Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter Six: Demand

Caricato da

Atif AslamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter Six: Demand

Caricato da

Atif AslamCopyright:

Formati disponibili

Chapter Six

Demand

Properties of Demand Functions

Comparative statics analysis of

ordinary demand functions -- the

study of how ordinary demands

x

1

*(p

1

,p

2

,y) and x

2

*(p

1

,p

2

,y) change as

prices p

1

, p

2

and income y change.

Own-Price Changes

How does x

1

*(p

1

,p

2

,y) change as p

1

changes, holding p

2

and y constant?

Suppose only p

1

increases, from p

1

to p

1

and then to p

1

.

x

1

x

2

p

1

= p

1

Fixed p

2

and y.

p

1

x

1

+ p

2

x

2

= y

Own-Price Changes

Own-Price Changes

x

1

x

2

p

1

= p

1

p

1

= p

1

Fixed p

2

and y.

p

1

x

1

+ p

2

x

2

= y

Own-Price Changes

x

1

x

2

p

1

= p

1

p

1

=

p

1

Fixed p

2

and y.

p

1

= p

1

p

1

x

1

+ p

2

x

2

= y

x

2

x

1

p

1

= p

1

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

)

Own-Price Changes

p

1

= p

1

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

)

p

1

x

1

*(p

1

)

p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

p

1

= p

1

x

2

x

1

x

1

*(p

1

)

p

1

x

1

*(p

1

)

p

1

p

1

= p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

)

p

1

p

1

= p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

= p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

= p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

x

1

*

Own-Price Changes

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

x

1

*

Own-Price Changes

Ordinary

demand curve

for commodity 1

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

x

1

*

Own-Price Changes

Ordinary

demand curve

for commodity 1

Fixed p

2

and y.

x

2

x

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

p

1

p

1

p

1

x

1

*

Own-Price Changes

Ordinary

demand curve

for commodity 1

p

1

price

offer

curve

Fixed p

2

and y.

Own-Price Changes

The curve containing all the utility-

maximizing bundles traced out as p

1

changes, with p

2

and y constant, is

the p

1

- price offer curve.

The plot of the x

1

-coordinate of the

p

1

- price offer curve against p

1

is the

ordinary demand curve for

commodity 1.

Own-Price Changes

What does a p

1

price-offer curve look

like for Cobb-Douglas preferences?

Own-Price Changes

What does a p

1

price-offer curve look

like for Cobb-Douglas preferences?

Take

Then the ordinary demand functions

for commodities 1 and 2 are

U x x x x

a b

( , ) .

1 2 1 2

=

Own-Price Changes

x p p y

a

a b

y

p

1 1 2

1

*

( , , ) =

+

x p p y

b

a b

y

p

2 1 2

2

*

( , , ) . =

+

and

Notice that x

2

* does not vary with p

1

so the

p

1

price offer curve is

Own-Price Changes

x p p y

a

a b

y

p

1 1 2

1

*

( , , ) =

+

x p p y

b

a b

y

p

2 1 2

2

*

( , , ) . =

+

and

Notice that x

2

* does not vary with p

1

so the

p

1

price offer curve is flat

Own-Price Changes

x p p y

a

a b

y

p

1 1 2

1

*

( , , ) =

+

x p p y

b

a b

y

p

2 1 2

2

*

( , , ) . =

+

and

Notice that x

2

* does not vary with p

1

so the

p

1

price offer curve is flat and the ordinary

demand curve for commodity 1 is a

Own-Price Changes

x p p y

a

a b

y

p

1 1 2

1

*

( , , ) =

+

x p p y

b

a b

y

p

2 1 2

2

*

( , , ) . =

+

and

Notice that x

2

* does not vary with p

1

so the

p

1

price offer curve is flat and the ordinary

demand curve for commodity 1 is a

rectangular hyperbola.

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

x

2

x

1

Own-Price Changes

Fixed p

2

and y.

x

by

a b p

2

2

*

( )

=

+

x

ay

a b p

1

1

*

( )

=

+

x

1

*(p

1

) x

1

*(p

1

)

x

1

*(p

1

)

x

2

x

1

p

1

x

1

*

Own-Price Changes

Ordinary

demand curve

for commodity 1

is

Fixed p

2

and y.

x

by

a b p

2

2

*

( )

=

+

x

ay

a b p

1

1

*

( )

=

+

x

ay

a b p

1

1

*

( )

=

+

Own-Price Changes

What does a p

1

price-offer curve look

like for a perfect-complements utility

function?

Own-Price Changes

What does a p

1

price-offer curve look

like for a perfect-complements utility

function?

U x x x x ( , ) min , .

1 2 1 2

Then the ordinary demand functions

for commodities 1 and 2 are

Own-Price Changes

x p p y x p p y

y

p p

1 1 2 2 1 2

1 2

* *

( , , ) ( , , ) . = =

+

Own-Price Changes

x p p y x p p y

y

p p

1 1 2 2 1 2

1 2

* *

( , , ) ( , , ) . = =

+

With p

2

and y fixed, higher p

1

causes

smaller x

1

* and x

2

*.

Own-Price Changes

x p p y x p p y

y

p p

1 1 2 2 1 2

1 2

* *

( , , ) ( , , ) . = =

+

With p

2

and y fixed, higher p

1

causes

smaller x

1

* and x

2

*.

p x x

y

p

1 1 2

2

0 = , .

* *

As

Own-Price Changes

x p p y x p p y

y

p p

1 1 2 2 1 2

1 2

* *

( , , ) ( , , ) . = =

+

With p

2

and y fixed, higher p

1

causes

smaller x

1

* and x

2

*.

p x x

y

p

1 1 2

2

0 = , .

* *

As

p x x

1 1 2

0 = , .

* *

As

Fixed p

2

and y.

Own-Price Changes

x

1

x

2

p

1

x

1

*

Fixed p

2

and y.

x

y

p p

2

1 2

*

=

+

x

y

p p

1

1 2

*

=

+

Own-Price Changes

x

1

x

2

p

1

x

y

p p

1

1 2

*

=

+

p

1

= p

1

y/p

2

p

1

x

1

*

Fixed p

2

and y.

x

y

p p

2

1 2

*

=

+

x

y

p p

1

1 2

*

=

+

Own-Price Changes

x

1

x

2

p

1

p

1

p

1

= p

1

x

y

p p

1

1 2

*

=

+

y/p

2

p

1

x

1

*

Fixed p

2

and y.

x

y

p p

2

1 2

*

=

+

x

y

p p

1

1 2

*

=

+

Own-Price Changes

x

1

x

2

p

1

p

1

p

1

x

y

p p

1

1 2

*

=

+

p

1

= p

1

y/p

2

p

1

x

1

*

Ordinary

demand curve

for commodity 1

is

Fixed p

2

and y.

x

y

p p

2

1 2

*

=

+

x

y

p p

1

1 2

*

=

+

x

y

p p

1

1 2

*

. =

+

Own-Price Changes

x

1

x

2

p

1

p

1

p

1

y

p

2

y/p

2

Own-Price Changes

What does a p

1

price-offer curve look

like for a perfect-substitutes utility

function?

U x x x x ( , ) .

1 2 1 2

Then the ordinary demand functions

for commodities 1 and 2 are

Own-Price Changes

x p p y

if p p

y p if p p

1 1 2

1 2

1 1 2

0

*

( , , )

,

/ ,

=

>

<

x p p y

if p p

y p if p p

2 1 2

1 2

2 1 2

0

*

( , , )

,

/ , .

=

<

>

and

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

Fixed p

2

and y.

x

2

0

*

=

x

y

p

1

1

*

=

p

1

= p

1

< p

2

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

x

2

0

*

=

x

y

p

1

1

*

=

p

1

p

1

= p

1

< p

2

x

y

p

1

1

*

=

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

p

1

p

1

= p

1

= p

2

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

p

1

p

1

= p

1

= p

2

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

x

2

0

*

=

x

y

p

1

1

*

=

p

1

p

1

= p

1

= p

2

x

1

0

*

=

x

y

p

2

2

*

=

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

x

2

0

*

=

x

y

p

1

2

*

=

p

1

p

1

= p

1

= p

2

x

1

0

*

=

x

y

p

2

2

*

=

0

1

2

s s x

y

p

*

p

2

= p

1

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

x

y

p

2

2

*

=

x

1

0

*

=

p

1

p

1

x

1

0

*

=

p

2

= p

1

Fixed p

2

and y.

Own-Price Changes

x

2

x

1

p

1

x

1

*

Fixed p

2

and y.

p

1

p

2

= p

1

p

1

x

y

p

1

1

*

=

0

1

2

s s x

y

p

*

y

p

2

p

1

price

offer

curve

Ordinary

demand curve

for commodity 1

Own-Price Changes

Usually we ask Given the price for

commodity 1 what is the quantity

demanded of commodity 1?

But we could also ask the inverse

question At what price for

commodity 1 would a given quantity

of commodity 1 be demanded?

Own-Price Changes

p

1

x

1

*

p

1

Given p

1

, what quantity is

demanded of commodity 1?

Own-Price Changes

p

1

x

1

*

p

1

Given p

1

, what quantity is

demanded of commodity 1?

Answer: x

1

units.

x

1

Own-Price Changes

p

1

x

1

*

x

1

Given p

1

, what quantity is

demanded of commodity 1?

Answer: x

1

units.

The inverse question is:

Given x

1

units are

demanded, what is the

price of

commodity 1?

Own-Price Changes

p

1

x

1

*

p

1

x

1

Given p

1

, what quantity is

demanded of commodity 1?

Answer: x

1

units.

The inverse question is:

Given x

1

units are

demanded, what is the

price of

commodity 1?

Answer: p

1

Own-Price Changes

Taking quantity demanded as given

and then asking what must be price

describes the inverse demand

function of a commodity.

Own-Price Changes

A Cobb-Douglas example:

x

ay

a b p

1

1

*

( )

=

+

is the ordinary demand function and

p

ay

a b x

1

1

=

+ ( )

*

is the inverse demand function.

Own-Price Changes

A perfect-complements example:

x

y

p p

1

1 2

*

=

+

is the ordinary demand function and

p

y

x

p

1

1

2

=

*

is the inverse demand function.

Income Changes

How does the value of x

1

*(p

1

,p

2

,y)

change as y changes, holding both

p

1

and p

2

constant?

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

Income Changes

A plot of quantity demanded against

income is called an Engel curve.

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

1

*

y

x

1

x

1

x

1

y

y

y

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

1

*

y

x

1

x

1

x

1

y

y

y

Engel

curve;

good 1

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

2

*

y

x

2

x

2

x

2

y

y

y

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

2

*

y

x

2

x

2

x

2

y

y

y

Engel

curve;

good 2

x

2

x

1

Income Changes

Fixed p

1

and p

2

.

y < y < y

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

1

*

x

2

*

y

y

x

1

x

1

x

1

x

2

x

2

x

2

y

y

y

y

y

y

Engel

curve;

good 2

Engel

curve;

good 1

Income Changes and Cobb-

Douglas Preferences

An example of computing the

equations of Engel curves; the Cobb-

Douglas case.

The ordinary demand equations are

U x x x x

a b

( , ) .

1 2 1 2

=

x

ay

a b p

x

by

a b p

1

1

2

2

* *

( )

;

( )

. =

+

=

+

Income Changes and Cobb-

Douglas Preferences

x

ay

a b p

x

by

a b p

1

1

2

2

* *

( )

;

( )

. =

+

=

+

Rearranged to isolate y, these are:

y

a b p

a

x

y

a b p

b

x

=

+

=

+

( )

( )

*

*

1

1

2

2

Engel curve for good 1

Engel curve for good 2

Income Changes and Cobb-

Douglas Preferences

y

y

x

1

*

x

2

*

y

a b p

a

x =

+ ( )

*

1

1

Engel curve

for good 1

y

a b p

b

x =

+ ( )

*

2

2

Engel curve

for good 2

Income Changes and Perfectly-

Complementary Preferences

Another example of computing the

equations of Engel curves; the

perfectly-complementary case.

The ordinary demand equations are

x x

y

p p

1 2

1 2

* *

. = =

+

U x x x x ( , ) min , .

1 2 1 2

=

Income Changes and Perfectly-

Complementary Preferences

Rearranged to isolate y, these are:

y p p x

y p p x

= +

= +

( )

( )

*

*

1 2 1

1 2 2

Engel curve for good 1

x x

y

p p

1 2

1 2

* *

. = =

+

Engel curve for good 2

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

Income Changes

x

1

x

2

y < y < y

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

y < y < y

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

y < y < y

x

1

x

1

x

2

x

2

x

2

x

1

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

y < y < y

x

1

x

1

x

2

x

2

x

2

x

1

x

1

*

y

y

y

y

Engel

curve;

good 1

x

1

x

1

x

1

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

y < y < y

x

1

x

1

x

2

x

2

x

2

x

1

x

2

*

y

x

2

x

2

x

2

y

y

y

Engel

curve;

good 2

Fixed p

1

and p

2

.

Income Changes

x

1

x

2

y < y < y

x

1

x

1

x

2

x

2

x

2

x

1

x

1

*

x

2

*

y

y

x

2

x

2

x

2

y

y

y

y

y

y

Engel

curve;

good 2

Engel

curve;

good 1

x

1

x

1

x

1

Fixed p

1

and p

2

.

Income Changes

x

1

*

x

2

*

y

y

x

2

x

2

x

2

y

y

y

y

y

y

x

1

x

1

x

1

y p p x = + ( )

*

1 2 2

y p p x = + ( )

*

1 2 1

Engel

curve;

good 2

Engel

curve;

good 1

Fixed p

1

and p

2

.

Income Changes and Perfectly-

Substitutable Preferences

Another example of computing the

equations of Engel curves; the

perfectly-substitution case.

The ordinary demand equations are

U x x x x ( , ) .

1 2 1 2

= +

Income Changes and Perfectly-

Substitutable Preferences

x p p y

if p p

y p if p p

1 1 2

1 2

1 1 2

0

*

( , , )

,

/ ,

=

>

<

x p p y

if p p

y p if p p

2 1 2

1 2

2 1 2

0

*

( , , )

,

/ , .

=

<

>

Income Changes and Perfectly-

Substitutable Preferences

x p p y

if p p

y p if p p

1 1 2

1 2

1 1 2

0

*

( , , )

,

/ ,

=

>

<

x p p y

if p p

y p if p p

2 1 2

1 2

2 1 2

0

*

( , , )

,

/ , .

=

<

>

Suppose p

1

< p

2

. Then

Income Changes and Perfectly-

Substitutable Preferences

x p p y

if p p

y p if p p

1 1 2

1 2

1 1 2

0

*

( , , )

,

/ ,

=

>

<

x p p y

if p p

y p if p p

2 1 2

1 2

2 1 2

0

*

( , , )

,

/ , .

=

<

>

Suppose p

1

< p

2

. Then x

y

p

1

1

*

=

x

2

0

*

=

and

Income Changes and Perfectly-

Substitutable Preferences

x p p y

if p p

y p if p p

1 1 2

1 2

1 1 2

0

*

( , , )

,

/ ,

=

>

<

x p p y

if p p

y p if p p

2 1 2

1 2

2 1 2

0

*

( , , )

,

/ , .

=

<

>

Suppose p

1

< p

2

. Then x

y

p

1

1

*

=

x

2

0

*

=

and

x

2

0

*

. = y p x =

1 1

*

and

Income Changes and Perfectly-

Substitutable Preferences

x

2

0

*

. =

y p x =

1 1

*

y y

x

1

* x

2

*

0

Engel curve

for good 1

Engel curve

for good 2

Income Changes

In every example so far the Engel

curves have all been straight lines?

Q: Is this true in general?

A: No. Engel curves are straight

lines if the consumers preferences

are homothetic.

Homotheticity

A consumers preferences are

homothetic if and only if

for every k > 0.

That is, the consumers MRS is the

same anywhere on a straight line

drawn from the origin.

(x

1

,x

2

) (y

1

,y

2

) (kx

1

,kx

2

) (ky

1

,ky

2

)

p p

Income Effects -- A

Nonhomothetic Example

Quasilinear preferences are not

homothetic.

For example,

U x x f x x ( , ) ( ) .

1 2 1 2

= +

U x x x x ( , ) .

1 2 1 2

= +

Quasi-linear Indifference Curves

x

2

x

1

Each curve is a vertically shifted

copy of the others.

Each curve intersects

both axes.

Income Changes; Quasilinear

Utility

x

2

x

1

x

1

~

Income Changes; Quasilinear

Utility

x

2

x

1

x

1

~

x

1

*

y

x

1

~

Engel

curve

for

good 1

Income Changes; Quasilinear

Utility

x

2

x

1

x

1

~

x

2

*

y

Engel

curve

for

good 2

Income Changes; Quasilinear

Utility

x

2

x

1

x

1

~

x

1

*

x

2

*

y

y

x

1

~

Engel

curve

for

good 2

Engel

curve

for

good 1

Income Effects

A good for which quantity demanded

rises with income is called normal.

Therefore a normal goods Engel

curve is positively sloped.

Income Effects

A good for which quantity demanded

falls as income increases is called

income inferior.

Therefore an income inferior goods

Engel curve is negatively sloped.

x

2

x

1

Income Changes; Goods

1 & 2 Normal

x

1

x

1

x

1

x

2

x

2

x

2

Income

offer curve

x

1

*

x

2

*

y

y

x

1

x

1

x

1

x

2

x

2

x

2

y

y

y

y

y

y

Engel

curve;

good 2

Engel

curve;

good 1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

Income

offer curve

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

x

1

*

y

Engel curve

for good 1

Income Changes; Good 2 Is Normal,

Good 1 Becomes Income Inferior

x

2

x

1

x

1

*

x

2

*

y

y

Engel curve

for good 2

Engel curve

for good 1

Ordinary Goods

A good is called ordinary if the

quantity demanded of it always

increases as its own price decreases.

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

p

1

price

offer

curve

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

p

1

price

offer

curve

x

1

*

Downward-sloping

demand curve

Good 1 is

ordinary

p

1

Giffen Goods

If, for some values of its own price,

the quantity demanded of a good

rises as its own-price increases then

the good is called Giffen.

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

p

1

price offer

curve

Ordinary Goods

Fixed p

2

and y.

x

1

x

2

p

1

price offer

curve

x

1

*

Demand curve has

a positively

sloped part

Good 1 is

Giffen

p

1

Cross-Price Effects

If an increase in p

2

increases demand for commodity 1

then commodity 1 is a gross

substitute for commodity 2.

reduces demand for commodity 1

then commodity 1 is a gross

complement for commodity 2.

Cross-Price Effects

A perfect-complements example:

x

y

p p

1

1 2

*

=

+

c

c

x

p

y

p p

1

2

1 2

2

0

*

. =

+

<

so

Therefore commodity 2 is a gross

complement for commodity 1.

Cross-Price Effects

p

1

x

1

*

p

1

p

1

p

1

y

p

2

Increase the price of

good 2 from p

2

to p

2

and

Cross-Price Effects

p

1

x

1

*

p

1

p

1

p

1

y

p

2

Increase the price of

good 2 from p

2

to p

2

and the demand curve

for good 1 shifts inwards

-- good 2 is a

complement for good 1.

Cross-Price Effects

A Cobb- Douglas example:

x

by

a b p

2

2

*

( )

=

+

so

Cross-Price Effects

A Cobb- Douglas example:

x

by

a b p

2

2

*

( )

=

+

c

c

x

p

2

1

0

*

. =

so

Therefore commodity 1 is neither a gross

complement nor a gross substitute for

commodity 2.

Potrebbero piacerti anche

- Unofficial Solutions Manual To R.A Gibbon's A Primer in Game TheoryDocumento36 pagineUnofficial Solutions Manual To R.A Gibbon's A Primer in Game TheorySumit Sharma83% (23)

- In Class Homework CH 2Documento4 pagineIn Class Homework CH 2Tiago Matos100% (1)

- Rounding Decimals - LESSON PLANDocumento2 pagineRounding Decimals - LESSON PLANAOA76% (17)

- Microeconomics Group Assignment ReportDocumento12 pagineMicroeconomics Group Assignment ReportMeselu TegenieNessuna valutazione finora

- Tableau TutorialDocumento113 pagineTableau TutorialMamidi KamalNessuna valutazione finora

- 10mat Beta Textbook 2 AnswersDocumento413 pagine10mat Beta Textbook 2 AnswersRaymond WangNessuna valutazione finora

- Varian - Chapter06 - Demand - Properties of Demand FunctionsDocumento14 pagineVarian - Chapter06 - Demand - Properties of Demand FunctionsBella NovitasariNessuna valutazione finora

- Chapter Nine: Buying and SellingDocumento45 pagineChapter Nine: Buying and SellinganirbanmbeNessuna valutazione finora

- CH 06 DemandDocumento69 pagineCH 06 Demandltqtrang1302Nessuna valutazione finora

- Properties of Demand Functions: Comparative Statics AnalysisDocumento69 pagineProperties of Demand Functions: Comparative Statics AnalysisUyên MiNessuna valutazione finora

- Properties of Demand Functions: Comparative Statics AnalysisDocumento69 pagineProperties of Demand Functions: Comparative Statics AnalysisUyên MiNessuna valutazione finora

- Lecture 13 DemandDocumento121 pagineLecture 13 Demandhibaelouadifi2005Nessuna valutazione finora

- Varian9e LecturePPTs Ch06Documento120 pagineVarian9e LecturePPTs Ch06王琦Nessuna valutazione finora

- Lesson 3Documento120 pagineLesson 3Hương NguyễnNessuna valutazione finora

- Ch9 - Buying N SellingDocumento45 pagineCh9 - Buying N SellingpratiwirahmadaniNessuna valutazione finora

- Buying and SellingDocumento47 pagineBuying and Sellingdoanquynhnth1019Nessuna valutazione finora

- Ch6 DemandDocumento120 pagineCh6 Demandselomonbrhane17171Nessuna valutazione finora

- Microeconomics Lecture 4Documento213 pagineMicroeconomics Lecture 4Megumi TsuchiyaNessuna valutazione finora

- Microeconomics Lecture 5Documento52 pagineMicroeconomics Lecture 5Megumi TsuchiyaNessuna valutazione finora

- Chapter Six: DemandDocumento120 pagineChapter Six: DemandDejene TumisoNessuna valutazione finora

- Ch06 MoodleDocumento98 pagineCh06 Moodleyuriycan.kindNessuna valutazione finora

- CH 09 Buying SellingDocumento26 pagineCH 09 Buying Sellingtzhr87yng5Nessuna valutazione finora

- Exponential Demand FunctionsDocumento19 pagineExponential Demand FunctionsDamini ThakurNessuna valutazione finora

- Micro - Exercises A Solutions (Sheet 1, 2, 3)Documento18 pagineMicro - Exercises A Solutions (Sheet 1, 2, 3)Nghĩa Nguyễn TrọngNessuna valutazione finora

- 2 - Inverse Trigonometic FunctionsDocumento19 pagine2 - Inverse Trigonometic FunctionsHarsh RaviNessuna valutazione finora

- Week 05 Elasticities of DD AnDocumento18 pagineWeek 05 Elasticities of DD AnTheo DayoNessuna valutazione finora

- HW2 PDFDocumento3 pagineHW2 PDFMantas SinkeviciusNessuna valutazione finora

- DemandDocumento54 pagineDemandjamesyuNessuna valutazione finora

- StolPer Samuelson Theorem NoteDocumento10 pagineStolPer Samuelson Theorem NoterthoangNessuna valutazione finora

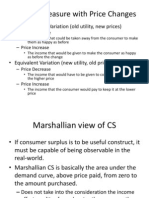

- Welfare Measure With Price Changes: - Compensating Variation (Old Utility, New Prices)Documento20 pagineWelfare Measure With Price Changes: - Compensating Variation (Old Utility, New Prices)Bella NovitasariNessuna valutazione finora

- Micro Varian SolutionDocumento6 pagineMicro Varian SolutionGo Green50% (2)

- Assinment 1Documento8 pagineAssinment 1suhaspujari93Nessuna valutazione finora

- Ch5 Rational ChoiceDocumento74 pagineCh5 Rational ChoicethutrangleNessuna valutazione finora

- 10 Elasticities PDFDocumento2 pagine10 Elasticities PDFFabulousFabs91Nessuna valutazione finora

- Elasticity of DemandDocumento88 pagineElasticity of DemandAkshay ThaparNessuna valutazione finora

- Elasticity Practice Problems - FinalDocumento22 pagineElasticity Practice Problems - Finalpavani sabarwalNessuna valutazione finora

- Revealed PreferenceDocumento18 pagineRevealed PreferenceAnadiGoelNessuna valutazione finora

- DemandDocumento31 pagineDemandhdhillon905740Nessuna valutazione finora

- Topic 7 Self Assessment I Partial Differentiation. 1. Find All First and Second Order Partial Derivatives of The Following FunctionsDocumento15 pagineTopic 7 Self Assessment I Partial Differentiation. 1. Find All First and Second Order Partial Derivatives of The Following FunctionsTNessuna valutazione finora

- Al Stge CHE 411 Separation Processes II First Semester 1429/1430 H-2008/2009G AbsorptionDocumento8 pagineAl Stge CHE 411 Separation Processes II First Semester 1429/1430 H-2008/2009G AbsorptionrockeygreatNessuna valutazione finora

- Ees 200 Revised Lecture Notes (Complete) Courtesy of Michelle OwinoDocumento167 pagineEes 200 Revised Lecture Notes (Complete) Courtesy of Michelle Owinoomondiobundu2021Nessuna valutazione finora

- Midterm 2013 Solutions ECO 310Documento7 pagineMidterm 2013 Solutions ECO 310meganndareNessuna valutazione finora

- Economic Applications of Implicit DifferentiationDocumento6 pagineEconomic Applications of Implicit DifferentiationARUPARNA MAITYNessuna valutazione finora

- H & Q, CH 11, Welfare EconomicsDocumento68 pagineH & Q, CH 11, Welfare EconomicsNeethu KinaraNessuna valutazione finora

- Pset6 Solutions HandoutDocumento10 paginePset6 Solutions HandoutthemiykNessuna valutazione finora

- Assignment - 1 Rasmus Fisker BangDocumento5 pagineAssignment - 1 Rasmus Fisker BangRasmusFiskerBangNessuna valutazione finora

- 2.0 Demand AnalysisDocumento25 pagine2.0 Demand AnalysisNotYGurLzNessuna valutazione finora

- Micro EconomicsDocumento4 pagineMicro EconomicsUWIZERA MoniqueNessuna valutazione finora

- CapmDocumento2 pagineCapmsmray2307Nessuna valutazione finora

- Exercises 16052023 SolutionsDocumento7 pagineExercises 16052023 SolutionsomerogolddNessuna valutazione finora

- Appendix For Introducing Financial Frictions and Unemployment Into A Small Open Economy Model'Documento43 pagineAppendix For Introducing Financial Frictions and Unemployment Into A Small Open Economy Model'RodrigoOdónSalcedoCisnerosNessuna valutazione finora

- dualityAndSensitivity PDFDocumento25 paginedualityAndSensitivity PDFsunil modiNessuna valutazione finora

- Mathematics For Microeconomics: Maximization of A Function of One VariableDocumento35 pagineMathematics For Microeconomics: Maximization of A Function of One VariableYbnias GrijalvaNessuna valutazione finora

- Homework IIxDocumento7 pagineHomework IIxblancaestherbsNessuna valutazione finora

- Ch9 Buying and SellingDocumento45 pagineCh9 Buying and Sellingselomonbrhane17171Nessuna valutazione finora

- Price Quantity Total Marginal Revenue Revenue 10 1 10 9 2 18 8 8 3 24 6 7 4 28 4 6 5 30 2 5 6 30 0 4 7 28 - 2 3 8 24 - 4 2 9 18 - 6 1 10 10 - 8Documento37 paginePrice Quantity Total Marginal Revenue Revenue 10 1 10 9 2 18 8 8 3 24 6 7 4 28 4 6 5 30 2 5 6 30 0 4 7 28 - 2 3 8 24 - 4 2 9 18 - 6 1 10 10 - 8Rahul Chawla0% (1)

- Corporate Finance Formulas: A Simple IntroductionDa EverandCorporate Finance Formulas: A Simple IntroductionValutazione: 4 su 5 stelle4/5 (8)

- Application of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsDa EverandApplication of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsValutazione: 5 su 5 stelle5/5 (1)

- Ch29 ExchangeDocumento107 pagineCh29 ExchangeanirbanmbeNessuna valutazione finora

- CH 23Documento71 pagineCH 23Atif AslamNessuna valutazione finora

- CH 28Documento81 pagineCH 28Atif Aslam100% (1)

- CH 27Documento95 pagineCH 27Atif AslamNessuna valutazione finora

- CH 24Documento84 pagineCH 24Atif AslamNessuna valutazione finora

- CH 25Documento47 pagineCH 25Atif AslamNessuna valutazione finora

- CH 26Documento11 pagineCH 26Atif AslamNessuna valutazione finora

- CH 22Documento79 pagineCH 22DANessuna valutazione finora

- CH 18Documento127 pagineCH 18Atif AslamNessuna valutazione finora

- CH 19Documento105 pagineCH 19Atif AslamNessuna valutazione finora

- CH 20Documento82 pagineCH 20Atif AslamNessuna valutazione finora

- CH 21Documento84 pagineCH 21Atif AslamNessuna valutazione finora

- CH 16Documento109 pagineCH 16Atif AslamNessuna valutazione finora

- CH 17Documento31 pagineCH 17Atif AslamNessuna valutazione finora

- CH 12Documento72 pagineCH 12Atif AslamNessuna valutazione finora

- CH 10Documento69 pagineCH 10Atif AslamNessuna valutazione finora

- CH 13Documento55 pagineCH 13Atif AslamNessuna valutazione finora

- CH 15Documento66 pagineCH 15Atif AslamNessuna valutazione finora

- CH 14Documento81 pagineCH 14Atif AslamNessuna valutazione finora

- Chapter Eleven: Asset MarketsDocumento27 pagineChapter Eleven: Asset MarketssarvanbalajiNessuna valutazione finora

- Chapter Seven: Revealed PreferenceDocumento127 pagineChapter Seven: Revealed PreferenceHelga HabisNessuna valutazione finora

- Income and Substitution EffectDocumento44 pagineIncome and Substitution EffectAndane TaylorNessuna valutazione finora

- Ch4 UtilityDocumento74 pagineCh4 UtilityanirbanmbeNessuna valutazione finora

- Ch2-Budget Constraints N ChoicesDocumento76 pagineCh2-Budget Constraints N ChoicesthutrangleNessuna valutazione finora

- Ch5 Rational ChoiceDocumento74 pagineCh5 Rational ChoicethutrangleNessuna valutazione finora

- CH 3Documento54 pagineCH 3Anastasia KolosovaNessuna valutazione finora

- CH 1 MarketDocumento60 pagineCH 1 MarketanirbanmbeNessuna valutazione finora

- Practice Questions For FinalDocumento19 paginePractice Questions For FinalAtif Aslam100% (1)

- JavaScript (JS) Cheat Sheet OnlineDocumento3 pagineJavaScript (JS) Cheat Sheet OnlinerajikareNessuna valutazione finora

- SPII - Grade 8 Mathematics - Curriculum REVISEDDocumento50 pagineSPII - Grade 8 Mathematics - Curriculum REVISEDJay B Gayle0% (1)

- Bom Pos 2014Documento9 pagineBom Pos 2014nadimduet1Nessuna valutazione finora

- Axiomatic DesignDocumento3 pagineAxiomatic Designkerekaype100% (1)

- Linear Programming (LP) : Deterministic Operations ResearchDocumento27 pagineLinear Programming (LP) : Deterministic Operations ResearchAbenetNessuna valutazione finora

- Shock and Vibration Analysis Using Ansys MechanicalDocumento54 pagineShock and Vibration Analysis Using Ansys Mechanicaltomekzawistowski100% (2)

- The Golden Ratio & The Golden Rectangle: Abstract-This Report Is Showing The ImportanceDocumento5 pagineThe Golden Ratio & The Golden Rectangle: Abstract-This Report Is Showing The ImportanceKhaled HANessuna valutazione finora

- Notes - Class X, Physics, - KinematicsDocumento9 pagineNotes - Class X, Physics, - Kinematicscmaheswara-1Nessuna valutazione finora

- Branson 1965 PDFDocumento16 pagineBranson 1965 PDFTatiane MagaNessuna valutazione finora

- BrachistochroneDocumento36 pagineBrachistochrone2010chanNessuna valutazione finora

- UTS Bahasa Inggris AnalisisDocumento4 pagineUTS Bahasa Inggris AnalisisCuapCuapIndyNessuna valutazione finora

- Hilary Putnam - Pragmatism - An Open QuestionDocumento60 pagineHilary Putnam - Pragmatism - An Open QuestionNikolay Ivanov100% (2)

- (Sergiu T. Chiriacescu (Eds.) ) Stability in The DyDocumento204 pagine(Sergiu T. Chiriacescu (Eds.) ) Stability in The DyHugo CostaNessuna valutazione finora

- MELC 2 Use Conditionals in Expressing ArgumentsDocumento2 pagineMELC 2 Use Conditionals in Expressing ArgumentsMar Sebastian100% (1)

- 2023 BSC Stochastik Skript enDocumento481 pagine2023 BSC Stochastik Skript enMelina SandrinNessuna valutazione finora

- Assignment 3 PROGRAMMINGDocumento7 pagineAssignment 3 PROGRAMMINGGeorges karamNessuna valutazione finora

- Assignment # 4Documento2 pagineAssignment # 4کلک رضاNessuna valutazione finora

- DAA Lab ProgramsDocumento26 pagineDAA Lab ProgramsV ManjunathNessuna valutazione finora

- Chapter 9 Traffic FlowDocumento3 pagineChapter 9 Traffic FlowMatthew DelgadoNessuna valutazione finora

- Upsc Cse Ifos Mathematics Optional Paper 1 Pyqs Till Year 2022 Mindset MakersDocumento98 pagineUpsc Cse Ifos Mathematics Optional Paper 1 Pyqs Till Year 2022 Mindset MakersBarnedNessuna valutazione finora

- Selina Solutions For Class 9 Physics Chapter 2 Motion in One DimensionDocumento39 pagineSelina Solutions For Class 9 Physics Chapter 2 Motion in One DimensionABHISHEK THAKURNessuna valutazione finora

- TextbooksDocumento4 pagineTextbooksMaria DoanNessuna valutazione finora

- Counting Trees Using Segmentation and Vectorization in SAGA GisDocumento6 pagineCounting Trees Using Segmentation and Vectorization in SAGA GisCassie SmithNessuna valutazione finora

- Computing Point-to-Point Shortest Paths From External MemoryDocumento15 pagineComputing Point-to-Point Shortest Paths From External MemoryJacco EerlandNessuna valutazione finora

- Matlab - An Introduction To MatlabDocumento36 pagineMatlab - An Introduction To MatlabHarsh100% (2)

- Lecture - 05 Properties of Walrasian DemandDocumento22 pagineLecture - 05 Properties of Walrasian DemandAhmed GoudaNessuna valutazione finora

- PHD Thesis JD - CR - GS - FinalDocumento185 paginePHD Thesis JD - CR - GS - FinalmvillabrNessuna valutazione finora