Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MBA560 Chapter 14 10th

Caricato da

Ashok Chowdary GCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MBA560 Chapter 14 10th

Caricato da

Ashok Chowdary GCopyright:

Formati disponibili

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

Chapter 14

Options:

Puts and

Calls

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-2

Options: Puts, Calls, and Warrants

Learning Goals

1. Discuss the basic nature of options in general, and puts

and calls in particular, and understand how these

investment vehicles work.

2. Describe the options market, and note key options

provisions, including strike prices and expiration dates.

3. Explain how put and call options are valued and the

forces that drive options prices in the marketplace.

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-3

Options: Puts, Calls, and Warrants

Learning Goals (contd)

4. Describe the profit potential of puts and calls, and note

some popular put and call investment strategies.

5. Explain the profit potential and loss exposure from

writing covered call options, and discuss how writing

options can be used as a strategy for enhancing

investment returns.

6. Describe market index options, puts and calls on

foreign currencies, and LEAPS, and discuss how

investors can use these securities.

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-4

Options: Puts, Calls and Warrants

Financial Asset: asset that represents a

financial claim on an issuing organization

Stocks, bonds and convertible securities

are examples

Option: the right to buy or sell a certain

amount of an underlying financial asset at a

specified price for a given period of time

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-5

Types of Options

Types of Options

Puts

Calls

Rights

Warrants

All of the above are types of derivative securities,

which derive their value from the price behavior of

an underlying real or financial asset

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-6

Options: Puts and Calls

Puts and calls may be traded on:

Common stocks

Stock indexes

Exchange traded funds

Foreign currencies

Debt instruments

Commodities and financial futures

Owners of put and call options have no voting

rights, no privileges of ownership, and no interest

or dividend income

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-7

Options: Puts and Calls

(contd)

Options allow buyers to use leverage;

investors can buy a lot of price action with

limited capital

Options allows investors to nearly always

enjoy limited exposure to risk

Puts and calls are created by individual

investors, not by the organizations that

issue the underlying financial asset

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-8

Options: Puts and Calls

(contd)

Option Buyer:

Has the right to buy or sell an underlying asset

for a given period of time, at a price that was

fixed at the time of the option contract in

exchange for paying the seller a fee

Buyer can walk away from a bad option

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-9

Options: Puts and Calls

(contd)

Option Seller/Maker/Writer:

Has the obligation to buy or sell the underlying

asset according to the terms of the option

contract, for which the seller has been paid a

certain amount of money

Seller cannot walk away from a bad option

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-10

Options: Puts and Calls

(contd)

Put and call options trade in the open market

much like any other security and may be bought

and sold through securities brokers and dealers

Values of puts and calls change with the values of

the underlying assets

Values of puts and calls change with the time

period before they expire:

Closer to expiration date, option values go down

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-11

Advantages of Puts and Calls

Allows use of leverage

Leverage: the ability to obtain a given equity

position at a reduced capital investment,

thereby magnifying total return

Option buyers exposure to risk is limited to

fee paid to purchase the put or call option

Investor can make money when value of

assets go up or down

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-12

Disadvantages of Puts and

Calls

Investor does not receive any interest or

dividend income

Options expire; the investor has limited time to

benefit from options before they become worthless

Options are complex and tricky

Option sellers exposure to risk may be unlimited

Options are risky because an investor has to be

correct on two decisions to make money:

Which direction the price of the asset will move

When the price change will occur

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-13

How Calls Work

Call: a negotiable instrument that gives the holder

(buyer) the right to buy the underlying security at a

specified price over a set period of time from the

seller/maker/writer in exchange for a fee paid to

the seller/maker/writer

The buyer of the call option wants the price of the

underlying assets to go up

The seller/maker/writer of the call option wants the price

of the underlying assets to go down

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-14

How Calls Work (contd)

If the price of the underlying assets goes up:

The buyer will buy the asset at the lower strike price

from the seller/maker/writer and sell it at the higher

market price, making a profit

The seller will sell the assets at a price lower than the

market price. If the seller does not already own the

assets, then the seller will have to purchase them at the

higher market price

Covered call: seller owns the asset

Naked call: seller does not own the asset

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

How Calls Work (contd)

If the price of the underlying assets

go down:

The buyer will let the call option expire

worthless and lose the fee paid

The seller will keep the fee received and make

a profit

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-16

How Calls Work (contd)

Example: Assume the market price for a share of common stock is

$50. A call option to purchase 100 shares of the stock at a strike price

of $50 per share may be purchased for $500

If the market price of the stock goes up to $75 per share, the buyer will

purchase 100 shares at the strike price from the seller/maker/writer

and sell them at the higher market price.

The buyers profit will be:

The seller/maker/writers loss will be:

Profit = [(Market price Strike price) 100 Shares] Cost of call

$2,000 = [($75 $50) 100 Shares] $500

Loss = [(Strike price Market price) 100 Shares] + Fee for call

$(2,000) = [($50 $75) 100 Shares] + $500

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-17

How Calls Work:

The Value of Leverage

Example: Assume the market price for a share of common stock is

$50. A call option to purchase 100 shares of the stock at a strike price

of $50 per share may be purchased for $500

If the market price of the stock goes up to $75 per share, the buyer will

purchase 100 shares at the strike price from the seller/maker/writer

and sell them at the higher market price. The buyers profit will be

$2,000.

The buyers total return using the call option will be:

The buyers total return directly owning the stock would be:

Total Return =

Profit

Amount invested

=

$2,000

$500

= 400%

Total Return =

Profit

Amount invested

=

$2,000

$5,000

= 40%

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-18

How Calls Work (contd)

Example: Assume the market price for a share of common stock is

$50. A call option to purchase 100 shares of the stock at a strike price

of $50 per share may be purchased for $500

If the market price of the stock goes down to $25 per share, the buyer

will allow the call option to expire worthless.

The buyers loss will be:

The seller/maker/writers profit will be:

Loss = Cost of call

Loss = $(500)

Profit = Fee of call

Profit = $(500)

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-19

How Puts Work

Put: a negotiable instrument that enables the

holder (buyer) to sell the underlying security at a

specified price over a set period of time to the

seller/maker/writer in exchange for a fee paid to

the seller/maker/writer

The buyer of the put option wants the price of the

underlying assets to go down

The seller/maker/writer of the put option wants the price

of the underlying assets to go up

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-20

How Puts Work (contd)

If the price of the underlying assets goes down:

The buyer will buy the asset on the market at the lower

price and force the seller/maker/writer to buy the asset

at the higher option price, making a profit

The seller will pay a price higher than the market price

and will own expensive assets or will have to sell them

at a loss

If the price of the underlying assets go up:

The buyer will let the put option expire worthless and

lose the fee paid

The seller will keep the fee received and make a profit

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-21

How Puts Work (contd)

Example: Assume the market price for a share of common stock is

$50. A put option to sell 100 shares of the stock at a strike price of $50

per share may be purchased for $500.

If the market price of the stock goes down to $25 per share, the buyer

will purchase 100 shares at the market price and force the

seller/maker/writer to buy them at the option strike price.

The buyers profit will be:

The seller/maker/writers loss will be:

Profit = [(Strike price Market price) 100 shares] Cost of put

$2,000 = [($50 $25) 100 Shares] $500

Loss = [(Market price Strike price) 100 shares] + Fee for put

($2,000) = [($25 $50) 100 Shares] + $500

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-22

How Puts Work (contd)

Example: Assume the market price for a share of common

stock is $50. A put option to sell 100 shares of the stock at

a strike price of $50 per share may be purchased for $500.

If the market price of the stock goes up to $75 per share,

the buyer will allow the put option to expire worthless.

The buyers loss will be:

The seller/maker/writers profit will be:

Loss = Cost of put

Loss = $(500)

Profit = Fee for put

Profit = $500

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-23

Put and Call Options Markets

Conventional (OTC) Options

Sold over the counter

Primarily used by institutional investors

Listed Options

Created in 1973 by the Chicago Board Option Exchange (CBOE)

Puts and calls traded through CBOE exchange, as well as

International Securities Exchange, AMEX, Philadelphia exchange,

NYSE Arca and Boston Options Exchange.

Provided convenient market that made options trading more

popular and help create a secondary market

Helped standardize expiration dates and exercise/strike prices

Reduced trading costs

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-24

Stock Options

Common Stock Options

Over 1.5 billion option contracts are traded

each year

Options on common stocks is the most popular

form of option

Over 90% of all option contracts are

stock options

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-25

Key Provisions of Stock

Options

Strike Price

Stated price at which you can buy a security with a call

or sell a security with a put

Conventional (OTC) options may have any strike price

Listed options have standardized prices with price

increments determined by the price of the stock

Expiration Date

Stated date when the option expires and becomes

worthless if not exercised

Conventional (OTC) options may have any working day

as expiration date

Listed options have standardized expiration dates

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-26

Figure 14.1 Quotations

for Listed Stock Options

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-27

Expiration Date of Listed

Stock Options

Three Expiration Cycles

The January/April/July/October cycle

The February/May/August/November cycle

The March/June/September/December cycle

The longest-term expiration dates are normally no longer

than nine months

The options that are longer than nine months are called

LEAPS, and they are only available on some of the stocks

Listed options always expire on the third Friday of the

month of expiration

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-28

Valuation of Stock Options

Option Premium (Price): the quoted price

the investor pays to buy a listed put or

call option

Option premiums (prices) are affected by:

Fundamental (intrinsic) value: based upon

current market price of underlying assets

Time Premium: amount that option price

exceeds the fundamental value

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-29

Valuation of Stock Options:

Fundamental Value of a Call

Fundamental value of a call =

Market price of

underlying

common stock,

or other

financial asset

Strike price

on

the call

|

\

|

.

|

|

|

|

100

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-30

Valuation of Stock Options:

Fundamental Value of a Put

Fundamental value of a put =

Strike price

on

the put

Market price of

underlying

common stock,

or other

financial asset

|

\

|

.

|

|

|

|

100

V = SPP MP ( ) 100

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-31

Figure 14.2 The Valuation

Properties of Put and Call Options

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-32

Valuation of Stock Options

In-the-Money

Call option: when the strike price is less than the market

price of the underlying security

Put option: when the strike price is greater than the

market price of the underlying security

Out-of-the-Money

Call option: when the strike price is greater than the

market price of the underlying security

Put option: when the strike price is less than the market

price of the underlying security

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-33

Table 14.1 Option Price Components

for an Actively Traded Call Option

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-34

Option Trading Strategies

Buying for Speculation

Hedging to modify risks

Writing Options to enhance returns

Spreading Options to enhance returns

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-35

Speculating with Stock Options

Similar to investing in common stocks

Goal is to buy low, sell high

Buyer does not need as much capital since can

use leverage

Buyer cannot lose more than cost of the option

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-36

Table 14.2 Speculating with Call

Options

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-37

Hedging with Stock Options

Purpose is to reduce or eliminate risk

Combines two or more securities into a single investment

position

Hedging a Long Position

Buying a put and holding appreciated stock in the same company

Buying a put would provide insurance in case the stock price went

down before you sold the stock

Hedging a Short Position

Selling stock short and buying a call

Buying a call would allow you to buy stock to cover the short sale if

the stock price went up instead of down

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-38

Table 14.3 Limiting Capital Loss

with a Put Hedge

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-39

Table 14.4 Protecting Profits

with a Put Hedge

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-40

Writing Stock Options

The seller/maker/writer is betting that the option buyer will

be wrong about the direction of the stock price or the time

period the price change will occur

Statistically, the odds favor the writer over the buyer

Easy money if the option expires worthless. The writer cannot

make more than the fee received

High risk if the option is in-the-money

Naked options: writer does not own the optioned securities and has to

buy them. No limit on loss exposure

Covered options: writer owns the optioned securities. Loss exposure is

limited to the price originally paid for the securities

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-41

Table 14.5 Covered Call

Writing

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-42

Spreading Options

Purpose is to take advantage of differences in prevailing

option prices and premiums

Combines two or more options into a single transaction

Vertical Spread

Buying a call at one strike price and writing a call (on same stock

for same expiration date) at a higher strike price

Option Straddle

Simultaneous purchase (or sale) of both a put and a call on the

same underlying common stock

Spreading options is extremely tricky and should be used

only by knowledgeable investors

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-43

Stock-Index Options

Stock-Index Option: a put or call option

written on a specific stock market index

Major stock indexes for options:

The S&P 500 Index

The S&P 100 Index

The Dow Jones Industrial Average

The Nasdaq 100 Index

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-44

Stock-Index Options (contd)

Market price is function of strike price of option and latest

published stock market index value

Valuation techniques are similar to valuing options for

individual securities

Price behavior and investment risk are similar to options

for individual securities

May be used to hedge a whole portfolio of stocks rather

than individual stocks

May be used to speculate on the stock market as a whole

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-45

Other Types of Options

Exchange traded funds: put and call options

written on exchange traded funds (EFTs)

Very similar to market index options

Interest rate options: put and call options written

on fixed-income (debt) securities

Small market involving only U.S. Treasury securities

Option prices change with yield behavior of

debt securities

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-46

Other Types of Options (contd)

Currency options: put and call options written on

foreign currencies

Available on most major world currencies

Option prices change as exchange rates between

currencies fluctuate

LEAPS: long-term options that may extend out

to 3 years

Available on several hundred stocks and over two

dozen stock indexes and ETFs

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-47

Chapter 14 Review

Learning Goals

1. Discuss the basic nature of options in general, and puts

and calls in particular, and understand how these

investment vehicles work.

2. Describe the options market, and note key options

provisions, including strike prices and expiration dates.

3. Explain how put and call options are valued and the

forces that drive options prices in the marketplace.

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-48

Chapter 14 Review (contd)

Learning Goals (contd)

4. Describe the profit potential of puts and calls, and note

some popular put and call investment strategies.

5. Explain the profit potential and loss exposure from

writing covered call options, and discuss how writing

options can be used as a strategy for enhancing

investment returns.

6. Describe market index options, puts and calls on

foreign currencies, and LEAPS, and discuss how

investors can use these securities.

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

Chapter 14

Additional

Chapter Art

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-50

Figure 14.3 Quotations on Index

Options

Copyright 2008 Pearson Addison-Wesley. All rights reserved.

14-51

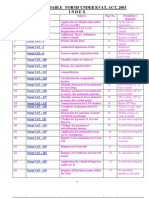

Table 14.6 Foreign Currency Option

Contracts on the Philadelphia Exchange

Potrebbero piacerti anche

- Chapter Six Using Options As InvestmentsDocumento31 pagineChapter Six Using Options As InvestmentsAltesa AbicheNessuna valutazione finora

- Chap 6Documento32 pagineChap 6natiman090909Nessuna valutazione finora

- Multinational Business Finance 12th Edition Slides Chapter 08Documento44 pagineMultinational Business Finance 12th Edition Slides Chapter 08Alli TobbaNessuna valutazione finora

- CH 8Documento42 pagineCH 8Muhammad BasitNessuna valutazione finora

- Lecture7 Derivatives RevisitedDocumento52 pagineLecture7 Derivatives RevisitedLulu KatimaNessuna valutazione finora

- 6 - Introduction To OptionsDocumento9 pagine6 - Introduction To OptionsPulkit PahwaNessuna valutazione finora

- Options & ModelsDocumento48 pagineOptions & ModelsPraveen Kumar SinhaNessuna valutazione finora

- Topic Five: (Text Book: Chapter 7)Documento35 pagineTopic Five: (Text Book: Chapter 7)Hamdan HassinNessuna valutazione finora

- DerivativesDocumento29 pagineDerivativessumitbabar0% (1)

- Derivative and Risk ManagementDocumento35 pagineDerivative and Risk ManagementRajendra LamsalNessuna valutazione finora

- Unit - 7Documento37 pagineUnit - 7Tesfaye KebebawNessuna valutazione finora

- Derivatives Notes and Tutorial 2017Documento16 pagineDerivatives Notes and Tutorial 2017Chantelle RamsayNessuna valutazione finora

- Major Types of Orders Available To Investors and Market Maker WEEK2 &3 LECT 2023Documento57 pagineMajor Types of Orders Available To Investors and Market Maker WEEK2 &3 LECT 2023Manar AmrNessuna valutazione finora

- Call Option: Example of A Call Option On A StockDocumento4 pagineCall Option: Example of A Call Option On A StockNiraj KumarNessuna valutazione finora

- Futures and Options:: Emerging TrendsDocumento48 pagineFutures and Options:: Emerging TrendsMihika BaxiNessuna valutazione finora

- Foreign Currency Derivatives: Futures and OptionsDocumento35 pagineForeign Currency Derivatives: Futures and OptionsMinerva Education100% (1)

- Commodities and Financial FuturesDocumento36 pagineCommodities and Financial Futuresjhonatan jhonatanNessuna valutazione finora

- FD - Unit - III OptionsDocumento11 pagineFD - Unit - III OptionspulpsenseNessuna valutazione finora

- Chapter 7 SummaryDocumento12 pagineChapter 7 Summarymark leeNessuna valutazione finora

- 04 - 05 - Option Strategies & Payoff'sDocumento66 pagine04 - 05 - Option Strategies & Payoff'sMohammedAveshNagoriNessuna valutazione finora

- Lecture 02Documento13 pagineLecture 02Atiqullah sherzadNessuna valutazione finora

- Options StrategiesDocumento26 pagineOptions StrategiesPrasad VeesamshettyNessuna valutazione finora

- Options - FinalDocumento12 pagineOptions - FinalNa Ri TaNessuna valutazione finora

- Derivatives - Options: Mahesh GujarDocumento22 pagineDerivatives - Options: Mahesh GujarMahesh GujarNessuna valutazione finora

- Options WritingDocumento44 pagineOptions Writingshankarvs84Nessuna valutazione finora

- Introduction To OptionsDocumento9 pagineIntroduction To OptionsKumar NarayananNessuna valutazione finora

- CSC Ch10 DerivativesDocumento54 pagineCSC Ch10 DerivativesAbraha Girmay GebruNessuna valutazione finora

- Options SapmDocumento22 pagineOptions SapmHitesh MendirattaNessuna valutazione finora

- Difference Between A Put Option and Call OptionDocumento5 pagineDifference Between A Put Option and Call OptionMuhammad TariqNessuna valutazione finora

- Option - DerivativesDocumento89 pagineOption - DerivativesProf. Suyog ChachadNessuna valutazione finora

- Lesson 02 Structure of Options MarketsDocumento34 pagineLesson 02 Structure of Options MarketsRoman SerondoNessuna valutazione finora

- Introduction To Derivatives Market: Khader ShaikDocumento45 pagineIntroduction To Derivatives Market: Khader Shaikms.AhmedNessuna valutazione finora

- Option Applications & Corporate FinanceDocumento25 pagineOption Applications & Corporate FinancetzsyxxwhtNessuna valutazione finora

- What Are OptionsDocumento14 pagineWhat Are OptionsSonal KothariNessuna valutazione finora

- Hedging of ExposuresDocumento25 pagineHedging of ExposuresRonit NarulaNessuna valutazione finora

- 4 Hybrid SecuritiesDocumento27 pagine4 Hybrid SecuritiesRoselle SNessuna valutazione finora

- Chapter 7Documento57 pagineChapter 7Levy ANessuna valutazione finora

- Option and FutureDocumento28 pagineOption and Futuresunil_das95Nessuna valutazione finora

- Foreign Currency Derivatives: Futures and OptionsDocumento43 pagineForeign Currency Derivatives: Futures and Optionsanon_355962815Nessuna valutazione finora

- AC6101 Lecture 7 - Real Option AnalysisDocumento21 pagineAC6101 Lecture 7 - Real Option AnalysisKelsey GaoNessuna valutazione finora

- 07 Financial Option ContractsDocumento20 pagine07 Financial Option ContractsJyoti PaiNessuna valutazione finora

- An Introduction To Derivatives: A Presentation by Derivative ResearchDocumento45 pagineAn Introduction To Derivatives: A Presentation by Derivative ResearchUmeshwari RathoreNessuna valutazione finora

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsDa EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNessuna valutazione finora

- Online Trading DerivativesDocumento35 pagineOnline Trading DerivativesAmol Kadam100% (2)

- DerivativesDocumento53 pagineDerivativesnikitsharmaNessuna valutazione finora

- Presented by:-D.Pradeep Kumar Exe-MBA, IIPM, HydDocumento25 paginePresented by:-D.Pradeep Kumar Exe-MBA, IIPM, Hydpradeep3673Nessuna valutazione finora

- Option TradingDocumento3 pagineOption TradingRahul JaiswarNessuna valutazione finora

- Options &futuresDocumento32 pagineOptions &futuresguglianitishaNessuna valutazione finora

- Chapter Option ValuationDocumento18 pagineChapter Option ValuationAk TanvirNessuna valutazione finora

- Chapter 4 DerivativesDocumento38 pagineChapter 4 DerivativesTamrat KindeNessuna valutazione finora

- How Securities Are TradedDocumento23 pagineHow Securities Are TradedGreg AubinNessuna valutazione finora

- The Extensive and Essential Options Trading GuideDocumento22 pagineThe Extensive and Essential Options Trading Guidealucian100% (1)

- Lesson 3 - Stocks and Its ClassificationDocumento40 pagineLesson 3 - Stocks and Its ClassificationJames Adam VecinoNessuna valutazione finora

- Manajemen Investasi "Rangkuman Chapter 17 & 18": Dr. Vinola Herawaty, Ak., M.B.ADocumento7 pagineManajemen Investasi "Rangkuman Chapter 17 & 18": Dr. Vinola Herawaty, Ak., M.B.AAlief AmbyaNessuna valutazione finora

- Group 7 InvestmentDocumento5 pagineGroup 7 Investmentliah lachicaNessuna valutazione finora

- E Book of OptionsDocumento29 pagineE Book of OptionsmohitNessuna valutazione finora

- Mechanics of OptionsDocumento39 pagineMechanics of Optionsluvnica6348Nessuna valutazione finora

- 05derivativesmarketarz 100709171035 Phpapp01Documento40 pagine05derivativesmarketarz 100709171035 Phpapp01leblitzer_0Nessuna valutazione finora

- Sales & Distribution SAP Overview TrainingDocumento69 pagineSales & Distribution SAP Overview TrainingAjay DayalNessuna valutazione finora

- Nitin MangalDocumento3 pagineNitin MangalhemantNessuna valutazione finora

- Acc 305 PDFDocumento147 pagineAcc 305 PDFgosaye desalegn100% (3)

- SD RRB DocumentDocumento12 pagineSD RRB DocumentДмитрий Харланов100% (2)

- Challenges Faced by Sales ManagerDocumento29 pagineChallenges Faced by Sales ManagerniharikkaNessuna valutazione finora

- Good Qualities For BusinessmenDocumento36 pagineGood Qualities For BusinessmenPradeepKumarNessuna valutazione finora

- Production Planning Questionnaire: 1 Enterprise StructureDocumento19 pagineProduction Planning Questionnaire: 1 Enterprise Structurezaki83Nessuna valutazione finora

- Government Accounting MidtermDocumento8 pagineGovernment Accounting MidtermTan RoncalNessuna valutazione finora

- Nism Series 15 Model PaperDocumento54 pagineNism Series 15 Model PaperRohit Shet50% (4)

- Forms KvatDocumento63 pagineForms KvatShashi KanthNessuna valutazione finora

- A Case Study of PepsiDocumento13 pagineA Case Study of PepsiYvonne Obaob-CabangNessuna valutazione finora

- MKTG & IB 317 - Class Syllabus Summer 2014Documento11 pagineMKTG & IB 317 - Class Syllabus Summer 2014Abdalla FarisNessuna valutazione finora

- Interview Questions and AnswersDocumento2 pagineInterview Questions and AnswersC Fay ManNessuna valutazione finora

- Fraud Detection in The Financial Services IndustryDocumento24 pagineFraud Detection in The Financial Services Industrychiragjuneja234100% (3)

- The Economics of Tobacco ControlDocumento380 pagineThe Economics of Tobacco ControlMy SunshineNessuna valutazione finora

- MKT PotentialDocumento56 pagineMKT PotentialPankaj Wamanrao BombleNessuna valutazione finora

- Inchausti v. CromwellDocumento2 pagineInchausti v. CromwellGennard Michael Angelo AngelesNessuna valutazione finora

- Final DKSSKDocumento79 pagineFinal DKSSKSarita Latthe100% (2)

- Quiz Review CH 5 6 7Documento8 pagineQuiz Review CH 5 6 7yanto ismailNessuna valutazione finora

- Financial AnalysisDocumento44 pagineFinancial AnalysisHeap Ke Xin100% (3)

- Sap MM TablesDocumento3 pagineSap MM TablesAlexNessuna valutazione finora

- Islam and Business EthicsDocumento27 pagineIslam and Business EthicsSyed Oon Haider ZaidiNessuna valutazione finora

- Surf ExcelDocumento13 pagineSurf Excelpushkargtm100% (2)

- Bedford Hills SFDocumento1 paginaBedford Hills SFapi-23721120Nessuna valutazione finora

- HQP-HLF-274 Special Power of Attorney Know All Men by These PresentsDocumento2 pagineHQP-HLF-274 Special Power of Attorney Know All Men by These PresentsMelissaNessuna valutazione finora

- INCOTERMS Are A Set of Three-Letter Standard Trade Terms Most Commonly Used inDocumento3 pagineINCOTERMS Are A Set of Three-Letter Standard Trade Terms Most Commonly Used inNyeko FrancisNessuna valutazione finora

- Amazon Service Marketing Case StudyDocumento36 pagineAmazon Service Marketing Case StudyAbhiNessuna valutazione finora

- Chartier Et Al IndictmentDocumento48 pagineChartier Et Al IndictmentNewsdayNessuna valutazione finora

- Contract For The Sale of GoodsDocumento3 pagineContract For The Sale of Goodsdusan4Nessuna valutazione finora

- Lect21!22!31st Mar - Integrated Marketing CommunicationDocumento19 pagineLect21!22!31st Mar - Integrated Marketing CommunicationBhanu PrathapNessuna valutazione finora