Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cost ppt1

Caricato da

Azlan Psp0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

50 visualizzazioni75 pagineaaaa

Titolo originale

cost ppt1

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoaaaa

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

50 visualizzazioni75 pagineCost ppt1

Caricato da

Azlan Pspaaaa

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 75

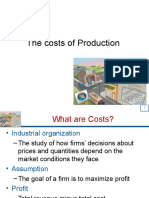

The Analysis of Costs

1. The Economic Role of

Costs

=The (opportunity) cost of

producing the item indicates

the desire of consumers for

other goods.

Economic Role of Costs

=The demand for a product

indicates the intensity of

consumers desires for an

item.

Opportunity costs

The value of the other products that the resources

used in production could have produced at their

next best alternative

Historical costs

The amount the firm actually paid for a particular

input

Explicit and

Implicit Costs

=Costs may be either explicit or

implicit.

EExplicit costs result when a

monetary payment is made.

EImplicit costs involve resources

owned by the firm and dont

involve a monetary payment.

Ee.g.: Time spent by owner running

the firm or the normal rate of return

on the owners financial investment

(opportunity cost of equity capital).

Explicit vs. implicit costs

=Explicit costs include the ordinary items that

an accountant would include as the firms

expenses

=Implicit costs include opportunity costs of

resources owned and used by the firms owner

Total Cost:

Total

Cost

=

explicit costs implicit costs

+

Accounting and

Economic Profit

=Economic profit is total revenues

minus total costs (including all

opportunity costs).

=Economic profit only occurs when the

rate of return is above the normal rate

of return (the opportunity cost of

capital).

EFirms earning zero economic profit are

earning exactly the market (normal)

rate of return.

=Accounting profit is total revenue

minus expenses of firm over a

designated time period.

Accounting and

Economic Profit

EOften excludes implicit costs

such the opportunity cost of

equity capital.

EAccounting profit is generally

greater than economic profit

The Nature of Costs and

Profits

=ACCOUNTING PROFITS: Total Revenue

(TR) - Total Costs (TC)

=ECONOMIC PROFITS: Total Revenue -

(Explicit Costs + Implicit Costs)

=OPPORTUNITY COST OF CAPITAL:

Implicit Return that must be paid to

investors to induce them to supply capital

to the firm

The (Un)Profitable Ethnic

Restaurant

Total Revenue $800,000

- Cost of Goods Sold

Direct Labor $300,000

Direct Materials $200,000

- Explicit Indirect Costs

Administration $ 80,000

Overheads $100,000

Interest/Depreciation $ 40,000

-----------

Accounting Profit $ 80,000

- Implicit Costs

Interest Foregone(10%on$500,000) $ 50,000

Wages Foregone $ 60,000

-----------

Economic Profit(Loss) ($30,000)

1. What are implicit costs? Do implicit costs

contribute to the opportunity cost of production?

Should an implicit cost be counted as cost? Give 3

examples of implicit costs. Why do economists

consider normal returns to capital as a cost?

Questions for Thought:

2. How does economic profit differ from accounting

profit? If a firm is making zero economic profit,

does this indicate that it is about to go out of

business? What does economic profit indicate?

3. What is shirking? If the managers of a firm are

attempting to maximize the profits of the firm, will

they have an incentive to limit shirking? How might

they go about doing so?

3. Short and Long Run

=In the short run, output can

only be altered by changing

the usage of variable

resources such as labor and

raw materials.

Short Run

=The short run is a period of

time so short that the firms

level of plant and heavy

equipment (capital) is fixed.

Long Run

=The long run is a period of

time sufficient for the firm to

alter all factors of production.

=In the long run, firms can

enter and exit the industry.

=The actual short run and long

run differs by industry

2. Output and Costs

In the Short Run

Short run

A period of time so short that the firm cannot alter

the quantity of some of its inputs

=Typically plant and equipment are fixed inputs

in the short run

=Fixed inputs determine the scale of the firms

operation

Three concepts of total

tosts

=Total fixed costs = FC

=Total variable costs = VC

=Total costs = FC + VC

EExamples: insurance premiums,

property taxes, opportunity cost

of fixed assets.

Total Fixed Costs

=Total Fixed Costs (TFC) are costs

that remain unchanged in the short

run when output is altered.

EDecline as output expands.

Average Fixed Costs

=Average Fixed Costs (AFC) are

fixed costs per unit (i.e,

TFC/output).

Variable Costs

=Total Variable Costs (TVC) are the

sum of costs that rise as output

expands.

EExamples: cost of labor and raw

material.

=Average Variable Costs (AVC) are

variable costs per unit (i.e,

TVC/output).

Total Cost

=Total Cost (TC) = Total Fixed

Cost + Total Variable Cost

=Average Total Cost (ATC) =

Average Fixed Cost + Average

Variable Cost

EMC will decline initially, reach a

minimum, and then rise.

Marginal Cost

=Marginal Cost (MC) is the increase

in total cost associated with a one-

unit increase in production.

Q

p

Average Total Costs will be a U-shaped curve

since AFC will be high for small rates of output

and MC will be high as the plants production

capacity ( q ) is approached.

Q

p

Marginal Costs will rise sharply as the plants

production capacity ( q ) is approached.

Q

p Average Fixed Costs will be high for small rates

of output (as they are divided across few units),

but they will always decline as output expands

(as they are divided across more units).

Short-Run Cost Curves

ATC

MC

AFC

q

q

Shape of ATC Curve

=The ATC curve is U-shaped.

EATC is high for an underutilized

plant because AFC is high.

EATC is high for an over-utilized

plant because MC is high.

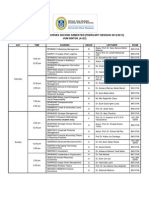

OUTPUT FC VC TC

0 2000 0 2000

1 2000 100 2100

2 2000 180 2180

3 2000 280 2280

4 2000 392 2392

5 2000 510 2510

6 2000 650 2650

7 2000 800 2800

8 2000 960 2960

9 2000 1140 3140

10 2000 1340 3340

11 2000 1560 3560

12 2000 2160 4160

Fixed, variable, and total costs

Media Corp.

Fixed, Variable, and Total Costs --

Media Corp.

0

1000

2000

3000

4000

5000

0 5 10 15

Units of Output

d

o

l

l

a

r

s

FC

VC

TC

Average and marginal costs

Media Corp.

OUTPUT AFC AVC ATC MC

0

1 2000.0 100.0 2100.0 100

2 1000.0 90.0 1090.0 80

3 666.7 93.3 760.0 100

4 500.0 98.0 598.0 112

5 400.0 102.0 502.0 118

6 333.3 108.3 441.7 140

7 285.7 114.3 400.0 150

8 250.0 120.0 370.0 160

9 222.2 126.7 348.9 180

10 200.0 134.0 334.0 200

11 181.8 141.8 323.6 220

12 166.7 180.0 346.7 600

Average and marginal costs

Media Corp.

0

500

1000

1500

2000

0 2 4 6 8 10 12

Units of output

$

$

$

AFC

AVC

ATC

MC

Diminishing Returns

and Cost Curves

=If a firm faces diminishing returns,

MC will rise with additional output.

EAs MC continues to rise, it will

eventually exceed ATC and raise

ATC.

EBefore that point, MC is below

ATC and is bringing down ATC

TFC

TC

TVC

0

Total

Costs

4 2

Here we graph the general shape of the

firms short-run total cost curves.

50

100

150

200

6 8

50

10

TC TVC TFC

Output

per day

1

2

3

4

5

6

7

8

9

10

0

15

25

34

42

52

64

79

98

122

152

Note that total fixed costs are flat and

remain the same for 0 units or 11 units.

Output

Total Costs Curves

=

+

11

202

50

50

50

50

50

50

50

50

50

50

50

50

65

75

84

92

102

114

129

148

172

202

252

12

250

Note that total variable costs increase as

more variable inputs are utilized.

As total costs are the combination of

TVC and TFC, they are everywhere

positive and increase sharply with output

AFC

0

Cost

per unit

4 2

To understand the relationship between

the average and marginal curves, we

calculate each of the average curves

from the total curves and then introduce

the marginal curve.

6 8

50

10

AFC TFC

Output

per day

1

2

3

4

5

6

7

8

9

10

----

$ 50.00

$ 25.00

$ 16.67

$ 12.50

$ 10.00

$ 8.33

$ 6.25

$ 5.56

$ 5.00

Output

=

/

11

$ 4.55

50

50

50

50

50

50

50

50

50

50

50

12

The average fixed cost curve (AFC) is

the total fixed cost (TFC) divided by the

output level. It is high for a few units,

and becomes small as output increases.

20

40

60

80

$ 7.14

Average and

Marginal Cost Curves

AVC

AFC

0

Cost

per unit

4 2 6 8 10

AVC

Output

per day

1

2

3

4

5

6

7

8

9

10

----

$ 15.00

$ 12.50

$ 11.33

$ 10.50

$ 10.40

$ 10.67

$ 12.25

$ 13.56

$ 15.20

=

/

11

$ 18.36

12

The average variable cost curve (AVC)

is the total variable cost (TVC) divided

by the output level. It is higher either

for a few or lot of units and has some

minimal point between the two where,

when graphed later, marginal costs

(MC) will cross it.

20

40

60

80

$ 11.29

TVC

0

15

25

34

42

52

64

79

98

122

152

202

Average and

Marginal Cost Curves

Output

MC

AVC

AFC

Cost

per unit

4 2 6 8 10

MC

Output

1

1

1

1

1

1

1

1

1

1

$ 15.00

$ 10.00

$ 9.00

$ 8.00

$ 10.00

$ 12.00

$ 19.00

$ 24.00

$ 30.00

=

/

1 $ 50.00

12

20

40

60

80

$ 15.00

TC

50

65

75

84

92

102

114

129

148

172

202

252

Note that MC starts low and increases as

output increases. It also crosses AVC at

its minimum point.

TC

10

9

8

10

12

15

50

19

24

30

15

To calculate the marginal costs curve

(MC) we must take the change in the TC

curve ( TC) and divide that by the

change in output ( Output). Our

increments for increasing output here

are to increase by 1 ( 1).

I mportant Note :

MC always crosses AVC

at its minimum point.

Average and

Marginal Cost Curves

Output

MC

AVC

AFC

0

Cost

per unit

4 2 6 8 10

ATC

Output

per day

1

2

3

4

5

6

7

8

9

10

----

$ 65.00

$ 37.50

$ 28.00

$ 23.00

$ 20.40

$ 19.00

$ 18.50

$ 19.11

$ 20.20

=

/

11

$ 22.91

12

Note that when the output is low, ATC is

high because AFC is very high. Also,

ATC is high when output is large as MC

becomes large when output is high.

20

40

60

80

$ 18.43

TC

50

65

75

84

92

102

114

129

148

172

202

252

These two relationships explain why the

ATC curve has its distinct U - shape.

Lastly we graph the average total cost

curve (ATC) as TC divided by the output.

Note: MC crosses ATC at its minimum.

ATC

I mportant Note :

MC always crosses ATC

at its minimum point.

Average and

Marginal Cost Curves

Output

3. Output and Costs

In the Long Run

Long Run ATC

=The long-run ATC shows the

minimum average cost of

producing each output level when

a firm is able to choose plant size.

Cost

per unit

Output Level

LRATC

Planning Curve

The ATC curve for the firm will depend upon the size

of the plant that is operating.

Representative Short-run

Average Cost Curves

If, as here, the cost per unit varies according to the size

of the facility, then a Long Run Average Total Cost

(LRATC) can be mapped out as the surface of all the

minimum points possible at all the possible degrees of scale.

Economies of Scale

=Economies of Scale: Reductions in

per unit costs as output (plant

size) expands can occur for three

reasons.

EMass production

ESpecialization

EImprovements in production as

a result of experience

EBureaucratic inefficiencies may

result as size expands.

Diseconomies of

Scale

=Diseconomies of Scale: increases in

per unit costs as output (plant

size) expands can occur

Constant Returns to

Scale

=Constant Returns to Scale:

Unit costs that are constant as

plant size is changed.

demonstrating

Diseconomies of Scale meaning that a further expansion in plant

size leads to higher levels of cost.

Cost

per unit

Output Level

LRATC

Different Types of LRATC

Often the LRATC will have segments that represent either

Economies of scale, constant returns to scale, or even

diseconomies of scale.

Below, the LRATC represented has a downward sloping segment

demonstrating Economies of Scale for that range of output,

meaning that an further expansion in plant size can reduce

per unit cost up to output level q.

There is also a upward sloping segment,

q

Economies of Scale Diseconomies of Scale

Plant of

Ideal Size

Cost

per unit

Output Level

LRATC

demonstrating Diseconomies of Scale,

Different Types of LRATC

Below, the LRATC represented has a downward sloping segment

demonstrating Economies of Scale for that range of output,

an upward sloping segment,

q

1

Economies

of Scale

Diseconomies

of Scale

q

2

Constant Returns

to Scale

Plant of

Ideal Size

and a flat segment, demonstrating Constant Returns to Scale.

Constant Returns to Scale suggests that the ideal plant size would

be one of any size that delivers between q

1

and q

2

. Increases in

plant size from q

1

to any point below or including q

2

would

result in neither a reduction nor an increase in the per unit costs

of production due to scale.

Cost

per unit

Output

Level

LRATC

Different Types of LRATC

Below, the LRATC represented has a downward sloping segment

demonstrating Economies of Scale for the entire range of output,

which implies that the most efficient size plant available would

be the largest one possible.

q

Economies of Scale

Plant of

Ideal Size

Long-run cost functions

=Often considered to be the firms planning horizon

=Describes alternative scales of operation when all

inputs are variable

Quantity of output

Average

cost

Long-run average cost function

Shows the minimum cost per unit of producing each output

level when any scale of operation is available

Quantity of output

Average

cost

SR average cost

functions

LR average cost

Key steps:

Cost estimation process

Definition of costs

Correction for price level changes

Relating cost to output

Matching time periods

Controlling product, technology, and plant

Length of period and sample size

Minimum efficient scale

The smallest output at which long-run average

cost is a minimum.

Quantity of output

Average

cost

Q

mes

The Survivor Technique

=Classify the firms in an industry by size and

compute the percentage of industry output

coming from each size class at various times

=If the share of one class diminishes over time,

it is assumed to be inefficient

=These firms are then operating below

minimum efficient scale

Economies of Scope

Exist when the cost of producing two (or more)

products jointly is less than the cost of

producing each one alone.

S = C(Q

1

) + C(Q

2

) - C(Q

1

+ Q

2

)

C(Q

1

+ Q

2

)

6. What Factors Cause

the Firms Cost Curves

to Shift?

Cost Curve Shifters

=Prices of resources

=Taxes

=Regulations

=Technology

Cost

per unit

Output Level

Higher Resource Prices and

Cost

If resource prices increase, the cost of production

increases and thus the ATC and the MC move

upward simultaneously.

ATC

1

MC

1

ATC

2

MC

2

5. The Economic Way of

Thinking about Costs

Sunk Costs

=Sunk Costs are historical costs

associated with past decisions that

cant be changed.

ESunk costs may provide

information, but are not

relevant to current choices.

ECurrent choices should be made

on current and future costs and

benefits.

Cost and Supply

=In the short run, when making

supply decisions, the marginal

cost of producing additional

units is the relevant cost

consideration

=In the long run, the average

total cost is vital to the supply

decision

1. If a firm maximizes profit, it must minimize the

cost of producing the profit-maximum output.

Is this statement true or false? Explain your

answer.

Questions for Thought:

2. Draw a U-shaped short-run ATC curve for a firm.

Construct the accompanying MC and AVC curves.

3. Firms that make a profit have increased the

value of the resources they used; their actions

created wealth. In contrast, the actions of firms

that make losses reduce wealth. The discovery

and undertaking of profit-making opportunities

are key ingredients of economic progress.

Evaluate this statement.

Special Topics in Cost:

Breakeven Analysis

=BE Analysis involves the short run and is used

when there are fixed costs that need to be

covered

=BE Analysis reveals the relationship between

profits, variable costs, fixed costs and volume

=It is useful tool for analyzing the financial

characteristics of alternative production systems

Special Topics: BE

Analysis (cont.)

=It focuses on how total costs and profits

vary with volume of output as the firm

operates in a more mechanized or

automated manner and thus substitutes

fixed costs for variable costs

Break-even Analysis

Quantity of output

Dollars

Total Revenue

Total Cost

Loss

Profit

Determining the Break-

even Point

=The BE Point is given by the intersection of the

total cost line with the total revenue line, that is,

where total revenues cover total costs. At BE

pt., TR = TFC + TVC

or PxQ = TFC + AVCxQ

or (P-AVC)Q = TFC

or Qbe = TFC/(P-AVC)

The Break-even Point

(cont.)

=Thus, if P = $50 per unit

and AVC= $25 per unit

and TFC = $100,000

then, Qbe = 100,000/(50-25)

= 4,000 units

=The fixed costs that must be recovered

from the sales dollar after the deduction

of variable costs determines Qbe

Operating Leverage

=Operating Leverage (OL) reflects the

extent to which fixed production facilities,

as opposed to variable factors of

production are used in operations

=The Degree of Operating Leverage (DOL)

at a particular level of output is simply the

percentage change in profits over the

percentage change in output/sales that

produces that change in profits

Operating Leverage (cont.)

=DOL is an elasticity concept, and can be

called the operating leverage elasticity of

profits

= DOL = % Profits/ % Output

= ( Profits/ Q) (Q/Profits)

= [Q(P-AVC)]/[Q(P-AVC)-TFC]

=The further actual output is from Qbe, the

lower is the DOL

Operating Leverage (cont.)

=The greater the ratio of price to variable costs

per unit, the greater the absolute sensitivity of

profits to volume changes and the greater the

degree of operating leverage for all levels of

output

=The firm having the greater total fixed cost will

have the higher DOL

=The DOL can be used as an indicator of risk

Operating Leverage (cont.)

DOL for Two Firms

Firm A Firm B

Price = $10.00 Price = $10.00

AVC= $5.00 AVC= $2.00

TFC= $1,000 TFC= $4,000

-----------------------------------------------------------------------------------------------------------

-----

Rate of Output Profit DOL

Firm A Firm B Firm A Firm B

0 -$1,000 -$4,000 0 0

200 0 -$2,400 Undefined -0.67

500 $1,500 0 1.67 Undefined

1,000 $4,000 $4,000 1.25 2.00

1,500 $6,500 $8,000 1.15 1.50

2,000 $9,000 $12,000 1.11 1.33

Operating Leverage (cont.)

=Characteristics of the example:

EDOLs are 0 are a zero output rate and negative until

a breakeven rate of output is reached

EWhen the firm is incurring losses, DOL is not

meaningful because it suggests that profit falls as

output increases, which is not the case

EWhen profits are earned, a negative DOL is

maeningful

Operating Leverage (cont.)

=Characteristics of the example (cont.)

EA DOL when positive profits are being earned means

that output has increased beyond that rate that

maximizes profit

EDOL is greatest for smaller output rates around Qbe

and declines as output moves away from Qbe

EAt the same rate of output, DOL is always higher for

Firm B than A because of its higher fixed costs vs.

variable costs (risk)

Profit Contribution

Analysis

=The difference between price and average

variable costs (P-AVC) is defined as profit

contribution. At outputs below Qbe, profit

contribution is used to cover fixed costs

and afterwards, it is a direct contributor to

profit

=Profit Contribution Analysis allows a

manager to find the output rate that

covers TFC & earn a required profit

Profit Contribution

Analysis (cont.)

=Thus, the required rate of profit can be

expressed by the equation,

Required Profit = PQ-AVC(Q)-TFC

so that the output necessary is given by

Q = (TFC+Required Profit)/(P-AVC)

=Breakeven Analysis is a specific case of

Profit Contribution Analysis when the

Required Profit is equal to zero

Margin of Profitability

=A third measure of current profitability is a firms

Margin of Profitability (MOP)

=MOP is the ratio of economic profit to total fixed

cost

=It is measured as MOP = (Qa-Qbe)/Qbe

=MOP is a measure of the amount of production

in excess of breakeven and shows the cushion

available to the manager before Qbe is reached

Managerial Uses of BE

Analysis

=It provides management a good deal of

information about the operating and

business risks of the company. Given an

approximate B.E. Point, management can

relate fluctuations in expected future

volume to this point and ascertain the

stability of profits - knowledge that may

be useful to determine the ability of the

firm to service debt

Managerial Uses of BE

Analysis (cont.)

=It is important when the acquisition of

assets is planned. The expected future

trend and stability of volume, together

with the ratio of expected price to

expected AVC, will bear heavily on the

decision to increase fixed costs

=It is useful in pricing decisions since it

tells the effect on profits of changes in

prices and costs

Limitations of BE Analysis

= Assumes constant P and AVC irrespective of volume, when sales volume

may very often influence P and AVC

= Assumes that TFC remains fixed over the entire volume range, when in fact

this range may be limited by the immediate physical capacity of the firm

and TFC may be a step function as volume changes

= It ignores the problem in practice of classifying some costs that are

partially fixed and partially variable, that is, semi-variable costs, e.g. rent,

insurance etc. with discounts

= It is based on one-product analysis and not very suited to multiple-product

analysis where there is a major problem of allocating common costs

= Acoounting information used for BE analysis is based on historical costs

which are not stable over time and which do not reflect the forward-looking

nature of managerial decisions

= It is short-run analysis and not suitable for long-range planning

Potrebbero piacerti anche

- World-Class Universities or World Class Systems - Rankings and Hi PDFDocumento23 pagineWorld-Class Universities or World Class Systems - Rankings and Hi PDFAzlan PspNessuna valutazione finora

- Big Data Capabilities Create Business Value - The Mediating Role of Decision-Making ImpactDocumento11 pagineBig Data Capabilities Create Business Value - The Mediating Role of Decision-Making ImpactAzlan PspNessuna valutazione finora

- Building A Culture of Data Driven Decision Making in HigherDocumento4 pagineBuilding A Culture of Data Driven Decision Making in HigherAzlan PspNessuna valutazione finora

- Attachment 3-BAFE 2018 Brochure V6Documento3 pagineAttachment 3-BAFE 2018 Brochure V6Azlan PspNessuna valutazione finora

- USM Strategic Plan-Poster-v2 PDFDocumento1 paginaUSM Strategic Plan-Poster-v2 PDFAzlan PspNessuna valutazione finora

- USM Strategic Plan-Poster-v2 PDFDocumento1 paginaUSM Strategic Plan-Poster-v2 PDFAzlan PspNessuna valutazione finora

- SETARA '11 Summary Instrument-Conventional PDFDocumento7 pagineSETARA '11 Summary Instrument-Conventional PDFAzlan PspNessuna valutazione finora

- Emcee SpeechDocumento53 pagineEmcee SpeechAzlan PspNessuna valutazione finora

- Worksheet Band2 Y2Documento7 pagineWorksheet Band2 Y2Azlan PspNessuna valutazione finora

- Theme: World of Stories Topic: The TwinsDocumento46 pagineTheme: World of Stories Topic: The TwinsAzlan PspNessuna valutazione finora

- Academic Calendar FIRST SEMESTER 2013/2014 (131) SECOND SEMESTER 2013/2014Documento2 pagineAcademic Calendar FIRST SEMESTER 2013/2014 (131) SECOND SEMESTER 2013/2014Amalina SolahuddinNessuna valutazione finora

- Hrcmo GrantsDocumento3 pagineHrcmo GrantsAzlan PspNessuna valutazione finora

- Setara '11 Advertorial BiDocumento1 paginaSetara '11 Advertorial BiAzlan PspNessuna valutazione finora

- Emcee ScriptDocumento2 pagineEmcee ScriptAzlan PspNessuna valutazione finora

- Master A122Documento3 pagineMaster A122Azlan PspNessuna valutazione finora

- Vocabulary List For PplsDocumento2 pagineVocabulary List For PplsAzlan PspNessuna valutazione finora

- Vocabulary MCQDocumento6 pagineVocabulary MCQPrakash RaoNessuna valutazione finora

- Sample WritingDocumento18 pagineSample WritingAzlan PspNessuna valutazione finora

- Vocabulary MCQDocumento5 pagineVocabulary MCQAzlan PspNessuna valutazione finora

- Vocabulary List For PplsDocumento2 pagineVocabulary List For PplsAzlan PspNessuna valutazione finora

- Proverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindDocumento5 pagineProverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindAzlan PspNessuna valutazione finora

- Proverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindDocumento5 pagineProverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindAzlan PspNessuna valutazione finora

- Worksheet Band1 Y2Documento13 pagineWorksheet Band1 Y2balanNessuna valutazione finora

- Worldwide Paper CompanyDocumento22 pagineWorldwide Paper CompanyAzlan PspNessuna valutazione finora

- OligopolyDocumento3 pagineOligopolyAzlan PspNessuna valutazione finora

- Emcee SpeechDocumento53 pagineEmcee SpeechAzlan PspNessuna valutazione finora

- Welcome Ceremony Emcee ScriptDocumento4 pagineWelcome Ceremony Emcee ScriptKhairur Razi89% (122)

- Emcee ScriptDocumento2 pagineEmcee ScriptAzlan PspNessuna valutazione finora

- All Homework Questions Revised-3Documento30 pagineAll Homework Questions Revised-3Azlan PspNessuna valutazione finora

- Decision MakingDocumento23 pagineDecision MakingAzlan PspNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Final Assignment Course: BUS525 (Managerial Economics)Documento8 pagineFinal Assignment Course: BUS525 (Managerial Economics)MushfiqNessuna valutazione finora

- NTA NET Economics 30 September 2020 Evening Shift Part 1Documento4 pagineNTA NET Economics 30 September 2020 Evening Shift Part 1Ulaganathan SNessuna valutazione finora

- Costs. QuizezDocumento2 pagineCosts. QuizezSanda ZahariaNessuna valutazione finora

- Marginal Costing of Larsen ToubroDocumento31 pagineMarginal Costing of Larsen ToubroShubashPoojariNessuna valutazione finora

- Production Exercise 1Documento8 pagineProduction Exercise 1Nasir Hussain100% (3)

- Intermediate MicroeconomicsDocumento35 pagineIntermediate MicroeconomicsJulia KimberlyNessuna valutazione finora

- Department of Economics: Bharathiar UniversityDocumento44 pagineDepartment of Economics: Bharathiar UniversityPratyusha Khandelwal0% (1)

- Competitive Markets: T T T T Multiple Choice QuestionsDocumento12 pagineCompetitive Markets: T T T T Multiple Choice QuestionsLance TizonNessuna valutazione finora

- 2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulyDocumento67 pagine2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulysiyandankosiyekhayaNessuna valutazione finora

- Answer Key To Problem Set 4Documento11 pagineAnswer Key To Problem Set 4ryohazuki76Nessuna valutazione finora

- The Development of The Firm'S Short Run Cost CurvesDocumento3 pagineThe Development of The Firm'S Short Run Cost CurvesShobi DionelaNessuna valutazione finora

- Certs - Managerial EconomicsDocumento42 pagineCerts - Managerial EconomicsCJ ManaloNessuna valutazione finora

- The Costs of Production: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityDocumento28 pagineThe Costs of Production: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityHabiba AliNessuna valutazione finora

- TJC Paper 2 AnswerDocumento30 pagineTJC Paper 2 AnswerdavidbohNessuna valutazione finora

- Econ Homework #7 ANSWER KEYDocumento2 pagineEcon Homework #7 ANSWER KEYGielarmi Julie RequinaNessuna valutazione finora

- CFA Level 1 Complete Flashcards - Quizlet PDFDocumento211 pagineCFA Level 1 Complete Flashcards - Quizlet PDFBinh100% (1)

- Workbook 1. CompetitionDocumento2 pagineWorkbook 1. CompetitionlenaNessuna valutazione finora

- Business Economics For HoteliersDocumento61 pagineBusiness Economics For HoteliersMaarisha ChhajtaNessuna valutazione finora

- Jamb Economics Past QuestionsDocumento84 pagineJamb Economics Past Questionsumarsabo100% (2)

- Managerial Economics Analysis Problems Cases 8th Edition Truett Test BankDocumento35 pagineManagerial Economics Analysis Problems Cases 8th Edition Truett Test Bankkeelindominicmxzcj100% (28)

- Pbea Unit-IiiDocumento24 paginePbea Unit-IiiYugandhar YugandharNessuna valutazione finora

- Midterm - Basic Micro Economics - Lesson 1Documento11 pagineMidterm - Basic Micro Economics - Lesson 1Nhiel Bryan BersaminaNessuna valutazione finora

- Business Economics Unit-3 - 2126Documento28 pagineBusiness Economics Unit-3 - 2126g tejaNessuna valutazione finora

- 1.5.2 Perfect CompetitionDocumento35 pagine1.5.2 Perfect CompetitionMmonie MotseleNessuna valutazione finora

- Business EconomicsDocumento519 pagineBusiness Economicsadelineo vlog O67% (3)

- AP Microeconomics As Block MidtermDocumento18 pagineAP Microeconomics As Block MidtermKenny Cohen100% (1)

- EC1301 Post Lecture Quiz 5Documento7 pagineEC1301 Post Lecture Quiz 5Liu XinchengNessuna valutazione finora

- Answers Quiz2 2010Documento4 pagineAnswers Quiz2 2010Mohamed Yousif HamadNessuna valutazione finora

- Power System Economics - Unilag Lecture NotesDocumento43 paginePower System Economics - Unilag Lecture Noteseresuyi100% (3)