Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Urban Waters

Caricato da

Rahul Tiwari100%(2)Il 100% ha trovato utile questo documento (2 voti)

1K visualizzazioni15 pagineThis document provides financial projections for a water filtration company over three years, including income statements, balance sheets, and cash flow statements. It shows increasing revenues, profits, and number of customers over the three years as the business scales up. It also outlines key operating expenses and capital investments in filters, vehicles, and other equipment. The consultant answers two questions, noting that unearned estimated revenue losses should not be included in revenue, and additional assumptions around filter losses, transaction fees, and water supply disruptions could strengthen the business plan analysis.

Descrizione originale:

anthony robert accounting and texts

Titolo originale

Urban Waters PPT - Copy

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document provides financial projections for a water filtration company over three years, including income statements, balance sheets, and cash flow statements. It shows increasing revenues, profits, and number of customers over the three years as the business scales up. It also outlines key operating expenses and capital investments in filters, vehicles, and other equipment. The consultant answers two questions, noting that unearned estimated revenue losses should not be included in revenue, and additional assumptions around filter losses, transaction fees, and water supply disruptions could strengthen the business plan analysis.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

100%(2)Il 100% ha trovato utile questo documento (2 voti)

1K visualizzazioni15 pagineUrban Waters

Caricato da

Rahul TiwariThis document provides financial projections for a water filtration company over three years, including income statements, balance sheets, and cash flow statements. It shows increasing revenues, profits, and number of customers over the three years as the business scales up. It also outlines key operating expenses and capital investments in filters, vehicles, and other equipment. The consultant answers two questions, noting that unearned estimated revenue losses should not be included in revenue, and additional assumptions around filter losses, transaction fees, and water supply disruptions could strengthen the business plan analysis.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

Case study solution

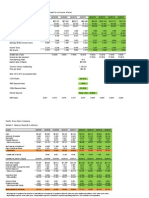

Operating Expenses Year 1 Year 2 Year 3

Technicians' Wages 3600 120000 180000

Local Management

Salaries 120000 325000 400000

Sales Staff Salaries 0 18000 18000

Water Testing & Filter

Maintenance 10200 408000 612000

Marketing Expenses 60000 75000 171400

Vehicle Expenses 2500 65000 110000

Given Facts

Narration Year 1 Year 2 Year 3

Number of vendors 50 2000 3000

Customers per

vendor 150 150 150

Water rate per litre 0.08 0.08 0.08

Number of working

days 365 365 365

Revenue 219000 8760000 13140000

Assumptions

for Revenue

Calculation

Narration Year 1 Year 2 Year 3

Local Politicians 43800 1752000 2628000

Underreporting 32850 1314000 1971000

Assumptions

for Revenue

loss under

certain

condition

Underreporting is calculated at 15% of Gross

Revenue

Informal cost to Local politicians is calculated at

20% of Gross Revenue

Capital

Investment Year 1 Year 2 Year 3

Number installed 50 1950 1000

Cost of each filter 400 250 250

Total Expenditure 20000 487500 250000

Depriciation per

filter 26.67 16.67 16.67

Depreciation 1333.33 33833.33 50500.00

Capital Cost

and

Depreciation-

Slow sand

filters

Life expectancy for Filter is 15 years

Capital

Investment Year 1 Year 2 Year 3

Number 3 97 50

Cost per

motorcycle 2500 2500 2500

Total expenditure 7500 242500 125000

Depriciation 1500 50000 75000

Capital Cost

and

Depreciation-

Motorcycles

Life expectancy for Motorcycle is 5 years

Capital Investment Year 1 Year 2 Year 3

Number 1 20 9

Cost per vehicle 12500 12500 12500

Total expenditure 12500 250000 112500

Depriciation 2500 52500 75000

Capital Cost

and

Depreciation-

Trucks

Life expectancy for Truck is 5 years

Capital Investment Year 1 Year 2 Year 3

Sand filter 1333.33 33833.33 50500.00

Motorcycle 1500 50000 75000

Truck 2500 52500 75000

Total 5333.33

136333.3

3 200500

Depreciation

Narration Year 1 Year 2 Year 3

Revenues 219000 8760000 13140000

Less: COGS 43800 1752000 2628000

Less: Loss on

underreporting 32850 1314000 1971000

GROSS PROFIT 142350 5694000 8541000

Less: Operating Costs

Technicians' Wages 3600 120000 180000

Local Management

Salaries 120000 325000 400000

Sales Staff Salaries 0 18000 18000

Water Testing & Filter

Maintenance 10200 408000 612000

Marketing Expenses 60000 75000 171400

Vehicle Expenses 2500 65000 110000

Other Costs 47800 1756000 2632000

Depreciation 5333.5 136340 200510

TOTAL OPERATING

COSTS 249433.5 2903340 4323910

OPERATING PROFIT -107084 2790660 4217090

Interest Charge 0 100000

PROFIT BEFORE

TAXES -107084 2690660 4217090

Income

Statement

Projections

Year 0 Year 1 Year 2 Year 3

Capital 200000 200000 200000 200000

Retained Earnings -107084 2583577

6800666.

5

Outside Liabilities 0

TOTAL

LIABILITIES 92916.5 2783577

7000666.

5

GROSS FIXED

ASSETS

Slow-sand Filters 20000 507500 757500

Motorcycles and

Trucks 20000 512500 750000

Total 40000 1020000 1507500

Less:

Accumulated

depreciation 5333.5 141673.5 342183.5

Net Fixed Assets 34666.5 878326.5

1165316.

5

Deferred revenue

expenditure 40000 36000 32000 28000

Cash 160000 22250 1873250 5807350

TOTAL ASSETS 200000 92916.5 2783577

7000666.

5

Balance Sheet

Year 1 Year 2 Year 3

Operating Profit -107084 2790660 4217090

Add back:

Depreciation 5333.5 136340 200510

Add

expense:Consultancy

investment turned

expense 4000 4000 4000

Cash From

Operations -97750 2931000 4421600

Debt raised 0 1000000 0

Debt repaid 1000000

Interest on debt paid 100000

Cash From Financing 100000

Investment in fixed

assets 40000 980000 487500

Investment in current

assets

Investment in Blue

future consultancy 40000 0

Cash from

Investments 80000 980000 487500

Opening balance of

cash 200000 22250 1873250

Cash flow during the

year -177750 1851000 3934100

Closing balance of

cash 22250 1873250 5807350

Cash flow

Statement

Question- 2

The template provided for Income Statement first reports gross

revenue from sales earned and then allows for underreporting

losses in computing gross profits for the three years. Keeping with

the principles of the Revenue Recognition concept on the one hand

and the Conservatism concept on the other, in your opinion, what is

the best way to report revenues for Urban Water Partners?

Answer

While reporting revenues underreporting losses need not be

accounted for since that amount of sale was never earned and is just

an assumption that a percentage of expected revenue shall be lost

in underreporting.

However in the current context it is necessary to mention it in order

to inform the investor on business model, its outflow and risk

associated with the business.

Question- 2

The template provided for Income Statement first reports gross

revenue from sales earned and then allows for underreporting

losses in computing gross profits for the three years. Keeping with

the principles of the Revenue Recognition concept on the one hand

and the Conservatism concept on the other, in your opinion, what is

the best way to report revenues for Urban Water Partners?

Answer

While reporting revenues underreporting losses need not be

accounted for since that amount of sale was never earned and is just

an assumption that a percentage of expected revenue shall be lost

in underreporting.

However in the current context it is necessary to mention it in order

to inform the investor on business model, its outflow and risk

associated with the business.

Question 3-If you were a consultant vetting the

students business plan, what assumptions would

you change? Any additions or deletions that you

would make?

Answer-

1. No monetary assumption on filter related

losses is accounted which needs to be

quantified.

2. Transaction charges occurring out of the

payment gateway through mobile networks is

not calculated and needs to be assumed.

3. Availability of uninterrupted water supply is

assumed however in real case scenario some

contingency may arise and cost of it needs to

be assumed and included.

Thank You

Potrebbero piacerti anche

- Urban Water PartnersDocumento2 pagineUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Urban Water Partners Group ADocumento5 pagineUrban Water Partners Group AAman jhaNessuna valutazione finora

- Income StatementDocumento3 pagineIncome StatementBiswajit SarmaNessuna valutazione finora

- AirThread G015Documento6 pagineAirThread G015Kunal MaheshwariNessuna valutazione finora

- Blaine SolutionDocumento4 pagineBlaine Solutionchintan MehtaNessuna valutazione finora

- Ocean Carriers MemoDocumento2 pagineOcean Carriers MemoAnkush SaraffNessuna valutazione finora

- BurtonsDocumento6 pagineBurtonsKritika GoelNessuna valutazione finora

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocumento30 pagineKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNessuna valutazione finora

- Burton SensorsDocumento2 pagineBurton SensorsSankalp MishraNessuna valutazione finora

- Ocean CarriersDocumento17 pagineOcean CarriersMridula Hari33% (3)

- Mercuryathleticfootwera Case AnalysisDocumento8 pagineMercuryathleticfootwera Case AnalysisNATOEENessuna valutazione finora

- Tire City Spreadsheet SolutionDocumento7 pagineTire City Spreadsheet SolutionSyed Ali MurtuzaNessuna valutazione finora

- Hansson Private Label: Operating ResultsDocumento28 pagineHansson Private Label: Operating ResultsShubham SharmaNessuna valutazione finora

- Case Study 1 Anadam MFG Instructions and NotesDocumento1 paginaCase Study 1 Anadam MFG Instructions and NotesSaifuddin Mohammed Tarek0% (1)

- Teuer Furniture Case AnalysisDocumento3 pagineTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- Strategic ManagementDocumento9 pagineStrategic ManagementdiddiNessuna valutazione finora

- Blaine Kitchenware ExcelDocumento1 paginaBlaine Kitchenware ExcelRoderick Jackson JrNessuna valutazione finora

- Polar SportDocumento4 paginePolar SportKinnary Kinnu0% (2)

- Case - Polar SportsDocumento12 pagineCase - Polar SportsSagar SrivastavaNessuna valutazione finora

- Airthread SolutionDocumento30 pagineAirthread SolutionSrikanth VasantadaNessuna valutazione finora

- Tire City Inc. Case StudyDocumento8 pagineTire City Inc. Case StudyKyeli TanNessuna valutazione finora

- Polar SportsDocumento7 paginePolar SportsShah HussainNessuna valutazione finora

- Assumptions: Comparable Companies:Market ValueDocumento18 pagineAssumptions: Comparable Companies:Market ValueTanya YadavNessuna valutazione finora

- Flash Memory AnalysisDocumento25 pagineFlash Memory AnalysisTheicon420Nessuna valutazione finora

- Blaine Kitchenware: Case Exhibit 1Documento15 pagineBlaine Kitchenware: Case Exhibit 1Fahad AliNessuna valutazione finora

- Exhibits of Blaine Kitchenware, Inc - CaseDocumento6 pagineExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Jones Electrical DistributionDocumento5 pagineJones Electrical DistributionAsif AliNessuna valutazione finora

- Ocean Carriers ExerciseDocumento13 pagineOcean Carriers ExercisesafderNessuna valutazione finora

- Burton SensorsDocumento4 pagineBurton SensorsAbhishek BaratamNessuna valutazione finora

- Ocean Carrier CaseDocumento17 pagineOcean Carrier CasechiaweesengNessuna valutazione finora

- MercuryDocumento5 pagineMercuryமுத்துக்குமார் செNessuna valutazione finora

- Online AnswerDocumento4 pagineOnline AnswerYiru Pan100% (2)

- Pacific Grove Spice Company SpreadsheetDocumento7 paginePacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- Blaine-Kitchenware Case CalculationsDocumento6 pagineBlaine-Kitchenware Case CalculationsDennis Alexander Guerrero100% (1)

- Mercury Athletic (Student Templates) FinalDocumento6 pagineMercury Athletic (Student Templates) FinalGarland GayNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento7 paginePacific Grove Spice CompanySajjad Ahmad100% (1)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocumento4 pagineProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Documento30 pagineTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNessuna valutazione finora

- OceanCarriers KenDocumento24 pagineOceanCarriers KensaaaruuuNessuna valutazione finora

- NHDC Solution EditedDocumento5 pagineNHDC Solution EditedShreesh ChandraNessuna valutazione finora

- Calculation of Blain Kitchenware CaseDocumento2 pagineCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Sneakers SolutionDocumento7 pagineSneakers SolutionRamesh Singh100% (1)

- New Heritage DollDocumento8 pagineNew Heritage DollJITESH GUPTANessuna valutazione finora

- Blaine Excel HWDocumento5 pagineBlaine Excel HWBoone LewisNessuna valutazione finora

- Airthread Valuation Group#2Documento24 pagineAirthread Valuation Group#2Himanshu AgrawalNessuna valutazione finora

- WrigleyDocumento28 pagineWrigleyKaran Rana100% (1)

- Session 19 - Dividend Policy at Linear TechDocumento2 pagineSession 19 - Dividend Policy at Linear TechRichBrook7Nessuna valutazione finora

- Mercury Athletic CaseDocumento3 pagineMercury Athletic Casekrishnakumar rNessuna valutazione finora

- FIP Submission - Pacific Grove Spice Company - CLASS 2 - TEAM 2 - Recorded VersionDocumento12 pagineFIP Submission - Pacific Grove Spice Company - CLASS 2 - TEAM 2 - Recorded VersionSameer KumarNessuna valutazione finora

- CASE Exhibits - HertzDocumento15 pagineCASE Exhibits - HertzSeemaNessuna valutazione finora

- PhuketBEach RashiDocumento9 paginePhuketBEach RashiShreya JainNessuna valutazione finora

- Balance Sheet As On 2011: Assets LiabilitiesDocumento1 paginaBalance Sheet As On 2011: Assets LiabilitiesbotrohitNessuna valutazione finora

- DCF ValuationDocumento19 pagineDCF ValuationVIJAYARAGAVANNessuna valutazione finora

- Basaveshwar Engineering College (Autonomous) BagalkotDocumento20 pagineBasaveshwar Engineering College (Autonomous) Bagalkotsagar sherkhaneNessuna valutazione finora

- Practise Question Chap 11Documento20 paginePractise Question Chap 11SaadNessuna valutazione finora

- Micky & Pluto Fin. StatementsDocumento5 pagineMicky & Pluto Fin. StatementskhushbookhetanNessuna valutazione finora

- Pick and Drop Business PlanDocumento23 paginePick and Drop Business Plananon_4856232670% (1)

- Fianl AccountsDocumento10 pagineFianl AccountsVikram NaniNessuna valutazione finora

- Car Rental Own Company FinalDocumento10 pagineCar Rental Own Company FinalAkshaya LadNessuna valutazione finora

- Financial ModelDocumento6 pagineFinancial ModelMuneeb MateenNessuna valutazione finora

- Valuing Project AchieveDocumento2 pagineValuing Project AchieveRahul TiwariNessuna valutazione finora

- Corporate Finance QuizDocumento9 pagineCorporate Finance QuizRahul TiwariNessuna valutazione finora

- Cooper PresentationDocumento8 pagineCooper PresentationRahul TiwariNessuna valutazione finora

- Group 7 Credit DerivativesDocumento2 pagineGroup 7 Credit DerivativesRahul TiwariNessuna valutazione finora

- Kotak Vs Yes Bank InvestmentDocumento22 pagineKotak Vs Yes Bank InvestmentRahul TiwariNessuna valutazione finora

- Commodity DerivativesDocumento13 pagineCommodity DerivativesRahul TiwariNessuna valutazione finora

- Case Study Pinetree MotelDocumento2 pagineCase Study Pinetree MotelRahul Tiwari100% (2)

- Prestige FinalDocumento11 paginePrestige FinalRahul Tiwari0% (2)

- Lone Pine CafeDocumento4 pagineLone Pine CafeRahul TiwariNessuna valutazione finora

- Case Study Lone Pine CafeDocumento6 pagineCase Study Lone Pine CafeRahul TiwariNessuna valutazione finora

- Income Statement Lone Pine CafeDocumento2 pagineIncome Statement Lone Pine CafeRahul TiwariNessuna valutazione finora

- REXTAR User and Service GuideDocumento58 pagineREXTAR User and Service GuidewellsuNessuna valutazione finora

- Patient Experience Measurement: Presented by Anum HashmiDocumento16 paginePatient Experience Measurement: Presented by Anum HashmiAnumNessuna valutazione finora

- PSTC-Appendix C - Cleaning Test SurfacesDocumento4 paginePSTC-Appendix C - Cleaning Test SurfacesChung LeNessuna valutazione finora

- Cambium PTP 250 Series 02-14 System Release NoteDocumento6 pagineCambium PTP 250 Series 02-14 System Release NotemensoNessuna valutazione finora

- Eco MainDocumento37 pagineEco MainAarti YadavNessuna valutazione finora

- Syllabus Income TaxationDocumento10 pagineSyllabus Income TaxationValery Joy CerenadoNessuna valutazione finora

- Kantar Worldpanel - Accelerating The Growth of Ecommerce in FMCG - ReportDocumento16 pagineKantar Worldpanel - Accelerating The Growth of Ecommerce in FMCG - ReportAbhishek GoelNessuna valutazione finora

- 108-Article Text-409-3-10-20200211Documento8 pagine108-Article Text-409-3-10-20200211NadaNessuna valutazione finora

- Ultrasync Relay Expansion Modules: Um-R4 & Um-R10Documento2 pagineUltrasync Relay Expansion Modules: Um-R4 & Um-R10Omar Andres Novoa MartinezNessuna valutazione finora

- Syllabus Rhe306 Onramps C Fall 2018 CDocumento8 pagineSyllabus Rhe306 Onramps C Fall 2018 Capi-213784103Nessuna valutazione finora

- Case StudyDocumento10 pagineCase StudyJessica FolleroNessuna valutazione finora

- SECTION 4.00: TroubleshootingDocumento12 pagineSECTION 4.00: TroubleshootingMahmoudNessuna valutazione finora

- Autodesk 2015 Products Direct Download LinksDocumento2 pagineAutodesk 2015 Products Direct Download LinksALEXNessuna valutazione finora

- Unit 5-Elements of Costing-Financial Accounting-Nikita KeshanDocumento58 pagineUnit 5-Elements of Costing-Financial Accounting-Nikita Keshanharshita bhatiaNessuna valutazione finora

- DD Form 2657 BlankDocumento3 pagineDD Form 2657 BlankdavejschroederNessuna valutazione finora

- Photos - MV. Bahtera CemerlangDocumento46 paginePhotos - MV. Bahtera CemerlangEka Prasetya NugrahaNessuna valutazione finora

- IOT Door Buzzer & Home Security DeviceDocumento5 pagineIOT Door Buzzer & Home Security Devicekutty vickyNessuna valutazione finora

- 5 1 5 PDFDocumento376 pagine5 1 5 PDFSaransh KejriwalNessuna valutazione finora

- Decline of RomeDocumento3 pagineDecline of RomeTruman Younghan IsaacsNessuna valutazione finora

- Flat BottomDocumento2 pagineFlat BottomPatricia Ruiz EstopierNessuna valutazione finora

- Andrew Allen: 454 CR 3504 Quinlan, TX 75474 (903) 269-7874Documento3 pagineAndrew Allen: 454 CR 3504 Quinlan, TX 75474 (903) 269-7874api-250314960Nessuna valutazione finora

- Public Private Partnership in Public Administration Discipline A Literature ReviewDocumento25 paginePublic Private Partnership in Public Administration Discipline A Literature ReviewJuan GalarzaNessuna valutazione finora

- Michael Torres ResumeDocumento2 pagineMichael Torres Resumeapi-263470871Nessuna valutazione finora

- Vector Control of Cage Induction Motors, A Physical InsightDocumento10 pagineVector Control of Cage Induction Motors, A Physical InsightSamuel Alves de SouzaNessuna valutazione finora

- Hussain 2020Documento13 pagineHussain 2020Prince RajputNessuna valutazione finora

- Social Justice in The Age of Identity PoliticsDocumento68 pagineSocial Justice in The Age of Identity PoliticsAndrea AlvarezNessuna valutazione finora

- Infosys - Covid-19 CrisisDocumento21 pagineInfosys - Covid-19 CrisisDhivyaNessuna valutazione finora

- Literary CriticismDocumento3 pagineLiterary CriticismAnnabelle LerioNessuna valutazione finora

- MACDES Exit Exam 1Q1920 1 PDFDocumento3 pagineMACDES Exit Exam 1Q1920 1 PDFJanelle Marie Benavidez100% (1)

- VPRS 4300V VPRM5450Documento3 pagineVPRS 4300V VPRM5450Tuan MinhNessuna valutazione finora