Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Module 6

Caricato da

atul_rockstarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Module 6

Caricato da

atul_rockstarCopyright:

Formati disponibili

Course Facilitator: Prof.

Radhakrishna

Financing is concerned with the procurement of required long-term funds at the proper time. It is concerned with the identification of the sources from which funds can be raised, and the determination of the amount of funds that can be raised from each source, which make up the capital structure of an enterprise.

According to C.W Gerstenberg capital structure refers to the make-up, form or composition of a firms capitalization, i.e., the types of securities to be issued and the relative proportion of each type of securities in the total capitalization The capital structure of a company refers to a combination of the long-term finances used by the firm.

It means estimating the total amount of longterm capital required by a company for financing its business and determining the composition and the proportion of the securities to be issued to raise the required capital.

Is quite essential for the successful promotion and smooth functioning of any business undertaking. In fact, many technically sound and economically viable projects have failed simply because of poor capital structure planning. Is must not only in the case of big enterprises, but also in the case of small enterprises.

Would ensure liquidity of funds. Would bring to light the surplus funds available funds available for expansion . Would ensure availability of sufficient funds for meeting permanent working capital and emergencies. Contribute to rational utilization of the available resources. Would contribute to the elimination of wastes. Make things easy for the management team to function smoothly. For determining the total capital requirements of undertaking and for fixing the relative proportion.

1)

2)

3) 4)

Estimating the total amount of long term capital funds needed by a company for financing its business. Determining the form and the proportion of the securities to be issued for raising the funds Setting the companys financial objectives Formulation of financial policies

Trading on Equity

The term equity means equity share capital and term trading means taking advantage of. So, trading on equity means taking advantage of equity share capital as base to raise funds through the issue of preference shares and or debentures on reasonable terms to ensure higher return on equity share capital. the use of borrowed funds or preferred stock, for financing is known as trading on equity. The degree to which debt is used in acquiring assets is called trading on equity.

Desire to retain control Nature of the enterprise: Pubilc utilities (Debt) or manufacturing co. (equity) Size of the Company: Small Co.(Equity) and Large Co. (Debt) Purpose of finance: productive purposes (Debt) and Nonproductive purposes (Equity) Period of finance: if funds are required more or less permanently (equity) and for 8 to 10 years (Debt)

Desire to have flexibility or elasticity of financial plan Need to make provision for the future: Legal requirements Requirements or preferences of investors Market situations or market sentiments Government policies

Optimum capital structure refers to that capital structure at which there is an ideal relationship between debt and equity securities, resulting in maximizing the value of the companys equity shares in the stock exchange and minimizing the average cost of capital.

Maximization of return or profit Minimization of cost Minimization of risk preservation of control Maintaining of proper liquidity Full utilization of resources Flexibility

In the general sense, leverage means force, power of influence. In other words, it means force applied at a particular point of time to have a desired effect at another point. In financial management, the term leverage means the influence of one financial variable over some other related financial variable. To be more specific, the term is used to describe, the ability of a company to use fixed charges sources of funds to magnify the returns to shareholders.

There are three measures of leverage commonly used in financial analysis. They are Operating Leverage Financial Leverage Combined or Composite Leverage

Operating leverage may be defined as the ability of a concern to use fixed operating costs to magnify the effect of change in sales on its operating profits. In other words, it is the tendency of the operating profits to change disproportionately with sales, when a firm employs more fixed costs in the production process in relation to total operating costs.

Contribution Operating profit Where Contribution = Sales Variable cost

Measurement or Computation of Operating Leverage:

Operating profit (EBIT) = Sales Variable cost Fixed cost

operating leverage refers to the percentage of change in operating profit, resulting from a percentage of change in sales. It can be calculated as follows. Percentage of change in operating profit Percentage of change in sales

Degree of Operating Leverage (DOL): Degree of

Indicates the impact of change in sales on the operating profit. Measures the business risk (i.e., the variability of operating profit).

Financial leverage may be defined as the use of fixed interest bearing securities along with equity share capital in the capital structure of a company with view to produce more gains for the equity shareholders. In other words the term financial leverage refers to the relationship between operating profit or earnings before interest and tax and earnings per share

The financial leverage is measured or calculated with the help of the following formula.

Operating profit (EBIT) Earnings before tax (EBT) Degree of Financial leverage (DFL) indicates the percentage of change in earnings per share in relation to percentage of change in earnings before interest and taxes. Percentage of change in EPS Percentage of change in EBIT

Helpful to know how the taxable profit of a concern would respond to a given change in the operating profit. Better tool than operating leverage to know the earnings per share and marker price per share. Measures the financial risk (i.e., the variability of earnings per share) taking place due to the employment of long-term borrowings.

Combined leverage is the combination of operating leverage and financial leverage. The combined leverage expresses the effect of a change in sales over change in the taxable profits of the company. Combined Leverage = Operating leverage x financial leverage CL = Contribution x EBIT EBIT EBT CL = Contribution / EBT DCL = % change in EPS / % change in Sales

Helpful to know the change in earnings per share taking place as a result of changes in sales. Measures the total risk (i.e., the variability of earnings per share). This leverage is useful to forecast the future sales level and the resultant increase or decrease in taxable profits.

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. It is the reward of the shareholders for investments made by them in the shares of the company.

There are many forms of dividend. They are 1. Cash dividend 2. Stock dividend 3. Scrip dividend (Scrip dividend means payment of dividend in scrip of promissory notes.) 4. Bond dividend 5. Property dividend

Once a company makes a profit, management must decide on what to do with those profits. They could continue to retain the profits within the company, or they could pay out the profits to the owners of the firm in the form of dividends. Once the company decides on whether to pay dividends they may establish a somewhat permanent dividend policy, which may in turn impact on investors and perceptions of the company in the financial markets. What they decide depends on the situation of the company now and in the future. It also depends on the preferences of investors and potential investors.

1) 2) 3) 4) 5)

6) 7)

External Factors General state of the economy State of capital market Legal restrictions Contractual restrictions Tax policy of the Government and tax position of the shareholders Inflation Costs differential between external equity and retained earnings

1)

2)

3) 4) 5)

6) 7) 8) 9)

Internal Factors Dividend payout ratio Access to capital market Stability of dividends Dilution of control Rate of return on the alternative investment of the shareholders Nature of Earnings or Profits of the company Liquidity position of the company Shareholders preference Other factors

The various types of dividend policies are follows: Regular Dividend Policy Stable Dividend Policy Irregular Dividend Policy No Dividend Policy Residual Dividend Policy

Payment of dividend at the usual rate is termed as regular dividend. The investors such as retired persons, widows and other economically weaker persons prefer to get regular dividends. However, it must be remembered that regular dividends can be maintained only by companies of long standing and stable earnings. A company should establish the regular dividend at a lower rate as compared to the average earnings of the company

The term stability of dividends means consistency or lack of variability in the stream of dividend payments. In more precise terms, it means payment of certain minimum amount of dividend regularly. A stable dividend policy may be established in any of the following three forms. (a) Constant dividend per share (b) Constant pay out ratio (c) Stable rupee dividend plus extra dividend

Some companies follow irregular dividend payments on account of the following: a. Uncertainty of earnings. b. Unsuccessful business operations. c. Lack of liquid resources. d. Fear of adverse effects of regular dividends on the financial standing of the company.

A company may follow a policy of paying no dividends presently because of its unfavourable working capital position or on account of requirements of funds for future expansion and growth.

Under the Residual approach, dividends are paid out of profits after making provision for money required to meet upcoming capital expenditure commitments

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Adani Power: Type Industry Founded Headquarters Key People ProductsDocumento7 pagineAdani Power: Type Industry Founded Headquarters Key People Productsatul_rockstarNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Term Paper ON: "Study To Analyse Customer's Take On E-Banking Services"Documento8 pagineTerm Paper ON: "Study To Analyse Customer's Take On E-Banking Services"atul_rockstarNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- S Ensitivity A NalysisDocumento44 pagineS Ensitivity A Nalysisatul_rockstarNessuna valutazione finora

- The M&A ParadoxDocumento5 pagineThe M&A Paradoxatul_rockstarNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Features of Free Trade: Free Trade Is A Policy by Which A Government Does Not Discriminate Against Imports or InterfereDocumento6 pagineFeatures of Free Trade: Free Trade Is A Policy by Which A Government Does Not Discriminate Against Imports or Interfereatul_rockstarNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Normal DistributionDocumento29 pagineNormal Distributionatul_rockstarNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 13-DELIVRPRESNTN - PPT ZeeshanDocumento7 pagine13-DELIVRPRESNTN - PPT Zeeshanatul_rockstarNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- AtulDocumento14 pagineAtulatul_rockstarNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Analyze The Consumer Behavior Toward Point Blank ProjectDocumento55 pagineAnalyze The Consumer Behavior Toward Point Blank Projectatul_rockstar0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- History of OrganisationDocumento9 pagineHistory of Organisationatul_rockstarNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Questionnaire MethodDocumento3 pagineQuestionnaire Methodatul_rockstarNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Project On Rayen Steels by Atul JainDocumento81 pagineA Project On Rayen Steels by Atul Jainatul_rockstar0% (1)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Project On Garuda Fashions by Atul JainDocumento51 pagineA Project On Garuda Fashions by Atul Jainatul_rockstarNessuna valutazione finora

- MSPL SteelsDocumento26 pagineMSPL Steelsatul_rockstarNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Organisation Study On BHEL Company by AtulDocumento77 pagineOrganisation Study On BHEL Company by Atulatul_rockstar100% (4)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Features of Rights Issue of SharesDocumento3 pagineFeatures of Rights Issue of SharesHaunter khanNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Music Mart FormatDocumento4 pagineMusic Mart FormatOggy SharmaNessuna valutazione finora

- Project Report On Everest Bank LTDDocumento28 pagineProject Report On Everest Bank LTDdt_rock4463% (24)

- India - Prabal-Gupta-Duff & Phelps Youniversity Presentation-2019Documento41 pagineIndia - Prabal-Gupta-Duff & Phelps Youniversity Presentation-2019cristianoNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- IMD ClassDocumento12 pagineIMD ClassrlyunqueNessuna valutazione finora

- DPWH Special-Provision 2019Documento205 pagineDPWH Special-Provision 2019Pearl AndreaNessuna valutazione finora

- APA Result Announcement 2014Documento5 pagineAPA Result Announcement 2014Mame SomaNessuna valutazione finora

- Slides 9Documento32 pagineSlides 9Cagla SaribayrakdarogluNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Reliance Baking Soda CaseDocumento5 pagineReliance Baking Soda Caseankur_srivastava_26Nessuna valutazione finora

- Module 3 (Government Land Management Activities)Documento9 pagineModule 3 (Government Land Management Activities)7-Idiots Future EngineersNessuna valutazione finora

- Reforms of BhuttoDocumento11 pagineReforms of BhuttoBilal Hussain63% (19)

- Chapter 1 MKTG MGTDocumento38 pagineChapter 1 MKTG MGTJohn Raven TobeoNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Duties of Procurement HeadDocumento1 paginaDuties of Procurement HeadstephenogunladeNessuna valutazione finora

- Economics: Paper 2281/01 Multiple ChoiceDocumento6 pagineEconomics: Paper 2281/01 Multiple Choicemstudy123456Nessuna valutazione finora

- Brand Strategy TemplateDocumento9 pagineBrand Strategy TemplateKritika SharmaNessuna valutazione finora

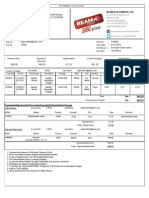

- Beam Telecom PVT LTD.: 8-2-610/A, Road No.10, Banjara Hills, Hyderabad-500034 Tel: +91-40-66272727Documento2 pagineBeam Telecom PVT LTD.: 8-2-610/A, Road No.10, Banjara Hills, Hyderabad-500034 Tel: +91-40-66272727Raghav Reddy NelloreNessuna valutazione finora

- Corporate Governance Christine Mallin Chapter 8 Directors and Board Structure CompressDocumento5 pagineCorporate Governance Christine Mallin Chapter 8 Directors and Board Structure CompressMathildeNessuna valutazione finora

- Mahb Sustainability Report 2019Documento102 pagineMahb Sustainability Report 2019Dennis AngNessuna valutazione finora

- 09 Social Science Key Notes Eco ch3 Poverty As A ChallengeDocumento2 pagine09 Social Science Key Notes Eco ch3 Poverty As A ChallengePrem KukrejaNessuna valutazione finora

- ACT00348 - Analysis DocumentDocumento6 pagineACT00348 - Analysis DocumentBharat SahniNessuna valutazione finora

- Abm 112Documento2 pagineAbm 112l mNessuna valutazione finora

- ESOP Under FEMA RegulationDocumento8 pagineESOP Under FEMA RegulationDeeksha NCNessuna valutazione finora

- Challenges Confronted by Service SectorsDocumento16 pagineChallenges Confronted by Service SectorsRinku ShahNessuna valutazione finora

- Financial Accounting Practice and Review InventoryDocumento3 pagineFinancial Accounting Practice and Review Inventoryukandi rukmanaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Runwal GroupDocumento13 pagineRunwal Groupypatel82Nessuna valutazione finora

- CapDev BrochureDocumento2 pagineCapDev BrochureVinvin EsoenNessuna valutazione finora

- Circular: VPS - Your Trusted Partner For A Sustainable FutureDocumento2 pagineCircular: VPS - Your Trusted Partner For A Sustainable FutureJackson_Dsouza_1551Nessuna valutazione finora

- Slides About SISI IndiaDocumento11 pagineSlides About SISI IndiameerutNessuna valutazione finora

- 3 The EcommerceDocumento5 pagine3 The EcommerceJonathan GonzalezNessuna valutazione finora

- 233 BusinessR&RAnswersDocumento108 pagine233 BusinessR&RAnswersValeriaLópezNessuna valutazione finora