debit

Side

Right

or

Credit

Side

Title of the Account

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-4

Lets see how

debits and credits

are recorded in the

Cash account for

JJs Lawn Care

Service.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-5

Cash

5/1 8,000 5/2 2,500

5/25 75 5/8 2,000

5/29 750 5/28 150

5/31 50

5/31 4,125

Bal.

Receipts

are on

the debit

side.

Payments

are on the

credit

side.

The balance is the

difference between

the debit and credit

entries in the

account.

Debit and Credit Entries

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-6

A = L + OE

ASSETS

Debit

for

Increase

Credit

for

Decrease

EQUITIES

Debit

for

Decrease

Credit

for

Increase

LIABILITIES

Debit

for

Decrease

Credit

for

Increase

Debits and credits affect accounts as follows:

Debit and Credit Rules

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-7

A = L + OE

Debit

balances

Credit

balances

=

In the double-entry accounting system,

every transaction is recorded by equal

dollar amounts of debits and credits.

Double Entry Accounting The Equality of

Debits and Credits

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-8

Lets record

selected

transactions for

JJs Lawn Care

Service in the

accounts.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-9

May 1: Jill Jones and her family invested $8,000

in JJs Lawn Care Service and received 800 shares

of stock.

Will Cash increase

or decrease?

Will Capital Stock

increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-10

Capital Stock

5/1 8,000

Cash

5/1 8,000

May 1: Jill Jones and her family invested $8,000

in JJs Lawn Care Service and received 800 shares

of stock.

Cash increases

$8,000 with a debit.

Capital Stock

increases $8,000

with a credit.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-11

May 2: JJs purchased a riding lawn mower

for $2,500 cash.

Will Cash increase

or decrease?

Will Tools &

Equipment increase

or decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-12

May 2: JJs purchased a riding lawn mower

for $2,500 cash.

Tools & Equipment

5/2 2,500

Cash

5/1 8,000 5/2 2,500

Cash decreases

$2,500 with a credit.

Tools & Equipment

increases $2,500

with a debit.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-13

May 8: JJs purchased a $15,000 truck. JJs

paid $2,000 in cash and issued a note payable

for the remaining $13,000.

Will Truck increase

or decrease?

Will Cash and

Notes Payable

increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-14

May 8: JJs purchased a $15,000 truck. JJs

paid $2,000 in cash and issued a note payable

for the remaining $13,000.

Truck

5/8 15,000

Cash

5/1 8,000 5/2 2,500

5/8 2,000

Notes Payable

5/8 13,000

Truck increases

$15,000 with a debit.

Cash decreases

$2,000 with a credit.

Notes Payable

increases $13,000

with a credit.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-15

May 11: JJs purchased some repair parts

for $300 on account.

Will Tools &

Equipment increase

or decrease?

Will Accounts

Payable increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-16

May 11: JJs purchased some repair parts

for $300 on account.

Tools & Equipment

increases $300 with

a debit.

Accounts Payable

increases $300 with

a credit.

Tools & Equipment

5/2 2,500

5/11 300

Accounts Payable

5/11 300

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-17

May 18: JJs sold half of the repair parts to

ABC Lawns for $150, a price equal to JJs cost.

ABC Lawns agrees to pay JJs within 30 days.

Will Tools &

Equipment increase

or decrease?

Will Accounts

Receivable increase

or decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-18

May 18: JJs sold half of the repair parts to

ABC Lawns for $150, a price equal to JJs cost.

ABC Lawns agrees to pay JJs within 30 days.

Tools & Equipment

decreases $150 with

a credit.

Accounts Receivable

increases $150 with

a debit.

Tools & Equipment

5/2 2,500 5/18 150

5/11 300

Accounts Receivable

5/18 150

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-19

In an actual accounting system, transactions

are initially recorded in the journal.

GENERAL JOURNAL

Date Account Titles and Explanation Debit Credit

2005

May 1 Cash 8,000

Capital Stock 8,000

Owners invest cash in the business.

The Journal

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-20

Posting

involves

copying

information

from the

journal to the

ledger

accounts.

Posting Journal Entries to the Ledger

Accounts

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-21

GENERAL JOURNAL

Date Account Titles and Explanation Debit Credit

2005

May 1 Cash 8,000

Capital Stock 8,000

Owners invest cash in the business.

General Ledger

Cash

Date Debit Credit Balance

2005

May 1 8,000 8,000

Posting Journal Entries to the Ledger

Accounts

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-22

GENERAL JOURNAL

Date Account Titles and Explanation Debit Credit

2005

May 1 Cash 8,000

Capital Stock 8,000

Owners invest cash in the business.

General Ledger

Capital Stock

Date Debit Credit Balance

2005

May 1 8,000 8,000

Posting Journal Entries to the Ledger

Accounts

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-23

GENERAL JOURNAL

Date Account Titles and Explanation Debit Credit

2005

May 2 Tools & Equipment 2,500

Cash 2,500

Purchased lawn mower.

Lets see what the cash account looks like after

posting the cash portion of this transaction for

JJs Lawn Care Service.

Posting Journal Entries to the Ledger

Accounts

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-24

General Ledger

Cash

Date Debit Credit Balance

2005

May 1 8,000 8,000

2 2,500 5,500

This ledger format is referred to as a

running balance.

Ledger Accounts After Posting

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-25

General Ledger

Cash

Date Debit Credit Balance

2005

May 1 8,000 8,000

2 2,500 5,500

T accounts are simplified versions of

the ledger account that only show the

debit and credit columns.

Ledger Accounts After Posting

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-26

Net income is not an asset its an increase in

owners equity from profits of the business.

A = L + OE

Increase

This effects occur as net

income is earned . . .

Increase

. . . but this is

what net income

really means.

What is Net Income?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-27

A = L + OE

Retained Earnings

Capital

Stock

Retained

Earnings

The balance in the Retained Earnings account represents

the total net income of the corporation over the entire

lifetime of the business, less all amounts which have

been distributed to the stockholders as dividends.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-28

JJ's Lawn Care Service

Income Statement

For the Month Ended May 31, 2005

Sales Revenue 750 $

Operating Expense:

Gasoline Expense 50

Net Income 700 $

The income statement summarizes the profitability

of a business for a specified period of time.

The Income Statement: A Preview

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-29

Accounting Periods

Time Period Principle

To provide users of financial

statements with timely

information, net income is

measured for relatively short

accounting periods of equal

length.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-30

Revenue and Expenses

The price for

goods sold

and services

rendered during a

given accounting

period.

Increases

owners equity.

The costs of

goods and

services used up

in the process of

earning revenue.

Decreases

owners equity.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-31

The Realization Principle: When To

Record Revenue

Realization Principle

Revenue should be

recognized at the

time goods are sold

and services are

rendered.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-32

The Matching Principle: When To

Record Expenses

Matching Principle

Expenses should be

recorded in the

period in which they

are used up.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-33

Debits and Credits for Revenue and

Expense

EQUITIES

Debit

for

Decrease

Credit

for

Increase

Expenses

decrease

owners

equity.

Revenues

increase

owners

equity.

EXPENSES

Credit

for

Decrease

Debit

for

Increase

REVENUES

Debit

for

Decrease

Credit

for

Increase

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-34

EQUITIES

Debit

for

Decrease

Credit

for

Increase

Payments to

owners

decrease

owners

equity.

Owners

investments

increase

owners

equity.

DIVIDENDS

Credit

for

Decrease

Debit

for

Increase

Investments by and Payments to Owners

CAPITAL STOCK

Debit

for

Decrease

Credit

for

Increase

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-35

Lets analyze the

revenue and

expense

transactions for

JJs Lawn Care

Service for the

month of May.

We will also

analyze a dividend

transaction.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-36

May 29: JJs provided lawn care services for a

client and received $750 in cash.

Will Cash increase

or decrease?

Will Sales Revenue

increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-37

Sales Revenue

5/29 750

May 29: JJs provided lawn care services for a

client and received $750 in cash.

Cash increases

$750 with a debit.

Sales Revenue

increases $750 with

a credit.

Cash

5/1 8,000 5/2 2,500

5/29 750 5/8 2,000

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-38

May 31: JJs purchased gasoline for the lawn

mower and the truck for $50 cash.

Will Cash increase

or decrease?

Will Gasoline

Expense increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-39

Gasoline Expense

5/31 50

May 31: JJs purchased gasoline for the lawn

mower and the truck for $50 cash.

Cash decreases $50

with a credit.

Gasoline Expense

increases $50 with a

debit.

Cash

5/1 8,000 5/2 2,500

5/29 750 5/8 2,000

5/31 50

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-40

May 31: JJs Lawn Care paid Jill Jones and

her family a $200 dividend.

Will Cash increase

or decrease?

Will Dividends

increase or

decrease?

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-41

Dividends

5/31 200

May 31: JJs Lawn Care paid Jill Jones and

her family a $200 dividend.

Cash decreases

$200 with a credit.

Dividends increase

$200 with a debit.

Cash

5/1 8,000 5/2 2,500

5/29 750 5/8 2,000

5/31 50

5/31 200

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-42

Now, lets look at

the Trial Balance

for JJs Lawn Care

Service for the

month of May.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-43

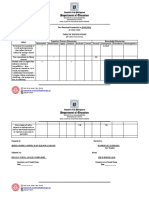

JJ's Lawn Care Service

Unadjusted Trial Balance

May 31, 2005

Cash 3,925 $

Accounts receivable 75

Tools & equipment 2,650

Truck 15,000

Notes payable 13,000 $

Accounts payable 150

Capital stock 8,000

Dividends 200

Sales revenue 750

Gasoline expense 50

Total 21,900 $ 21,900 $

All balances

are taken from

the ledger

accounts on

May 31 after

considering all

of JJs

transactions

for the month.

Proves equality

of debits and

credits.

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-44

Journalize

transactions.

Post entries to

the ledger

accounts.

Prepare trial

balance.

Make end-of-

year

adjustments.

Prepare adjusted

trial balance.

Prepare

financial

statements.

Prepare after-closing

trial balance.

Journalize and

post closing

entries.

The Accounting Cycle

The McGraw-Hill Companies, Inc., 2005

McGraw-Hill/Irwin

3-45

End of Chapter 3

Potrebbero piacerti anche

- Eastern Europe SourcebookDocumento110 pagineEastern Europe SourcebookDaniel Alan93% (15)

- The Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Documento5 pagineThe Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Justinn AbrahamNessuna valutazione finora

- Oxford Math AA SL Exam Practise Additional ResourcesDocumento172 pagineOxford Math AA SL Exam Practise Additional ResourcesSıla DenizNessuna valutazione finora

- Banana Stem Patty Pre Finale 1Documento16 pagineBanana Stem Patty Pre Finale 1Armel Barayuga86% (7)

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocumento32 pagineCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNessuna valutazione finora

- Workbook On Ratio AnalysisDocumento9 pagineWorkbook On Ratio AnalysisZahid HassanNessuna valutazione finora

- FCFEDocumento7 pagineFCFEbang bebetNessuna valutazione finora

- Chemical Recycling of Textile PolymersDocumento8 pagineChemical Recycling of Textile PolymersVaishali RaneNessuna valutazione finora

- Republic V Mangotara DigestDocumento3 pagineRepublic V Mangotara DigestMickey Ortega100% (1)

- Manufacturing Finance With SAP ERP Financials: Subbu RamakrishnanDocumento33 pagineManufacturing Finance With SAP ERP Financials: Subbu RamakrishnanKhalifa Hassan100% (1)

- PURL Questions and AnswersDocumento3 paginePURL Questions and AnswersSHAHAN VS100% (5)

- Food Cart Franchise DetailsDocumento33 pagineFood Cart Franchise Detailscharvin_strong32Nessuna valutazione finora

- Tle7 Ict TD M2 V3Documento28 pagineTle7 Ict TD M2 V3Rowemar Corpuz100% (1)

- Prelims Reviewer Biochem LabDocumento4 paginePrelims Reviewer Biochem LabRiah Mae MertoNessuna valutazione finora

- Aicpa Accounting GlossaryDocumento24 pagineAicpa Accounting GlossaryRafael AlemanNessuna valutazione finora

- Valuing Private Companies:: Factors and Approaches To ConsiderDocumento35 pagineValuing Private Companies:: Factors and Approaches To ConsiderAvinash DasNessuna valutazione finora

- The Time Value of MoneyDocumento66 pagineThe Time Value of MoneyrachealllNessuna valutazione finora

- Discounted Cash Flow ApplicationsDocumento27 pagineDiscounted Cash Flow ApplicationsAvinash DasNessuna valutazione finora

- Different Customer Roles How To Create Value For All These RolesDocumento22 pagineDifferent Customer Roles How To Create Value For All These RolespremjsNessuna valutazione finora

- ARNDTECH Solutions Inc ARNDTECH Solutions IncDocumento17 pagineARNDTECH Solutions Inc ARNDTECH Solutions IncAmer AliNessuna valutazione finora

- Pre-Money Valuation: Multiple ApproachDocumento16 paginePre-Money Valuation: Multiple ApproachDavid ChikhladzeNessuna valutazione finora

- Pricing Strategy and ManagementDocumento15 paginePricing Strategy and Managementadibhai06Nessuna valutazione finora

- Company Profile: Kalikasthan, Dillibazar, Kathmandu, Nepal Tel: +977 - 1 - 4442435, 4424743 EmailDocumento13 pagineCompany Profile: Kalikasthan, Dillibazar, Kathmandu, Nepal Tel: +977 - 1 - 4442435, 4424743 EmailSaahil GoyalNessuna valutazione finora

- Module 5 - Game TheoryDocumento14 pagineModule 5 - Game Theorychandni_murthy_46404Nessuna valutazione finora

- Fauji Fertilizer Company Vs Engro Fertilizer CompanyDocumento14 pagineFauji Fertilizer Company Vs Engro Fertilizer CompanyArslan Ali Butt100% (1)

- CVP Analysis - 2018Documento23 pagineCVP Analysis - 2018Ali KhanNessuna valutazione finora

- L8 Raising CapitalDocumento26 pagineL8 Raising CapitalKranthi ManthriNessuna valutazione finora

- Sensitivity AnalysisDocumento6 pagineSensitivity AnalysisLovedale JoyanaNessuna valutazione finora

- Auditing CA Final Investigation and Due DiligenceDocumento26 pagineAuditing CA Final Investigation and Due Diligencevarunmonga90Nessuna valutazione finora

- Goal Seek in ExcelDocumento2 pagineGoal Seek in ExcelsauravnarukaNessuna valutazione finora

- Accounting I N ActionDocumento38 pagineAccounting I N ActionJr RoqueNessuna valutazione finora

- Project TimelineDocumento4 pagineProject TimelineAnonymous Rr4x3z46JNessuna valutazione finora

- CH - 4 - Time Value of MoneyDocumento49 pagineCH - 4 - Time Value of Moneyak sNessuna valutazione finora

- Extending Credit To Businesses and Individuals (Managing Credit Risk)Documento81 pagineExtending Credit To Businesses and Individuals (Managing Credit Risk)Subhajit KarmakarNessuna valutazione finora

- Fraud Risk FactorsDocumento7 pagineFraud Risk FactorsFrancis Azul SimalongNessuna valutazione finora

- Pricing StrategiesDocumento14 paginePricing StrategiesAnonymous ibmeej9Nessuna valutazione finora

- Days-Sales-Outstanding-TemplateDocumento3 pagineDays-Sales-Outstanding-TemplateKaren Anne Pineda IngenteNessuna valutazione finora

- Val PacketDocumento157 pagineVal PacketKumar PrashantNessuna valutazione finora

- Ration Analysis of M&SDocumento72 pagineRation Analysis of M&SRashid JalalNessuna valutazione finora

- Goal SseekDocumento5 pagineGoal SseekFilip NikolovskiNessuna valutazione finora

- Report On New Business Plan: (Mr. Fast Food)Documento24 pagineReport On New Business Plan: (Mr. Fast Food)shahidul0Nessuna valutazione finora

- Fundamental Equity Analysis & Analyst Recommendations - SX5E Eurostoxx 50 Index ComponentsDocumento103 pagineFundamental Equity Analysis & Analyst Recommendations - SX5E Eurostoxx 50 Index ComponentsQ.M.S Advisors LLCNessuna valutazione finora

- Lee Chee How 21wbd08408 IndvassignmentDocumento19 pagineLee Chee How 21wbd08408 Indvassignmentho cheeNessuna valutazione finora

- Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDSDocumento11 pagineGlossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDSFUCKYOU21170% (1)

- Feasibility Study of ProjectDocumento15 pagineFeasibility Study of ProjectMauliddha RachmiNessuna valutazione finora

- S12 Retail PricingDocumento66 pagineS12 Retail PricingVishnuvardhan Ravichandran0% (1)

- Feasibility Study On New BusinessDocumento8 pagineFeasibility Study On New BusinessWyn OkpapiNessuna valutazione finora

- PranDocumento84 paginePranNoor Ibne SalehinNessuna valutazione finora

- Timeline TemplateDocumento8 pagineTimeline Templateoliveira1305Nessuna valutazione finora

- Pricing StrategiesDocumento4 paginePricing StrategiesvinniieeNessuna valutazione finora

- PRAN RFL Ratio AnalysisDocumento5 paginePRAN RFL Ratio AnalysisMasud RanaNessuna valutazione finora

- Pestle Analysis - Alesh and GroupDocumento18 paginePestle Analysis - Alesh and GroupJay KapoorNessuna valutazione finora

- Actuaries 4Documento69 pagineActuaries 4MuradNessuna valutazione finora

- Chapter14, Pricing StrategyDocumento25 pagineChapter14, Pricing StrategysekaramariliesNessuna valutazione finora

- RC Equity Research Report Essentials CFA InstituteDocumento3 pagineRC Equity Research Report Essentials CFA InstitutetheakjNessuna valutazione finora

- Evaluation of Investment Project Using IRR and NPVDocumento6 pagineEvaluation of Investment Project Using IRR and NPVchew97Nessuna valutazione finora

- Investor Guide BookDocumento169 pagineInvestor Guide BooktonyvinayakNessuna valutazione finora

- FMDocumento99 pagineFMvinit1117Nessuna valutazione finora

- Potato and Banana ChipsDocumento6 paginePotato and Banana ChipsNikhil KumarNessuna valutazione finora

- Part D.2-Vertical AnalysisDocumento32 paginePart D.2-Vertical AnalysisQuendrick Surban100% (1)

- RCF Ratio AnlysisDocumento46 pagineRCF Ratio AnlysisAnil KoliNessuna valutazione finora

- Pricing StrategyDocumento19 paginePricing StrategyKamal SinghNessuna valutazione finora

- Cash Flow Forecast, Cost-Benefit Evaluation TechniquesDocumento15 pagineCash Flow Forecast, Cost-Benefit Evaluation Techniqueswaqar chNessuna valutazione finora

- Financial Desion MakingDocumento35 pagineFinancial Desion MakingFrancisca LotraNessuna valutazione finora

- Capital+budgeting UnsolvedDocumento4 pagineCapital+budgeting UnsolvedutamiNessuna valutazione finora

- Balanced Scorecard Excel TemplateDocumento9 pagineBalanced Scorecard Excel TemplateRemi AboNessuna valutazione finora

- Sample Operational Financial Analysis ReportDocumento8 pagineSample Operational Financial Analysis ReportValentinorossiNessuna valutazione finora

- Sensitivity AnalysisDocumento19 pagineSensitivity AnalysisMarcin KotNessuna valutazione finora

- Pricing StrategiesDocumento34 paginePricing StrategiesshwetambarirupeshNessuna valutazione finora

- Accounting Cycle (I) - : Recording Economic TransactionsDocumento49 pagineAccounting Cycle (I) - : Recording Economic TransactionsDevang BharaniaNessuna valutazione finora

- Seinfelt - The CheesecakeDocumento31 pagineSeinfelt - The Cheesecakeseinfelt100% (2)

- Fatty AcidsDocumento13 pagineFatty AcidsRaviraj MalaniNessuna valutazione finora

- The London SchoolDocumento3 pagineThe London SchoolKhawla Adnan100% (5)

- Report Liquid Detergent BreezeDocumento12 pagineReport Liquid Detergent BreezeDhiyyah Mardhiyyah100% (1)

- 1778 3557 1 SM PDFDocumento4 pagine1778 3557 1 SM PDFjulio simanjuntakNessuna valutazione finora

- 2020 ESIA Guideline Edited AaDocumento102 pagine2020 ESIA Guideline Edited AaAbeje Zewdie100% (1)

- SR Cheat Sheets PDFDocumento4 pagineSR Cheat Sheets PDFDevin ZhangNessuna valutazione finora

- Lesson PlansDocumento12 pagineLesson Plansapi-282722668Nessuna valutazione finora

- English Paper 1 Mark Scheme: Cambridge Lower Secondary Sample Test For Use With Curriculum Published in September 2020Documento11 pagineEnglish Paper 1 Mark Scheme: Cambridge Lower Secondary Sample Test For Use With Curriculum Published in September 2020ABEER RATHINessuna valutazione finora

- Industrial SafetyDocumento5 pagineIndustrial Safetykamujula reddyNessuna valutazione finora

- American J Political Sci - 2023 - Eggers - Placebo Tests For Causal InferenceDocumento16 pagineAmerican J Political Sci - 2023 - Eggers - Placebo Tests For Causal Inferencemarta bernardiNessuna valutazione finora

- MSDS Potassium DichromateDocumento8 pagineMSDS Potassium DichromateAyu Lakshemini OkaNessuna valutazione finora

- Lesson 3 - Practical ResearchDocumento17 pagineLesson 3 - Practical ResearchBenNessuna valutazione finora

- TOS 1st QuarterDocumento6 pagineTOS 1st QuarterQuerisa Ingrid MortelNessuna valutazione finora

- History of Communication - Project - File - 455 PDFDocumento20 pagineHistory of Communication - Project - File - 455 PDFlathaNessuna valutazione finora

- Business ProblemsDocumento5 pagineBusiness ProblemsMaureen GarridoNessuna valutazione finora

- UX-driven Heuristics For Every Designer: OutlineDocumento7 pagineUX-driven Heuristics For Every Designer: OutlinemuhammadsabirinhadisNessuna valutazione finora

- Case AnalyzerDocumento19 pagineCase AnalyzeranuragNessuna valutazione finora

- Building Interactive AppsDocumento17 pagineBuilding Interactive AppsJRoman OrtizNessuna valutazione finora

- The Design and Development of Organic Chemistry Module For College StudentsDocumento6 pagineThe Design and Development of Organic Chemistry Module For College StudentsEight AlykNessuna valutazione finora