Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pool Financial Reporting Deloitte

Caricato da

yunfrank0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

61 visualizzazioni38 paginefinancial reporting

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentofinancial reporting

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

61 visualizzazioni38 paginePool Financial Reporting Deloitte

Caricato da

yunfrankfinancial reporting

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 38

Jim Laures

Deloitte & Touche LLP

March 2, 2010

Fair Value and Derivatives

Measurement and Disclosure

2010 Deloitte Touche Tohmatsu

Agenda

1.FASB Accounting Standards Codification (ASC) Topic 815, Derivative and

Hedging (formerly, Statement of Financial Accounting Standards (SFAS) No.

161, Disclosures about Derivatives and Hedging Activities--an amendment of

FASB Statement No. 133) (ASC 815)

2.FASB ASC Topic 820, Fair Value Measurements and Disclosures (formerly

SFAS No. 157, Fair Value Measurements) (ASC 820)

a. FASB Accounting Standards Update (ASU) 2009-12, Fair Value Measurements and Disclosures

(Topic 820)Investments in Certain Entities That Calculate Net Asset Value per Share (or Its

Equivalent) (ASU 2009-12)

b. FASB ASU 2010-06, Fair Value Measurements and Disclosures (Topic 820)Improving

Disclosures About Fair Value Measurements (ASU 2010-06)

c. FASB Staff Position No. FAS 157-4, Determining Fair Value when the Volume and Level of

Activity for the Asset or Liability have Significantly Decreased and Identifying Transactions that

are Not Orderly (FSP FAS 157-4)

3. Other

1

2010 Deloitte Touche Tohmatsu

ASC 815

When and Why Issued

Issued March 2008

Expands existing disclosure requirements to improve transparency of financial

reporting and provide users of financial statements with an enhanced

understanding of:

How and why derivatives are used

How derivatives and related hedged items are accounted for under SFAS No. 133

How derivative instruments affect an entitys financial position and results of operations

Effective for periods beginning after November 15, 2008 (2009 for calendar year

entities)

Comparative disclosures required only for periods subsequent to initial adoption

2

2010 Deloitte Touche Tohmatsu

ASC 815

Qualitative Disclosures

Purpose and objectives for using derivatives, strategies for achieving objectives

Distinguish between instruments used for risk management (hedging) and those

used for other purposes (trading)

Further disaggregate current required disclosures by the primary underlying risk

exposure

interest rate

credit

foreign exchange rate

equity

Describe volume of derivatives activity by type of instrument

Notional amounts

Number of contracts

Etc.

3

2010 Deloitte Touche Tohmatsu

ASC 815

Quantitative Disclosures Statement of Assets and Liabilities

No change in current presentation of derivatives on Statement of Assets and

Liabilities

No change in disclosure of each derivative by type within the Schedule of

Investments or in Footnotes

However, new tabular disclosure of derivatives required

Summarize by primary risk exposure

Identify location (by line item) in Statement of Assets and Liabilities

Period end fair value--gross basis

Even when derivatives are subject to master netting arrangements and qualify for net presentation

Cash collateral payables and receivables associated with derivatives should not be added to/netted

against the fair value amounts

4

2010 Deloitte Touche Tohmatsu

ASC 815

Statement of Operations Realized & Unrealized Gain (Loss)

No change to existing presentation within Statement of Operations

However, new tabular disclosure of derivatives realized and change in

unrealized gains/losses required

Summarize by primary risk exposure

Identify location (by line item) in Statement of Operations

5

2010 Deloitte Touche Tohmatsu

ASC 815

Example Illustration Statement of Assets and Liabilities Assets

Fair Values of Derivatives in the Assets section of Statement of Assets and

Liabilities (remains unchanged)

6

2010 Deloitte Touche Tohmatsu

ASC 815

Example Illustration Statement of Assets and Liabilities Liabilities

Fair Values of Derivatives in the Liabilities section of Statement of Assets and

Liabilities (remains unchanged)

7

2010 Deloitte Touche Tohmatsu

ASC 815

Example Tabular Disclosure Footnote (Statement of Assets and

Liabilities) for Derivatives not accounted for as hedging

instruments

8

2010 Deloitte Touche Tohmatsu

ASC 815

Example Illustration Statement of Operations

Excerpt of Realized Gain (Loss) and Change in Net Unrealized appreciation

(depreciation) section (remains unchanged)

9

2010 Deloitte Touche Tohmatsu

ASC 815

Example Tabular Disclosure Footnote (Statement of Operations)

Derivatives not accounted for as hedging instruments [Note:

Separate tabular disclosure for realized and for unrealized is not required; realized

and unrealized can be combined into one tabular disclosure.]

10

2010 Deloitte Touche Tohmatsu

ASC 815

Other Key Requirements

Adds credit risk disclosure requirements

Disclose existence and nature of credit-risk-related contingent features that require,

upon occurrence of a credit event (e.g., credit rating downgrade), settlement of

derivative or posting of collateral

Clarifies that derivatives are subject to concentration of credit risk disclosures

required by FASB ASC Topic 825, Financial Instruments (formerly SFAS No.

107, Disclosure About Fair Value of Financial Instruments)

Cross-referencing from derivatives footnote to other footnotes required when

disclosure information is presented elsewhere in financial statements

Resource

Managed Funds Association Discussion Paper on FAS 161 Disclosures about

Derivative Instruments and Hedging Activities, an amendment of FASB

Statement No. 133 (Feb 2010) [members only]

11

2010 Deloitte Touche Tohmatsu

ASU 2009-12

When and Why Issued

Issued September 30, 2009

Creates a practical expedient for measuring the fair value of investments in

certain entities (Investee) that calculate net asset value per share (NAV)

Prior to issuance, there was diversity in practice in how investors estimated fair

value of investments in funds that calculate NAV

NAV is determinative of fair value, without further adjustment as of the reporting date

NAV adjusted to account for impact of the attributes of the investment--e.g., restrictions

on redemption (e.g., lockups and gates), unfunded commitments, and intangible benefits

Effective for interim and annual periods ending after December 15, 2009 (2009

for calendar year entities)

Early application is permitted; however, if applied, an entity may defer adoption

of the disclosure provisions

12

2010 Deloitte Touche Tohmatsu

Scope

Applies to an investment in an Investee:

That has attributes of an investment company (as defined in FASB ASC Topic 946,

Financial Services Investment Companies), or

For which it is industry practice to issue financial statements using guidance consistent

with the measurement principles of FASB ASC Topic 946

Does not apply to an investment with a readily determinable fair value

Examples:

Certain investments in:

Hedge funds

Private equity funds

Venture capital funds

Real estate funds

Foreign hedge funds

Certain investments in:

Operating entities

Mutual funds

Closed-end funds transacted on an

exchange

Closed-end funds transacted in an over-

the-counter market

Potentially In Potentially Out

13

ASU 2009-12

2010 Deloitte Touche Tohmatsu

ASU 2009-12

What it Does

Permits reporting entity to use of NAV per share (or its equivalent) to measure

fair value for alternative investments (e.g., hedge funds, private equity funds,

etc.)

If NAV is not calculated as of reporting entitys measurement date, requires

reporting entity to adjust NAV for significant market events that may have

occurred since the Investee calculated NAV

Investment-by-investment election

Requires either Level 2 or Level 3 classification by the reporting entity

determined by ability to redeem

Level 2: ability to redeem at NAV at measurement date

Level 3: will never have the ability to redeem at NAV at measurement date

Level 2 or 3: if cant redeem at NAV at measurement date (but may be able to redeem at

a later date), evaluate length of time until investment will become redeemable

14

2010 Deloitte Touche Tohmatsu

ASU 2009-12

What it Does (continued)

Prohibits use of NAV as a practical expedient if it is probable the reporting entity

will sell the investment (or portion thereof) at a price other than NAV. To be

considered probable:

Management with authority to approve the action commits to a plan to sell

Active program to locate a buyer or other actions to complete the plan to sell has been

initiated

Investment is available for immediate sale subject only to terms and conditions that are

usual and customary for such sales

Actions required to complete the plan indicate that it is unlikely that plan will be

significantly changed or withdrawn

15

2010 Deloitte Touche Tohmatsu

ASU 2009-12

Disclosure by major category of investments

Fair value of investments and description of significant investment strategies of

the Investee(s)

Estimate of period over which an Investee may liquidate underlying investments

(This disclosure applies only to investments (a) that cannot be redeemed and (b)

when the reporting entity receives distributions via liquidation of the underlying

investments by the Investee)

Amount of reporting entitys unfunded commitments related to investments in the

major categories

General description of terms and conditions upon which the reporting entity may

redeem the investments --e.g., quarterly redemption with 60 days notice, etc.

Circumstances in which an otherwise redeemable investment might not be

redeemablee.g., because of lockups or gates, etc.

16

2010 Deloitte Touche Tohmatsu

ASU 2009-12

Disclosures by major category of investments (continued)

For investments that are redeemable but restricted from redemption as of

reporting entitys measurement date:

Best estimate of when restriction from redemption might lapse; or

Fact that an estimate cannot be made.

Other significant restrictions on the reporting entitys ability to sell the investment

as of measurement date.

Sale of investments:

Total fair value and remaining actions required to finalize sale of investments for which it

is probable that the reporting entity will sell the investment for an amount other than NAV

However, if reporting entity has not identified the individual investment that it is probable

will be sold, reporting entity must still disclose its plan to sell and remaining actions

required to complete the sale

Example Case D Disclosure in ASU 2009-12

17

2010 Deloitte Touche Tohmatsu

ASU 2009-12

AICPA Resource

AICPA issued guidance in the form of Technical Questions and Answers (TIS)

(commonly referred to as Technical Practice Aids or TPAs) and placed them in

TIS Sections 2220, Long-Term Investments, including them in TIS Sections

2220.18-27 (Alternative Investments TPA)

Guidance considered non-authoritative and not part of the FASB Accounting

Standards Codification

Available on the AICPAs Web site.

18

2010 Deloitte Touche Tohmatsu

ASU 2010-06

When Issued and What Changed

Issued January 2010

Amends ASC 820 (formerly SFAS No.157):

New requirements for disclosures about transfers into and out of Level 1 and Level 2

Separate disclosures about purchases, sales, issuances, and settlements relating to

Level 3 measurements

Clarifies existing fair value disclosures about level of disaggregation and inputs and

valuation techniques used to measure fair value

Generally effective for first interim or annual reporting period beginning after

December 15, 2009 (2010 for calendar year entities)

19

2010 Deloitte Touche Tohmatsu

ASU 2010-06

Level of Disaggregation

Existing Disclosure--provide disclosures by each major category of assets and

liabilities.

Term major category often has been interpreted to be a line item in the statement of

financial position

New/Amended Disclosureprovide disclosures by each class of asset and

liability

Determine class on basis of nature and risks of securities--consider activity or business

sector, vintage, geographic concentration, credit quality, and economic characteristic

(consistent with FASB Topic ASC 320, InvestmentsDebt and Equity Securities)

For other assets and liabilities:

Use judgment to determine appropriate classes

Consider requirements under other U.S. GAAP--e.g., disclosure level for derivatives per ASC Topic

815 Derivatives and Hedging

In addition to nature and risks, also consider placement in fair value hierarchy (i.e.,

Levels 1, 2, or 3)e.g., greater number of classes may be necessary for fair value

measurements with significant unobservable inputs (Level 3) due to increased

uncertainty and subjectivity

20

2010 Deloitte Touche Tohmatsu

ASU 2010-06

Transfers into/out of Levels 1, 2 and 3

Existing Disclosuretransfers into/out of Level 3 only

New/Amended Disclosure:

Significant transfers between Level 1 and Level 2 and reasons for transfers

Transfers into/out of Level 3 and reasons for transfers

Consistent application of policies for determining when transfers are recognized and

policies should be the same for transfers into/out of Levels 1, 2 and 3

21

2010 Deloitte Touche Tohmatsu

ASU 2010-06

Level 3 Reconciliation

Existing Disclosure:

No separate disclosures of total gains/losses recognized in OCI

Purchases, sales, issuances and settlements (on net basis)

Transfers into/out of Level 3

New/Amended Disclosure:

Total gains/losses recognized in OCI

Purchases, sales, issuances and settlements (on gross basis)

Transfers into/out of Level 3 (separately if significant ) and reasons for transfers

22

2010 Deloitte Touche Tohmatsu

ASU 2010-06

Valuation Techniques and Inputs

Existing Disclosure:

Input and valuation technique(s) used to measure fair value

Discussion of changes in valuation techniques and related inputs, if any, during period

New/Amended Disclosure--for Levels 2 and 3:

Description of valuation techniques and input used to determine fair values of each class

Discussion of changes in valuation techniques, if any, and reasons for them

23

2010 Deloitte Touche Tohmatsu

ASU 2010-06

Effective Date

Generally effective for first interim or annual reporting period beginning after

December 15, 2009 (2010 for calendar year entities)

Requirement to provide Level 3 activity of purchases, sales, issuances. and settlements

(on gross basis) effective for fiscal years beginning after December 15, 2010 (2011 for

calendar year entities)

In period of initial adoption, not required to provide amended disclosures for any

previous periods presented

Early adoption permitted

24

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Timeline of Events

25

FASB Statement No.

157, Fair Value

Measurements,

established a single

definition of fair value

and a framework for

measuring fair value.

The statement also

expanded disclosures

of fair value

measuerment.

The Valuation

Resource Group

provided their views to

FASB that additional

guidance on inactive

markets and

distressed

transactions was

warranted.

The Emergency

Economic

Stabilization Act of

2008 mandated the

SEC to conduct a

study on market-to-

market accounting

standards.

The study was

released in December

2008, concluding that

existing fair value

accounting

requirements should

not be supsended and

recommended

measures to improve

the application of such

requirements.

FASB issued FSP

FAS 157-3,

Determining the Fair

Value of a Financial

Market when the

Market for that Asset

is not Active.

Primary intent was to

reinforce the

principles of FAS 157

and to emphasize the

ability of an entity to

use its own

assumptions when

obeservable inputs

are not available.

September 2006 October 2008 December 2008 February 2009

FASB issues FSP

157-4, Determining

Fair Vlaue when the

Volume and Level of

Activiity for the Asset

or Liability Have

Significantly

Decreased and

Identifying

Transactions that are

Not Orderly.

FSP 157-4

superseded FSP FAS

157-3.

April 2009

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

What it Does

Provides application guidance

Determining fair value when the volume and level of market activity has significantly

declined

Identifying transactions that are not orderly

Fair value is a market-based measurement, not an entity-specific measurement

Use of significant judgment

Reemphasizes the exit price notion

Amends disclosures

Supersedes FSP FAS 157-3

26

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

What Changed

Significant changes from Exposure Draft:

Eliminates presumption that all transactions are distressed in inactive markets

Exit price notion under current market conditions vs. hypothetical active market

Focus is on markets with a significant decline in market activity vs. markets which have

always been inactive

Effective Date

Effective for interim and annual periods ending after June 15, 2009 (2009 for

calendar year entities)

Early application permitted for interim and annual periods ending after March 15,

2009

27

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Decrease in Trading Volume

Description of factors (not all-inclusive) that might indicate a decrease in trading

volume occurred:

scarcity of recent transactions

price quotes are not based on current information

substantial variation in price quotes

indexes no longer correlated with indications of fair values

widening difference between present value of future cash flows versus quoted or

transaction prices (implying discounts relating to liquidity and other performance

indicators)

wider bid-ask spread

less new issuance in the market for similar assets or liabilities

little information is available publicly

If significant decline, transaction price or quoted price may not be

representative of fair value; perform additional analysis

28

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Determining Whether a Transaction is Orderly

Must not presume that all transactions are not orderly (forced or distressed)

Assess factors to determine if the transaction is not orderly:

Not adequate exposure to market (before measurement date) to allow for marketing

activities that are usual and customary under current conditions

Seller marketed the asset to a single participant

Seller is in or near bankruptcy or receivership, or required to sell to meet regulatory

requirements (that is, forced)

Transaction price is an outlier when compared to other recent transactions (for same or

similar assets or liability)

29

Note

Entities may consider additional factors. Must evaluate the circumstances to determine

whether the transaction is orderly based on the weight of the evidence.

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Determining Whether a Transaction is Orderly (continued)

A reporting entity shall evaluate the circumstances to determine whether the

transaction is orderly based on the weight of the evidence.

30

Place little, if any, weight on that transaction price

Transaction is not

orderly

Consider the transaction price when estimating fair value

Weighting depends on facts and circumstances such as the volume of the

transaction, comparability of transaction and the proximity of the transaction with

measurement date

Transaction is orderly

Consider the transaction when estimating fair value

Transaction price may not be determinative of fair value

Weighting of a transaction in which there is not sufficient information shall be less

than a transaction which is known to be orderly

Insufficient evidence to

determine if transaction

is orderly

What does

this mean?

Entities should not ignore information that is available without undue cost and effort.

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Quoted Prices

Does not exclude the use of quoted prices (broker quotes or pricing services)

Entities should evaluate whether the quoted price is based on:

Current information that reflects orderly transactions, or

A valuation technique that reflects market participant assumptions (including about risk)

Appropriately weight the quoted price in determining fair value:

Indicative

Binding

If a significant decrease in trading volume, quotes may not represent fair value

31

What does

this mean?

Entities should assess the nature of the quoted price and, based on its assessment,

appropriately weight the quoted price along with other inputs in determining fair value.

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Additional Reporting Requirements

FSP amends FASB Topic 820 (formerly SFAS No.157):

Requires disclosure of inputs and valuation technique(s) used to measure fair

value and discussion of changes in valuation techniques and related inputs, if

any.

Defines major category

1

for equity securities and debt securities to be major

security types as described in paragraph 19 of FASB Statement No. 115, which

states in part:

Major security types shall be based on the nature and risks of the security. An enterprise should

consider the (shared) activity or business sector, vintage, geographic concentration, credit quality,

or economic characteristic in determining whether disclosure for a particular security type is

necessary and whether it is necessary to further separate a particular security type into greater

detail.

1

See paragraphs 32 and 33 of Statement 157

32

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Additional Reporting Requirements (continued)

Major security types include:

1. Equity securities (segregated by industry type, company size, or investment objective)

2. Debt securities issued by the U.S. Treasury and other U.S. government corporations

and agencies

3. Debt securities issued by states of the United States and political subdivisions of the

states

4. Debt securities issued by foreign governments

5. Corporate debt securities

6. Residential mortgage-backed securities

7. Commercial mortgage-backed securities

8. Collateralized debt obligations

9. Other debt obligations

33

2010 Deloitte Touche Tohmatsu

FSP FAS 157-4

Additional Reporting Requirements (continued)

The FSP also requires the reconciliation of beginning and ending Level 3 holdings

(i.e., the Level 3 roll-forward) to be provided by major security type.

34

Example level disclosure:

Level 1 Level 2 Level 3 Total

Common stocks - Consumer

durable goods 1,086,000 $ - $ - $ 1,086,000 $

Common stocks - Consumer

nondurable goods 155,000 - 3,280,000 3,435,000 $

Common stocks - Other industries 921,000 - - 921,000 $

Convertible bonds - 5,400,000 - 5,400,000 $

Mortgage-backed securities - 2,710,000 - 2,710,000 $

U.S. government obligations - 3,475,000 - 3,475,000 $

Repurchase agreements - 500,000 - 500,000 $

TOTAL 2,162,000 $ 12,085,000 $ 3,280,000 $ 17,527,000 $

2010 Deloitte Touche Tohmatsu

Other

FASB ASU 2010-10, Consolidation (Topic 810) Amendments for Certain

Investment Funds (issued Feb 2010) (ASU 2010-10):

Amends consolidation requirements for variable interest entities (VIEs) contained in FASB

Statement No. 167, Amendments to FASB Interpretation 46(R) [issued June 2009]

FASB No. 167 would have required, under certain circumstances, a reporting entity such as a commodity pool

operator (CPO) to consolidate, in its audited financial statements, the funds it sponsors (effective 2010)

Application of the FASB No. 167 consolidation requirements are deferred for certain entities (e.g.,

mutual funds, hedge funds, private equity funds, etc.)

However, certain disclosures for all VIEs in which the reporting entity holds a variable interest,

including VIEs that qualify for the ASU 2010-10 deferral, are required

FASB ASU, 2010-09, Subsequent Events (Topic 855)Amendments to Certain

Recognition and Disclosure Requirements (Feb 2010)

35

2010 Deloitte Touche Tohmatsu

Contact Information

Jim Laures (Chicago)

jlaures@deloitte.com

(312) 486-3331

36

2010 Deloitte Touche Tohmatsu 37

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- AP Research Survival Guide - RevisedDocumento58 pagineAP Research Survival Guide - RevisedBadrEddin IsmailNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- V Ships Appln FormDocumento6 pagineV Ships Appln Formkaushikbasu2010Nessuna valutazione finora

- Chapter 3-The Hospitality & Travel Marketing SystemDocumento14 pagineChapter 3-The Hospitality & Travel Marketing SystemCharis AbadNessuna valutazione finora

- Name: Chakshu Purohit Course: BBA LLB Subject: Legal Research and Methodology Submitted To: Utkarsh MishraDocumento5 pagineName: Chakshu Purohit Course: BBA LLB Subject: Legal Research and Methodology Submitted To: Utkarsh Mishrachakshu purohitNessuna valutazione finora

- Pirates and Privateers of the Caribbean: A Guide to the GameDocumento25 paginePirates and Privateers of the Caribbean: A Guide to the GameLunargypsyNessuna valutazione finora

- Long Standoff Demolition Warheads For Armor, Masonry and Concrete TargetsDocumento27 pagineLong Standoff Demolition Warheads For Armor, Masonry and Concrete Targetsahky7Nessuna valutazione finora

- Texas LS Notes 19-20Documento2 pagineTexas LS Notes 19-20Jesus del CampoNessuna valutazione finora

- Organization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcDocumento32 pagineOrganization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcManny HermosaNessuna valutazione finora

- Base Is OkDocumento84 pagineBase Is OkajaydevmalikNessuna valutazione finora

- Baella-Silva v. Hulsey, 454 F.3d 5, 1st Cir. (2006)Documento9 pagineBaella-Silva v. Hulsey, 454 F.3d 5, 1st Cir. (2006)Scribd Government DocsNessuna valutazione finora

- TD EGGER Eurospan E1E05 TSCA Hydro P3 (Rec 224) enDocumento2 pagineTD EGGER Eurospan E1E05 TSCA Hydro P3 (Rec 224) enClarencegiNessuna valutazione finora

- Sustainability 15 06202Documento28 pagineSustainability 15 06202Somesh AgrawalNessuna valutazione finora

- Mumbai Tourist Attractions.Documento2 pagineMumbai Tourist Attractions.Guru SanNessuna valutazione finora

- JMC250Documento2 pagineJMC250abhijit99541623974426Nessuna valutazione finora

- Coca Cola Live-ProjectDocumento20 pagineCoca Cola Live-ProjectKanchan SharmaNessuna valutazione finora

- Writing Lesson Plan LMDocumento6 pagineWriting Lesson Plan LMapi-457032696Nessuna valutazione finora

- Ajwin Handbuch enDocumento84 pagineAjwin Handbuch enEnzo AguilarNessuna valutazione finora

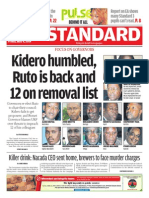

- The Standard 09.05.2014Documento96 pagineThe Standard 09.05.2014Zachary Monroe100% (1)

- Hydroponics SummaryDocumento4 pagineHydroponics SummaryJose NovoaNessuna valutazione finora

- Valhalla Repair ManualDocumento8 pagineValhalla Repair ManualKirby AllenNessuna valutazione finora

- List of Psychotropic Drugs Under International ControlDocumento32 pagineList of Psychotropic Drugs Under International ControlRadhakrishana DuddellaNessuna valutazione finora

- MT8820C LTE Measurement GuideDocumento136 pagineMT8820C LTE Measurement GuideMuthannaNessuna valutazione finora

- Reasons for Conducting Qualitative ResearchDocumento12 pagineReasons for Conducting Qualitative ResearchMa. Rhona Faye MedesNessuna valutazione finora

- PuppetsDocumento11 paginePuppetsShar Nur JeanNessuna valutazione finora

- Sles-55605 C071D4C1Documento3 pagineSles-55605 C071D4C1rgyasuylmhwkhqckrzNessuna valutazione finora

- Effects of Zero Moment of Truth On Consumer Behavior For FMCGDocumento14 pagineEffects of Zero Moment of Truth On Consumer Behavior For FMCGBoogii EnkhboldNessuna valutazione finora

- Cambridge IGCSE: Computer Science 0478/12Documento16 pagineCambridge IGCSE: Computer Science 0478/12Rodolph Smith100% (2)

- Subtracting-Fractions-Unlike DenominatorsDocumento2 pagineSubtracting-Fractions-Unlike Denominatorsapi-3953531900% (1)

- DRUG LISTDocumento45 pagineDRUG LISTAmitKumarNessuna valutazione finora

- Rapid ECG Interpretation Skills ChallengeDocumento91 pagineRapid ECG Interpretation Skills ChallengeMiguel LizarragaNessuna valutazione finora