Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Charles Schwab Corporation

Caricato da

Neha Bhomia GuptaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Charles Schwab Corporation

Caricato da

Neha Bhomia GuptaCopyright:

Formati disponibili

Charles Schwab Corporation (A)

Submitted by : Group 4, Section B

Chirag Arora Dhruv Aggarwal Neha Sushilkumar Bhomia Nidhi Singh Nitya Saxena 2013PGP112 2013PGP128 2013PGP248 2013PGP249 2013FPM008

Prasenjit Chakrabarti

2013FPM009

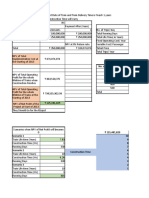

Alternatives for David Pottruck

David Pottruck could resolve the distinction between e.Schwab and regular Schwab customer services by offering all customers low priced Internet trading with full complement of Schwabs customer service options through expanded Internet offering He thus considered three price points - Since it had no intention of price war with brokers, it was not a viable option - Schwabs idea was based on great service at great price, its brand would hurt as would not be able to provide associated services at this price - The range of services commanded at least a $10 price premium to the mid sized firms and a $20 premium on the bare bone providers - At this price point, there is no sufficient revenue addition by increasing the volume - Internal analysis projects less price elasticity at this price point - At this price point, price is more elastic as compared to $39.95 - It could still determine the industry standard and would have the scope to drop the price later owing to competition

$29.95

$19.95

$39.95

Reasons for not cutting prices

To compete in highly contesting category of trading, it should reduce its price to prevent low cost internet brokerage firm from eating away its market share By improving on its internet trading capability on competitive term, it can retain its heavy traders and attract new customers from full service brokerage by providing low price and high quality Also the company possessed right core competencies to make Internet trading expansion a successful initiative, thus leveraging Internet as transformational technology for favorable customer response Charles Schwab has always capitalized on long term value of taking aggressive decision and capture the early market position Although, this initiative estimated revenue and profit reduction in first year, but in long run, projected earnings shortfall could be offset by other parts of its business

It should thus combine its two existing Internet offerings into one new offering and lower the price

Decision : Thus, Lower the price to $29.95 and capitalize by expanding Market Share

Key IT issues faced by Dawn Lepore

Charles Schwab commission-charging system was overdue for an upgrade To provide additional pricing flexibility in order to handle the large number of new customers who will be adopting internet trading, the upgrading was a necessity Internet offering was expanding at a fast rate, pricing flexibility was needed to handle the growth. Currently, it could handle only one type of pricing structure and limited number of pricing schedule

They had developed a workaround for the e.Schwab product but it would be difficult to upscale the system

Internet trading capabilities needed to be enhanced to tackle competition and retain heavy traders and also attract new investors. The work on upgrade was going on but it was far from complete Some of the IT initiatives of Schwab were leading to cannibalization of their core business and a way-out need to be found for this problem They were spending heavily on training, spending on average $2000 per IT staff member per year. Hiring people with experience was focused on due to huge growth of the organization

Merrill Lynch late Entry Right or Wrong?

There was a 5-fold growth in Internet trading market during 1995-97 ( 14million to 69 million). Online trading firms enjoyed the growth by leveraging their IT capabilities .Merrill Lynch, being a late entrant , needed to build the IT capabilities and so ,it could not enjoy the growth There was a shift happening in investment and trading market towards do-ityourself model .Being a Investment Bank, Merrill Lynch had positioned itself mainly as research and advisory services. So , Merrill Lynch lost the market of those investors who opened their online trading accounts to other online brokerage firms Industry was going through intense price war. It was not possible for Merrill Lynch , being a late entrant , to reach scale in terms of IT investment within a very short period of time. So, it would be difficult for them to fight price war Data shows that , Schwabs customer asset had shown CAGR of 42% between 199097, compared to 15% at Merrill Lynch.

Thus, Merrill Lynch was not right being a late entrant in the market

Potrebbero piacerti anche

- Charles Schwab Corporation: Group 3 - Section DDocumento8 pagineCharles Schwab Corporation: Group 3 - Section DdvnshNessuna valutazione finora

- Charles Schwab Corporation (A)Documento4 pagineCharles Schwab Corporation (A)IIMnotes100% (4)

- Charles SchawabDocumento3 pagineCharles SchawabAmar VermaNessuna valutazione finora

- Charles SchwabbDocumento4 pagineCharles SchwabbAnusha BeesettiNessuna valutazione finora

- Charles Schwab CorporationDocumento50 pagineCharles Schwab CorporationAjitesh AbhishekNessuna valutazione finora

- Charles Shwab ISM GROUP4Documento4 pagineCharles Shwab ISM GROUP4Eshan Bhatt100% (1)

- Case Analysis-Charles SchwabDocumento11 pagineCase Analysis-Charles Schwabhoney08priyaNessuna valutazione finora

- Sunwind AB - Group 8 - Section HDocumento5 pagineSunwind AB - Group 8 - Section HNiyati GargNessuna valutazione finora

- Case Analysis NucorDocumento1 paginaCase Analysis NucorSunil Jathar0% (2)

- Charles Schwab & CoDocumento19 pagineCharles Schwab & CoJhuliana Mangones100% (1)

- Moore Medical CorpDocumento21 pagineMoore Medical CorpMadhan Raj100% (1)

- Davey MukullDocumento6 pagineDavey MukullMukul Kumar SinghNessuna valutazione finora

- Classic Knitwear Case (Section-B Group-1)Documento5 pagineClassic Knitwear Case (Section-B Group-1)Swapnil Joardar100% (1)

- AG6 MooreDocumento5 pagineAG6 MooreKavan VaghelaNessuna valutazione finora

- Classic Knitwear Case StudyDocumento5 pagineClassic Knitwear Case Studybinzidd007100% (2)

- Netscape Initial Public OfferingDocumento1 paginaNetscape Initial Public Offeringaruncec2001Nessuna valutazione finora

- Case Answers For Pharmacy Service Improvement at CVSDocumento3 pagineCase Answers For Pharmacy Service Improvement at CVSRahul MundadaNessuna valutazione finora

- Moore Medical CorporationDocumento6 pagineMoore Medical CorporationMitesh Patel100% (1)

- Pashu Khadya Company LimitedDocumento4 paginePashu Khadya Company Limitedgogana93Nessuna valutazione finora

- Salesoft, Inc - Ca NoteDocumento5 pagineSalesoft, Inc - Ca NoteRambabu NaikNessuna valutazione finora

- C&S Wholesale GrocersDocumento15 pagineC&S Wholesale GrocersGanesh Shankar0% (2)

- Salesoft, IncDocumento5 pagineSalesoft, IncArpit Kasture0% (1)

- PGP2 Nict 2013PGPM010Documento3 paginePGP2 Nict 2013PGPM010Rachit PradhanNessuna valutazione finora

- MIS Assignment - Harrah's Entertainment Inc.Documento3 pagineMIS Assignment - Harrah's Entertainment Inc.Sabyasachi RoutNessuna valutazione finora

- Group 2 - Appex CorporationDocumento12 pagineGroup 2 - Appex CorporationAmritanshu Shekhar100% (3)

- Sunwind AB Case StudyDocumento6 pagineSunwind AB Case StudyTanmoy BoseNessuna valutazione finora

- Usha Martin: Competitive Advantage Through Vertical IntegrationDocumento9 pagineUsha Martin: Competitive Advantage Through Vertical IntegrationsafwanhossainNessuna valutazione finora

- Project Assessment at Railways FinalDocumento5 pagineProject Assessment at Railways FinaldebojyotiNessuna valutazione finora

- Alesoft NC: Vinit Chheda Ankita Ray Dixi Zaveri Kanika Ahuja Shraddha Patel Aditi BhattacharyaDocumento39 pagineAlesoft NC: Vinit Chheda Ankita Ray Dixi Zaveri Kanika Ahuja Shraddha Patel Aditi BhattacharyaAnkita RayNessuna valutazione finora

- Marketing Head's Conundrum (Group 7)Documento13 pagineMarketing Head's Conundrum (Group 7)Rini Rafi100% (2)

- Executive Shirt CompanyDocumento13 pagineExecutive Shirt CompanySandeep Chowdhury100% (1)

- San FabianDocumento1 paginaSan FabianMeenal Malhotra100% (2)

- SUnwind A BDocumento5 pagineSUnwind A BChetan Duddagi0% (1)

- Zara Staying Fast and Fresh Case StudyDocumento2 pagineZara Staying Fast and Fresh Case StudyMichelle0% (1)

- Nucor at Crossroads: Presented By: Jayesh Baldania Rinki Kumari Satish Kumar KeshriDocumento10 pagineNucor at Crossroads: Presented By: Jayesh Baldania Rinki Kumari Satish Kumar KeshriNicolas AlfredNessuna valutazione finora

- Indian Food Specialities Ltd.Documento10 pagineIndian Food Specialities Ltd.mayankj_147666100% (3)

- Sun WindDocumento18 pagineSun WindAnand Prakash Jha100% (2)

- Vdocuments - MX Bayonne Packaging Inc Case StudyDocumento11 pagineVdocuments - MX Bayonne Packaging Inc Case StudyPaula Andrea GarciaNessuna valutazione finora

- Steel Frame FurnitureDocumento17 pagineSteel Frame FurnitureDev AnandNessuna valutazione finora

- SalesoftDocumento32 pagineSalesoftBhuvaneswari HarikrishnanNessuna valutazione finora

- Practice ProblemsDocumento2 paginePractice ProblemsAmandeep DahiyaNessuna valutazione finora

- Harrah's Entertainment Case - CRM AssignmentDocumento3 pagineHarrah's Entertainment Case - CRM AssignmentzqasimNessuna valutazione finora

- Harrah S Entertainment IncDocumento13 pagineHarrah S Entertainment IncjarjonaeNessuna valutazione finora

- Sotarg CalcDocumento6 pagineSotarg CalcjatinNessuna valutazione finora

- Group 2 - Shodh Case Analysis - MKT504Documento6 pagineGroup 2 - Shodh Case Analysis - MKT504Arpita GuptaNessuna valutazione finora

- Design by Kate: The Power of Direct SalesDocumento8 pagineDesign by Kate: The Power of Direct SalesSaurabh PalNessuna valutazione finora

- Nucor Case AnalysisDocumento6 pagineNucor Case AnalysisAsjad HameedNessuna valutazione finora

- Nor' Easters Maximizing RevenuesDocumento8 pagineNor' Easters Maximizing RevenuesVruhali Soni100% (1)

- Arrow Electronics Case SolutionDocumento15 pagineArrow Electronics Case SolutionKimberly ReyesNessuna valutazione finora

- American Well: The Doctor Will E-See You Now - CaseDocumento7 pagineAmerican Well: The Doctor Will E-See You Now - Casebinzidd007Nessuna valutazione finora

- G6 CharlesDocumento6 pagineG6 Charlesabhishek pattanayakNessuna valutazione finora

- Charles Scwab Corporation: Group 5Documento8 pagineCharles Scwab Corporation: Group 5Gyan SinhaNessuna valutazione finora

- BOSS Assignment 1Documento14 pagineBOSS Assignment 1charu.chopra3237100% (1)

- Lead GenerationDocumento38 pagineLead Generationatulit27Nessuna valutazione finora

- Solution Manual For Cases in Strategic Management An Integrated Approach 9th Edition by HillDocumento10 pagineSolution Manual For Cases in Strategic Management An Integrated Approach 9th Edition by HillJonathanBradshawsmkc100% (47)

- Intellibuzz: People: Intellibuzz Was Started Sagar Mehta Who Then Had Done Bachelor in ComputerDocumento5 pagineIntellibuzz: People: Intellibuzz Was Started Sagar Mehta Who Then Had Done Bachelor in ComputerKapil ShahNessuna valutazione finora

- Charles Schwab Corporation (A) Group - 10Documento14 pagineCharles Schwab Corporation (A) Group - 10risheek saiNessuna valutazione finora

- AnikChakraborty - C20 - 026 - B2B ET APR 20Documento7 pagineAnikChakraborty - C20 - 026 - B2B ET APR 20Anik ChakrabortyNessuna valutazione finora

- Hubspot CaseDocumento4 pagineHubspot CaseTatsat Pandey100% (1)

- Einventing Your Business ModelDocumento17 pagineEinventing Your Business ModelSrishti Chadha100% (1)

- Automobiles March 2014Documento38 pagineAutomobiles March 2014hemachandra12Nessuna valutazione finora

- Telecom Enabling Growth and Serving The MassesDocumento48 pagineTelecom Enabling Growth and Serving The MassesNeha Bhomia GuptaNessuna valutazione finora

- Strategic It Alignment at Vermont Teddy Bear: Information Systems For Managers-IIDocumento6 pagineStrategic It Alignment at Vermont Teddy Bear: Information Systems For Managers-IINeha Bhomia GuptaNessuna valutazione finora

- Does IT Payoff? Strategies of Two Banking Giants: Submitted By: Group 4, Section BDocumento5 pagineDoes IT Payoff? Strategies of Two Banking Giants: Submitted By: Group 4, Section BNeha Bhomia GuptaNessuna valutazione finora

- ITC Corporate Presentation PDFDocumento56 pagineITC Corporate Presentation PDFNeha Bhomia GuptaNessuna valutazione finora

- The Arts Club Membership ApplicationDocumento5 pagineThe Arts Club Membership ApplicationkerstinsaidlerNessuna valutazione finora

- COVID-19 Assistance To Restart Enterprises (CARES) Program: Loan ApplicationDocumento2 pagineCOVID-19 Assistance To Restart Enterprises (CARES) Program: Loan Applicationramir batongbakalNessuna valutazione finora

- Sathuruvin UbayamDocumento4 pagineSathuruvin UbayamAON WebdesignNessuna valutazione finora

- FIN424 - Assignment 1-2nd Term-2021-22Documento7 pagineFIN424 - Assignment 1-2nd Term-2021-22Memoona NawazNessuna valutazione finora

- Acctba3 E2-1, E2-2, E2-3Documento13 pagineAcctba3 E2-1, E2-2, E2-3DennyseOrlido100% (2)

- Semester - Iii Core Financial Accounting PDFDocumento38 pagineSemester - Iii Core Financial Accounting PDFDhritiNessuna valutazione finora

- Apparel Roi CalculatorDocumento3 pagineApparel Roi CalculatorRezza AdityaNessuna valutazione finora

- Gaurav Kumar: Jeevan Lakshya (Plan No. 933)Documento2 pagineGaurav Kumar: Jeevan Lakshya (Plan No. 933)Gaurav KumarNessuna valutazione finora

- Property and Liability InsuranceDocumento528 pagineProperty and Liability Insurancegiyer06111986Nessuna valutazione finora

- Joint Circular No. 01, S. 1998Documento4 pagineJoint Circular No. 01, S. 1998Kinleah Vida100% (1)

- Introduction To Accounting: Financial Statements AnalysisDocumento15 pagineIntroduction To Accounting: Financial Statements AnalysisFaizal AbdullahNessuna valutazione finora

- Vocabulary Words in Araling Panlipunan Grade 7Documento3 pagineVocabulary Words in Araling Panlipunan Grade 7Sonia50% (2)

- Chemical Engineering Plant Economics MCQ Questions & Answers - Chemical EngineeringDocumento6 pagineChemical Engineering Plant Economics MCQ Questions & Answers - Chemical Engineeringsrinu02062Nessuna valutazione finora

- Capital Budgeting Techniques IRRDocumento12 pagineCapital Budgeting Techniques IRRraza572hammadNessuna valutazione finora

- LTCCDocumento16 pagineLTCCandzie09876Nessuna valutazione finora

- 5-1 ACC 345 Business Valuation Report TemplateDocumento6 pagine5-1 ACC 345 Business Valuation Report Templatezainab0% (1)

- Certificate of Registration of A Russian Organization With A Tax Authority at Its LocationDocumento2 pagineCertificate of Registration of A Russian Organization With A Tax Authority at Its Locationdaniel100% (1)

- REFLECTION-PAPER-BA233N-forex MarketDocumento6 pagineREFLECTION-PAPER-BA233N-forex MarketJoya Labao Macario-BalquinNessuna valutazione finora

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentDocumento6 pagineA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- 54 IBA MBA Intake QSN (Math)Documento4 pagine54 IBA MBA Intake QSN (Math)Raihan RahmanNessuna valutazione finora

- Gibson10e ch02Documento23 pagineGibson10e ch02SHAMRAIZKHANNessuna valutazione finora

- Balance of Payments Credit Debit Current AccountDocumento3 pagineBalance of Payments Credit Debit Current AccountVijay ManeNessuna valutazione finora

- Contract Admin Manual 2 Works May 2018 PDFDocumento149 pagineContract Admin Manual 2 Works May 2018 PDFSaddam H. MussieNessuna valutazione finora

- 4AC0 01 Que 20150107Documento20 pagine4AC0 01 Que 20150107anupama dissanaykeNessuna valutazione finora

- Villena v. Batangas (Retirement Pay)Documento9 pagineVillena v. Batangas (Retirement Pay)Ching ApostolNessuna valutazione finora

- Money Math WorkbookDocumento109 pagineMoney Math WorkbookIamangel1080% (10)

- Manual Download 100 B - ArthurDocumento13 pagineManual Download 100 B - ArthurSlamet S89% (9)

- 3441 Fulton ST TeaserDocumento1 pagina3441 Fulton ST TeaserZach FirestoneNessuna valutazione finora

- Central Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013Documento10 pagineCentral Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013malaarunNessuna valutazione finora

- Activity ProposalDocumento6 pagineActivity ProposalJeffre AbarracosoNessuna valutazione finora