Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Partnership Formation

Caricato da

illustra7Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Partnership Formation

Caricato da

illustra7Copyright:

Formati disponibili

1

PARTNERSHIP

A CONTRACT WHEREBY TWO OR MORE PERSONS BIND THEMSELVES TO

CONTRIBUTE MONEY, PROPERTY, OR INDUSTRY INTO A COMMON

FUND WITH THE INTENTION OF DIVIDING THE PROFITS AMONG

THEMSELVES

Article 1767 Civil Code of the

Philippines

2

CHARACTERISTICS OF A PARTNERSHIP

UNLIMITED

LIABILITY

MUTUAL

AGENCY

LIMITED

LIFE

MUTUAL

PARTICIPATION

IN PROFITS

CO-

OWNERSHIP

OF

PROFPERTY

LEGAL

ENTITY

INCOME

TAX

3

ADVANTAGES OF A PARTNERSHIP

EASY AND

INEXPENSIVE TO

ORGANIZE

EASY CREDIT DUE TO

UNLIMITED LIABILITY

COMBINED

PERSONAL

LIABILITIES OF

PARTNERS

MEANSEASY ACCESS

TO CAPITAL

CLOSER

SUPERVISION OF ALL

PARTNERSHIP

ACTIVITIES

PERSONAL ELEMENT

IN THE CHARACTERS

OF THE PARTNERS IS

RETAINED

4

DISADVANTAGES OF A PARTNERSHIP

UNLIMITED LIABILITY

DETERS THE

CAPITALIST TO

INVEST

WRONGFUL ACTS OF

A PARTNER MAY

SUBJECT THE

OTHERS TO

PERSONAL

LIABILITIES

CAN EASILY BE

DISSOLVED

LESS STABLE

DIVIDED AUTHORITY

AMONG PARTNERS

THE LIKELIHOOD OF

DISSENSION AND

DISAGREEMENT

5

6

AS TO ACTIVITY

7

TRADING

NON TRADING

AS TO OBJECT

8

UNIVERSAL PARTNERSHIP

OF ALL PROPERTIES

UNIVERSAL PARTNERSHIP

OF ALL PROFITS

PARTICULAR

PARTNERSHIP

AS TO LIABILITY OF PARTNERS

GENERAL PARTNERSHIP

Majority of the partners have unlimited

liability

LIMITED PARTNERSHIP

Majority of the partners have limited

liability

9

AS TO DURATION

PARTNERSHIP AT WILL

PARTNERSHIP WITH A FIXED TERM

10

ORDINARY PARTNERSHIP

PARTNERSHIP BY ESTOPPEL

11

AS TO LEGALITY OF EXISTENCE

DE JURE PARTNERSHIP

Has complied with all requirements for its

establishment

DE FACTO PARTNERSHIP

Has failed to comply with the requirements

(one or more) for its establishment

12

AS TO PUBLICITY

SECRET PARTNERSHIP

The existence of certain partners are not

known

OPEN PARTNERSHIP

Names of certain persons or partners are

made known to the public by the firm

13

14

AS TO CONTRIBUTION

CAPITALIST INDUSTRIAL

INDUSTRIAL-

CAPITALIST

15

AS TO LIABILITY

GENERAL PARTNER

LIMITED PARTNER

16

AS TO MANAGEMENT

MANAGING PARTNER

SILENT PARTNER

Does not participate in the management of

partnership affairs

17

OTHER CLASSIFICATIONS

LIQUIDATING

PARTNER

in charge of liquidating

parnterhship affairs

OSTENSIBLE

PARTNER

Active in the

management and

is known as a

partner

SECRET

PARTNER

Active in

management but

not known as a

partner

NOMINAL

PARTNER

Partner in name

only.

For the protection

of the real partner

DORMANT

PARTNER

Not active in

management and

both secret and

silent partner

18

ARTICLES OF CO-PARTNERSHIP

19

Name of the Partnership

Names and addresses of the

partners, classes of partners,

Effective date of the contact

ARTICLES OF CO-PARTNERSHIP

20

The purpose or purposes and

principal place of business

Names and addresses of the

partners, classes of partners,

Rights and duties of each

partner

ARTICLES OF CO-PARTNERSHIP

21

The manner of dividing profits and losses among

partners including allowance and interest

The conditions under which the partners may

withdraw money or other assets for personal use

The manner of keeping the books of accounts

ARTICLES OF CO-PARTNERSHIP

Causes for dissolution

Provision of the arbitration in settling

disputes

22

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Securities and Exchange

Commission

Articles of Co-Partnership

Filled SEC Registration

Form

SEC Certificate

23

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Securities and Exchange

Commission

Articles of Co-Partnership

Filled SEC Registration

Form

SEC Certificate

Department of Trade and

Industry

Articles of Co-Partnership

SEC Certificate

Certificate of Registration

of Business name (

renewable every 5 years)

24

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Securities and Exchange

Commission

Articles of Co-Partnership

Filled SEC Registration

Form

SEC Certificate

Department of Trade and

Industry

Articles of Co-Partnership

SEC Certificate

Certificate of Registration

of Business name (

renewable every 5 years)

City or Municipal Mayors

Office

Certificate of Registration

of Business Name

Mayors Permit and

License to Operate

(renewable annually)

25

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Bureau of Internal

Revenue

SEC Registration

Articles of Co-Partnership

BIR Registration No.

Tax identification No.

Registration of books, invoices, and

official receipts

26

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Bureau of Internal

Revenue

SEC Registration

Articles of Co-Partnership

BIR Registration No.

Tax identification No.

Registration of books, invoices, and

official receipts

Social Security

System

Filled SSS Application Form

List of Employees

SSS Certificate of Membership

SSS Employee ID Number

27

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Bureau of Internal

Revenue

SEC Registration

Articles of Co-Partnership

BIR Registration No.

Tax identification No.

Registration of books, invoices, and

official receipts

Social Security

System

Filled SSS Application Form

List of Employees

SSS Certificate of Membership

SSS Employee ID Number

Philhealth Insurance

Corp.

SEC Registration

Employee Data Record

Philhealth Employer Number and

Certificate of Registration

Philhealth Identification Number and

member Data Record

28

PLACE FOR

REGISTRATION

REQUIREMENTS FOR

REGISTRATION

CERTIFICATES ISSUED

Bureau of Internal

Revenue

SEC Registration

Articles of Co-Partnership

BIR Registration No.

Tax identification No.

Registration of books, invoices, and

official receipts

Social Security

System

Filled SSS Application Form

List of Employees

SSS Certificate of Membership

SSS Employee ID Number

Philhealth Insurance

Corp.

SEC Registration

Employee Data Record

Philhealth Employer Number and

Certificate of Registration

Philhealth Identification Number and

member Data Record

PAG_IBIG Fund SEC Registration

Articles of Co-Partnership

PAG-IBIG Fund Certificate of

Membership

PAG-IBIG Fund Employer ID No.

29

30

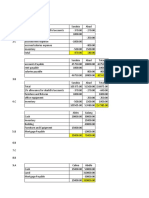

ASSETS

Current Assets

Cash P 993,000.00

Trade and other receivables ( note1) 42,000.00

Prepaid expenses ( Note 2) 56,000.00

1,091,000.00

Non- Current Assets

Plant, property and equipment (Note 3) 585,000.00

Total assets P 1,676,000.00

LIABILITIES AND PARTNERS' EQUITY

Current Liabilities

Trade and other payables (note 4) P 64,000.00

Partners' Equity

Marie, capital P 806,000.00

Rodario, capital 806,000.00 1,612,000.00

TOTAL LIABILITIES & PARTNERS' EQUITY P 1,676,000.00

32

Unadjusted Adjusted Increase/(Decrease)

Trade and other receivables* 5,000.00 8,000.00 (3,000.00)

Supplies inventory 38,000.00 36,000.00 (2,000.00)

Building 300,000.00 280,000.00 (20,000.00)

Sewing Equipment 225,000.00 220,000.00 (5,000.00)

Furniture and fixtures 82,000.00 85,000.00 3,000.00

(27,000.00)

# Trade and other receivables

Accounts receivable 50,000.00 50,000.00

Allowance for doubtful

Accounts 5,000.00 8,000.00

Net realizable value 45,000.00 42,000.00

FORMS OF INVESTMENT

CASH FACE VALUE

NON- CASH ASSETS AGREED VALUE / FAIR MARKET VALUUE / BOOK

VALUE

SERVICES

33

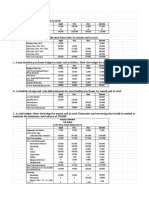

EXERCISE 1-4 CASE A

34

DR CR

Cash 500,000.00

Equipment 45,000.00

Rose, capital 545,000.00

Investment of Rose

EXERCISE 1-4

35

Furniture and fixtures 100,000.00

Guada, capital 100,000.00

Investment of Guada

EXERCISE 1-4

36

Marie, capital

Marie invested her

management expertise

in the business.

EXERCISE 1-4 CASE B

37

Building 1,500,000.00

Office equipment 30,000.00

Mortgage payable 300,000.00

Romy, capital 1,230,000.00

Investment of Romy

CASE B

Cash 550,000

Office equipment 220,000

Furniture and fixtures 50,000

Vic, capital 820,000

Investment of Vic

Computation:

Romy, capital 1,230,000.00

Romy's interest 60%

Total partners' equity 2,050,000.00

Vic' interest 40%

Vic, capital 820,000.00

Vic's investment 270,000.00

Vic's additional investment 550,000.00

EXERCISE 1-4

38

39

CASE C

DEBIT CREDIT

Cash 205,000.00

Accounts receivable 95,000.00

Allowance for doubtful accounts 10,000.00

Office supplies 12,000.00

Office equipment 320,000.00

Furniture and fixtures 140,000.00

Rosario, capital 320,000.00

Guadalup, capital 225,000.00

Maria, capital 217,000.00

772,000.00 772,000.00

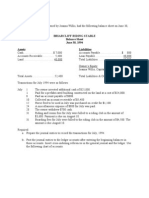

RGM PARTNERSHIP

STATEMENT OF FINANCIAL POSITION

JULY 4, 2012

40

ASSETS

Current Assets

Cash P 205,000.00

Trade and other receivables (Note 1) 85,000.00

Office supplies 12,000.00

Total 302,000.00

Non-current assets

Plant property and eequipment note 2) 460,000.00

Total Assets P 762,000.00

PARTNERS' EQUITY

Rosario, capital P 320,000.00

Guadalupe, capital 225,000.00

Maria, capital 217,000.00

P 762,000.00

Potrebbero piacerti anche

- General Information Sheet 2014 SampleDocumento8 pagineGeneral Information Sheet 2014 SamplekokatuNessuna valutazione finora

- Cash and Cash EquivalentsDocumento10 pagineCash and Cash EquivalentsZerjo Cantalejo67% (3)

- Loan and Security Agreement (Sample)Documento53 pagineLoan and Security Agreement (Sample)Raymond AlhambraNessuna valutazione finora

- Accounting For Partnership FormationDocumento28 pagineAccounting For Partnership FormationKrislyn Audrey Chan CresciniNessuna valutazione finora

- Aquino III vs. Comelec, G.R. No. 189793, April 7, 2010Documento4 pagineAquino III vs. Comelec, G.R. No. 189793, April 7, 2010illustra7Nessuna valutazione finora

- AstDocumento19 pagineAstshaylieeeNessuna valutazione finora

- Toa Consolidated Sample QuestionsDocumento60 pagineToa Consolidated Sample QuestionsBabi Dimaano NavarezNessuna valutazione finora

- CMA Question August-2013Documento58 pagineCMA Question August-2013zafar71Nessuna valutazione finora

- Working Capital Simulation: Managing Growth V2Documento5 pagineWorking Capital Simulation: Managing Growth V2Abdul Qader100% (6)

- Home Office and Branched Agencies by Little Boy AsperoDocumento43 pagineHome Office and Branched Agencies by Little Boy AsperoShielarien Donguila100% (1)

- Sample Mid Semester Exam With AnswersDocumento15 pagineSample Mid Semester Exam With AnswersjojoinnitNessuna valutazione finora

- Comprehensive Problem 23Documento29 pagineComprehensive Problem 23Nicole Fidelson100% (2)

- Midterms Quiz 1 GdocsDocumento41 pagineMidterms Quiz 1 GdocsIris FenelleNessuna valutazione finora

- ABM 003 Performance Task #1 (2G)Documento8 pagineABM 003 Performance Task #1 (2G)Zoe LustivaNessuna valutazione finora

- 01 Introduction and FormationDocumento18 pagine01 Introduction and Formationm_kobayashiNessuna valutazione finora

- Partnership Operations2Documento32 paginePartnership Operations2illustra7Nessuna valutazione finora

- Interest Rates and Bond ValuationDocumento75 pagineInterest Rates and Bond ValuationOday Ru100% (1)

- Notes in Tax On IndividualsDocumento4 pagineNotes in Tax On IndividualsPaula BatulanNessuna valutazione finora

- Partnership Operations and Financial ReportingDocumento45 paginePartnership Operations and Financial ReportingChristine Joyce EnriquezNessuna valutazione finora

- FAR - Midterms and FinalsDocumento14 pagineFAR - Midterms and FinalsShanley Vanna EscalonaNessuna valutazione finora

- Accounting CycleDocumento5 pagineAccounting Cycleruth san jose100% (1)

- Auditing Problem Test Bank 1Documento14 pagineAuditing Problem Test Bank 1EARL JOHN Rosales100% (5)

- Peak Load Pricing (Philippines)Documento2 paginePeak Load Pricing (Philippines)lishechenNessuna valutazione finora

- Module 3 Conceptual Frameworks and Accounting StandardsDocumento10 pagineModule 3 Conceptual Frameworks and Accounting StandardsJonabelle DalesNessuna valutazione finora

- Polaroid Corporation - MP19006, 19015, 19016,19026Documento8 paginePolaroid Corporation - MP19006, 19015, 19016,19026KshitishNessuna valutazione finora

- ACCCOB1 - Reviewer FormationDocumento4 pagineACCCOB1 - Reviewer Formationbea's backupNessuna valutazione finora

- CAT Level 1 Mock Examination-1Documento4 pagineCAT Level 1 Mock Examination-1Nadine ReidNessuna valutazione finora

- Case Study: Soltronicz EmsDocumento7 pagineCase Study: Soltronicz EmsFritz John Tiamsing MingaoNessuna valutazione finora

- Multiple ChoiceDocumento2 pagineMultiple ChoicesppNessuna valutazione finora

- Group 7 Final Strategy Paper - Maycar Foods Inc.Documento34 pagineGroup 7 Final Strategy Paper - Maycar Foods Inc.Mig SablayNessuna valutazione finora

- Dda 2 12Documento7 pagineDda 2 12genius_blueNessuna valutazione finora

- CH 5 - AdjustmentsDocumento24 pagineCH 5 - Adjustmentsmuhamad elmiNessuna valutazione finora

- Partnership Formation Learning ExercisesDocumento78 paginePartnership Formation Learning ExercisesAndrea Beverly TanNessuna valutazione finora

- Chapter 9 PDFDocumento40 pagineChapter 9 PDFJoshua GibsonNessuna valutazione finora

- Ch. 1 HW Solutions-9eDocumento19 pagineCh. 1 HW Solutions-9eNgNessuna valutazione finora

- 2 CFAS Course Assessment A To DDocumento4 pagine2 CFAS Course Assessment A To DKing SigueNessuna valutazione finora

- Review For Quiz 3 Part 2Documento18 pagineReview For Quiz 3 Part 2Mariah ValizadoNessuna valutazione finora

- Financial StatementsDocumento8 pagineFinancial StatementsJohn Carldel VivoNessuna valutazione finora

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)Documento1 paginaAcc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)nicole bancoroNessuna valutazione finora

- Ch12 Fraud Scheme DetectionDocumento18 pagineCh12 Fraud Scheme DetectionPanda BoarsNessuna valutazione finora

- FinAcc Vol. 3 Chap3 ProblemsDocumento26 pagineFinAcc Vol. 3 Chap3 ProblemsGelynne Arceo33% (3)

- Philippine Cooperative Code of 2008 (RA 9520) : Title of The ActDocumento34 paginePhilippine Cooperative Code of 2008 (RA 9520) : Title of The ActErica UyNessuna valutazione finora

- Para and Luman: Partnership InvestmentDocumento6 paginePara and Luman: Partnership InvestmentDaphne RoblesNessuna valutazione finora

- Case 8-31: April May June QuarterDocumento2 pagineCase 8-31: April May June QuarterileviejoieNessuna valutazione finora

- Lcasean PaperDocumento6 pagineLcasean Paperkean ebeoNessuna valutazione finora

- Ch28 Test Bank 4-5-10Documento14 pagineCh28 Test Bank 4-5-10KarenNessuna valutazione finora

- Financial Management: Topic: Session 6: Philippine Financial Securities and InstitutionsDocumento9 pagineFinancial Management: Topic: Session 6: Philippine Financial Securities and InstitutionsAngelo MedinaNessuna valutazione finora

- Chapter 1 Financial EnvironmentDocumento57 pagineChapter 1 Financial Environmentn nNessuna valutazione finora

- W4 Module 4 FINANCIAL RATIOS Part 2BDocumento12 pagineW4 Module 4 FINANCIAL RATIOS Part 2BDanica VetuzNessuna valutazione finora

- AbsVarcosting Handout 2Documento6 pagineAbsVarcosting Handout 2Gwy PagdilaoNessuna valutazione finora

- Chapter 3 ReceivablesDocumento22 pagineChapter 3 ReceivablesCale Robert RascoNessuna valutazione finora

- CH 12Documento49 pagineCH 12Natasya SherllyanaNessuna valutazione finora

- Inventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesDocumento16 pagineInventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesKIU PUBLICATION AND EXTENSIONNessuna valutazione finora

- IM - LAW 20033 - Regulatory Framework Legal Issues in BusinessDocumento40 pagineIM - LAW 20033 - Regulatory Framework Legal Issues in Businessrachel banana hammockNessuna valutazione finora

- Chapter8 Fiancial Reporting by James HallDocumento43 pagineChapter8 Fiancial Reporting by James Hallkessa thea salvatoreNessuna valutazione finora

- SM City Management Report and AnalysisDocumento15 pagineSM City Management Report and AnalysisVal Benedict MedinaNessuna valutazione finora

- IcebreakerDocumento5 pagineIcebreakerRyan MagalangNessuna valutazione finora

- Semi Final Exam (Accounting)Documento4 pagineSemi Final Exam (Accounting)MyyMyy JerezNessuna valutazione finora

- Universal Robina Corporation:: Holy Angel UniversityDocumento5 pagineUniversal Robina Corporation:: Holy Angel UniversityRawr rawrNessuna valutazione finora

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocumento4 pagineLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNessuna valutazione finora

- Accounting For Partnership and CorporationDocumento19 pagineAccounting For Partnership and CorporationJoelyn Grace MontajesNessuna valutazione finora

- GuidelinesDocumento3 pagineGuidelines123r12f1Nessuna valutazione finora

- Ayala Corp Class B Preferred Shares - Preliminary ProspectusDocumento387 pagineAyala Corp Class B Preferred Shares - Preliminary ProspectusEunjina MoNessuna valutazione finora

- AYALA CORPORATION and Key Economic Indicators (ACADEMIC PURPOSES ONLY)Documento25 pagineAYALA CORPORATION and Key Economic Indicators (ACADEMIC PURPOSES ONLY)Danah RoyceNessuna valutazione finora

- Key Accob3 Exercises On CVP and BeDocumento16 pagineKey Accob3 Exercises On CVP and BeJanine Sabrina LimquecoNessuna valutazione finora

- Chapter 11 v2Documento14 pagineChapter 11 v2Sheilamae Sernadilla GregorioNessuna valutazione finora

- Philippine Stock ExchangeDocumento4 paginePhilippine Stock ExchangeSheila LisondraNessuna valutazione finora

- Ayala Corporation ReportDocumento10 pagineAyala Corporation ReportFranchesca de MesaNessuna valutazione finora

- Unit 1 WBsolutionFormation Acctba2Documento28 pagineUnit 1 WBsolutionFormation Acctba2justinNessuna valutazione finora

- Requirement For Accreditation CPAs in Public Practice PDFDocumento2 pagineRequirement For Accreditation CPAs in Public Practice PDFRicalyn E. SumpayNessuna valutazione finora

- Financial Accounting 4th Edition Chapter 2Documento67 pagineFinancial Accounting 4th Edition Chapter 2Joey TrompNessuna valutazione finora

- PARCOR - 1Nature-and-Formation-of-a-PartnershipDocumento31 paginePARCOR - 1Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNessuna valutazione finora

- Partnership Theories - OperationsDocumento90 paginePartnership Theories - OperationsBrIzzyJ100% (1)

- Jocelyn Limkaichong Vs COMELEC Uber DigestsDocumento6 pagineJocelyn Limkaichong Vs COMELEC Uber Digestsillustra7Nessuna valutazione finora

- Daza vs. SingsonDocumento6 pagineDaza vs. Singsonillustra7Nessuna valutazione finora

- Pundaodaya vs. ComelecDocumento6 paginePundaodaya vs. Comelecillustra7Nessuna valutazione finora

- Bengzon Vs Senate Blue Ribbon CommiteeDocumento28 pagineBengzon Vs Senate Blue Ribbon Commiteeillustra7Nessuna valutazione finora

- Lecture Day 6: Networks Shortest-Route Problem Minimum Spanning Tree Problem Maximal Flow ProblemDocumento46 pagineLecture Day 6: Networks Shortest-Route Problem Minimum Spanning Tree Problem Maximal Flow Problemillustra7Nessuna valutazione finora

- Management Science Lecture Day 10Documento108 pagineManagement Science Lecture Day 10illustra7Nessuna valutazione finora

- Lecture Day 8: Project Scheduling Stochastic PERT Critical Path MethodDocumento52 pagineLecture Day 8: Project Scheduling Stochastic PERT Critical Path Methodillustra7Nessuna valutazione finora

- Lecture Day 7: Project Scheduling Work Breakdown Structure Gantt Charts Program Evaluation & Review TechniqueDocumento39 pagineLecture Day 7: Project Scheduling Work Breakdown Structure Gantt Charts Program Evaluation & Review Techniqueillustra7Nessuna valutazione finora

- Management Science Lecture Day 9Documento48 pagineManagement Science Lecture Day 9illustra7Nessuna valutazione finora

- Lecture 11 (Notes)Documento59 pagineLecture 11 (Notes)illustra7Nessuna valutazione finora

- Linear Programming Models: Graphical and Computer Methods: To AccompanyDocumento92 pagineLinear Programming Models: Graphical and Computer Methods: To Accompanyillustra7Nessuna valutazione finora

- Delinquent SubscriptionsDocumento10 pagineDelinquent Subscriptionsillustra7Nessuna valutazione finora

- Problem Set 2 (Econtwo)Documento1 paginaProblem Set 2 (Econtwo)illustra7Nessuna valutazione finora

- Lecture Day 1: Introduction To Management Science Linear ProgrammingDocumento30 pagineLecture Day 1: Introduction To Management Science Linear Programmingillustra7Nessuna valutazione finora

- Lecture Day 4: Solving Linear Programming Problems Using The Simplex Method Special Cases in Using The Simplex MethodDocumento47 pagineLecture Day 4: Solving Linear Programming Problems Using The Simplex Method Special Cases in Using The Simplex Methodillustra7Nessuna valutazione finora

- Econorg Review Guide: EcontwoDocumento6 pagineEconorg Review Guide: Econtwoillustra7Nessuna valutazione finora

- Partnership Dissolution2Documento38 paginePartnership Dissolution2illustra7Nessuna valutazione finora

- Quiz Quiz 2 Single Entry and Cash Accrual Accounting PDFDocumento28 pagineQuiz Quiz 2 Single Entry and Cash Accrual Accounting PDFluismorenteNessuna valutazione finora

- Accounting RatiosDocumento38 pagineAccounting RatiosMohan RajNessuna valutazione finora

- FIM - Special Class - 4 - 2020 - OnlineDocumento42 pagineFIM - Special Class - 4 - 2020 - OnlineMd. Abu NaserNessuna valutazione finora

- Accounting Sample QuestionsDocumento6 pagineAccounting Sample QuestionsScholarsjunction.comNessuna valutazione finora

- Problem 1:: Company Final Accounts: Problems and Solutions - AccountingDocumento28 pagineProblem 1:: Company Final Accounts: Problems and Solutions - AccountingRafidul Islam100% (1)

- Assignment 1Documento6 pagineAssignment 1Haider Chelsea KhanNessuna valutazione finora

- Exemplar Questions: TH THDocumento9 pagineExemplar Questions: TH THAman KakkarNessuna valutazione finora

- CORRECTION OF ERRORS Theories PDFDocumento7 pagineCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodNessuna valutazione finora

- Accounts Receivable and Sales Memorandum: Team #5 Section 002 Due Date: Thursday, March 23, 2017Documento5 pagineAccounts Receivable and Sales Memorandum: Team #5 Section 002 Due Date: Thursday, March 23, 2017yea okayNessuna valutazione finora

- Worksheet For Merchandising BusinessDocumento1 paginaWorksheet For Merchandising Businesspuarica1Nessuna valutazione finora

- Quiz 1 On Applied AuditingDocumento4 pagineQuiz 1 On Applied AuditingVixen Aaron EnriquezNessuna valutazione finora

- Adv CH - 1 PARTNERSHIPSDocumento21 pagineAdv CH - 1 PARTNERSHIPSMohammed AwolNessuna valutazione finora

- 2010-09-10 013205 WinterschidDocumento6 pagine2010-09-10 013205 WinterschidJa Mi LahNessuna valutazione finora

- Financial Perfomance Analysis of Hero Motocorp LTDDocumento77 pagineFinancial Perfomance Analysis of Hero Motocorp LTDSubin chhatriaNessuna valutazione finora

- Dr. Vandana Srivastava Nitin Chauhan: (Assistant Professor) Roll. No. - 0925170032 GLA University Mba - Ii Mathura (U.P)Documento50 pagineDr. Vandana Srivastava Nitin Chauhan: (Assistant Professor) Roll. No. - 0925170032 GLA University Mba - Ii Mathura (U.P)himanshuooNessuna valutazione finora

- Incomplete Records (Single Entry)Documento15 pagineIncomplete Records (Single Entry)Kabiir RathodNessuna valutazione finora

- Ratio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilityDocumento6 pagineRatio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilitysolomonNessuna valutazione finora