Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chap 004

Caricato da

sufyanbutt007Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chap 004

Caricato da

sufyanbutt007Copyright:

Formati disponibili

McGraw-Hill/I rwin Copyright 2011 by The McGraw-Hill Companies, I nc. All rights reserved.

Chapter 4

Adjustments, Financial Statements, and

Financial Results

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Fred Phillips, Ph.D., CA

Learning Objective 1

Explain why adjustments are

needed.

4-3

Solution: Adjustments are made to the accounting

records at the end of the period to state assets, liabilities,

revenues, and expenses at appropriate amounts.

Why Adjustments Are Needed

However, cash is not always received in the period

in which the company earns the related revenue;

likewise, cash is not always paid in the period in

which the company incurs the related expense.

Accounting systems are designed to record most

recurring daily transactions, particularly any

involving cash.

4-4

Why Adjustments Are Needed

Income Statement

Revenues are

recorded when

earned.

Expenses are

recorded in the same

period as the

revenues to which

they relate.

Balance Sheet

Assets are reported

at amounts

representing the

economic benefits

that remain at the end

of the period.

Liabilities are

reported at amounts

owed at the end of

the period.

4-5

1. Deferral Adjustments

An expense or revenue has been deferred if we have

postponed reporting it on the income statement until a

later period.

Sept. 1 Sept. 30

Use-up rent

benefits

Cash paid for

rent in advance

Adjustment

needed

Jan. 1 Jan. 31

Deliver

subscription

service

Cash received

for subscription

in advance

Adjustment

needed

4-6

1. Deferral Adjustments

Deferral adjustments

are used to decrease

balance sheet accounts

and increase

corresponding income

statement accounts.

Each deferral

adjustment involves

one asset and one

expense account, or

one liability and one

revenue account.

4-7

2. Accrual Adjustments

Accrual adjustments are needed when a company has

earned revenue or incurred an expense in the current

period but has not yet recorded it because the related

cash will not be received or paid until a later period.

Sept. 1 Sept. 30

Incur income

taxes

Adjustment

needed

Jan. 1 Jan. 31

Earn

interest

Adjustment

needed

Dec. 31

Cash paid for

income taxes

Mar. 31

Cash received

for interest

4-8

2. Accrual Adjustments

Accrual adjustments

are used to record

revenue or expenses

when they occur prior

to receiving or paying

cash, and to adjust

corresponding balance

sheet accounts.

Each accrual

adjustment involves

one asset and one

revenue account, or

one liability and one

expense account.

4-9

Learning Objective 2

Prepare adjustments needed

at the end of the period.

4-10

Making Required Adjustments

Adjustments are not made on a daily basis

because its more efficient to do them all at

once at the end of each period.

4-11

Adjustment Analysis, Recording

and Summarizing

1 Analyze

Determine the necessary adjustments to make to

the accounting records.

4-12

4-13

Deferral Adjustments

(a) Supplies Used during the Period.

Of the $1,600 in supplies received in early September, $400 remain on hand at

September 30.

Assets = Liabilities + Stockholders' Equity

(a) Supplies -1,200 Supplies

Expense (+E) -1,200

1 Analyze

2 Record

(a) Supplies Expense (+E, -SE) 1,200

Supplies (-A) 1,200

3

Summarize

4-14

Deferral Adjustments

(b) Rent Benefits Expired during the Period.

Three months of rent were prepaid on September 1 for $7,200, but one month has

now expired, leaving only two months prepaid at September 30.

1

/

3

x $7,200 = $2,400 expense

used up as of Sept. 30

2

/

3

x $7,200 = $4,800 asset remains

prepaid as of Sept. 30

4-15

Deferral Adjustments

Three months of rent were prepaid on September 1 for $7,200, but one month has

now expired, leaving only two months prepaid at September 30.

Assets = Liabilities + Stockholders' Equity

(b) Prepaid Rent

Rent -2,400 Expense (+E) -2,400

1 Analyze

2 Record

(b) Rent Expense (+E, -SE) 2,400

Prepaid Rent (-A) 2,400

3

Summarize

(b) Rent Benefits Expired during the Period.

4-16

Deferral Adjustments

(c) Depreciation Is Recorded for Use of Equipment.

The restaurant equipment, which was estimated to last five years, has now been

used for one month, representing an estimated expense of $1,000.

Depreciation is the process of allocating the cost of

buildings, vehicles, and equipment to the accounting

periods in which they are used.

A contra-account

is an account that

is an offset to, or

reduction of,

another account.

4-17

Deferral Adjustments

The restaurant equipment, which was estimated to last five years, has now been

used for one month, representing an estimated expense of $1,000.

Assets = Liabilities + Stockholders' Equity

(c) Accumulated Depreciation

Depr. +1,000 Expense (+E) +1,000

1 Analyze

2 Record

(c) Depreciation Expense (+E, -SE) 1,000

Accumulated Depreciation (+xA, -A) 1,000

3

Summarize

(c) Depreciation Is Recorded for Use of Equipment.

4-18

Depreciation

Accumulated

Depreciation

Balance

Sheet

Depreciation

Expense

Income

Statement

Note 1

Accumulated

Depreciation

Total Amount

Depreciated

Equipment

Original cost

Note 2

Contra-

Account

Opposes

account it

offsets

Note 3

Depreciation

Amount

Depends on

method used

Note 4

4-19

Deferral Adjustments

(d) Gift Cards Redeemed for Service.

Pizza Aroma redeemed $160 of gift cards that customers used to pay for pizza.

Assets = Liabilities + Stockholders' Equity

(d) Unearned Pizza

Revenue -160 Revenue (+R) +160

1 Analyze

2 Record

(d) Unearned Revenue (-L) 160

Pizza Revenue (+R, +SE) 160

3

Summarize

4-20

Accrual Adjustments

(e) Revenues Earned but Not Yet Recorded.

Pizza Aroma provided $40 of Pizza to Mauricios close friend on the last day of

September, with payment to be received in October.

Assets = Liabilities + Stockholders' Equity

(e) Accounts Pizza

Receivable +40 Revenue (+R) +40

1 Analyze

2 Record

(e) Accounts Receivable (+A) 40

Pizza Revenue (+R, +SE) 40

3

Summarize

4-21

Accrual Adjustments

(f) Wages Expense Incurred but Not Yet Recorded.

Pizza Aroma owes $900 of wages to employees for work done in the last three

days of September.

Assets = Liabilities + Stockholders' Equity

(f) Wages Wages

Payable +900 Expense (+E) -900

1 Analyze

2 Record

(f) dr Wages Expense (+E, -SE) 900

cr Wages Payable (+L) 900

3

Summarize

4-22

Accrual Adjustments

(g) Interest Expense Incurred but Not Yet Recorded.

Pizza Aroma has not paid or recorded the $100 interest that it owes for this month

on its note payable to the bank.

Assets = Liabilities + Stockholders' Equity

(g) Interest Interest

Payable +100 Expense (+E) -100

1 Analyze

2 Record

(g) dr Interest Expense (+E, -SE) 100

cr Interest Payable (+L) 100

3

Summarize

4-23

Accrual Adjustments

(h) Income Taxes Incurred but Not Yet Recorded.

Pizza Aroma pays income tax at an average rate equal to 40 percent of the

companys income before taxes.

Assets = Liabilities + Stockholders' Equity

(h) Income Tax Income Tax

Payable +400 Expense (+E) -400

1 Analyze

2 Record

(h) dr Income Tax Expense (+E, -SE) 400

cr Income Tax Payable (+L) 400

3

Summarize

$1,000 x 40% = $400

4-24

Additional Comments

Adjusting journal entries

never involve cash.

Adjusting entries always

include one balance sheet

and one income statement

account.

Dividends are not

expenses. Instead, they

are a reduction of the

retained earnings.

4-25

Pizza Aromas Accounting Records

(i) Dividend Declared.

Pizza Aroma declares and pays a $500 cash dividend.

Assets = Liabilities + Stockholders' Equity

(i) Cash -500 Dividends

Declared (+D) -500

1 Analyze

2 Record

(i) dr Dividends Declared (+D, -SE) 500

cr Dividends Payable (+ L) 500

4-26

Learning Objective 3

Prepare an adjusted trial

balance.

4-27

Debit Credit

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Equipment 60,000

Accumulated Depreciation 1,000 $

Accounts Payable 1,030

Dividends Payable 500

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Note Payable 20,000

Contributed Capital 50,000

Retained Earnings -

Dividends Declared 500

Pizza Revenue 15,700

Wages Expense 9,000

Rent Expense 2,400

Supplies Expense 1,200

Depreciation Expense 1,000

Utilities Expense 600

Advertising Expense 400

Interest Expense 100

Income Tax Expense 400

Total 89,770 $ 89,770 $

Partial Listing of T-accounts

4-28

Learning Objective 4

Prepare financial statements.

4-29

Debit Credit

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Equipment 60,000

Accumulated Depreciation 1,000 $

Accounts Payable 1,030

Dividends Payable 500

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Note Payable 20,000

Contributed Capital 50,000

Retained Earnings -

Dividends Declared 500

Pizza Revenue 15,700

Wages Expense 9,000

Rent Expense 2,400

Supplies Expense 1,200

Depreciation Expense 1,000

Utilities Expense 600

Advertising Expense 400

Interest Expense 100

Income Tax Expense 400

Total 89,770 $ 89,770 $

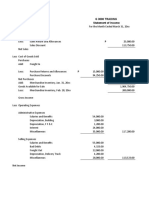

PIZZA AROMA

Adjusted Trial Balance

As of September 30, 2010

Revenues

Pizza Revenue 15,700 $

Total Revenue 15,700

Expenses

Wages Expense 9,000

Rent Expense 2,400

Supplies Expense 1,200

Depreciation Expense 1,000

Utilities Expense 600

Advertising Expense 400

Interest Expense 100

Income Tax Expense 400

Total Expenses 15,100

Net Income 600 $

For the Month Ended September 30, 2010

Income Statement

PIZZA AROMA, INC.

Retained Earnings, Sept. 1, 2010 - $

Add: Net Income 600

Subtract: Dividends Declared (500)

Retained Earnings, Sept. 30, 2010 100 $

For the Month Ended September 30, 2010

PIZZA AROMA, INC.

Statement of Retained Earnings

4-30

Debit Credit

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Equipment 60,000

Accumulated Depreciation 1,000 $

Accounts Payable 1,030

Dividends Payable 500

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Note Payable 20,000

Contributed Capital 50,000

Retained Earnings -

Dividends Declared 500

Pizza Revenue 15,700

Wages Expense 9,000

Rent Expense 2,400

Supplies Expense 1,200

Depreciation Expense 1,000

Utilities Expense 600

Advertising Expense 400

Interest Expense 100

Income Tax Expense 400

Total 89,770 $ 89,770 $

PIZZA AROMA

Adjusted Trial Balance

As of September 30, 2010

Current Assets

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Total Current Assets 14,170

Equipment 60,000 $

Accumulated Depreciation (1,000) 59,000

Total Assets 73,170 $

Liabilities

Current Liabilities

Accounts Payable 1,030 $

Dividends Payable 500 $

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Total Current Liabilities 3,070

Note Payable 20,000

Total Liabilities 23,070

Stockholders' Equity

Contributed Capital 50,000

Retained Earnings 100

Total Stockholders' Equity 50,100

Total Liabilities and Stockholders' Equity 73,170 $

Balance Sheet

At September 30, 2010

Assets

Liabilities and Stockholders' Equity

4-31

Learning Objective 5

Explain the closing process.

4-32

Closing Temporary Accounts

Transfer net income (or

loss) and dividends to

Retained Earnings.

Establish zero

balances in all income

statement and dividend

accounts.

4-33

Temporary accounts

track financial

results for a limited

period of time.

Closing Temporary Accounts

Revenues

E

x

p

e

n

s

e

s

D

i

v

i

d

e

n

d

s

Temporary

Accounts

Permanent

Accounts

Assets

L

i

a

b

i

l

i

t

i

e

s

E

q

u

i

t

y

Permanent accounts

track financial

results from year to

year.

4-34

Two closing journal entries are

needed.

Closing Temporary Accounts

Debit Revenue accounts and

credit Expense accounts.

Debit or credit the difference

to Retained Earnings.

Credit Dividends Declared

and debit Retained Earnings.

4-35

dr Pizza Revenue (-R) 15,700

cr Wages Expense (-E) 9,000

cr Rent Expense (-E) 2,400

cr Supplies Expense (-E) 1,200

cr Depreciation Expense (-E) 1,000

cr Utilities Expense (-E) 600

cr Advertising Expense (-E) 400

cr Interest Expense (-E) 100

cr Income Tax Expense (-E) 400

cr Retained Earnings (+SE) 600

dr Retained Earnings (-SE) 500

cr Dividends Declared (-D) 500

Debit Credit

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Equipment 60,000

Accumulated Depreciation 1,000 $

Accounts Payable 1,030

Dividends Payable 500

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Note Payable 20,000

Contributed Capital 50,000

Retained Earnings -

Dividends Declared 500

Pizza Revenue 15,700

Wages Expense 9,000

Rent Expense 2,400

Supplies Expense 1,200

Depreciation Expense 1,000

Utilities Expense 600

Advertising Expense 400

Interest Expense 100

Income Tax Expense 400

Total 89,770 $ 89,770 $

Adjusted Trial Balance

As of September 30, 2010

4-36

After posting these

closing entries, all

the income

statement accounts

and the dividend

account will have a

zero balance.

dr Pizza Revenue (-R) 15,700

cr Wages Expense (-E) 9,000

cr Rent Expense (-E) 2,400

cr Supplies Expense (-E) 1,200

cr Depreciation Expense (-E) 1,000

cr Utilities Expense (-E) 600

cr Advertising Expense (-E) 400

cr Interest Expense (-E) 100

cr Income Tax Expense (-E) 400

cr Retained Earnings (+SE) 600

dr Retained Earnings (-SE) 500

cr Dividends Declared (-D) 500

Closing Temporary Accounts

4-37

Final check that all

debits still equal

credits and that all

temporary accounts

have been closed.

Contains balances for

only permanent

accounts.

Is the last step in the

accounting process.

4-38

Debit Credit

Cash 8,100 $

Accounts Receivable 240

Supplies 400

Prepaid Rent 4,800

Cookware 630

Equipment 60,000

Accumulated Depreciation 1,000 $

Accounts Payable 1,030

Dividends Payable 500

Unearned Revenue 140

Wages Payable 900

Income Tax Payable 400

Interest Payable 100

Note Payable 20,000

Contributed Capital 50,000

Retained Earnings 100

Dividends Declared -

Pizza Revenue -

Wages Expense -

Rent Expense -

Supplies Expense -

Depreciation Expense -

Utilities Expense -

Advertising Expense -

Interest Expense -

Income Tax Expense -

Total 74,170 $ 74,170 $

Post-Closing Trial Balance

As of September 30, 2010

Learning Objective 6

Explain how adjustments

affect financial results.

4-39

Adjusted Financial Results

Adjustments help to ensure that all revenues

and expenses are reported in the period in

which they are earned and incurred.

Without adjustments, the financial statements

present an incomplete and misleading picture

of the companys financial performance.

4-40

Chapter 4

Solved Exercises

M4-5, M4-6, M4-9, M4-10, M4-18,

E4-18

M4-5 Determine Accounting Equation Effects of Adjustments

For each of the following transactions for the Sky Blue Corporation, give

the accounting equation effects of the adjustments required at the end of

the month on December 31, 2009:

a. Collected $1,200 rent for the period December 1, 2009, to February

28, 2010, which was credited to Unearned Rent Revenue on

December 1, 2009.

b. Paid $2,400 for a two-year insurance premium on December 1, 2009;

debited Prepaid Insurance for that amount.

c. Used a machine purchased on December 1, 2009 for $48,000. The

company estimates annual depreciation of $4,800.

Assets = Liabilities + Stockholders' Equity

(a) Unearned Rent Rent

Revenue -400 Revenue +400

Assets = Liabilities + Stockholders' Equity

(b) Prepaid Insurance

Insurance -100 Expense -100

Assets = Liabilities + Stockholders' Equity

(c) Accumulated Depreciation

Depreciation -400 Expense -400

4-42

M4-6 Recording Adjusting Journal Entries

Using the information in M4-5, prepare the adjusting journal entries

required on December 31, 2009.

a. dr Unearned Rent Revenue (L) 400

cr Rent Revenue (+R, +SE) 400

($400 = 1/3 x $1,200)

b. dr Insurance Expense (+E, SE) 100

cr Prepaid Insurance (A) 100

($100 = 1/24 x $2,400)

c. dr Depreciation Expense (+E, SE) 400

cr Accumulated Depreciation (+xA, A) 400

($400 =1/12 x $4,800)

4-43

M4-9 Preparing Journal Entries for Deferral Transactions and

Adjustments

For each of the following independent situations, prepare journal

entries to record the initial transaction and the adjustment required at

the end of the month indicated.

a. Hockey Helpers paid $2,000 cash on September 30, to rent an

arena for the months of October and November.

September 30:

October 31 AJE:

dr Prepaid Rent (+A) 2,000

cr Cash (-A) 2,000

dr Rent Expense (+E, -SE) 1,000

cr Prepaid Rent (-A) 1,000

($2,000/2=$1,000 per month)

4-44

M4-9 Preparing Journal Entries for Deferral Transactions and

Adjustments

b. Super Stage Shows received $6,000 on September 30, for

season tickets that admit patrons to a theatre event that will be

held twice (on October 31 and November 30).

September 30:

October 31 AJE:

dr Cash (+A) 6,000

cr Unearned Revenue (+L) 6,000

dr Unearned Revenue (-L) 3,000

cr Admissions Revenue (+R, +SE) 3,000

($6,000/2=$3,000 per month)

4-45

M4-9 Preparing Journal Entries for Deferral Transactions and

Adjustments

c. Risky Ventures paid $3,000 on September 30, for insurance

coverage for the months of October, November, and December.

September 30:

October 31 AJE:

dr Prepaid Insurance (+A) 3,000

cr Cash (-A) 3,000

dr Insurance Expense (+E, -SE) 1,000

cr Prepaid Insurance (-A) 1,000

($3,000/3=$1,000 per month)

4-46

M4-10 Preparing Journal Entries for Deferral Transactions and

Adjustments

For each of the following independent situations, prepare journal

entries to record the initial transaction and the adjustment required at

the end of the month indicated.

a. Magnificent Magazines received $12,000 on December 30,

2010, for subscriptions to magazines that will be published and

distributed in January through December 2011.

December 30, 2010:

January 31, 2011 AJE:

Cash (+A) 12,000

Unearned Revenue (+L) 12,000

dr Unearned Revenue (-L) 1,000

cr Subscriptions Revenue (+R, +SE) 1,000

($12,000/12=$1,000 per month)

4-47

M4-10 Preparing Journal Entries for Deferral Transactions and

Adjustments

b. Walker Window Washing paid $1,200 cash for supplies on

December 30, 2010. As of January 31, 2011, $200 of these

supplies had been used up.

December 30, 2010:

January 31, 2011 AJE:

Supplies (+A) 1,200

Cash (-A) 1,200

dSupplies Expense (+E, -SE) 200

Supplies (-A) 200

4-48

M4-10 Preparing Journal Entries for Deferral Transactions and

Adjustments

c. Indoor Raceway received $3,000 on December 30, 2010, from

race participants for three races. One race is held January 31,

2011, and the other two will be held in March 2011.

December 30, 2010:

January 31, 2011 AJE:

dr Cash (+A) 3,000

cr Unearned Revenue (+L) 3,000

dr Unearned Revenue (-L) 1,000

cr Racing Revenue (+R, +SE) 1,000

($3,000/3=$1,000 per race)

4-49

M4-18 Preparing and Posting Adjusting Journal Entries

At December 31, the unadjusted trial balance of H&R Tacks reports

Prepaid Insurance of $7,200 and Insurance Expense of $0. The

insurance was purchased on July 1 and provides coverage for 12

months. Prepare the adjusting journal entry on December 31. In

separate T-accounts for each account, enter the unadjusted balances,

post the adjusting journal entry, and report the adjusted balance.

dr Insurance Expense (+E, SE) 3,600

cr Prepaid Insurance (A) 3,600

($7,200 x

6

/

12

= $3,600 used)

+ Prepaid Insurance (A)

+ Insurance Expense (E)

Bal. 7,200 Bal. 0

AJE 3,600 AJE 3,600

End. 3,600 End. 3,600

4-50

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event a

(1)

(2) Assets = Liabilities + Stockholders' Equity

(3) Credit

(4)

On January 22, 2009, MSM received $24,000 cash from customers for one-

year subscriptions to the magazine for February 2009 January 2010.

Debit Account Names

(1)

(2) Assets = Liabilities + Stockholders' Equity

Cash +24,000 Unearned

Revenue +24,000

(3) Credit

24,000

(4)

24,000 24,000

On January 22, 2009, MSM received $24,000 cash from customers for one-

year subscriptions to the magazine for February 2009 January 2010.

Debit

24,000

Unearned Revenue Cash

Account Names

Cash (+A)

Unearned Revenue (+L)

4-51

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event b:

(1)

(2) Assets = Liabilities + Stockholders' Equity

(3) Credit

3,000

(4)

Debit

3,000

Account Names

Utilities Expense (+E, -SE)

Accounts Payable (+L)

(1)

(2) Assets = Liabilities + Stockholders' Equity

Accounts

Payable +3,000

Utilities

Expense (+E) -3,000

(3) Credit

3,000

(4)

3,000

MSM owes $3,000 for utilities used during the period.

3,000

Debit

3,000

Utilities Expense Accounts Payable

Account Names

Utilities Expense (+E, -SE)

Accounts Payable (+L)

4-52

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event c:

(1)

(2) Assets = Liabilities + Stockholders' Equity

Unearned

Revenue -2,000

Subscription

Revenue (+R) +2,000

(3) Credit

(4)

Debit Account Names

(1)

(2) Assets = Liabilities + Stockholders' Equity

Unearned

Revenue -2,000

Subscription

Revenue (+R) +2,000

(3) Credit

2,000

(4)

2,000 2,000

MSM provided $2,000 of subscriptions for which they previously received

payment for.

Debit

2,000

Subscription Revenue Unearned Revenue

Account Names

Unearned Revenue (-L)

Subscription Revenue (+R, +SE)

4-53

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event d:

(1)

(2) Assets = Liabilities + Stockholders' Equity

(3) Credit

(4)

MSM recorded an adjusting entry for this months depreciation of $10,000.

Debit Account Names

(1)

(2) Assets = Liabilities + Stockholders' Equity

Accumulated

Depreciation (+xA) -10,000

Depreciation

Expense (+E) -10,000

(3) Credit

10,000

(4)

10,000

MSM recorded an adjusting entry for this months depreciation of $10,000.

10,000

Debit

10,000

Depreciation Expense Accumulated Depreciation

Account Names

Depreciation Expense (+E, -SE)

Accumulated Depreciation (+xA, -A)

4-54

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event e: (1)

(2) Assets = Liabilities + Stockholders' Equity

(3) Credit

(4)

5,000 5,000

Debit

Prepaid Rent Cash

Account Names

(1)

(2) Assets = Liabilities + Stockholders' Equity

Cash -5,000

Prepaid Rent +5,000

(3) Credit

5,000

(4)

5,000

Debit

5,000

Prepaid Rent Cash

Account Names

Prepaid Rent (+A)

Cash (-A)

MSM paid $5,000 rent in advance of obtaining its benefits.

5,000

4-55

E4-18 Analyzing, Recording, and Summarizing Business Activities

and Adjustments

The following transactions relate to a magazine company called My Style Mag

(MSM).

Required:

For each event af, complete the three missing items using your understanding

of the relationships among: (1) business activities, (2) accounting equation

effects, (3) journal entries, and (4) T-accounts.

Event f

(1)

(2) Assets = Liabilities + Stockholders' Equity

(3) Credit

(4)

10,000 10,000

Debit

Advertising Revenue Accounts Receivable

Account Names

(1)

(2) Assets = Liabilities + Stockholders' Equity

Accounts

Receivable +10,000

Advertising

Revenue (+R) +10,000

(3) Credit

10,000

(4)

10,000 10,000

Debit

10,000

Advertising Revenue Accounts Receivable

Account Names

Accounts Receivable (+A)

Advertising Revenue (+R, +SE)

MSM provided $10,000 of advertising services to customers on account.

4-56

End of Chapter 4

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Profit and Loss Account: Net Spread Earned 10,645 10,452 9,366Documento8 pagineProfit and Loss Account: Net Spread Earned 10,645 10,452 9,366sufyanbutt007Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- SWOT Analysis of Meezan BankDocumento10 pagineSWOT Analysis of Meezan Banksufyanbutt007Nessuna valutazione finora

- M.a.D's SWOT Analysis of Meezan Bank!Documento10 pagineM.a.D's SWOT Analysis of Meezan Bank!Muhammad Ali DanishNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Notes For Microsoft WordDocumento3 pagineNotes For Microsoft WordKaran KumarNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Mission and VisionDocumento2 pagineMission and VisionmahibuttNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- 1947Documento8 pagine1947sufyanbutt007Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Ingredients: Buy These Ingredients NowDocumento1 paginaIngredients: Buy These Ingredients Nowsufyanbutt007Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- BCRWDocumento56 pagineBCRWsufyanbutt007Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Profit and Loss Account: Net Spread Earned 10,645 10,452 9,366Documento8 pagineProfit and Loss Account: Net Spread Earned 10,645 10,452 9,366sufyanbutt007Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Labo Par Uske Kabhi Baddua Nahi HotiDocumento2 pagineLabo Par Uske Kabhi Baddua Nahi Hotisufyanbutt007Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- What Is The Distinction Between Auditing and AccountingDocumento1 paginaWhat Is The Distinction Between Auditing and Accountingsufyanbutt007Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Principles of Banking IDocumento2 paginePrinciples of Banking Isufyanbutt007Nessuna valutazione finora

- 1947Documento8 pagine1947sufyanbutt007Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Labo Par Uske Kabhi Baddua Nahi HotiDocumento2 pagineLabo Par Uske Kabhi Baddua Nahi Hotisufyanbutt007Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Muhammad Tayyab Graphics Designer: Address: Muhalla Bakhtay Wala Gala Gulam Muhammad Thaikadar Wala Street # 1 House # 2Documento2 pagineMuhammad Tayyab Graphics Designer: Address: Muhalla Bakhtay Wala Gala Gulam Muhammad Thaikadar Wala Street # 1 House # 2sufyanbutt007Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Relationship Between Education and Economic Growth in Pakistan: A Time Series AnalysisDocumento6 pagineRelationship Between Education and Economic Growth in Pakistan: A Time Series AnalysisSmile AliNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Business Law Guess Papers 2014 BDocumento2 pagineBusiness Law Guess Papers 2014 Bsufyanbutt007Nessuna valutazione finora

- Random ExperimentDocumento4 pagineRandom Experimentsufyanbutt007Nessuna valutazione finora

- Relationship Between Education and Economic Growth in Pakistan: A Time Series AnalysisDocumento6 pagineRelationship Between Education and Economic Growth in Pakistan: A Time Series AnalysisSmile AliNessuna valutazione finora

- 2Documento39 pagine2Neeraj TiwariNessuna valutazione finora

- Economics of Pakistan Guess Papers 2015 BDocumento6 pagineEconomics of Pakistan Guess Papers 2015 Bsufyanbutt007Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- ConclusionDocumento1 paginaConclusionsufyanbutt007Nessuna valutazione finora

- Labour EconomicsDocumento29 pagineLabour EconomicsAniketh Anchan100% (1)

- Audit Working Papers What Are Working Papers?Documento8 pagineAudit Working Papers What Are Working Papers?sufyanbutt007Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hu 1032 Principles of Investiga TonDocumento4 pagineHu 1032 Principles of Investiga Tonsufyanbutt007Nessuna valutazione finora

- MBFDocumento1 paginaMBFsufyanbutt007Nessuna valutazione finora

- Principles of Economics IDocumento2 paginePrinciples of Economics Isufyanbutt007Nessuna valutazione finora

- TaleemDocumento46 pagineTaleemsufyanbutt007Nessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- MBFDocumento1 paginaMBFsufyanbutt007Nessuna valutazione finora

- Introduction To Business Guess Papers 2014 BDocumento1 paginaIntroduction To Business Guess Papers 2014 Bsufyanbutt007Nessuna valutazione finora

- Personal Monthly Budget1Documento3 paginePersonal Monthly Budget1Alam Mo Ba?Nessuna valutazione finora

- Maksi Soal Kuis 1 Ak. KeuanganDocumento4 pagineMaksi Soal Kuis 1 Ak. KeuanganRenny NNessuna valutazione finora

- Practice Problems in Professional Industrial EngineeringDocumento15 paginePractice Problems in Professional Industrial EngineeringBlair0% (1)

- AP 9 LAS Quarter 3Documento71 pagineAP 9 LAS Quarter 31111111111gfg67% (3)

- Receipt of House Rent Free Doc Format TemplateDocumento6 pagineReceipt of House Rent Free Doc Format Templateparag0019Nessuna valutazione finora

- Trinidad and Tobago Emolument Income Tax 2012Documento5 pagineTrinidad and Tobago Emolument Income Tax 2012Anand RockerNessuna valutazione finora

- Instructions For A Cash Flows Statement Direct MethodDocumento5 pagineInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- American Outdoor Brands 1Documento5 pagineAmerican Outdoor Brands 1Loise GakiiNessuna valutazione finora

- Profit-And-Loss-Statement WELLS FARGODocumento2 pagineProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Company Final AccountsDocumento13 pagineCompany Final Accountsshanthala mNessuna valutazione finora

- Arithmetic - Simple InterestDocumento1 paginaArithmetic - Simple InterestVenkateswararao BuridiNessuna valutazione finora

- CFAS Reviewer - Module 3Documento8 pagineCFAS Reviewer - Module 3Lizette Janiya SumantingNessuna valutazione finora

- Sujahabad Group of IndustriesDocumento32 pagineSujahabad Group of IndustriesvirtulianNessuna valutazione finora

- Dynamo Fs 2021 DraftDocumento193 pagineDynamo Fs 2021 DraftNrkNessuna valutazione finora

- 11 Economics Notes ch01 Introduction PDFDocumento2 pagine11 Economics Notes ch01 Introduction PDFMuhammed SwadNessuna valutazione finora

- Хариу HW2 ACC732Documento6 pagineХариу HW2 ACC732ZayaNessuna valutazione finora

- Reconcilliation Part1Documento25 pagineReconcilliation Part1019. Disha Das fybafNessuna valutazione finora

- Short Equity Note - Bata ShoeDocumento8 pagineShort Equity Note - Bata ShoeShakkhor HaqueNessuna valutazione finora

- G 3000 Trading Statement of IncomeDocumento6 pagineG 3000 Trading Statement of IncomeFrancine Angelika Conda TañedoNessuna valutazione finora

- Holiday Pay Holiday Pay: Homecrew Best Services Phils. Corp. Homecrew Best Services Phils. CorpDocumento1 paginaHoliday Pay Holiday Pay: Homecrew Best Services Phils. Corp. Homecrew Best Services Phils. CorpVic CumpasNessuna valutazione finora

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Documento18 pagineACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNessuna valutazione finora

- Abm 4 Module 5Documento5 pagineAbm 4 Module 5Argene AbellanosaNessuna valutazione finora

- Taxation First Preboard 93 - QuestionnaireDocumento16 pagineTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNessuna valutazione finora

- Meeting 1Documento9 pagineMeeting 1erlina nurliaNessuna valutazione finora

- Lesson 3: Poverty and Inequality: BBE 4303-Economic DevelopmentDocumento22 pagineLesson 3: Poverty and Inequality: BBE 4303-Economic DevelopmentMark ChouNessuna valutazione finora

- E34Documento9 pagineE34Nguyen Nguyen KhoiNessuna valutazione finora

- BMBE SeminarDocumento60 pagineBMBE SeminarBabyGiant LucasNessuna valutazione finora

- Factors Influencing Tax Avoidance PDFDocumento6 pagineFactors Influencing Tax Avoidance PDFJoseNessuna valutazione finora

- Business Finance (Quarter 1 - Weeks 3 & 4)Documento11 pagineBusiness Finance (Quarter 1 - Weeks 3 & 4)Francine Dominique CollantesNessuna valutazione finora

- Statement of Comprehensive Income Part 2Documento8 pagineStatement of Comprehensive Income Part 2AG VenturesNessuna valutazione finora