Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Estimating The Optimal Capital Structure

Caricato da

Aqeel Ahmad KhanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Estimating The Optimal Capital Structure

Caricato da

Aqeel Ahmad KhanCopyright:

Formati disponibili

Estimating the Optimal Capital

Structure

Managers should choose the capital structure

that maximizes shareholders wealth.

A trial approach can be used to try different

capital structures and examine its effect on

shareholders wealth

There are five steps for the analysis of each

potential capital structure

5-steps in optimal capital structure

(1) Estimate the interest rate the firm will pay.

(2) Estimate the cost of equity.

(3) Estimate the weighted average cost of

capital.

(4) Estimate the free cash flows and their

present value, which is the value of the firm.

(5) Deduct the value of the debt to find the

shareholders wealth, which we want to

maximize.

1. Estimating the Cost of Debt

analyze industry conditions and prospects.

Appraise business risk, based on past financial

statements and current technology and

customer base.

Consider current market conditions and

interest rate paid by other firms in the

industry

At various debt ratios, interest rates can be

different

The Cost of Debt with Different Capital

Structures (supposed)

2. Estimating the Cost of Equity, r

s

An increase in the debt ratio also increases the

risk faced by shareholders, and this has an

effect on the cost of equity, r

s

CAPM equation can be used for cost of equity

It has been proved both theoretically and

empirically, that beta increases with financial

leverage

In CAPM equation, beta is the only variable

that management can influence

3. Estimating the Weighted Average

Cost of Capital, WACC

Estimate NOP = $400,000

Tax Rate = 40%

4. Estimating the Firms Value

If the firm has zero growth, we can use the

constant growth version

FCF (Free-cash flow) is net operating profit

after taxes (NOPAT) minus the required net

investment in capital

5. Estimating Shareholder Wealth and

Stock Price

If the firm has less than 40% debt, it should

now recapitalize, meaning that it should issue

debt and use the proceeds to repurchase

stock

The shareholders wealth after the recap

would be equal to the payment they receive

from the share repurchase plus the remaining

value of their equity.

To find the remaining value of equity, we need

to specify how much debt is issued in the new

capital structure

Since we know the percent of debt in the

capital structure and the resulting value of the

firm, we can find the dollar value of debt as

follows:

D = W

d

V

For example, at the optimal capital structure

of 40 percent debt, the dollar value of debt is

about $88,889 = 0.40($222,222).

The market value of the remaining equity, S, is

equal to the total value minus the value of the

debt.

Stock Price and Earnings per Share

Financial Information of the Firm used

in Example

Potrebbero piacerti anche

- Unit6 2-ValuationofPreferredandCommonStockDocumento77 pagineUnit6 2-ValuationofPreferredandCommonStockHay JirenyaaNessuna valutazione finora

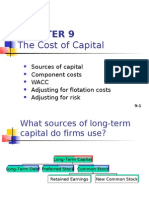

- CH 09 RevisedDocumento36 pagineCH 09 RevisedNiharikaChouhanNessuna valutazione finora

- Capital StructureDocumento41 pagineCapital StructureRAJASHRI SNessuna valutazione finora

- Chapter Three: Valuation of Financial Instruments & Cost of CapitalDocumento68 pagineChapter Three: Valuation of Financial Instruments & Cost of CapitalAbrahamNessuna valutazione finora

- Designing A Capital StructureDocumento16 pagineDesigning A Capital StructureDHARMA DAZZLE100% (1)

- Capital Budgeting MethodsDocumento3 pagineCapital Budgeting MethodsRobert RamirezNessuna valutazione finora

- Cost of CapitalDocumento18 pagineCost of CapitalJoshua CabinasNessuna valutazione finora

- Chapter 4 Financing Decisions PDFDocumento72 pagineChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Sources and Raising of LT FinanceDocumento52 pagineSources and Raising of LT FinanceAshutoshNessuna valutazione finora

- R21 Capital Budgeting Q Bank PDFDocumento10 pagineR21 Capital Budgeting Q Bank PDFZidane KhanNessuna valutazione finora

- Cost of CapitalDocumento45 pagineCost of CapitalG-KaiserNessuna valutazione finora

- M09 Gitman50803X 14 MF C09Documento56 pagineM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNessuna valutazione finora

- Cost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitDocumento54 pagineCost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitArundhati SinhaNessuna valutazione finora

- Capital StructureDocumento59 pagineCapital StructureRajendra MeenaNessuna valutazione finora

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocumento24 pagineCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNessuna valutazione finora

- Chapter 04 Working Capital 1ce Lecture 050930Documento71 pagineChapter 04 Working Capital 1ce Lecture 050930rthillai72Nessuna valutazione finora

- Capital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional ApproachDocumento50 pagineCapital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional Approachthella deva prasadNessuna valutazione finora

- Lecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelDocumento34 pagineLecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelL SNessuna valutazione finora

- Capital Structure: Overview of The Financing DecisionDocumento68 pagineCapital Structure: Overview of The Financing DecisionHay JirenyaaNessuna valutazione finora

- Capital Structure: Theory and PolicyDocumento31 pagineCapital Structure: Theory and PolicySuraj ShelarNessuna valutazione finora

- Cost of capital analysis for Stansted AirportDocumento37 pagineCost of capital analysis for Stansted AirportJames HoldenNessuna valutazione finora

- Chapter 4 Cost of CapitalDocumento19 pagineChapter 4 Cost of CapitalmedrekNessuna valutazione finora

- Chap 014Documento79 pagineChap 014hanguyenhihiNessuna valutazione finora

- Dividend PolicyDocumento52 pagineDividend PolicyKlaus Mikaelson100% (1)

- Risk Adjusted Discount Rate Method ExplainedDocumento13 pagineRisk Adjusted Discount Rate Method ExplainedathiranbelliNessuna valutazione finora

- Capital StructureDocumento41 pagineCapital StructurethejojoseNessuna valutazione finora

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityDocumento23 pagineCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanNessuna valutazione finora

- Calculate Terminal Cash FlowDocumento9 pagineCalculate Terminal Cash FlowKazzandraEngallaPaduaNessuna valutazione finora

- Definition, Nature & Scope of WCDocumento12 pagineDefinition, Nature & Scope of WCAshish Gautam0% (1)

- CHAPTER 9 The Cost of CapitalDocumento37 pagineCHAPTER 9 The Cost of CapitalAhsanNessuna valutazione finora

- CVP Analysis Final 1Documento92 pagineCVP Analysis Final 1Utsav ChoudhuryNessuna valutazione finora

- Portfolio Selection Using Sharpe, Treynor & Jensen Performance IndexDocumento15 paginePortfolio Selection Using Sharpe, Treynor & Jensen Performance Indexktkalai selviNessuna valutazione finora

- Risk, Cost of Capital, and ValuationDocumento34 pagineRisk, Cost of Capital, and ValuationNguyễn Cẩm HươngNessuna valutazione finora

- Cost of CapitalDocumento37 pagineCost of Capitalrajthakre81Nessuna valutazione finora

- Chapter 2 - The Business Plan Road Map To SuccessDocumento52 pagineChapter 2 - The Business Plan Road Map To SuccessFanie SaphiraNessuna valutazione finora

- 6may IIBF ALMDocumento62 pagine6may IIBF ALMmevrick_guyNessuna valutazione finora

- WACC or Cost of CapitalDocumento19 pagineWACC or Cost of CapitalSaeed Agha AhmadzaiNessuna valutazione finora

- Leasing RossDocumento15 pagineLeasing Rosstinarosa13Nessuna valutazione finora

- Risk, Cost of Capital, and Valuation: Mcgraw-Hill/IrwinDocumento35 pagineRisk, Cost of Capital, and Valuation: Mcgraw-Hill/IrwinThế Vũ100% (1)

- Lecture 15 Cost of CapitalDocumento7 pagineLecture 15 Cost of CapitalA.D. Home TutorsNessuna valutazione finora

- Chapter 6 Discounted Cash Flow ValuationDocumento27 pagineChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Valuation of Bonds and Shares WorkbookDocumento3 pagineValuation of Bonds and Shares Workbookkrips16100% (1)

- FM11 CH 09 Cost of CapitalDocumento54 pagineFM11 CH 09 Cost of CapitalMadeOaseNessuna valutazione finora

- Basic Bond Valuation TutorialDocumento2 pagineBasic Bond Valuation Tutorialtai kianhongNessuna valutazione finora

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocumento21 pagineChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNessuna valutazione finora

- Creating Value Through Required ReturnDocumento74 pagineCreating Value Through Required Returnriz4winNessuna valutazione finora

- Capital Budgeting Practice Questions QueDocumento9 pagineCapital Budgeting Practice Questions QuemawandeNessuna valutazione finora

- Calculating Cost of Capital and WACCDocumento21 pagineCalculating Cost of Capital and WACCMardi UmarNessuna valutazione finora

- Introduction To Corporate FinanceDocumento29 pagineIntroduction To Corporate FinanceRifki AyyashNessuna valutazione finora

- Optimum Capital StructureDocumento6 pagineOptimum Capital StructureAshutosh Pednekar100% (1)

- Quiz 2 - QUESTIONSDocumento18 pagineQuiz 2 - QUESTIONSNaseer Ahmad AziziNessuna valutazione finora

- Presentation On WACCDocumento12 paginePresentation On WACCIF387Nessuna valutazione finora

- Current Liabilities and Contingencies: HapterDocumento58 pagineCurrent Liabilities and Contingencies: Haptergellie mare floresNessuna valutazione finora

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocumento3 pagineMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNessuna valutazione finora

- Cost of Capital ExplainedDocumento18 pagineCost of Capital ExplainedzewdieNessuna valutazione finora

- Capital GainsDocumento22 pagineCapital Gainsswathi aluruNessuna valutazione finora

- Corporate Finance and Investment AnalysisDocumento80 pagineCorporate Finance and Investment AnalysisCristina PopNessuna valutazione finora

- Valuation of Bonds PDFDocumento17 pagineValuation of Bonds PDFMoud KhalfaniNessuna valutazione finora

- Estimatingthe Optimal Capital StructureDocumento22 pagineEstimatingthe Optimal Capital StructureKashif KhurshidNessuna valutazione finora

- Cost of Capital Lecture Slides in PDF FormatDocumento18 pagineCost of Capital Lecture Slides in PDF FormatLucy UnNessuna valutazione finora

- International FinanceDocumento46 pagineInternational FinanceAqeel Ahmad KhanNessuna valutazione finora

- Value-at-RiskDocumento41 pagineValue-at-RiskAqeel Ahmad KhanNessuna valutazione finora

- New Microsoft Word DocumentDocumento3 pagineNew Microsoft Word DocumentAqeel Ahmad KhanNessuna valutazione finora

- If and The ConditionalDocumento2 pagineIf and The ConditionalhafidzdwowoNessuna valutazione finora

- Organizational StructureDocumento31 pagineOrganizational StructureAqeel Ahmad Khan100% (1)

- Function WordsDocumento1 paginaFunction WordsAqeel Ahmad KhanNessuna valutazione finora

- Solved Past Paper of Fia InspectorDocumento4 pagineSolved Past Paper of Fia InspectorAqeel Ahmad Khan73% (11)

- Emerging IssuesDocumento2 pagineEmerging IssuesAqeel Ahmad KhanNessuna valutazione finora

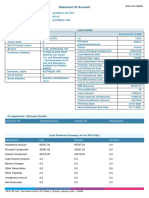

- AccountStatement0603 001 002214037 001 0Documento1 paginaAccountStatement0603 001 002214037 001 0Aqeel Ahmad KhanNessuna valutazione finora

- 7 2Documento37 pagine7 2Rahul KadamNessuna valutazione finora

- Vault-Finance Practice GuideDocumento126 pagineVault-Finance Practice GuideMohit Sharma100% (1)

- CourseDocumento3 pagineCourseAqeel Ahmad KhanNessuna valutazione finora

- RabiullahDocumento3 pagineRabiullahAqeel Ahmad KhanNessuna valutazione finora

- Jumatul Wida Observed With Religious Fervor As Moon Sighting Controversy ContinuesDocumento1 paginaJumatul Wida Observed With Religious Fervor As Moon Sighting Controversy ContinuesAqeel Ahmad KhanNessuna valutazione finora

- Most Common Prefixes and SuffixesDocumento2 pagineMost Common Prefixes and Suffixesseanwindow5961Nessuna valutazione finora

- Freeze or Lock Rows and ColumnsDocumento2 pagineFreeze or Lock Rows and ColumnsAqeel Ahmad KhanNessuna valutazione finora

- Fact Sheet - Risk Management ProcessDocumento6 pagineFact Sheet - Risk Management ProcessShoaib AkhtarNessuna valutazione finora

- RabiullahDocumento3 pagineRabiullahAqeel Ahmad KhanNessuna valutazione finora

- 15 Answers To All ProblemsDocumento25 pagine15 Answers To All ProblemsAqeel Ahmad KhanNessuna valutazione finora

- Final Internship Report On PTCLDocumento83 pagineFinal Internship Report On PTCLRed Eyes1177% (30)

- Corporate Finance Lecture 1Documento3 pagineCorporate Finance Lecture 1Aqeel Ahmad KhanNessuna valutazione finora

- BookDocumento2 pagineBookAqeel Ahmad KhanNessuna valutazione finora

- If Funciton ExerciseDocumento1 paginaIf Funciton ExerciseAqeel Ahmad KhanNessuna valutazione finora

- Chairman Imran KhanDocumento1 paginaChairman Imran KhanAqeel Ahmad KhanNessuna valutazione finora

- If Funciton ExerciseDocumento1 paginaIf Funciton ExerciseAqeel Ahmad KhanNessuna valutazione finora

- If Funciton ExerciseDocumento1 paginaIf Funciton ExerciseAqeel Ahmad KhanNessuna valutazione finora

- Leverage TheoryDocumento5 pagineLeverage TheorypappujanNessuna valutazione finora

- If Funciton ExerciseDocumento1 paginaIf Funciton ExerciseAqeel Ahmad KhanNessuna valutazione finora

- If Funciton ExerciseDocumento1 paginaIf Funciton ExerciseAqeel Ahmad KhanNessuna valutazione finora

- Assignment Questions PDFDocumento3 pagineAssignment Questions PDFFahim TanvirNessuna valutazione finora

- Accel Club - Pitch Deck - September FullDocumento62 pagineAccel Club - Pitch Deck - September FullAlexanderNessuna valutazione finora

- This Study Resource WasDocumento2 pagineThis Study Resource WasKate Crystel reyesNessuna valutazione finora

- Financial Evaluation of ProjectsDocumento14 pagineFinancial Evaluation of ProjectsTrifan_DumitruNessuna valutazione finora

- FIN 432 - Investment Analysis and Management Review Notes For Midterm ExamDocumento15 pagineFIN 432 - Investment Analysis and Management Review Notes For Midterm ExamPhuc Hong PhamNessuna valutazione finora

- Ops Mgmt & Fin MgmtDocumento8 pagineOps Mgmt & Fin MgmtIngrid VeronicaNessuna valutazione finora

- e-StatementBRImo 585401009753509 Jul2023 20230731 081457Documento2 paginee-StatementBRImo 585401009753509 Jul2023 20230731 08145709. BUNGA NUR YUNITA SARINessuna valutazione finora

- BFC1010: Fundamentals of Accounting - InventoryDocumento8 pagineBFC1010: Fundamentals of Accounting - InventoryBusiswa MsiphanyanaNessuna valutazione finora

- Part 1 Sobeys Inc S Balance Sheet Reports The AssetDocumento1 paginaPart 1 Sobeys Inc S Balance Sheet Reports The AssetMuhammad ShahidNessuna valutazione finora

- MBA Corporate Finance SummariesDocumento37 pagineMBA Corporate Finance SummariesOnikaNessuna valutazione finora

- Accountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20Documento3 pagineAccountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20PRABHAT JOSHINessuna valutazione finora

- MPERS Vs MFRS - KamDocumento28 pagineMPERS Vs MFRS - KamKamaruzzaman Mohd100% (1)

- IFSEDocumento42 pagineIFSEvenkatNessuna valutazione finora

- Roce EvaDocumento20 pagineRoce EvafabilNessuna valutazione finora

- Prelim ExamDocumento40 paginePrelim ExamAbegail RafolsNessuna valutazione finora

- 2 InvestmentsDocumento4 pagine2 InvestmentsAdrian MallariNessuna valutazione finora

- 917 SumedhaBanerjeeDocumento26 pagine917 SumedhaBanerjeearya jhaNessuna valutazione finora

- Goodwill Questions and Their SolutionsDocumento8 pagineGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- Final Fin33Documento2 pagineFinal Fin33RonieOlarteNessuna valutazione finora

- CLIX2Documento2 pagineCLIX2Digi CreditNessuna valutazione finora

- Jul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearDocumento32 pagineJul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearProtyay ChakrabortyNessuna valutazione finora

- Omnicom - 1-Page AppraisalDocumento1 paginaOmnicom - 1-Page AppraisalAndy ParkNessuna valutazione finora

- Management Accounting Study MaterialDocumento164 pagineManagement Accounting Study MaterialT S Kumar Kumar100% (1)

- Statement of Cash FlowsDocumento2 pagineStatement of Cash FlowsMae MarinoNessuna valutazione finora

- Case Study - Max Software Services - Relative ValuationDocumento9 pagineCase Study - Max Software Services - Relative ValuationRajkumarNessuna valutazione finora

- Financial Management September 2010 Marks Plan ICAEWDocumento10 pagineFinancial Management September 2010 Marks Plan ICAEWMuhammad Ziaul HaqueNessuna valutazione finora

- Chapter 12 - Test BankDocumento25 pagineChapter 12 - Test Bankgilli1tr100% (1)

- Merchandising Handout - Perpetual Vs PeriodicDocumento1 paginaMerchandising Handout - Perpetual Vs PeriodicTineNessuna valutazione finora

- Model Question Paper for Assistant Director of Co-operative AuditDocumento12 pagineModel Question Paper for Assistant Director of Co-operative AuditChandan NNessuna valutazione finora

- Case Analysis on Surya Tutoring expansion financingDocumento4 pagineCase Analysis on Surya Tutoring expansion financingAbhishek KumarNessuna valutazione finora