Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Ratio Analysis

Caricato da

Kagami ElieDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Ratio Analysis

Caricato da

Kagami ElieCopyright:

Formati disponibili

Liquidity or Short-term solvency Ratio

Stability or long-term solvency Ratio Profitability Ratio

Profitability

ratio helps to measure the profitability position of the business concern.

Ratio RoR on Sales Rate of Return on Total Asset Asset turnover

Formula Net Income/ Net Sales Net Income/ Ave. Total Assets Net sales/ Ave. Total Assets

X 100

X 100

X 100

Gross profit ratio

Gross profit/ Net sales

X 100

Ratio

Formula Cost of Sales + Operating Expenses Net Sales Net Income Average Current Asset

Operating ratio

Rate of Return on Current Asset Current Asset Turnover RoR per Current Asset Turnover

Cost of Sales + Operating Expenses (excluding charges not requiring current asset) Average Current Asset

RoR on Current Assets Current Asset turnover

Ratio

Formula Net Income/ Average Working Capital

Cost of Sales + Operating Expenses (excluding charges not requiring working capital)/ Average Working Capital

RoR on Working Capital

Working Capital Turnover RoR per Working Capital Turnover

RoR on Working Capital/ Working Capital Turnover

Invested Capital Turnover

Net Sales/ Average Owners Equity

Net Income/ Average Owners Equity

Net Income less preferred stock dividend requirement/ Ave. No. Of Common Shares Outstanding

RoR on Owners Equity

Earnings per Share

Ratio

Formula Market Price per Share/ Earnings per Share Earnings per Share/ Market Price per share Dividends paid or declared/ Common shares outstanding

Price Earnings Ratio

Capitalization Rate

Dividends per Share

Yield on Common Stock

Dividends per share/ Market value per share of Common Stock

Dividends per share/ Earnings per share Retained earnings/ Capital Stock

Payout ratio Retained Earnings to Capital Stock

It is also called as short-term ratio. This ratio helps to understand the liquidity in a business which is the potential ability to meet current obligations. This ratio expresses the relationship between current assets and current assets of the business concern during a particular period.

Ratio

Formula Current Asset/ Current liabilities Quick Asset/ Current Liabilities Current Assets/ Total Assets Each current asset item/ Total current assets Net credit sales/ Average receivables 360/ Receivable Turnover

Current Ratio

Acid Test Ratio Current Asset to Total Asset Ratio of each current asset item to total current asset Receivable Turnover No. Of days Sales in average receivables or average collection period

Ratio Merchandise Inventory Turnover Work in Process Turnover Raw Materials Turnover No. Of days Supply in Inventory

Formula Cost of Goods Sold/ Average Inventory Cost of Goods Manufactured/ Average Work in Process Inventory Raw materials used/ Ave. Raw materials inventory 360/ Inventory Turnover Cost of goods sold + Operating expenses (excluding charges not requiring working capital)/ Ave. Working capital Cost of goods sold + Operating expenses (excluding charges not requiring current assets)/ Ave. Current asset

Working Capital Turnover

Current Asset Turnover

Ratio Payable Turnover Cash and marketable securities turnover No. Of days operating covered by cash and marketable securities

Formula Net Credit purchases/ Ave. Payables Cost of goods sold + Operating expenses (excluding charges not requiring cash)/ Ave. Marketable Securities 360/ Cash and marketable Securities Turnover

It

is also called as leverage ratio, which measures the long-term obligation of the business concern. This ratio helps to understand, how the long-term funds are used in the business concern.

Ratio

Formula Total Liabilities/ Owners Equity Owners Equity/ Total Liabilities Owners Equity/ Total Assets

Debt/Equity ratio

Equity/Debt Ratio

Proprietary (Equity) Ratio

Debt ratio

Fixed Assets to total Owners equity Fixed Asset to Total Equity

Total Liabilities/ Total assets

Fixed Asset/ Total Owners Equity Fixed Assets/ Total Liabilities and Owner Equity

Ratio Fixed Asset to total longterm liabilities Plant turnover

Formula Fixed Asset/ Total long-term liabilities Net Sales/ Ave. Fixed assets (net) Common stock Equity/ No. Of common shares outstanding

Book Value per share

No. Of times interest is earned

No. Of times preferred dividend requirement is earned No. Of times fixed charges are earned

Income before interest and taxes/ Annual interest charges

Net Income after tax/ Preferred stock dividend requirement Income before taxes and fixed charges/ Fixed Charges (Rent expense + Interest etc.)

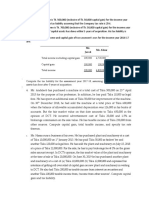

Rate of Return on Equity is the product of Profit margin multiply by asset turnover multiply by equity ratio or equity multiplier ROE = NI/NS * NS/TA * TA/TE = ROA * TA/TE Components that affects ROE - Profit margin - Asset turnover - Equity Multiplier

Potrebbero piacerti anche

- Chapter Vii FsDocumento25 pagineChapter Vii FsKagami ElieNessuna valutazione finora

- An Example of The Use of Financial Ratio AnalysisDocumento9 pagineAn Example of The Use of Financial Ratio AnalysisAnonymous VVSLkDOAC1Nessuna valutazione finora

- Feasib Grading SheetDocumento5 pagineFeasib Grading SheetKagami ElieNessuna valutazione finora

- Chapter Vii FsDocumento25 pagineChapter Vii FsKagami ElieNessuna valutazione finora

- Prospective Banks For OJTDocumento1 paginaProspective Banks For OJTKagami ElieNessuna valutazione finora

- Rooij, Antonius Johannes Van - Online Video Game Addiction. Thesis PrintDocumento137 pagineRooij, Antonius Johannes Van - Online Video Game Addiction. Thesis PrintAliven JohnNessuna valutazione finora

- College of Accountancy and Finance: Polytechnic University of The PhilippinesDocumento1 paginaCollege of Accountancy and Finance: Polytechnic University of The PhilippinesKagami ElieNessuna valutazione finora

- 09 ManagementDocumento27 pagine09 ManagementKagami ElieNessuna valutazione finora

- BBF 1-1Documento12 pagineBBF 1-1Kagami ElieNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Accounting Uses and StakeholdersDocumento10 pagineAccounting Uses and StakeholdersImeesha ShavindiNessuna valutazione finora

- What is a Real Estate Investment Trust? (REITDocumento45 pagineWhat is a Real Estate Investment Trust? (REITkoosNessuna valutazione finora

- FA RatiosDocumento3 pagineFA Ratiosnath.sandipNessuna valutazione finora

- LG 10sr 12-FullenDocumento88 pagineLG 10sr 12-FullenAnh Khoa PhạmNessuna valutazione finora

- VIMA 2.0 Model Venture Capital LexiconDocumento8 pagineVIMA 2.0 Model Venture Capital LexiconRaushan AljufriNessuna valutazione finora

- ACCA F3 Revision Notes OpenTuition PDFDocumento23 pagineACCA F3 Revision Notes OpenTuition PDFPeterNessuna valutazione finora

- Separation of Powers in Company LawDocumento3 pagineSeparation of Powers in Company LawVARSHA KARUNANANTH 1750567Nessuna valutazione finora

- Dividend Policy in Developed and Developing Countries: A Literature ReviewDocumento5 pagineDividend Policy in Developed and Developing Countries: A Literature ReviewXorexkZ-ROBLOXNessuna valutazione finora

- CorrectDocumento40 pagineCorrectaskerman 3Nessuna valutazione finora

- Chapter 1 - LiabilitiesDocumento3 pagineChapter 1 - LiabilitiesPatrick Jayson VillademosaNessuna valutazione finora

- Pas 7 - Statement of Cash FlowsDocumento12 paginePas 7 - Statement of Cash FlowsAresta, Novie MaeNessuna valutazione finora

- NU - Correction of Errors Single Entry Cash To AccrualDocumento8 pagineNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNessuna valutazione finora

- McDonald-Company ProfileDocumento3 pagineMcDonald-Company Profilegdpi09Nessuna valutazione finora

- محاضرات انجليزية اقتصاد كميDocumento98 pagineمحاضرات انجليزية اقتصاد كميMaya ManelNessuna valutazione finora

- Jecc 2018Documento75 pagineJecc 2018Frederick SimanjuntakNessuna valutazione finora

- (2013 Pattern) April 2018Documento128 pagine(2013 Pattern) April 2018Pranab BordoloiNessuna valutazione finora

- Stocks and Their ValuationDocumento17 pagineStocks and Their ValuationSafaet Rahman SiyamNessuna valutazione finora

- TH Plantation AR2016 Part1-FINALDocumento49 pagineTH Plantation AR2016 Part1-FINALkonspiratsiaNessuna valutazione finora

- Strictly Confidential: (For Internal and Restricted Use Only)Documento28 pagineStrictly Confidential: (For Internal and Restricted Use Only)Simran KaurNessuna valutazione finora

- Sample Online Test 2020-2021Documento7 pagineSample Online Test 2020-2021Tiago TagueroNessuna valutazione finora

- Slide Far670 7e VS MynewsDocumento31 pagineSlide Far670 7e VS MynewsNurul Nadia MuhamadNessuna valutazione finora

- FinQuiz Level2Mock2016Version4JunePMQuestionsDocumento40 pagineFinQuiz Level2Mock2016Version4JunePMQuestionsAjoy RamananNessuna valutazione finora

- Financial Management PGDM Study MaterialDocumento152 pagineFinancial Management PGDM Study MaterialSimranNessuna valutazione finora

- Tax Assignment For FinalDocumento4 pagineTax Assignment For FinalEnaiya IslamNessuna valutazione finora

- Ato Megersa AnswerDocumento5 pagineAto Megersa AnswerbiniamNessuna valutazione finora

- Financial Instruments With Characteristics of Equity: Discussion PaperDocumento34 pagineFinancial Instruments With Characteristics of Equity: Discussion PaperMohammedYousifSalihNessuna valutazione finora

- Econ 3024 Assignment 1 (Final Version)Documento2 pagineEcon 3024 Assignment 1 (Final Version)Van Law Wai LunNessuna valutazione finora

- Dealings in Property: Lesson 12Documento18 pagineDealings in Property: Lesson 12lcNessuna valutazione finora

- Risk and Return in Capital Markets ChapterDocumento100 pagineRisk and Return in Capital Markets ChapterChessking Siew HeeNessuna valutazione finora

- Valuation Notes For Financial Reporting CA Final May 2014Documento12 pagineValuation Notes For Financial Reporting CA Final May 2014Shrey KunjNessuna valutazione finora