Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ch13 - NLP, DP, GP

Caricato da

Mochammad Adji FirmansyahTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ch13 - NLP, DP, GP

Caricato da

Mochammad Adji FirmansyahCopyright:

Formati disponibili

1

Nonlinear Models:

Dynamic, Goal and

Nonlinear Programming

Chapter 13

2

13.1 Introduction to Nonlinear

Programming

Most real-life situations are more

accurately depicted by nonlinear models

than by linear models.

Nonlinear models formulated in this

chapter fall into three broad categories:

Dynamic programming models (DP).

Goal programming models (GP).

General nonlinear programming models

(NLP).

3

13.2 Dynamic Programming

Dynamic programming problems can be thought

of as multistage problems, in which decisions are

made in sequence.

Known applications of dynamic programming in

business:

Resource allocation,

Equipment replacement,

Production and inventory control,

Reliability.

4

13.2 Dynamic Programming

At stage n a system is found to be in a certain

state.

A decision made at stage n takes the system to

stage n+1, and leaves it in a new state for a stage-

state related cost/profit.

The decision makers challenge is to find a set of

optimal decisions for the entire process.

5

THE U.S. DEPARTMENT OF LABOR

6

The U.S. Department of Labor has made up to

$5 million available to the city of Houston for job

creation.

Requests for funding are to be prepared by four

departments.

The Department of Labor would like to allocate

funds to maximize the number of jobs created.

THE U.S. DEPARTMENT OF LABOR

7

Data

Department Cost $ millions Jobs Created

Housinng 4 225

Employment 1 45

2 125

3 190

Highway 50 jobs per $1 million funding

Law Enforcement 2 75

3 155

4 220

Estimated new jobs created for proposal

THE U.S. DEPARTMENT OF LABOR

8

SOLUTION

The U.S. Department of Labor wants to:

Maximize the total number of new jobs.

Limit funding to $5 million.

Fund at most one proposal from each

department

9

Notation

D

j

= the amount allocated to department j, where j is:

1 - housing, 2 - Employment, 3 - Highway, 4 - Law Enforcement.

R(D

j

) = the number of new jobs created by funding department j with

$D

j

million.

The model

Max R

1

(D

1

) + R

2

(D

2

) + R

3

(D

3

) + R

4

(D

4

)

ST

D

1

+

D

2

+ D

3

+ D

4

<= 5

D

1

,

D

2

, D

3

, D

4

>= 0

Non-linear functions

SOLUTION

10

Define F

j

(X

j

) as the maximum number of new

jobs created by departments (stages) j,

j+1,, 4, given that there is $X

j

million in

funding available for departments j (state)

through 4.

The Backward Dynamic Programming

11

Stage 4: The Law Enforcement,(LED)

Start with the last stage j=4 (Law Enforcement

department, LED).

Allocate to this department funds that maximize the

number of new jobs created

Obviously, the optimal solution for the last department

is to use all the amount available at this stage).

The optimal solution for the last stage is called The

boundary condition

The Backward Dynamic Programming

12

Stage 4: The Law Enforcement table

Available Optimal Funding Maximum jobs

Funding For Stage 4 F4(X4)

0 0 0

1 0 0

2 2 75

3 3 155

4 4 220

5 5 220

States

Cost Jobs

Law Enforcement 2 75

3 155

4 220

Recall

SOLUTION

13

Stage 3: The Highway Department, (HD)

At this stage we consider the funding of both the

Highway department and the Law Enforcement

department.

For a given amount of funds available for funding of

these two departments, the decision regarding the

funds allocated to the HD affects the funds available

for the LED).

SOLUTION

14

Available Possible Remaining Max. New Jobs Optimal F3(X3)

Funding Funding Funds for When Allocating

for Stage 3,4 for Stage 3 Stage 4 D3 to Stage 3 Optimal D3

(X3) (D3) (X3-D3) R3(D3)+F4(X3-D3)

0 0 0 0 + 0 F3(0) = 0; D3(0) = 0

1 0 1 0+0

1 0 50+0 = 50 F3(1) = 50; D3 = 1

2 0 2 0+75 = 75

1 1 50+0 = 50

2 0 100+0 F3(3) = 100; D3 = 2

3 0 3 0+155 = 155

1 2 50+75 = 125

2 1 100+0 = 100

3 0 150+0 = 150 F3(3) = 155; D3 = 0

Stage 3: The Highway Department table

SOLUTION

15

Available Possible Remaining Max. New Jobs Optimal F3(X3)

Funding Funding Funds for When Allocating

for Stage 3,4 for Stage 3 Stage 4 D3 to Stage 3 Optimal D3

(X3) (D3) (X3-D3) R3(D3)+F4(X3-D3)

4 0 4 0+220 = 220

1 3 50+155 = 205

2 2 100+75 = 175

3 1 150+ 0 = 150

4 0 200+ 0 = 220 F3(4) = 220; D3 = 0

5 0 5 0+220 = 220

1 4 50+220 = 270

2 3 100+155 = 255

3 2 150+75 = 225

4 1 200+0 = 200

5 0 250+0 = 250 F3(5) = 270; D3 = 1

SOLUTION

Stage 3: The Highway Department table

16

Stage 2: The Employment Department, (ED)

At this stage we consider the funding of both the

Employment Department and the previous

departments (HD and the LED)

For a given state (the amount of funds available

for funding of these three departments), the

decision regarding the funds allocated to the ED

affects the funds available for the HD and LED.

(the state at the stage j=3)

SOLUTION

17

Funding Funding Funds for When Allocating

for Stage 2,3,4 for Stage 2 Stage 3,4 D2 to Stage 2 Optimal D2

(X2) (D2) (X2-D2) R2(D2)+F3(X2-X2)

0 0 0 0 + 0 F2(0) = 0; D2 = 0

1 0 1 0+50 = 50

1 0 45+0 = 45 F2(1) = 50; D2 = 0

2 0 2 0+100 = 100

1 1 45+50 = 95

2 0 125+0 = 125 F2(2) = 125; D2 = 2

3 0 3 0+155 = 155

1 2 45+100 = 145

2 1 125+50 = 175

3 0 190+0 = 190 F2(3) = 190; D2 = 3

4 0 4 0+220 = 220

1 3 45+155 = 195

2 2 125+100 = 225

3 1 190+50 = 240 F2(4) = 240; D2 = 3

5 0 5 0+270 = 270

1 4 45+220 = 265

2 3 125+155 = 280

3 2 190+100 = 290 F2(5) = 290; D2 = 3

SOLUTION

18

Stage 1: The Housing Department

At this stage we consider the funding for the

Housing Department and all previous

departments.

Note that at stage 1 we know there is exactly $5

million to allocate

(X

1

= 5).

SOLUTION

19

Stage 1: The Housing Department submitted

only one proposal of $4 million, thus

(D

1

= 0, 4).

Available Possible Remaining Max. New Jobs Optimal F1(X1)

Funding Funding Funds for When Allocating

for Stage 1,2,3,4 for Stage 1 Stage 2,3,4 D3 to Stage 3 Optimal D1

(X1) (D1) (X1-D1) R1(D1)+F2(X1-D1)

5 0 5 0+290 = 290

4 1 225+50 = 275 F1(5) = 290; D1 = 0

Do not fund Fund the project

SOLUTION

20

Stage State

0 1 2 3 4 5

1 D1 = 0

2 D2 = 0 D2 = 0 D2 = 2 D2 = 3 D2 = 3 D2 = 3

3 D3 = 0 D3 = 1 D3 = 2 D3 = 0 D3 = 0 D3 = 1

4 D4 = 0 D4 = 1 D4 = 2 D4 = 3 D4 = 4 D4 = 5

In summary, the optimal funds allocation

to maximize the number of jobs created is:

Housing = $0

Employment = $3 million

Highways = $2 million

Law Enforcement = $0

Maximum number of jobs created = 290

SOLUTION

21

Notation Description Example

Stage Variable j A decision point The four departments

State Variable Xj The amount of resource Funds left to allocate

left to be allocated to departments

Decision Variable Dj A possible decision Funds that could have

at stage j been give to department j

Stage Return Values Rj(Dj) The stage return for Number of jobs created

making decision Dj at department j if funding Dj

Optimal Value Fj(Xj) The best cumulative Maximum number of new

return for stages j and jobs created for dept j,,4.

remaining stages at state Xj.

Boundary Condition F(XN) A set of optimal values The new jobs created from

for the last stage (N) funding Dept 4 with $X4 million.

Optimal Solution F1(T) The best cumulative The maximum total number

Value return of new jobs given $Tmillion to

allocate to all departments

Components of Dynamic Programming

22

Bellmans principle of optimality.

From a given state at a given stage, the optimal solution for the

remainder of the process is independent of any previous

decisions made to that point.

Dynamic programming is a recursive process.

The following recursive relationship describes the process for

the U.S. Department of Labor problem.

Define F

j

(X

j

) as the maximum number of new jobs created by

departments (stages) j, j+1,, 4, given that there is $X

j

million

in funding available for departments j (state) through 4.

F

j

(X

j

) = Max

{(R

j

(X

j

) + F

j+1

(X

j

- D

j

)}

all feasible X

j

Dynamic Recursive Relationship

23

The form of the recursion relation differs from

problem to problem, but the general idea is the

same:

Do the best you can for the remaining

stages with the remaining resources

available.

Dynamic Recursive Relationship

24

13.3 Computational Properties

of Dynamic Programming

Dynamic programming versus total

enumeration

Dynamic programming approach eliminates

from consideration combinations that have

no chance of being optimal.

Tricks for reducing computations further

We can reduce computational effort by

smart definition of state variable(s);

noticing the feasible range of state variables.

25

Networks can be used to model multistage decision

problems that are solved by dynamic programming

approach.

Each node represents a state variable value at each stage.

Each arc represents a possible decision at the particular

state.

The stage return is the value assigned to each arc.

The objective is to find the longest (shortest) path.

Dynamic programs as networks

26

Network Presentation-

The US Department of Labor

27

Dynamic programming problems are

typically solved using computer programs.

Since, dynamic problems differ from one

another, there is no universal code to solve

them.

Some problems do fit a particular type, and

are presented in the next section.

Computers and dynamic programming

28

13.4 Dynamic Programming - Examples

In our examples we focus on identifying the

following elements:

The stage variable.

The state variable.

The decision variable.

The stage return or cost function(s).

The optimal value function.

The boundary conditions.

The optimal solution value (stopping rule).

The recurrence relation.

29

KNAPSACK PROBLEMS

This problem belongs to the family of resource

allocation problems.

A hiker carries a knapsack with limited space.

Each item (j) has a volume (W

i

)

and a value V

i.

Limited quantity of each item (U

i

) may be available.

There is a minimum requirement (L

i

) for the amount of each

item that is to be taken.

Fill the knapsack with items such that the total value of items

selected is maximized.

30

KNAPSACK PROBLEMS

The Integer Linear Model

. eger int is D

) j item each for ( U D

) j item each for ( L D

C D W ST

D V Maximize

i

i i

i i

i

i i

i i

s

>

s

where D

i

is the units of item j put in the knapsack.

31

The NWC firms representatives need to deliver

boxes of items the company wants to present in a

conference.

The companys small jet will be used to transport

the team. It can carry a maximum of 127 pounds of

cargo for the show.

Quantities of four different items must be carried :

4Advertising buttons 4 Laser printers

4Advertisig brochures 4 Notebook computers

NORTHWESTERN COMPUTER

32

Data

At least one box of brochures, two printers,

and two notebook computers must be

taken.

Availability, weight, and profit per item are:

Weight Profit

Item Available (lbs.) Potential ($)

Boxes of Buttons 4 4 600

Boxes of Brochures 5 9 1,100

Laser Printers 4 21 4,000

Notebook Computers 5 12 1,500

How many of each item should be loaded on the small jet

to maximize the total profit potential of the trip?

NORTHWESTERN COMPUTER

33

Stage variable= the item j under consideration.

j=1 buttons; j=2 brochures; j=3 printers; j=4 computers

State variable X

j

= The amount of weight left for

transporting item j, j+1, ,notebook computers.

Stage return function = the added value obtained by

taking D

j

additional type j items.

Optimal value function F

j

(X

j

) = the maximum total profit

potential of transporting item j through 4 (notebook

computers) if X

j

pounds remain to take these items.

Northwestern Definitions

34

Let j = 4 represent notebook computer.

F

4

(X

4

) = 0 for all values of X

4

= 0,1,2,,11; D

4

= 0

F

4

(X

4

) = 1,500 for all values of X

4

= 12, 13,,23; D

4

= 1

F

4

(X

4

) = 3,000 for all values of X

4

= 24, 25, ,35; D

4

= 2

F

4

(X

4

) = 4,500 for all values of X

4

= 36, 37, ,48; D

4

= 3

Free space = 127 - 4 lbs of buttons box - 7 lbs of brochure box

- 2(21) lbs of printer boxes - 2(12) lbs of computer boxes = 48 lbs.

Northwestern - Boundary Conditions

35

F

j

(X

j

) = Maximum{V

j

D

j

+ F

j+1

(X

j

- W

j

D

j

)

D

j

s the number of remaining items of type j

W

j

D

j

sX

j

Recursive Calculations

See a demonstration of several

recursive calculations next

36

Recursive Calculations

37

RELIABILITY PROBLEMS

Product reliability and safety are significant

concern for consumers and manufacturers.

Products must be designed with an

acceptable probability of operating

satisfactorily.

Dynamic programming can be used to

determine minimum cost product design that

ensures

minimum required level of reliability, or

highest possible degree of reliability.

38

PLAYCO TOYS, INC.

Playtco Toys manufactures the Watkins Glen

remote-control race car.

Manufacturing cost reduction must come from

three electronic components ordered from a

supplier at the following cost per unit:

Power unit $12

Sound unit $ 5

Remote control unit $ 8

$25

To remain competitive

the total cost per unit

of $25 must be reduced

to $18.

39

Other suppliers offer reduced costs for these

components, but the reliability level of their

components has been proven to be lower.

Playco needs to determine which manufacturer

component to use in order to get the highest degree

of reliability without exceeding the $18 limit.

Power Sound Remote

Manufacturer Unit Cost Reliability Unit Cost Reliability Unit Cost Reliability

DSL, Inc. 12 0.998 5 0.995 5 0.998

Karrow Industries 10 0.994 4 0.987 8 0.999

ELO Elaectronic 5 0.975 2 0.980 4 0.995

PLAYCO TOYS, INC.

40

PLAYCO TOYS - SOLUTION

Define:

P

j

(D

j

) = the probability that component j is

operational if it is purchased for $D

j

.

The reliability of the product is the probability

that all three units operate properly (the product

is functional).

Assuming independence between the

components, the reliability is calculated by :

P

1

(D

1

) P

2

(D

2

) P

3

(D

3

)

- -

41

Stage variable j = the electrical component.

State variable X

j

= the amount of money left to

purchase component j, and subsequent components.

Decision variable D

j

= the amount spent for

component j.

Optimal value function F

j

(X

j

) = the highest probability

that all the components j through 3 will function if $X

j

is

spent to purchase these components.

PLAYCO TOYS Definitions

42

Playco must spend at least $4 on remote control (stage

3).

F

3

(X

3

) = 0 for X

3

= 0, 1, 2, 3 D

3

= 0

F

3

(X

3

) = 0.995 for X

3

= 4 D

3

= 4

F

3

(X

3

) = 0.998 for X

3

= 5, 6, 7 D

3

= 5

F

3

(X

3

) = 0.999 for X

3

= 8, 9,, 18 D

3

= 8

Boundary Conditions Stage 3: Remote

43

F

j

(X

j

) = Max {P

j

(D

j

) F

j+1

(X

j

- D

j

)}

Over all values of D

j

The Recursion Stage 2: Sound unit

At least $6 is required to purchase both a

sound unit and a remote control unit. At most

$13 is required to purchase the most reliable

sound and remote control units.

Thus, the feasible range for X

2

= 3, 4, ,13.

-

44

Amount left Reliability of

for allocation to Allocation to Components 2 and 3 Optimal F2(X2)

Stage 2 and 3 (X2) Stage 2 (D2) P(D2)F3(X2 - D2) Optimal D2

0 - 5 0 ********** 0

6 2 .980(.995) 0.975100

7 2 .980(.998) 0.978040

8 2 .980(.998) 0.97804

4 .987(.995) 0.982065

9 2 .980(.998) 0.978040

4 .987(.998) 0.985026

5 .995(.995) 0.990025

10 2 .980(.999) 0.979020

4 .987(.998) 0.985026

5 .995(.998) 0.993010

Sound Remote

Unit Cost Reliability Unit Cost Reliability

5 0.995 5 0.998

4 0.987 8 0.999

2 0.980 4 0.995

Recursive Calculations

Stage 2: Sound unit

45

We only need to calculate F

1

(18)

Reliability of Components Optimal Value

Allocation to 1 through 3 and Decision

Stage 1 (D1) P(D1)F(X1-D1) F1(X1)

5 .975(.994005) 0.969155

10 .994(.982065) 0.976173

12 .998(.975100) 0.973150

Power

Unit Cost Reliability

12 0.998

10 0.994

5 0.975

Recursive Calculations Stage 1:

Power Supply

46

Amount left

for allocation to Allocation to

Stage 2 and 3 (X2) Stage 2 (D2)

0 - 5 0

6 2

7 2

8 2

4

Allocation to

Stage 1 (D1)

5

10

12

Amount left

for allocation

for stage 3 Allocation

4 4

Purchase

power supply from

Karrow Industries

Purchase

sound unit from

Karrow Industries

Purchase

remote unit from

ELO Electronic

PLAYCO TOYS Solution summary

47

PRODUCTION AND INVENTORY

PROBLEMS

During the course of a certain production run

certain parameters may vary (prices of raw

material, storage space available, etc.)

A dynamic programming modeling approach

can be found very useful in these situations.

48

CJM INDUSTRIES

CJM builds classic replicars using original

car bodies from the 1920s, 30s, 40s, and

50s.

CJM is planning a 15 cars production run of

1957 Chrysler convertibles for the months of

May, June,, September.

49

Data

Maximum production level is 3 for July, and 4 for any other

month.

Up to 2 vehicles may be stored and displayed at a cost of

$2,500 per month ($3,000 for May).

Fixed costs (due to utilities, insurance, etc.) are incurred only

when cars are been actually produced.

Month Fixed Production Cars to be

j Costs Sj ($) Costs Pj ($) Delivered Cj

May 2000 21,000 3

June 3000 16,000 2

July 4000 9,000 1

August 3000 13,000 5

September 2000 23,000 4

CJM INDUSTRIES

50

Develop a production schedule that

minimizes total cost.

CJM INDUSTRIES the Objective

51

Stage variable j: The current month.

State variable X

j

: The number of cars

in inventory at the beginning of month j.

Decision variable D

j

: The production

quantity for month j.

CJM - Definitions

52

Production costs PC

j

(D

j

) in month j are proportional to

the number of cars produced

PC

j

(D

j

) = P

j

D

j

Holding (storage) costs HC

j

(D

j

) in month j are paid for

cars that are left unsold at the end of this month.

For month j =1: HC

1

(D

1

) = 3000(X

1

+ D

1

- C

1

)= 3000D

1

9000

For months j = 2, 3, 4, 5: HC

j

(D

j

) =2500(X

j

+D

j

- C

j

)

Stage cost function:

Fixed costs FC

j

(D

j

) are incurred in month j if there is a car

production. That is

FC

j

(D

j

) = S

j

if D

j

> 0

FC

j

(0) = 0 if D

j

= 0

CJM - Definitions

Given: X

1

= 0 and C

1

= 3

53

The optimal value function F

j

(X

j

) in month j is the minimum

total cost incurred from month j through month 5

(September), given X

j

cars are inventoried at the beginning

of month j.

Boundary conditions F

5

(X

5

):

F

5

(0) = 2,000 + 23,000(4) = $94,000; D

5

= 4

F

5

(1) = 2,000 + 23,000(3) = $71,000; D

5

= 3

F

5

(2) = 2,000 + 23,000(2) = $48,000; D

5

= 2

Optimal solution F

1

(0) is the minimum cost from month 1

(May) through month 5 (September) given that there is no

initial inventory.

CJM - Definitions

54

F

j

(X

j

) = Min{FC

j

(D

j

) + PC

j

(D

j

) + HC

j

(D

j

) + F

j+1

(X

j

+D

j

- C

j

)},

D

j

is feasible only if it satisfies the following conditions:

D

j

+ X

j

> C

j

;

D

3

s 3 for July; D

j

s 4 for j = 1, 2, 4, 5;

D

j

+ X

j

- C

j

s 2;

D

j

> 0

over all feasible D

j

.

The Recursion

55

Recursive Calculations Stage 4: August

X

4

Possible D

4

X

4

+ D

4

C

4

FC

4

PC

4

HC

4

F

5

(X

4

+D

4

C

4

) Total Optimal

Production Units Stored Cost Value

0 Infeasible Infeasible Infeasible

1 4 0 3 52 0 94 149.0 F

4

=149

D

4

=4

2 4 1 3 52 2.5 71 128.5 F

4

=128.5

3 0 3 39 0 94 136.0 D

4

=4

56

X

3

Possible D

3

X

3

+ D

3

C

3

FC

3

PC

3

HC

3

F

4

(X

3

+D

3

C

3

) Total Optimal

Production Units Stored Cost Value

0 2 1 4 18 2.5 149 173.5 F

3

=164.5

3 2 4 27 5.0 128.5 164.5 D

3

=3

1 1 1 4 9 2.5 149 164.5 F

3

=155.5

2 2 4 18 5 128.5 155.5 D

3

=2

2 0 1 0 0 2.5 149 151.5 F

3

=146.5

1 2 4 9 5 128.5 146.5 D

3

=1

Recursive Calculations Stage 3: July

57

13.5 Goal Programming

In real life decision situations, virtually all

problems have several objectives.

When objectives are conflicting, the

optimal decision is not obvious.

Goal programming is an approach that

seeks to simultaneously take into account

several objectives.

58

Goals are prioritized in some sense, and their level of

aspiration is stated.

An optimal solution is attained when all the goals are

reached as close as possible to their aspiration level, while

satisfying a set of constraints.

There are two types of goal programming models:

Nonpreemtive goal programming - no goal is pre-determined to

dominate any other goal.

Preemtive goal programming - goals are assigned different priority

levels. Level 1 goal dominates level 2 goal, and so on.

13.5 Goal Programming

59

A company is considering three forms of

advertising.

Goals

Goal 1: Spend no more $25,000 on advertising.

Goal 2: Reach at least 30,000 new potential

customers.

Goal 3: Run at least 10 television spots.

NONPREEMTIVE GOAL PROGRAMMING

An Advertisement Example

Cost per Ad Customers

Television 3000 1000

Radio 800 500

Newspaper 250 200

60

If these were constraints rather than goals we

would have:

3000X

1

+ 800X

2

+ 250X

3

s25,000

1000X

1

+ 500X

2

+ 200X

3

> 30,000

X

1

> 10

No feasible solution exists that satisfies all the

constraints.

When these constraints are simply goals they

are to be reached as close as possible.

An Advertisement Example

61

Detrimental variables

Ui = the amount by which the left hand side

falls short of (under) its right had side

value.

Ei = the amount by which the left side

exceeds its right had side value.

The goal equations

3000X

1

+ 800X

2

+ 250X

3

+ U

1

E

1

= 25,000

1000X

1

+ 500X

2

+ 200X

3

+ U

2

E

2

= 30,000

X

1

+ U

3

E

3

= 10

An Advertisement Example

62

The objective is to minimize the penalty of

not meeting the goals, represented by the

detrimental variables

E1, U2, U3.

An Advertisement Example

s25,000 > 30,000 > 10

63

The penalties are estimated to be as follows:

Each extra dollar spent on advertisement above

$25,000 cost the company $1.

There is a loss of $5 to the company for each

customer not being reached, below the goal of

30,000.

Each television spot below 10 is worth 100 times

each dollar over budget.

An Advertisement Example

64

It is assumed that no advantage is gained by

overachieving a goal.

Minimize 1E

1

+ 5U

2

+ 100U

3

s.t.

3000X

1

+ 800X

2

+ 250X

3

+ U

1

E

1

= 25,000

1000X

1

+ 500X

2

+ 200X

3

+ U

2

E

2

= 30,000

X

1

+ U

3

E

3

= 10

All variables are non-negative.

An Advertisement Example

The goal programming model

65

The NECC is planning next month production

of its two bicycles B2 and S10.

Data

Both models use the same seats and tires.

2000 seats are available; 2400 tires are available.

1000 gear assembly are available (used only in

the S10 model).

Production time per unit: 2 hours for B2; 3 hours

for S10.

Profit: $40 for each B2; 10$ for each S10.

PREEMTIVE GOAL PROGRAMMING -

New England Cycle Company

66

Priority 1: Fulfill a contract for

400 B2 bicycles to be delivered

next month.

NECC Prioritized Goals

Priority 4:

At least 200 tires left

over at the end of the

month.

At least 100 gear

assemblies left over at

the end of the month.

Priority 2: Produce at least

1000 total bicycles during

the month.

Priority 3:

Achieve at least

$100,000 profit for the

month.

Use no more than 1600

labor-hours during the

month.

67

Management wants to determine the

production schedule that best meets its

prioritized schedule.

New England Cycle Company Example

68

NECC - SOLUTION

Decision variables

X

1

= The number of B2s to be produced next month

X

2

= The number of S10s to be produced next month

Functional / nonnegativity constraints

0 X , X

Tires 2400 X 2 X 2

assemblies Gear 1000 X

Seats 2000 X X 2

2 1

2 1

2

2 1

>

s +

s

s +

69

Goal constraints

Priority 1 (goal 1): Production of at least 400 B2s

X

1

+ U

1

- E

1

= 400

Priority 2 (goal 2): Production of at least 1000 total cycles

X

1

+ X

2

+ U

2

- E

2

= 1000

Priority 3 (goal 3) Profit of at least $100,000

.04X

1

+ .10X

2

+ U

3

- E

3

= 100 (in $1000)

Priority 3 (goal 4) Use a maximum of 1600 labor hours

2X

1

+ 3X

2

+ U

4

- E

4

= 1600

Priority 4 (goal 5) At least 200 leftover tires

2X

1

+ 2X

2

+ U

5

- E

5

= 2200

Priority 4 (goal 6) At least 100 leftover gear assembly

X

2

+ U

6

- E

6

= 900

NECC - SOLUTION

70

Priority level objectives

Priority 1: Underachieving a production of 400 B2s:

Minimize U

1

Priority 2: Underachieving a total production of 1000:

Minimize U

2

NECC - SOLUTION

71

Priority level objectives

Priority 3: Underachieving a $100,000 profit

Using more than 1600 labor-hours

Minimize 30U

3

+ E

4

NECC - SOLUTION

Each $1,000 short of the $100,000 goal is considered

30 times as important as utilizing an extra labor-hour.

72

Priority level objectives

Priority 4: Using more than 2200 tires

Using more than 900 gear assemblies

Minimize E

5

+ 2E

6

NECC - SOLUTION

Each leftover gear assembly is deemed

twice as important as leftover tire.

73

Solve the linear goal programming for priority 1 objective, under

the set of regular constraints and goal constraint as shown below

Minimize U

1

ST

NECC - The solution procedure

X

1

+ U

1

- E

1

= 400

Tires 2400 X 2 X 2

Gear 1000 X

Seats 2000 X X 2

2 1

2

2 1

s +

s

s +

X

1

= 400, thus

U

1

= 0, and

priority 1 goal is

fully achieved.

74

Solve the linear goal programming for priority 2 level objective,

under the set of original constraints plus the constraint X

1

> 400

(maintain the level of achievement of the priority 1 goal).

Minimize U

2

ST

NECC - The solution procedure

Every point that

satisfies X

1

+ X

2

>

1000 yields U

2

= 0,

and therefore,

priority 2 goal is fully

achieved.

Tires 2400 X 2 X 2

Gear 1000 X

Seats 2000 X X 2

2 1

2

2 1

s +

s

s +

X

1

> 400

X

1

+ X

2

+ U

2

- E

2

= 1000

75

Solve the linear goal programming for priority 3

level objective, under the set of original constraints

plus the constraint X

1

> 400 (maintain the level of

achievement of the priority 1 goal), plus the

constraint X

1

+ X

2

> 1000 (maintain the level of

achievement of the priority 2 goal).

Every point in the range X

1

= 400 and 600 s X

2

s 800 is

optimal for this model; 30U

3

+ E

4

= 1720 is the level of

achievement for the priority 3 goal.

NECC - The solution procedure

76

Solve the linear goal programming for priority 4

level objective, and notice that after the previous

step the feasible region is reduced to a segment of

a straight line between the points (400,600) and

(400,800).

X1 =400; 600 s X2 s 700 and E5 + 2E6 = 0

NECC - The solution procedure

77

In summary NECC should produce

400 B2 model

Between 600 and 700 S10 model

NECC - Solution Summary

78

13.6 Nonlinear Programming

A nonlinear programming problem (NLP) is one in

which the objective function, F, and or one or more

constraint functions, G

i

, possess nonlinear terms.

There is no a universal algorithm that can find the

optimal solution to every NLP.

One class of NLPs Convex Programming Problems

can be solved by algorithms that are guaranteed to

converge to the optimal solution.

79

The objective is to maximize a concave

function or to minimize a convex function.

The set of constraints form a convex set.

Properties of Convex Programming

Problems

80

A smooth function (no sharp points, no

discontinuities)

One global maximum (minimum).

A line drawn between any two points on the

curve of the function will lie below (above) the

curve or on the curve.

A One Variable Concave (Convex)

Function

X

A Concave function

A convex function

X

81

An illustration of a two variable

convex function

82

If a straight line that joins any two points in

the set lies within the set, then the set is

called a convex set.

Convex set

Non-convex set

Convex Sets

83

In a NLP model all the constraints are of

the less than or equal to form G

i

(X) s B.

If all the functions G

i

are convex, the set

of constraints forms a convex set.

NLP and Convex Sets

84

13.7 Unconstrained Nonlinear

Programming

One-variable unconstrained problems are

demonstrated by the Toshi Camera

problem.

The inverse relationships between

demand for an item and its value (price)

are utilized in this problem.

85

TOSHI CAMERA

Toshi camera of Japan has just

developed a new product, the Zoomcam.

It is believed that demand

for the initial product will

be linearly related to the

price.

Price Estimated

P ($) Demand (X)

100 350,000

150 300,000

200 250,000

250 200,000

300 150,000

350 100,000

86

Unit production cost is estimated to be $50.

What is the production quantity that

maximizes the total profit from the initial

production run?

SOLUTION

Total profit = Revenue - Production cost

F(X) = PX - 50X

TOSHI CAMERA

87

From the Price / Demand table it can be verified

that P = 450 - .001X

The Profit function becomes

F(X) = (450 - .001X)X = 400X - .001X

2

This is a concave function.

400,000 0

TOSHI CAMERA

88

To obtain an optimal solution (maximum profit),

two conditions must be satisfied:

A necessary condition dF/dX = 0

A sufficient condition d

2

F/dX

2

< 0.

The necessary condition is satisfied at:

dF/dX = 400 - 2(.001)X = 0; X = 200,000.

The sufficient condition is satisfied since

d

2

F/dX

2

= -.002.

The optimal solution:

Produce 200,000 cameras.

The profit is F(200,000) = $40,000,000.

TOSHI CAMERA

89

If a function is known to be concave or

convex at all points, the following condition is

both a necessary and sufficient condition for

optimality:

The point X* gives the maximum value for a

concave function, or the minimum value for a

convex function, F(X), if at X*

dF/dX = 0

Optimal solutions for concave/convex

functions with one variable

90

Determining whether or not a multivariate

function is concave or convex requires analysis

of the second derivatives of the function.

A point X* is optimal for a concave (convex)

function if all its partial derivatives are equal to

zero at X*.

For example, in the three variable case:

c

c

c

c

c

c

F

X

F

X

F

X

1

1

2

2

3

3

0 0 0 = = = ; ; ;

Optimal solutions for concave/convex

functions with more than one variable

91

13.8 Constrained Nonlinear

Programming Problems one variable

The feasible region for a one variable

problem is a segment on a straight line

(X > a or X s b).

When the objective function is nonlinear

the optimal solution must not be at an

extreme point.

92

TOSHI CAMERA - revisited

Toshi Camera needs to determine the

optimal production level from among the

following three alternatives:

150,000 s X s 300,000

50,000 s X s 175,000

150,000 s X s 350,000

93

400 0

X > 250,000

X s 350,000

X* = 250,000

400

0

400 0

Maximize F(X) = 400X - .001X

2

X > 150,000

X s 300,000

150

X > 50,000

X s 175,000

50 175

X*=200,000

X* = 175,000

The objective function does not change:

TOSHI CAMERA solution

94

Constrained Nonlinear Programming

Problems m variables

m n 2 1

2 n 2 1

1 n 2 1

n 2 1

B ) X ..., , X , Gm(X

.

.

.

B ) X ..., , X , G2(X

B ) X ..., , X , G1(X

ST

) X ..., , X , X ( F Maximize

s

s

s

Let us define Y

1

, Y

2

, ,Y

m

as the instantaneous improvement

in the value of F for one unit

increase in B

1

, B

2

, B

m

respectively.

95

This is a set of necessary conditions for optimality of

most nonlinear problems.

If the problem is convex, the K-T conditions are also

sufficient for a point X* to be optimal.

|

.

|

\

|

c

c

+ +

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

=

c

c

|

.

|

\

|

c

c

+ +

|

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

=

c

c

= = =

>

m

m

2 1

1

m

m 2

1

1

1

m m 2 2 1 1

m 2 1

X

Gm

Y ...

X

2 G

2 Y

X

1 G

Y

Xn

F

.

.

.

X

Gm

Y ...

X

2 G

Y

X

1 G

Y

X

F

. 4

0 S Y ..., , 0 S Y , 0 S Y . 3

0 Y ..., , Y , Y . 2

. feasible is * X . 1

2

S1, S2, ,Sm

are defined as

the slack variables

in each constraint.

Kuhn-Tucker optimality conditions

96

PBI INDUSTRIES

PBI wants to determine an optimal production

schedule for its two CD players during the month

of April.

Data

Unit production cost for the portable CD player = $50.

Unit production cost for the deluxe table player = $90.

There is additional intermix cost of $0.01(the

number of portable CDs)(the number of deluxe

CDs).

97

Forecasts indicate that unit selling price for

each CD player is related to the number of

units sold as follows:

Portable CD player unit price = 150 - .01X1

Deluxe CD player unit price = 350 - .02X2

PBI INDUSTRIES

98

Resource usage

Each portable CD player uses 1 unit of a particular

electrical component, and .1 labor hour.

Each deluxe CD player uses 2 units of the

electrical component, and .3 labor hour.

Resource availabilty

10,000 units of the electrical component units;

1,500 labor hours.

PBI INDUSTRIES

99

PBI INDUSTRIES SOLUTION

Decision variables

X1 - the number of portable CD players to produce

X2 - the number of deluxe CD players to produce

The model

Max (150-.

X X X X X

ST

X X

X

01X1)X1+(350-.02X2)X2 - 50X1- 90X2-.01X1X2 =

-.01X1

.1X1 +.3X2 1,500

- X1

2

+ +

+ s

s

s

s

. .

,

02 2 01 1 2 100 1 260 2

1 2 2 10 000

0

2 0

2

Production cannot be negative

Resource constraints

100

For a point X1, X2 to be optimal, the K-T conditions

require that:

Y1S1 = 0; Y2S2 = 0; Y3S3 = 0; Y4S4 = 0, and

) 1 ( Y ) 0 ( Y ) 3 (. Y ) 2 ( Y 260 2 X 04 . X 01 .

or

X

G

Y

X

G

Y

X

G

Y

X

G

Y

X

F

) 0 ( Y ) 1 ( Y ) 1 (. Y ) 1 ( Y 100 X 01 . X 02 .

or

X

G

4 Y

X

G

Y

X

G

Y

X

G

Y

X

F

4 3 2 1 1

2

4

4

2

3

3

2

2

2

2

1

1

2

4 3 2 1 2 1

1

4

1

3

3

1

2

2

1

1

1

1

+ + + = +

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

=

c

c

+ + + = +

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

+

|

.

|

\

|

c

c

=

c

c

PBI INDUSTRIES SOLUTION

101

Finding an optimal production plan.

Assume X1>0 and X2>0.

The assumption implies S3>0 and S4>0.

Thus, Y3 = 0 and Y4 = 0.

Add the assumption that S1 = 0 and S2 = 0.

From the first two constraints we have X1 = 0 and

X2 = 5000.

X1= 0

A contradiction X1>0

AS A RESULT THE SECOND ASSUMPTION CANNOT BE TRUE

PBI INDUSTRIES SOLUTION

102

Change the second assumption. Assume that S1 = 0

and S2 > 0.

As before, from the first assumption S3 > 0 and S4 > 0.

Thus, Y3 = 0 and Y4 = 0.

From the second assumption Y2 = 0.

Substituting the values of all the Ys in the partial derivative

equations we get the following two equations:

-.02X1 - .01X2 + 100 = Y1

-.01X1 - .04X2 + 260 = 2Y1

Also, since S1 = 0 (by the second assumption)

X1 + 2X2 = 10,000

Solving the set of three equations in three unknowns we get:

PBI INDUSTRIES SOLUTION

103

X1 = 1000, X2 = 4500, Y1 = 35

This solution is a feasible point (check the constraints).

X1 and X2 are positive.

1X1 + 2X2 <= 10,000 [1000 + 2(4500) = 10,000]

.1X1 + .3X2 <= 1,500 [.1(1000) + .3(4500) = 1450]

This problem represents a convex program since

It can be shown that the objective function F is concave.

All the constraints are linear, thus, form a convex set.

The K-T conditions yielded an optimal solution

PBI INDUSTRIES SOLUTION

104

Portable Deluxe Total Profit

April Production 1000 4500 810000

Portable Deluxe Used Available

Electrical Components 1 2 10000 10000

Labor Hours 0.1 0.3 1450 1500

PBI INDUSTRIES

PBI INDUSTRIES Excel SOLUTION

105

Copyright 2002 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that named in

Section 117 of the United States Copyright Act without the express

written consent of the copyright owner is unlawful. Requests for

further information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. Adopters of the textbook are

granted permission to make back-up copies for their own use only,

to make copies for distribution to students of the course the

textbook is used in, and to modify this material to best suit their

instructional needs. Under no circumstances can copies be made

for resale. The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Potrebbero piacerti anche

- Tom Quayle - From Rock To Fusion DVDDocumento11 pagineTom Quayle - From Rock To Fusion DVDJuan Villegas100% (2)

- Mochammad Adji Firmansyah Study PlanDocumento1 paginaMochammad Adji Firmansyah Study PlanMochammad Adji Firmansyah100% (1)

- Forecasting Time Series With Arma and Arima Models The Box-Jenkins MethodologyDocumento35 pagineForecasting Time Series With Arma and Arima Models The Box-Jenkins MethodologyMochammad Adji FirmansyahNessuna valutazione finora

- Slightly Out of Reach (Solos) : Keyboard SoloDocumento3 pagineSlightly Out of Reach (Solos) : Keyboard SoloMochammad Adji FirmansyahNessuna valutazione finora

- Pengantar Manajemen Rantai Pasok: Oleh: Erma SuryaniDocumento53 paginePengantar Manajemen Rantai Pasok: Oleh: Erma SuryaniMochammad Adji FirmansyahNessuna valutazione finora

- Harmony LessonDocumento6 pagineHarmony LessonMochammad Adji FirmansyahNessuna valutazione finora

- Contoh KuesionerDocumento2 pagineContoh KuesionerMochammad Adji FirmansyahNessuna valutazione finora

- TQ 1Documento6 pagineTQ 1Mochammad Adji Firmansyah80% (5)

- Far LowDocumento4 pagineFar LowDidier ArchambaultNessuna valutazione finora

- PreparationDocumento2 paginePreparationMochammad Adji FirmansyahNessuna valutazione finora

- Tq1 Hopes NotesDocumento1 paginaTq1 Hopes NotesMochammad Adji FirmansyahNessuna valutazione finora

- Buyer ChevronDocumento2 pagineBuyer ChevronMochammad Adji FirmansyahNessuna valutazione finora

- Cw1 Drivin TabDocumento10 pagineCw1 Drivin Tabarturxox1zNessuna valutazione finora

- Form SuratDocumento1 paginaForm SuratMochammad Adji FirmansyahNessuna valutazione finora

- Flow AnalysisDocumento27 pagineFlow AnalysisMochammad Adji FirmansyahNessuna valutazione finora

- Pokok Bahasan #5 Transactions ProcessingDocumento56 paginePokok Bahasan #5 Transactions ProcessingMochammad Adji FirmansyahNessuna valutazione finora

- Analisis 3: Nilai Negatif Pada Analisis 1 Yang Di Drop Lalu Model Dijalankan Kembali - Hasil Analisisnya Sebagai BerikutDocumento3 pagineAnalisis 3: Nilai Negatif Pada Analisis 1 Yang Di Drop Lalu Model Dijalankan Kembali - Hasil Analisisnya Sebagai BerikutMochammad Adji FirmansyahNessuna valutazione finora

- Tugas 2 SMBDDocumento11 pagineTugas 2 SMBDMochammad Adji FirmansyahNessuna valutazione finora

- Pokok Bahasan #1-1 Review BDDocumento30 paginePokok Bahasan #1-1 Review BDMochammad Adji FirmansyahNessuna valutazione finora

- Pokok Bahasan #1-2 Review DB ArchitectureDocumento53 paginePokok Bahasan #1-2 Review DB ArchitectureMochammad Adji FirmansyahNessuna valutazione finora

- Angel of DarknessDocumento13 pagineAngel of DarknessMochammad Adji FirmansyahNessuna valutazione finora

- Slightly Out of Reach (Solos) : Keyboard SoloDocumento3 pagineSlightly Out of Reach (Solos) : Keyboard SoloMochammad Adji FirmansyahNessuna valutazione finora

- CADocumento19 pagineCAMochammad Adji FirmansyahNessuna valutazione finora

- Pokok Bahasan #11 DB Design & TuningDocumento20 paginePokok Bahasan #11 DB Design & TuningMochammad Adji FirmansyahNessuna valutazione finora

- Tugas 1 SMBDDocumento6 pagineTugas 1 SMBDMochammad Adji FirmansyahNessuna valutazione finora

- Is It YouDocumento2 pagineIs It YouSamuel ValeniaNessuna valutazione finora

- Vitali T - Major II - V7 - I As The Chromatic PentatonicsDocumento3 pagineVitali T - Major II - V7 - I As The Chromatic PentatonicsMochammad Adji FirmansyahNessuna valutazione finora

- Post TestDocumento1 paginaPost TestMochammad Adji FirmansyahNessuna valutazione finora

- C Dominant 7flat5 Arpeggio: 44 P V Ev Ev V V Ev Ev V V Ev Ev V V V V V V Ev eVV JDocumento2 pagineC Dominant 7flat5 Arpeggio: 44 P V Ev Ev V V Ev Ev V V Ev Ev V V V V V V Ev eVV JMochammad Adji FirmansyahNessuna valutazione finora

- Formulir Pendaftaran Djarum Beasiswa Plus 2011 2012 PDFDocumento4 pagineFormulir Pendaftaran Djarum Beasiswa Plus 2011 2012 PDFIrwan AnugrahNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Cross Cutting Concerns: Linh DangDocumento16 pagineThe Cross Cutting Concerns: Linh DanglinhdanghongNessuna valutazione finora

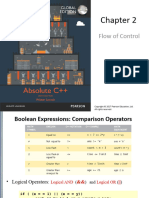

- Lec2. C++ Flow of ControlDocumento29 pagineLec2. C++ Flow of ControlMajd AL KawaasNessuna valutazione finora

- Coding UnpluggedDocumento76 pagineCoding UnpluggedMubiru RodneyNessuna valutazione finora

- Unit 4 SolutionDocumento3 pagineUnit 4 SolutionxavierNessuna valutazione finora

- Introduction To C++ and Code BlocksDocumento22 pagineIntroduction To C++ and Code BlocksAbdullah RandhawaNessuna valutazione finora

- Roll No.: 101 Practical 18: Program To Implement Minimin CriterionDocumento4 pagineRoll No.: 101 Practical 18: Program To Implement Minimin CriterionvirusyadavNessuna valutazione finora

- Updates To The Postscript Language Reference Manual, Second EditionDocumento26 pagineUpdates To The Postscript Language Reference Manual, Second EditionSándor NagyNessuna valutazione finora

- Coding Systems - ASCII and UnicodeDocumento23 pagineCoding Systems - ASCII and UnicodeIbrahim AbdulaliNessuna valutazione finora

- Key Quiz 3Documento7 pagineKey Quiz 3krimo oranNessuna valutazione finora

- If, Functions, Variables.Documento23 pagineIf, Functions, Variables.Luke LippincottNessuna valutazione finora

- AStudyon Dataminingtechniquestoimprovestudentsperformancein Higher EducationDocumento7 pagineAStudyon Dataminingtechniquestoimprovestudentsperformancein Higher Educationddol36899Nessuna valutazione finora

- System Verilog Interview Questions - 2 ?Documento24 pagineSystem Verilog Interview Questions - 2 ?bhanu prakask 013Nessuna valutazione finora

- Java New Technology For Smart CardsDocumento7 pagineJava New Technology For Smart CardsZaid MohamedNessuna valutazione finora

- CSC312 EXAM 2019-2020 ModeratedDocumento2 pagineCSC312 EXAM 2019-2020 ModeratedJustinNessuna valutazione finora

- Cryptography Networks and Security SystemsDocumento42 pagineCryptography Networks and Security Systemspokemonlover14116666Nessuna valutazione finora

- Principles of Programming Languages: Dr. N. PapannaDocumento375 paginePrinciples of Programming Languages: Dr. N. PapannaTharaka RoopeshNessuna valutazione finora

- Company Wise Different QuestionsDocumento10 pagineCompany Wise Different Questionsmanasa grandhiNessuna valutazione finora

- Ooad 5Documento17 pagineOoad 5EXAMCELL - H4Nessuna valutazione finora

- Lec03 SearchDocumento57 pagineLec03 SearchGautiiiNessuna valutazione finora

- ML 08Documento38 pagineML 08Dreadqueen RathianNessuna valutazione finora

- C - 3 NotesDocumento37 pagineC - 3 NotesJyotir BhattNessuna valutazione finora

- Logcat 1701137114711Documento39 pagineLogcat 1701137114711akocerryelNessuna valutazione finora

- L5 Slides - Python Programming With Sequences of Data - Y9Documento21 pagineL5 Slides - Python Programming With Sequences of Data - Y9Sullam SullamNessuna valutazione finora

- JAVA OOPsDocumento38 pagineJAVA OOPsRajesh LohithNessuna valutazione finora

- Chapter 1 - Introduction JavaDocumento14 pagineChapter 1 - Introduction JavaTuyền Nhữ VănNessuna valutazione finora

- Visvesvaraya Technological University: "Title of The Project"Documento14 pagineVisvesvaraya Technological University: "Title of The Project"VishalNessuna valutazione finora

- Support Vector Machines: Andrew W. Moore Professor School of Computer Science Carnegie Mellon UniversityDocumento65 pagineSupport Vector Machines: Andrew W. Moore Professor School of Computer Science Carnegie Mellon UniversityKyuudaimeNessuna valutazione finora

- Ugc Care ListDocumento4 pagineUgc Care Listrikaseo rikaNessuna valutazione finora

- Lab 2 SimioDocumento16 pagineLab 2 SimioAysha Ait0% (2)

- Sorting Algorithms: Bubble, Insertion, Selection, Quick, Merge, Bucket, Radix, HeapDocumento24 pagineSorting Algorithms: Bubble, Insertion, Selection, Quick, Merge, Bucket, Radix, HeapAryan ApteNessuna valutazione finora