Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Inventory Management

Caricato da

somarritadCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Inventory Management

Caricato da

somarritadCopyright:

Formati disponibili

INVENTORY MANAGEMENT

Prof. S. K. GARG

Why Keep Inventory

Transaction Motive: Ensure synchronization in

inflow and outflow (decouple them)

Precautionary Motives: A cushion against

uncertainty

Speculative Motive: Store in anticipation of

future price rise

Economic Motive: Take advantage of

economic lot size

Purpose of Keeping Inventory

Reduce purchasing efforts and cost

Meet unexpected demand

Smooth seasonal or cyclical demand

Meet variations in customer demand

Meet uncertainty in Supply

Take advantage of price discounts

Hedge against price increases

Objectives of Inventory Management

To Decide:

When to order?

How much to order?

By considering:

Carrying/ Holding Cost

Ordering Cost/ Changeover Cost

Shortage Cost

To Provide the Desired Customer

Service

Types of Inventory

Raw Material Inventory

Purchased parts and supplies

In-process (partially completed) products

Finished Products

Lubricants, Spares and Consumables

Tools, machinery, and equipment

Working capital

Labour

6

Inventory Carrying Cost

Cost of capital

Cost of storage space

Depreciation and Deterioration cost

Pilferage cost

Handling cost

Record keeping and administration cost

Taxes and insurance

Shortage Cost

Loss of production

Loss of sales

Expediting and follow up

Loss of goodwill

Ordering Cost

Administrative cost of tendering etc

Follow up

Transport cost

Receiving, inspection cost

Administrative cost of releasing payment

9

Inventory Order Cycle Q System

Demand

rate

Time

I

n

v

e

n

t

o

r

y

L

e

v

e

l

Order quantity, Q

0

10

Inventory Order Cycle Q System

Demand

rate

Time

Lead

time

Lead

time

Order

placed

Order

placed

Order

receipt

Order

receipt

I

n

v

e

n

t

o

r

y

L

e

v

e

l

Reorder point, R

Order quantity, Q

0

11

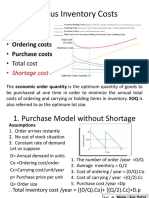

Economic Order Quantity (EOQ)

Slope = 0

Total Cost

Order Quantity, Q

A

n

n

u

a

l

c

o

s

t

Minimum

total cost

Optimal order Q

opt

Carrying Cost = C

1

Q/2

Ordering Cost = C

3

R/Q

Total inventory cost = Ordering cost + Carrying cost

Q = order size (units)

D = annual demand (units/year)

C

o

= Ordering cost (Rs/order)

C

h

= Carrying cost (Rs/unit/year)

h

o

opt

C

DC

Q

2

=

o h opt

C DC TotalCost 2 =

h o

C

Q

C

Q

D

TC

2

+ =

Assumptions

Demand is Uniform and Certain

Shortages not permitted/ Shortage Cost is

very high

Replenishment is instantaneous

Lead time is constant and certain (Receive

order quantity all at once)

No price/ quantity discount

The annual demand of an item is 2000 units.

The cost of placing an order is Rs 400 and the

cost of carrying inventory is Rs 16 per unit per

year . Calculate Economic Order Quantity,

Average Inventory, No. of Order per Year and

Total Cost.

DATA

D = 2000 units (Annual demand)

C

o

= Rs 400 per order (Order cost)

C

h

= Rs 16 per unit per year (Inventory Holding Cost)

RESULTS

EOQ= 1000 Units

Average Inventory = 500 Units

Total Cost = Rs 16,000 per annum

Number of orders per year = 16

h

o

opt

C

DC

Q

2

=

o h opt

C DC TotalCost 2 =

Illustrative Example

The annual demand of an item is 2000 units. The cost of placing an order is Rs 400

and the cost of carrying inventory is Rs 16 per unit per year . Calculate Economic

Order Quantity, Average Inventory, No. of Order per Year and Total Cost.

DATA

D = 2000 units (Annual demand)

C

o

= Rs 400 per order (Order cost)

C

h

= Rs 16 per unit per year (Inventory Holding Cost)

RESULTS

EOQ= 1000 Units

Average Inventory = 500 Units

Total Cost = Rs 16,000 per annum

Number of orders per year = 16

Illustrative Example

The annual demand of an item is 5000 units. The

cost of placing an order is Rs 1000 and the cost of

carrying inventory is Rs 40 per unit per year .

Calculate Economic Order Quantity, Average

Inventory, No. of Order per Year and Total Cost.

DATA FORMULAS

D = units (annual demand)

C

o

= (Ordering cost)

C

h

= (Inventory Holding Cost)

RESULTS

EOQ=

Average Inventory =

Total Cost =

Number of orders per year =

h

o

opt

C

DC

Q

2

=

o h opt

C DC TotalCost 2 =

Illustrative Example

The annual demand of an item is 5000 units. The cost of placing an order is Rs

1000 and the cost of carrying inventory is Rs 40 per unit per year . Calculate

Economic Order Quantity, Average Inventory, No. of Order per Year and Total

Cost.

DATA

D = 5,000 units (annual demand)

C

o

= Rs 1,000 (Ordering cost)

C

h

= Rs 40 (Inventory Holding Cost)

RESULTS

EOQ= 500 Units

Average Inventory = 250 Units

Total Cost = Rs 20,000 per annum

Number of orders per year = 10

18

400 units:

TC = (40)(400/2) + 1,000(5,000/400)

= 8,000 + 12,500 = Rs 20,500.

Added cost = Rs20,500 Rs 20,000

= Rs 500.

What is the added cost if the firm orders

400 units or 600 units at a time

rather than the EOQ?

600 units:

TIC = (40)(600/2) + 1,000(5,000/600)

= 12,000 +8,333 = Rs 20,333.

Added cost = Rs 20,333 Rs 20,000

= Rs 333.

2

h o

QC

Q

DC

TC + =

19

Weekly usage rate = 5,000/52

= 96 units.

If order lead time = 2 weeks, firm must

reorder when:

Inventory level = 2(96) = 192 units.

Suppose delivery takes 2 weeks.

Assuming certainty in delivery and

usage, at what inventory level should

the firm reorder?

20

Weekly usage rate = 5,000/52

= 96 units.

If order lead time = 2 weeks, firm must

reorder when:

Inventory level = 2(96) = 192 units.

Suppose delivery takes 2 weeks.

Assuming certainty in delivery and

usage, at what inventory level should

the firm reorder?

21

Without safety stocks, the firms total inventory

costs = Rs 20,000.

Cost of carrying additional 200 units

= C

h

(Safety stock)

= (Rs 40)(200) = Rs 8,000.

Total inventory costs = 20,000 + 8,000

= Rs 28,000.

Assume a 200-unit safety stock is

carried. What effect would this have

on total inventory costs?

22

Discount affects operating inventory only.

Discount price = Rs 200(0.99) = Rs 198.

TC = CP(Q/2) + A(D/Q)

= 0.2(198)(1,000/2) + 1,000(5,000/1,000)

= 19,800 + 5,000 = Rs 24,800.

Suppose the firm could receive a

discount of 1% on orders of 1,000

or more. Should the firm take the

discount?

(More...)

23

Savings (discount) = 0.01(200)(5,000) = Rs 10,000

Added costs = Rs 24,800 Rs 20,000 = Rs 4,800

Net savings = Rs 10,000 Rs 4,800 = Rs 5,200

Firm should take the discount.

Price-Break Another Example

A company has a chance to reduce their inventory ordering

costs by placing larger quantity orders using the price-break

order quantity schedule below. What should their optimal

order quantity be if this company purchases this single

inventory item with an e-mail ordering cost of Rs 40, a

carrying cost rate of 20% of the inventory cost of the item,

and an annual demand of 10,000 units?

Order Quantity(units) Price/unit(Rs)

0 to 2,499 Rs1.20

2,500 to 3,999 1.00

4,000 or more .98

Price-Break Example Solution

units 1,826 =

0.2(1.20)

40) 2(10,000)(

=

iC

2DCo

= Q

OPT

Annual Demand (D)= 10,000 units

Cost to place an order (S)= Rs 40

First, plug data into formula for each price-break value of C

units 2,000 =

0.2(1.00)

40) 2(10,000)(

=

iC

2DCo

= Q

OPT

units 2,020 =

0.2(0.98)

40) 2(10,000)(

=

iC

2DCo

= Q

OPT

Carrying cost % of total cost (i)= 20%

Cost per unit (C) = Rs1.20, Rs1.00, Rs0.98

Interval from 0 to 2499, the

Q

opt

value is feasible

Interval from 2500-3999, the

Q

opt

value is not feasible

Interval from 4000 & more,

the Q

opt

value is not feasible

Next, determine if the computed Q

opt

values are feasible or not

Price-Break Example Solution (Part 3)

Since the feasible solution occurred in the first price-

break, it means that all the other true Q

opt

values occur

at the beginnings of each price-break interval. Why?

0 1826 2500 4000 Order Quantity

Total

annual

costs

So the candidates

for the price-

breaks are 1826,

2500, and 4000

units

Because the total annual cost function is

a u shaped function

Price-Break Example Solution (Part 4)

iC

2

Q

+ S

Q

D

+ DC = TC

Next, we plug the true Q

opt

values into the total cost annual cost

function to determine the total cost under each price-break

TC(0-2499)=(10000*1.20)+(10000/1826)*40+(1826/2)(0.2*1.20)

= Rs12,438.18

TC(2500-3999) = Rs10,410.00

TC(4000&more) = Rs 10292.00

Finally, we select the least costly Q

opt

, which is this problem occurs

in the 4000 & more interval. In summary, our optimal order quantity

is 4000 units

28

I

n

v

e

n

t

o

r

y

t

p

t

Time

PRODUCTION MODEL

29

D=5,000 P=25,000 C

h

= Rs 40 C

o

= 1000

|

.

|

\

|

= =

|

.

|

\

|

=

|

.

|

\

|

=

P

D

C DC C C Dk TC

P

D

C

DC

q

P

D

k

h o o h opt

h

o

opt

1 2 2

1

2

1

1

1

K

1

= 1-5000/25000 = 0.8

2(5,000)(1000)

0.8(40)

\

30

I

n

v

e

n

t

o

r

y

Time

t

t1

t2

R

q

I

S

MODEL WITH SHORTAGE PERMITTED

31

opt

s h

s

opt

q

C C

C

I

(

+

=

2

2

k C

DC

q

h

o

opt

=

s h opt

C C Dk TC

2

2 =

(

+

=

s h

s

C C

C

K

2

Formulas for Inventory Model Under Shortages

32

opt

s h

s

opt

q

C C

C

I

(

+

=

2

2

k C

DC

q

h

o

opt

=

s h opt

C C Dk TC

2

2 =

(

+

=

s h

s

C C

C

K

2

Illustration for Inventory Model Under Shortages

D=5,000

C

h

= Rs 40

C

s

= Rs 200

C

o

= 1000

K

2

= 200/ (40+200)

=5/6

Q

opt

=

I

opt

=

TC

opt

=

33

O

A

B

C

D

F

q

S

P - R

R

t1 t2

t3 t4

I

n

v

e

n

t

o

r

y

Time

General Case Production and Shortages

34

2 1

*

2

k k C

DC

q

h

o

=

o h

C C k Dk TC

2 1

*

2 =

Formulas for Production Model Under Shortages

35

Holding Cost =

( )

1

2 1

2

C

t

t t S +

Where t=(t

1

+t

2

+t

3

+t

4

)

Shortage Cost =

( )

2

4 3

2

1

C

t

t t

h

+

Set-up Cost =

3

C

q

R

Derivation

36

Total Cost =

( )

+

+

1

2 1

2

C

t

t t S ( )

+

+

2

4 3

2

1

C

t

t t

h

3

C

q

R

1 2 1

3 2

*

) (

) ( 2

C C C

C C

P

R P R

S

+

=

2 2 1

3 1

*

) (

) ( 2

C C C P

C C R P R

h

+

=

2 1

2 1 3

) (

) ( 2

*

C C P R

C C RPC

q

+

=

Derivation

37

Selective Inventory Control

Prioritize items on some logical basis

Prioritize managerial efforts

Monitor and control selectively

38

Selective Inventory Control :

Pareto Analysis or ABC analysis

Pareto analysis (sometimes referred to as the

80/20 rule and as ABC analysis) is a method of

classifying items, events, or activities according

to their relative importance (Annual Usage

Value).

It is frequently used in inventory management

where it is used to classify stock items into

groups based on the total annual expenditure or

total stockholding cost of each item. Companies

often concentrate on the high value/important

items.

Procedure of ABC Analysis

List all the items to be kept in Inventory

Determine the Unit Price and annual demand

(Consumption) in previous year.

Calculate Annual Usage Value by multiplying

Annual Demand by Unit Price

Arrange the items in descending order of Annual

Usage value.

Calculate Cumulative Annual Usage Value

Plot the graph between Item number and

cumulative annual usage value

Divide the curve into 3 parts, where there is a

major change in slope

Item No Description Unit Price Annual Demand Annual Usage Value

1 AAA1 4 100 400

2 AAA2 200 25 5000

3 AAA3 1 50 50

4 AAA4 150 10 1500

5 AAA5 300 40 12000

6 AAA6 15 20 300

7 AAA7 100 5 500

8 AAA8 50 40 2000

9 AAA9 20 50 1000

Item No Description Unit Price Annual Demand Annual Usage Value Cumulative

1 AAA5 300 40 12000 12000

2 AAA2 200 25 5000 17000

3 AAA8 50 40 2000 19000

4 AAA4 150 10 1500 20500

5 AAA9 20 50 1000 21500

6 AAA7 100 5 500 22000

7 AAA1 4 100 400 22400

8 AAA6 15 20 300 22700

9 AAA3 1 50 50 22750

0

5000

10000

15000

20000

25000

30000

1 2 3 4 5 6 7 8 9 10

Series1

Series2

43

% of Inventory Items

Classifying Items as ABC

0

20

40

60

80

100

0 50 100

% Annual Rs Usage

A

B

C

Class % Rs Vol % Items

A 80 15

B 15 30

C 5 55

44

Pareto (ABC) Analysis

Vital few/ Trivial many !

10 20 30 40 50 60 70 80 90 100

Percentage of items

P

e

r

c

e

n

t

a

g

e

o

f

d

o

l

l

a

r

v

a

l

u

e

100

90

80

70

60

50

40

30

20

10

0

Class C

Class A

Class B

45

Selective Inventory Control

- ABC (Based on Price and volume of use)

- VED (Vital, Essential, and Desirable)

- FSN (Fast, Slow, and Normal).

- HML (High, Medium, and Low)

- SDE (Scarce, Difficult, and Easy to Obtain)

- GOLF (Government, Ordinary, Local, and

Foreign)

VED Classification

Criteria Criticality of Item

V- Vital

E- Essential

D- Desirable

V E D

A 99 80

B

c 99.9999 99.999

Service Level Requirements for

Different Category of Items

48

Periodic Inventory System

for B and C Class items

S

s

0 1 2 3 4 5

Review Periods

Decision Rule:

If the stock level q at review time is more than small s,

no order is placed.

If the q is less than small s, then order quantity Q = Big S-q

q

q

q

q

49

Inventory System

With Multi Items from a Vendor

EXAMPLE

Item

No.

D H DH

1 350 Rs 7 2450

2 800 4 3200

3 1000 8 8000

TOTAL 13650

Ordering Cost S = Rs 100 per order

50

CASE I - INDEPENDENT EOQ AND TC

H

2DS

= Q

OPT

2DSH = TC

OPT

Item No. Q

OPT

TC

OPT

1 100 700

2 200 800

3 100 2000

TOTAL 3500

51

CASE II - COMBINED DECISION

HD all of Sum

2S

D = Q

OPT

DH) all of 2S(sum = TC

OPT

Item No. Q

OPT

1 42

2 97

3 121

TOTAL COST = 1300

No. of Orders per year = 8.25

52

Multi Item Inventory System under

Budget Constraints

Space Constraint (in Area)

Space Constraint (in No. of units)

53

EXAMPLE

ITEMS 1 2 3

Holding Cost H 20 20 20

Setup Cost S 50 40 60

Cost per unit C 6 7 5

Annual Demand D 10,000 12000 7500

Determine Q

OPT

when total value of average

inventory levels of three items is Rs 1000.

54

CASE I NO BUDGET CONSTRAINTS

Item No. Q

OPT

1 223

2 219

3 212

Average Inventory Value = (62232) + (62232) + (62232)

= Rs 1965.50

Amount required is greater than the budgets of Rs 1000.

55

CASE II UNDER BUDGET CONSTRAINTS

k 2C D H

S 2D

= Q

OPT(i)

(i) (i) (i)

(i) (i)

+

K is Lagrange multiplier

Item No. K=4

K=5

K=4.7

1 121 111 114

2 112 102 105

3 123 113 116

Average Inventory

Cost

1062.50 972.50 999

The most suitable value of k is 4.7 by interpolation

Inventory Models under Uncertainty

Single Period/ Static/ Newspaper Boy Problem

For Spares/ Perishable items/ Items which can

be procured only once

Multi Period/ Dynamic Safety Stock

Uncertainty in Demand

Uncertainty in Lead Time

Both

57

Safety Stocks

Safety stock

buffer added to on

hand inventory

during lead time

Stockout

an inventory

shortage

Service level

probability that the

inventory available

during lead time will

meet demand

Figure 10.5 Variable Demand with Reorder Point

Reorder

point, R

Q

LT

Time

LT

I

n

v

e

n

t

o

r

y

l

e

v

e

l

0

58

Safety Stocks

Prevent stockout under uncertain demand

Reorder

point, R

Q

LT

Time

LT

I

n

v

e

n

t

o

r

y

l

e

v

e

l

0

Safety Stock

59

Reorder Point with Variable Demand

Reorder point with safety stock

Service level = probability of NO stockout

L z L d R

d

o + =

stock safety

y probabilit level service the

to ing correspond deviations standard of number

demand daily of deviation standard

time lead

demand daily average

= o

=

=

=

=

L z

z

L

d

d

d

Reorder Point with Deterministic Demand

and Variable Lead Time

Reorder point with safety stock

Service level = probability of NO stockout

L

zd L d RoP o + =

stock safety

y probabilit level service the

to ing correspond deviations standard of number

time lead of deviation standard

time lead average

demand daily

=

=

=

=

=

L

L

zd

z

L

d

o

Reorder Point with Variable Demand and

Variable Lead Time

Reorder point with safety stock

Service level = probability of NO stockout

2

2

2

L d

d L z L d RoP o o + + =

y probabilit level service the

to ing correspond deviations standard of number

time lead of deviation standard

demand of deviation standard

time lead average

demand daily average

=

=

=

=

=

z

L

d

L

d

ABC VED ANALYSIS

A B C

V 95 99 99.999 %

E 90 95 99

D 50% 90 95

Single-Period Inventory Model

u o

u

C C

C

q) P(d

+

= s

This model states that we should continue to increase the size of

the inventory so long as the probability of selling the last unit

added is equal to or greater than the ratio of: Cu/Co+Cu

Where

Cu is the cost of under stocking

Co is the cost of over stocking

P (d<=q) is the probability that the demand d during season is

less than q.

Single Period Probabilistic Inventory Model

Example1

A newspaper boy buys papers for Re 1.00

each and sells them at Rs. 1.50 each. He

canot return unsold newspapers. Daily

demand has the following distribution:

No of Customers : 225 250 275 300 325 350 370

Probability : 0.05 0.15 0.20 0.30 0.15 0.10 0.05

If each day demand is independent to the

previous days demand, how many papers

should he order each day?

Single Period Probabilistic Inventory Model

Example2

An item sells for Rs 25 per unit and costs Rs.

10. Unsold items can be sold for Rs4 each. It

is assumed that there is no shortage penalty

cost besides the lost revenue. The demand is

known to be any value between 600 and

1000 items. Determine the optimal number of

units of the item to be stocked?

Ans. 886 units

Single Period Probabilistic Inventory Model

Example3

Our college basketball team is playing in a

tournament game this weekend. Based on

our past experience we sell on average 2,400

shirts with a standard deviation of 350. We

make Rs10 on every shirt we sell at the

game, but lose Rs 5 on every shirt not sold.

How many shirts should we make for the

game?

C

u

= Rs10 and C

o

= Rs5; P 10 / (10 + 5) = .667

Z

.667

= .432 (use NORMSDIST(.667) or Appendix E)

therefore we need 2,400 + .432(350) = 2,551 shirts

Vendor Managed Inventory

Supporting/ Proactive Approaches

Standardization

Vendor management

Lead time management

Use of IT

Spoke vs Rim System

JIT

Kanban

Potrebbero piacerti anche

- Various Inventory Costs: - Holding / - Ordering Costs - Purchase Costs - Total CostDocumento28 pagineVarious Inventory Costs: - Holding / - Ordering Costs - Purchase Costs - Total CostAditya Dashputre100% (2)

- Special Inventory MGMT ModelsDocumento42 pagineSpecial Inventory MGMT ModelsPradeep SethiaNessuna valutazione finora

- International Marketing TybmsDocumento4 pagineInternational Marketing Tybmssglory dharmarajNessuna valutazione finora

- Ilide - Info Review Qs PRDocumento93 pagineIlide - Info Review Qs PRMobashir KabirNessuna valutazione finora

- FinancialManagement MB013 QuestionDocumento31 pagineFinancialManagement MB013 QuestionAiDLo50% (2)

- Working Capital ManagementDocumento32 pagineWorking Capital ManagementrutikaNessuna valutazione finora

- CASE STUDY - Titan Industries LTD PDFDocumento2 pagineCASE STUDY - Titan Industries LTD PDFSaurabh SethNessuna valutazione finora

- Practice of Cost Volume Profit Breakeven AnalysisDocumento4 paginePractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- Topic 8 - AS 20Documento10 pagineTopic 8 - AS 20love chawlaNessuna valutazione finora

- Break Even AnalysisDocumento6 pagineBreak Even AnalysisNafi AhmedNessuna valutazione finora

- Cost Ii CH 2Documento23 pagineCost Ii CH 2TESFAY GEBRECHERKOSNessuna valutazione finora

- Inventory control model key elementsDocumento17 pagineInventory control model key elementsAnn Okoth100% (1)

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Documento65 pagineMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNessuna valutazione finora

- CVP AnalysisDocumento11 pagineCVP AnalysisPratiksha GaikwadNessuna valutazione finora

- Pom Question Bank Set 2013Documento40 paginePom Question Bank Set 2013divyanishaNessuna valutazione finora

- Inventory Management (2021)Documento8 pagineInventory Management (2021)JustyNessuna valutazione finora

- Cost Accounting MCQs and ProblemsDocumento5 pagineCost Accounting MCQs and ProblemsEnbathamizhanNessuna valutazione finora

- 1.risk & Uncertainity MCQ'SDocumento12 pagine1.risk & Uncertainity MCQ'SMuhammad Waseem100% (1)

- Study Note 4.2, Page 169-197Documento29 pagineStudy Note 4.2, Page 169-197s4sahith0% (1)

- Joint Products & by Products: Solutions To Assignment ProblemsDocumento5 pagineJoint Products & by Products: Solutions To Assignment ProblemsXNessuna valutazione finora

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 01Documento27 pagineCost & Management Accounting - MGT402 Power Point Slides Lecture 01iris2326Nessuna valutazione finora

- What Are Material Losses in Cost Accounting?Documento10 pagineWhat Are Material Losses in Cost Accounting?Keval HirparaNessuna valutazione finora

- Graphical Method of Solving Linear Programming ProblemDocumento25 pagineGraphical Method of Solving Linear Programming ProblemGuruvayur Maharana67% (3)

- STPD of Jyoti LaboratoryDocumento6 pagineSTPD of Jyoti LaboratoryMonisha BhatiaNessuna valutazione finora

- Nature and Scope of Managerial EconomicsDocumento19 pagineNature and Scope of Managerial EconomicsBedria NariNessuna valutazione finora

- CMA Individual Assignment 1 & 2Documento3 pagineCMA Individual Assignment 1 & 2Abdu YaYa Abesha100% (2)

- Cost Accounting Short QuestionsDocumento5 pagineCost Accounting Short QuestionsMalika HaiderNessuna valutazione finora

- Scope of financial management and its objectivesDocumento4 pagineScope of financial management and its objectivesgosaye desalegnNessuna valutazione finora

- Contract Process ProblemsDocumento24 pagineContract Process ProblemsAakef SiddiquiNessuna valutazione finora

- Machine Hour Rate Ormat of Computation of Machine Hour RateDocumento4 pagineMachine Hour Rate Ormat of Computation of Machine Hour RatekchahalNessuna valutazione finora

- Brkeven Ex2 PDFDocumento1 paginaBrkeven Ex2 PDFSsemakula Frank0% (1)

- ADL 56 Cost & Management Accounting 2V3Documento20 pagineADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Costing System at Plastim CorporationDocumento10 pagineCosting System at Plastim CorporationKumar SunnyNessuna valutazione finora

- Process Costing Breakdown/TITLEDocumento76 pagineProcess Costing Breakdown/TITLEAnas4253Nessuna valutazione finora

- Trips and TrimsDocumento14 pagineTrips and TrimsPraveen Kumar100% (1)

- Financial Management MCQs on Capital Budgeting, Risk AnalysisDocumento17 pagineFinancial Management MCQs on Capital Budgeting, Risk Analysis19101977Nessuna valutazione finora

- Business Income IllustrationsDocumento12 pagineBusiness Income IllustrationsPatricia NjeriNessuna valutazione finora

- Class Discussion Questions For Capital Gains ChapterDocumento3 pagineClass Discussion Questions For Capital Gains ChapterHdkakaksjsbNessuna valutazione finora

- Tme 601Documento14 pagineTme 601dearsaswatNessuna valutazione finora

- Chapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsDocumento54 pagineChapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsViruchika PahujaNessuna valutazione finora

- Accounting MCQSDocumento94 pagineAccounting MCQSYaseenNessuna valutazione finora

- CA Final Costing Guideline Answers May 2015Documento12 pagineCA Final Costing Guideline Answers May 2015jonnajon92-1Nessuna valutazione finora

- Ratio AnalysisDocumento42 pagineRatio AnalysiskanavNessuna valutazione finora

- Cost Volume Profit Analysis (Decision Making) - TaskDocumento9 pagineCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikNessuna valutazione finora

- Marginal Costing Numericals PDFDocumento7 pagineMarginal Costing Numericals PDFSubham PalNessuna valutazione finora

- PDF To DocsDocumento72 paginePDF To Docs777priyankaNessuna valutazione finora

- Ratio Analysis: Profitability RatiosDocumento10 pagineRatio Analysis: Profitability RatiosREHANRAJNessuna valutazione finora

- Ipcc Cost Accounting RTP Nov2011Documento209 pagineIpcc Cost Accounting RTP Nov2011Rakesh VermaNessuna valutazione finora

- Marginal CostingDocumento13 pagineMarginal CostingKUNAL GOSAVINessuna valutazione finora

- Assignment-2 CmaDocumento8 pagineAssignment-2 CmaAYESHA BOITAINessuna valutazione finora

- Target Return PricingDocumento3 pagineTarget Return PricingChayan Ard100% (1)

- Corporate Accounting - IiDocumento26 pagineCorporate Accounting - Iishankar1287Nessuna valutazione finora

- Part A: 1. Differentiate Among Financial Accounting, Cost Accounting & Management AccountingDocumento5 paginePart A: 1. Differentiate Among Financial Accounting, Cost Accounting & Management AccountingSisir AhammedNessuna valutazione finora

- A Numerical Example of Target and Lifecycle CostingDocumento2 pagineA Numerical Example of Target and Lifecycle CostingAtulSinghNessuna valutazione finora

- Statistics Lesson on Constructing Frequency DistributionsDocumento16 pagineStatistics Lesson on Constructing Frequency DistributionsMandeep KaurNessuna valutazione finora

- Gandhian Approach to Rural DevelopmentDocumento4 pagineGandhian Approach to Rural Developmentdipon sakibNessuna valutazione finora

- Sheet 7 PDFDocumento4 pagineSheet 7 PDFIniyan I TNessuna valutazione finora

- InventoryDocumento38 pagineInventoryNamita DeyNessuna valutazione finora

- Procurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Documento7 pagineProcurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Aqba ImtiazNessuna valutazione finora

- SCM310 Chap 14 Fall 2012Documento46 pagineSCM310 Chap 14 Fall 2012CfhunSaatNessuna valutazione finora

- FIT FinalDocumento10 pagineFIT FinalShasank JalanNessuna valutazione finora

- Sapm Final DeckDocumento45 pagineSapm Final DeckShasank JalanNessuna valutazione finora

- CH 1 Intro To LeanDocumento26 pagineCH 1 Intro To LeanIslam FouadNessuna valutazione finora

- SM Project TopicsDocumento1 paginaSM Project TopicsShasank JalanNessuna valutazione finora