Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Statement Analysi-Introduction

Caricato da

divakar1130 valutazioniIl 0% ha trovato utile questo documento (0 voti)

27 visualizzazioni45 pagineanalysis

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoanalysis

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

27 visualizzazioni45 pagineFinancial Statement Analysi-Introduction

Caricato da

divakar113analysis

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 45

DECISION MAKING PROCESS

Defining the problem/Setting the goal

Identifying the alternatives

Evaluating the alternatives

Selecting the best alternative

Implementing the decision

DECISION MAKERS

SECURITY ANALYSTS

INVESTMENT ADVISORS

FUND MANAGERS

INVESTMENT BANKERS

CREDIT RATERS

CORPORATE BANKERS

INDIVIDUAL INVESTORS

EQUITY

SHAREHOLDERS

MAY

INVESTIGATE

INTO

WHAT ARE BUSINESS PROSPECTS

WHAT ARE COMPETITIVE STRENGTHS AND

WEAKNESSES

WHAT STRATEGIC INITIATIVES HAVE BEEN

TAKEN OR PLANNED TO TAKE, IN RESPONSE TO

BUSINESS OPPORTUNITIES AND THREATS

WHAT IS EARNINGS POTENTIAL

WHAT IS THE RECENT EARNINGS PERFORMANCE

HOW SUSTAINABLE ARE CURRENT EARNINGS

WHAT ARE THE DRIVERS OF PROFITABILITY

WHAT ESTIMATES CAN BE MADE ABOUT

EARNINGS GROWTH

WHAT IS CURRENT FINANCIAL CONDITION

WHAT RISKS AND REWARDS DOES FINANCING

STRUCTURE PORTRAY

ARE EARNINGS AVAILBLE TO VARIABILITY

DOES IT POSSESS FINANCIAL STRENGTH TO

OVERCOME A PERIOD OF POOR PROFITABILITY

HOW DOES IT COMPARE WITH ITS

COMPETITORS, BOTH DOMESTICALLY AND

GLOBALLY

WHAT IS REASONABLE PRICE FOR THE

COMPANYS STOCK

CREDITORS AND LENDERS

MAY LOOK INTO

WHAT ARE BUSINESS PLANS AND PROSPECTS

WHAT ARE ITS NEEDS FOR FUTURE FINANCING

WHAT ARE ITS LIKELY SOURCES FOR PAYMENT OF

INTEREST AND PRINCIPAL

HOW MUCH CUSHION DOES IT HAVE IN ITS

EARNINGS AND CASH FLOWS TO PAY INTEREST

AND PRINCIPAL

WHAT IS THE LIKELIHOOD IT WILL BE UNABLE

TO MEET ITS FINANCIAL OBLIGATIONS

HOW VOLATILE ARE ITS EARNINGS AND CASH

FLOWS

DOES IT HAVE THE FINANCIAL STRENGTH TO PAY

ITS COMMITMENTS IN A PERIOD OF POOR

PROFITABILITY

BUSINESS ANALYSIS

Analyst should know the business she/he is covering

First, the business model (business concept or

business strategy)is to be identified.

What is the company aiming to do?

How does it see itself to be generating value?

Strategy Analysis

Strategy analysis Assessing a companys expected

strategic responses to its business environment and

the impact of these responses on its future success and

growth.

Many details of the business to know, which may be

considered under five categories.

PRODUCT

Type

Demand

Price elasticity of demand

Substitutes Differentiated on price or quality

Brand

Patent protection

PRODUCTION AND DISTRIBUTION

Production process

Marketing process

Distribution channels

Supplier network

Cost structure

Economies of scale

Technology

KNOWLEDGE BASE

Direction and pace of technological change

R&D

Managerial talent

Ability to innovate in product development

Ability to innovate in production technology

INDUSTRY

Capacity in the industry Excess capacity or under-

capacity

Number of firms and their sizes

Barriers to entry

Firms position in the industry

Competitiveness of suppliers

Relationships

ENVIRONMENT

Political

Legal

Regulatory

Ethical

FINANCIAL STATEMENT ANALYSIS

AN IMPORTANT AND INTEGRAL PART OF

BUSINESS ANALYSIS

IT IS THE APPLICATION OF ANALYTICAL TOOLS

AND TECHNIQUES TO FINANCIAL DATA TO

DRAW INFERENCES OR TO EXTRACT

INFORMATION.

FINANCIAL STATEMENTS

REFLECTIONS OF BUSINESS

ACTIVITIES

PLANNING ACTIVITIES

Information on company objectives, strategies and tactics, market demands,

competitive analysis, sales strategies (pricing, promotion and distribution),

management performance, etc. is often revealed in financial statements.

FINANCING ACTIVITIES

Methods used to raise the funds

External financing Equity and debt

Internal financing Earnings retention

INVESTING ACTIVITIES

Acquisition and maintenance of assets Operating assets and

financial assets

OPERATING ACTIVITIES

Primary source of earnings

May include R&D, procurement, production, marketing and administration

NATURE OF FINANCIAL

STATEMENTS

FINANCIAL STATEMENTS ARE THE LENS ON

THE BUSINESS

BUT OFTEN PRODUCE A BLURRED PICTURE

FINANCIAL STATEMENT ANALYSIS FOCUSES

THE LENS TO PRODUCE A CLEARER PICTURE

OBJECTIVES OF FINANCIAL

STATEMENT ANALYSIS

IT REDUCES RELIANCE ON HUNCHES, GUESSES

AND INTUTION FOR BUSINES DECISIONS

IT DECREASES THE UNCERTINITY OF BUSINESS

ANALYSIS

IT DOES NOT LESSEN THE NEED FOR EXPERT

JUDGEMENT, BUT, INSTEAD, PROVIDES A

SYSTEMATIC AND EFFECTIVE BASIS FOR BUSINESS

ANALYSIS

ACCOUNTING ANALYSIS

PROCESS OF EVALUATING THE EXTENT TO

WHICH A COMPANYS ACCOUNTING REFLECTS

ECONOMIC REALITY

ASSESSING THE EFFECTS OF ACCOUNTING

POLICIES ON FINANCIAL STATEMENTS

ADJUSTING THE STATEMENTS TO BOTH BETTER

REFLECT THE UNDERLYING ECONOMICS

BALANCE SHEET

Figures have been taken from the balances shown on

the books of accounts

Pro forma balance sheet--Hypothetical balance sheet

that adjusts regular balance sheet to reflect the

changes which are contemplated

Object is to show the financial condition on a certain

date, yet the values show the cost at which they are

acquired

INCOME STATEMENT

Also known as Profit and Loss Account/Statement

Representation of the operating activities

Measures financial performance between balance sheet

dates.

Provides details of revenues, expenses, gains, and losses for

a time period.

Related to balance sheet as it states the nature of those

transactions that have changed the earned surplus as

reported in two successive balance sheets.

BOTTOM LINE EARNINGS (NET INCOME) INDICATES

PROFITABILITY.

Interrelationship among income, cash flow, and assets

is captured by the concept of economic earnings.

Economic earnings is defined as the net cash flows

plus the change in market value of the firms net

assets.

Market value of the firms assets is equal to the present

value of their cash flows discounted at the required

rate of return.

Distributable earnings are defined as the amount of

earnings that can be paid out as dividends without

changing the value of the firm. This concept is derived

from the Hicksian definition of income, which goes:

The amount that a person can consume during a period of

time and be as well off at the end of that time as at the

beginning.

Sustainable income refers to the level of income that can be

maintained in the future given the firms stock of capital

investment (e.g. fixed assets and inventory).

Permanent earnings amount that can normally be earned

given the firms assets and equals the market value of those

assets times the firms required rate of return.

Financial reporting concept of incomeaccounting

income is often quite different. The analyst,

therefore, needs to relate accounting income to the

economic income.

STATEMENT OF SHAREHOLDERS

EQUITY

Provides changes in the accounts that make up equity

Useful in identifying reasons for changes in equity

holders claim on the assets of the company

STATEMENT OF CASH FLOWS

Accounting yields numbers different from cash flow

accounting

Reports cash inflows and cash outflows separately for

operating, investing, and financing activities over a

period of time

ARTICULATION OF FINANCIAL

STATEMENTS

Linking of Financial Statements by design

Period- of- time statements (income statement,

statement of cash flows, and statement of

shareholders equity) explain point-in-time balance

sheets

Every transaction captured in period-of-time

statements impacts the balance sheet.

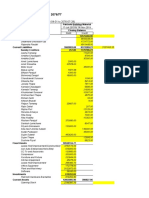

Cash Flow Statement Year 1

Cash from Operations

Cash from Investing

Debt Financing

Equity Financing

Net Change in cash

Statement of Shareholders

Equity Year 1

Investment and disinvestment by

owners

Earnings

Net Change in owners equity

Income Statement Year 1

Cash from operations

+ Accruals

Net Income

Ending Balance Sheet

Year 0

Cash 0

+Other Assets 0

-Liabilities 0

Owners Equity 0

Ending Balance

Sheet Year 1

Cash 1

+Other Assets 1

-Liabilities 1

Owners Equity 1

1. Net cash flows from all activities increases cash in

the balance sheet.

2. Cash from operations increases net income and

shareholders equity.

3. Cash investments increase other assets.

4. Cash from debt financing increases liabilities.

5. Cash from equity financing increases shareholders

equity.

6. Accruals increase net income, shareholders equity,

assets, and liabilities.

TOOLS OF FINANCIAL ANALYSIS

Comparative financial statement analysis

Common-size financial statement analysis

Ratio analysis

Cash flow analysis

Valuation models

COMPARATIVE FINANCIAL

STATEMENT ANALYSIS

Reviewing consecutive balance sheets, income

statements or statements of cash flows from period to

period.

A comparison of statements over many periods can

reveal the direction, pace, and extent of trend.

Also known as horizontal analysis

TECHNIQUES OF COMPARATIVE

ANALYSIS

Year-to-year Change analysis

* Useful for comparing over relatively short-time

periods.

* Has the advantage of presenting changes in

absolute amounts s well as in percentages

Index-number Trend analysis

* Using index numbers with a base period for

all items

Certain changes, like those from negative amounts to positive

amounts cannot be expressed by means of index numbers

COMMON SIZE FINANCIAL

STATEMENT ANALYSIS

Knowing what proportion of a group or a sub-group is

made up of a particular account

In analyzing balance sheet, total assets are taken as

100%, then accounts within these groupings are

expressed as a percentage of their respective total

In analyzing income statement, sales are often set at

100% with the remaining income statement accounts

expressed as a percentage of sales.

Also called vertical analysis given the up-down (or

down-up) evaluation of accounts

RATIO ANALYSIS

Mathematical relation between two quantities

Ratio is simple arithmetic calculation, but its

interpretation is more complex

Several factors influence the ratios which may include

economic events, industry factors, management

policies, and accounting methods

Any limitations in accounting measurements impact

the effectiveness of ratios.

Ratios must be interpreted with care because factors

affecting the numerator can correlate with those

affecting with denominator.

RATIOS-- USES

Measuring Risk

Liquidity- Ability to meet short-term obligations

Capital structure and solvency Ability to meet

long term obligations

Measuring profitability

* Return on investment

* Operating performance

* Asset utilization

Measuring value

CASH FLOW ANALYSIS

Used as a tool to evaluate the sources and uses of funds

Used in cash flow forecasting

Part of liquidity analysis

Provides insights into how a company is obtaining its

financing and deploying its resources

VALUATION MODELS

Refers to estimating the intrinsic value of an

organization or its equity stock

Present value theory --- Value is equal to the sum of

all expected future payoffs that are discounted to the

present at an appropriate discount rate

Additional Information

Management Report

Auditor Report

Explanatory Notes

Supplementary Information

Limitations of F.S. Analysis

QUALITY OF FINANCIAL ANALYSIS DEPENDS ON

THE RELIABILIITY OF FINANCIAL STATEMENTS

THAT IN TURN DEPENDS ON THE QUALITY OF

ACCOUNTING ANALYSIS

Accounting limitations affect the FSA

Lack of uniformity leading to comparability problem

Discretion and imprecision in accounting

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 0527XXXXXXXXX524624 06 2019Documento1 pagina0527XXXXXXXXX524624 06 2019ErPrakashSamotaNessuna valutazione finora

- Discount MarketDocumento13 pagineDiscount MarketAakanksha SanctisNessuna valutazione finora

- Maintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial StabilityDocumento54 pagineMaintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial Stabilityfrancis reddyNessuna valutazione finora

- About Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDocumento5 pagineAbout Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDaniel keith LucasNessuna valutazione finora

- Eco Book For May 2023Documento185 pagineEco Book For May 2023Kshitij PatilNessuna valutazione finora

- Himilo University: Direct QuestionsDocumento2 pagineHimilo University: Direct QuestionsSabina MaxamedNessuna valutazione finora

- Financial LiteracyDocumento7 pagineFinancial LiteracyRochelle Ann Galvez Gabaldon100% (1)

- A Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofDocumento10 pagineA Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofbabuluckyNessuna valutazione finora

- Cuomo Mining Corporation A Public Company Whose Stock Trades On PDFDocumento2 pagineCuomo Mining Corporation A Public Company Whose Stock Trades On PDFTaimur TechnologistNessuna valutazione finora

- Mcqs 1Documento2 pagineMcqs 1aashir chNessuna valutazione finora

- Audit PointsDocumento37 pagineAudit PointsRajaniseer SrinivasanNessuna valutazione finora

- Indian Financial SystemDocumento38 pagineIndian Financial SystemNikita DakiNessuna valutazione finora

- Rich Dad Poor DadDocumento26 pagineRich Dad Poor DadKhalid Iqbal100% (1)

- Statement Ending 11/30/2022: Summary of AccountsDocumento4 pagineStatement Ending 11/30/2022: Summary of AccountsGrégoire TSHIBUYI KATINANessuna valutazione finora

- FRMUnit IDocumento17 pagineFRMUnit IAnonNessuna valutazione finora

- TallyDocumento2 pagineTallyManan ShahNessuna valutazione finora

- LSPU Quiz No. 3Documento4 pagineLSPU Quiz No. 3Jamie Rose AragonesNessuna valutazione finora

- Class Notes Redemption of Preference Share - PDFDocumento4 pagineClass Notes Redemption of Preference Share - PDFBhavya MehtaNessuna valutazione finora

- Uts Finance IvanDocumento28 pagineUts Finance IvanIvan ZackyNessuna valutazione finora

- Palchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)Documento19 paginePalchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)SworajNessuna valutazione finora

- Private Placement Trade Programs ExplainedDocumento18 paginePrivate Placement Trade Programs ExplainedMike Weiner100% (6)

- Refund and Excess Payments (Credit Balances) Policy and Procedure PDFDocumento8 pagineRefund and Excess Payments (Credit Balances) Policy and Procedure PDFMinh DuongNessuna valutazione finora

- Sime Darby BerhadDocumento16 pagineSime Darby Berhadjue -Nessuna valutazione finora

- Cfap 4 PKDocumento300 pagineCfap 4 PKmuhammad osamaNessuna valutazione finora

- Chapter 5 - Effects of InflationDocumento19 pagineChapter 5 - Effects of InflationTanveer Ahmed HakroNessuna valutazione finora

- Example of Muet WritingDocumento6 pagineExample of Muet WritingZulhelmie ZakiNessuna valutazione finora

- Microfinance Management: Chapter - 1Documento251 pagineMicrofinance Management: Chapter - 1sunit dasNessuna valutazione finora

- Introduction To Corporate Finance 4Th Edition Booth Solutions Manual Full Chapter PDFDocumento36 pagineIntroduction To Corporate Finance 4Th Edition Booth Solutions Manual Full Chapter PDFbarbara.wilkerson397100% (11)

- 2023 10 02 11 04 28jul 23 - 605009Documento3 pagine2023 10 02 11 04 28jul 23 - 605009prasannapharaohNessuna valutazione finora

- Financial Risk Management in BusinessDocumento10 pagineFinancial Risk Management in BusinessLuis SeijasNessuna valutazione finora