Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dividend Policy DEVA

Caricato da

GANAPATHY.SDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dividend Policy DEVA

Caricato da

GANAPATHY.SCopyright:

Formati disponibili

DIVIDEND AND DIVIDENT POLICY INTRODUCTION The financial manager must take careful decisions on how the profit

should be distributed among shareholders. It is very important and crucial part of the business concern, because these decisions are directly related with the value of the business concern and shareholders wealth. Like financing decision and investment decision, dividend decision is also a major part of the financial manager. When the business concerns decide dividend policy, they have to consider certain factors such as retained earnings and the nature of shareholder of the business concern.

Meaning of Dividend Dividend refers to the business concerns net profits distributed among the shareholders. It may also be termed as the part of the profit of a business concern, which is distributed among its shareholders. According to the Institute of Chartered Accountant of India, dividend is defined as a distribution to shareholders out of profits or reserves available for this purpose.

TYPES OF DIVIDEND/FORMS OF DIVIDEND Dividend may be distributed among the shareholders in the form of cash or stock. Hence, Dividends are classified into: A. Cash dividend B. Stock dividend C. Bond dividend D. Property dividend Cash Dividend If the dividend is paid in the form of cash to the shareholders, it is called cash dividend. It is paid periodically out the business concerns EAT Earnings after interest and tax). Cash dividends are common and popular types followed by majority of the business concerns.

Stock Dividend Stock dividend is paid in the form of the company stock due to raising of more finance. Under this type, cash is retained by the business concern. Stock dividend may be bonus issue. This issue is given only to the existing shareholders of the business concern. Bond Dividend Bond dividend is also known as script dividend. If the company does not have sufficient funds to pay cash dividend, the company promises to pay the shareholder at a future specific date with the help of issue of bond or notes.

Property Dividend Property dividends are paid in the form of some assets other than cash. It will distributed under the exceptional circumstance. This type of dividend is not published in India. DIVIDEND DECISION Dividend decision of the business concern is one of the crucial parts of the financial manager, because it determines the amount of profit to be distributed among shareholders and amount of profit to be treated as retained earnings for financing its long term growth. Hence, Dividend decision consists of two important concepts which are based on the relationship between dividend decision and value of the firm.

Irrelevance of Dividend According to professors Soloman, Modigliani and Miller, dividend policy has no effect on the share price of the company. There is no relation between the dividend rate and value of the firm. Dividend decision is irrelevant of the value of the firm. RELEVANCE OF DIVIDEND According to this concept, dividend policy is considered to affect the value of the firm. Dividend relevance implies that shareholders prefer current dividend and there is a direct relationship between dividend policy and value of the firm. Relevance of dividend concept is supported by two eminent persons like Walter and Gordon.

Modigliani and Millers Approach According to MM, under a perfect market condition, the dividend policy of the company is irrelevant and it does not affect the value of the firm. Under conditions of perfect market, rational investors, absence of tax discrimination between dividend income and capital appreciation, given the firms investment policy, its dividend policy may have no influence on the market price of shares.

Assumptions MM approach is based on the following important assumptions: 1. Perfect capital market. 2. Investors are rational. 3. There are no tax. 4. The firm has fixed investment policy. 5. No risk or uncertainty.

Criticism of MM approach MM approach consists of certain criticisms also. The following are the major criticisms of MM approach. MM approach assumes that tax does not exist. It is not applicable in the practical life of the firm. MM approach assumes that, there is no risk and uncertain of the investment. It is also not applicable in present day business life. MM approach does not consider floatation cost and transaction cost. It leads to affect the value of the firm. MM approach considers only single decrement rate, it does not exist in real practice. MM approach assumes that, investor behaves rationally. But we cannot give assurance that all the investors will behave rationally.

Walters Model Prof. James E. Walter argues that the dividend policy almost always affects the value of the firm. Walter model is based in the relationship between the following important factors: Rate of return I Cost of capital (k) According to the Walters model, if r > k, the firm is able to earn more than what the shareholders could by reinvesting, if the earnings are paid to them. The implication of r > k is that the shareholders can earn a higher return by investing

elsewhere. If the firm has r = k, it is a matter of indifferent whether earnings are retained or distributed.

Assumptions Walters model is based on the following important assumptions: 1. The firm uses only internal finance. 2. The firm does not use debt or equity finance. 3. The firm has constant return and cost of capital. 4. The firm has 100 recent payout. 5. The firm has constant EPS and dividend. 6. The firm has a very long life.

Criticism of Walters Model The following are some of the important criticisms against Walter model: Walter model assumes that there is no extracted finance used by the firm. It is not practically applicable. There is no possibility of constant return. Return may increase or decrease, depending upon the business situation. Hence, it is applicable. According to Walter model, it is based on constant cost of capital. But it is not applicable in the real life of the business.

Gordons Model Myron Gorden suggest one of the popular model which assume that dividend policy of a firm affects its value, and it is based on the following important assumptions: 1. The firm is an all equity firm. 2. The firm has no external finance. 3. Cost of capital and return are constant. 4. The firm has perpetual life. 5. There are no taxes. 6. Constant relation ratio (g=br). 7. Cost of capital is greater than growth rate (Ke>br).

Criticism of Gordons Model Gordons model consists of the following important criticisms: 1. Gordon model assumes that there is no debt and equity finance used by the firm. 2. It is not applicable to present day business. 3. Ke and r cannot be constant in the real practice. 4. According to Gordons model, there are no tax paid by the firm. It is not practically applicable. FACTORS DETERMINING or AFFECTING DIVIDEND POLICY Profitable Position of the Firm Dividend decision depends on the profitable position of the business concern. When the firm earns more profit, they can distribute more dividends to the shareholders.

Uncertainty of Future Income Future income is a very important factor, which affects the dividend policy. When the shareholder needs regular income, the firm should maintain regular dividend policy. Legal Constrains The Companies Act 1956 has put several restrictions regarding payments and declaration of dividends. Similarly, Income Tax Act, 1961 also lays down certain restrictions on payment of dividends.

Liquidity Position Liquidity position of the firms leads to easy payments of dividend. If the firms have high liquidity, the firms can provide cash dividend otherwise, they have to pay stock dividend. Sources of Finance If the firm has finance sources, it will be easy to mobilize large finance. The firm shall not go for retained earnings. Growth Rate of the Firm High growth rate implies that the firm can distribute more dividend to its shareholders. Tax Policy Tax policy of the government also affects the dividend policy of the firm. When the government gives tax incentives, the company pays more dividend. Capital Market Conditions Due to the capital market conditions, dividend policy may be affected. If the capital market is prefect, it leads to improve the higher dividend.

TYPES OF DIVIDEND POLICY Dividend policy depends upon the nature of the firm, type of shareholder and profitable position. On the basis of the dividend declaration by the firm, the dividend policy may be classified under the following types: Regular dividend policy Stable dividend policy Irregular dividend policy No dividend policy.

Regular Dividend Policy Dividend payable at the usual rate is called as regular dividend policy. For e.g., XYZ COMPANY regularly paying a dividend of more than 4% on their capital as dividend to its shareholders regularly. This type of policy is suitable to the small investors, retired persons and others. Stable Dividend Policy Stable dividend policy means payment of certain minimum amount of dividend regularly. This dividend policy consists of the following three important forms:

1. Constant dividend per share Rams & co., is always used to declare Rs.2 per share as Dividend 2. Constant payout ratio Thumb & Co., is always used to declare 2% per share as Dividend 3. Stable rupee dividend plus extra dividend. jumbu & Co., is always used to declare Rs 0.20 paise for every one rupee of share price as Dividend and 0.10 paise for every one rupee of share price as dividend if profit is more than Rs.1,00,00,000 (1 Crore)

Irregular Dividend Policy When the companies are facing constraints of earnings and unsuccessful business operation, they may follow irregular dividend policy. It is one of the temporary arrangements to meet the financial problems. These types are having adequate profit. For others no dividend is distributed. For e.g., ABC Ltd., is used to pay dividend on the basis of profit, if the profit is more, they may declare highest rate of profit, otherwise they may declare lowest rate of profit when there is BEP they wont declared anything as dividend

No Dividend Policy Sometimes the company may follow no dividend policy because of its unfavorable working capital position of the amount required for future growth of the concerns. K.D. & co., will not declare any dividend to its shareholders, the reason is working capital of K.D. & Co., is always negative.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- QIS-ForM I, II, III Manufacturing FormatDocumento9 pagineQIS-ForM I, II, III Manufacturing FormatAshish Gupta67% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Wedgeworth Sentencing MemorandumDocumento218 pagineWedgeworth Sentencing MemorandumActionNewsJaxNessuna valutazione finora

- Admission Form Play SchoolDocumento4 pagineAdmission Form Play SchoolGANAPATHY.S83% (6)

- White Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiDocumento41 pagineWhite Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiOlga KutnovaNessuna valutazione finora

- 11th Economics 1235 Marks Study Material English MediumDocumento138 pagine11th Economics 1235 Marks Study Material English MediumGANAPATHY.SNessuna valutazione finora

- Management Information System Questions and Answers BBADocumento140 pagineManagement Information System Questions and Answers BBAShraddha NepalNessuna valutazione finora

- F8 Theory NotesDocumento29 pagineF8 Theory NotesKhizer KhalidNessuna valutazione finora

- Principles of Mangement MG2351Documento156 paginePrinciples of Mangement MG2351funhemu100% (30)

- Anatolia Cultural FoundationDocumento110 pagineAnatolia Cultural FoundationStewart Bell100% (3)

- 1.1 BackgroundDocumento3 pagine1.1 BackgroundGANAPATHY.SNessuna valutazione finora

- April 2021Documento4 pagineApril 2021Jegan JerohNessuna valutazione finora

- Commerce RanklistDocumento17 pagineCommerce RanklistGANAPATHY.SNessuna valutazione finora

- Unit 1 IntrodutionDocumento23 pagineUnit 1 IntrodutionGANAPATHY.SNessuna valutazione finora

- Victory Tuition CentreDocumento1 paginaVictory Tuition CentreGANAPATHY.SNessuna valutazione finora

- One Marks 12 STDDocumento18 pagineOne Marks 12 STDGANAPATHY.SNessuna valutazione finora

- 11th Accountancy First Revision Test 2019 Question Paper English MediumDocumento4 pagine11th Accountancy First Revision Test 2019 Question Paper English MediumGANAPATHY.S100% (1)

- Namma Kalvi 11th Accountancy Government Model Question Paper Answer Key emDocumento48 pagineNamma Kalvi 11th Accountancy Government Model Question Paper Answer Key emGANAPATHY.SNessuna valutazione finora

- User ManualDocumento20 pagineUser ManualSunny ChawlaNessuna valutazione finora

- Regular Exam UG & PG TTDocumento4 pagineRegular Exam UG & PG TTGANAPATHY.SNessuna valutazione finora

- Victory Tuition CentreDocumento2 pagineVictory Tuition CentreGANAPATHY.SNessuna valutazione finora

- Leave Your Foot Ware HereDocumento1 paginaLeave Your Foot Ware HereGANAPATHY.SNessuna valutazione finora

- Enrolment Guide: Pathways Noida SchoolDocumento15 pagineEnrolment Guide: Pathways Noida SchoolGANAPATHY.SNessuna valutazione finora

- VTC AdDocumento2 pagineVTC AdGANAPATHY.SNessuna valutazione finora

- User ManualDocumento20 pagineUser ManualSunny ChawlaNessuna valutazione finora

- Admission FormDocumento1 paginaAdmission FormGANAPATHY.SNessuna valutazione finora

- University of Madras: Choice Based Credit SystemDocumento2 pagineUniversity of Madras: Choice Based Credit SystemGANAPATHY.SNessuna valutazione finora

- Birthdays: 28 August 2016 Closer To TheeDocumento2 pagineBirthdays: 28 August 2016 Closer To TheeGANAPATHY.SNessuna valutazione finora

- ResumeDocumento2 pagineResumeGANAPATHY.SNessuna valutazione finora

- Global Kids BrochureDocumento16 pagineGlobal Kids BrochureGANAPATHY.SNessuna valutazione finora

- 11th Commerce 3 Marks Study Material English MediumDocumento21 pagine11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNessuna valutazione finora

- College of Engineering & TechnologyDocumento3 pagineCollege of Engineering & TechnologyGANAPATHY.SNessuna valutazione finora

- Auc 2013Documento80 pagineAuc 2013Sampathkumar MtechNessuna valutazione finora

- 10 Steps To Conflict ResolutionDocumento4 pagine10 Steps To Conflict ResolutionGANAPATHY.SNessuna valutazione finora

- Banarasi Saree KKDocumento1 paginaBanarasi Saree KKGANAPATHY.SNessuna valutazione finora

- Favorite BookDocumento3 pagineFavorite BookGANAPATHY.SNessuna valutazione finora

- Notes On Qawaid FiqhiyaDocumento2 pagineNotes On Qawaid FiqhiyatariqsoasNessuna valutazione finora

- TaclobanCity2017 Audit Report PDFDocumento170 pagineTaclobanCity2017 Audit Report PDFJulPadayaoNessuna valutazione finora

- Oracle Optimized Solution For Backup and RecoveryDocumento37 pagineOracle Optimized Solution For Backup and Recoverywish_newNessuna valutazione finora

- Christopher Hall@usdoj GovDocumento2 pagineChristopher Hall@usdoj GovEquality Case FilesNessuna valutazione finora

- BalayanDocumento7 pagineBalayananakbalayanNessuna valutazione finora

- Merger, Akuisisi Dan Konsolidasi Compile 14.00 NisaDocumento18 pagineMerger, Akuisisi Dan Konsolidasi Compile 14.00 Nisaalfan halifa100% (1)

- Managing Wholesalers N FranchisesDocumento45 pagineManaging Wholesalers N FranchisesRadHika GaNdotra100% (1)

- Sex Trafficking Statistics 2022 Worldwide (Bedbible - Com Reveals)Documento4 pagineSex Trafficking Statistics 2022 Worldwide (Bedbible - Com Reveals)PR.comNessuna valutazione finora

- 8DIO Claire Flute Virtuoso Manual PDFDocumento10 pagine8DIO Claire Flute Virtuoso Manual PDFaaaaaaaaaaNessuna valutazione finora

- SUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoDocumento4 pagineSUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoPrince CalicaNessuna valutazione finora

- Swadhar Greh SchemeDocumento12 pagineSwadhar Greh SchemeShuchi SareenNessuna valutazione finora

- Pulseelectronicsnetwork Jk08001nl Pcndesignspecification 2926Documento3 paginePulseelectronicsnetwork Jk08001nl Pcndesignspecification 2926Guilherme NevesNessuna valutazione finora

- Corod DWR Regular Strength 29feb12Documento3 pagineCorod DWR Regular Strength 29feb12Ronald LlerenaNessuna valutazione finora

- C022031601010479 SoadDocumento5 pagineC022031601010479 Soadnitu kumariNessuna valutazione finora

- Last Two Verse of Surah AlDocumento5 pagineLast Two Verse of Surah AlMhonly MamangcaoNessuna valutazione finora

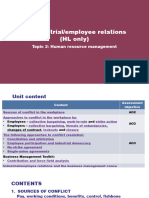

- 2.7 Industrial and Employee RelationDocumento65 pagine2.7 Industrial and Employee RelationadhityakinnoNessuna valutazione finora

- JD 1-Moral Values: Kathrina Lana S. LanajaDocumento2 pagineJD 1-Moral Values: Kathrina Lana S. LanajaBrigitte YambaNessuna valutazione finora

- Configuration of VIO On Power6 PDFDocumento39 pagineConfiguration of VIO On Power6 PDFchengabNessuna valutazione finora

- Right To Social JusticeDocumento13 pagineRight To Social Justicejooner45Nessuna valutazione finora

- Samuel Newton v. Weber CountyDocumento25 pagineSamuel Newton v. Weber CountyThe Salt Lake TribuneNessuna valutazione finora

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDocumento2 paginePastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNessuna valutazione finora

- SBI's Microfinance InitiativesDocumento3 pagineSBI's Microfinance InitiativesSandeep MishraNessuna valutazione finora

- Rickshaw IndividualismDocumento5 pagineRickshaw Individualismoakster510Nessuna valutazione finora

- Peavey Valveking 100 212Documento12 paginePeavey Valveking 100 212whitestratNessuna valutazione finora

- Uthm Pme Talk - Module 1Documento22 pagineUthm Pme Talk - Module 1emy syafiqahNessuna valutazione finora