Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Forecasting

Caricato da

Sumeet GaikwadDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Forecasting

Caricato da

Sumeet GaikwadCopyright:

Formati disponibili

Forecasting

Rohit Kapoor

Motivating Example: A Reality

When Big Bazaar launched this scheme, Sabse Sasta Teen

Din, in 2006, they sold goods worth of Rs. 260 million.

Encouraged by the response, they ran the scheme for 3 days in

2007. During this 3-day period, approximately 6 million people

visited their stores. The 43 outlets of Big Bazaar sold goods

worth Rs. 1.25 billion. A total of 108 thousands bed-sheets,

30,000 cell-phones and 11,000 pieces of apparel were sold.

There were reports that the company had to shutdown many of

the outlets as they had not anticipated the customer response and

the stocks of several popular items had been exhausted.

Learning: predicting the demand for such schemes is always

tricky

Characteristics of Forecasts

During the economic downturn in 2001, CISCO found that its sales

plunged by 30 percent and it was stuck with huge inventory. CISCO

decided to write - off an inventory of $2.2 billion, and CISCOs stock

price dropped to a record low at $13.36 (stock price was quoted at $83

in 2000). Though all networking companies are affected by the

downturn, the losses suffered by CISCO surprised everyone. CSICO

relied very heavily on its state of the art virtual close software and

expected that demand will rise when other companies in the industry

expected the demand to decline. CISCOs software had built-in

growth bias and was not designed to capture the impact of change in

economy. Experts believe that this over reliance on the forecasting

technology led people to undervalue human judgment and intuition,

and inhibited frank conversations among supply chain partners. The

CEO John Chambers admitted in the interview that We never built

models to anticipate something of this magnitude

www.cio.com/article/viewArticle/30413/What_Went_Wrong_at_Cisco_in.

Characteristics of Forecasts

Contd.

Longer the forecast horizon, the worse the forecast

7-Eleven Japan has exploited this key property to improve

its performance. The company has instituted a replenishment

process that enables it to respond to an order within hours.

For example, if a store manager places an order by 10:00

AM, the order is delivered by 7:00 PM the same day.

Therefore, the manager only has to forecast what will sell

that night less than 12 hours before the actual sale.

Aggregate forecasts are more accurate

Farther up the supply chain, more will be the error

in forecasting

An Interesting Forecasting by

Asian Paints

Asian Paints found that in certain districts of Maharashtra

there is a spike in demand for a 50-100 ml packs of

deep orange shade during a specific period of the year.

Further investigations revealed that a few districts of

Maharashtra observe a local festival called Pola, and

during that festival, farmers paint the horns of bullocks

with deep orange shade. Asian Paints is aware of the

fact that the paint-buying decision is linked to festivals,

and India being a diverse country with different regions

celebrating various festivals at different times of the

year, it is important for Asian Paints to capture the

same in their forecasting models.

www.cio.in/article/view/viewArticle?ARTICLEID=1237

Analytical Methods for

Forecasting

Static Methods

Adaptive Methods

Casual Methods

Static Methods

Case 1: Forecasting the trend form

Case 2: Forecasting seasonality

Case 3: Forecasting combination of

seasonality and trend

Case 1: Forecasting the Trend

Form

A constant increase or decrease in demand

denotes

Linear trend

Model

Forecast (t) = a + b * t

Case 1: Forecasting the Trend

Form

t D(t)

1 328

2 310

3 355

4 362

5 375

6 380

7 408

8 415

9 417

10 412

11 429

12 434

13 449

14 471

15 475

16 489

D(t)

0

100

200

300

400

500

600

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Period

D

e

m

a

n

d

D(t)

Case 1: Forecasting the Trend

Form Calculations

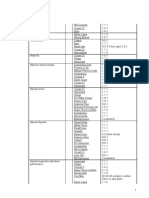

t D(t) t-Tavg D(t) - Davg (t-Tavg) * (D(t)-Davg) (t-tavg)^2 Forecast Abs error

1 328 -7.5 -78.81 591.09 56.25 326.40 1.60

2 310 -6.5 -96.81 629.28 42.25 337.12 27.12

3 355 -5.5 -51.81 284.97 30.25 347.84 7.16

4 362 -4.5 -44.81 201.66 20.25 358.56 3.44

5 375 -3.5 -31.81 111.34 12.25 369.29 5.71

6 380 -2.5 -26.81 67.03 6.25 380.01 0.01

7 408 -1.5 1.19 -1.78 2.25 390.73 17.27

8 415 -0.5 8.19 -4.09 0.25 401.45 13.55

9 417 0.5 10.19 5.09 0.25 412.17 4.83

10 412 1.5 5.19 7.78 2.25 422.90 10.90

11 429 2.5 22.19 55.47 6.25 433.62 4.62

12 434 3.5 27.19 95.16 12.25 444.34 10.34

13 449 4.5 42.19 189.84 20.25 455.06 6.06

14 471 5.5 64.19 353.03 30.25 465.78 5.22

15 475 6.5 68.19 443.22 42.25 476.51 1.51

16 489 7.5 82.19 616.41 56.25 487.23 1.77

Mean 8.5 406.8125 7.57

Sum 3645.5 340

b 10.72206

a 315.675

Forecast vs. Actual Demand

Actual Demand vs. Forecasted Demand

0

100

200

300

400

500

600

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Period

D

e

m

a

n

d

D(t)

Forecast

Estimating Forecasting Error

Four ways:

Mean error (ME)

Value close to 0

Magnitude of the error?

Mean absolute deviation (MAD)

Mean square error (MSE)

Higher value of error should attract higher penalties!

Mean absolute percentage error (MAPE)

Different Estimates of Forecast

Error

Month Sales Forecast Error

Absolute

Deviation

Square

Error

Absolute

% Error

1 328 326 2 2 4 0.61%

2 310 337 -27 27 729 8.71%

3 355 348 7 7 49 1.97%

4 362 359 3 3 9 0.83%

5 375 369 6 6 36 1.60%

6 380 380 0 0 0 0.00%

7 408 391 17 17 289 4.17%

8 415 401 14 14 196 3.37%

9 417 412 5 5 25 1.20%

10 412 423 -11 11 121 2.67%

11 429 434 -5 5 25 1.17%

12 434 444 -10 10 100 2.30%

13 449 455 -6 6 36 1.34%

14 471 466 5 5 25 1.06%

15 475 476 -1 1 1 0.21%

16 489 487 2 2 4 0.41%

Mean 0.0625 7.5625 103.0625 1.98%

ME MAD MSE MAPE

Case 2: Forecasting Seasonality

Time Block

Period

within

block Demand

1 1 6

2 2 55

3 3 249

4 4 646

5 1 24

6 2 73

7 3 140

8 4 569

9 1 12

10 2 28

11 3 136

12 4 631

1

2

3

0

100

200

300

400

500

600

700

1 2 3 4 5 6 7 8 9 10 11 12

D

e

m

a

n

d

Period

Demand Data

Demand

Case 2: Forecasting Seasonality

Periodicity

p = 4

Peak demand at 4, 8, 12

Lowest demand at 1, 5, 9

Data is divided into blocks

m blocks having p demand periods

Seasonality index

Block j and period i

Seasonality index for i

th

period

Average seasonality index for period i across the blocks

Case 2: Forecasting Seasonality

Some Equations

Seasonality index of period i for block j

S(i, j) = (d

i

)/[(d

1

+ d

2

+ + d

p

)/p]

For each period i within block j

Average seasonality index for period i

within a block

S(i)

Case 2: Forecasting Seasonality

Analysis

Time Block

Period

within

block Demand Average

Seasonal

Index of

Period

1 1 6 0.03

2 2 55 0.23

3 3 249 1.04

4 4 646 2.70

5 1 24 0.12

6 2 73 0.36

7 3 140 0.69

8 4 569 2.82

9 1 12 0.06

10 2 28 0.14

11 3 136 0.67

12 4 631 3.13

1

2

3

239

201.5

201.75

Case 2: Forecasting Seasonality

Seasonality Index Calculation

Period/Block S(i, 1) S(i, 2) S(i, 3)

Average

Seasonality

Index

1 0.03 0.12 0.06 0.07

2 0.23 0.36 0.14 0.24

3 1.04 0.69 0.67 0.80

4 2.70 2.82 3.13 2.88

Case 2: Forecasting Seasonality

De-seasonalizing Demand

De-seasonalized demand data (t)

Demand(t)/S(t)

Forecast (t)

[Level (t)] * Seasonal index (t)

Case 2: Forecasting Seasonality

Calculations

Time Block

Period

within

block Demand Average

Seasonal

Index of

Period

De-

Seasonlized

Demand Forecast Abs Error

1 1 6 0.03 88 14 8

2 2 55 0.23 226 52 3

3 3 249 1.04 310 171 78

4 4 646 2.70 224 613 33

5 1 24 0.12 353 14 10

6 2 73 0.36 300 52 21

7 3 140 0.69 174 171 31

8 4 569 2.82 197 613 44

9 1 12 0.06 177 14 2

10 2 28 0.14 115 52 24

11 3 136 0.67 169 171 35

12 4 631 3.13 219 613 18

Mean 213 26

1

2

3

239

201.5

201.75

Case 2: Forecasting Seasonality

Fit

0

100

200

300

400

500

600

700

1 2 3 4 5 6 7 8 9 10 11 12

D

e

m

a

n

d

Period

Demand Data Vs. Actual Data

Demand

Forecast

Case 3: Forecasting Combination

of Seasonality and Trend

Quarter Sales

1 45

2 335

3 520

4 100

5 70

6 370

7 590

8 170

9 100

10 585

11 830

12 285

13 100

14 725

15 1160

16 310

Sales

0

200

400

600

800

1000

1200

1400

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Quarter

D

e

m

a

n

d

Sales

Case 3: Forecasting Combination

of Seasonality and Trend

Observation

Seasonality with periodicity, p = 4

Demand seems to be increasing every year

Hence, trend component is also present

Case 3: Forecasting Combination

of Seasonality and Trend

Methodology

Forecasting model

Demand (t) = (Level (t) + Trend parameter * t) * Seasonality

parameter (t) + random error

Step 1: Determine the seasonality index for each time

period within a block (similar to Case 2)

Step 2: De-seasonalize the demand data (similar to

Case 2)

Step 3: Determine the trend and level components for

the de-seasonalized data series (similar to Case 1)

Step 4: Finalize the forecasting model

Case 3: Forecasting Combination

of Seasonality and Trend

Analysis

Time Block

Period

within

Block Demand

Average

Demand

Seasonality

Index

1 1 45 0.18

2 2 335 1.34

3 3 520 2.08

4 4 100 0.40

5 1 70 0.23

6 2 370 1.23

7 3 590 1.97

8 4 170 0.57

9 1 100 0.22

10 2 585 1.30

11 3 830 1.84

12 4 285 0.63

13 1 100 0.17

14 2 725 1.26

15 3 1160 2.02

16 4 310 0.54

1

2

3

4

250

300

450

573.75

Case 3: Forecasting Combination

of Seasonality and Trend

Analysis

Period/Block 1 2 3 4

Average

Seasonality

Index

1 0.18 0.23 0.22 0.17 0.20

2 1.34 1.23 1.30 1.26 1.28

3 2.08 1.97 1.84 2.02 1.98

4 0.40 0.57 0.63 0.54 0.54

Case 3: Forecasting Combination

of Seasonality and Trend

Analysis

Time

De-

seasonlized

Demand t-Tavg D(t) - Davg (t-Tavg) * (D(t) - Davg) (t-tavg)^2

1 222 -7.5 -172 1290.14 56.25

2 261 -6.5 -133 867.28 42.25

3 263 -5.5 -131 722.82 30.25

4 187 -4.5 -207 933.27 20.25

5 346 -3.5 -49 169.89 12.25

6 288 -2.5 -106 265.44 6.25

7 298 -1.5 -96 144.05 2.25

8 318 -0.5 -77 38.29 0.25

9 494 0.5 100 49.82 0.25

10 456 1.5 61 91.86 2.25

11 420 2.5 25 63.21 6.25

12 533 3.5 138 484.23 12.25

13 494 4.5 100 448.37 20.25

14 565 5.5 170 936.40 30.25

15 586 6.5 192 1248.66 42.25

16 579 7.5 185 1388.05 56.25

Mean 8.5 394.28

Sum b 27 9141.77 340

a 165.74

Case 3: Forecasting Combination

of Seasonality and Trend

Analysis

Step 1, 2 and 3 are complete

Step 4:

Forecast(t) = (165.74 + 27 * t) * Seasonality Index(t)

Case 3: Forecasting Combination

of Seasonality and Trend

Analysis

Time Block

Period

within

Block Demand Average Demand

Seasonality

Index

De-

seasonlized

Demand Forecast Abs Error

1 1 45 0.18 222 39 6

2 2 335 1.34 261 282 53

3 3 520 2.08 263 487 33

4 4 100 0.40 187 146 46

5 1 70 0.23 346 61 9

6 2 370 1.23 288 420 50

7 3 590 1.97 298 700 110

8 4 170 0.57 318 204 34

9 1 100 0.22 494 83 17

10 2 585 1.30 456 558 27

11 3 830 1.84 420 913 83

12 4 285 0.63 533 261 24

13 1 100 0.17 494 104 4

14 2 725 1.26 565 696 29

15 3 1160 2.02 586 1126 34

16 4 310 0.54 579 319 9

1

2

3

4

250

300

450

573.75

Case 3: Forecasting Combination

of Seasonality and Trend Fit

Forecasted Demand Vs. Actual Demand

0

200

400

600

800

1000

1200

1400

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Period

D

e

m

a

n

d

Demand

Forecast

Adaptive Methods

Moving Average

Simple Exponential Smoothening

Holts Method

Winters Method

Basic Data

Month TV Sales CD Sales AC Sales

1 30 40 13

2 32 47 7

3 30 50 23

4 39 49 32

5 33 56 58

6 34 53 60

7 34 55 90

8 38 63 93

9 36 68 63

10 39 65 39

11 30 72 37

12 36 69 29

13 38 79 36

14 30 82 21

15 35 80 47

16 30 85 81

17 34 94 112

18 40 89 139

19 36 96 230

20 32 100 201

21 40 100 122

22 36 105 84

23 40 108 74

24 34 110 62

TV Sales

TV Sales

0

5

10

15

20

25

30

35

40

45

13579

1

1

1

3

1

5

1

7

1

9

2

1

2

3

Month

T

V

S

a

l

e

s

TV Sales

CD Sales

CD Sales

0

20

40

60

80

100

120

147

1

0

1

3

1

6

1

9

2

2

Month

C

D

S

a

l

e

s

CD Sales

AC Sales

0

50

100

150

200

250

1 3 5 7 9 11 13 15 17 19 21 23

A

C

S

a

l

e

s

Month

AC Sales

AC Sales

Moving Average Method

Time series that fluctuates about a constant

base level

F

t,1

Forecast for period t + 1made after observing x

t

F

t,1

= Average of last N observations

= average of x

t

, x

t-1

, x

t-2

, , x

t-N+1

Moving Average Method

Calculations

Month TV Sales MAF (N = 2) Error MAF (N = 3) Error MAF (N = 4) Error MAF (N = 5) Error MAF (N = 6) Error

1 30

2 32

3 30 31 1

4 39 31 8 30.67 8.33

5 33 34.5 1.5 33.67 0.67 32.75 0.25

6 34 36 2 34.00 0.00 33.50 0.50 32.80 1.20

7 34 33.5 0.5 35.33 1.33 34.00 0.00 33.60 0.40 33.00 1.00

8 38 34 4 33.67 4.33 35.00 3.00 34.00 4.00 33.67 4.33

9 36 36 0 35.33 0.67 34.75 1.25 35.60 0.40 34.67 1.33

10 39 37 2 36.00 3.00 35.50 3.50 35.00 4.00 35.67 3.33

11 30 37.5 7.5 37.67 7.67 36.75 6.75 36.20 6.20 35.67 5.67

12 36 34.5 1.5 35.00 1.00 35.75 0.25 35.40 0.60 35.17 0.83

13 38 33 5 35.00 3.00 35.25 2.75 35.80 2.20 35.50 2.50

14 30 37 7 34.67 4.67 35.75 5.75 35.80 5.80 36.17 6.17

15 35 34 1 34.67 0.33 33.50 1.50 34.60 0.40 34.83 0.17

16 30 32.5 2.5 34.33 4.33 34.75 4.75 33.80 3.80 34.67 4.67

17 34 32.5 1.5 31.67 2.33 33.25 0.75 33.80 0.20 33.17 0.83

18 40 32 8 33.00 7.00 32.25 7.75 33.40 6.60 33.83 6.17

19 36 37 1 34.67 1.33 34.75 1.25 33.80 2.20 34.50 1.50

20 32 38 6 36.67 4.67 35.00 3.00 35.00 3.00 34.17 2.17

21 40 34 6 36.00 4.00 35.50 4.50 34.40 5.60 34.50 5.50

22 36 36 0 36.00 0.00 37.00 1.00 36.40 0.40 35.33 0.67

23 40 38 2 36.00 4.00 36.00 4.00 36.80 3.20 36.33 3.67

24 34 38 4 38.67 4.67 37.00 3.00 36.80 2.80 37.33 3.33

Moving Average Method

N MAD

2 3.27

3 3.21

4 2.78

5 2.79

6 3.08

Simple Exponential Smoothing

A time series that fluctuates about a base

level

A

t

= x

t

+ (1 ) A

t-1

A

0

= 32

= 0.1

Simple Exponential Smoothing

Calculations

Month TV Sales Forecast At et

1 30 32 31.8 2.00

2 32 31.8 31.82 0.20

3 30 31.82 31.64 1.82

4 39 31.64 32.37 7.36

5 33 32.37 32.44 0.63

6 34 32.44 32.59 1.56

7 34 32.59 32.73 1.41

8 38 32.73 33.26 5.27

9 36 33.26 33.53 2.74

10 39 33.53 34.08 5.47

11 30 34.08 33.67 4.08

12 36 33.67 33.91 2.33

13 38 33.91 34.32 4.09

14 30 34.32 33.88 4.32

15 35 33.88 34.00 1.12

16 30 34.00 33.60 4.00

17 34 33.60 33.64 0.40

18 40 33.64 34.27 6.36

19 36 34.27 34.45 1.73

20 32 34.45 34.20 2.45

21 40 34.20 34.78 5.80

22 36 34.78 34.90 1.22

23 40 34.90 35.41 5.10

24 34 35.41 35.27 1.41

Simple Exponential Smoothing

Alpha MAD

0.05 3.20

0.1 3.04

0.15 2.94

0.2 2.89

0.25 2.88

0.3 2.90

0.35 2.94

0.4 2.98

0.45 3.05

0.5 3.14

Simple Exponential Smoothing

some concepts

If = 2/(N + 1)

Equivalent to N-period moving average

Larger the value of

More weight is given to the most recent

observations

= 0.2?

= 0.5?

Holts Method: Exponential

Smoothing with Trend

Base Level at the end of t

th

period = L

t

The per-period trend at the end of t

th

period = T

t

For e.g., if L

20

= 20 and T

20

= 2. Implication?

L

t

= x

t

+ (1 ) (L

t-1

+ T

t-1

)

T

t

= (L

t

- L

t-1

) + (1 ) T

t-1

F

t,k

= L

t

+ k * T

t

T

0

= average monthly increase in the time series

during the previous year

L

0

= Last months observation

Holts Method Calculations

Let, the CD sales during each of the last 12

months are given by 4, 6, 8, 10, 14, 18, 20,

22, 24, 28, 31, 34.

T

0

= [(6 - 4) + (8 6) + (10 8) + + (34 31)]/11 = 2.73

L

0

= 34

= 0.3

= 0.1

Holts Method Calculations

Month CD Sales Lt Tt ft-1,1 et

1 40 37.71 2.83 36.73 3.27

2 47 42.47 3.02 40.53 6.47

3 50 46.85 3.15 45.49 4.51

4 49 49.70 3.12 50.00 1.00

5 56 53.78 3.22 52.82 3.18

6 53 55.80 3.10 57.00 4.00

7 55 57.73 2.98 58.90 3.90

8 63 61.40 3.05 60.71 2.29

9 68 65.51 3.16 64.45 3.55

10 65 67.57 3.05 68.67 3.67

11 72 71.03 3.09 70.62 1.38

12 69 72.59 2.94 74.12 5.12

13 79 76.57 3.04 75.52 3.48

14 82 80.32 3.11 79.61 2.39

15 80 82.40 3.01 83.44 3.44

16 85 85.29 3.00 85.41 0.41

17 94 90.00 3.17 88.29 5.71

18 89 91.92 3.04 93.17 4.17

19 96 95.27 3.07 94.96 1.04

20 100 98.84 3.12 98.35 1.65

21 100 101.38 3.06 101.97 1.97

22 105 104.61 3.08 104.44 0.56

23 108 107.78 3.09 107.69 0.31

24 110 110.61 3.06 110.87 0.87

Choice of &

Beta

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

0.1 2.86 2.80 2.74 2.70 2.75 2.80 2.83 2.86 2.92

0.2 2.77 2.73 2.76 2.79 2.84 2.92 2.97 2.98 2.99

0.3 2.85 2.87 2.91 2.95 2.99 3.04 3.13 3.22 3.29

Alpha 0.4 2.96 3.00 3.05 3.11 3.17 3.23 3.30 3.35 3.39

0.5 3.07 3.13 3.19 3.25 3.31 3.36 3.43 3.50 3.58

0.6 3.19 3.26 3.33 3.40 3.48 3.59 3.69 3.78 3.88

0.7 3.32 3.39 3.47 3.60 3.72 3.84 3.95 4.07 4.21

0.8 3.43 3.53 3.67 3.81 3.94 4.07 4.27 4.47 4.68

0.9 3.54 3.69 3.85 4.02 4.23 4.46 4.69 4.95 5.25

Winters Method

c = number of periods in the length of the seasonal

pattern

c = 4 for quarterly data; c = 12 for monthly data.

s

t

= seasonal multiplicative factor for month t,

obtained after observing x

t

.

Month 7 is July and s

7

= 2 (lets say!)

After observing months 7 air conditioner sales, we

believe that Julys air conditioner sales will (all other

things being equal)

Equal twice the sales expected during an average month.

If month 24 is December and s

24

= 0.4, what will be the

implication?

Winters Method

L

t

= (x

t

/s

t-c

) + (1 ) (L

t-1

+ T

t-1

)

T

t

= (L

t

- L

t-1

) + (1 ) T

t-1

s

t

= (x

t

/L

t

) + (1 ) s

t-c

f

t,k

= (L

t

+ k * T

t

) * S

t+k-c

Initialization of Winters Method

L

0

= estimate of base at beginning of month 1

T

0

= estimate of trend at beginning of month 1

S

-11

= estimate of January seasonal factor at the

beginning of month 1

S

-10

= estimate of February seasonal factor at the

beginning of month 1

.

S

0

= estimate of December seasonal factor at the

beginning of month 1.

Initialization of Winters Method

Variety of methods are available to estimate

above parameters

A simple approach:

Suppose we have two years of data

Year 2: 4, 3, 10, 14, 25, 26, 38, 40, 28, 17, 16, 13

Year 1: 9, 6, 18, 27, 48, 50, 75, 77, 52, 33, 31, 24

Total sales during year 2 = 234

Total sales during year 1 = 450

Initialization of Winters Method

T

0

= [(Avg. monthly sales during year 1) (Avg.

monthly sales during year 2)]/12

T

0

= 1.5

L

0

= Avg. monthly demand during year 1.

Further correction

This estimates the base at the middle of the year 1

Month 6.5 of year 1

Hence, to bring this estimate to the end of the year

Add, (12 6.5)T

0

= 5.5T

0

L

0

= 37.5 + 5.5(1.5) = 45.75

Initialization of Winters Method

To estimate the seasonality factor for a

given month (say, January = s

-11

)

we take an estimate of January seasonality of

year 2 and year 1 and average them.

In year 2, average monthly demand = 19.5

In January of year 2, number of ACs sold = 4

Therefore, s

-11

= [(4/19.5) + (9/37.5)]/2 = 0.22

Initialization of Winters Method

s

-10

= 0.16, .., s

0

= 0.65

Observation

Sum of initial seasonal factor estimates should

average to 1

At the beginning of month 1, our forecast

for month 1 AC sales is

f

0,1

= (L

0

+ T

0

)s

0+1-12

= (45.75 + 1.5)0.22 = 10.40

Initialization of Winters Method

At the beginning of month 1, our forecast

for month 7 AC sales is

f

0,7

= (L

0

+ 7T

0

)s

0+7-12

= (45.75 + 7 *1.5) 1.97 = 110.81

For

= 0.5

= 0.4

= 0.6

Winters Method for Air-

Conditioners

Month Sales Lt Tt st ft-1,1 Error

1 13 52.83 3.73 0.24 10.52 2.48

2 7 50.58 1.34 0.15 8.88 1.88

3 23 49.13 0.22 0.48 25.78 2.78

4 32 46.93 -0.75 0.70 35.48 3.48

5 58 45.73 -0.93 1.27 59.16 1.16

6 60 44.90 -0.89 1.34 59.74 0.26

7 90 44.80 -0.57 2.00 86.90 3.10

8 93 44.77 -0.36 2.07 90.76 2.24

9 63 44.53 -0.31 1.41 62.68 0.32

10 39 44.37 -0.25 0.88 38.73 0.27

11 37 44.52 -0.09 0.83 36.34 0.66

12 29 44.41 -0.10 0.65 29.03 0.03

Some Final Thoughts

Indian Contexts

Businesses uses Gregorian calendar

Most of the festivals uses lunar calendar

festivals (Diwali, Eid, Chinese festival ) occur in

different weeks or months

Inauspicious periods

Potrebbero piacerti anche

- JMP Connections: The Art of Utilizing Connections In Your DataDa EverandJMP Connections: The Art of Utilizing Connections In Your DataNessuna valutazione finora

- ForecastingDocumento56 pagineForecastingsumeetgkdNessuna valutazione finora

- Demand ForecastingDocumento34 pagineDemand ForecastingASHOK SUTHARNessuna valutazione finora

- ForecastingDocumento50 pagineForecastingMartinus Bagus WicaksonoNessuna valutazione finora

- Chap003 ModifiedDocumento32 pagineChap003 Modifiedjgu1994Nessuna valutazione finora

- H.V Asmaa TayehDocumento26 pagineH.V Asmaa TayehSamer AlsadiNessuna valutazione finora

- 02.3 DekomposisiDocumento51 pagine02.3 DekomposisiMuhamad Iqbal ArsaNessuna valutazione finora

- Instructions:: This Is An Online, Closed Book ExaminationDocumento18 pagineInstructions:: This Is An Online, Closed Book ExaminationChandan SahNessuna valutazione finora

- Speciality Packaging Case StudyDocumento20 pagineSpeciality Packaging Case StudyNitin ShankarNessuna valutazione finora

- 3 ForecastingDocumento53 pagine3 ForecastingMarsius SihombingNessuna valutazione finora

- BS SRR-3Documento20 pagineBS SRR-3anveshvarma365Nessuna valutazione finora

- Speciality Packaging Case Study PDFDocumento20 pagineSpeciality Packaging Case Study PDFরাকিবইসলামNessuna valutazione finora

- ADA FormulaDocumento11 pagineADA FormulaDinesh RaghavendraNessuna valutazione finora

- Forecasting SKDocumento20 pagineForecasting SKNirmay Mufc ShahNessuna valutazione finora

- Kokemuller, N. (2017) - The Disadvantage of Excess Inventory. Retrieved July 18, 2017, From ChronDocumento3 pagineKokemuller, N. (2017) - The Disadvantage of Excess Inventory. Retrieved July 18, 2017, From ChronEdric HuangNessuna valutazione finora

- EC203 Tutorial 12 Time Series 16Documento4 pagineEC203 Tutorial 12 Time Series 16R and R wweNessuna valutazione finora

- Lecture-1 IntroductionDocumento47 pagineLecture-1 IntroductionMoiz AntariaNessuna valutazione finora

- Report OMDocumento13 pagineReport OMRenaliz GonzalesNessuna valutazione finora

- Chapter 2 Understanding Time Series Student PDFDocumento16 pagineChapter 2 Understanding Time Series Student PDFshuting_teohNessuna valutazione finora

- New Malls Contribute: Capitamalls AsiaDocumento7 pagineNew Malls Contribute: Capitamalls AsiaNicholas AngNessuna valutazione finora

- Time Series DataDocumento41 pagineTime Series DataxinzhiNessuna valutazione finora

- Forecasting MDocumento42 pagineForecasting MYenny Dusty PinkNessuna valutazione finora

- Module 4 (Data Management) - Math 101Documento8 pagineModule 4 (Data Management) - Math 101Flory CabaseNessuna valutazione finora

- Hanke9 Odd-Num Sol 03Documento10 pagineHanke9 Odd-Num Sol 03NiladriDas100% (1)

- M05 Rend6289 10 Im C05Documento14 pagineM05 Rend6289 10 Im C05Yamin Shwe Sin Kyaw100% (2)

- Supply Chain Forecasting - QuantsDocumento36 pagineSupply Chain Forecasting - QuantsAsmita KandariNessuna valutazione finora

- 2020 - Class 10 - Revision - Q - For StudentsDocumento4 pagine2020 - Class 10 - Revision - Q - For StudentsCartieNessuna valutazione finora

- Plagrism ReportDocumento3 paginePlagrism ReportLalith LalluNessuna valutazione finora

- Introduction To Econometrics: Dinh Thi Thanh Binh, PHD Faculty of International Economics, FtuDocumento25 pagineIntroduction To Econometrics: Dinh Thi Thanh Binh, PHD Faculty of International Economics, FtuHai Anh DoNessuna valutazione finora

- OPSCMProject AniDocumento6 pagineOPSCMProject Anianiket.negi1996Nessuna valutazione finora

- Mb0040 Statistics For Management FinalDocumento16 pagineMb0040 Statistics For Management FinalDip KonarNessuna valutazione finora

- Mgt1102 - Final OutputDocumento2 pagineMgt1102 - Final OutputDessiren De GuzmanNessuna valutazione finora

- Acca Paper f9Documento130 pagineAcca Paper f9cheeka87100% (1)

- Ch07 - ForecastDocumento20 pagineCh07 - ForecastAya_NoahNessuna valutazione finora

- Decomposition MethodsDocumento42 pagineDecomposition MethodsAiman NawawiNessuna valutazione finora

- Ken Black QA ch17Documento58 pagineKen Black QA ch17Rushabh Vora100% (1)

- MGS3100 Chapter 13 Forecasting: Slides 13b: Time-Series Models Measuring Forecast ErrorDocumento36 pagineMGS3100 Chapter 13 Forecasting: Slides 13b: Time-Series Models Measuring Forecast ErrorVinod Kumar Patel100% (2)

- 1.ACS 800 Dallah and Adeleke Business ForecastingDocumento102 pagine1.ACS 800 Dallah and Adeleke Business ForecastingLLOYD LloydNessuna valutazione finora

- Chapter 4 Project Preparation and Analysis - 2Documento54 pagineChapter 4 Project Preparation and Analysis - 2Aida Mohammed100% (1)

- OPSCM Project - Vimalakar - PolamarasettyDocumento6 pagineOPSCM Project - Vimalakar - PolamarasettyvimalakarpolamarasettyNessuna valutazione finora

- Carrying Cost: Inventory CostsDocumento31 pagineCarrying Cost: Inventory CostsVivek Kumar GuptaNessuna valutazione finora

- Practice ForecastingDocumento4 paginePractice ForecastingDexter KhooNessuna valutazione finora

- Decision and Risk AnalysisDocumento31 pagineDecision and Risk AnalysisTrans TradesNessuna valutazione finora

- PMMT100 FT 11 2020 1Documento4 paginePMMT100 FT 11 2020 1Kaoma MofyaNessuna valutazione finora

- QuanticoDocumento6 pagineQuantico19EBKCS082 PIYUSHLATTANessuna valutazione finora

- P4-Advanced Financial ManagementDocumento454 pagineP4-Advanced Financial ManagementJack Tan100% (1)

- Ek VLDocumento1 paginaEk VLJohn Aldridge ChewNessuna valutazione finora

- Supply Chain Management: Demand ForecastingDocumento37 pagineSupply Chain Management: Demand Forecastingzubair_ahmed_importsNessuna valutazione finora

- QTF PROJECT MSC Samkit Shah Roll No.20Documento12 pagineQTF PROJECT MSC Samkit Shah Roll No.20shahsamkit08Nessuna valutazione finora

- ACCA F9 Class Notes June 2011 - Copy 111111111Documento185 pagineACCA F9 Class Notes June 2011 - Copy 111111111pkv12Nessuna valutazione finora

- Forecasting With Seasonality: Dr. Ron Tibben-Lembke Sept 9, 2003Documento10 pagineForecasting With Seasonality: Dr. Ron Tibben-Lembke Sept 9, 2003kaushalsingh2Nessuna valutazione finora

- Ops CM ProjectDocumento6 pagineOps CM Projectnamratagadkari05Nessuna valutazione finora

- Practice Problems, CH 9 10 (MCQ)Documento5 paginePractice Problems, CH 9 10 (MCQ)scridNessuna valutazione finora

- Silicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityDa EverandSilicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityNessuna valutazione finora

- Applied Predictive Analytics: Principles and Techniques for the Professional Data AnalystDa EverandApplied Predictive Analytics: Principles and Techniques for the Professional Data AnalystNessuna valutazione finora

- Monetizing Your Data: A Guide to Turning Data into Profit-Driving Strategies and SolutionsDa EverandMonetizing Your Data: A Guide to Turning Data into Profit-Driving Strategies and SolutionsNessuna valutazione finora

- Breakthroughs in Decision Science and Risk AnalysisDa EverandBreakthroughs in Decision Science and Risk AnalysisNessuna valutazione finora

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementDa EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNessuna valutazione finora

- Mobile Communication Networks: Exercices 4Documento2 pagineMobile Communication Networks: Exercices 4Shirley RodriguesNessuna valutazione finora

- NDTDocumento2 pagineNDTRoop Sathya kumarNessuna valutazione finora

- Brock Planetary Declination SDocumento6 pagineBrock Planetary Declination SDositheus Seth100% (2)

- Coca ColaDocumento50 pagineCoca Colamariyha PalangganaNessuna valutazione finora

- Logistics Operation PlanningDocumento25 pagineLogistics Operation PlanningLeonard AntoniusNessuna valutazione finora

- Paper 2 With Solution MathematicsDocumento17 paginePaper 2 With Solution MathematicsFaiz AhmadNessuna valutazione finora

- Color Codes and Irregular MarkingDocumento354 pagineColor Codes and Irregular MarkingOscarGonzalezNessuna valutazione finora

- Diwali Pujan BookletDocumento10 pagineDiwali Pujan Bookletman_ishkumarNessuna valutazione finora

- Microscope MaintenanceDocumento2 pagineMicroscope MaintenanceCharlyn KeithNessuna valutazione finora

- Fluid Solids Operations: High HighDocumento20 pagineFluid Solids Operations: High HighPriscilaPrzNessuna valutazione finora

- Disa Match: A Match You Can Count OnDocumento8 pagineDisa Match: A Match You Can Count OngNessuna valutazione finora

- Metageographies of Coastal Management: Negotiating Spaces of Nature and Culture at The Wadden SeaDocumento8 pagineMetageographies of Coastal Management: Negotiating Spaces of Nature and Culture at The Wadden Seadwi kurniawatiNessuna valutazione finora

- Diablo Watch Newsletter, FALL 2009 Save Mount DiabloDocumento16 pagineDiablo Watch Newsletter, FALL 2009 Save Mount DiabloIoannqisHatzopoulosNessuna valutazione finora

- Offsetting Macro-Shrinkage in Ductile IronDocumento13 pagineOffsetting Macro-Shrinkage in Ductile IronmetkarthikNessuna valutazione finora

- Homophones WorksheetDocumento3 pagineHomophones WorksheetAmes100% (1)

- Afectiuni Si SimptomeDocumento22 pagineAfectiuni Si SimptomeIOANA_ROX_DRNessuna valutazione finora

- CDM816DSpare Parts Manual (Pilot Control) 2Documento55 pagineCDM816DSpare Parts Manual (Pilot Control) 2Mohammadazmy Sobursyakur100% (1)

- Karan AsDocumento3 pagineKaran AsHariNessuna valutazione finora

- Phytoremediation Acuatic PlantsDocumento120 paginePhytoremediation Acuatic PlantsFranco Portocarrero Estrada100% (1)

- DHT, VGOHT - Catloading Diagram - Oct2005Documento3 pagineDHT, VGOHT - Catloading Diagram - Oct2005Bikas SahaNessuna valutazione finora

- HBT vs. PHEMT vs. MESFET: What's Best and Why: Dimitris PavlidisDocumento4 pagineHBT vs. PHEMT vs. MESFET: What's Best and Why: Dimitris Pavlidissagacious.ali2219Nessuna valutazione finora

- Scientific American Psychology 2nd Edition Licht Test BankDocumento44 pagineScientific American Psychology 2nd Edition Licht Test Bankpurelychittra3ae3100% (24)

- 19 Work Energy TNDocumento2 pagine19 Work Energy TNAna DorueloNessuna valutazione finora

- Mwangi, Thyne, Rao - 2013 - Extensive Experimental Wettability Study in Sandstone and Carbonate-Oil-Brine Systems Part 1 - Screening ToDocumento7 pagineMwangi, Thyne, Rao - 2013 - Extensive Experimental Wettability Study in Sandstone and Carbonate-Oil-Brine Systems Part 1 - Screening ToMateo AponteNessuna valutazione finora

- COUNTERS IN PLC - Portal PDFDocumento88 pagineCOUNTERS IN PLC - Portal PDFAhwangg xGAMINGNessuna valutazione finora

- EASA - Design OrganisationsDocumento30 pagineEASA - Design Organisationsyingqi.yangNessuna valutazione finora

- 14 WosDocumento6 pagine14 WosATUL KURZEKARNessuna valutazione finora

- Organic Chemistry (Some Basic Principles and TechniquesDocumento30 pagineOrganic Chemistry (Some Basic Principles and TechniquesNaveen SharmaNessuna valutazione finora

- 5 Years High and Low PointsDocumento7 pagine5 Years High and Low PointsNaresh Kumar VishwakarmaNessuna valutazione finora

- Smart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamDocumento14 pagineSmart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamQuynh LeNessuna valutazione finora