Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Modern Interest Theory

Caricato da

Appan Kandala VasudevacharyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Modern Interest Theory

Caricato da

Appan Kandala VasudevacharyCopyright:

Formati disponibili

Modern theory of interest or IS-LM Model in Closed Economy This theory integrates Money, Interest and income into

a general equilibrium model. Hicks and Hanson diagrammatic frame work known as IS-LM model. The term IS is the equality of I and S which represents product market equilibrium. On the other hand the term LM of the equality of Money Demand (L) and Money Supply (M) represents money market equilibrium. In order to analyse the general equilibrium of product and money markets the study of IS-LM functions is an important one. Derivation of IS Curve: The derivation of the IS Curve shown in Fig in Panel (A) of this fig, the saving curve S in relation to Income is drawn in a fixed position on the Keynesian assumption that the rate of interest has a little effect on Saving. The saving curve shows that saving increases as Income Increases, so S = f (Y): I = f (Y, R) so if R remain constant Y increases and I also increases.

Derivation LM Curve: The LM curve shows all combinations of interest rate and levels of income at which the DM and SM are equal. In other words, the LM schedule shows the combinations of interest rates and levels of income.

Where the DM (L) and SM (M) are equal such that the money market equilibrium.

Schedule in part C of the diagram represents Td for Money, assuming demand to be proportional to Y. the schedule B is simply an identity line that mechanically divides the total MS into Td & Sd components. Schedule D is the LM curve. Beganing A with a known interest r, the volume of Sd is L2. Given the total MS, that potion not held as speculative balances must be held in transaction balances (T1) as shown in B. The schedule C shows that level of real income (Y1) must prevail in order to get the public to willingly absorb the money available for TD in that form.

Thus, as we see in D for interest rate r, the only possible money market equilibrium volume of Y is Y1.

Now we study how these markets are brought into simulateneous equilibrium.

It is only when the equilibrium pairs of interest rates and income of the IS Curve equal the pairs of interest rate & Income levels of the LM curve that the general equilibrium is established.

If there is any deviation from equilibrium certain forces will act and react in such a manner that the equilibrium will be restored.

Derivation of LM Curve: The LM Curve is the locus of all those various combinations of the aggregate money income and the rate of interest at which the money market is in equilibrium (MS=MD). Each point located on the LM Curve shows a particular money income and the rate of interest against his income as which the total demand for money equals to total supply of money. Given a family of demand curves for money and the money supply, the LM Curve can be easily derived.

L1 (Y,R), L2 (Y,R) etc curves shows total amount of money demand at different money incomes and rates of interest. Assumption is money supply is insensitive to changes in rate of interest.

At corresponding to each such pair of money income and rate of interest the demand for money and supply of money are in equilibrium. Plotting these different equilibrium money income and interest rate pairs on the graph paper gives the LM Curve.

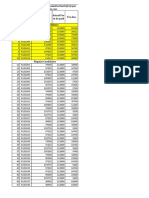

The LM Curve positively sloping showing that with the fixed money supply and the increase in income, equilibrium in the money market is possible only through an increase in the rate of interest. Y Y1=100 Y2=200 Y3=300 Y4=400 r% 2 3 6 8 DM(M1+M2) 200 200 200 200 M 200 200 200 200

Potrebbero piacerti anche

- Classical Theory of IntrestDocumento5 pagineClassical Theory of Intrestvaibhav001988Nessuna valutazione finora

- Exc CH 5Documento34 pagineExc CH 5Syafiah Khairunnisa33% (3)

- Cost Acctg ReviewerDocumento106 pagineCost Acctg ReviewerGregory Chase83% (6)

- Chapter 4: The Market Forces of Supply and Dem... : What Is A Market?Documento5 pagineChapter 4: The Market Forces of Supply and Dem... : What Is A Market?Savannah Simone PetrachenkoNessuna valutazione finora

- The Modern Theory of Income and EmploymentDocumento12 pagineThe Modern Theory of Income and EmploymentShivani Goel100% (1)

- Marginal Efficiency of CapitalDocumento9 pagineMarginal Efficiency of CapitalAppan Kandala VasudevacharyNessuna valutazione finora

- Theories of Money SupplyDocumento15 pagineTheories of Money SupplyAppan Kandala Vasudevachary100% (1)

- IS-LM Model ExplainedDocumento36 pagineIS-LM Model ExplainedSyed Ali Zain100% (1)

- Meaning and Factors of Marginal Efficiency of Capital (MECDocumento15 pagineMeaning and Factors of Marginal Efficiency of Capital (MECJester LabanNessuna valutazione finora

- Is-LM Open EconomyDocumento16 pagineIs-LM Open EconomyAppan Kandala VasudevacharyNessuna valutazione finora

- ACT-671 Introduction Econometrics-2012Documento29 pagineACT-671 Introduction Econometrics-2012Zaheer AhmadNessuna valutazione finora

- Cambridge Approach To Demand For MoneyDocumento6 pagineCambridge Approach To Demand For MoneyAppan Kandala Vasudevachary100% (1)

- IntroEconmerics AcFn 5031 (q1)Documento302 pagineIntroEconmerics AcFn 5031 (q1)yesuneh98Nessuna valutazione finora

- Harrod's Dynamic Growth Theory ModelDocumento11 pagineHarrod's Dynamic Growth Theory ModelnareshmallikNessuna valutazione finora

- Real Balance EffectDocumento6 pagineReal Balance EffectSaeed MujadidNessuna valutazione finora

- Econometrics Till MidsemDocumento236 pagineEconometrics Till MidsemApurv PatelNessuna valutazione finora

- Tobin'sDocumento3 pagineTobin'sAppan Kandala Vasudevachary0% (1)

- Econometrics EssayDocumento9 pagineEconometrics EssayBettinaD'AlessandroNessuna valutazione finora

- 05 PNB V Reblando - RSJDocumento3 pagine05 PNB V Reblando - RSJJet SiangNessuna valutazione finora

- The Marginal Efficiency of InvestmentDocumento3 pagineThe Marginal Efficiency of InvestmentSuniel Chhetri100% (3)

- The Real Balance Effect - Suraj B GuptaDocumento15 pagineThe Real Balance Effect - Suraj B GuptaAshu KhatriNessuna valutazione finora

- Macro EconomicsDocumento9 pagineMacro EconomicsAjay RoyNessuna valutazione finora

- ABM II KEY CORRECTIONSDocumento4 pagineABM II KEY CORRECTIONSJomar Villena100% (1)

- Evolution of The Indian Financial SectorDocumento18 pagineEvolution of The Indian Financial SectorVikash JontyNessuna valutazione finora

- MAEC-106: MAEC-12 (M.A. Economics) Second Year, Examination-2015Documento8 pagineMAEC-106: MAEC-12 (M.A. Economics) Second Year, Examination-2015sanjeevchaswalNessuna valutazione finora

- Modern Theory of Interest RateeDocumento9 pagineModern Theory of Interest RateeAppan Kandala VasudevacharyNessuna valutazione finora

- Modern Theory of Interest RateeDocumento9 pagineModern Theory of Interest RateeAppan Kandala VasudevacharyNessuna valutazione finora

- Econometrics Notes PDFDocumento8 pagineEconometrics Notes PDFumamaheswariNessuna valutazione finora

- Capital MarketDocumento32 pagineCapital MarketAppan Kandala Vasudevachary80% (5)

- Introduction To Econometrics For FinanceDocumento93 pagineIntroduction To Econometrics For FinanceAshenafi Zeleke100% (1)

- Modern Theory of Interest or IsDocumento6 pagineModern Theory of Interest or IsAppan Kandala Vasudevachary100% (4)

- IS-LM ModelDocumento6 pagineIS-LM ModelAnand Kant JhaNessuna valutazione finora

- Theory of Marginal Utility AnalysisDocumento4 pagineTheory of Marginal Utility AnalysisBalasingam Prahalathan100% (3)

- MEI vs MEC - Understanding Investment Elasticity and Expected ReturnsDocumento2 pagineMEI vs MEC - Understanding Investment Elasticity and Expected ReturnsshashankNessuna valutazione finora

- Classical Theory of EmploymentDocumento13 pagineClassical Theory of EmploymentAnkita TiwariNessuna valutazione finora

- National Income As An Index of DevelopmentDocumento7 pagineNational Income As An Index of DevelopmentNguyễn Tùng SơnNessuna valutazione finora

- The Phillips Curve Relationship Between Inflation and UnemploymentDocumento1 paginaThe Phillips Curve Relationship Between Inflation and Unemploymentkt6345Nessuna valutazione finora

- Theories of Consumption and InvestmentDocumento25 pagineTheories of Consumption and InvestmentSamridh AgarwalNessuna valutazione finora

- Supply of MoneyDocumento13 pagineSupply of MoneyNonit Hathila100% (1)

- Tax Multiplier in Keynesian Model of Macroeconomics Derive The Expression For Tax MultiplierDocumento7 pagineTax Multiplier in Keynesian Model of Macroeconomics Derive The Expression For Tax Multiplierniloy100% (1)

- A.C.Pigou: An British Economist, - Arthur Cecil Pigou - 1877-1959Documento12 pagineA.C.Pigou: An British Economist, - Arthur Cecil Pigou - 1877-1959Tosheet Singh ThakuriNessuna valutazione finora

- Breaking Up Price Effect Into Income and Substitution EffectDocumento9 pagineBreaking Up Price Effect Into Income and Substitution Effectanushka KumariNessuna valutazione finora

- Basic Macroeconomic ConceptsDocumento3 pagineBasic Macroeconomic ConceptsAlexanderNessuna valutazione finora

- Macro Economics 11e Arnold CH 7 Homework No4Documento5 pagineMacro Economics 11e Arnold CH 7 Homework No4PatNessuna valutazione finora

- E RDocumento367 pagineE RshabbirqauNessuna valutazione finora

- Macro CH 7 & 8 PDFDocumento26 pagineMacro CH 7 & 8 PDFAKSHARA JAINNessuna valutazione finora

- The Circular Flow of Income Lesson 1 and 2Documento16 pagineThe Circular Flow of Income Lesson 1 and 2api-53255207Nessuna valutazione finora

- Supreme Court Judgement On Pay Parity Between Permanent and Temporary EmployeesDocumento102 pagineSupreme Court Judgement On Pay Parity Between Permanent and Temporary EmployeesLatest Laws Team100% (1)

- Business Economics Why India Needs Supply Side EconomicsDocumento7 pagineBusiness Economics Why India Needs Supply Side Economicsrishi jainNessuna valutazione finora

- The Simple Keynesian Model of Income Determination ExplainedDocumento60 pagineThe Simple Keynesian Model of Income Determination ExplainedRakesh Seela100% (2)

- Concept of Money SupplyDocumento7 pagineConcept of Money SupplyMD. IBRAHIM KHOLILULLAHNessuna valutazione finora

- Quantity Theory of MoneyDocumento15 pagineQuantity Theory of MoneyAntra AzadNessuna valutazione finora

- Measures of DispersionDocumento26 pagineMeasures of DispersionAshish Sen GuptaNessuna valutazione finora

- Tobin's Portfolio Balance ApproachDocumento15 pagineTobin's Portfolio Balance ApproachAmanda RuthNessuna valutazione finora

- Sebi Grade A 2020: Economics-Multiplier & AcceleratorDocumento6 pagineSebi Grade A 2020: Economics-Multiplier & AcceleratorThabarak ShaikhNessuna valutazione finora

- Patinkins Real Balance EffectDocumento16 paginePatinkins Real Balance EffectAshu KhatriNessuna valutazione finora

- National Income AccountsDocumento13 pagineNational Income AccountsPlatonicNessuna valutazione finora

- New ECONOMICS NEP Syllabus Revised 2Documento25 pagineNew ECONOMICS NEP Syllabus Revised 2Chotu KumarNessuna valutazione finora

- TheoryDocumento128 pagineTheorykrishna45Nessuna valutazione finora

- AEconometricAnalysisofQualitativeVariablesDocumento21 pagineAEconometricAnalysisofQualitativeVariablesClaudio AballayNessuna valutazione finora

- Rural-Urban Migration ModelDocumento5 pagineRural-Urban Migration ModelSilviaNessuna valutazione finora

- Baumol Inventory Theory - Amitabha SarkarDocumento3 pagineBaumol Inventory Theory - Amitabha SarkarTripti Dutta100% (1)

- Lecture 5Documento39 pagineLecture 5Tiffany TsangNessuna valutazione finora

- Mankiw Chapter 5 Open Economy InvestmentDocumento59 pagineMankiw Chapter 5 Open Economy InvestmentYusi PramandariNessuna valutazione finora

- Monetarists Vs Rational E, PresentationDocumento34 pagineMonetarists Vs Rational E, PresentationTinotenda Dube100% (2)

- Say's Law of MarketDocumento16 pagineSay's Law of Marketgulmehak chandhokNessuna valutazione finora

- Economics - Definition and Nature & Scope of Economics - Divisions of EconomicsDocumento8 pagineEconomics - Definition and Nature & Scope of Economics - Divisions of EconomicsNikita 07Nessuna valutazione finora

- DispersionDocumento58 pagineDispersionYash Juneja50% (2)

- Complete Business Statistics: Simple Linear Regression and CorrelationDocumento50 pagineComplete Business Statistics: Simple Linear Regression and Correlationmallick5051rajatNessuna valutazione finora

- General Equilibrium, Growth, and Trade II: The Legacy of Lionel McKenzieDa EverandGeneral Equilibrium, Growth, and Trade II: The Legacy of Lionel McKenzieNessuna valutazione finora

- IS-LM (Macroeconomics)Documento11 pagineIS-LM (Macroeconomics)GETinTOthE SySteMNessuna valutazione finora

- Keynes Liquidity Preference ApproachDocumento8 pagineKeynes Liquidity Preference ApproachAppan Kandala VasudevacharyNessuna valutazione finora

- Demand For MoneyDocumento6 pagineDemand For MoneyAppan Kandala VasudevacharyNessuna valutazione finora

- Demand For Money in IndiaDocumento14 pagineDemand For Money in IndiaAppan Kandala VasudevacharyNessuna valutazione finora

- Money SupplyDocumento12 pagineMoney SupplyAppan Kandala VasudevacharyNessuna valutazione finora

- Monetary PolicyDocumento13 pagineMonetary PolicyAppan Kandala VasudevacharyNessuna valutazione finora

- Monetary Transmission Mechanism in IndiaDocumento7 pagineMonetary Transmission Mechanism in IndiaAppan Kandala VasudevacharyNessuna valutazione finora

- Monetary Transmission MechanismDocumento13 pagineMonetary Transmission MechanismAppan Kandala VasudevacharyNessuna valutazione finora

- Classical Neo-Classical Interest RateDocumento7 pagineClassical Neo-Classical Interest RateAppan Kandala VasudevacharyNessuna valutazione finora

- Guidelines To Prepare Research Proposal For ICSSR Sponsored ProjectsDocumento2 pagineGuidelines To Prepare Research Proposal For ICSSR Sponsored ProjectsAppan Kandala Vasudevachary100% (1)

- Lesson-9 Capital Market in India. Primary and Secondary Markets and Regulation of Capital MarketsDocumento11 pagineLesson-9 Capital Market in India. Primary and Secondary Markets and Regulation of Capital MarketsAppan Kandala VasudevacharyNessuna valutazione finora

- Friedman Modern QTDocumento5 pagineFriedman Modern QTAppan Kandala VasudevacharyNessuna valutazione finora

- Inflation & Unemployment - PhillipsDocumento22 pagineInflation & Unemployment - PhillipsAppan Kandala VasudevacharyNessuna valutazione finora

- 1 An Analysis of Growth and Development in Telangana StateDocumento11 pagine1 An Analysis of Growth and Development in Telangana StateAppan Kandala VasudevacharyNessuna valutazione finora

- Monetary Approach To BOP or IS-LM ModelDocumento8 pagineMonetary Approach To BOP or IS-LM ModelAppan Kandala VasudevacharyNessuna valutazione finora

- MoneterismDocumento38 pagineMoneterismAppan Kandala VasudevacharyNessuna valutazione finora

- Commercial BanksDocumento4 pagineCommercial BanksAppan Kandala VasudevacharyNessuna valutazione finora

- MTMDocumento9 pagineMTMAppan Kandala VasudevacharyNessuna valutazione finora

- wp45 2007Documento30 paginewp45 2007Siddharth JoshiNessuna valutazione finora

- New Monetary Aggregates IntroductionDocumento12 pagineNew Monetary Aggregates IntroductionSudipta BhattacharjeeNessuna valutazione finora

- Concepts and Principles of InsuranceDocumento20 pagineConcepts and Principles of InsuranceAppan Kandala VasudevacharyNessuna valutazione finora

- Globalization in IndiaDocumento24 pagineGlobalization in IndiaShyam SundarNessuna valutazione finora

- Changing Role of State in IndiaDocumento4 pagineChanging Role of State in IndiaAppan Kandala VasudevacharyNessuna valutazione finora

- Financial Sector RefomsDocumento50 pagineFinancial Sector RefomsAppan Kandala VasudevacharyNessuna valutazione finora

- Foreign Trade Policy in IndaDocumento36 pagineForeign Trade Policy in IndaAppan Kandala VasudevacharyNessuna valutazione finora

- Textbook Statistics TalebDocumento17 pagineTextbook Statistics TalebDom DeSiciliaNessuna valutazione finora

- Pricing and Employment InputsDocumento10 paginePricing and Employment InputsNitin MahindrooNessuna valutazione finora

- (Affiliated To Satavahana University) : 1. Business Economics Is Mainly A Study at The Level ofDocumento3 pagine(Affiliated To Satavahana University) : 1. Business Economics Is Mainly A Study at The Level ofSadhi KumarNessuna valutazione finora

- Price List of Plots, Shankarpally PDFDocumento1 paginaPrice List of Plots, Shankarpally PDFmtashNessuna valutazione finora

- Chapter 2 Macro SolutionDocumento14 pagineChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Fee Details 2013-14 Admitted Batch (E2Documento18 pagineFee Details 2013-14 Admitted Batch (E2hariNessuna valutazione finora

- 12 STD Business Math 6 Mark FaqsDocumento15 pagine12 STD Business Math 6 Mark FaqsCody LeeNessuna valutazione finora

- Chapter 09 - AnswerDocumento30 pagineChapter 09 - Answerlooter198Nessuna valutazione finora

- PME Question Bank 3Documento1 paginaPME Question Bank 3Mohammed AliNessuna valutazione finora

- Implied Volatility PDFDocumento14 pagineImplied Volatility PDFAbbas Kareem SaddamNessuna valutazione finora

- Arvind Pai ThesisDocumento80 pagineArvind Pai ThesisrakeshsampathNessuna valutazione finora

- BM - Group 5A - The Case of Pricing PredicamentDocumento11 pagineBM - Group 5A - The Case of Pricing PredicamentEsha SharmaNessuna valutazione finora

- Basics of Capital BudgetingDocumento26 pagineBasics of Capital BudgetingChaitanya JagarlapudiNessuna valutazione finora

- CBSE Class 12 Economics Full Study MaterialDocumento85 pagineCBSE Class 12 Economics Full Study Materialsakshamkohli97Nessuna valutazione finora

- Compound InterestDocumento10 pagineCompound InterestgetphotojobNessuna valutazione finora

- Accept Thomson Division Bid for New Box DesignDocumento2 pagineAccept Thomson Division Bid for New Box Designruchika vartakNessuna valutazione finora

- Answers To Quiz 10Documento3 pagineAnswers To Quiz 10George RahwanNessuna valutazione finora

- MKT 101 Chap 10Documento21 pagineMKT 101 Chap 10বহুব্রীহি আর একটা দাঁড়কাকNessuna valutazione finora

- Instructions On How To Create A Units of Production Depreciation ScheduleDocumento2 pagineInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Stochastic Volatility Models With Closed-Form SsolutionsDocumento99 pagineStochastic Volatility Models With Closed-Form SsolutionsSolomon AntoniouNessuna valutazione finora

- IIMU PGPX - 2016 Assignment 1: A Report Submitted To Prof. Vinay RamaniDocumento10 pagineIIMU PGPX - 2016 Assignment 1: A Report Submitted To Prof. Vinay RamaniGourav SinghalNessuna valutazione finora

- ECO202-Practice Test - 15 (CH 15)Documento4 pagineECO202-Practice Test - 15 (CH 15)Aly HoudrojNessuna valutazione finora

- 613PS07Documento2 pagine613PS07adamNessuna valutazione finora

- A Formal Proof of Walras LawDocumento6 pagineA Formal Proof of Walras LawgeromNessuna valutazione finora