Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

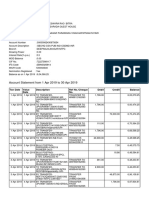

Balance Sheet and Ratio Analysis of A Bank

Caricato da

ArchanaHegde0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

112 visualizzazioni52 paginebank balance sheet analysis

Titolo originale

Balance Sheet and Ratio Analysis of a Bank

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentobank balance sheet analysis

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

112 visualizzazioni52 pagineBalance Sheet and Ratio Analysis of A Bank

Caricato da

ArchanaHegdebank balance sheet analysis

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 52

Presented by

9164 Jenovah Carl Fernandes

9117 Ashwini Jadhav

9108 Amit Bhamare

1

Balance Sheet

Of

A bank

2

A Snap Shot

A photograph of financial worth of

the concern at certain time.

The study of the balance sheet reveal

whether the business of the

bank is healthy and growing and

has a promising future or not

3

What is Balance Sheet

Liquid Assets

Loans

Marketable Securities

Investment Securities

Fixed Assets

Accrued Interest

Other Assets

Total Assets

4

Cash included cash in hand and RBI including

foreign currencies and balances with other

banks.

Cash is kept in hand by the banks to meet the

demand and obligation of the customer.

Cash is the primary reserve or first line of

defense against depositors

The banks advance short term loans to their

customers.

These loans are advanced on a normal

interest with the promise that these will be

returned to the bank on short notice

The amount advanced for short period is

called money at call and at short notice and is

regarded.

The bank invest funds in the govt. securities.

bonds, gold or other profitable commodities

or instrument for short and long term

investment

The investment in these items are quite liquid

and profit yielding

The advances includes loans, cash credits,

overdrafts, bills discounted.

Advances are the largest items on the assets

side of the commercial bank.

These advances have high yield but low

liquidity

Deposits

Bank Borrowings

Accrued Expenses

Other Liabilities

Shareholders Equity

Total Liabilities

9

Fixed deposits and saving ,etc

Liabilities Borrowing

This is the amount which the bank borrows

from RBI.

Loans may be obtained against securities.

Share Capital

Reserves

Retained Earnings

Revaluation Surplus

Share Premiums

Net Income

Total S/H Equity

11

The bank raises capital from its shareholder

and the sale of ordinary shares.

Reserves

This is the amount which is accumulated over

the years out of net undistributed profit.

That tries to give maximum profit to the

shareholders.

That lends rationally.

That give security to their depositors

Interest Rates

Interest Sensitivity

Due Dates

Foreign Currency

breakdown

Collateral

14

AMEL

This system was adopted in India since

1995

Under this system the rating of individual

banks is done along five key parameters.

Each of the five dimensions of performance

is rated on a scale of 1 to 5, varying from

fundamentally strong bank to

fundamentally weak bank.

15

Capital Adequacy

Asset Quality

Management

Earnings

Liquidity

16

17

The Capital of a

Bank protects the

Bank against

unexpected future

losses.

18

CAPITAL ADEQUACY

1. Is level of capital high enough ?

2. Is capital growing proportionate to

assets ?

3. Can additional debt be raised if needed

4. Is there pressure to pay high dividends

19

1.

Shareholders Equity

-----------------------------------

Total Assets

The ability of the present Capital to support

the further growth of Assets

20

2.

Shareholders Equity

------------------------

Risk Weighted Assets

21

TIER ONE CAPITAL:

Which can absorb losses without a bank being

required to cease trading

Tier I Capital = Ordinary Capital+Retained

Earnings& Share Premium - Intangible assets

22

TIER TWO CAPITAL : Which can absorb losses

in the event of a winding-up and so provides

a lesser degree of protection to depositors.

Tier II Capital = Undisclosed

Reserves+General Bad Debt Provision+

Revaluation Reserve + Subordinate debt+

Redeemable Preference shares

23

24

25

26

4.

Total Debt

--------------------------

Shareholders Equity

The ability to raise additional Debt Capital

27

5. Financial Leverage :

Total Assets

-----------------------

Shareholders Equity

28

6. Capital Formation Rate :

Retained Net Income (RNI)

------------------------------

Average Shareholders Equity

RNI = Net Income - Dividends to be paid

The internal growth of Equity Capital

29

Minimum requirements of capital fund in

India:

* Existing Banks 09 %

* New Private Sector Banks 10 %

* Banks undertaking Insurance business 10 %

* Local Area Banks 15%

30

Asset quality is another important aspect of

the evaluation of a banks performance under

the Reserve Bank of India guidelines.

Bank managers are concerned with the quality

of their loans since that provides earnings for

the bank. Loan quality and asset quality are

two terms with basically the same meaning.

31

ASSET QUALITY

1. Are net charge - off s reasonable ?

2. Is management slow to charge off loans?

3. Is loan growth reasonable ?

4. Is loan loss reserve level adequate ?

5. Do earnings comfortably cover loan

losses ?

32

1.

Loans

------------------

Total Assets

33

2. Non Performing Loans =

a) Loans past due more than 90 days

b) Loans not accruing interest

c) Loans with low interest rates

d) Loans on which repayment terms

have been renegotiated.

34

3. Non Performing Loans

------------------------

Total Loans

Indicates how much of the loan portfolio is

non performing.

35

4. Reserves for Non Performing Loans

--------------------------------

Non Performing Loans

Indicates the ability of the loan loss reserve to

absorb potential losses from currently non

performing loans.

36

5. Loan Loss Provision

--------------------

Average Loans

Shows current income reduction in

anticipation of loan losses.

37

6.

Interest Earning Assets

---------------------------

Total Assets

7. Non Interest Earning Assets

------------------------------

Total Assets

38

A bank can not sustain itself long without a

positive cash flow.

Earnings are essential to :

1.Absorb loan losses

2.Finance internal growth of capital

3.Attract investors to supply capital

EARNINGS

1. Are earnings at an adequate level ?

2. Does valid reporting exist for earnings?

IF POOR, ASCRIBABLE TO :

1. Low asset yield

2. High cost of funds

3. Inadequate non interest income

4. High loan charge off s

5. High loan loss provisions

6. Mismanaging taxes

7. High overhead costs

IF STRONG, ASCRIBABLE TO :

1. Strong asset yield

2. Low cost of funds

3. Adequate non - interest income

4. High loan charge off s

5. High loan loss provisions

6. Adequate taxes

7. Low overhead costs

1. Return on Assets ( ROA )

Net Income

---------------------------

Total Average Assets

2. Return on Equity ( ROE )

Net Income

----------------------------

Average Shareholders Equity

3. Net interest margin

net interest Income

--------------------------

Average Interest Earning Assets

4. Net non interest income

Non interest income- non interest expenses

-------------------------------------

Total average assets

5. Operating expense ratio

Total Operating Expense

--------------------------------

Total Operating Income

6. Efficiency Ratio

Non Interest Expense

----------------------------

Net total income

10. Interest Rate Sensitivity Gap :

Interest Rate Sensitive Assets

(-)

Interest Rate Sensitive Liabilities

11. Interest Rate Sensitivity Gap Ratio :

Interest Rate Sensitive Assets

---------------------------------

Interest Rate Sensitive Liabilities

A class of financial metrics that is used to

determine a bank's ability to pay off its short-

terms debts obligations.

LIQUIDITY

1. Is bank dependent on bought money ?

2. Is core deposit growth proportionate

to asset growth ?

4. Is volatile funds significant to assets?

1.Loan- deposit ratio

Loans

-----------------

Deposits

2.Liquid assets ratio

Liquid Assets

--------------

Deposits

3. Liquid Assets

--------------------

Large Liabilities

Measures the assets readily available to cover

a loss of large liabilities.

5. Core Deposits

----------------------

Earning Assets

Indicates the extend to which earning assets

are funded by those deposits considered

stable and not subject to interest rate

disintermediation.

THANK YOU

Potrebbero piacerti anche

- Balance Sheet Analysis of Maruti SuzukiDocumento63 pagineBalance Sheet Analysis of Maruti Suzukikeyur5867% (6)

- Balance SheetDocumento30 pagineBalance SheetBhuvan GuptaNessuna valutazione finora

- Balance Sheet AnalysisDocumento42 pagineBalance Sheet Analysismusadhiq_yavarNessuna valutazione finora

- Segment AnalysisDocumento53 pagineSegment AnalysisamanNessuna valutazione finora

- Ratio Analysis - Tata and M Amp MDocumento38 pagineRatio Analysis - Tata and M Amp MNani BhupalamNessuna valutazione finora

- Comparative Ratio Analysis of Two Companies: Bata & Apex 2011-14Documento21 pagineComparative Ratio Analysis of Two Companies: Bata & Apex 2011-14Arnab Upal100% (2)

- Handout # 1 Solutions (L)Documento10 pagineHandout # 1 Solutions (L)Prabhawati prasadNessuna valutazione finora

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Documento32 pagine4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNessuna valutazione finora

- Balance Sheet AnalysisDocumento18 pagineBalance Sheet Analysisrajat ranjanNessuna valutazione finora

- Types Financial RatiosDocumento8 pagineTypes Financial RatiosRohit Chaudhari100% (1)

- Chapter 7 Notes Question Amp SolutionsDocumento7 pagineChapter 7 Notes Question Amp SolutionsPankhuri SinghalNessuna valutazione finora

- Ratio Analysis: Theory and ProblemsDocumento51 pagineRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (1)

- Bond ImmunisationDocumento29 pagineBond ImmunisationVaidyanathan RavichandranNessuna valutazione finora

- Value Based Management BCG ApproachDocumento14 pagineValue Based Management BCG ApproachAvi AhujaNessuna valutazione finora

- Ratio AnalysisDocumento12 pagineRatio AnalysisSachinNessuna valutazione finora

- Financial Statement Analysis and Valuation (Penman) FA2013Documento5 pagineFinancial Statement Analysis and Valuation (Penman) FA2013Saurabh VashistNessuna valutazione finora

- Advantages of Accounting RatiosDocumento3 pagineAdvantages of Accounting RatiosNeha BatraNessuna valutazione finora

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocumento7 pagineModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNessuna valutazione finora

- Relative Valuation JaiDocumento29 pagineRelative Valuation JaiGarima SinghNessuna valutazione finora

- SynopsisDocumento7 pagineSynopsisAnchalNessuna valutazione finora

- ICAI Corporate ValuationDocumento47 pagineICAI Corporate Valuationqamaraleem1_25038318Nessuna valutazione finora

- Company AnalysisDocumento11 pagineCompany AnalysisRamesh Chandra DasNessuna valutazione finora

- Continuous Assignments: Ram Kumar KakaniDocumento10 pagineContinuous Assignments: Ram Kumar KakaniKabeer KarnaniNessuna valutazione finora

- Valuing Real Assets in The Presence of Risk: Strategic Financial ManagementDocumento15 pagineValuing Real Assets in The Presence of Risk: Strategic Financial ManagementAnish Mittal100% (1)

- 3 Financial RatiosDocumento29 pagine3 Financial RatiosAB12P1 Sanchez Krisly AngelNessuna valutazione finora

- Accounting Standard IndiaDocumento114 pagineAccounting Standard IndiakprakashmmNessuna valutazione finora

- Receivable Management KanchanDocumento12 pagineReceivable Management KanchanSanchita NaikNessuna valutazione finora

- Financial Analysis TATA STEElDocumento18 pagineFinancial Analysis TATA STEElneha mundraNessuna valutazione finora

- CH 09Documento34 pagineCH 09Azhar SeptariNessuna valutazione finora

- Final Project Format For Profitability Ratio Analysis of Company A, Company B and Company C in Same Industry For FY 20X1 20X2 20X3Documento15 pagineFinal Project Format For Profitability Ratio Analysis of Company A, Company B and Company C in Same Industry For FY 20X1 20X2 20X3janimeetmeNessuna valutazione finora

- Investment Valuation RatiosDocumento18 pagineInvestment Valuation RatiosVicknesan AyapanNessuna valutazione finora

- FM - 1 AssignmentDocumento6 pagineFM - 1 AssignmentBHAVEN ASHOK SINGHNessuna valutazione finora

- Business Valuation PresentationDocumento43 pagineBusiness Valuation PresentationNitin Pal SinghNessuna valutazione finora

- Unit 6 Financial Statements Analysis and InterpretationDocumento58 pagineUnit 6 Financial Statements Analysis and Interpretationdaniel rajkumarNessuna valutazione finora

- Dabur IndiaDocumento37 pagineDabur IndiaBandaru NarendrababuNessuna valutazione finora

- Chapter 11 Valuation Using MultiplesDocumento22 pagineChapter 11 Valuation Using MultiplesUmar MansuriNessuna valutazione finora

- BCG ApproachDocumento2 pagineBCG ApproachAdhityaNessuna valutazione finora

- Financial Ratio Analysis Dec 2013 PDFDocumento13 pagineFinancial Ratio Analysis Dec 2013 PDFHạng VũNessuna valutazione finora

- Capital Budgeting Illustrative NumericalsDocumento6 pagineCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Chap 12Documento23 pagineChap 12Maria SyNessuna valutazione finora

- PHT and KooistraDocumento4 paginePHT and KooistraNilesh PrajapatiNessuna valutazione finora

- 03 Financial AnalyticsDocumento11 pagine03 Financial AnalyticsII MBA 2021Nessuna valutazione finora

- CH 10Documento18 pagineCH 10prashantgargindia_93Nessuna valutazione finora

- SFM - Forex - QuestionsDocumento23 pagineSFM - Forex - QuestionsVishal SutarNessuna valutazione finora

- Case QuestionsDocumento5 pagineCase Questionsaditi_sharma_65Nessuna valutazione finora

- Lecture5 6 Ratio Analysis 13Documento39 pagineLecture5 6 Ratio Analysis 13Cristina IonescuNessuna valutazione finora

- Vegetron ExcelDocumento21 pagineVegetron Excelanirudh03467% (3)

- Analysis and Interpretation of Financial StatementsDocumento23 pagineAnalysis and Interpretation of Financial StatementsJohn HolmesNessuna valutazione finora

- A Note On Valuation in Entrepreneurial SettingsDocumento4 pagineA Note On Valuation in Entrepreneurial SettingsUsmanNessuna valutazione finora

- 395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMDocumento13 pagine395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMblazeweaver67% (3)

- A PPT On Money MarketDocumento25 pagineA PPT On Money MarketBrinder SinghNessuna valutazione finora

- Cost of CapitalDocumento8 pagineCost of CapitalAreeb BaqaiNessuna valutazione finora

- Financial Ratios and Their InterpretationDocumento10 pagineFinancial Ratios and Their InterpretationPriyanka_Bhans_7838100% (3)

- BR Act, 1949Documento7 pagineBR Act, 1949aki16288Nessuna valutazione finora

- ALM PPT FinalDocumento49 pagineALM PPT FinalNishant SinhaNessuna valutazione finora

- Bfm-Mod - D PDFDocumento18 pagineBfm-Mod - D PDFparul yadavNessuna valutazione finora

- Meaning of A Balance Sheet of A Bank: 2) Liabilities of The Commercial BanksDocumento4 pagineMeaning of A Balance Sheet of A Bank: 2) Liabilities of The Commercial BanksShilpan ShahNessuna valutazione finora

- A Study of Non Performing Assets in Bank of BarodaDocumento68 pagineA Study of Non Performing Assets in Bank of BarodaMohamed Tousif81% (21)

- Chapter 5Documento36 pagineChapter 5Baby KhorNessuna valutazione finora

- Chapter 2Documento127 pagineChapter 2Dung Hoàng Khưu VõNessuna valutazione finora

- Foreign Exchange Operations of Jamuna BankDocumento43 pagineForeign Exchange Operations of Jamuna BankHole StudioNessuna valutazione finora

- JAIIB Paper 4 RBWM Module C Support Services Marketing of Banking Services Products PDFDocumento39 pagineJAIIB Paper 4 RBWM Module C Support Services Marketing of Banking Services Products PDFAssr MurtyNessuna valutazione finora

- 15624702052231UoGssBO9TQOUnD5 PDFDocumento5 pagine15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNessuna valutazione finora

- Delhi Co-Operative Housing Finance Corporation LTDDocumento6 pagineDelhi Co-Operative Housing Finance Corporation LTDLalit SharmaNessuna valutazione finora

- 9 Sebi, S M (P #1-C) : Hare Arket IllarDocumento19 pagine9 Sebi, S M (P #1-C) : Hare Arket IllarVCITYNessuna valutazione finora

- A BadulaDocumento4 pagineA Badulanotapernota101Nessuna valutazione finora

- Metrobank FoundationDocumento11 pagineMetrobank FoundationAbigail LeronNessuna valutazione finora

- European Central BankDocumento2 pagineEuropean Central BanknairpranavNessuna valutazione finora

- Accounting Peculiarity of CoopDocumento6 pagineAccounting Peculiarity of CoopRoann AguirreNessuna valutazione finora

- IBPS Po 2012 Exam Question Papers & AnswersDocumento12 pagineIBPS Po 2012 Exam Question Papers & AnswersVenkey Goud100% (2)

- Foreign Currency ValuationDocumento12 pagineForeign Currency ValuationAhmed ElhawaryNessuna valutazione finora

- BRM ProjectDocumento23 pagineBRM Projectrbhatter007Nessuna valutazione finora

- Module - 2 Banking System and Operations: Rajneesh MishraDocumento51 pagineModule - 2 Banking System and Operations: Rajneesh MishramarianmadhurNessuna valutazione finora

- Bank StatementDocumento1 paginaBank Statementcodex hdNessuna valutazione finora

- POA Section 7 Part 1Documento4 paginePOA Section 7 Part 1kxng ultimateNessuna valutazione finora

- RE Financiers ListDocumento15 pagineRE Financiers ListAhmed Mobashshir SamaniNessuna valutazione finora

- 01Documento2 pagine01ishtee894Nessuna valutazione finora

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Documento13 paginePrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNessuna valutazione finora

- MTech QROR InterviewDocumento3 pagineMTech QROR InterviewMohammadChharchhodawalaNessuna valutazione finora

- Loan Pricing 916Documento22 pagineLoan Pricing 916Gonçalo MadalenoNessuna valutazione finora

- Partnership Resolution SampleDocumento2 paginePartnership Resolution SamplePatrick John Salalila Paguio89% (9)

- Disbursement HandbookDocumento152 pagineDisbursement Handbookasf100% (1)

- Problem 3Documento3 pagineProblem 3Joyce GijsenNessuna valutazione finora

- Arbes Obs enDocumento12 pagineArbes Obs enAndy PhuongNessuna valutazione finora

- NomadGuide CHIANG MAI Guide Book PreviewDocumento33 pagineNomadGuide CHIANG MAI Guide Book PreviewMichael John Hughes100% (1)

- WL WL: Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Documento1 paginaWL WL: Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)amrit90320Nessuna valutazione finora

- SLM-19667-BBA - Fiancial Markets and InstitutionsDocumento155 pagineSLM-19667-BBA - Fiancial Markets and InstitutionsMadhusudanNessuna valutazione finora

- SidbiDocumento26 pagineSidbiAnand JoshiNessuna valutazione finora

- History of EurobondsDocumento2 pagineHistory of Eurobondsterigand50% (2)

- D.V.V. Satya Prasad and Ors. vs. The Government of AndhraDocumento42 pagineD.V.V. Satya Prasad and Ors. vs. The Government of AndhrapraveenaNessuna valutazione finora