Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

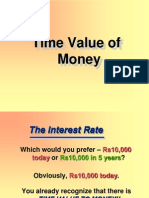

Even When You Don't Do Anything With It. Why? Inflation!

Caricato da

Aayushi SinghDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Even When You Don't Do Anything With It. Why? Inflation!

Caricato da

Aayushi SinghCopyright:

Formati disponibili

Even when you dont do anything with

it.

Why?

Inflation!

If the compound interest rate is i %, future

value is the value that the rupees grows to

after a period of time.

If i = 10%, Rs 100 grows to Rs 110 after one

year and so the future value of Rs 100 after

one year (written as FV

1

) is Rs 110.

After two years? FV

2

is Rs 121.

After n years? FV

n

is Rs 100(1.1)

n

.

In general, if the rate is i %, then the future value of P

rupees

one period from today is PV(1+i),

two periods from today is PV(1+i)

2

,

n periods from today is FV

n

= PV(1+i)

n

PV FV

n

= PV(1+i)

n

0 1 2 3 n

If the compound interest rate is i %, present value

of FV

n

rupees is the value PV to be invested n

periods back that grows to FV

n

.

If i = 10% and FV

1

= Rs 100, the present value PV =

Rs 90.91

because Rs 90.91 grows to Rs100 after one year.

If FV

2

= Rs 100, what is PV?

PV = Rs 82.64.

If FV

n

= Rs100, what is PV?

PV = Rs 100/(1.1)

n

.

In general, if the discount rate is i %, present

value of

FV

1

rupees is FV

1

/(1+i),

FV

2

is FV

2

/(1+i)

2

FV

n

is FV

n

/(1+i)

n

.

FV

n

0 1 2 3 n

PV =FV

n

/ (1+i)

n

Mansingh, a courtier of Akbar, purchased a township

land of 1000 acres near Agra, from the local villagers

for approximately Rs 24 in 1643

It is often claimed that the villagers got a raw deal.

What do you think?

What would Rs 24 in 1637 be worth in 2013? Certainly more

than Rs 24 if invested prudently

1643 2013

Rs24

Rs ?

Assess the worth of Rs24 today if invested in a

conservative project that earns 8% per year for 370

years.

FV

1

= 24(1.08)

= Rs25.92

1643 1644

Rs24

Rs 25.92

After two years?

FV

2

= 24(1.08)

2

= Rs28.00

1643 1644

Rs24

Rs 28.00

After fifty years?

FV

50

= 24(1.08)

50

= Rs1125.64

1643 1693

Rs24 Rs 1126

After 370 years?

Rs55,847,118,732,148 = Rs55 trillion

or Rs 555,84,711 crores

If Rs 500 grows to Rs 1039.50 at a rate of 5%. How

many years was the amount invested?

1039.50 = 500(1+0.05)

n

and we need to solve for n.

Take the logarithm?

FV = Rs 1039.50, PV = Rs500, Rate = 5%,

Time = 15 years

A zero-coupon bond is a bond that pays no

coupon and sells at a discount.

A zero-coupon bond promises to pay Rs1000

after 28 years.

The appropriate discount rate for the bond

(given its risk characteristics) is 9.5%.

What is the bonds current market price?

Market Price = PV = 1000/(1+0.095)

28

= Rs78.78.

If you believe that the proper discount rate for the

bond is 9.2%, would you buy or sell it at the

market price of Rs78.78?

By your reckoning PV = 1000/(1+0.092)

28

=

Rs85.07.

So you will buy the bond at Rs78.78 until......the

price rises to Rs85.07 ...or until you change your

mind about the discount rate of 9.2% seeing that

several investors in the marketplace believe that

the discount rate is above 9.2%.

100

0

1

2

3

225 140

140/(1.1)

3

225/(1.1)

2

100/(1.1)

What happens when you have two or more cash flows? Can

we write their present value? If r = 10% and we have:

Therefore, present value (PV) of the cash flows is

the sum of the present values of the three flows,

i.e., 90.91+185.95+105.18 = Rs382.04

Consider a set of cash flows {PMT

t

} and a discount rate

i. The cash flows can be depicted on a time line:

PMT

1

PMT

2

PMT

3

PMT

n

0 1 2 3 n

Perpetuity is a constant payment of Rs PMT every

period forever. By assumption, the payment PMT

occurs at the end of each period. The first

payment occurs at t=1, the second at t=2, etc.:

PMT PMT PMT

0 1 2 n

The present value of a perpetuity is:

i

PMT

PV =

Multiplying the equation by (1+i):

Subtracting the first equation from

the second:

+

+

+ +

+

+

+

+

+

=

n

i) (

PMT

...

i) (

PMT

i) (

PMT

i) (

PMT

PV

1 1 1 1

3 2

+

+

+ +

+

+

+

+ = +

1 2

1 1 1

1

n

i) (

PMT

...

i) (

PMT

i) (

PMT

PMT PV i) (

In the 1800s, the British Government decided to

consolidate all its debt thru a single issue of 2.5%

consols.

A 2.5% consol was a perpetuity promising to pay 25

British Pounds each year forever.

Suppose the appropriate discount rate for a consol is

10.5%. What is the price of a consol?

PV = PMT / i = 25/0.105 = 238.09 British Pounds.

A growth perpetuity is a payment that starts with

Rs PMT and grows every period at a growth rate g

forever. By assumption, the payment occurs at the

end of each period. The first payment occurs at

t=1, the second at t=2, etc.:

PMT PMT(1+g) PMT(1+g)

n-1

0 1 2 n

We can write the present value of a growth perpetuity

as:

+

+

+

+ +

+

+

+

+

+

+

+

=

n

i

n

g PMT

i

g PMT

i

g PMT

i

PMT

PV

) 1 (

1

) 1 (

...

3

) 1 (

2

) 1 (

2

) 1 (

) 1 (

) 1 (

g i

PMT

PV

=

The sum of this infinite series is finite if

i > g and can be written as:

A business house proposes to endow a chair at FORE

School of Management

The proposal is to provide Rs1,500,000 plus a raise of 5%

each year.

Suppose the interest rate earned by endowments is 10%.

How much should the benefactor donate?

1,500,000 1,500,000(1.05) 1,500,000(1.05)

t-1

0 1 2 t

000 , 000 , 30

05 . 0 10 . 0

000 , 1500

Rs

g i

PMT

PV

=

=

An annuity is like a perpetuity except that it

does not go on forever: it is a constant payment

PMT every period until time n.

By assumption, the payment PMT occurs at the

end of each period. The first payment occurs at

t = 1, the second at t = 2, etc..

The present value of an annuity is easiest to

work out by thinking of it as a difference

between two perpetuities.

|

|

.

|

\

|

+

=

(

+

+

+

+ +

+

+

+

+

+

+

+ +

+

+

+

=

(

+

+

+

+

+

+

+

+

+

+

+ +

+

+

+

=

+

+ +

+

+

+

=

+ +

+ + + +

n

n n n n

n n n n n

n

n

i) ( i

PMT

...

i) (

PMT

i) (

PMT

i) (

...

i) (

PMT

i) (

PMT

i) (

PMT

...

i) (

PMT

i) (

PMT

...

i) (

PMT

i) (

PMT

...

i) (

PMT

i) (

PMT

i) (

PMT

...

i) (

PMT

i) (

PMT

i) (

PMT

...

i) (

PMT

i) (

PMT

PVA

1

1

1

1 1 1

1

1 1 1 1 1

1 1 1 1 1 1 1

1 1 1

2 2 1 2

2 1 2 1 2

2

PMT

0 1 2 n n+1 n+2

PMT PMT PMT PMT

-PMT -PMT

MCD is considering offering 60 year care contracts for its

parks.

It estimates that maintenance will average Rs250,000 every

year.

If the appropriate discount rate is 5.5%, how much one

needs to charge to break even on a perpetual care contract?

. 460 , 362 , 4

) 055 . 0 1 (

1

1

055 . 0

250000

60

Rs

Rs

PV =

(

+

=

The present value of a constantly growing annuity

is given below:

1

= 1

1

n

A g

P

i g i

(

+

| |

(

|

+

\ .

(

(

+ =

+ =

|

|

.

|

\

|

+

=

1 ) 1 (

) 1 (

) 1 (

1

1

n

i

i

PMT

n

PVA

n

i

n

FVA

n

i

i

PMT

n

PVA

) 1 ( ) 1 (

|

.

|

\

|

+ +

=

n

g

n

i

g i

PMT

n

FVA

5 . 337 , 43 , 84

) 08 . 0 1 (

1

1

08 . 0

000 , 750

30

Rs

Rs

=

(

Rahul plans to retire in 40 years.

He wishes to plan for 30 years beyond retirement.

Also, given his present status, he proposes to consume

Rs750,000 each year.

Suppose he can invest money at 8%.

How much does he need to have at retirement?

| |

year Rs PMT

Rs

RsPMT

/ 7 . 592 , 32

5 . 337 , 43 , 84 1 ) 08 . 0 1 (

08 . 0

40

=

= +

How much Rahul needs to save every year for 40 years to

have Rs844,333.75 at the end if he can invest money at 8%.

Compounding does not have to be on an annual

basis.

Compounding can be done quarterly, monthly,

daily, or even continuously!

What is the effect of compounding two times

during the same year? Or more times?

Intuitively, the money should grow faster. Why?

Because interest is paid earlier and reinvested.

The same formulas still work, but

n now becomes the number of compounding periods

i becomes the interest earned in a compounding period

For example, if we compounded monthly for 4 years at 12%,

the number of compounding periods n would be 48, and

the interest rate i would be 1%.

An annual interest rate of 10% compounded four

times a year, is an interest rate of 2.5% paid every

quarter.

If we invest Rs 1 for one year at this rate, we would

use our compounding formula with n = 4 and i =

2.5% to find out its future value after a year.

Therefore, after one year Rs 1 becomes...

Rs1 x (1 + 0.025)

4

= Rs1.1038.

Therefore, Rs 1 invested at an annual rate of 10%

compounded quarterly becomes Rs1.1038 in a year.

It was as if a rate of 10.38% was applied only one time

during that year.

We refer to the nominal rate of 10% as the Annual

Percentage Rate (APR).

Also, we refer to the annualized rate of 10.38% that

incorporates the effect of compounding, as the Effective

Annual Rate (EAR).

m

m

APR

EAR

(

+ = + 1 1

In general, if Rs PMT is invested at an APR of i % and

compounded m times during the year, we can write the

following relation between APR and EAR:

n m

m

APR

PMT

n

FV

(

+ = 1

Alternatively, if Rs PMT is invested at an APR of i %

compounded m times during a year, for n years, we can

write its future value after n years as:

This also means that the present value of Rs PMT

that is received after n years, is:

n m

m

APR

PMT

PV

+

=

1

Yield Rate

8.82 8.55

One-Year FD

m

m

|

.

|

\

|

+ =

0855 . 0

1 0882 . 1

We want to compound 8.55% sufficient number of times

to make it yield 8.82%.

You can solve the equation mathematically, or by trial and

error.

The answer is m = 4 and so Mera Bank will compound an

annual APR of 8.55% each quarter, giving you a quarterly

rate of 2.1375%.

n m

m

APR

PMT

n

FV

(

+ = 1

We know that if Rs PMT is invested at an APR of i %

compounded m times during a year, for n years, its

future value after n years is:

If m approaches infinity, we get:

( ) APR n

e PMT

n

FV

=

Sinking fund is a fund, which is created out of fixed

payments each period to accumulate to a future sum

after a specified period. For example, companies

generally create sinking funds to retire bonds

(debentures) on maturity.

The factor used to calculate the annuity for a given

future sum is called the sinking fund factor (SFF).

=

(1 ) 1

n

n

i

A F

i

(

(

+

Capital recovery is the annuity of an investment

made today for a specified period of time at a given

rate of interest. Capital recovery factor helps in the

preparation of a loan amortisation (loan

repayment) schedule.

The reciprocal of the present value annuity factor is

called the capital recovery factor (CRF).

,

1

=

PVAF

n i

A P

(

(

= CRF

n,i

A P

Annuity due is a series of fixed receipts or

payments starting at the beginning of each period

for a specified number of periods.

Future Value of an Annuity Due

Present Value of an Annuity Due

,

= CVFA (1 )

n n i

F A i +

= PVFA (1 + )

n, i

P A i

Net present value (NPV) of a financial decision is

the difference between the present value of cash

inflows and the present value of cash outflows.

0

1

NPV =

(1 + )

n

t

t

t

C

C

k

=

A bond that pays some specified amount in future

(without periodic interest) in exchange for the

current price today is called a zero-interest bond

or zero-coupon bond. In such situations, we

would be interested to know what rate of interest

the advertiser is offering. We can use the concept

of present value to find out the rate of return or

yield of these offers.

The rate of return of an investment is called

internal rate of return since it depends

exclusively on the cash flows of the investment.

The formula for Internal Rate of Return is given

below. Here, all parameters are given except r

which can be found by trial and error.

0

1

NPV = 0

(1 + )

n

t

t

t

C

C

r

=

=

Compute the annual percentage rate (APR) on an

investment if Rs 1,580 invested today and

compounded every week yields Rs 2,120 in three

and a half years.

( )

% 4 . 8

% 7 . 0

1560

1

2120

182

=

=

=

+

APR

r

r

Hritik proposes to set aside Rs950 toward retirement

every month for the next 20 years. If the annual interest

rate is 13.6% compounded every month, how much will

Hritik have in the retirement account in 20 years?

( ) | |

333 , 169 , 1

1 011333 . 0 1

011333 . 0

950

240

Rs FV

FV

=

+ =

Vivek proposes to sell land for Rs17,71,400 and invest the proceeds

in shares. Vivek expects the investment to pay Rs6200 next month

and an amount that grows at an annual 3.5% paid every month

subsequently forever. What is the annual percentage rate on the

investment?

% 7 . 7

% 6417 . 0

00 , 714 , 17

12

035 . 0

6200

=

=

=

|

.

|

\

|

APR

r

Rs

r

Rs

A loan of Rs6000 at 15% interest rate is to be repaid

in four equal installments at the end of each year.

What is the annual payment of the loan?

( )

58 . 101 , 2

6000

015 . 0 1

1

1

015 . 0

4

Rs PMT

PMT

=

=

(

Raju has won Rs3 million in Kaun Banega Crorepati , Junior!

To be received in Rs1 lac installments at the end of each of

the next 30 years, of course!

If the appropriate discount rate is 7.5%, what is the amount

really worth?

. 038 , 81 , 11

) 075 . 0 1 (

1

1

075 . 0

000 , 00 , 1

30

Rs

Rs

PV =

(

+

=

Potrebbero piacerti anche

- Engineering Economics FundamentalsDocumento15 pagineEngineering Economics Fundamentalsapi-27237371100% (4)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Da EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Valutazione: 4 su 5 stelle4/5 (9)

- Practice Questions Time Value of MoneyDocumento16 paginePractice Questions Time Value of MoneyS Jawad Ul Hasan88% (8)

- GenMath11 - Q2 - Mod5 - Demesa CE 1 Ce 2 EDITEDDocumento31 pagineGenMath11 - Q2 - Mod5 - Demesa CE 1 Ce 2 EDITEDAngel Lou Datu50% (6)

- The Time Value of Money: (Chapter 9)Documento22 pagineThe Time Value of Money: (Chapter 9)ellaNessuna valutazione finora

- Petroleum Economics PDFDocumento156 paginePetroleum Economics PDFZeljko Belosic100% (2)

- Time Value of MoneyDocumento76 pagineTime Value of Moneyrhea agnesNessuna valutazione finora

- Simple AnnuitiesDocumento33 pagineSimple Annuitieselma anacletoNessuna valutazione finora

- 02 How To Calculate Present ValuesDocumento5 pagine02 How To Calculate Present ValuesMộng Nghi TôNessuna valutazione finora

- Business IntelligenceDocumento26 pagineBusiness IntelligenceAayushi SinghNessuna valutazione finora

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDa EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNessuna valutazione finora

- Time Value of Money: Future Value Present ValueDocumento58 pagineTime Value of Money: Future Value Present ValueeyraNessuna valutazione finora

- REFM HP 12c Skills Study GuideDocumento27 pagineREFM HP 12c Skills Study GuideGGrahameNessuna valutazione finora

- Concept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyDocumento34 pagineConcept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyRasumathi SNessuna valutazione finora

- Time Value of MoneyDocumento35 pagineTime Value of MoneyChimmy ParkNessuna valutazione finora

- Time Value of MoneyDocumento54 pagineTime Value of MoneyBibhudatta SinghSamantNessuna valutazione finora

- Time Value of MoneyDocumento8 pagineTime Value of MoneyLj SzeNessuna valutazione finora

- Present Value Calculations for Retirement PlanningDocumento38 paginePresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- Setting Up Payment Gateway in IndiaDocumento16 pagineSetting Up Payment Gateway in Indiaps100% (1)

- L'Oréal - Masters MulticulturalismDocumento12 pagineL'Oréal - Masters MulticulturalismAayushi Singh100% (1)

- Attachment Summary Sheet Time Value of MoneyDocumento9 pagineAttachment Summary Sheet Time Value of Moneydevesh chaudharyNessuna valutazione finora

- BookMyShow ReportDocumento3 pagineBookMyShow ReportAayushi SinghNessuna valutazione finora

- DLP For Compound InterestDocumento9 pagineDLP For Compound InterestGemma Canong Magdato100% (2)

- Groupp-1 Topic 1Documento37 pagineGroupp-1 Topic 1Shaina BaptistaNessuna valutazione finora

- Time Value of Money IDocumento44 pagineTime Value of Money IVipul MehtaNessuna valutazione finora

- TVM 4 NaishaDocumento13 pagineTVM 4 Naishahitisha agrawalNessuna valutazione finora

- Time Value of MoneyDocumento42 pagineTime Value of MoneyVipul MehtaNessuna valutazione finora

- AnnuityDocumento23 pagineAnnuityEnock MaunyaNessuna valutazione finora

- TIME VALUE OF MONEY EXPLAINEDDocumento60 pagineTIME VALUE OF MONEY EXPLAINEDJash ChhedaNessuna valutazione finora

- Chapter 2 TVMDocumento45 pagineChapter 2 TVMGupta AashiyaNessuna valutazione finora

- Time Value of MoneyDocumento55 pagineTime Value of MoneyAtul Sudhakaran0% (1)

- Chapter-2 Time Value Analysis: Dr.M.Mariappan Centre For Hospital Management, SHSSDocumento60 pagineChapter-2 Time Value Analysis: Dr.M.Mariappan Centre For Hospital Management, SHSSRutvi Shah RathiNessuna valutazione finora

- TVM Solved Ex.Documento7 pagineTVM Solved Ex.hardika jadavNessuna valutazione finora

- IBF Time Value Problems With SolutionsDocumento41 pagineIBF Time Value Problems With SolutionsasaandNessuna valutazione finora

- The Time Value of MoneyDocumento29 pagineThe Time Value of Moneymasandvishal50% (2)

- Time Value of Money ConceptsDocumento76 pagineTime Value of Money ConceptsAmit KaushikNessuna valutazione finora

- Time Value of MoneyDocumento62 pagineTime Value of Moneyemmanuel JohnyNessuna valutazione finora

- Chapter 9 - Time Value of MoneyDocumento29 pagineChapter 9 - Time Value of Moneyrohan angelNessuna valutazione finora

- L 2 TIMEV1 - Class NotesDocumento12 pagineL 2 TIMEV1 - Class NotesSEKEETHA DE NOBREGANessuna valutazione finora

- Key Concepts of Finance: Understanding MoneyDocumento4 pagineKey Concepts of Finance: Understanding MoneyAkshay HemanthNessuna valutazione finora

- Time ValueDocumento10 pagineTime ValueBhaskar VishalNessuna valutazione finora

- Time Value of Money ExplainedDocumento37 pagineTime Value of Money Explainedansary75Nessuna valutazione finora

- A4 - Annuity AmortizationDocumento27 pagineA4 - Annuity AmortizationNoel GatbontonNessuna valutazione finora

- 2 - Time Value of MoneyDocumento68 pagine2 - Time Value of MoneyDharmesh GoyalNessuna valutazione finora

- The Time Value of MoneyDocumento25 pagineThe Time Value of MoneyShveta HastirNessuna valutazione finora

- Financial Management FundamentalsDocumento61 pagineFinancial Management FundamentalsAyush JaggiNessuna valutazione finora

- Chapter1 - Return CalculationsDocumento37 pagineChapter1 - Return CalculationsChris CheungNessuna valutazione finora

- #WS1 Applying The Concept of Time Value of Money Understanding Opportunity CostDocumento51 pagine#WS1 Applying The Concept of Time Value of Money Understanding Opportunity Costblessingisichei99Nessuna valutazione finora

- F-Fin Analysis-Class 1 & 2Documento26 pagineF-Fin Analysis-Class 1 & 2Karan Setia100% (1)

- TVM Concepts for Financial ManagementDocumento32 pagineTVM Concepts for Financial ManagementBhanu PratapNessuna valutazione finora

- Time Value of MoneyDocumento10 pagineTime Value of MoneyAnu LundiaNessuna valutazione finora

- Arbaminch Distance Chapter 3Documento16 pagineArbaminch Distance Chapter 3Gizaw BelayNessuna valutazione finora

- 1-Time Value of Money-FinalDocumento61 pagine1-Time Value of Money-FinalGaurav AgrawalNessuna valutazione finora

- A212 - Topic 3 - FV PV - Part I (Narration)Documento31 pagineA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNessuna valutazione finora

- TVM Chapter 6 Key ConceptsDocumento27 pagineTVM Chapter 6 Key ConceptsMahe990Nessuna valutazione finora

- What Is The Time Value of Money Exercise2Documento8 pagineWhat Is The Time Value of Money Exercise2Sadia JuiNessuna valutazione finora

- Reading 6: The Time Value of MoneyDocumento31 pagineReading 6: The Time Value of MoneyAndy Thibault-MilksNessuna valutazione finora

- Module 1 - Time Value of Money Handout For LMS 2020Documento8 pagineModule 1 - Time Value of Money Handout For LMS 2020sandeshNessuna valutazione finora

- 2 Power System Economics 1-58Documento87 pagine2 Power System Economics 1-58Rudraraju Chaitanya100% (1)

- Financial Theory and Practice 1Documento7 pagineFinancial Theory and Practice 1Sunnia WilliamNessuna valutazione finora

- Introduction To Time Value of MoneyDocumento70 pagineIntroduction To Time Value of Moneymubashir_mm4uNessuna valutazione finora

- Visualizing Cash Flows Over TimeDocumento30 pagineVisualizing Cash Flows Over TimekhanNessuna valutazione finora

- Lec2 TVMDocumento58 pagineLec2 TVMvivek patelNessuna valutazione finora

- Session 5 and 6 - Time Value of MoneyDocumento24 pagineSession 5 and 6 - Time Value of MoneyDebi PrasadNessuna valutazione finora

- Chapter 1Documento135 pagineChapter 1Balti TubeNessuna valutazione finora

- Financial Management FM 1: Introduction & Time Value of MoneyDocumento20 pagineFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNessuna valutazione finora

- Time Value of Money-BASICSDocumento59 pagineTime Value of Money-BASICSVaidyanathan RavichandranNessuna valutazione finora

- Handbook of Capital Recovery (CR) Factors: European EditionDa EverandHandbook of Capital Recovery (CR) Factors: European EditionNessuna valutazione finora

- Cooperative Advertising in Reliance FreshDocumento2 pagineCooperative Advertising in Reliance FreshAayushi SinghNessuna valutazione finora

- Accenture SMDocumento2 pagineAccenture SMAayushi SinghNessuna valutazione finora

- 1415 AMR Session 1Documento39 pagine1415 AMR Session 1Mitul KathuriaNessuna valutazione finora

- Role of IT in Business OrganizationsDocumento14 pagineRole of IT in Business OrganizationsAayushi SinghNessuna valutazione finora

- 12th Plan Report FMG22A Group1 PioneersDocumento15 pagine12th Plan Report FMG22A Group1 PioneersAayushi SinghNessuna valutazione finora

- 0000014362-RG&a 2014 - Planning and Monitoring BA Process (Session 2)Documento26 pagine0000014362-RG&a 2014 - Planning and Monitoring BA Process (Session 2)Aayushi SinghNessuna valutazione finora

- LG FinalDocumento27 pagineLG FinalAayushi SinghNessuna valutazione finora

- 0000014362-RG&a 2014 - Req Introduction (Session 1)Documento18 pagine0000014362-RG&a 2014 - Req Introduction (Session 1)Aayushi SinghNessuna valutazione finora

- Decision Making Models Project ReportDocumento18 pagineDecision Making Models Project ReportAayushi SinghNessuna valutazione finora

- Long Report - CommunicationDocumento21 pagineLong Report - CommunicationAayushi SinghNessuna valutazione finora

- Accenture Masters of Rural Markets Selling Profitably To Rural ConsumersDocumento29 pagineAccenture Masters of Rural Markets Selling Profitably To Rural ConsumersAnkitSinghNessuna valutazione finora

- 0000006722-HRM BHEL AssisnmentDocumento20 pagine0000006722-HRM BHEL AssisnmentAayushi SinghNessuna valutazione finora

- 10 Ways in Which Social Media Can Help Your BrandDocumento16 pagine10 Ways in Which Social Media Can Help Your BrandAayushi SinghNessuna valutazione finora

- 0000006722-Hr Practices at Bharti AirtelDocumento7 pagine0000006722-Hr Practices at Bharti AirtelAayushi SinghNessuna valutazione finora

- IITDocumento15 pagineIITAayushi SinghNessuna valutazione finora

- Bajaj Electricals Fans Group9 Part1Documento26 pagineBajaj Electricals Fans Group9 Part1Aayushi Singh100% (1)

- Hbo Pioneers LagaanDocumento18 pagineHbo Pioneers LagaanAayushi SinghNessuna valutazione finora

- Basics of EconomicsDocumento81 pagineBasics of EconomicsNidhi KhuntetaNessuna valutazione finora

- BE AssignmentDocumento2 pagineBE AssignmentAayushi SinghNessuna valutazione finora

- Coca Cola Business Statistics CaseDocumento9 pagineCoca Cola Business Statistics CaseAayushi SinghNessuna valutazione finora

- Booklist PDFDocumento7 pagineBooklist PDFpankajagg121Nessuna valutazione finora

- Profit Vs Wealth MaximasationDocumento8 pagineProfit Vs Wealth MaximasationAayushi SinghNessuna valutazione finora

- IPL (A) Group9 FinalDocumento9 pagineIPL (A) Group9 FinalAayushi SinghNessuna valutazione finora

- Cola Wars 2010Documento7 pagineCola Wars 2010Prerna MakhijaniNessuna valutazione finora

- MR IndustryDocumento13 pagineMR IndustryAayushi SinghNessuna valutazione finora

- Module 5 Basic Time Value of MoneyDocumento33 pagineModule 5 Basic Time Value of Moneylord kwantoniumNessuna valutazione finora

- Exercise 1 For Time Value of MoneyDocumento8 pagineExercise 1 For Time Value of MoneyChris tine Mae MendozaNessuna valutazione finora

- Financial Management:: The Time Value of Money-Annuities and Other TopicsDocumento78 pagineFinancial Management:: The Time Value of Money-Annuities and Other Topicsfreakguy 313Nessuna valutazione finora

- Topic 1 - TVMDocumento61 pagineTopic 1 - TVMBaby KhorNessuna valutazione finora

- Petroleum Project Economics 03Documento34 paginePetroleum Project Economics 03ediwskiNessuna valutazione finora

- Week 2 Lecture Slides - Ch02Documento39 pagineWeek 2 Lecture Slides - Ch02LuanNessuna valutazione finora

- Fundamentals of Corporate Finance: Third Canadian EditionDocumento51 pagineFundamentals of Corporate Finance: Third Canadian EditionkarandeepNessuna valutazione finora

- SLM GM11 Quarter2 Week3Documento28 pagineSLM GM11 Quarter2 Week3Dish SlenNessuna valutazione finora

- Multiple Choice Questions: Answer: B. Wealth MaximisationDocumento20 pagineMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- Narrative Graphic Report On Interest and LoansDocumento11 pagineNarrative Graphic Report On Interest and LoansCheska MANIQUISNessuna valutazione finora

- Core Chapter 04 Excel Master 4th Edition StudentDocumento150 pagineCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNessuna valutazione finora

- Practise Chapter 5+6+7 (For Quiz 2)Documento17 paginePractise Chapter 5+6+7 (For Quiz 2)Phạm Hồng Trang Alice -Nessuna valutazione finora

- Ringkasan Manajemen KeuanganDocumento68 pagineRingkasan Manajemen KeuanganMira Alya SafiraNessuna valutazione finora

- GESB2000Documento43 pagineGESB2000JIALU LIANG (Carrot)Nessuna valutazione finora

- Excel Basic FormulasDocumento97 pagineExcel Basic FormulasDeepanker AnandNessuna valutazione finora

- Mathematics of Finance: Course: MATH6135-Business Mathematics Effective Period: September 2020Documento32 pagineMathematics of Finance: Course: MATH6135-Business Mathematics Effective Period: September 2020OceanifyNessuna valutazione finora

- Maths MTPDocumento18 pagineMaths MTPaim.cristiano1210Nessuna valutazione finora

- Graph Logarithmic FunctionsDocumento19 pagineGraph Logarithmic FunctionsKristina PabloNessuna valutazione finora

- 4.1 Time Value of Money PDFDocumento13 pagine4.1 Time Value of Money PDFPractice AddaNessuna valutazione finora

- Engineering EconomicsDocumento2 pagineEngineering EconomicsGoverdhan ShresthaNessuna valutazione finora

- Chapter 05 GitmanDocumento69 pagineChapter 05 GitmanLBL_LowkeeNessuna valutazione finora

- Time Value of Money ExplainedDocumento37 pagineTime Value of Money Explainedansary75Nessuna valutazione finora

- 105 - Quantitative Analysis For Management DecisionsDocumento21 pagine105 - Quantitative Analysis For Management DecisionsMycareer RamNessuna valutazione finora

- Bond Prices and Interest Rate RiskDocumento100 pagineBond Prices and Interest Rate RiskMarwa HassanNessuna valutazione finora