Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

8.starting A Venture - Legal Forms

Caricato da

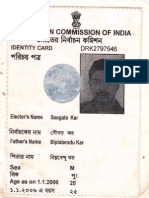

Saugat KarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

8.starting A Venture - Legal Forms

Caricato da

Saugat KarCopyright:

Formati disponibili

Prof.B.D.

Gupta

Todays Topic

Legal & regulatory Issues

What are the various legal factors affecting a venture?

What are the different forms of organization?

Selecting a form of organization

1.Sole proprietorship

2.Partnership firm

3.Private Limited company

The Legal Environment

Once a the basic plan of a new business

venture has been drawn up what is the

process of starting it?

Legal & regulatory Issues

Financial issues

People issues

The Legal Environment

What are the various legal factors affecting a venture?

Selecting a form of organization

Getting approval for a new project

Arranging for taxes or duties payable

Protecting or managing intellectual property

Ministry of Micro, Small and Medium

Enterprises

(Government of India)

http://msme.gov.in/msme_aboutus.htm

Define Micro, Small & Medium

scale Enterprises.

Definition of Micro, Small and

Medium Enterprises

A micro enterprise is an enterprise where investment

in plant and machinery

does not exceed Rs. 25 lakh;

Definition of Micro, Small and

Medium Enterprises

A small enterprise is an enterprise where the

investment in plant and machinery (original

cost excluding land and building ) is more than Rs. 25

lakh but does

not exceed Rs. 5 crore;

Definition of Micro, Small and

Medium Enterprises

A medium enterprise is an enterprise where the

investment in plant and machinery

(original cost excluding land and building ) is more

than Rs.5 crore

but does not exceed Rs.10 crore.

What are the different forms of

organization?

1.Sole proprietorship

2.Partnership firm

3.Private Limited company

4.Public Limited Company

1.Sole proprietorship

Small Shops and Boutiques

Artisans and Musicians

Independent Contractors

1.Sole proprietorship Business

Sole proprietorship allows you to run and own your

business as an extension of your personal finances

rather than as a separate entity.

If you want to establish a small firm in India

without the complications of corporation

formation and registration, a sole proprietorship

will allow you to do so.

Sole proprietorships are the most common type of

business in India because of the easy procedure

for establishing them.

Characteristics of sole

proprietorship business

Ownership

As the sole proprietor, the business owner makes all

business decisions.

The owner controls and manages the proprietorship

while creating and implementing changes.

The sole proprietor may have several employees, but it

is common for the sole proprietor to be the

business's only employee.

Characteristics of sole

proprietorship business

Liability

As the sole owner of the business, the sole proprietor

accepts complete responsibility for the business's

liabilities, as well as its income.

The owner is financially responsible for the

business's debts, expenses and payables and

creditors can garnish the sole proprietor's personal

income if the business falters or fails.

Characteristics of sole

proprietorship business

Risk

Since the sole proprietorship accepts all the risk,

the proprietorship is often subject to less

restrictive regulations than partnership and

corporation entities.

The sole proprietorship is not required to charter the

business with the state, though the business may be

required to register the business's name and

operations.

The advantages of sole

proprietorship business

1.Ease of formation

2.Complete control

3.Promptness in decision making

4.Flexibility of operation

5.Minimum government interference

The disadvantages of sole

proprietorship business

1.Amount of capital is limited

2.Managerial ability can be limited

3.Liability is unlimited

4.Heavy personal risk

5.Uncertainity of continuty

Partnership business

Characteristics

1.It is an association of two or more

persons

2. It is based on agreement

3.The purpose of sharing of profits in

a business

4,It has no separate legal existence

from its owners

Partnership business

The legal implications:

1.It is not a legal entity

2.The minimum no of partners must be two and

maximum no can be 10 in banking business and

20 in case of others.

3.Liability is unlimited, joint or individual

4. Share of interest can not be transferred without

the permission of other partners.

5.Death or insolvency of a partner dissolves the

firm

Corporations

1. Recommended for large scale operation

2. As a legal entity it has a separate life from its

owners.

3, Share

unit of equity ownership in a corporation. This

ownership is represented by a stock certificate,

which names the company and the shareowner.

4.Private Limited Company

5. Public limited company

Private limited company

Characteristics

1. Separate legal entity

2.Ease of operations

3.Has a common seal which is used while dealing with

outsiders.

4.The liabilities are limited

5.Continues to exist even if the shareholders die

Test yourself

A Private Limited Company in India is a company

limited by shares in which there can be maximum 50

shareholders, no invitation can be made to the public

for subscription of shares or debentures and cannot

make or accept deposits from public.

True False

Test yourself

A Private Limited Company in India is a company

limited by shares in which there can be maximum 50

shareholders, no invitation can be made to the public

for subscription of shares or debentures and cannot

make or accept deposits from public.

True False

Prof.B.D.Gupta

IIPM,Kolkata

How do I start my company in India?

Today's Topics

How do I start my company in India?

Important Contacts

1. WBIDC :http://www.wbidc.com/

3.Ministry of Corporate Affairs website

(www.mca.gov.in)

2. To Register a Company in India

http://business.mapsofindia.com/india-

company/register.html

West Bengal Industrial Development

Corporation Limited (WBIDC)

What are the basic functions of WBIDC?

WBIDC is a one stop shop that takes care of

the most diverse of needs such as

financing medium and large scale

industries through various loan

schemes;

providing escort services and

facilitating investment proposals

through single window agency called

Shilpabandhu or State Investment

Facilitation Centre (SIFC):

Contact

WEST BENGAL INDUSTRIAL DEVELOPMENT

CORPORATION LIMITED

"Protiti",

23, Abanindranath Tagore Sarani, (Camac Street)

Kolkata - 700017,

West Bengal, India

Phone: +91 33 2255 3700 - 705

Fax: +91 33 2255 3737

Shilpa Bandhu or the State Investment

Facilitation Centre (SIFC)

Shilpa Bandhu or the State Investment Facilitation Centre

(SIFC) acts as the single-window agency of the State Government

for setting up industries.

SIFC offers assistance in the following areas:

Approvals from the Secretariat for Industrial Assistance

and Foreign investment Promotional Board.

Registration by Directorate of Industries.

Clearance from the Pollution Control Board.

All clearances related to Power. Identification, allotment,

mutation / conversion of land and other infrastructural

facilities.

Guidance to entrepreneurs on investment prospects in

more than 200 ready projects developed by WBIDC.

Important Contacts

COMPANY REGISTRATION & INCORPORATION

Registrar of Companies,

Department of Company Affairs, West Bengal

Nizam Palace

2nd MSO Building, 2nd Floor, 234/4, A.J.C Bose Road,

phone: 033-22800409

http://www/mca.gov.in

APPLICATION FOR TRADE LICENCE (KMC AREA)

Kolkata Municipal Corporation

5, S.N. Banerjee Road, Kolkata 700013

Ph: +91 33 2244 7432

www.kolkatamycity.com

Important Contacts

APPROVAL FOR CONSTRUCTION OF FACTORY

SHED / BUILDING, REGISTRATION & LICENSING

UNDER FACTORIES ACT

Chief Inspector Factories, W.B.

New Secretariat Bldg., 8th Floor, 1, K.S. Roy Road,

Kolkata 700001

Tel: 22103274

http://dgfasli.nic.in

Important Contacts

COMMERCIAL TAXES

Directorate of Commercial Taxes, Government of West

Bengal

14, Beliaghata Road, Kolkata 700015

2251-8068

www.wbcomtax.com

Important Contacts

REGISTRATION UNDER EMPLOYEES

PROVIDENT FUND

REGIONAL Provident Fund Commissioner

44, Park Street, kolkata 700 016

Sector-II, Salt Lake City,

Karunamoyee,

Kolkata 700091

www.epfindia.com

Important Contacts

STATE POLLUTION CLEARANCE Consent to

Operate & Establish

West Bengal Pollution Control Board (WBPCB)

Paribesh Bhawan, 10A, Block LA, Sector III, Saltlake,

Kolkata 700098

Phone: (033) 23359088

www.wbpcb.gov.in

How do I start my company in

India?

Step 1: Attain director identification number

(DIN) by filling Form DIN-1.

Step 2: Acquire digital signature certificate ( DSC)

to utilize the latest electronic registration system

under MCA 21

Step 3: Cache the company name with the

Registrar of Companies (ROC) and Google

Step 4 : Finalize the objects and rules for internal

regulation of the company Memorandum and

Articles of Association.

How do I start my company in India?

Step 5 - Seal the company credentials at the State

Treasury (State) or certified private bank.

Step 6 - Attain the Certificate of Incorporation from

the Registrar of Companies, Ministry of Corporate

Affairs

Step 7 - Make a seal (applicable for the private limited

companies).

Step 8 - Attain a Permanent Account Number

(PAN) for submitting IT return

Step 9 - Acquire a Tax Account Number (TAN) for

income taxes deduction at source

How do I start my company in

India?

Step 10 - Enroll with the Office of Inspector, Shops,

and Establishment Act (State/Municipal).

Step 11 - Enroll for Value-Added Tax (VAT) at the

Commercial Tax Office (State).

Explanation : Step 1 & 2

Step 1: Attain director identification

number (DIN) by filling Form DIN-1.

Step 2: Acquire digital signature

certificate ( DSC) to utilize the latest

electronic registration system under

MCA 21

Director Identification Number (DIN)

What is Director Identification Number (DIN) ?

Every person before becoming a director has

to get DIN from MCA by filling e form.

Director Identification Number

(DIN)

Any individual who is a director or intends to

become a director of a company should apply for

DIN. DIN is mandatory for e-filing of forms and

documents.

All the directors of a company must obtain DIN. Application for allotment of Director

Identification NumberSection 266A inserted by the Companies (Amendment) Act, 2006 which,

has been notified by Notification No. G.S.R. 648E dated 19th Oct. 2006 and has come into the force

w.e.f. 1st Nov., 2006. The new section provides that every-

(a) Individual, intending to be appointed as director of a company; or(b) Director of a Company

appointed before the commencement of the Companies(Amendment) Act, 2006, shall make an

application for allotment of Director Identification Number to the Central Government in form DIN-

1.

Every applicant, who has made an application for allotment of Director Identification Number, may

be appointed as a director in a company, or, hold office as director in a company till such time such

applicant has been allotted Director Identification Number.

Digital Signature Certificate (DSC)

What is a Digital Signature Certificate (DSC)?

The Information Technology Act, 2000 provides for use of

Digital Signatures on the documents submitted in

electronic form in order to ensure the security and

authenticity of the documents filed electronically.

This is the only secure and authentic way that a document

can be submitted electronically.

As such, all filings done by the companies under MCA21 e-

Governance programme are required to be filed with the

use of Digital Signatures by the person authorised to

sign the documents.

What is digital

signature?

How do I get DSC & DIN?

Registration for DSC and DIN for Professionals and

Small & Medium-sized companies can be done by

licensed Certifying Authorities for example:

1. SafeScrypt (mcacert.safescrypt.com)

2. (n) code Solutions : www.ncodesolutions.com/

Step 3

Cache the company name with the Registrar of Companies

(ROC) and Google

Guidelines for Name Availability

Step 3: Registration of company name: Select the

name with which the company will be registered and

apply for registration to MCA. Give six (6) proposed

names in the application.

Application :

http://www.elcot.in/document/Form1A_help.pdf

A Company can not use the same name or closely

similar name of another existing company

registered in India.

Guidelines for Name Availability

The name of a company starts with a noun followed by

activity and ends with the words 'Private Limited' in case

of private limited company and the word 'Limited' in case

of public limited company.

For example, 'Tata Consultancy Services Limited' is a public

limited company. The name starts with the noun 'Tata',

activity 'Consultancy Services' and ends with 'Limited'

as it is a public limited company.

No promoter can register a company with the name 'Tata

Consultancy Services Limited' or closely similar to that.

Similarly, a trade mark owner can claim the text of the

mark, if any, for registering a company with that name.

Test Yourself

'Tata Consultancy Services Limited' is a public limited or

private Limited company?

Ans: Public Limited company.

The name starts with the noun 'Tata', activity

'Consultancy Services' and ends with 'Limited' as it is a

public limited company.

Can you apply for a company name: Tutu Consultancy

Services?

Ans: No promoter can register a company with the name

'Tata Consultancy Services Limited' or closely similar to

that. Similarly, a trade mark owner can claim the text of the

mark, if any, for registering a company with that name.

Guidelines for Name Availability

If the proposed name contains words India or Bharat,

Universal etc higher capital will be required.

Test Yourself:

Pratik plans to invest 10 lakhs in a small scale start up

company which will develop software for video games.

Which of the following company names is likely to get

approval from the Ministry of Company Affairs?

Pratik Software Pvt. Ltd.,

International Software Pvt. Ltd.

India Software Pvt. Ltd.

Bharat Software Pvt.Ltd.?

Sl.No. Key words in Company name

Authorized Capital Required

(INR)

1 Corporation 5 crores (50 million)

2

Asia, Asian, Asiatic, Continental, Globe, Global,

International, Inter-Continental, Universal, Universal,

World -- being the first word of the company name

1 crore (10 million)

3 Industrial, Industries, Industry, Udyog 1 crore (10 million)

4

Asia, Asian, Asiatic, Continental, Globe, Global,

International, Inter-Continental, Universal, Universal,

World -- used within the company namewith or

without brackets

50 Lacs (5 million)

5

Bharat, Bhrarati, Bharatiya, Bharateeya, Hindustan,

Hindustani, Hindustanee, India, Indian -- being

the first word of the company name

50 Lacs (5 million)

6

Business, Enterprise, Enterprises, Manufacturing,

Manufacture, Product, Products

10 Lacs (1 million)

7

Bharat, Bhrarati, Bharatiya, Bharateeya, Hindustan,

Hindustani, Hindustanee, India, Indian --

used within the company name with or without

brackets

5 Lacs (0.5 million)

Few words are associated with higher authorized capital and are allowed

to be used only if the company is registered with the required capital or

more. Refer to this table for key words and their capital requirements:

Step 4: Memorandum and Articles

of Association

Step 4 : Finalize the objects and rules for internal

regulation of the company Memorandum and

Articles of Association.

Test Yourself

The Memorandum of Association is a document that

A) sets out the constitution of the company

B) the objectives of the company

C) the scope of activity of the company

D) defines the relationship of the company with the

outside world

E) None of these

F) All of these

Test Yourself

The Memorandum of Association is a document that

A) sets out the constitution of the company

B) the objectives of the company

C) the scope of activity of the company

D) defines the relationship of the company with the

outside world

E) None of these

F) All of these

Test Yourself

The Articles of Association contain

A) the rules and regulations of the company for the

management of its internal affairs

B) the rules and regulations for achieving the company

objectives

C) None of these

D) All of these,

Test Yourself

The Articles of Association contain

A) the rules and regulations of the company for the

management of its internal affairs

B) the rules and regulations for achieving the

company objectives

C) None of these

D) All of these,

Test Yourself

The clause ISSUE OF EQUITY SHARES TO

EMPLOYEES UNDER STOCK OPTION PLAN will be

included in

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause ISSUE OF EQUITY SHARES TO

EMPLOYEES UNDER STOCK OPTION PLAN will be

included in

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause A member may transfer his share(s) to a

member or to his relative(s) as defined in Section 6 of

the Act will be included in :

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause A member may transfer his share(s) to a

member or to his relative(s) as defined in Section 6 of

the Act will be included in :

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause The Authorised Share Capital of the

Company is Rs. 10,00,000/- (Rupees Ten Lakhs only)

divided into 10,000 (Ten Thousand) Equity Shares of

Rs. 100/- (Rupees One Hundred only) each: will be

included in

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause The Authorised Share Capital of the

Company is Rs. 10,00,000/- (Rupees Ten Lakhs only)

divided into 10,000 (Ten Thousand) Equity Shares of

Rs. 100/- (Rupees One Hundred only) each: will be

included in

A) the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause THE MAIN OBJECTS OF THE COMPANY

TO BE PURSUED BY THE COMPANY ON ITS

INCORPORATION ARE AS FOLLOWS:

To design, buy, import, manufacture, fabricate,

assemble, distribute, export, sell or lease and/or

otherwise to deal in all kinds of Bio Pharmaceuticals

will be included in

A)the Memorandum of Association

B) the Articles of Association.

Test Yourself

The clause THE MAIN OBJECTS OF THE COMPANY

TO BE PURSUED BY THE COMPANY ON ITS

INCORPORATION ARE AS FOLLOWS:

To design, buy, import, manufacture, fabricate,

assemble, distribute, export, sell or lease and/or

otherwise to deal in all kinds of Bio Pharmaceuticals

will be included in

A) the Memorandum of Association

B) the Articles of Association.

Memorandum and Articles of

Association

The Memorandum of Association and Articles of Association are

the most important documents to be submitted to the ROC for

the purpose of incorporation of a company.

The Memorandum of Association is a document that sets out the

constitution of the company. It contains, amongst others, the

objectives and the scope of activity of the company besides

also defining the relationship of the company with the outside

world.

The Articles of Association contain the rules and regulations

of the company for the management of its internal affairs.

While the Memorandum specifies the objectives and purposes

for which the Company has been formed, the Articles lay down

the rules and regulations for achieving those objectives

and purposes.

Step 5

Step 5 - Seal the company credentials at the State Treasury

(State) or certified private bank.

Seal the company credentials at the State Treasury

(State) or certified private bank. The appeal for

stamping the inclusion certificates should be

complemented by unsigned copies of the Articles

of Association, Form - 1 and Memorandum and

Articles of Association.

The firm must make sure that no promoter has written

anything nor have signed on the documents which are

deposited to the Superintendent of Stamps or to the

certified bank for stamping. The price of stamp duty

differs from state to state.

Step 6 - Attain the Certificate of Incorporation

from the Registrar of Companies, Ministry of

Corporate Affairs.

The forms which are required to be filled online on the

Ministry of Company Affairs website are: e-form 1; e-

form 18; and e-form 32.

Along with these papers, copies of agreement of the

original directors and signed and sealed form of the

Memorandum and Article of Association must be

enclosed in Form 1.

Step 7 - Make a seal (applicable for the

private limited companies).

Making a company seal is not a legal

obligation for the firm to be integrated,

but firms require a seal to deliver share

certificates and other certificates.

Test Yourself

The Tax Account Number (TAN) is required by anyone

accountable for

A) Deducting or gathering tax at source

B) Paying income tax

C) Paying commercial tax

Test Yourself

The Tax Account Number (TAN) is required by anyone

accountable for

A) Deducting or gathering tax at source

B) Paying income tax

C) Paying commercial tax

Test Yourself

What is the difference between PAN and TAN ?

A) While TAN is used for deducting or gathering tax

at source PAN is used for submitting annual

personal tax return;

B) While PAN is used for submitting commercial

tax TAN is used for submitting sales tax

Test Yourself

What is the difference between PAN and TAN ?

A) While TAN is used for deducting or gathering

tax at source PAN is used for submitting annual

personal tax return;

B) While PAN is used for submitting commercial

tax TAN is used for submitting sales tax

Step 8 - Permanent Account Number (PAN) is a ten-

digit alphanumeric number, issued in the form of a

laminated card, by the Income Tax Department.

Attain a Permanent Account Number (PAN) from a certified franchise or

agent allotted by the National Securities Depository Ltd. (NSDL) or the

Unit Trust of India (UTI) Investors Services Ltd., as outsourced by the

Income Tax Department (National).

Each person is entitled to state his or her Permanent Account Number

(PAN) for the purpose of tax payment under the Income Tax Act, 1961 and

the Tax Account Number (TAN) for submitting tax reduced at source.

One can get PAN application from IT PAN Service Centers or TIN

Facilitation Centers using Form 49A with the acknowledged copy of the

certificate of registration, released by the Registrar of Companies along

with the identity and residence proof.

Step 9 - Acquire a Tax Account Number (TAN) for

income taxes abstracted at source from the Assessing

Office of the Income Tax Department.

The Tax Account Number (TAN) is required by

anyone accountable for deducting or gathering

tax.

The prerequisites of Section 203A of the Income Tax

Act state that all individuals who subtract or collect

tax at the source must submit an application for a

TAN. The submission for allotment of a TAN must

be registered using Form 49B and deposited at any

TIN Facilitation Center certified to accept e-TDS

returns.

Step 10- Enroll with the Office of

Inspector, Shops, and Establishment Act

(State/Municipal).

Under this procedure, a proclamation

incorporating the names of employer's

and manager's and the establishment's

name (if any), postal address, and group

must be delivered to the local shop

inspector with the pertinent fees.

Step 11 - Enroll for Value-Added Tax (VAT) at the

Commercial Tax Office (State).

Registration of VAT requires filling up of Form 101.

Other credentials which need to be enclosed with

Form 101 are:

Attested copy of the memorandum and articles of

association of the company,

Residence proof,

Proof of location of company,

Applicant's one current passport-sized photograph,

Copy of PAN card,

Challan on Form No. 210

Thank You

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Jared Martinez - 10 Keys To Successful Forex TradingDocumento42 pagineJared Martinez - 10 Keys To Successful Forex Tradinglatnrythmz75% (4)

- Eula Microsoft Visual StudioDocumento3 pagineEula Microsoft Visual StudioqwwerttyyNessuna valutazione finora

- Img 0017Documento1 paginaImg 0017Saugat KarNessuna valutazione finora

- পাশ্চাত্যDocumento1 paginaপাশ্চাত্যSaugat KarNessuna valutazione finora

- Projects SS FW 13 15Documento6 pagineProjects SS FW 13 15Saugat KarNessuna valutazione finora

- Thursday 5th Dec 2013 Class ScheduleDocumento1 paginaThursday 5th Dec 2013 Class ScheduleSaugat KarNessuna valutazione finora

- 6.096 Problem Set 4: 1 Additional MaterialDocumento5 pagine6.096 Problem Set 4: 1 Additional MaterialSaugat KarNessuna valutazione finora

- MIT6 096IAP11 Sol03Documento10 pagineMIT6 096IAP11 Sol03Saugat KarNessuna valutazione finora

- Eula Microsoft Visual StudioDocumento3 pagineEula Microsoft Visual StudioqwwerttyyNessuna valutazione finora

- Lab 1 Solutions: 1 "Hello, World" (10 Points)Documento10 pagineLab 1 Solutions: 1 "Hello, World" (10 Points)Khaled Mohamed MagdyNessuna valutazione finora

- MIT6 096IAP11 Sol02Documento7 pagineMIT6 096IAP11 Sol02Saugat KarNessuna valutazione finora

- 1000 Various VerbsDocumento98 pagine1000 Various VerbsSaugat KarNessuna valutazione finora

- MIT6 096IAP11 Sol04Documento4 pagineMIT6 096IAP11 Sol04VinayNessuna valutazione finora

- MIT6 096IAP11 ProjectDocumento3 pagineMIT6 096IAP11 ProjectSaugat KarNessuna valutazione finora

- Mca PDFDocumento15 pagineMca PDFSaugat KarNessuna valutazione finora

- MIT6 096IAP11 Assn02Documento12 pagineMIT6 096IAP11 Assn02Saugat KarNessuna valutazione finora

- MIT6 096IAP11 Assn03Documento15 pagineMIT6 096IAP11 Assn03Saugat KarNessuna valutazione finora

- Img 0002Documento1 paginaImg 0002Saugat KarNessuna valutazione finora

- MIT1 00S12 Lec 2Documento12 pagineMIT1 00S12 Lec 2Cristian GaborNessuna valutazione finora

- MIT6 096IAP11 Assn01Documento15 pagineMIT6 096IAP11 Assn01Nguyen Hoang AnhNessuna valutazione finora

- MG University Meghalaya Results 2Documento1 paginaMG University Meghalaya Results 2Saugat KarNessuna valutazione finora

- PGP IIMM 2013 15 - 2nd - Sem PDFDocumento29 paginePGP IIMM 2013 15 - 2nd - Sem PDFSaugat KarNessuna valutazione finora

- PGP IIMM 2013 15 - 2nd - Sem PDFDocumento29 paginePGP IIMM 2013 15 - 2nd - Sem PDFSaugat KarNessuna valutazione finora

- Lab 1 Solutions: 1 "Hello, World" (10 Points)Documento10 pagineLab 1 Solutions: 1 "Hello, World" (10 Points)Khaled Mohamed MagdyNessuna valutazione finora

- Contact Details TERM New 1Documento4 pagineContact Details TERM New 1Saugat KarNessuna valutazione finora

- 1560524480pv PDFDocumento18 pagine1560524480pv PDFSaugat KarNessuna valutazione finora

- IIPMDocumento1 paginaIIPMSaugat KarNessuna valutazione finora

- Registration Form 122762 PDFDocumento2 pagineRegistration Form 122762 PDFSaugat KarNessuna valutazione finora

- IIPMDocumento1 paginaIIPMSaugat KarNessuna valutazione finora

- Document Verification Date 27.10.2020Documento2 pagineDocument Verification Date 27.10.2020shelharNessuna valutazione finora

- Website File1 1Documento86 pagineWebsite File1 1aryan_1982Nessuna valutazione finora

- Detailed Advertisement General Instructions KVK Positions PDFDocumento9 pagineDetailed Advertisement General Instructions KVK Positions PDFPuspak DasNessuna valutazione finora

- Alif Profile ChecklistDocumento2 pagineAlif Profile ChecklistnaveenshaniNessuna valutazione finora

- Certificate of Incorporation: Government of India Ministry of Corporate AffairsDocumento1 paginaCertificate of Incorporation: Government of India Ministry of Corporate AffairsAdam V. ArzateNessuna valutazione finora

- Ekam ApplicationDocumento17 pagineEkam ApplicationSehgal EstatesNessuna valutazione finora

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocumento4 pagineShri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesProficient CyberNessuna valutazione finora

- MSC Securty RefundDocumento2 pagineMSC Securty Refundgolu100% (1)

- Account Modification FormDocumento2 pagineAccount Modification FormPruthvish ShuklaNessuna valutazione finora

- Raipur To MumbaiDocumento2 pagineRaipur To MumbaiTazin nazNessuna valutazione finora

- CeBCF PMJDY Low 040118 PDFDocumento6 pagineCeBCF PMJDY Low 040118 PDFArif Jamal100% (1)

- Admit Card: Paschim Medinipur Zilla Parishad Midnapore - 721 101Documento2 pagineAdmit Card: Paschim Medinipur Zilla Parishad Midnapore - 721 101swapnil sardarNessuna valutazione finora

- Indusind ProjectDocumento18 pagineIndusind ProjectSanchit Mehrotra100% (2)

- 12368/vikramshila Exp Sleeper Class (SL)Documento3 pagine12368/vikramshila Exp Sleeper Class (SL)Rahul GuptaNessuna valutazione finora

- Tata Capital FormDocumento5 pagineTata Capital FormTAYYAB ANSARINessuna valutazione finora

- 9102015322912nit Afd, Vesda, Acc, C-Dot NGN MHS, Pune - 1516Documento37 pagine9102015322912nit Afd, Vesda, Acc, C-Dot NGN MHS, Pune - 1516vigneshNessuna valutazione finora

- Faculty Declaration Form (For AY 2021 - 22) : Remarks and Signature of AssessorDocumento7 pagineFaculty Declaration Form (For AY 2021 - 22) : Remarks and Signature of Assessorgopal trustNessuna valutazione finora

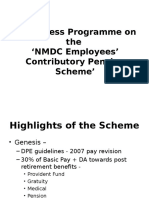

- Awareness Programme On The NMDC Employees' Contributory Pension Scheme'Documento20 pagineAwareness Programme On The NMDC Employees' Contributory Pension Scheme'ssprasadNessuna valutazione finora

- Going TicketDocumento2 pagineGoing Ticketkshitijtiwari.indiaNessuna valutazione finora

- 12495/pratap Express Third Ac (3A)Documento2 pagine12495/pratap Express Third Ac (3A)miteshsinghal21Nessuna valutazione finora

- Appointment RecieptDocumento3 pagineAppointment RecieptNipam patelNessuna valutazione finora

- Form-12BB 2019-20Documento1 paginaForm-12BB 2019-20sabir aliNessuna valutazione finora

- Customs Brokers Licensing Regulations English 2019Documento22 pagineCustoms Brokers Licensing Regulations English 2019abhishek ghagNessuna valutazione finora

- Godrej Meridien Booking FormDocumento8 pagineGodrej Meridien Booking FormLuxe HabitatNessuna valutazione finora

- Joint Declaration FormDocumento2 pagineJoint Declaration FormmurugamanieshNessuna valutazione finora

- Tel: 040-23147107 Fax: 040-29807791 E.mail: Sbi.18359@sbi - Co.inDocumento6 pagineTel: 040-23147107 Fax: 040-29807791 E.mail: Sbi.18359@sbi - Co.inRevunuru Suresh ReddyNessuna valutazione finora

- Individual Account Opening Form: (Demat + Trading)Documento30 pagineIndividual Account Opening Form: (Demat + Trading)ONE STEP for othersNessuna valutazione finora

- Distributor RegistrationDocumento2 pagineDistributor RegistrationborseNessuna valutazione finora

- CKYC Application Form For IndividualDocumento6 pagineCKYC Application Form For IndividualNaresh SharmaNessuna valutazione finora

- National Pension System (NPS) : Form 101-GSDocumento10 pagineNational Pension System (NPS) : Form 101-GSSREERAMULU MADINE0% (1)