Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reinsurance

Caricato da

Jay KoliDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reinsurance

Caricato da

Jay KoliCopyright:

Formati disponibili

REINSURANCE IN INDIA

Presented By:

Rohit Ranganathan

WHAT IS REINSURANCE?

In simple terms reinsurance is insurance for

insurance companies.

It is a means by which an insurance company can

protect itself from risks.

The company who requests for the cover is called

the cedant and the reinsurer is called the ceded.

Risk Transfer

Greater individual risks than its size

Offer higher limits of protection to a policyholder

Income Smoothing

Absorbing larger losses

Surplus relief

Solvency Margin

Arbitrage

Price differential between two or more markets

Reinsurers Expertise

Manageable and Profitable Portfolio

Managing Cost of Capital

Capital In terms of Reinsurance

WHY REINSURANCE

How Reinsurance Works

Transfer Of

Risk

Risk Takers

Middle

Persons

Insurance

Policy

Holders

Insurance

Companies

Reinsurance

Companies

Agents

Brokers

Reinsurance

Intermediaries

TYPES OF REINSURANCE

There are two types of reinsurance:

Facultative

Treaty

Each type of reinsurance can be structured in one

of the following two ways:

Proportional

Non Proportional

FACULTATIVE REINSURANCE

Facultative reinsurance applies to an individual risk,

i.e., one commercial fire policy or even only one

location.

Insurer and reinsurer agree to the reinsurance terms

on each individual agreement.

It is generally used to reinsure:

a) Extra-hazardous or unusual risks which might be

excluded from treaty reinsurance agreements.

b) High valued risks with policy limits exceeding

maximum treaty parameters.

TREATY REINSURANCE

Applies to an insurance companys entire book of

business.

Some of these include all commercial fire polices, all

automobile policies, all workers compensation

policies, all homeowners policies, or, more generally,

any combination of the above.

Treaty reinsurance is the one in which both pro-data

and excess of loss forms are used.

PROPORTIONAL REINSURANCE

One or more reinsurers take a stated percent share

of each policy that an insurer produces.

The reinsurer will receive the stated percentage of

each dollar of premiums and will pay that percentage

of each dollar of losses.

Example: Surplus share: Reinsurer assumes pro

rata responsibility for only that portion of any risk

which exceeds the companys established retentions.

NON PROPORTIONAL REINSURANCE

This insurance responds when the loss suffered by the

insurer exceeds a certain amount.

Example:

The insurer is prepared to accept a loss of $1 million for any

loss which may occur and they purchase a layer of reinsurance

of $4 million in excess of $1 million. If a loss of $3 million

occurs, then insurer will retain 1Million and will recover $2

million from its reinsurer(s).In this example, the reinsured

will retain any loss exceeding $5 million unless they have

purchased a further excess layer (second layer) of say $10

million excess of $5 million.

Reinsurance the Reinsurance companies.

Reinsurance seller is Retrocessionaries

Reinsurance buyer is Retrocedant

RETROCESSION

WAYS TO REINSURE

Pooled Reinsurance

Reciprocity

Subsidies

The sole domestic reinsurance company of India

AAA+ Rating

Incorporated on 22 November 1972

Subsidiary companies of GIC

National Insurance Company Limited

The New India Assurance Company Limited

The Oriental Insurance Company Limited

United India Insurance Company Limit

GIC Asset Management to manage

GIC Mutual Fund

GIC Housing Finance

Export Credit Guarantee Corporation

Business Of GIC

Domestic Reinsurance Business(73% of the Revenues

GIC + Hannover Deal (60:40) Life Insurance

International Reinsurance Business (27% of the Revenues)

Investment and Fund Management

GENERAL INSURANCE CORPORATION (GIC)

20% of each policy with reinsurance company

Inter-company cession between four public sector

companies.

First GIC and then International companies.

Insurance company to inform before 45 Days.

Not more than 10% of reinsurance premium to be

placed with one re-insurer.

No re-insurer will have a rating of less than BBB from

standard and poor

REINSURANCE REGULATION IN INDIA - IRDA

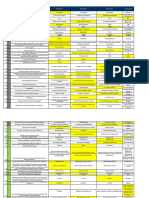

In Rs. Crores 2008-2009 2007-2008 % Change

Net Profit 1407 992.7 41.75

Net Premium 7402.3 6750.8 18.71

Gross Premium 8061.13 7981.9 1.4

Solvency Margin 3.67% 3.36% -

Net Incurred

Claims

6217.1 4582.95 35.65

Income from

Investment

1785.8 - -

Investments 21,714 - -

FINANCIAL RESULTS

CLASS WISE EARNINGS FOR YEAR 2007-2008

Earned Premium: Incurred Claims:

CLASS WISE EARNINGS FOR YEAR 2007-2008

1.Misc

Covers are not available for liability, professional

indemnities, financial risks, oil and energy etc.

International competitors dont quote for small ticket

deals

Premium rates are costlier as foreign competitors quote

more

Desirable quotes from the Indian market are not

available with promptitude

Different dates of finalization of accounts globally

Reinsurance cover for terrorist attacks is still a debate

CHALLENGES FOR REINSURANCE INDUSTRY IN

INDIAN MARKET

CASE STUDIES: CASE 1 PREMIER INSURANCE

COMPANY IN GUJARAT

CASE STUDIES: CASE 2 REINSURANCE ON

TERRORISM

Earthquake in 2001 followed by floods

600 Crores of losses

Stop the business / receive help

GIC to Rescue

Socially being responsible by giving incentives and clearing out dues

WTC Attack

Effect on Indian Industry

What next???

Pool GIC, 4 Subsidiary & 6 Private companies

200 Crores Pool Which is too less

New development regarding this Debate still on

Potrebbero piacerti anche

- Wedgeworth Sentencing MemorandumDocumento218 pagineWedgeworth Sentencing MemorandumActionNewsJaxNessuna valutazione finora

- MCQ Chapter5645644645632Documento15 pagineMCQ Chapter5645644645632bharath834Nessuna valutazione finora

- Motor OD Manual - Underwriting & Calims PDFDocumento201 pagineMotor OD Manual - Underwriting & Calims PDFMani Rathinam100% (1)

- RI GlossaryDocumento33 pagineRI Glossarynk2k100% (1)

- Cirrus 5.0 Installation Instructions EnglishDocumento62 pagineCirrus 5.0 Installation Instructions EnglishAleksei PodkopaevNessuna valutazione finora

- Essentials of Life InsuranceDocumento15 pagineEssentials of Life InsuranceAayush AgrawalNessuna valutazione finora

- Ic33 Print Out 660 English PDFDocumento54 pagineIc33 Print Out 660 English PDFumesh100% (1)

- Chapter 03 - Principles & Practice of Life InsuranceDocumento21 pagineChapter 03 - Principles & Practice of Life InsuranceShubham GuptaNessuna valutazione finora

- Life Insurance, Marine Insurance, Fire Insurance, Business Insurance ProgramsDocumento10 pagineLife Insurance, Marine Insurance, Fire Insurance, Business Insurance Programsvijayadarshini vNessuna valutazione finora

- Rnis College of Insurance: New Ic 33 - Model Test 4Documento6 pagineRnis College of Insurance: New Ic 33 - Model Test 4Raj Kumar DepalliNessuna valutazione finora

- Credit Point SystemDocumento3 pagineCredit Point Systemshanmuga89Nessuna valutazione finora

- And Development Authority of India: Insurance RegulatoryDocumento21 pagineAnd Development Authority of India: Insurance RegulatoryHaseef LoveforeverNessuna valutazione finora

- Miscellaneous InsuranceDocumento27 pagineMiscellaneous InsuranceRavneet KaurNessuna valutazione finora

- Motor InsuranceDocumento66 pagineMotor InsuranceVijay86% (7)

- Principles of InsuranceDocumento2 paginePrinciples of Insurancepsawant77Nessuna valutazione finora

- Mock TestDocumento11 pagineMock TestSnehil SinghNessuna valutazione finora

- Free Irda Ic 38 Insurance Agents GeneralDocumento12 pagineFree Irda Ic 38 Insurance Agents GeneralShabaz AliNessuna valutazione finora

- INS21 - Q N ADocumento28 pagineINS21 - Q N AMiniP.Kumar100% (1)

- Insurance SectorDocumento45 pagineInsurance Sectorverma786786100% (1)

- A. Life Insurance Contractual ProvisionsDocumento23 pagineA. Life Insurance Contractual ProvisionsMadhu dollyNessuna valutazione finora

- IC-38 - Short Notes Life QPDocumento137 pagineIC-38 - Short Notes Life QPkuntal199Nessuna valutazione finora

- QUESTION One (Multiple Choice) : Insurance Company OperationsDocumento14 pagineQUESTION One (Multiple Choice) : Insurance Company Operationsmamush fikaduNessuna valutazione finora

- Insurance and Risk ManagementDocumento140 pagineInsurance and Risk Managementgg100% (1)

- Ic 57 Fire Insurane One LinerDocumento14 pagineIc 57 Fire Insurane One Linerprabhat87aish50% (2)

- Life Insurance Policies and Classifications 2Documento15 pagineLife Insurance Policies and Classifications 2kavyaNessuna valutazione finora

- Motor Tariff Gist - Study MaterialDocumento9 pagineMotor Tariff Gist - Study MaterialSadasivuni007Nessuna valutazione finora

- Employee Benefits: Qualified Retirement Plans: OverviewDocumento14 pagineEmployee Benefits: Qualified Retirement Plans: OverviewAtticus SinNessuna valutazione finora

- Rnis College of Insurance: New Ic 33 - Model Test 3Documento6 pagineRnis College of Insurance: New Ic 33 - Model Test 3Raj Kumar DepalliNessuna valutazione finora

- Mock Test AnswersDocumento19 pagineMock Test Answerstoll_meNessuna valutazione finora

- Unit 5 - Sbaa7001 Insurance Intermediaries and RegulationsDocumento45 pagineUnit 5 - Sbaa7001 Insurance Intermediaries and RegulationsGracy100% (1)

- Question Answer FINALDocumento47 pagineQuestion Answer FINALLalit Barhate78% (9)

- IRDA Workbook PDFDocumento662 pagineIRDA Workbook PDFNancy Singh100% (1)

- Basic of Reinsurance 03 June 21 Munch ReDocumento24 pagineBasic of Reinsurance 03 June 21 Munch ReFernand DagoudoNessuna valutazione finora

- IC-24 - Legal Aspects of Life AssuranceDocumento1 paginaIC-24 - Legal Aspects of Life Assuranceaman vermaNessuna valutazione finora

- INS21 Chapter 2Documento30 pagineINS21 Chapter 2Pallavi Kammaje SeetharamNessuna valutazione finora

- Facultative Reinsurance PDFDocumento2 pagineFacultative Reinsurance PDFLindsay0% (1)

- Legal Aspects of Indian BusinessDocumento124 pagineLegal Aspects of Indian BusinessGuruKPO100% (3)

- Reinsurance Guidelines - Ir Guid 14 10 0017Documento11 pagineReinsurance Guidelines - Ir Guid 14 10 0017Steven DreckettNessuna valutazione finora

- IC38 SushantDocumento46 pagineIC38 SushantAyush BhardwajNessuna valutazione finora

- Chapter:-1 Introduction of Insurance: Introduction To Service SectorDocumento56 pagineChapter:-1 Introduction of Insurance: Introduction To Service SectorDinesh RominaNessuna valutazione finora

- Chapter 9 Test Risk ManagementDocumento18 pagineChapter 9 Test Risk ManagementNicole LabbaoNessuna valutazione finora

- Fire & Consequential Loss Insurance 57Documento15 pagineFire & Consequential Loss Insurance 57surjith rNessuna valutazione finora

- Question 1bDocumento14 pagineQuestion 1bPankaj GuptaNessuna valutazione finora

- Motor Insurance Study Material FinalDocumento67 pagineMotor Insurance Study Material FinalsekkilarjiNessuna valutazione finora

- Indemnity and Guarantee PPT LawDocumento8 pagineIndemnity and Guarantee PPT LawMuhammad Khawaja100% (1)

- B. Principle of Insurance - 6Documento28 pagineB. Principle of Insurance - 6Han HanNessuna valutazione finora

- Industrial Project On Reliance Life Insurance Company LimitedDocumento116 pagineIndustrial Project On Reliance Life Insurance Company LimitedTimothy Brown100% (1)

- Risk Management Solution Manual Chapter 04Documento6 pagineRisk Management Solution Manual Chapter 04hawlkar100% (1)

- Ic 72Documento1 paginaIc 72Sandeep NehraNessuna valutazione finora

- Insurance Objective Qtn&AnsDocumento26 pagineInsurance Objective Qtn&AnsSsengondo100% (1)

- 613a - Principles of Insurance IIDocumento23 pagine613a - Principles of Insurance IIRavi ShankarNessuna valutazione finora

- New Syllabus PDFDocumento77 pagineNew Syllabus PDFPrashantNessuna valutazione finora

- Insurance Law in IndiaDocumento44 pagineInsurance Law in IndiaVaibhav AhujaNessuna valutazione finora

- Department of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IDocumento18 pagineDepartment of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IAman SharmaNessuna valutazione finora

- ReinsuranceDocumento14 pagineReinsuranceKrishnanunni VijayakumarNessuna valutazione finora

- New Black Book General Insurance 2017Documento69 pagineNew Black Book General Insurance 2017Siddhesh VarerkarNessuna valutazione finora

- 88 - IC-Marketing-and-Public-RelationsDocumento1 pagina88 - IC-Marketing-and-Public-RelationsVINAY S N33% (3)

- Reinsurance in IndiaDocumento30 pagineReinsurance in IndiaRahul JainNessuna valutazione finora

- Reinsurance Industry in IndiaDocumento18 pagineReinsurance Industry in Indiapriyank2380804621100% (12)

- Introduction To ReinsuranceDocumento27 pagineIntroduction To Reinsurancebhushanvelapure100% (1)

- What Is Reinsurance?Documento62 pagineWhat Is Reinsurance?Dr S Rajesh KumarNessuna valutazione finora

- General InsuranceDocumento100 pagineGeneral InsuranceShivani YadavNessuna valutazione finora

- OperationDocumento3 pagineOperationJay KoliNessuna valutazione finora

- 3rd RoundApplication Form Part Time 2017 2020 2nd RoundDocumento7 pagine3rd RoundApplication Form Part Time 2017 2020 2nd RoundJay KoliNessuna valutazione finora

- SCSS MarketingDocumento3 pagineSCSS MarketingJay KoliNessuna valutazione finora

- Python WorkDocumento4 paginePython WorkJay KoliNessuna valutazione finora

- OperationDocumento3 pagineOperationJay KoliNessuna valutazione finora

- Statistics Basics For Data Science Cheat Sheet: Property Formula What To RememberDocumento1 paginaStatistics Basics For Data Science Cheat Sheet: Property Formula What To RemembernimarNessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- Eco Presentation - 27122019Documento33 pagineEco Presentation - 27122019Jay KoliNessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- ER Ch05 Solution ManualDocumento14 pagineER Ch05 Solution Manualsupering143Nessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- Accounts ProjectDocumento5 pagineAccounts ProjectJay KoliNessuna valutazione finora

- Research DesignDocumento16 pagineResearch DesignJay KoliNessuna valutazione finora

- 2a ProductionDocumento24 pagine2a ProductionJay KoliNessuna valutazione finora

- Problems of NPADocumento3 pagineProblems of NPAJay KoliNessuna valutazione finora

- National Accreditation Board For Testing and Calibration LaboratoriesDocumento1 paginaNational Accreditation Board For Testing and Calibration LaboratoriesJay KoliNessuna valutazione finora

- IDFC FIRST - Bank - Annual - Report - 2019 PDFDocumento292 pagineIDFC FIRST - Bank - Annual - Report - 2019 PDFJay KoliNessuna valutazione finora

- IDFC FIRST - Bank - Annual - Report - 2019 PDFDocumento292 pagineIDFC FIRST - Bank - Annual - Report - 2019 PDFJay KoliNessuna valutazione finora

- ImcDocumento20 pagineImcJay KoliNessuna valutazione finora

- Final Project ArbitrageDocumento43 pagineFinal Project ArbitrageJay KoliNessuna valutazione finora

- Employee Motivation Research Project LibreDocumento28 pagineEmployee Motivation Research Project LibreMoeshfieq WilliamsNessuna valutazione finora

- Circular No 146ADocumento60 pagineCircular No 146APrakash GanesanNessuna valutazione finora

- RbiDocumento7 pagineRbiJay KoliNessuna valutazione finora

- ISO-8859-1 Business LawDocumento61 pagineISO-8859-1 Business Lawshree601Nessuna valutazione finora

- ApecDocumento1 paginaApecJay KoliNessuna valutazione finora

- Toothpaste Brands - A Study of Consumer BehaviorDocumento13 pagineToothpaste Brands - A Study of Consumer BehaviorKrupa NavadiaNessuna valutazione finora

- Upload ScribdDocumento44 pagineUpload ScribdJay KoliNessuna valutazione finora

- Departmentofbusinessmanagement 121010095539 Phpapp02Documento27 pagineDepartmentofbusinessmanagement 121010095539 Phpapp02AnjnaKandariNessuna valutazione finora

- Israeli Decision MakingDocumento204 pagineIsraeli Decision MakingAmirul Asyraf100% (1)

- 0053 SoftDocumento344 pagine0053 SoftManish KumarNessuna valutazione finora

- 3.1 Geographical Extent of The Foreign Exchange MarketDocumento8 pagine3.1 Geographical Extent of The Foreign Exchange MarketSharad BhorNessuna valutazione finora

- Historical Background of The PNPDocumento1 paginaHistorical Background of The PNPGloria AsuncionNessuna valutazione finora

- Right To Social JusticeDocumento13 pagineRight To Social Justicejooner45Nessuna valutazione finora

- TRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseDocumento2 pagineTRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseBea Clarence IgnacioNessuna valutazione finora

- El Presidente - Film AnalysisDocumento4 pagineEl Presidente - Film AnalysisMary AshleyNessuna valutazione finora

- Advintek CP 1Documento6 pagineAdvintek CP 1mpathygdNessuna valutazione finora

- Student School PoliciesDocumento2 pagineStudent School Policiesapi-320463853Nessuna valutazione finora

- The Birds of Pulicat Lake Vs Dugarajapatnam PortDocumento3 pagineThe Birds of Pulicat Lake Vs Dugarajapatnam PortVaishnavi JayakumarNessuna valutazione finora

- Confidentiality Statement 02Documento1 paginaConfidentiality Statement 02Herbert KaplanNessuna valutazione finora

- ANSYS Meshing Users GuideDocumento520 pagineANSYS Meshing Users GuideJayakrishnan P SNessuna valutazione finora

- Rule 119-127Documento10 pagineRule 119-127xychotic100% (1)

- NEW GL Archiving of Totals and DocumentsDocumento5 pagineNEW GL Archiving of Totals and Documentsantonio xavierNessuna valutazione finora

- The English School of ThoughtDocumento2 pagineThe English School of ThoughtSetyo Aji PambudiNessuna valutazione finora

- GodsBag Invoice PDFDocumento1 paginaGodsBag Invoice PDFambarsinghNessuna valutazione finora

- KASDocumento83 pagineKASJALALUDHEEN V KNessuna valutazione finora

- It's That Time of Year Again - Property Tax Payments Due: VillagerDocumento16 pagineIt's That Time of Year Again - Property Tax Payments Due: VillagerThe Kohler VillagerNessuna valutazione finora

- Stanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11Documento81 pagineStanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11stanwichNessuna valutazione finora

- United States v. Salvatore Salamone, 902 F.2d 237, 3rd Cir. (1990)Documento6 pagineUnited States v. Salvatore Salamone, 902 F.2d 237, 3rd Cir. (1990)Scribd Government DocsNessuna valutazione finora

- CPC Foriegn JudgmentDocumento13 pagineCPC Foriegn JudgmentmehakNessuna valutazione finora

- CHAPTER 7:, 8, & 9 Group 3Documento25 pagineCHAPTER 7:, 8, & 9 Group 3MaffyFelicianoNessuna valutazione finora

- Presidential Decree No. 1829, S. 1981 - Official Gazette of The Republic of The PhilippinesDocumento4 paginePresidential Decree No. 1829, S. 1981 - Official Gazette of The Republic of The PhilippinesXean Min KuNessuna valutazione finora

- Motion For Preliminary InjunctionDocumento4 pagineMotion For Preliminary InjunctionElliott SchuchardtNessuna valutazione finora

- Kinds of CorporationDocumento1 paginaKinds of Corporationattyalan50% (2)

- DarapelDocumento2 pagineDarapelChristian ChetcutiNessuna valutazione finora

- Create An Informational Flyer AssignmentDocumento4 pagineCreate An Informational Flyer AssignmentALEEHA BUTTNessuna valutazione finora

- Chapter 1 - Electricity and MagnetismDocumento41 pagineChapter 1 - Electricity and MagnetismDarwin Lajato TipdasNessuna valutazione finora