Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Determination of Income and Employment

Caricato da

Shrey GoelDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Determination of Income and Employment

Caricato da

Shrey GoelCopyright:

Formati disponibili

Determination of Income and

Employment

Classical Propositions

Prominent proponents

David Ricardo, James Mill, A C Pigou, J B

Say

Propositions

An economy is always in equilibrium

It always enjoys full employment

Money plays insignificant role

Underlying Assumptions

Closed economy

Demand and supply interact freely; no

government control/regulation

Consumers choose to maximize

satisfaction

Producers produce to maximize profits

Wages and prices are flexible

Economy in equilibrium-

Says Law

J B Say

Supply creates its own demand

Explains self correcting mechanism in

case of overproduction or

underproduction

Disequilibrium, if exists, is temporary

Economy at full employment

equilibrium

In case there is unemployment, wage

flexibility will drive the labour demand

and supply close to each other so that no

involuntary unemployment prevails

If demand for labour exceeds its

availability, wage flexibility will again

restore labour market equilibrium

Money is insignificant

Money acts as a medium of exchange

Money aids transactional efficiency

Do you see anything wrong in

the Classical propositions?

Meaning: Output/Income

Actual Output : The output and therefore

the income which is generated in the

economy at the prevailing level of

employment

Potential Output: The level of output

which the economy would produce if all

the factors were fully employed

Output/Income

In short run, actual

output may deviate

from potential output

Short Run

fluctuations define

the business cycles

that are experienced

by economies all over

the world

In long run, actual

output potential

output

Also, potential output

grows over time as

the economys stock

of factor inputs grows

TROUGH/RECESSION

Low prices

Low profits

High unemployment

Low wages, interest

Pessimism prevails

Economic suffering

RECOVERY/EXPANSION

Low prices induce materialization of consumer

demand

This induces demand for capital goods

Sales recover in all sectors

Employment improves

Prices recover, wages scale up, interest rates

increase.

BOOM/PEAK

Sales grow, production facilities are expanded,

inventories grow

Unemployment is low, employees feel more

secure, factors experience near full employment,

command high prices

Healthy profits allow firms to pay good wages

and employees are able to afford goods, revival

of consumption

Hectic activity everywhere/overheated economy

DECLINE/CONTRACTION

Economy has experienced the peak and now

begins to slow down

Extremely high prices discourage new ventures

Eventually the expansion in demand, new hiring

and new lending come to a halt

Unintended piling of inventories, prices have to

be lowered, profits turn into losses, layoffs and

bankruptcies are prevalent

What is the contrast in the

objective of a firm and the

objective of an economy?

A firm aims at equilibrium

output

An economy wants full

employment level of output

Keynesian Proposition

J M Keynes

Involuntary Unemployment prevails in

the economy

Underemployment equilibrium output is

routine rather than an exception

Wage and price flexibility is questionable

Unemployment - Variants

Voluntary Unemployment

Seasonal Unemployment

Frictional Unemployment

Structural Unemployment

Disguised Unemployment

Cyclical Unemployment

Keynesian Model (Short Run)

Assumptions: All prices and wages are

fixed at given levels; involuntary unN

t

prevails

Supply expands to meet demand if

operating at < full N

t

level

Actual output = Aggregate demand (in

equilibrium)

Aggregate Demand

In a two sector economy:

AD = C + I

Consumption Function: C = f (Y)

C = a + bY

Show this graphically

What are the savings in this case?

Propensity to consume/save

Average propensity to consume willingness to

use a proportion of income for consumption

Marginal propensity to consume proportion of

additional consumption out of the additional

income

APC +APS = 1

MPC +MPS = 1

Factors influencing propensity to

consume

Base level of income

Stability of income receipts

Prices

Future expectations

Credit facilities

AD

Investment demand means the firms desired

additions to their physical capital and

inventories

Investment demand depends upon the current

guesses about future demand for their output

Assume: I = I

According to Keynes..

Investment is independent of current

national income levels

Investment is dependent on

Rate of interest to be paid on the

borrowings made for spending on capital

goods

Marginal efficiency of capital

Equilibrium

Given the assumptions, the output market is in

SR equil. when AD or planned aggregate

spending equal the output that is actually

produced

AD = Y

If AD < Y, there is unplanned addition to stocks

If AD > Y, there is unplanned reduction in stocks

Equilibrium - Graphically

Examples

Let C = 100 + 0.75Y and I = 200

Find equilibrium level of NY

Another example -

Let C = 8 + 0.7Y

I = 22

Find equilibrium Y

If I =-9, find the new equilibrium Y

Multiplier

A change in autonomous spending

changes the national income/output by a

multiple of the initial change; this

multiple is known as the multiplier

Defined as : the ratio of change in

equilibrium output to change in

autonomous spending

Multiplier, k = 1 / (1 b)

Paradox of Thrift

When AD is low and the economy has

spare resources, paradox of thrift shows

that a reduction in the desire to save will

increase the spending and increase the

equilibrium income level.

So, society will benefit from higher

output and employment

Show this Paradox graphically

In this 2 sector model

Discouraging HH saving is tough, so C is

adversely affected and therefore Y

Firms may not invest as demand may not

be forthcoming, this also adversely affects

Y

The economy will settle at an

underemployment equilibrium !

Potrebbero piacerti anche

- Aggregate Demand & Keynesian Multiplier PDFDocumento6 pagineAggregate Demand & Keynesian Multiplier PDFArunabh ChoudhuryNessuna valutazione finora

- IB Economics SL10/11 - Macroeconomic ObjectivesDocumento7 pagineIB Economics SL10/11 - Macroeconomic ObjectivesTerran100% (2)

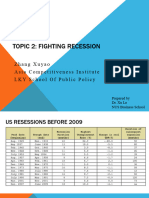

- Week 2 Fighting RecessionDocumento42 pagineWeek 2 Fighting Recessiondaisyruyu2001Nessuna valutazione finora

- Unit - 3 Trade Cycle and InflationDocumento43 pagineUnit - 3 Trade Cycle and InflationTARAL PATELNessuna valutazione finora

- Aggregate Demand - MacroDocumento21 pagineAggregate Demand - MacroHaardik GandhiNessuna valutazione finora

- Keynesian TheoryDocumento98 pagineKeynesian TheorysamrulezzzNessuna valutazione finora

- Economic$: Author: Jethro (Documento17 pagineEconomic$: Author: Jethro (Jethro KuanNessuna valutazione finora

- Business Cycles: The TheoryDocumento39 pagineBusiness Cycles: The TheorySagar IndranNessuna valutazione finora

- Lecture #7 - Theory of Income DeterminationDocumento53 pagineLecture #7 - Theory of Income DeterminationMike Viet Hoa NguyenNessuna valutazione finora

- Aggregate Demand and Aggregate SupplyDocumento24 pagineAggregate Demand and Aggregate SupplyAri HaranNessuna valutazione finora

- My Aggregate Demand & Aggregate Supply (Edited For Class)Documento113 pagineMy Aggregate Demand & Aggregate Supply (Edited For Class)ShivamNessuna valutazione finora

- Classical Theory As Economics of Full EmploymentDocumento11 pagineClassical Theory As Economics of Full EmploymentBHANU TYAGINessuna valutazione finora

- CH 10 Lo - Economic - InstabilityDocumento26 pagineCH 10 Lo - Economic - Instabilitytariku1234Nessuna valutazione finora

- RevisionDocumento20 pagineRevisionAman KumarNessuna valutazione finora

- Classical TheoryDocumento13 pagineClassical TheorySajal ChakarvartyNessuna valutazione finora

- ME Cycle 8 Session 7Documento96 pagineME Cycle 8 Session 7OttilieNessuna valutazione finora

- Economic Issues and Concepts: (Chapter One) Principles of Macroeconomics Econ1202.2BDocumento27 pagineEconomic Issues and Concepts: (Chapter One) Principles of Macroeconomics Econ1202.2BNayem ImtiazNessuna valutazione finora

- Consumption Savings Investment. ParadoxDocumento46 pagineConsumption Savings Investment. ParadoxChristine Joy LanabanNessuna valutazione finora

- Lecture No. 03 CLASSICAL ECONOMICS - IDocumento23 pagineLecture No. 03 CLASSICAL ECONOMICS - IAnaghNessuna valutazione finora

- Aggregate Supply and Aggregate Demand: R. Santos, "Economics: Principles & Application." Prepared by Rick HelserDocumento18 pagineAggregate Supply and Aggregate Demand: R. Santos, "Economics: Principles & Application." Prepared by Rick HelserIndivineNessuna valutazione finora

- EC 102 Revisions Lectures - Macro - 2015Documento54 pagineEC 102 Revisions Lectures - Macro - 2015TylerTangTengYangNessuna valutazione finora

- Keynasian Theory of EmploymentDocumento29 pagineKeynasian Theory of Employmentsunita agrawalNessuna valutazione finora

- Macroeconomics III: Consumption and Investment: Gavin Cameron Lady Margaret HallDocumento21 pagineMacroeconomics III: Consumption and Investment: Gavin Cameron Lady Margaret HallIrina StefanaNessuna valutazione finora

- Determinants of Aggregate Demand: by Samran and The FuduDocumento8 pagineDeterminants of Aggregate Demand: by Samran and The FuduNina BahiaNessuna valutazione finora

- Eco 3rd UnitDocumento30 pagineEco 3rd UnitMaha LakshmiNessuna valutazione finora

- Session 3 & 4 Aggregate Demand and Multiplier ModelDocumento64 pagineSession 3 & 4 Aggregate Demand and Multiplier ModelPrateek BabbewalaNessuna valutazione finora

- Consumption FunctionDocumento39 pagineConsumption FunctionAnku SharmaNessuna valutazione finora

- Aggregate Expenditure and Equilibrium OutputDocumento69 pagineAggregate Expenditure and Equilibrium OutputhongphakdeyNessuna valutazione finora

- Macroeconomics: Lecturer: Mr. AllicockDocumento35 pagineMacroeconomics: Lecturer: Mr. AllicockPrecious MarksNessuna valutazione finora

- Econ101B NotesDocumento97 pagineEcon101B NotesYilena HsueNessuna valutazione finora

- What Is Economics PreDocumento32 pagineWhat Is Economics PreРоман КирьяновNessuna valutazione finora

- Adil Khan - 19-M-475Documento40 pagineAdil Khan - 19-M-475Adil KhanNessuna valutazione finora

- Macro TopicsDocumento30 pagineMacro TopicsThalisson RamiresNessuna valutazione finora

- MECO121 UM S2024 Session14Documento35 pagineMECO121 UM S2024 Session14rizwanf026Nessuna valutazione finora

- CHP 4 The Keynesian Principle of Effective DemandDocumento12 pagineCHP 4 The Keynesian Principle of Effective DemandNidhi SoniNessuna valutazione finora

- TERM 1-Credits 3 (Core) TAPMI, Manipal Session 19: Prof Madhu & Prof RajasulochanaDocumento26 pagineTERM 1-Credits 3 (Core) TAPMI, Manipal Session 19: Prof Madhu & Prof RajasulochanaAnikNessuna valutazione finora

- Lecture 3 The Macro Economic EnvironmentDocumento19 pagineLecture 3 The Macro Economic EnvironmentKiri chrisNessuna valutazione finora

- ENSC 105 - Midterm ReviewerDocumento4 pagineENSC 105 - Midterm ReviewerKarylle Anne MontoyaNessuna valutazione finora

- Applied Economics Lesson 1 PDFDocumento41 pagineApplied Economics Lesson 1 PDFStephanie Mae BulaongNessuna valutazione finora

- Contemporary Models of DevelopmentDocumento45 pagineContemporary Models of DevelopmentUmair UsmanNessuna valutazione finora

- Unit - 2 Theory of Employment and Wages and EmploymentDocumento45 pagineUnit - 2 Theory of Employment and Wages and EmploymentTARAL PATELNessuna valutazione finora

- 5 Inflation Unemployment BCDocumento39 pagine5 Inflation Unemployment BCSara BatoolNessuna valutazione finora

- AD-AS Model To Study Business Cycles: Prof. Biswa Swarup Misra Dean, XIMBDocumento58 pagineAD-AS Model To Study Business Cycles: Prof. Biswa Swarup Misra Dean, XIMBDeepak GrandheNessuna valutazione finora

- Mail To Reg Stud 72232 610769 20230904 062954 670Documento39 pagineMail To Reg Stud 72232 610769 20230904 062954 670UshaNessuna valutazione finora

- Micro 01 EconomicThinking-3Documento33 pagineMicro 01 EconomicThinking-3SamNessuna valutazione finora

- Increase in Demand and SupplyDocumento9 pagineIncrease in Demand and SupplyJon LeinsNessuna valutazione finora

- Socsci4: Basic Economics With Taxation and Agrarian ReformDocumento70 pagineSocsci4: Basic Economics With Taxation and Agrarian ReformFritz Perez AguillonNessuna valutazione finora

- Macroeconomic Theory NotesDocumento49 pagineMacroeconomic Theory Notesmuriungi2014Nessuna valutazione finora

- IB Economics SL4 - Government InterventionDocumento7 pagineIB Economics SL4 - Government InterventionTerran100% (5)

- Lecture 5 - Cyclical InstabilityDocumento66 pagineLecture 5 - Cyclical InstabilityTechno NowNessuna valutazione finora

- CONCEPT OF SHORT RUN Class 12Documento18 pagineCONCEPT OF SHORT RUN Class 12Divya RaniNessuna valutazione finora

- Introductory Macroeconomics ECON10003: Lecture 6: The Keynesian Model of The Economy IDocumento24 pagineIntroductory Macroeconomics ECON10003: Lecture 6: The Keynesian Model of The Economy IImaweeb 77Nessuna valutazione finora

- Macroeconomics - Keynesian ModelsDocumento22 pagineMacroeconomics - Keynesian ModelsAlfa RydesterNessuna valutazione finora

- COVID 19 and Tax Policy Responses 4 (DJA)Documento11 pagineCOVID 19 and Tax Policy Responses 4 (DJA)zikra tanjungNessuna valutazione finora

- CH5 Economic Instability - A Critique of The Self-Regulating EconomyDocumento37 pagineCH5 Economic Instability - A Critique of The Self-Regulating EconomyTiviyaNessuna valutazione finora

- Development Problem 1 (ch3)Documento49 pagineDevelopment Problem 1 (ch3)AbelNessuna valutazione finora

- Inequality and DevelopementDocumento39 pagineInequality and DevelopementSrushti KadiyaNessuna valutazione finora

- Mac 4&5Documento28 pagineMac 4&5Shubham DasNessuna valutazione finora

- ECONOMICS 01 EconomicThinkingDocumento33 pagineECONOMICS 01 EconomicThinkingJordan CustodioNessuna valutazione finora

- Mac Econs 1Documento36 pagineMac Econs 1Shrey GoelNessuna valutazione finora

- Banking: Brief Industry OverviewDocumento4 pagineBanking: Brief Industry OverviewShrey GoelNessuna valutazione finora

- Exchange Rate DeterminationDocumento15 pagineExchange Rate DeterminationShrey GoelNessuna valutazione finora

- PDF EvaDocumento36 paginePDF EvaShrey GoelNessuna valutazione finora

- Poverty in India: Made By: Archu Monika Ashish.m ShreyDocumento16 paginePoverty in India: Made By: Archu Monika Ashish.m ShreyShrey GoelNessuna valutazione finora

- Sir Isaac Vivian Alexander RichardsDocumento5 pagineSir Isaac Vivian Alexander RichardsShrey GoelNessuna valutazione finora

- Foreign Exchange RatesDocumento13 pagineForeign Exchange RatesShrey GoelNessuna valutazione finora

- Retail Banking Consumer Banking - I: Syed Fazal AzizDocumento34 pagineRetail Banking Consumer Banking - I: Syed Fazal AzizamiraleemNessuna valutazione finora

- Cruffy PancakeDocumento10 pagineCruffy PancakeJuvilyn SesioNessuna valutazione finora

- Strategic and Marketing Planning Lesson 5 POMDocumento18 pagineStrategic and Marketing Planning Lesson 5 POMJesfie VillegasNessuna valutazione finora

- Wk3 Tutorial SolutionsDocumento9 pagineWk3 Tutorial SolutionsDhivyaa Thayalan100% (2)

- UPS Competes Globally With Information TechnologyDocumento6 pagineUPS Competes Globally With Information TechnologyMuhammadYudithEddwina100% (2)

- 121604053-MIS-Domino-s PizzaDocumento32 pagine121604053-MIS-Domino-s PizzaAnuj SharmaNessuna valutazione finora

- TTK Prestige Techno Research ReportDocumento10 pagineTTK Prestige Techno Research ReportNaveenNessuna valutazione finora

- Chapter 9 - The Organizational PlanDocumento14 pagineChapter 9 - The Organizational PlanFatima ChowdhuryNessuna valutazione finora

- MSC Marketing Management Marketing Management & Strategy: Tutor: Hazel HuangDocumento14 pagineMSC Marketing Management Marketing Management & Strategy: Tutor: Hazel HuangDeeban BabuNessuna valutazione finora

- PMEX Registered Brokers With SECP: Member Code Name of Broker Status Reg. # Address Phone # As at November 15, 2019Documento2 paginePMEX Registered Brokers With SECP: Member Code Name of Broker Status Reg. # Address Phone # As at November 15, 2019noname1Nessuna valutazione finora

- Lean Project Delivery SystemDocumento7 pagineLean Project Delivery SystemSebastian BernalNessuna valutazione finora

- Certified Public AccountantDocumento3 pagineCertified Public AccountantDesiree IrraNessuna valutazione finora

- Starbucks Globalization StrategiesDocumento7 pagineStarbucks Globalization StrategiesSajid Ali MaariNessuna valutazione finora

- Consumers' Attitude Towards Green Products - An Exploratory Study in Erode DistrictDocumento8 pagineConsumers' Attitude Towards Green Products - An Exploratory Study in Erode DistrictarcherselevatorsNessuna valutazione finora

- Entrepreneurship Compensation CorporationDocumento16 pagineEntrepreneurship Compensation CorporationPankaj GuptaNessuna valutazione finora

- Dokumentation EDI Odette Kurs PDFDocumento17 pagineDokumentation EDI Odette Kurs PDFrubenmun_Nessuna valutazione finora

- 12 Month Sales ForecastDocumento1 pagina12 Month Sales ForecastSaulo FernandesNessuna valutazione finora

- Accounting: South Pacific Form Seven CertificateDocumento35 pagineAccounting: South Pacific Form Seven CertificateArun ThakurNessuna valutazione finora

- Foreign Exchange Guidelines by Bangladesh Bank PDFDocumento380 pagineForeign Exchange Guidelines by Bangladesh Bank PDFMohammad Khaled Saifullah Cdcs100% (1)

- Business License Application-1Documento5 pagineBusiness License Application-1Keller Brown JnrNessuna valutazione finora

- KPO An Opportunity For CADocumento5 pagineKPO An Opportunity For CApathan1990Nessuna valutazione finora

- Porter's Five Force Analysis of Food Processing Industry: Marketing StrategyDocumento30 paginePorter's Five Force Analysis of Food Processing Industry: Marketing Strategydeepak boraNessuna valutazione finora

- BLA ProgrammeDocumento4 pagineBLA ProgrammeAnonymous 1ij7Cqx2QWNessuna valutazione finora

- Strategic ManagementDocumento24 pagineStrategic ManagementzaldeNessuna valutazione finora

- Ddr2017 Va WebDocumento424 pagineDdr2017 Va WebElkSh KaneNessuna valutazione finora

- Sip Hotel IndustryDocumento25 pagineSip Hotel IndustryParas WaliaNessuna valutazione finora

- This Study Resource Was: Day 2 Negotiation (Coffee Contract)Documento2 pagineThis Study Resource Was: Day 2 Negotiation (Coffee Contract)Elad BreitnerNessuna valutazione finora

- Presentation HIRARCDocumento12 paginePresentation HIRARCahmad syouqiNessuna valutazione finora

- Bakery Project Start-Up Business PlanDocumento35 pagineBakery Project Start-Up Business PlanAbenet Ajeme89% (297)

- Perlakuan Perpajakan, Kepabeanan, Dan Cukai Pada KekDocumento3 paginePerlakuan Perpajakan, Kepabeanan, Dan Cukai Pada KekKiki MiawNessuna valutazione finora