Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IDX Latest Update - 140417 - RP

Caricato da

AmeliaErfaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IDX Latest Update - 140417 - RP

Caricato da

AmeliaErfaCopyright:

Formati disponibili

Latest Updates on the

Indonesia Stock Exchange

17 April 2014

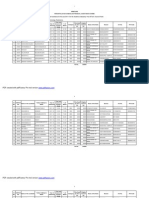

Equity Trading Activities

INDONESIA STOCK EXCHANGE PERFORMANCE

Average Daily Trading and Market Capitalization

2007 17 April 2014

Volume (in Million Share)

6,090

4,226

2007

5,432

4,873

3,283

2008

2009

2010

2011

Value (in Billion Rp)

5,503

4,932

4,284

2012

2013

2014*

4,269

4,436

4,046

2007

2008

2009

Frequency (in Times)

4,801

4,953

4,537

2010

2011

2012

6,238

6,207

2013

2014*

Market Capitalization (in Trillion Rp)

219,943

153,686

48,216

55,905

2007

2008

87,040

105,790

113,454

121,712

3,247

3,537

2010

2011

4,127

4,219

4,849

2,019

1,988

1,076

2009

2010

2011

2012

2013

2014*

2007

2008

2009

2012

*) 17 April 2014

2013

2014*

Jakarta Composite Index and Capital Market Milestones

1992 17 April 2014

5,500

20-May-2013

Highest Index

5,214.976

5,000

4,500

6-Aug-1996

Founding of KPEI

554.790

4,000

3,500

3,000

28-Mar-2002

Implementation of

Remote Trading

481.775

24-Jul-1995

Merging process of SSX into

Bursa Paralel Indonesia

509.532

2,000

30-Nov-2007

Consolidation of the SSX into

JSX to become the IDX

2,688.332

21-Jul-2000

Scriptless Trading

512.617

22-May-1995

JATS

461.389

2,500

13-Jul-1992

Privatization of JSX

321.544

06-Jan-2014

New Lot Size & Tick Size

4,202.809

6-Oct-2004

Launching of

Stock Option

856.060

23-Dec-1997

Founding of

KSEI

397.031

1,500

02-Jan-2013

New Trading Hours

4,254.816

8-Oct-2008

Suspend Trading

1,451.669

1,000

500

28-Oct-2008

Lowest Index in 2008

1,111.390

9-Sep-2002

T+4 to T+3 Settlement

430.271

23-Jul-1997

Financial Crisis

718.189

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2-Mar-2009

JATS Next G

1,256.109

2009

2010

2011

*) 17 April 2014

2012

2013

2014*

Jakarta Composite Index

2003 17 April 2014

5,500

4,897.052

5,000

4,500

4,316.687

4,000

4,274.177

3,703.512

3,500

3,821.992

3,000

2,745.826

2,534.356

2,500

2,000

1,805.523

1,500

1,000.233

1,000

1,162.635

1,355.408

691.895

500

62.82%

44.56%

16.24%

55.30%

52.08%

2003

2004

2005

2006

2007

-50.64%

2008

86.98%

46.13%

3.20%

12.94%

2009

2010

2011

2012

-0.98%

2013

*) 17 April 2014

14.57%

2014*

Distributions of Tradeable Stocks*

Based on Investors Nationality (2011 March 2014)

Investors Nationality

(Equity Only)

March 2014

(IDR Billion)

2013

%

(IDR Billion)

2012

%

(IDR Billion)

2011

%

(IDR Billion)

945,450

36.49%

868,718

37.06%

1,040,619

41.21%

839,319

40.14%

Individual

165,128

17.47%

157,417

18.12%

140,026

13.46%

150,951

17.98%

Institution

777,289

82.21%

709,834

81.71%

899,339

86.42%

687,203

81.88%

3,034

0.32%

1,466

0.17%

1,254

0.12%

1,166

0.14%

1,645,521

63.51%

1,475,457

62.94%

1,484,385

58.79%

1,251,886

59.86%

Individual

28,653

1.74%

25,687

1.74%

31,145

2.10%

23,704

1.89%

Institution

1,095,708

66.59%

975,049

66.08%

1,025,196

69.07%

907,916

72.52%

521,159

31.67%

474,720

32.17%

428,044

28.84%

320,266

25.58%

Local Investor

Others

Foreign Investor

Others

TOTAL

2,590,971

2,344,174

2,525,005

2,091,205

Institutions includes

Insurance, Mutual Fund, Pension Fund, Financial Institution,

Corporate, Securities Company, Foundation

Source Data

Indonesia Central Securities Depository (KSEI)

*) Scripless Stocks

Net Buying by Foreign Investor

At Indonesia Stock Exchange: 2009 17 April 2014

32,538

24,290

20,982

15,881

14,476

13,290

9,356

9,069

Jan

(1,503)

Mar

May

Apr

Jul

(1,973)

2,655

413

Jun

Aug

Nov

Sep

Oct

123

Dec

1,828

Jan

(3,074)

Feb

Mar

2,330

722 May Jun

Apr

(356)

Jul

Sep

Oct

Nov Dec

(365)

(1,981)

(3,859)

(5,266)

(5,695)

(2,480)

(7,691)

(20,647)

Aug

2014

2012

2011

2010

2009

Feb

2013

1,465

7,915

7,817

5,695

4,587

2,455

11,242

Jan

Feb

Mar

Apr

(20,132)

Figures in Billion Rupiah

Market Capitalization and Trading Value By Industry

17 April 2014

Market

Capitalization

Trade, Services &

Investment (112)

Finance (81)

24.1%

12.6%

14.9%

24.3%

Agriculture (20)

3.1%

Infrastructure, Utilities &

Transportation (50)

Trading

Value

13.1%

15.7%

4.9%

5.9%

Property And Real Estate

(54)

14.1%

19.9%

Consumer Goods

Industry (38)

7.0%

Mining (39)

7.7%

Basic Industry And

Chemicals (62)

6.2%

6.9%

6.3%

5.3%

7.9%

Miscellaneous Industry

(41)

Top 20 in Market Capitalization

17 April 2014

No.

Code

Market Capitalization

(in Trillion Rp)

Company

1.

ASII

Astra International Tbk. [S]

316.78

6.53

2.

HMSP

HM Sampoerna Tbk.

304.40

6.28

3.

BBCA

Bank Central Asia Tbk.

273.37

5.64

4.

BBRI

Bank Rakyat Indonesia (Persero) Tbk.

244.22

5.04

5.

UNVR

Unilever Indonesia Tbk. [S]

235.00

4.85

6.

TLKM

Telekomunikasi Indonesia (Persero) Tbk. [S]

234.36

4.83

7.

BMRI

Bank Mandiri (Persero) Tbk.

227.53

4.69

8.

PGAS

Perusahaan Gas Negara (Persero) Tbk. [S]

129.69

2.67

9.

GGRM

Gudang Garam Tbk.

97.36

2.01

10.

SMGR

Semen Indonesia (Persero) Tbk. [S]

93.87

1.94

11.

BBNI

Bank Negara Indonesia (Persero) Tbk.

93.23

1.92

12.

INTP

Indocement Tunggal Prakarsa Tbk. [S]

86.32

1.78

13.

UNTR

United Tractors Tbk. [S]

80.57

1.66

14.

KLBF

Kalbe Farma Tbk. [S]

72.42

1.49

15.

CPIN

Charoen Pokphand Indonesia Tbk. [S]

69.04

1.42

16.

INDF

Indofood Sukses Makmur Tbk. [S]

63.22

1.30

17.

ICBP

Indofood CBP Sukses Makmur Tbk. [S]

58.16

1.20

18.

SCMA

Surya Citra Media Tbk. [S]

47.81

0.99

19.

AALI

Astra Agro Lestari Tbk. [S]

44.64

0.92

20.

LPPF

Matahari Department Store Tbk.

43.77

0.90

Market Capitalization of The 20 Stocks

2,815.79

58.07

Total IDX

4,848.86

[S] Sharia Compliant Stock

10

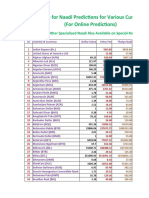

Top 20 in Trading Value

20 TOP LISTED COMPANIES BY TOTAL TRADING VALUE (RP)

02 January 17 April 2014

No.

Code

Value of Transaction

(in Trillion Rp)

Company

1.

BBRI

Bank Rakyat Indonesia (Persero) Tbk.

30.83

6.90

2.

ASII

Astra International Tbk. [S]

27.18

6.08

3.

BMRI

Bank Mandiri (Persero) Tbk.

25.32

5.67

4.

TLKM

Telekomunikasi Indonesia (Persero) Tbk. [S]

20.82

4.66

5.

TRAM

Trada Maritime Tbk.

20.75

4.64

6.

BBCA

Bank Central Asia Tbk.

18.52

4.15

7.

SMGR

Semen Indonesia (Persero) Tbk. [S]

11.67

2.61

8.

BBNI

Bank Negara Indonesia (Persero) Tbk.

10.91

2.44

9.

PGAS

Perusahaan Gas Negara (Persero) Tbk. [S]

9.90

2.22

10.

LPKR

Lippo Karawaci Tbk. [S]

8.38

1.88

11.

SILO

Siloam International Hospitals Tbk. [S]

8.07

1.81

12.

LPPF

Matahari Department Store Tbk.

7.96

1.78

13.

MPPA

Matahari Putra Prima Tbk. [S]

7.40

1.65

14.

KLBF

Kalbe Farma Tbk. [S]

7.35

1.65

15.

SSMS

Sawit Sumbermas Sarana Tbk.

6.97

1.56

16.

BTPN

Bank Tabungan Pensiunan Nasional Tbk.

6.57

1.47

17.

LSIP

PP London Sumatra Indonesia Tbk. [S]

6.35

1.42

18.

WIKA

Wijaya Karya (Persero) Tbk. [S]

6.29

1.41

19.

INTP

Indocement Tunggal Prakarsa Tbk. [S]

6.28

1.40

20.

ADHI

Adhi Karya (Persero) Tbk. [S]

5.86

1.31

Total of The 20 Stocks

253.38

56.70

Total IDX

446.87

[S] Sharia Compliant Stock

Listed Company

FINANCIAL PERFORMANCE OF LISTED COMPANIES

12

Total Comprehensive Income of Listed Companies

Financial Statement Date : Dec 2003 September 2013* (in trillion Rp)

2003

Comprehensive

Income

38.11

2004

48.08

26.16%

2005

54.17

12.66%

2006

67.68

24.93%

2007

105.01

55.17%

2008

74.54

-29.02%

2009

123.20

65.29%

2010

170.65

38.52%

2011

235.21

37.83%

2012

231.32

-1.65%

September-12

167.63

September-13

181.26

Year

Change

-19.98%

235.21

231.32

181.26

170.65

8.13%

167.63

123.20

105.01

38.11

2003

48.08

2004

54.17

2005

*) 474 companies out of 479 companies listed

74.54

67.68

2006

2007

2008

2009

2010

2011

2012

September- September12

13

13

Performance of Listed Companies

FR September 2013* compared to FR September 2012 (in trillion Rp)

Revenues

Increased

72.73%

Earning Before Tax

Increased

57.12%

Comprehensive Income

Increased

8.13%

1,806.75

Sep-12

1,045.98

Sep-13

244.06

155.34

Total Revenues

*) 474 companies out of 479 companies listed

Total EBT

167.63

181.26

Total Comprehensive Income

Top 40 Listed Companies by Comprehensive Income (1)

September 2013* compared to September 2012

No

Code

Total Comprehensive Income

(Trillion Rp)

Listed Companies

30-Sep-13

30-Sep-12

Change

(%)

1.

ASII

Astra International Tbk. [S]

16.04

16.99

-5.58%

2.

TLKM

Telekomunikasi Indonesia (Persero) Tbk. [S]

15.73

14.13

11.29%

3.

BBRI

Bank Rakyat Indonesia (Persero) Tbk.

14.42

13.63

5.79%

4.

BMRI

Bank Mandiri (Persero) Tbk.

12.43

11.82

5.14%

5.

BBCA

Bank Central Asia Tbk.

9.18

8.21

11.81%

6.

PGAS

Perusahaan Gas Negara (Persero) Tbk. [S]

7.58

6.14

23.50%

7.

HMSP

HM Sampoerna Tbk.

5.01

7.47

-32.95%

8.

UNTR

United Tractors Tbk. [S]

4.45

4.61

-3.47%

9.

BBNI

Bank Negara Indonesia (Persero) Tbk.

4.28

4.99

-14.24%

10.

UNVR

Unilever Indonesia Tbk. [S]

4.09

3.65

11.96%

11.

SMGR

Semen Indonesia (Persero) Tbk. [S]

3.89

3.41

13.95%

12.

INTP

Indocement Tunggal Prakarsa Tbk. [S]

3.81

3.37

13.15%

13.

INDF

Indofood Sukses Makmur Tbk. [S]

3.67

3.85

-4.54%

14.

GGRM

Gudang Garam Tbk.

3.28

3.04

7.71%

15.

BDMN

Bank Danamon Indonesia Tbk.

3.02

3.03

-0.32%

16.

ENRG

Energi Mega Persada Tbk.

2.49

0.20

1,120.51%

17.

BSDE

Bumi Serpong Damai Tbk. [S]

2.31

1.04

121.56%

18.

CPIN

Charoen Pokphand Indonesia Tbk. [S]

2.21

2.47

-10.52%

19.

ITMG

Indo Tambangraya Megah Tbk. [S]

2.14

3.48

-38.54%

20.

ADRO

Adaro Energy Tbk. [S]

2.07

3.30

-37.33%

Total of 20 Listed Companies

122.09

118.85

2.73%

Total IDX

181.26

167.63

8.13%

*) 474 companies out of 479 companies listed

14

Top 40 Listed Companies by Comprehensive Income (2)

September 2013* compared to September 2012

No

Code

Total Comprehensive Income

(Trillion Rp)

Listed Companies

30-Sep-13

30-Sep-12

Change

(%)

21.

ICBP

Indofood CBP Sukses Makmur Tbk. [S]

1.94

1.74

11.68%

22.

PNBN

Bank Pan Indonesia Tbk.

1.80

1.90

-5.28%

23.

BTPN

Bank Tabungan Pensiunan Nasional Tbk.

1.79

1.44

24.06%

24.

JIHD

Jakarta International Hotels & Dev. Tbk. [S]

1.76

0.06

3,084.69%

25.

SCBD

Danayasa Arthatama Tbk. [S]

1.75

0.06

3,084.27%

26.

INKP

Indah Kiat Pulp & Paper Tbk.

1.68

0.21

705.59%

27.

MLPL

Multipolar Tbk. [S]

1.68

0.24

602.66%

28.

KLBF

Kalbe Farma Tbk. [S]

1.43

1.27

12.52%

29.

MNCN

Media Nusantara Citra Tbk. [S]

1.36

1.24

9.91%

30.

PTBA

Tambang Batubara Bukit Asam (Persero) Tbk. [S]

1.30

2.21

-40.97%

31.

LPKR

Lippo Karawaci Tbk. [S]

1.30

1.85

-29.63%

32.

ADMF

Adira Dinamika Multi Finance Tbk.

1.24

1.10

12.33%

33.

BNLI

Bank Permata Tbk.

1.23

1.07

14.54%

34.

EMTK

Elang Mahkota Teknologi Tbk.

1.18

3.19

-63.08%

35.

BJBR

BPD Jawa Barat dan Banten Tbk.

1.10

0.95

15.93%

36.

CTRA

Ciputra Development Tbk. [S]

1.03

0.54

91.96%

37.

AKRA

AKR Corporindo Tbk. [S]

1.01

0.59

70.57%

38.

SCMA

Surya Citra Media Tbk. [S]

0.97

0.66

48.51%

39.

JSMR

Jasa Marga (Persero) Tbk. [S]

0.97

1.26

-23.28%

40.

EXCL

XL Axiata Tbk. [S]

0.95

2.19

-56.63%

Total of 40 Listed Companies

149.55

142.59

4.88%

Total IDX

181.26

167.63

8.13%

*) 474 companies out of 479 companies listed

15

16

Comprehensive Income Distributions - by Sectors

September 2013*

BasicIndustry

7.7%

Mining Agriculture

2.50%

1%

Infrastructure

13%

Finance

34%

No

Property

10%

Trade

10%

Top 10 Finance Sector by Comprehensive Income (in Tril Rp)

Code

Listed Companies

Total

Comprehensive

Income

30-Sep-13

Infrastructure

13%

Misc-Ind

10%

% of

Total IDX

1 BBRI

Bank Rakyat Indonesia (Persero) Tbk.

14.42

23.47%

7.96%

2 BMRI

Bank Mandiri (Persero) Tbk.

12.43

20.23%

6.86%

3 BBCA

Bank Central Asia Tbk.

9.18

14.93%

5.06%

4 BBNI

Bank Negara Indonesia (Persero) Tbk.

4.28

6.97%

2.36%

5 BDMN

Bank Danamon Indonesia Tbk.

3.02

4.92%

1.67%

6 PNBN

Bank Pan Indonesia Tbk.

1.80

2.92%

0.99%

7 BTPN

Bank Tabungan Pensiunan Nasional Tbk.

1.79

2.91%

0.99%

8 ADMF

Adira Dinamika Multi Finance Tbk.

1.24

2.02%

0.68%

9 BNLI

Bank Permata Tbk.

1.23

1.99%

0.68%

BPD Jawa Barat dan Banten Tbk.

Total 10 Companies

1.10

1.78%

0.60%

50.48

82.15%

27.85%

Total Finance Sector

61.44

Total of IDX

181.26

10 BJBR

*) 474 companies out of 479 companies listed

% of

Finance

Sector

Comprehensive Income Growth - by Sectors

September 2013* compared to September 2012

Property, Real Estate and

Building Construction

Sep-13

Rp. 18.68 Tril

18.78%

Basic Industry and Chemical

Trade, Services &

Investment

Finance

-4.41%

-6.51%

-17.66%

-52.53%

-81.43%

*) 474 companies out of 479 companies listed

Sep-12

Rp. -7.10 Tril

12.00%

1.46%

Consumer Goods Industry

Miscellaneous Industry

Infrastructure, Utilities &

Transportation

Mining

Agriculture

17

Bond Trading Activities

INDONESIA STOCK EXCHANGE PERFORMANCE

19

Bond Trading Activities

2004 February 2014

Corporate Bond

Outstanding

Year

Listed & Traded

(Miliar Rp)

Government Bond

Outstanding

Daily Average Transactions

Volume

(Miliar Rp)

Frequency

(X )

Year

Listed & Traded

(Miliar Rp)

Daily Average Transactions

Volume

(Miliar Rp)

Frequency

(X)

2004

61,300

71.98

21

2004

399,304

2,128.58

112

2005

62,891

98.55

21

2005

399,859

2,144.05

100

2006

67,806

138.18

11

2006

418,751

1,216.22

134

2007

84,553

282.98

63

2007

475,578

5,062.87

227

2008

73,979

219.30

50

2008

525,695

3,833.48

206

2009

88,330

162.89

41

2009

574,659

3,224.12

218

2010

115,348

364.02

70

2010

641,215

6,794.50

381

2011

146,969

511.69

73

2011

723,606

7,950.45

433

2012

189,443

650.89

103

2012

820,266

8,113.32

552

2013

218,220

751.90

81

2013

995,252

7,602.17

492

2014 *

219,155

614.39

71

2014 *

1,063,923

9,954.56

592

*) February 2014

20

Bond Ownership Distributions

March 2014 (in Trillion Rp)

Government Bond Ownership

Corporate Bond Ownership

Individual Foundation

2.59

Others 5.48

1.23%

2.60%

5.74

2.72%

Corporate

12.51

5.93%

Insurance

33.91

16.07%

Mutual Fund

42.32

20.06%

Securities

Company

1.07

0.51%

Pension Fund

61.14

28.98%

Individual

Pension Fund 39.66

44.15

3.70%

4.12%

Others

45.75

4.26%

BI

30.44

2.84%

Securities

Company

0.83

0.08%

Mutual Fund

49.72

4.63%

Bank

360.91

33.64%

Insurance

Company

141.28

13.17%

Financial Inst

46.24

21.92%

Source : Indonesia Central Securities Depository (KSEI)

Foreign

359.99

33.56%

Source : Indonesian Debt Management Office (DJPU)

21

Mutual Fund Asset Allocations

Total Net Asset Value (NAV) January 2014: Rp199.77 Trillion

Index

Sharia-Fixed Income Sharia-Protection

Sharia-Index

0.52

0.33

1.40

ETF-Equity

0.34

0.26%

0.17%

Sharia-Equity

0.70%

0.38

0.17%

2.56

0.19%

1.28%

Sharia-Mixed

1.59

0.80%

Sharia-Mixed

4.56

2.28%

Mixed

Money Market

Equity

19.45

13.25

84.50

9.74%

6.63%

42.30%

Fixed Income

28.54

14.29%

Capital Protection

Fund

42.21

21.13%

Source : OJK

ETF-Equity

0.11

0.06%

Sharia-money

market

0.03

0.02%

IDX Comparative Performance

PERFORMANCE OF IDX AMONG

REGIONAL EXCHANGE

23

JCI in Comparison to Regional Indices Performance

2012 17 April 2014

2012

2013

Change

12-13

2014*

Change

13-14*

IDX

Indonesia Stock Exchange (IDX)

4,316.687

4,274.177

-0.98%

4,897.052

14.57%

PSE

Philippine Stock Exchange

5,812.730

5,889.830

1.33%

6,671.180

13.27%

SET

Stock Exchange of Thailand (SET)

1,391.930

1,298.710

-6.70%

1,408.780

8.48%

BSE

Bombay Stock Exchange (BSE)

19,513.450

21,127.730

8.27%

22,626.030

7.09%

SGX

Singapore Exchanges (SGX)

3,167.080

3,153.290

-0.44%

3,253.800

3.19%

SSE

Shanghai Stock Exchange (SSE)

2,269.128

2,097.530

-7.56%

2,098.885

0.06%

DJI

Dow Jones (DJI)

13,104.140

16,478.410

25.75%

16,424.850

-0.33%

KRX

Korea Exchanges (KRX)

1,997.050

2,011.340

0.72%

1,992.050

-0.96%

BM

Bursa Malaysia (BM)

1,688.950

1,872.520

10.87%

1,850.540

-1.17%

22,656.920

23,244.870

2.60%

22,760.240

-2.08%

5,897.810

6,742.880

14.33%

6,567.500

-2.60%

10,395.180

16,291.310

56.72%

14,417.530

-11.50%

HKeX

Hong Kong Exchanges (HKeX)

FT100

UK (FT100)

TSE

*) 17 April 2014

Tokyo Stock Exchange (TSE)

24

Growth of Regional Indices

2007 17 April 2014

150.00%

125.00%

100.00%

75.00%

50.00%

25.00%

-0.00%

-25.00%

-50.00%

-75.00%

2007

2008

2009

2010

2011

2012

2013

17-Apr-14

Indonesia

52.08%

-50.64%

86.98%

46.13%

3.20%

12.94%

-0.98%

14.57%

Thailand

26.22%

-47.56%

63.25%

40.60%

-0.72%

35.76%

-6.70%

8.48%

Korea

32.25%

-40.73%

49.65%

21.88%

-10.98%

9.38%

0.72%

-0.96%

Malaysia

31.82%

-39.33%

45.17%

19.34%

0.78%

10.34%

10.87%

-1.17%

Singapore

16.07%

-49.17%

64.49%

10.09%

-17.04%

19.68%

-0.44%

3.19%

Jepang (Nikkei 225)

-11.13%

-42.12%

19.04%

-3.01%

-17.34%

22.94%

56.72%

-11.50%

Hong Kong

39.31%

-48.27%

52.02%

5.32%

-19.97%

22.91%

2.60%

-2.08%

USA (Dow Jones)

6.43%

-33.84%

18.82%

11.02%

5.53%

7.26%

25.75%

-0.33%

Inggris (FT100)

3.80%

-31.33%

22.07%

9.00%

-5.55%

5.84%

14.33%

-2.60%

Shanghai

96.66%

-65.39%

79.98%

-14.31%

-21.68%

3.17%

-7.56%

0.06%

India (Mumbai)

47.15%

-52.45%

81.03%

17.43%

-24.64%

26.26%

8.27%

7.09%

Philippine

21.43%

-48.29%

63.00%

37.62%

4.07%

32.95%

1.33%

13.27%

25

Market Cap Among Asia-Pacific Region Exchanges

16 April 2014 (Billion USD)

4,280

3,452

3,365

1,429

1,244

1,231

605

TSE

IDX

KRX

SET

BM

SGX

TSE

HKEX

SSE

BSE

ASX

PSE

Source : Bloomberg

HKEX

:

:

:

:

:

:

:

:

:

:

:

SSE

ASX

Indonesia Stock Exchange

Korea Exchange

Stock Exchange of Thailand

Bursa Malaysia

Singapore Exchanges

Tokyo Stock Exchange

Hong Kong Exchanges

Shanghai Stock Exchange

Mumbai Stock Exchange

Australia Stock Exchange

Philippine Stock Exchange

BSE

KRX

SGX

513

423

379

BM

IDX

SET

HKEX

20.12%

237

PSE

SSE

19.61%

ASX

8.33%

TSE

24.94%

PSE

1.38%

BSE

7.25%

KRX

7.17%

SET

2.21%

SGX

BM

IDX 2.99% 3.53%

2.47%

26

Market Capitalization to GDP Ratio In Asia

224%

253%

2011

2012

2013

Singapore

Malaysia

India

Source : World Economic Outlook & Bloomberg

Japan

Australia

Thailand

Philippines

Indonesia

18%

36%

37%

41%

48%

45%

81%

69%

93%

92%

102%

77%

93%

88%

80%

61%

60%

65%

55%

94%

131%

163%

151%

137%

179%

Capital market penetration in Indonesia

Is relatively low in Asia ...

China

Summary

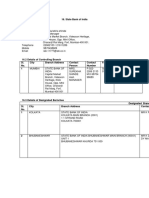

IDX MARKET HIGHLIGHT

28

IDX Statistical Highlight

April 17, 2014

2007

2008

2009

2010

2011

2012

2013

2014

2,745.826

383

2

22

8

1,988.33

211.10

1,039.54

1,050.15

114.93

11,861

246

1,355.408

396

2

19

6

1,076.49

98.31

787.85

1,064.53

112.57

13,417

240

2,534.356

398

2

13

11

2,019.38

214.08

1,467.66

975.13

96.20

20,977

241

3,703.512

420

2

23

1

3,247.10

361.67

1,330.87

1,176.24

129.78

25,919

245

3,821.992

440

2

25

5

3,537.29

390.09

1,203.55

1,223.44

140.50

28,023

247

4,316.687

459

3

23

4

4,126.99

426.78

1,053.76

1,116.11

119.02

29,941

246

4,274.177

483

5

1

31

7

4,219.02

343.85

1,342.66

1,522.12

147.83

37,499

244

4,897.052

493

6

1

10

4,848.86

424.67

355.11

446.87

38.24

15,836

72

4,225.78

4,268.92

467.21

48,216

3,282.69

4,435.53

469.05

55,905

6,089.87

4,046.20

399.18

87,040

5,432.10

4,800.97

529.70

105,790

4,872.67

4,953.20

568.84

113,454

4,283.59

4,537.05

483.83

121,712

5,502.69

6,238.21

605.86

153,686

4,932.08

6,206.55

531.17

219,943

102

556.81

477.75

79.07

105.00

90

598.70

525.69

73.01

-

85

670.64

581.75

88.90

-

86

757.06

641.21

115.84

-

96

870.58

723.61

146.97

80.00

99

1,009.71

820.27

189.44

100.00

106

1,215.79

995.25

220.58

290.00

105

1,292.29

1,072.74

219.55

640.00

48.90

16.87

29.50

2.53

116.96

82.98

24.39

56.61

1.98

103.34

14.91

3.85

8.56

2.50

124.25

79.71

29.68

48.16

1.87

161.60

62.31

19.59

42.14

0.58

208.35

29.96

10.14

18.19

1.64

266.91

57.81

16.75

38.80

2.26

323.01

6.71

2.89

3.59

0.23

94.45

86.76

30.20

165.86

90.48

12.86

186.32

94.57

29.68

139.17

122.53

39.07

241.31

163.12

45.23

80.00

270.66

197.55

69.36

20.00

296.87

264.44

58.56

190.00

380.82

91.70

2.75

350.00

101.16

EQUITY

Composite Index

Number of Listed Companies

Number of ETF

Number of REIT

Number of New Stock Issuers

Delisted Companies

Market Capitalization (trill. Rp)

Market Capitalization (bill. US$)

Trading Volume (bill. shares)

Trading Value (trill. Rp)

Trading Value (bill. US$)

Number of Trades (th. times)

Number of Trading Days

Average Daily Trading:

Volume (mill. shares)

Value (bill. Rp)

Value (mill. US$)

Number of Transaction

BOND

Issuers of Corporate Bonds

Total Outstanding (trill. Rp)

Government Bonds & Sukuk

Corporate Bonds, Sukuk & ABS

USD Bonds Outstanding (mill. US$)

FUND RAISED

Equity (trill. Rp)

Equity IPO

Rights

Warrant

Bond (trill. Rp)

Government Bonds & Sukuk IPO

Corporate Bonds, Sukuk & ABS IPO

USD Bonds IPO (mill. USD)

Total Fund Raised (tril Rp)*

* : Only Securities Denominated in Rupiah

Thank You

Potrebbero piacerti anche

- Wiley Insight IFRS Conceptual FrameworkDocumento14 pagineWiley Insight IFRS Conceptual FrameworkAmeliaErfaNessuna valutazione finora

- Comprehensive Income StatementDocumento4 pagineComprehensive Income StatementAmeliaErfaNessuna valutazione finora

- Sia-Exerciseac412 (Task 2)Documento9 pagineSia-Exerciseac412 (Task 2)AmeliaErfaNessuna valutazione finora

- Accounting Information Systems: 9 EditionDocumento58 pagineAccounting Information Systems: 9 EditionAmeliaErfaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- A. Choose The Correct Answer by Crossing (X) A, B, C or D! Pilihlah Jawaban Yang Benar Dengan Memberi Tanda Silang (X) Pada A, B, C Atau D!Documento9 pagineA. Choose The Correct Answer by Crossing (X) A, B, C or D! Pilihlah Jawaban Yang Benar Dengan Memberi Tanda Silang (X) Pada A, B, C Atau D!Airita SolehahNessuna valutazione finora

- Invoice Oo1 OctDocumento1 paginaInvoice Oo1 OctUbuntu AakashNessuna valutazione finora

- Techser Power Solutions Pvt. Ltd.Documento2 pagineTechser Power Solutions Pvt. Ltd.Ritam BhattacharjeeNessuna valutazione finora

- Bank's IFSCsDocumento32.767 pagineBank's IFSCsamanish05100% (1)

- Centac Reembrasement 2011-12 (Fresh)Documento111 pagineCentac Reembrasement 2011-12 (Fresh)Kali Kumar VardhineediNessuna valutazione finora

- Our International Network: BankingDocumento4 pagineOur International Network: BankingLaura ParkaNessuna valutazione finora

- FeesDocumento2 pagineFeesRaye Rhouieze MirandaNessuna valutazione finora

- FIRMS ContactsDocumento25 pagineFIRMS Contactspratyush1200Nessuna valutazione finora

- Yearwise Regular Coins of Republic IndiaDocumento9 pagineYearwise Regular Coins of Republic IndiaFarook Mohideen100% (1)

- SLBCDocumento1 paginaSLBCyogesh shingareNessuna valutazione finora

- Naadi Rate World CurrenciesDocumento14 pagineNaadi Rate World CurrenciesSamruddhi jadhavNessuna valutazione finora

- Apex Banks of 20 CountriesDocumento12 pagineApex Banks of 20 Countrieskarthik0407Nessuna valutazione finora

- Currency ListDocumento5 pagineCurrency Listanon_878976340100% (1)

- Simbol, Rosalie-ComboDocumento6 pagineSimbol, Rosalie-ComboFrederick SimbolNessuna valutazione finora

- OCS Group India Pvt. LTDDocumento12 pagineOCS Group India Pvt. LTDNivedan KothekarNessuna valutazione finora

- SbiDocumento70 pagineSbiAnshul AgarwalNessuna valutazione finora

- Planning CommissionDocumento2 paginePlanning Commission26amitNessuna valutazione finora

- Rsia. Puri Betik Hati Billing Statement SummaryDocumento39 pagineRsia. Puri Betik Hati Billing Statement Summaryyayang indah100% (1)

- Tax Collection On GST Portal 2019 2020Documento16 pagineTax Collection On GST Portal 2019 2020Disha MohantyNessuna valutazione finora

- Pricelist Corral @malibu As of Feb, 3Rd 2020 DP 1X: Dalam Ribuan Rupiah (,000)Documento14 paginePricelist Corral @malibu As of Feb, 3Rd 2020 DP 1X: Dalam Ribuan Rupiah (,000)AlvianNessuna valutazione finora

- HƯỚNG DẪN SỬ DỤNG BIẾN TẦN FRENIC-ACE - CHƯƠNG 2 LẮP ĐẶT PDFDocumento64 pagineHƯỚNG DẪN SỬ DỤNG BIẾN TẦN FRENIC-ACE - CHƯƠNG 2 LẮP ĐẶT PDFcauvongkhongmauNessuna valutazione finora

- 2022 World Currency Symbols, Names & Codes - EurochangeDocumento10 pagine2022 World Currency Symbols, Names & Codes - EurochangeTayyab SaleemNessuna valutazione finora

- OIAL High Yld and Distressed Pricing - 30 Apr '19Documento19 pagineOIAL High Yld and Distressed Pricing - 30 Apr '19SSNessuna valutazione finora

- Ex Commodity Floating Ex-Commodity Pegged Developed Float Code Developed (Excom) Peg CodeDocumento5 pagineEx Commodity Floating Ex-Commodity Pegged Developed Float Code Developed (Excom) Peg CodeGiandri NugrohoNessuna valutazione finora

- Banking Seminar Report Sem 1Documento6 pagineBanking Seminar Report Sem 1Farukh ShaikhNessuna valutazione finora

- Summary of Account As On 30-11-2022 I. Operative Account in INRDocumento25 pagineSummary of Account As On 30-11-2022 I. Operative Account in INRAntony SureshNessuna valutazione finora

- List of Banks Enabled For Epayeezz Registration As Per Mfu / Npci With Various Modes of Registrations SR - No. Bank Name Net Banking Debit CardDocumento2 pagineList of Banks Enabled For Epayeezz Registration As Per Mfu / Npci With Various Modes of Registrations SR - No. Bank Name Net Banking Debit CardJpNessuna valutazione finora

- Banks Enabled For Customer Payment Through RTGSDocumento5.262 pagineBanks Enabled For Customer Payment Through RTGSkenshai1Nessuna valutazione finora

- CBSE Class 3 Mathematics Worksheet (47) - Indian CurrencyDocumento3 pagineCBSE Class 3 Mathematics Worksheet (47) - Indian Currencyarshi banuNessuna valutazione finora

- 5.-Abstract-of-Canvass GRASS CUTTERDocumento2 pagine5.-Abstract-of-Canvass GRASS CUTTERAřčhäńgël KäśtïelNessuna valutazione finora