Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Importance of Accounting in Overall Accounting System

Caricato da

Manasa Priya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

949 visualizzazioni21 pagineUsers of financial statements Owners / investors Management Government Banks and other creditors Employees Customers and suppliers. Different types of accounting works involved Reporting: preparation of logical reports and statements - decision making. Limitations financial accounting Historical in nature and reflects the present position Does not reflect the qualitative aspects of business.

Descrizione originale:

Titolo originale

Accounting

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoUsers of financial statements Owners / investors Management Government Banks and other creditors Employees Customers and suppliers. Different types of accounting works involved Reporting: preparation of logical reports and statements - decision making. Limitations financial accounting Historical in nature and reflects the present position Does not reflect the qualitative aspects of business.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

949 visualizzazioni21 pagineImportance of Accounting in Overall Accounting System

Caricato da

Manasa PriyaUsers of financial statements Owners / investors Management Government Banks and other creditors Employees Customers and suppliers. Different types of accounting works involved Reporting: preparation of logical reports and statements - decision making. Limitations financial accounting Historical in nature and reflects the present position Does not reflect the qualitative aspects of business.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 21

Importance of accounting in

overall accounting system

It’s to communicate to various users of

financial statements the financial

position/economic position of the

business.

Who are the users of financial statements?

Users of financial statements

• Owners /investors

• Management

• Government

• Banks and other creditors

• Employees

• Customers and suppliers

According to Smith and Ashburne

Definition of “accounting

• is the science of recording and classifying

business transactions and events,

• primarily of financial character and the art

of making significant summaries,

• analysis and interpretations of those

transactions and events

• communicating the results to persons who

must make decisions or form judgements”

different types of accounting

works involved

• Constructing: formulation of policy

• recording: Book Keeping following basic rules

of Accountancy

• classifying: the process of grouping or sorting

of the business transactions to get meaningful

information. Done using ledger.

• summarizing: provides a result for the

transactions undertaken by the company. (all

revenue will give profit or loss)

different types of accounting

works involved

• Reporting: preparation of logical reports and

statements - decision making. The financial

statements, budgetary reports etc

• Interpreting: understand financial matters and

relationships between variables. Ratio analysis,

trend analysis, cash flow.

• Auditing: verification of authenticity, accuracy

and correctness of book keeping activity and

reports drawn from those records.

The accounting systems are

• Cash system: normally used by charitable

institutions, doctors etc,

• Single entry system: incomplete books of

records which recognizes only cash and

personal aspects and ignores impersonal

aspects .eg. Sole-Proprietor.

• Double entry system

accounting activities

• Financial/stewardship accounting:

2. identify financial events/ transactions,

3. measure them in terms of money (highly

successful manager recruited),

4. to organize the data in to meaningful info

and to analyse,

5. interpret and communicate to the

various stakeholders.

Limitations financial accounting

• Historical in nature and reflects the

present position

• Does not reflect the qualitative aspects of

business

• Gives only overview but detailed business

plans require in depth analysis

• Requires accounting knowledge

accounting activities

• Cost accounting

extension of general accounting.

Accumulates the costs of certain activity and

gives cost information to the management

See the Xerox

areas of decision making like cost control,

identify profitable areas of business (sales

mix).

Accounting activities

• Management accounting:/ MCS:

uses financial and cost data to evaluate the

entire business or various departments in

relation to pre determined targets

For corrective action in case of deviation.

(differences xerox given)

Limitations of management

accountancy:

• depends on financial and cost data the

validity of the reports is dependent upon

the historical data.

• principle of objectivity is not followed

• as is based on intuition and managers go

for short term benefits than the long term

ones.

Limitations of management

accountancy:

• heavy on time as its is continuous

development of the process

• heavy on manpower as the person dealing

should have comprehensive knowledge of

all accounting activities and all subjects

like engineering, taxation, statistics etc.

Accounting Activities

• Management Reporting

• It is the process of communicating the

right information to the management at

the right time and in the right manner for

effective decision making.

Accounting activities

• Income tax accounting

preparation of the necessary records

required for filing returns for tax purposes.

For ex. The depreciation shown under

financial accounting is not acceptable by

the income tax authorities

Objectives of financial reporting:

• to provide information on financial position

(Balance Sheet)

• to provide information on financial

performance (profit and loss )

• changes in financial position( cash flow)

Qualitative Characteristics of

Accounting Information

relevance

• Relevance for decision making and

timeliness

• Must have predictive capability( is the

central of Quality of Earnings concepts)

and feed back value

• For example if Net income statement

gives the investor any idea about the

future cash flows has feed back value.

• Can be used for investing and predicting

invt cash flows

Reliability

• Verifiability implies a consensus among

different measurers.

• Representational faithfulness exists when

there is agreement between a measure or

description and the phenomenon it

purports to represent EX: “allowance for

uncollectible accounts” previously was

reserve for doubtful accounts

reliability

• neutrality is highly related to the

establishment of accounting standards.

• Accounting standards should be

established with overall societal goals and

specific objectives in mind and should try

not to favor particular groups or

companies.

SECONDARY QUALITATIVE

CHARACTERISTICS

• Comparability is the ability to help users

see similarities and differences between

events and conditions

• consistency of accounting practices over

time permits valid comparisons between

different periods. The predictive and

feedback value of information is enhanced

if users can compare the performance of a

company over time

• THANK YOU FOR YOUR ATTENTION

AND INTERACTION.

Potrebbero piacerti anche

- What is Financial Accounting and BookkeepingDa EverandWhat is Financial Accounting and BookkeepingValutazione: 4 su 5 stelle4/5 (10)

- Chapter - 1 Introduction To AccountingDocumento17 pagineChapter - 1 Introduction To AccountingMishika WadhwaniNessuna valutazione finora

- Accounting 1aDocumento66 pagineAccounting 1aPatrick Attankurugu100% (1)

- 11 Acc CH 1 Introduction To Accounting 23-24Documento15 pagine11 Acc CH 1 Introduction To Accounting 23-24Nathan DavidNessuna valutazione finora

- FMS Chapter OneDocumento19 pagineFMS Chapter OneEyael ShimleasNessuna valutazione finora

- Fabm1 M1Documento30 pagineFabm1 M1Colas MorNessuna valutazione finora

- Acc Fundamentals IntroductionDocumento18 pagineAcc Fundamentals IntroductionManisha DeyNessuna valutazione finora

- Introduction To AccountingDocumento34 pagineIntroduction To AccountingDhruv BhagatNessuna valutazione finora

- AccountingDocumento12 pagineAccountingveluswamiNessuna valutazione finora

- PoaDocumento76 paginePoaAdarsh Thakur100% (1)

- Basic Accounting ConceptDocumento19 pagineBasic Accounting ConcepttundsandyNessuna valutazione finora

- Intro To AcctgDocumento192 pagineIntro To AcctgKim Pacer100% (1)

- Prof. Rahul K Kavishwar: Introduction To Financial AccountingDocumento114 pagineProf. Rahul K Kavishwar: Introduction To Financial Accountingsameer_saud8780100% (1)

- Financial Accounting: Session No 1Documento37 pagineFinancial Accounting: Session No 1Anirudh DuttaNessuna valutazione finora

- Unit - I: Introduction To AccountingDocumento24 pagineUnit - I: Introduction To AccountingbuviaroNessuna valutazione finora

- Chapter 2: Introduction: Why Accounting Standards Exist?Documento7 pagineChapter 2: Introduction: Why Accounting Standards Exist?Danial FaizNessuna valutazione finora

- Basics of AccountingDocumento15 pagineBasics of Accountingvju chauhanNessuna valutazione finora

- BAANDocumento33 pagineBAANLavanya LakhwaniNessuna valutazione finora

- Lesson 1 Introduction To AccountingDocumento13 pagineLesson 1 Introduction To AccountingKelvin Jay Sebastian SaplaNessuna valutazione finora

- Lesson 1 & 2 Introduction To AccountingDocumento13 pagineLesson 1 & 2 Introduction To AccountingKelvin Jay Sebastian SaplaNessuna valutazione finora

- AccountingManagers 03Documento18 pagineAccountingManagers 03Alenne FelizardoNessuna valutazione finora

- Fundamentals of Accounting & Basic PrinciplesDocumento24 pagineFundamentals of Accounting & Basic PrinciplesRyan MartinezNessuna valutazione finora

- Financial Reporting and Analysis: Inam-Ul-HaqueDocumento36 pagineFinancial Reporting and Analysis: Inam-Ul-HaqueinamNessuna valutazione finora

- Acc CHP 1 11Documento5 pagineAcc CHP 1 11Pranith NarayananNessuna valutazione finora

- Accounting Is The - Of: - , - and - EconomicDocumento48 pagineAccounting Is The - Of: - , - and - EconomicKristia AnagapNessuna valutazione finora

- ACCT 101 Module 1 - The World of AccountingDocumento53 pagineACCT 101 Module 1 - The World of AccountingApril Naida100% (1)

- Introduction To AccountingDocumento51 pagineIntroduction To Accountingmonkey bean100% (1)

- ABM1 Branches AccountingDocumento17 pagineABM1 Branches AccountingKassandra KayNessuna valutazione finora

- Module 1Documento33 pagineModule 1Lavanya LakhwaniNessuna valutazione finora

- Management Accounting IntroductionDocumento18 pagineManagement Accounting IntroductionSAMEERNessuna valutazione finora

- Chapter 2 Accounting Concepts - ConventionsDocumento32 pagineChapter 2 Accounting Concepts - ConventionsfaaNessuna valutazione finora

- Introduction To Acc MKTDocumento14 pagineIntroduction To Acc MKTAbdallah SadikiNessuna valutazione finora

- Financial Accounting & AnalysisDocumento146 pagineFinancial Accounting & AnalysisGagan ChoudharyNessuna valutazione finora

- Revised Accounting For LawyersDocumento67 pagineRevised Accounting For Lawyersvinay rakshithNessuna valutazione finora

- Dr. Uma .G MeskkpucollegeDocumento43 pagineDr. Uma .G MeskkpucollegeLithal ANessuna valutazione finora

- An Introduction To AccountingDocumento13 pagineAn Introduction To AccountingSaid AoughaneNessuna valutazione finora

- Topic 1 Intermediate AccountingDocumento48 pagineTopic 1 Intermediate AccountingFoni NancyNessuna valutazione finora

- Unit 1Documento296 pagineUnit 1Raunak MaheshwariNessuna valutazione finora

- Financial AccDocumento392 pagineFinancial Accpratishtha shrivastavaNessuna valutazione finora

- American College of Technology Department of Business Studies Mba ProgramDocumento37 pagineAmerican College of Technology Department of Business Studies Mba ProgramTeke TarekegnNessuna valutazione finora

- CU DR Balwinder Singh 03112022 PDFDocumento64 pagineCU DR Balwinder Singh 03112022 PDFAkshat Sharma Roll no 21Nessuna valutazione finora

- Branches of AccountingDocumento54 pagineBranches of AccountingAbby Rosales - Perez100% (1)

- Management AccountingDocumento14 pagineManagement AccountingRohit RajNessuna valutazione finora

- Chapter 2 - Accounting As The Language of BusinessDocumento41 pagineChapter 2 - Accounting As The Language of BusinessMariel Aquillo CezarNessuna valutazione finora

- 303chapter 1. Foundation of AccountingDocumento43 pagine303chapter 1. Foundation of AccountingCherry ManandharNessuna valutazione finora

- Taanish1890 Xi Acc ProjectDocumento22 pagineTaanish1890 Xi Acc ProjectKanta abaowlNessuna valutazione finora

- Management Accounting: S.K. Gupta Guest LecturerDocumento37 pagineManagement Accounting: S.K. Gupta Guest LecturersantNessuna valutazione finora

- Finance and Accounting Siva-1Documento7 pagineFinance and Accounting Siva-1madinanysambaevaNessuna valutazione finora

- Fundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerDocumento64 pagineFundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerAliya SaeedNessuna valutazione finora

- Accounting Terminology 1Documento18 pagineAccounting Terminology 1Reetika VaidNessuna valutazione finora

- Accouting CycleDocumento17 pagineAccouting CycleMohammed YassinNessuna valutazione finora

- Accounting Unit 1Documento134 pagineAccounting Unit 1SUMIT100% (1)

- Lesson 1Documento9 pagineLesson 1Bervette HansNessuna valutazione finora

- Financial Reporting SystemDocumento78 pagineFinancial Reporting SystemSayedzahir SadatNessuna valutazione finora

- Welcome To The Journey of "Accounting For Managers" Thru' Mutual Interaction. - Prof. Puja KhannaDocumento11 pagineWelcome To The Journey of "Accounting For Managers" Thru' Mutual Interaction. - Prof. Puja KhannaKopal ChoubeyNessuna valutazione finora

- 1 Introduction To Corporate AccountingDocumento16 pagine1 Introduction To Corporate AccountingShahzad C7Nessuna valutazione finora

- Topic 1: Introduction To AccountingDocumento33 pagineTopic 1: Introduction To Accountingchittran313Nessuna valutazione finora

- Overview To Cost and Management AccountingDocumento22 pagineOverview To Cost and Management AccountingShubham agarwalNessuna valutazione finora

- UNIT II Branches of AccountingDocumento40 pagineUNIT II Branches of AccountingJOHN ,MARK LIGPUSANNessuna valutazione finora

- Management Accounting Chapter 1Documento30 pagineManagement Accounting Chapter 1dawsonNessuna valutazione finora

- Layout Plant PDFDocumento1 paginaLayout Plant PDFswarupNessuna valutazione finora

- 12 Macro Economics Key Notes CH 03 Money and BankingDocumento5 pagine12 Macro Economics Key Notes CH 03 Money and BankingKarsin ManochaNessuna valutazione finora

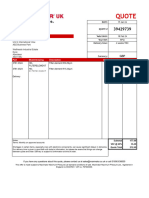

- Maximator Quote No 39429739Documento1 paginaMaximator Quote No 39429739William EvansNessuna valutazione finora

- Fedex Supply Chain Global SuccessDocumento2 pagineFedex Supply Chain Global SuccessEldho RoyNessuna valutazione finora

- FinalpdndDocumento32 pagineFinalpdndPulkit Garg100% (1)

- IBC Chap 2Documento28 pagineIBC Chap 2Chilapalli SaikiranNessuna valutazione finora

- BfinDocumento3 pagineBfinjonisugandaNessuna valutazione finora

- Software - Test Bank - FinalDocumento42 pagineSoftware - Test Bank - FinalAhmad OsamaNessuna valutazione finora

- Big Data, Digital Demand, and Decision-MakingDocumento24 pagineBig Data, Digital Demand, and Decision-MakingAbdulGhaffarNessuna valutazione finora

- Compensation Management at Tata Consultancy Services LTDDocumento4 pagineCompensation Management at Tata Consultancy Services LTDNishaant S Prasad0% (2)

- Understanding Process Change Management in Electronic Health Record ImplementationsDocumento35 pagineUnderstanding Process Change Management in Electronic Health Record ImplementationsssimukNessuna valutazione finora

- 23Documento2 pagine23Kenny RuizNessuna valutazione finora

- Chapter 12: Big Data, Datawarehouse, and Business Intelligence SystemsDocumento16 pagineChapter 12: Big Data, Datawarehouse, and Business Intelligence SystemsnjndjansdNessuna valutazione finora

- Tata Performance Management System: Presented By: Mahima Suri Aman Sharma Bhanuj SharmaDocumento19 pagineTata Performance Management System: Presented By: Mahima Suri Aman Sharma Bhanuj SharmaAman SharmaNessuna valutazione finora

- Ekonom InggrisDocumento2 pagineEkonom InggrisDewi Ayu SaraswatiNessuna valutazione finora

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Documento64 paginePIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNessuna valutazione finora

- Building The Resilience of Small Coastal BusinessesDocumento60 pagineBuilding The Resilience of Small Coastal BusinessesMona PorterNessuna valutazione finora

- HDFC Mutual Fund: VisionDocumento6 pagineHDFC Mutual Fund: VisionShyam NairNessuna valutazione finora

- A3 Problem-Solving: Title: A3 # Owner: TeamDocumento2 pagineA3 Problem-Solving: Title: A3 # Owner: TeamMayra HernándezNessuna valutazione finora

- Planning and Working Capital ManagementDocumento4 paginePlanning and Working Capital ManagementSheena Mari Uy ElleveraNessuna valutazione finora

- Ar 15Documento324 pagineAr 15ed bookerNessuna valutazione finora

- Tan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Documento2 pagineTan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Barrymore Llegado Antonis IINessuna valutazione finora

- Supply Chain of Automotive Industry V/S Suplly Chain of FMCG IndustryDocumento9 pagineSupply Chain of Automotive Industry V/S Suplly Chain of FMCG IndustryMuhammad Umar KhanNessuna valutazione finora

- BPI Family Savings Bank vs. St. Michael Medical Center, Inc. (DIGEST)Documento3 pagineBPI Family Savings Bank vs. St. Michael Medical Center, Inc. (DIGEST)Ericha Joy GonadanNessuna valutazione finora

- Class 1 Notes 06062022Documento4 pagineClass 1 Notes 06062022Munyangoga BonaventureNessuna valutazione finora

- MLR ResumeDocumento2 pagineMLR Resumeapi-631598645Nessuna valutazione finora

- Cost Volume Profit Analysis Lecture NotesDocumento34 pagineCost Volume Profit Analysis Lecture NotesAra Reyna D. Mamon-DuhaylungsodNessuna valutazione finora

- Course Outline Vendor Selection and Development NewDocumento10 pagineCourse Outline Vendor Selection and Development Newmajid aliNessuna valutazione finora

- Set ADocumento11 pagineSet ALizi100% (1)