Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Customs Act

Caricato da

Abhishek AgarwalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Customs Act

Caricato da

Abhishek AgarwalCopyright:

Formati disponibili

BY CA SURESH DHOOT,

9869005638

CUSTOMS ACT, 1962

ACT

RULES

REGULATIONS

BY CA SURESH DHOOT,

9869005638

FUNCTIONS OF CUSTOMS

Collection of custom duty

Prevention of smuggling

Classification of goods

Valuation of import / export goods

Enforcement of provision in the interest of

economy

Export incentives

BY CA SURESH DHOOT,

9869005638

USE OF CUSTOM ACT

Restrict imports to conserve foreign

currency

Protect indian industry from world

competition

Prohibit import & export of goods as per

Government policy

Regulating exports

BY CA SURESH DHOOT,

9869005638

SCOPE & COVERAGE OF

CUSTOM LAW

Entry 83 of list I of Schedule VII of

Constitution talks about Duties of Custom

including export duties.

Section 12 of Custom Act provides levy of

duty on Import of goods in India as well as

Export of goods out of India, at rates

prescribed in Customs tariff Act, 1975 or

any other law for the time being in force.

BY CA SURESH DHOOT,

9869005638

TAXABLE EVENT

Section 2(23) of customs act defines

Import as bringing into india while

Section 2(18) of customs act defines

Export as taking out of india to a place

outside India.

BY CA SURESH DHOOT,

9869005638

INDIA INCLUDES

Territorial water theory

Land mass theory.

As per court ruling taxable event will be

when the goods reaches custom barriers/

custom station / custom frontiers when

goods mix with mass and when BOE is

filed.

BY CA SURESH DHOOT,

9869005638

TERRITORIAL WATER

Section 2(27) of customs act defines India

includes territorial water of india.

Territorial water includes sea bed, sub soil

underlying therein and air space over such

TW upto 12 NM from base line.

TW includes any Bay, Gulf, Harbour,

Creek, or Tidal river.

BY CA SURESH DHOOT,

9869005638

CONTIGUOUS ZONE

Water upto 24 NM from base line, Central

government has control over this area for

Prevention

Punishment regarding custom, fiscal,

immigration law etc.

BY CA SURESH DHOOT,

9869005638

EXCLUSIVE ECONOMIC ZONE

Extend upto 200 NM

In this zone the coastal state has exclusive

right to exploit it for economic purpose

Eg. Oil exploration, fishing etc.

BY CA SURESH DHOOT,

9869005638

HIGH SEA

Beyond 200 NM is high sea

All countries have equal right

Any country can use it for navigation, over

flight etc.

BY CA SURESH DHOOT,

9869005638

IMPORT / EXPORT

BY

LAND SEA AIRPORT

Conveyance 2(g)

TRAIN/TRUCK VESSELS AIRCRAFT

Person in charge- 2(31)

Chief direction of conveyance / Pilot /

Master (Captain of vessels)

BY CA SURESH DHOOT,

9869005638

GOODS

Section 2 (22) defines goods includes

Vessels, aircraft and vehicles

Stores

Baggage

Currency and negotiable instruments

Any other kind of moveable property

BY CA SURESH DHOOT,

9869005638

GOODS IMPORTED CLASSIFIED

INTO

Goods entered for home consumption

Goods entered for Warehousing

Goods in transit

Goods for transhipment

Goods imported with restrictions &

Goods which are banned

BY CA SURESH DHOOT,

9869005638

IMPORT PROCEDURE

Person in charge of conveyance submits

Import General Manifest (IGM). Submitted

in advance before arrival normally through

agents.(Section 30) Penalty Rs. 50000/-

Proper officer grants Entry Inward subject

to availability of berth. (Section 31)

Entry inward not required for unloading of

baggage, mail bags, animals, perishable

goods and hazardous goods.

BY CA SURESH DHOOT,

9869005638

Import procedure

Unloading of reported goods is only

permissible (section 32)

Under supervision of custom officer goods

unloaded (Section 34)

Unloading on sundays or holidays and

after working hours can be done only after

giving notice and paying prescribed fees

(Section 36)

BY CA SURESH DHOOT,

9869005638

Import procedure

Goods are in custody of of Port trust

authorities in case of major port and

International airport authorities of India

(IAAI) in case of airports but controls is of

Custom Officers

BY CA SURESH DHOOT,

9869005638

Import procedure

Importer submits Bill of entry

White colour for home consumption

against payment of duty and clears goods

Yellow colour for warehousing on giving

bond normally twice the duty value.

Green colour for ex bond clearance ie

clearance from warehouse on payment of

duty.

BY CA SURESH DHOOT,

9869005638

Import procedure

Noting of Bill of entry by custom officers

Various documents submitted along with

BOE by importer.

Custom officer examines goods,

determines value / assessment and orders

for payment of duty if home consumption

or orders for shifting to bonded warehouse

BY CA SURESH DHOOT,

9869005638

Import procedure

In case of home consumption goods will

be cleared on payment of duty and

demurrage charges.

In case of warehousing goods will be

cleared on payment of duty, demurrage

charges, rent charges, interest and any

other charges.

BY CA SURESH DHOOT,

9869005638

Import procedure

Section 15 of custom act provides that the

rate of duty and tariff value applicable on

imported goods shall be the rate and

valuation in force, In case of home

consumption the date on which BOE is

presented or date of entry inward

whichever is later and in case of

warehousing when BOE is presented for

clearance from warehouse and in any

other case date of payment of duty.

BY CA SURESH DHOOT,

9869005638

Import procedure

Types of Bond

Provisional duty bond

Import trade control bond if importer is unable to produce

required import license or is unable to prove goods

imported is under OGL

Warehousing Bond

Duty free clearance for exhibition on recommendation of

India trade promotion council

Transhipment bond from gate way port to ICD

B 17 general purpose bond by EOU / STP / EHTP / SEZ

BY CA SURESH DHOOT,

9869005638

Import procedure

Each importer and Exporter has to get

Import Export code no. (IEC) from

directorate general of foreign trade

(DGFT) which is PAN based.

Self assessment on basis of Risk

Management System (RSM) for accredited

client having good track record and meet

specified criteria

BY CA SURESH DHOOT,

9869005638

Import procedure

Goods in transit

Section 53, In transit means goods

imported in any conveyance will be

allowed to remain on the conveyance and

to be transited without payment of duty to

any place out of india or any customs

station. It must be mentioned in import

manifest otherwise it will be treated as

prohibited.

BY CA SURESH DHOOT,

9869005638

Import procedure

Goods in Transshipment

Section 54 Goods for transshipment

means transfer of goods from one

conveyance to another conveyance with

out payment of duty for transportation to

any major port or to another country.

BY CA SURESH DHOOT,

9869005638

EXPORT PROCEDURE

Entry outward (Section 39)

Loading can start only after entry outward is granted by

proper officer. No entry outward required for baggage

and mail

Loading with permission (Section 40)

Export goods can be loaded only after shipping bill or bill

of export duly passed by custom officer is handed over

to person in charge of conveyance. (In case of baggage

and mail bags shipping bills not required)

Export manifest (Section 41)

Export general manifest / Export report should be

submitted before departure. This is not required if

conveyance is carrying only luggage of occupants.

BY CA SURESH DHOOT,

9869005638

Export Procedure

Exporter to obtain Business Identification

number from DGFT.

Open current account with designated

bank for duty draw back credit.

Register license / Advance license /DEPB

etc under Export promotion scheme.

Exporter to obtain Registration cum

membership certificate (RCMC) from

export promotion council.

BY CA SURESH DHOOT,

9869005638

Export procedure

Exporter has to submit Shipping bill along with

several documents.

Noting of shipping bill by custom officer.

Assessment / valuation / classification /

restriction / prohibition / examination by custom

officer

Pay export duty if any.

Let Export Order from custom officer.

Obtain ARE-1 form duly signed by custom

officer.

Claim duty drawback

BY CA SURESH DHOOT,

9869005638

Export procedure

Shipping bill for export of goods under claim for

duty draw back Green colour

Shipping bill for export of dutiable goods- Yellow

colour

Shipping bill for export of duty free goods- White

colour

Shipping bill for export of duty free goods ex

bond Pink colour

Shipping bill for export under DEPB scheme-

Blue colour

BY CA SURESH DHOOT,

9869005638

Export procedure

Custom authorities give serial number (called

Thoka number) to shipping bill when it is

presented.

RBI has prescribed GR (Guaranteed receipts) /

SDF (Statutory declaration form) form to be used

when shipping bills are processed manually in

custom house.

In case of export of software not in physical form

i.e. by direct data transmission / satellite links

SOFTEX form is to be used.

BY CA SURESH DHOOT,

9869005638

Export procedure

Section 16 of custom act, in case of export

relevant date for determination of rate of duty

and tariff valuation

(a) Section 50 Goods entered for export date on

which clearance for export is permitted by

custom officer . Section 51 after submission of

shipping bill. Permission is granted after

payment of export duty.

(b) In case of any other goods on payment of

export duty.

BY CA SURESH DHOOT,

9869005638

CUSTOM TARIFF ACT, 1975

Import duty 1

st

schedule to CTA, 1975

Two types 1. Preferential rate & 2.

standard rate.

Preferential rate applicable to goods

imported from MFN if country of origin is

produced.

Export duty 2

nd

schedule to CTA, 1975

BY CA SURESH DHOOT,

9869005638

TYPES OF DUTIES

Customs Act Basic Custom duty

(sec.12)

Finance act, 2004- Primary education cess

Finance bill 2007- Secondary and higher

education cess.

BY CA SURESH DHOOT,

9869005638

CUSTOM TARIFF ACT

Section 3(1) CVD FG

Section 3 (3) CVD RM

Section 3(5) CVD Sales tax

Section 6 Protective duty

Section 8B Safeguard duty

Section 8C safeguard duty for goods imported from

china

Section 9 CVD on subsidized articles

Section 9A Anti dumping duty

Domestic industry written application to designated

authority with evidence, Investigate, recommend and CG

implements

BY CA SURESH DHOOT,

9869005638

VALUATION

Section 14(1)

Deemed to be the price at which

- such goods / like goods are ordinarily

sold

- for delivery at time and place of removal

- Price is the sole consideration

- not related

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION

Section 14(1A)

If any of the condition of section 14(1) is

not satisfied then Custom valuation rules

1988 will apply

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION

Section 14(2)

CBEC may by notification fix tariff value for

any class of Import / export goods

Section 14(3)

Rate of exchange means as determined

by central government

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION RULE,

1988

Rule 1. General text/ title / preamble

Rule 2. Definition

Rule 3. Try Rule 4 if cant then go

sequentially for Rule 5 to 8

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION RULE

Rule 4. (1) Transaction value shall be the price paid or payable adjusted in accordance

with rule 9.

(2) Transaction Value is accepted if following condition (a) to (h) is satisfied

(a) Fully competitive price

(b) No abnormal discount

(c ) No special discount for exclusive dealers not accepted

(d) Quantifiable data must be available for adjustment u/r 9

(e) No restriction on use or disposal of goods

(f) No condition or consideration be attached for which value cannot be given

(g) No flow back of resale proceeds for which no adjustment can be made u/r 9

(h) Party shall not be related i.e. relationship has not influence the price

Related party Supplied to another party at same price

Deductive value

Computed value

(3) Relation as no influence on the price

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION RULES

Rule 5.T.V. of identical goods adjusted to commercial bench mark

i.e. quantity, quality, Same brand, specification, reputation, grade

etc. e.g. two benches

Rule 6.T.V. of similar goods more or less functionally substituted

e.g. two pens

Rule 6A Allow party to opt for Rule 7A & then Rule 7

Rule 7 Deductive value basis i.e. Sale price in India less deduction

of taxes /duties/Local cost

Rule 7A Computed Value i.e. cost plus basis

Rule 8 residual method i.e. reasonable basis Available data.

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION RULES

Rule 9 Addition Loading to price value

(1) Amount paid by buyer in relation to imported goods & not

included in price i.e. selling commission.

(Note buying commission i.e. commission paid on behalf of Importer

is not to be loaded.)

(2) Packing cost i.e. packing material supplied by to be loaded.

(3) Some material/mould /design/ drawings/ components supplied by

importer to be loaded

(4) Royalty technology transfer

(5) Freight 20% of FOB or actual whichever is less In case of

airfreight not more than 20% of FOB

(6) Insurance charges 1.25% of C & F

(7) Landing charges 1% of CIF or actual

BY CA SURESH DHOOT,

9869005638

CUSTOM VALUATION RULES

Rule 10 Declaration by importer GATT declaration Value

of goods Prosecution/confiscation/ penalty

Rule 10A Rejection of declaration on truth &accuracy it

means value cannot be determined u/r 4

Truth & accuracy is determined by calling information /

Expert opinion/contemporary power etc grounds of

rejection be given

Rule 11 Settlement of disputes resolve by applying u/s

14

Rule 12 Interpretation note shall apply

BY CA SURESH DHOOT,

9869005638

ASSESMENT

Section 17(1) deals with provision of

assessment of goods when BOE filed for home

consumption

Section 17(2)First information report BOE filed

, goods examined / tested by proper officer and

duty is assessed

Section 17(3) Second examination system

BOE filed, duty assessed on basis of information

provided, if correct OK, if not correct

Reassessment . Penalty proceedings

BY CA SURESH DHOOT,

9869005638

PROVISIONAL ASSESSMENT

Section 18

If further documents required

Needs report of such test performed on

goods

Potrebbero piacerti anche

- Custom DutyDocumento40 pagineCustom DutyVijayasarathi VenugopalNessuna valutazione finora

- Unit V: Export IncentivesDocumento37 pagineUnit V: Export IncentivesthensureshNessuna valutazione finora

- An Approach To How To Trade in Commodities Market 13052013Documento6 pagineAn Approach To How To Trade in Commodities Market 13052013sskr1307Nessuna valutazione finora

- Forex Business Plan.01Documento8 pagineForex Business Plan.01Kelvin Tafara SamboNessuna valutazione finora

- Day 2 - Sample-Trade-PlanDocumento3 pagineDay 2 - Sample-Trade-PlanJager HunterNessuna valutazione finora

- Order Execution Policy PDFDocumento20 pagineOrder Execution Policy PDFJennifer TimtimNessuna valutazione finora

- Critical Steps to Forex Trading Success for BeginnersDa EverandCritical Steps to Forex Trading Success for BeginnersNessuna valutazione finora

- Compounding SheetDocumento4 pagineCompounding SheetMouzam AliNessuna valutazione finora

- Advanced Forex Breakouts Preview Peter July 2012Documento92 pagineAdvanced Forex Breakouts Preview Peter July 2012aasdasdfNessuna valutazione finora

- The Lost Secret of ForexDocumento3 pagineThe Lost Secret of Forexlroyal23Nessuna valutazione finora

- Building A Trading PlanDocumento2 pagineBuilding A Trading PlanGeorge KangasNessuna valutazione finora

- MultiBank Company Profile English 2022Documento24 pagineMultiBank Company Profile English 2022Anonymous CQ4rbzLVENessuna valutazione finora

- Sales Tax On Services in PakistanDocumento98 pagineSales Tax On Services in Pakistansaudhassan100% (1)

- Director Trade Compliance in USA Resume John McElroyDocumento2 pagineDirector Trade Compliance in USA Resume John McElroyJohnMcElroy100% (1)

- Memorandum Articles of Association enDocumento24 pagineMemorandum Articles of Association enrahmajdNessuna valutazione finora

- FXST Business ManualDocumento25 pagineFXST Business ManualPDDY20002981100% (2)

- Intravest Forex Trading JournalDocumento26 pagineIntravest Forex Trading JournalEDWIN100% (1)

- Counter TradeDocumento30 pagineCounter TradeBharti VirmaniNessuna valutazione finora

- Foreign Exchange1Documento84 pagineForeign Exchange1Ashwin WasnikNessuna valutazione finora

- Piyush PPT of ZRAMDocumento16 paginePiyush PPT of ZRAMPiyush SharmaNessuna valutazione finora

- Introducing A Forex Trading BreakthroughDocumento12 pagineIntroducing A Forex Trading Breakthroughrajronson6938Nessuna valutazione finora

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Documento7 pagineStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaNessuna valutazione finora

- Autochartist enDocumento6 pagineAutochartist enAnonymous fE2l3DzlNessuna valutazione finora

- FOREXDocumento15 pagineFOREXmanoranjanpatra100% (3)

- Mental Training For Trading Success: CoachingDocumento5 pagineMental Training For Trading Success: CoachingAjith Moses0% (1)

- CCTV MAF and WarrantyDocumento2 pagineCCTV MAF and WarrantyChendu Camila ZangpoNessuna valutazione finora

- Chapter 1 Spot Exchange MarketDocumento20 pagineChapter 1 Spot Exchange Marketchaman_shrestha100% (2)

- Companies Involved in Online TradingDocumento10 pagineCompanies Involved in Online TradingAzaruddin Shaik B PositiveNessuna valutazione finora

- View Our You Tube Video To Know How To Trade Using Below LevelsDocumento3 pagineView Our You Tube Video To Know How To Trade Using Below LevelsNANDHA KUMARNessuna valutazione finora

- Market Fishers (The FiboTrend Strategy)Documento29 pagineMarket Fishers (The FiboTrend Strategy)TZ Mokoena100% (1)

- Trade Details: Half-Position of GBPDocumento4 pagineTrade Details: Half-Position of GBPImre GamsNessuna valutazione finora

- Unit-4 - Trading, Clearing and SettlementDocumento35 pagineUnit-4 - Trading, Clearing and SettlementK DIVYANessuna valutazione finora

- Fundamental and Technical AnalysisDocumento19 pagineFundamental and Technical AnalysisKarthi KeyanNessuna valutazione finora

- 6 Psychology Rules in TradingDocumento6 pagine6 Psychology Rules in Tradingfaiziiik2004Nessuna valutazione finora

- How To Spot Trading ChannelsDocumento54 pagineHow To Spot Trading ChannelsSundaresan SubramanianNessuna valutazione finora

- IgniteDocumento4 pagineIgniteTarunVarmaNessuna valutazione finora

- ActiveTrader User GuideDocumento50 pagineActiveTrader User GuideAhmed SaeedNessuna valutazione finora

- WWW BabypipsDocumento2 pagineWWW BabypipsSourabh BodkeNessuna valutazione finora

- Starbucks Corporation (SBUX) Balance SheetDocumento2 pagineStarbucks Corporation (SBUX) Balance Sheetstevan joeNessuna valutazione finora

- Jurnal Trading - TP - CLDocumento3 pagineJurnal Trading - TP - CLTrader Kaki LimaNessuna valutazione finora

- Annual ReportDocumento160 pagineAnnual ReportSivaNessuna valutazione finora

- Build You Own Trading StrategyDocumento5 pagineBuild You Own Trading StrategyTajudeen Adebayo100% (1)

- How To Open A Deriv Forex Account. PDF-4Documento30 pagineHow To Open A Deriv Forex Account. PDF-4moatlhodiNessuna valutazione finora

- How To Use IGCS in Your Trading PDFDocumento11 pagineHow To Use IGCS in Your Trading PDFNil DorcaNessuna valutazione finora

- Marketing PPT AssignmentDocumento13 pagineMarketing PPT AssignmentBogdan TomaNessuna valutazione finora

- Handbook of Procedures 2023Documento212 pagineHandbook of Procedures 2023Doond adminNessuna valutazione finora

- Commodities TradingDocumento2 pagineCommodities TradingAdityaKumarNessuna valutazione finora

- CRYPTO SCALPING STRATEGY - The Prop TraderDocumento2 pagineCRYPTO SCALPING STRATEGY - The Prop Traderyoussner327Nessuna valutazione finora

- Introduction To Forex ManagementDocumento6 pagineIntroduction To Forex ManagementDivakara Reddy100% (1)

- Financial Statement AnalysisDocumento48 pagineFinancial Statement Analysisroygaurav142Nessuna valutazione finora

- Options Introduction - TsugiTradesDocumento5 pagineOptions Introduction - TsugiTradeshassanomer2122Nessuna valutazione finora

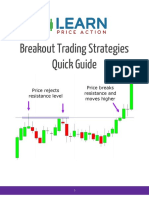

- Breakout Trading Strategies Quick GuideDocumento10 pagineBreakout Trading Strategies Quick GuideKiran KrishnaNessuna valutazione finora

- How To Use IG Client SentimentDocumento7 pagineHow To Use IG Client SentimentRJ Zeshan AwanNessuna valutazione finora

- FX GOAT SessionsDocumento6 pagineFX GOAT Sessionsjames johnNessuna valutazione finora

- Appendix A - Trading Plan Template: Financial GoalDocumento3 pagineAppendix A - Trading Plan Template: Financial GoalBrian KohlerNessuna valutazione finora

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocumento10 pagineForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNessuna valutazione finora

- How To Catch BlockbusterstocksDocumento12 pagineHow To Catch Blockbusterstocksdr.kabirdev100% (1)

- Learn Import Export Business From Industry ExpertsDocumento8 pagineLearn Import Export Business From Industry ExpertsImpex FedNessuna valutazione finora

- IIFL Amey Kulkarni PDFDocumento48 pagineIIFL Amey Kulkarni PDFPALLAVI KAMBLENessuna valutazione finora

- New Microsoft Office Word Document 220815Documento5 pagineNew Microsoft Office Word Document 220815Abhishek AgarwalNessuna valutazione finora

- Hindi: V VK B BZ M Å - , , S Vks Vks Va V &&&&&&&&& BZ &&&&&&&&&& VK &&&&&&&&& M &&&&&&&&&& B &&&&&&&&& Å &&&&&&&&&&Documento4 pagineHindi: V VK B BZ M Å - , , S Vks Vks Va V &&&&&&&&& BZ &&&&&&&&&& VK &&&&&&&&& M &&&&&&&&&& B &&&&&&&&& Å &&&&&&&&&&Abhishek AgarwalNessuna valutazione finora

- Gaana Plus Subscription - 6 Months: Grand Total 0.00Documento2 pagineGaana Plus Subscription - 6 Months: Grand Total 0.00Abhishek AgarwalNessuna valutazione finora

- Ym+Dk) Ksim+H) Ia (KK) V (KJKSVDocumento6 pagineYm+Dk) Ksim+H) Ia (KK) V (KJKSVAbhishek AgarwalNessuna valutazione finora

- New Microsoft Office Word Document FinalDocumento105 pagineNew Microsoft Office Word Document FinalAbhishek AgarwalNessuna valutazione finora

- Inventory Management System: Project Report OnDocumento1 paginaInventory Management System: Project Report OnAbhishek AgarwalNessuna valutazione finora

- Table Contents FinalDocumento2 pagineTable Contents FinalAbhishek AgarwalNessuna valutazione finora

- Redico ProjectDocumento94 pagineRedico ProjectAbhishek AgarwalNessuna valutazione finora

- Submitted in The Partial Fulfillment For The Degree of Master of Business "Administration" (Affiliated To Utter Pradesh Technical University, Lucknow)Documento74 pagineSubmitted in The Partial Fulfillment For The Degree of Master of Business "Administration" (Affiliated To Utter Pradesh Technical University, Lucknow)Abhishek AgarwalNessuna valutazione finora

- Sherkhan ProjectDocumento96 pagineSherkhan ProjectAbhishek AgarwalNessuna valutazione finora

- Custom Tambola Housie Tickets PDFDocumento5 pagineCustom Tambola Housie Tickets PDFAbhishek AgarwalNessuna valutazione finora

- Covering Letter: ComputerDocumento4 pagineCovering Letter: ComputerAbhishek AgarwalNessuna valutazione finora

- MIMR IndianBkgSys2 2011Documento71 pagineMIMR IndianBkgSys2 2011Abhishek AgarwalNessuna valutazione finora

- Country Analysis-BRAZILDocumento36 pagineCountry Analysis-BRAZILAbhishek AgarwalNessuna valutazione finora

- Mergers & Acquisitions Presentation On Mauritius: Group MembersDocumento37 pagineMergers & Acquisitions Presentation On Mauritius: Group MembersAbhishek AgarwalNessuna valutazione finora

- Liability of Third Person To PrincipalDocumento34 pagineLiability of Third Person To PrincipalKate CyrilNessuna valutazione finora

- 2021-06-07 Yoe Suárez Case UpdateDocumento1 pagina2021-06-07 Yoe Suárez Case UpdateGlobal Liberty AllianceNessuna valutazione finora

- Letter of IntentDocumento3 pagineLetter of Intentthe next miamiNessuna valutazione finora

- Raw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Documento34 pagineRaw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Swastik MaheshwaryNessuna valutazione finora

- Crimson Skies (2000) ManualDocumento37 pagineCrimson Skies (2000) ManualJing CaiNessuna valutazione finora

- Noise BookletDocumento8 pagineNoise BookletRuth Viotti SaldanhaNessuna valutazione finora

- CivproDocumento60 pagineCivprodeuce scriNessuna valutazione finora

- Chemical Bonding & Molecular Structure QuestionsDocumento5 pagineChemical Bonding & Molecular Structure QuestionssingamroopaNessuna valutazione finora

- Ramiro, Lorren - Money MarketsDocumento4 pagineRamiro, Lorren - Money Marketslorren ramiroNessuna valutazione finora

- Compania - General - de - Tabacos - de - Filipinas - V.20180926-5466-1aysvyyDocumento16 pagineCompania - General - de - Tabacos - de - Filipinas - V.20180926-5466-1aysvyyKier Christian Montuerto InventoNessuna valutazione finora

- OSG Reply - Republic V SerenoDocumento64 pagineOSG Reply - Republic V SerenoOffice of the Solicitor General - Republic of the Philippines100% (2)

- Merger Final 1Documento18 pagineMerger Final 1vgh nhytfNessuna valutazione finora

- Mockbar 2018 Criminal-Law GarciaDocumento9 pagineMockbar 2018 Criminal-Law GarciasmileycroixNessuna valutazione finora

- Legal Basis of International RelationsDocumento22 pagineLegal Basis of International RelationsCyra ArquezNessuna valutazione finora

- Project Report ON Ladies Garments (Tailoring-Unit)Documento4 pagineProject Report ON Ladies Garments (Tailoring-Unit)Global Law FirmNessuna valutazione finora

- FTP Chart1Documento1 paginaFTP Chart1api-286531621Nessuna valutazione finora

- MD Sirajul Haque Vs The State and OrsDocumento7 pagineMD Sirajul Haque Vs The State and OrsA.B.M. Imdadul Haque KhanNessuna valutazione finora

- Unit 1 - The Crisis of The Ancien Régime and The EnlightenmentDocumento2 pagineUnit 1 - The Crisis of The Ancien Régime and The EnlightenmentRebecca VazquezNessuna valutazione finora

- Petron Vs CaberteDocumento2 paginePetron Vs CabertejohneurickNessuna valutazione finora

- Saida DahirDocumento1 paginaSaida Dahirapi-408883036Nessuna valutazione finora

- Exhaution of Administrative Remedies and The Doctrine of Primary JurisdictionDocumento3 pagineExhaution of Administrative Remedies and The Doctrine of Primary JurisdictionSebastian BorcesNessuna valutazione finora

- Binani Industries Ltd. V. Bank of Baroda and Another - An AnalysisDocumento4 pagineBinani Industries Ltd. V. Bank of Baroda and Another - An AnalysisJeams ZiaurNessuna valutazione finora

- JWB Thesis 05 04 2006Documento70 pagineJWB Thesis 05 04 2006Street Vendor ProjectNessuna valutazione finora

- Assignment On Business PlanDocumento28 pagineAssignment On Business PlanFauzia AfrozaNessuna valutazione finora

- Contract Act 4 PDFDocumento18 pagineContract Act 4 PDFyisjoxaNessuna valutazione finora

- Department of Labor: Kaiser Permanente Bridge ProgramDocumento1 paginaDepartment of Labor: Kaiser Permanente Bridge ProgramUSA_DepartmentOfLaborNessuna valutazione finora

- Pestano V Sumayang, SandovalDocumento2 paginePestano V Sumayang, SandovalTricia SandovalNessuna valutazione finora

- God'S Order For Family Life: 1. God Created Man (Male/Female) in His Own Image (Documento7 pagineGod'S Order For Family Life: 1. God Created Man (Male/Female) in His Own Image (Divino Henrique SantanaNessuna valutazione finora

- Lecture 2 Partnership FormationDocumento58 pagineLecture 2 Partnership FormationSherwin Benedict SebastianNessuna valutazione finora

- MOU Barangay CuliananDocumento4 pagineMOU Barangay CuliananAldrinAbdurahimNessuna valutazione finora