Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Chap06

Caricato da

Jitendra NagvekarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting Chap06

Caricato da

Jitendra NagvekarCopyright:

Formati disponibili

6 - 1 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Banking Procedures

and Control of Cash

Chapter 6

6 - 2 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Internal Control of Cash

Separation and rotation of duties

Cash receipts deposited daily

Setting up a petty cash fund

All other payments made by check

Authorization required for activities

Checks and other documents prenumbered

6 - 3 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 1

Depositing, writing, and endorsing

checks for a checking account.

6 - 4 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

Signature card

Duplicate deposit tickets

ATM cards and personal identification

numbers are protected.

6 - 5 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

It is the signing or stamping of ones name

on the back left-hand side on the check.

6 - 6 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

Blank endorsement

Full endorsement

Restrictive endorsement

6 - 7 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

A check is a written order.

The drawer is the one who writes the check.

The drawee is the one who pays

the money to the payee (bank).

Drawer Drawee Bank

6 - 8 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

The payee is the one to

whom the check is payable.

Write checks properly to ensure that

amounts and payee cannot be changed.

6 - 9 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

The bank reconciliation is the process that verifies

the business records cash balance, and

the bank statement ending cash balance.

6 - 10 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

Items that cause differences between the

bank balance and the book balance.

A. Items recorded by the company but not yet

recorded by the bank:

Deposits in transit

Outstanding checks

6 - 11 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-1

(Bank Procedures)

B. Items on a bank statement but not

recorded by the business:

Bank credits

Electronic funds transfers

Service charge

Interest revenue earned on account

NSF checks

Errors

6 - 12 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 2

Reconciling a bank statement.

6 - 13 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

The Bank

Reconciliation Process

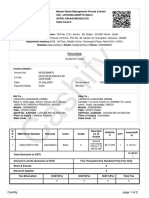

The bank statement of Debbie Wholesale Co.

shows a balance of $6,919 on April 30.

The balance of the Cash account on the

ledger has a balance of $7,330.

Paycheck for

Dep t. of Tre asure r

John Doe

Payc heck for

Date

Dep t. of Treasure r

Jane Doe

Date

6 - 14 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

The Bank

Reconciliation Process

1. The April 27 and 30 deposits of $500 and

$1,200 do not appear on the bank statement.

2. The bank charged $5 as service charges.

3. Two checks have not been paid by

the bank.

6 - 15 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

The Bank

Reconciliation Process

Check No. Amount

4 $ 594

5 700

Total $1,294

6 - 16 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Balance per bank, April 30 $6,919

Add deposit in transit 1,700

$8,619

Less outstanding checks 1,294

Adjusted bank balance $7,325

The Bank

Reconciliation Process

6 - 17 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Balance per books, April 30 $7,330

Deduct service charge 5

Adjusted book balance $7,325

The Bank

Reconciliation Process

Balance per books Balance per bank

These amounts are the same.

6 - 18 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objectives

3 and 4

Establishing and replenishing

a petty cash fund; setting up

an auxiliary petty cash record.

Establishing and replenishing

a change fund.

6 - 19 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-2 (The

Establishment of Petty Cash)

This is an account used for paying

small day-to-day expenses.

The only time petty cash is entered in the

journal is to establish the fund (or to

change the level of cash in the fund).

Expenses are debited and Cash

credited to replenish the fund.

6 - 20 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-2 (The

Establishment of Petty Cash)

Debbie Wholesale Co.

General Journal Page 1

Date

Account Title

and Description PR Dr. Cr.

200x

May 1

Petty Cash

Cash

Establishment of fund

60

60

6 - 21 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-2 (The

Establishment of Petty Cash)

Date Item Cost

2 Cleaning package $ 3.00

5 Postage stamps $ 9.00

8 First-aid supplies $15.00

9 Delivery expense $ 6.00

14 Delivery expense $15.00

27 Postage stamps $ 6.00

Total $54.00

Petty cash items documented

by vouchers for the May 200x:

6 - 22 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-2 (The

Establishment of Petty Cash)

Debbie Wholesale Co.

General Journal Page 1

Date

Account Title

and Description PR Dr. Cr.

200x

May 31

Various Expenses

Cash

Replenishment of fund

54

54

6 - 23 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 5

Handling transactions involving

cash short and over.

6 - 24 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 6-2 (The

Establishment of Change Fund)

Debbie Wholesale Co.

General Journal Page 1

Date

Account Title

and Description PR Dr. Cr.

200x

Apr 1

Change Fund

Cash

Establish change fund

120

120

6 - 25 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Cash Short and Over

If there is a shortage

Cash Short and Over is debited.

If there is an overage

Cash Short and Over is credited.

6 - 26 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

End of Chapter 6

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- PF ChallanDocumento1 paginaPF Challandhiru420Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- CFA Level 1Documento5 pagineCFA Level 1Jitendra NagvekarNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Motivation: Seven Basic LawsDocumento30 pagineMotivation: Seven Basic LawsHOSAM HUSSEINNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Balance Sheet (Opening) Asset Rs. Equities & Liabilities RsDocumento6 pagineBalance Sheet (Opening) Asset Rs. Equities & Liabilities RsJitendra NagvekarNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Practical Example of A Business PlanDocumento39 paginePractical Example of A Business PlanBianca Horvath100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Brief Notes Compliance Checklist Under Labour LawsDocumento39 pagineBrief Notes Compliance Checklist Under Labour LawsJitendra Nagvekar100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Qatar Labour LawDocumento43 pagineQatar Labour Lawcm senNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Goa Excise Duty Act & Rules, 1964Documento129 pagineThe Goa Excise Duty Act & Rules, 1964Jitendra NagvekarNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Fast Food RestaurantDocumento18 pagineFast Food RestaurantJitendra NagvekarNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Fastfood 140307054943 Phpapp02Documento28 pagineFastfood 140307054943 Phpapp02Jitendra NagvekarNessuna valutazione finora

- Sample Object ClauseDocumento12 pagineSample Object ClauseJitendra NagvekarNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Fast Food RestaurantDocumento25 pagineFast Food RestaurantJitendra NagvekarNessuna valutazione finora

- ACCPBased SOPsDocumento123 pagineACCPBased SOPsbijobijoNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Atharva ShirshaDocumento3 pagineAtharva Shirsharon2404Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Debits and Credits: Analyzing and Recording Business TransactionsDocumento31 pagineDebits and Credits: Analyzing and Recording Business TransactionsJitendra NagvekarNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Fast Food RestaurantDocumento25 pagineFast Food RestaurantJitendra NagvekarNessuna valutazione finora

- Cost Management TermsDocumento24 pagineCost Management TermsJitendra NagvekarNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Internal ControlsDocumento12 pagineInternal ControlsJitendra NagvekarNessuna valutazione finora

- Accounting Chapter 1Documento30 pagineAccounting Chapter 1Jitendra NagvekarNessuna valutazione finora

- ShawarmaDocumento1 paginaShawarmaJitendra NagvekarNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Accounting Chap04Documento28 pagineAccounting Chap04Jitendra Nagvekar100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Debits and Credits: Analyzing and Recording Business TransactionsDocumento31 pagineDebits and Credits: Analyzing and Recording Business TransactionsJitendra NagvekarNessuna valutazione finora

- Beginning The Accounting Cycle: Journalizing, Posting, and The Trial BalanceDocumento21 pagineBeginning The Accounting Cycle: Journalizing, Posting, and The Trial BalanceJitendra NagvekarNessuna valutazione finora

- Accounting Chapter 1Documento30 pagineAccounting Chapter 1Jitendra NagvekarNessuna valutazione finora

- Budgeting ConceptsDocumento19 pagineBudgeting ConceptsJitendra NagvekarNessuna valutazione finora

- TrainingDocumento16 pagineTrainingJitendra NagvekarNessuna valutazione finora

- Module6 StandardCostingDocumento25 pagineModule6 StandardCostingJitendra NagvekarNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Qatar Tax Law 2009Documento18 pagineQatar Tax Law 2009Jitendra NagvekarNessuna valutazione finora

- TrainingDocumento18 pagineTrainingJitendra NagvekarNessuna valutazione finora

- Alternative Approaches and Best Practices Potentially Benefiting TheDocumento54 pagineAlternative Approaches and Best Practices Potentially Benefiting Thechiffer venturaNessuna valutazione finora

- Act of State DoctrineDocumento6 pagineAct of State Doctrineaquanesse21Nessuna valutazione finora

- Combizell MHEC 40000 PRDocumento2 pagineCombizell MHEC 40000 PRToXiC RabbitsNessuna valutazione finora

- BBM 301 Advanced Accounting Chapter 1, Section 2Documento6 pagineBBM 301 Advanced Accounting Chapter 1, Section 2lil telNessuna valutazione finora

- New Income Slab Rates CalculationsDocumento6 pagineNew Income Slab Rates Calculationsphani raja kumarNessuna valutazione finora

- Oracle Optimized Solution For Backup and RecoveryDocumento37 pagineOracle Optimized Solution For Backup and Recoverywish_newNessuna valutazione finora

- 64 Zulueta Vs PAN-AMDocumento3 pagine64 Zulueta Vs PAN-AMShaira Mae CuevillasNessuna valutazione finora

- Beso v. DagumanDocumento3 pagineBeso v. DagumanMarie TitularNessuna valutazione finora

- Annotated BibliographyDocumento27 pagineAnnotated Bibliographyateam143100% (1)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Background To The Arbitration and Conciliation Act, 1996Documento2 pagineBackground To The Arbitration and Conciliation Act, 1996HimanshuNessuna valutazione finora

- Lucknow Pact - WikipediaDocumento8 pagineLucknow Pact - WikipediaHamza AfzalNessuna valutazione finora

- 9-14-10 Captain Frank G Sabatino-To Receive His FirearmDocumento2 pagine9-14-10 Captain Frank G Sabatino-To Receive His FirearmEwing Township, NJNessuna valutazione finora

- July 29.2011 - Inclusion of Road Safety Education in School Curriculums SoughtDocumento1 paginaJuly 29.2011 - Inclusion of Road Safety Education in School Curriculums Soughtpribhor2Nessuna valutazione finora

- REPUBLIC ACT No. 11479 - Anti Terrorism For Powerpoint PresentationDocumento30 pagineREPUBLIC ACT No. 11479 - Anti Terrorism For Powerpoint PresentationHendrix TilloNessuna valutazione finora

- Rawls TheoryDocumento4 pagineRawls TheoryAcademic ServicesNessuna valutazione finora

- 5 6183591383874404675Documento3 pagine5 6183591383874404675Dev BhandariNessuna valutazione finora

- Create An Informational Flyer AssignmentDocumento4 pagineCreate An Informational Flyer AssignmentALEEHA BUTTNessuna valutazione finora

- TachometerDocumento7 pagineTachometerEngr MahaNessuna valutazione finora

- Configuration of VIO On Power6 PDFDocumento39 pagineConfiguration of VIO On Power6 PDFchengabNessuna valutazione finora

- Fundamentals of Drilling Operations: ContractsDocumento15 pagineFundamentals of Drilling Operations: ContractsSAKNessuna valutazione finora

- QCP Installation of Ahu FahuDocumento7 pagineQCP Installation of Ahu FahuThulani DlaminiNessuna valutazione finora

- Criminal Law Notes CJDocumento12 pagineCriminal Law Notes CJPurplaawNessuna valutazione finora

- BalayanDocumento7 pagineBalayananakbalayanNessuna valutazione finora

- Legal Issues Identified by The CourtDocumento5 pagineLegal Issues Identified by The CourtKrishna NathNessuna valutazione finora

- NEW GL Archiving of Totals and DocumentsDocumento5 pagineNEW GL Archiving of Totals and Documentsantonio xavierNessuna valutazione finora

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingDocumento61 pagineWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaNessuna valutazione finora

- Table 1: Alagh Committee RecommendationsDocumento4 pagineTable 1: Alagh Committee RecommendationsNaveen Kumar Singh100% (1)

- Issues in EducationDocumento15 pagineIssues in EducationChinie DomingoNessuna valutazione finora

- Bill Iphone 7fDocumento2 pagineBill Iphone 7fyadawadsbNessuna valutazione finora

- Petitioner Vs Vs Respondent: First DivisionDocumento4 paginePetitioner Vs Vs Respondent: First DivisionAndrei Anne PalomarNessuna valutazione finora