Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bangkok Paper Re Mutliple Trains Operation 2nd Ed

Caricato da

Mario Francisco0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni23 pagineprocurement of rolling stock must a unified procurement policy to bring cost of maintenance and increase reliability of the LRT System.

Public sector maintenance brings down ridership based on MRT3 experience when public sector assumed procurement of maintenance services.

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoprocurement of rolling stock must a unified procurement policy to bring cost of maintenance and increase reliability of the LRT System.

Public sector maintenance brings down ridership based on MRT3 experience when public sector assumed procurement of maintenance services.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni23 pagineBangkok Paper Re Mutliple Trains Operation 2nd Ed

Caricato da

Mario Franciscoprocurement of rolling stock must a unified procurement policy to bring cost of maintenance and increase reliability of the LRT System.

Public sector maintenance brings down ridership based on MRT3 experience when public sector assumed procurement of maintenance services.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 23

Philippine Experience:

Rolling Stock Fleet Procurement and Maintenance

Rommel C. Gavieta MA (URP), MSc (Eng)

Metro Rail Transit Holdings Inc

Asia Rail Summit 2014

Shangrila Hotel Bangkok, Thaiiand

Metro Manila as a Mega-City and Traffic Congestion

21 mega-cities are in Asia out of 36 mega-cities (2012)

Metro Manila is second to Tokyo with 70% of the population taking public transportation.

(http://ncts.upd.edu.ph/old/research/docs/research/papers/tiglao-EASTS2007-02.pdf)

Jica experts has said that Philippine the government would need to invest P2.3 trillion through

2030 to overhaul transportation infrastructure in Metro Manila.

It estimated that about P2.4 billion in potential income was being lost daily due to congestion

at the capitals roads and railways.

(http://www.jica.go.jp/philippine/english/office/topics/news/130801.html and

http://business.inquirer.net/158419/jicas-expanded-mass-transport-study-seen-out-within-

2014#ixzz35kflDDX7)

Metro Manila as a Mega-City

http://www.forbes.com/sites/davidferris/2012/08/31/the-stark-environmental-challenge-of-

asias-megacities/2/

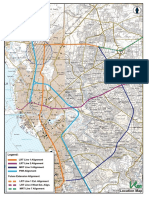

Proposed Metro Manila LRT/MRT and Rail Lines

Proposed Lines (JICA):

Primary Lines:

1. PNR rehabilitation or LRT5 (PhP25b Malolos-

Calamba), (LRT5)

2. MRT4 and MRT7 (Recto to Banaba PhP180billion),

3. Mega-Manila Subway (550billion)

4. Baclaran-Bacoor or LRT6 (PhP60billion PPP

awarded)

Secondary:

4. Ortigas-Angono (PhP32b),

5. Marikina-Katipunan (PhP32b),

6. Alabang-Zapote (PhP27b)

7. Zapote-General Tias (PhP26b)

1

2

5

4

Matching Design Capacity with

Appropriate Types of Rolling Stocks

Seven generic types of train:

Shorter Distance Self-Powered (diesel,

generally with 75 mph maximum speed);

Middle Distance Self-Powered (diesel, with 90/

100 mph capability);

Long Distance Self-Powered (diesel, with 100/

110/ 125 mph capability);

Shorter Distance Electric (generally with 75

mph maximum speed);

Middle Distance Electric (with 90/ 100/ 110

mph capability. Some future trains may require

125 mph capability);

Long Distance Electric (with 100/ 110/ 125 mph

capability);

Very High Speed Electric (140 mph and above,

for domestic services on HS1 and HS2).

(ATOC; Long Term Passenger Rolling Stock

Strategy for the Rail Industry; Feb 2013)

Existing Metro Manila LRT/MRT and Rail Lines

6

Existing LRT/MRT and PNR Lines

Capacities LRT/MRT and PNR Lines

LRT1: 15km competed 1985 (street cars operating as LRTs)

430,000 passengers a day

139 cars operating only 80 cars

550,000 passenger a day design capacity

LRT2: 14Km completed 2008 (MRT operating as LRT)

250,000 passengers a day

72 cars operating only 43 cars

360,000 passenger a day design capacity

MRT3: 16km completed 2000 (street cars operating as MRT)

450,000 passengers a day

70 cars operating 40 cars

350,000 passenger design capacity

PNR: 56 km Urban Line

100,000 passengers a day in a traffic corridor that carries

approximately 1.0million commuters a day.

18 cars and 56km

Benchmarking against Globally Accepted

Reliability Norms in Rail Revenue Service

MTR Hong Kong Train Reliability: train car-km per

train failure causing delays 5 minutes

Rolling Stock and Track Maintenance Co-

relationship

Strong mutual dependency and interference

of wear and tear of key assets (rolling stock

and infrastructure) this does not hold true

for gas and water, telecom and electricity, or

air transport

The cost and quality of train operations

depend on the condition of the tracks

(high maintenance requirement for rolling

stock, low maximum speed, etc. if tracks

are in bad condition)

The cost of infrastructure maintenance

depends on the condition and operation

of rolling stock (high wear and tear of

tracks if wheels are uneven, speed is

high, braking is strong, etc.)

Design Capacity and Operating Capacity

LRT1 Rolling Stock Fleet

(3 types and another type to be delivered approx. 2016 owned and

procured by public sector which was just recently privatized)

LRT1 1st generation LRVs

Delivered in 1984 from Belgium and refurbished in 2004

63-units,

Only 37-units are operational.

Maintenance Service only

Parts and Refurbishment are subject to annual appropriation risks

Based on DOTC's bid documents for the LRT1 South Extension Project (LRT1)

LRT1 2nd generation LRVs

Delivered in 1999 from AdTranz manufactured in Korea

28-units,

Only 8-units are operational.

Maintenance Service only

Parts and Refurbishment are subject to annual appropriation risks

LRT1 3

rd

generation LRVs

Delivered in 2007 from Japan

48-units

Only 44-units are operational

Maintenance Service only

Parts and Refurbishment are subject to annual appropriation risk

MRT Rolling Stock Fleet

(73 procured by private sector owner and 48 procured by public sector

operator subject to consent of private sector owner)

MRT3

73-cars from CKD procured by the Private Owners of the Assset

Reliability Centric maintenance service by Sumitomo

Corporation from Completion Date (2000) to 2012 with a

guaranteed availability of 60 cars, spare part inventory and

refurbishment requirement.

Service centric maintenance service by local company with no

spare part inventory requirement and no refurbishment

commitment

MRT3

48 cars from CNR procurement by operator

Deployment for revenue service requires the consent of the

owner of the MRT3 Asset and may pay trackage fees to alleviate

capacity congestion.

MRT3 Phase 1

Comparative Maintenance Administration

2000 - 2012: MRTC-Sumitomo

Corp. (TES-P)

2012 - 2013: DOTC-Metrostar-PH

Trams

2014 - onwards: Foreign Direct

Investor (FDI)

Phase 1

80% guaranteed availability of cars

or 60 rail cars available everyday

450,000 riders a day at 30% over

design capacity

Maintenance Provider was

Sumitomo and Bombardier

(Subcontractor Signalling)

Maintenance fee at US$1.2million

to US$ 1.4mn for parts, service and

refurbishment on 7

th

year

Phase 1

54% availability of cars or 40 rail

cars available everyday.

450,000 riders a day at crush

capacity

Maintenance Provider is PH Trams

Maintenance fee at US$ 1.2mn

service ONLY w/o parts and

refurbishment on 7

th

year.

Phase 1

90% guaranteed availability or 152

rail cars available everyday

4-car train & 2 minute interval

service

770,000 riders a day design

capacity

Maintenance with refurbishment

on 7

th

year.

LESS THAN 5 INCIDENCE OF

REVENUE SERVICE INTERRUPTION

A YEAR THAT IS GREATER THAN 5-

MINUTES

GREATER THAN 5 INCIDENCES OF

REVENUE SERVICE INTERRUPTION A

YEAR THAT IS GREATER THAN 5-

MINUTES

MRT3 Phase 1

Comparative Maintenance Project Benchmarks

2000 - 2012: MRTC-Sumitomo

Corp. (TES-P)

2012 - 2013: DOTC-Metrostar-PH

Trams

2014 - onwards: Foreign Direct

Investor (FDI)

Phase 1

80% guaranteed availability of cars

or 60 rail cars available everyday

450,000 riders a day at 30% over

design capacity

Maintenance Provider was

Sumitomo and Bombardier

(Subcontractor Signalling)

Maintenance fee at US$1.2million

to US$ 1.4mn for parts, service and

refurbishment on 7

th

year

Phase 1

54% availability of cars or 40 rail

cars available everyday.

450,000 riders a day at crush

capacity

Maintenance Provider is PH Trams

Maintenance fee at US$ 1.2mn

service ONLY w/o parts and

refurbishment on 7

th

year.

Phase 1

90% guaranteed availability or 152

rail cars available everyday

4-car train & 2 minute interval

service

770,000 riders a day design

capacity

Maintenance with refurbishment

on 7

th

year.

LESS THAN 5 INCIDENCE OF

REVENUE SERVICE INTERRUPTION

A YEAR THAT IS GREATER THAN 5-

MINUTES

GREATER THAN 5 INCIDENCES OF

REVENUE SERVICE INTERRUPTION A

YEAR THAT IS GREATER THAN 5-

MINUTES

Total subsidy is at least

PhP6.3billion

Total subsidy for the two years is a

total of PhP9.4billion

NO SUBSIDY

Lessons Learned from Public Sector Budget Allocation

2000 to 2013 for MRT3

(Lease Payment, Personnel Services, Maintenance & Other Operating

Expenses Capital Expenditure and Subsidy)

D

O

T

C

O

P

E

X

a

n

d

C

A

P

E

X

b

u

d

g

e

t

(

U

S

$

)

D

O

T

C

M

R

T

3

S

u

b

s

i

d

y

p

e

r

p

a

s

s

e

n

g

e

r

(

U

S

$

)

D

O

T

C

O

P

E

X

a

n

d

C

A

P

E

X

b

u

d

g

e

t

(

U

S

$

)

D

O

T

C

M

R

T

3

S

u

b

s

i

d

y

p

e

r

p

a

s

s

e

n

g

e

r

(

U

S

$

)

Actual O&M 25-year MRT3 Project

Modified ERP and O&M 25-year MRT3 Project

Lessons Learned in LRT1 and MRT3 Maintenance

Regimes and resulting Design Capacity and Actual

Ridership

LRT1 actual ridership is always

below potential design capacity

Public Sector Procurement of

rolling stock

Public Sector Procurement

Maintenance Services Only

MRT3 actual ridership was

higher than design capacity

during private sector

responsibility for procurement of

maintenance services

MRT3 actual ridership fell during

public sector responsibility for

procurement of maintenance

service only.

Indicative trend of

effect of shift from

a privately

administered

maintenance

service. to a

publicly

administered

maintenance

service

Recognition of Current Framework for Procurement

Practice of Rail Systems and Rolling Stock

LRTA Current Practice Proposed Action Moving Forward

Disconnected Procurement and O&M Policy

Recommendation

Harmonized procurement and O&M Policy

It is entirely appropriate that strategic decisions

about rolling stock procurement and

specification should be taken centrally. Given the

level of fragmentation of the sector/industry

(Butcher, L; Railways: rolling stock

Standard Note: SN3146; 31 October 2013; House of

Commons)

Procurement Policy driven specification and lowest

cost

Recommendation:

Procurement Policy that is Performance Standard

centric

Technical Strategy Leadership group; The Future Railway; 2012 UK

Current Level of

Awareness

Understanding Operations and Maintenance Cost

Rules of Thumb

Operation and maintnance represents approximately 80% of the Total Cost of Ownership

(TCO) .

In the case of the MRT3, over the concession period the ratio is 86% O&M and 14% project

cost

In the case of MRT3, the ratio distribution of the maintenance fee is 60% rolling stock and

40% infrastructure

Approximately 60% of maintenance cost are personnel cost and 40% for material and parts

Maintenance cost is the major cost position subject to optimization as energy and

depreciation stay consistent during lifecycle of rolling stock fleet.

(Author own calculation and Wyman, O.; Lean Rolling Stock Maintenance; 2009 oliverwyman

Strategic Framework for Procurement of Rail

Systems and Procurement of Rail O&M Services

Strategic consistency, not short-term

opportunism

If authorities are to deliver the desired

outcomes of transport projects, it is

desirable that they set a long-term

path and then work continuously

towards it.

Strategies and plans need to be fully

worked through by the authorities that

create them.

There is a risk that documents with

titles that include the word strategy

will, in fact, be short-term statements

of intent

(Success and failure in urban transport

infrastructure projects

A study by Glaister, Allport, Brown and Travers

KPMGs Infrastructure Spotlight Report)

Zoeteman, A.; Life Cycle Cost analysis for managing rail

infrastructure; EJTIT, 1, no. 4 (2001), p391-413; The

Netherlands

Limitations and constraints like capital funding, resource availability of plant, parts, operating budgets, time,

support services and workforce skills are realities that directly related to maintenance activities.

(http://www.apta.com/mc/rail/papers/Papers/WeissM-Challenges-of-Matching-Maintenance-Programs-to-an-

Aging-Rolling-Stock-Fleet.pdf)

Reliability Maintenance Framework

process to ensure that assets continue to do what their users require in their present operating context.

Successful implementation of RCM will lead to increase in cost effectiveness, machine uptime, and a greater

understanding of the level of risk that the organization is managing.

Predictive Maintenance Fraework

process designed to help determine the condition of in-service equipment in order to predict when maintenance

should be performed.

This approach promises cost savings over routine or time-based preventive maintenance, because tasks are

performed only when warranted.

The main promise of Predicted Maintenance is to allow convenient scheduling of corrective maintenance, and to

prevent unexpected equipment failures. The key is "the right information in the right time".

Challenges to managing rolling stock at various

stages of their life cycle are real and familiar to

railway operating agencies

Modified Predictive Maintenance Framework

19

There is a continual need to employ a Kaizening* process that confronts and combats

the challenges of common constraints, in order to create adaptive and balanced

maintenance programs, that are justifiably well planned and timely executed.

(http://www.apta.com/mc/rail/papers/Papers/WeissM-Challenges-of-Matching-Maintenance-Programs-to-an-Aging-

Rolling-Stock-Fleet.pdf)

Looking at the Benefits and Moving Forward

What are the benefits to the public first and then to public and private

sectors?

Robust fleet plans aligned with long term business strategies.

Effective vehicle architecture comparisons, enabling optimal fleet selection

for the intended application.

Rolling stock that aligns with the maintenance and operational philosophy

at an optimum cost.

A fleet with known lifecycle costs, capable of delivering a sustainable

service.

(http://www.lr.org/en/rail/rolling-stock/fleet-procurement/index.aspx)

20

Thank you for your time and patience

21

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Report IPCRaDocumento10 pagineReport IPCRaMario FranciscoNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Bureau of Customs (BOC) Proficiency Revalida Under The Performance Governance System (PGS) FrameworkDocumento46 pagineBureau of Customs (BOC) Proficiency Revalida Under The Performance Governance System (PGS) FrameworkMario FranciscoNessuna valutazione finora

- Report IPCRaDocumento10 pagineReport IPCRaMario FranciscoNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Report IPCRaDocumento10 pagineReport IPCRaMario FranciscoNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Report IPCRaDocumento10 pagineReport IPCRaMario FranciscoNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Updates 2019 & 2020 BOC Roadmap DeliverablesDocumento5 pagineUpdates 2019 & 2020 BOC Roadmap DeliverablesMario FranciscoNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- China Firewall and Golden Sheild (2017 SITS SIC Lectrure) July 24, 2017 8Documento44 pagineChina Firewall and Golden Sheild (2017 SITS SIC Lectrure) July 24, 2017 8Mario FranciscoNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Philippine National Railways Caloocan Depot Ramp Connection To NLEX SLEX Connector ProjectDocumento6 paginePhilippine National Railways Caloocan Depot Ramp Connection To NLEX SLEX Connector ProjectMario FranciscoNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- BOC Develop A Strategic Communication Plan of The Transformation Roadmap Phase 2Documento25 pagineBOC Develop A Strategic Communication Plan of The Transformation Roadmap Phase 2Mario FranciscoNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Historical Philippine and Other Sovereign Bond Rates Strama LectureDocumento14 pagineHistorical Philippine and Other Sovereign Bond Rates Strama LectureMario FranciscoNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- EDSA MRT3 Project Study - v2Documento53 pagineEDSA MRT3 Project Study - v2Mario Francisco100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Terms of Refence NiNaia PPP PhilippinesDocumento22 pagineTerms of Refence NiNaia PPP PhilippinesMario FranciscoNessuna valutazione finora

- Chinese Belt and Road Initiative and The Philippines' "Build, Build, Build" Infrastructure Financing Requirement - Manuscript For SCRBDDocumento31 pagineChinese Belt and Road Initiative and The Philippines' "Build, Build, Build" Infrastructure Financing Requirement - Manuscript For SCRBDMario FranciscoNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Drug Abuse and Economy CostDocumento6 pagineDrug Abuse and Economy CostMario FranciscoNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- ASEAN SME Preliminary Findings For ASEAN SMEWWG (JA and RG Revision)Documento19 pagineASEAN SME Preliminary Findings For ASEAN SMEWWG (JA and RG Revision)Mario FranciscoNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Proposed DOTC Rail Transportation Vision and Policy May 2016Documento16 pagineProposed DOTC Rail Transportation Vision and Policy May 2016Mario FranciscoNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- PGG Updated Presentation Nov 2016Documento45 paginePGG Updated Presentation Nov 2016Mario Francisco100% (1)

- Marketing Baseline Data For Online Lotto Philippines NG-OMG ProposalDocumento27 pagineMarketing Baseline Data For Online Lotto Philippines NG-OMG ProposalMario Francisco0% (1)

- Port of Manila Congestion (Hamburg Presentation) v2Documento39 paginePort of Manila Congestion (Hamburg Presentation) v2Mario FranciscoNessuna valutazione finora

- Arbitral Consent or Arbitral Award Feb 29 2016Documento6 pagineArbitral Consent or Arbitral Award Feb 29 2016Mario FranciscoNessuna valutazione finora

- 2014 Thailand Paper Re Mutliple Trains Operation 3rd EdDocumento28 pagine2014 Thailand Paper Re Mutliple Trains Operation 3rd EdrgavietaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- 2014 Singapore Paper Re Mutliple Trains Operation 3rd EdDocumento27 pagine2014 Singapore Paper Re Mutliple Trains Operation 3rd EdMario FranciscoNessuna valutazione finora

- Offshore Black Sand Mining in The Pihilippines Massart Hongkong Presentation - Updated 07042015Documento14 pagineOffshore Black Sand Mining in The Pihilippines Massart Hongkong Presentation - Updated 07042015Mario FranciscoNessuna valutazione finora

- Brief Overview of The Passenger Transport Sector in The Philippines-Gilberto M LLantoDocumento15 pagineBrief Overview of The Passenger Transport Sector in The Philippines-Gilberto M LLantoMario FranciscoNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 2014 Singapore Paper Public and Private Procurement of Maintenance Service Providers in Operation For LRT Systems: Philippine ExperienceDocumento26 pagine2014 Singapore Paper Public and Private Procurement of Maintenance Service Providers in Operation For LRT Systems: Philippine ExperienceMario FranciscoNessuna valutazione finora

- Medium Lift Tactical Aircraft C-27J 2007Documento45 pagineMedium Lift Tactical Aircraft C-27J 2007Mario Francisco75% (4)

- MeMilk Project Presentation - 140430 Rev1Documento14 pagineMeMilk Project Presentation - 140430 Rev1Mario FranciscoNessuna valutazione finora

- Comparison of Seamless Mrt-3 Project With Edsa Northrail Transit, Lrt-1 Extension To North Avenue and North Rail Extension To North Avenue ProjectsDocumento15 pagineComparison of Seamless Mrt-3 Project With Edsa Northrail Transit, Lrt-1 Extension To North Avenue and North Rail Extension To North Avenue ProjectsMario FranciscoNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Asset Management Contract Risk 2nd RevisionDocumento20 pagineAsset Management Contract Risk 2nd RevisionMario FranciscoNessuna valutazione finora

- Ce 506 Prestressed Concrete Design: M R M M MDocumento2 pagineCe 506 Prestressed Concrete Design: M R M M Mbadr amNessuna valutazione finora

- Technological University of The Philippines ManilaDocumento1 paginaTechnological University of The Philippines Manilalesterginno de guzmanNessuna valutazione finora

- Effects of Stiffness Degradation On DuctilityDocumento11 pagineEffects of Stiffness Degradation On DuctilitysalmanNessuna valutazione finora

- Operation Manual Transas M-2Documento62 pagineOperation Manual Transas M-2Дмитрий ПеснякNessuna valutazione finora

- PALRUF 100 Technical Guide (En)Documento6 paginePALRUF 100 Technical Guide (En)mohammed nafethNessuna valutazione finora

- ICMS Explained User Guide RICS 011217Documento36 pagineICMS Explained User Guide RICS 011217yohan_phillipsNessuna valutazione finora

- 5 Process SynchronizaionDocumento58 pagine5 Process SynchronizaionLokesh SainiNessuna valutazione finora

- Test Report (Revisi Fat)Documento5 pagineTest Report (Revisi Fat)Imamudin BuronanMertua TanpaSadar100% (1)

- Manual HL R 3830Documento52 pagineManual HL R 3830Kent BinkerdNessuna valutazione finora

- Lecture 3 Bending and Shear in Beams PHG A8 Oct17 PDFDocumento30 pagineLecture 3 Bending and Shear in Beams PHG A8 Oct17 PDFEvi32Nessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Seicos 21l IntrustionDocumento61 pagineSeicos 21l IntrustionkhoaNessuna valutazione finora

- Position - List - Tank 17 11 2023Documento8 paginePosition - List - Tank 17 11 2023simionalex1987Nessuna valutazione finora

- Non Vital BleachingDocumento19 pagineNon Vital BleachingPriyabrat Pattanaik100% (1)

- HP 15-Dy1038ca Emglish ManualDocumento78 pagineHP 15-Dy1038ca Emglish ManualRoxana PetrescuNessuna valutazione finora

- Legend: Add Subject Remove Subject: Student Number Name of StudentDocumento32 pagineLegend: Add Subject Remove Subject: Student Number Name of StudentJake ChesterphilNessuna valutazione finora

- VAV CablingDocumento2 pagineVAV Cablingsripriya01Nessuna valutazione finora

- Va Mri Design Plan Drawings and LayoutDocumento19 pagineVa Mri Design Plan Drawings and Layoutkusnanto erinNessuna valutazione finora

- DSV SVDocumento1 paginaDSV SVPUNITHA KUMARNessuna valutazione finora

- Aluminium Aluminum 6070 Alloy (UNS A96070)Documento2 pagineAluminium Aluminum 6070 Alloy (UNS A96070)HARIPRASATH PNessuna valutazione finora

- Low Noise, High Frequency MEMS Accelerometers /: ADXL1001 ADXL1002Documento14 pagineLow Noise, High Frequency MEMS Accelerometers /: ADXL1001 ADXL1002Phi MacNessuna valutazione finora

- Introduction To Bounding Volume Hierarchies: Herman J. Haverkort 18 May 2004Documento9 pagineIntroduction To Bounding Volume Hierarchies: Herman J. Haverkort 18 May 2004Alessandro MeglioNessuna valutazione finora

- General Purpose Hydraulic Valves: Float Level Control ValveDocumento2 pagineGeneral Purpose Hydraulic Valves: Float Level Control Valvevelikimag87Nessuna valutazione finora

- Marking and Ordering Code System (Capacitors)Documento6 pagineMarking and Ordering Code System (Capacitors)José TurinNessuna valutazione finora

- Maz18 Maz38 ManualDocumento5 pagineMaz18 Maz38 Manualheritage336Nessuna valutazione finora

- Users Manual For Oslo, Bremen and Turboaire.: Installation, Operation and Maintenance InstructionsDocumento40 pagineUsers Manual For Oslo, Bremen and Turboaire.: Installation, Operation and Maintenance Instructionsbuttler25Nessuna valutazione finora

- IRCLASS Systems and Solutions Pvt. Ltd. (A Wholy Owned Subsidiary of Indian Register of Shipping)Documento4 pagineIRCLASS Systems and Solutions Pvt. Ltd. (A Wholy Owned Subsidiary of Indian Register of Shipping)Mostafizur RahmanNessuna valutazione finora

- ML10 OwnersManualDocumento16 pagineML10 OwnersManualSalvador OlivasNessuna valutazione finora

- 4.0L EngineDocumento347 pagine4.0L EngineCapssa Oscar100% (2)

- BSS Steel Guide CataloguesDocumento52 pagineBSS Steel Guide Cataloguessaber66Nessuna valutazione finora

- A Mini Unmanned Aerial Vehicle (Uav) : System Overview and Image AcquisitionDocumento7 pagineA Mini Unmanned Aerial Vehicle (Uav) : System Overview and Image AcquisitionhougieNessuna valutazione finora