Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

International Risk

Caricato da

marjannaseri77Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

International Risk

Caricato da

marjannaseri77Copyright:

Formati disponibili

28- 1

Topics Covered

Foreign Exchange Markets Some Basic Exchange Rate Relationships Hedging Currency Risk Purchasing Power and Exchange Rates Exchange Rate Risk and International Investment Decisions Political Risk-Definition, Characteristics, Assessment Techniques, incorporation and ways to mitigate

28- 2

Foreign Exchange Markets

Exchange Rate - Amount of one currency needed to purchase one unit of another. Spot Rate of Exchange - Exchange rate for an immediate transaction. Forward Exchange Rate - Exchange rate for a forward transaction.

28- 3

Foreign Exchange Markets

Forward Premiums and Forward Discounts

Example - The Peso spot price is 10.9892 peso per dollar and the 3 month forward rate is 11.0408 Peso per dollar, what is the premium and discount relationship?

Spot Price T - 1 = Premium or (-Discount ) ForwardPrice 10.9892 4 - 1 = -1.90% 11.0408

28- 4

Foreign Exchange Markets

Forward Premiums and Forward Discounts

Example - The Peso spot price is 10.9892 peso per dollar and the 3 month forward rate is 11.0408 Peso per dollar, what is the premium and discount relationship? Answer - The dollar is selling at a 1.90% premium, relative to the peso. The peso is selling at a 1.90% discount, relative to the dollar.

28- 5

Exchange Rates

Example Swiss franc spot price is SF 1.4457 per $1 Swiss franc 6 mth forward price is SF1.4282 per $1 The franc is selling at a Forward Premium The Dollar is selling at a Forward Discount

This means that the market expects the dollar to get weaker, relative to the franc

Example (premium? discount?) The Japanese Yen spot price is 101.18 per $1 The Japanese 6mt fwd price is 103.52 per $1

28- 6

Exchange Rates

Example What is the franc premium (annualized)?

franc Premium = 2 x ( 1.4457 - 1.4282) = 2.45% 1.4282 Dollar Discount = 2.45%

Example What is the Yen discount (annualized)? Yen Discount = 2 x ( 103.52 - 101.18) = 4.26% 103.52 Dollar Premium = 4.26%

28- 7

Exchange Rate Relationships

Basic Relationships

1 + rforeign 1 + r$

equals equals

1 + i foreign 1 + i$

equals

f foreign / $ S foreign / $

equals

E(sforeign / $) S foreign / $

28- 8

Exchange Rate Relationships

1) Interest Rate Parity Theory

1 + rforeign 1 + r$

f foreign / $ S foreign / $

The ratio between the risk free interest rates in two different countries is equal to the ratio between the forward and spot exchange rates.

28- 9

Exchange Rate Relationships

Example - You have the opportunity to invest $1,000,000 for one year. All other things being equal, you have the opportunity to obtain a 1 year Mexican bond (in peso) @ 7.35 % or a 1 year US bond (in dollars) @ 5.05%. The spot rate is 10.9892 peso:$1 The 1 year forward rate is 11.2274 peso:$1 Which bond will you prefer and why? Ignore transaction costs

Value of US bond = $1,000,000 x 1.0122 = $1,050,500

Value of Mexican bond = $1,000,000 x 10.9892 = 10,989,200 peso exchange 10,989,200 peso x 1.0735 = 11,796,906 peso 11,796,906 peso / 11.2274= $1,050,725 bond pmt exchange

28- 10

Exchange Rate Relationships

2) Expectations Theory of Exchange Rates

f foreign / $ S foreign / $

E(sforeign / $) S foreign / $

Theory that the expected spot exchange rate equals the forward rate.

28- 11

Exchange Rate Relationships

3) Purchasing Power Parity

1 + i foreign 1 + i$

E(sforeign / $) S foreign / $

The expected change in the spot rate equals the expected difference in inflation between the two countries.

28- 12

Exchange Rate Relationships

Example - If inflation in the US is forecasted at 2.5% this year and Mexico is forecasted at 4.5%, what do we know about the expected spot rate? Given a spot rate of 10.9892 peso:$1

1 + i foreign 1 + i$

E(sforeign/$) Sforeign/$

1 .045 E(sforeign/$) = 1 + .025 10.9892

solve for Es Es = 11.204

28- 13

Exchange Rate Relationships

4) International Fisher effect

1 + rforeign 1 + r$

1 + i foreign 1 + i$

The expected difference in inflation rates equals the difference in current interest rates.

Also called common real interest rates

28- 14

Exchange Rate Relationships

Example - The real interest rate in each country is about the same

r (real )

1 + rforeign 1 + i foreign

1.0735 = - 1 = .027 1.045

1 + r$ 1.0505 r (real ) = - 1 = .025 1 + i $ 1.025

28- 15

Exchange Rates

Another Example You are doing a project in Switzerland which has an initial cost of $100,000. All other things being equal, you have the opportunity to obtain a 1 year Swiss loan (in francs) @ 8.0% or a 1 year US loan (in dollars) @ 10%. The spot rate is 1.4457sf:$1 The 1 year forward rate is 1.4194sf:$1 Which loan will you prefer and why? Ignore transaction costs

Cost of US loan = $100,000 x 1.10 = $110,000

Cost of Swiss Loan = $100,000 x 1.4457 = 144,570 sf

exchange

144,570 sf x 1.08 = 156,135 sf

156,135 sf / 1.4194 = $110,000

loan pmt

exchange

If the two loans created a different result, arbitrage exists!

28- 16

Exchange Rates

Swiss Example Given a spot rate of sf:$ Given a 1yr fwd rate of 1.4457:$1 1.4194:$1

If inflation in the US is forecasted at 4.5% this year, what do we know about the forecasted inflation rate in Switzerland?

E (Sf/$) = E ( 1 + if ) Sf/$ E ( 1 + i$ )

1.4194 = E( 1 + i) 1.4457 1 + .045

solve for i i = .026 or 2.6%

28- 17

Exchange Rates

Swiss Example In the previous examples, show the equilibrium of interest rates and inflation rates 1 + rf = 1.08 = .9818 1 + r$ 1.10 E ( 1 + if ) = 1.026 = .9818 E ( 1 + i$ ) 1.045

28- 18

International Prices

The Big Mac Index The price of a Big Mac in different countries (Feb 1, 2007)

Country Canada China Denmark Euro area Japan Mexico

Local Price Converted to U.S. Dollars 3.08 1.41 4.84 3.82 2.31 2.66

Country Philippines Russia South Africa Switzerland United Kingdom United States

Local Price Converted to U.S. Dollars 1.74 1.85 2.14 5.05 3.9 3.22

28- 19

Exchange Rate Risk

Example - Honda builds a new car in Japan for a cost + profit of 1,715,000 yen. At an exchange rate of 120.700Y:$1 the car sells for $14,209 in Indianapolis. If the dollar rises in value, against the yen, to an exchange rate of 134Y:$1, what will be the price of the car?

1,715,000 = $12,799 134

Conversely, if the yen is trading at a forward discount, Japan will experience a decrease in purchasing power.

28- 20

Exchange Rate Risk

Example - Harley Davidson builds a motorcycle for a cost plus profit of $12,000. At an exchange rate of 120.700Y:$1, the motorcycle sells for 1,448,400 yen in Japan. If the dollar rises in value and the exchange rate is 134Y:$1, what will the motorcycle cost in Japan?

$12,000 x 134 = 1,608,000 yen

28- 21

Exchange Rate Risk

Currency Risk can be reduced by using various financial instruments Currency forward contracts, futures contracts, and even options on these contracts are available to control the risk How to use these instruments?

28- 22

Capital Budgeting

Techniques 1) Exchange to $ and analyze 2) Discount using foreign cash flows and interest rates, then exchange to $. 3) Choose a currency standard ($) and hedge all non dollar CF.

28- 23

Example

Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 400 2 450 3 510 4 575 5 650

Q: What are the 1, 2, 3, 4, 5 year forward rates? A: E (Sf/$) = E ( 1 + if )t solve for E(S)

Sf/$

E(S) 2.02

E ( 1 + i$ )t

2.04 2.06 2.08 2.10

28- 24

Example

Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 400 2 450 3 510 4 575 5 650

Q: Convert the CF to $ using the forward rates. 1 2 3 4 5

CFg

400

450

2.04 221

510

2.06 248

575

2.08 276

650

2.10 310

E(S) 2.02 CF$ 198

28- 25

Example

Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 400 2 450 3 510 4 575 5 650

What is the PV of the project in dollars at a risk premium of 7.4%?

$ discount rate = 1.08 x 1.074 = 1.16

PV = $794,000

28- 26

Example

Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 400 2 450 3 510 4 575 5 650

What is the PV of the project in guilders at a risk premium of 7.4%? Convert to dollars. $ discount rate = 1.09 x 1.074 = 1.171 PV = 1,588,000 guilders exchanged at 2.0:$1 = $794,000

28- 27

Exchange Rate Issues

Does change in exchange rates (up or down) have any advantages and disadvantages? How to manage Exchange Rate Risk? What determines Exchange Rates? Why is US$ the world currency despite the odds faced by US in terms of slowing economy, large amount of debts, trade deficits.? Can the Chinese currency replace the US$? As the world-currency?

28- 28

Political Risks

Political Risk Characteristics Attitude of consumers in the host country - a tendency of residents to purchase only locally produced goods. Actions of the host government - A host government might impose pollution control standards and additional corporate taxes, as well as withholding taxes and fund transfer restrictions. Blockage of fund transfers - A host government may block fund transfers, which could force subsidiaries to undertake projects that are not optimal (just to make use of the funds). Currency inconvertibility - Some governments do not allow the home currency to be exchanged into other currencies

28- 29

Political Risks

War Conflicts with neighboring countries or internal turmoil can affect the safety of employees hired by an MNCs subsidiary or by salespeople who attempt to establish export markets for the MNC Inefficient bureaucracy - Bureaucracy can delay an MNCs efforts to establish a new subsidiary or expand business in a country. Corruption Corruption can occur at the firm level or with firmgovernment interactions. Transparency International has derived a corruption index for most countries (see www.transparency.org).

28- 30

Political Risks

Macro-assessment of country risk represents an overall risk assessment of a country and considers all variables that affect country risk except those that are firm-specific. Micro-assessment of country risk involves assessment of a country as it relates to the MNCs type of business.

28- 31

Techniques to Assess Political Risk

Checklist approach: ratings assigned to various factors Delphi technique: collection of independent opinions without group discussion Quantitative analysis: use of models such as regression analysis Inspection visits: Meetings with government officials, business executives, and consumers to clarify risk. Combination of techniques: many MNCs have no formal method but use a combination of methods.

28- 32

Political Risk

Political Risk Scores Maximum Score Luxembourg Netherlands Singapore UK Japan Germany United States Italy China Brazil Russia India Indonesia Somalia A 12 11 9 11 9 11 9 11 9 11 9 12 9 9 5 B 12 11 11 9 10 8 8 8 9 7 6 7 4 4 1 C 12 12 12 12 12 12 12 12 12 8 8 9 9 6 3 D 12 12 11 11 10 12 11 11 11 12 11 9 8 8 5 E 12 12 12 12 9 10 10 8 11 11 11 10 9 11 4 F 6 5 5 5 5 4 5 4 3 2 4 2 2 1 1 G 6 6 6 6 6 6 6 5 4 5 6 6 1 1 3 H 6 6 6 5 6 5 5 5 3 5 2 4 4 2 2 I 6 6 6 5 6 5 5 5 3 5 2 4 4 2 2 J 6 5 5 6 4 6 4 5 5 5 3 2 2 2 2 K 6 5 6 2 6 5 5 6 4 1 5 4 6 4 1 L 4 4 4 4 4 4 4 4 3 2 2 1 3 2 0 Total 100 95 91 87 86 86 83 81 78 71 69 68 59 52 27

A = Govt stability B = Socioeonmic conditions C = Investment profile D = Internal conflict E = External conflict F = Corruption

G = Military in politics H = Religious tensions I = Law and order J = Ethnic tensions K = Democratic accountability L = Bureaucracy quality

28- 33

Incorporating Political risks in Project Evaluation Adjustment of the discount rate: lower risk rating implies higher risk and higher discount rate. Adjustment of the estimated cash flows: adjust estimates for the probability that cash flows may not be realized. Assessing Risk of Existing Projects: review country risk periodically after project has been implemented.

28- 34

Ways to mitigate political risks

Strategies to reduce exposure to a host government takeover include: Use a short-term horizon Rely on unique supplies or technology Hire local labor Borrow local funds Purchase insurance Use project finance

28- 35

Case & Readings

Case:

Carrefour S.A. (Refer to pages 537 5 44 of the Book, Case Studies in Finance: Managing for Corporate Value Creation, by Robert F. Bruner, Kenneth M. Eades and Michael J. Schill, 6th Edition, McGraw-Hill International Edition, 2010). Articles: M.D. Levi and P. Sercu, Erroneous and Valid Reasons for Hedging Foreign Exchange Exposure, Journal of Multinational Financial Management 1 (1991), pp: 25-37. A.M. Taylor and M.P. Taylor, The Purchasing Power Parity Debate, Journal of Economic Perspectives 18 (Autumn 2004), pp: 135-158.

Potrebbero piacerti anche

- Finance OverviewDocumento9 pagineFinance OverviewRavi Chaurasia100% (1)

- Book Presentation:: Excess Returns - A Comparative Study of The Methods of The World's Greatest InvestorsDocumento71 pagineBook Presentation:: Excess Returns - A Comparative Study of The Methods of The World's Greatest InvestorsilbunNessuna valutazione finora

- Trading in The Shadow of The Smart Money BookDocumento192 pagineTrading in The Shadow of The Smart Money BookSalvo Nona85% (46)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Islamic BankingDocumento156 pagineIslamic Bankingmarjannaseri77100% (1)

- Practice Questions - International FinanceDocumento18 paginePractice Questions - International Financekyle7377Nessuna valutazione finora

- Theories of Foreign ExchangeDocumento19 pagineTheories of Foreign Exchangerockstarchandresh0% (1)

- Equity AnalysisDocumento90 pagineEquity AnalysisAbhishek SaxenaNessuna valutazione finora

- Foreign Exchange Market InsightsDocumento12 pagineForeign Exchange Market InsightsRuiting Chen100% (1)

- Financial Management by CabreraDocumento8 pagineFinancial Management by Cabrerachahunay0% (1)

- Lecture04 Derivatives StudentDocumento22 pagineLecture04 Derivatives StudentMit DaveNessuna valutazione finora

- Chapter Fourteen Foreign Exchange RiskDocumento14 pagineChapter Fourteen Foreign Exchange Risknmurar01Nessuna valutazione finora

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Da EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Nessuna valutazione finora

- Forex Trading For Beginners The Ultimate Strategies On How To Profit In Trading And Generate Passive IncomeDa EverandForex Trading For Beginners The Ultimate Strategies On How To Profit In Trading And Generate Passive IncomeNessuna valutazione finora

- More Straight Talk on Investing: Lessons for a LifetimeDa EverandMore Straight Talk on Investing: Lessons for a LifetimeNessuna valutazione finora

- Fundamentals of Capital MarketDocumento24 pagineFundamentals of Capital MarketBharat TailorNessuna valutazione finora

- Multinational Financial Management 9th Edition Shapiro Solutions ManualDocumento12 pagineMultinational Financial Management 9th Edition Shapiro Solutions Manualdecardbudgerowhln100% (34)

- Present Value Calculations for Retirement PlanningDocumento38 paginePresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- W.D. Gann - Masterforex-VDocumento2 pagineW.D. Gann - Masterforex-Vanthonycacciola100% (1)

- Inside the Currency Market: Mechanics, Valuation and StrategiesDa EverandInside the Currency Market: Mechanics, Valuation and StrategiesNessuna valutazione finora

- Finance for IT Decision Makers: A practical handbookDa EverandFinance for IT Decision Makers: A practical handbookNessuna valutazione finora

- What's Wrong with Money?: The Biggest Bubble of AllDa EverandWhat's Wrong with Money?: The Biggest Bubble of AllNessuna valutazione finora

- International Finance IF4 - FX MarketsDocumento37 pagineInternational Finance IF4 - FX MarketsMariem StylesNessuna valutazione finora

- International Parity Relationships and Forecasting FX Rates: Chapter FiveDocumento30 pagineInternational Parity Relationships and Forecasting FX Rates: Chapter FiveNamrata PrajapatiNessuna valutazione finora

- Solution HW 1 Econ434Documento3 pagineSolution HW 1 Econ434Noris PašićNessuna valutazione finora

- CHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsDocumento9 pagineCHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsKamran ShafiNessuna valutazione finora

- FRL 433 International Investment and DiversificationDocumento38 pagineFRL 433 International Investment and DiversificationAnantharaman KarthicNessuna valutazione finora

- International Corporate FinanceDocumento8 pagineInternational Corporate FinanceAnirudh DewadaNessuna valutazione finora

- Managing International Risk-Chapter 27-AnswersDocumento4 pagineManaging International Risk-Chapter 27-AnswersOsborn Xing100% (1)

- Problems and Solution 3Documento6 pagineProblems and Solution 3sachinremaNessuna valutazione finora

- Feenstra Intlecon3e SM Ch13econ Ch02macroDocumento6 pagineFeenstra Intlecon3e SM Ch13econ Ch02macroSebastian BrilNessuna valutazione finora

- Ps1 EF4331 - Revised Answer)Documento9 paginePs1 EF4331 - Revised Answer)Jason YP KwokNessuna valutazione finora

- Total Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inDocumento5 pagineTotal Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inFolk BluesNessuna valutazione finora

- PS7 Primera ParteDocumento5 paginePS7 Primera PartethomasNessuna valutazione finora

- Multinational Finance Butler 5th EditionDocumento2 pagineMultinational Finance Butler 5th EditionUnostudent2014Nessuna valutazione finora

- International Business Finance DocumentDocumento40 pagineInternational Business Finance DocumentKelvin ChenNessuna valutazione finora

- HW2 Q 1Documento6 pagineHW2 Q 1Paul NdegNessuna valutazione finora

- Financial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsDocumento15 pagineFinancial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsNg Chunye100% (1)

- Exchange Rates: Antu Panini MurshidDocumento33 pagineExchange Rates: Antu Panini MurshidbornilamazumderNessuna valutazione finora

- International Finance Policy and Practice LevischDocumento7 pagineInternational Finance Policy and Practice LevischvikbitNessuna valutazione finora

- FIN4218 Final 1701QA 2Documento14 pagineFIN4218 Final 1701QA 2Ng ChunyeNessuna valutazione finora

- Exchange Rates & Foreign Markets DocumentDocumento5 pagineExchange Rates & Foreign Markets DocumentclareNessuna valutazione finora

- Exchange Rate Determination and PPP ConceptsDocumento6 pagineExchange Rate Determination and PPP ConceptsHương Lan TrịnhNessuna valutazione finora

- Exchange Rates and Interest RatesDocumento25 pagineExchange Rates and Interest RatesshaziazaibNessuna valutazione finora

- Sample Midterm Exam 1: E E E I IDocumento3 pagineSample Midterm Exam 1: E E E I IRick CortezNessuna valutazione finora

- Topic 3 Solutions: I S E I I SDocumento8 pagineTopic 3 Solutions: I S E I I SNaeemNessuna valutazione finora

- Finance 407: Multinational Financial Management: Topic #6: Purchasing Power ParityDocumento20 pagineFinance 407: Multinational Financial Management: Topic #6: Purchasing Power ParityTram TruongNessuna valutazione finora

- HW2 Assignment - CH 4,5 - FIN465 Fall 2015Documento3 pagineHW2 Assignment - CH 4,5 - FIN465 Fall 2015Le Quang AnhNessuna valutazione finora

- Multinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFDocumento33 pagineMultinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFheadmostzooenule.s8hta6100% (7)

- HW2 QDocumento6 pagineHW2 Qtranthithanhhuong25110211Nessuna valutazione finora

- 7 Int Parity RelationshipDocumento40 pagine7 Int Parity RelationshipumangNessuna valutazione finora

- Interest Rates and Bond Valuation: DefaultDocumento23 pagineInterest Rates and Bond Valuation: DefaultrytnmmNessuna valutazione finora

- TUTORIAL 6 SOLUTION GUIDE (From Chapter 8) Q4Documento5 pagineTUTORIAL 6 SOLUTION GUIDE (From Chapter 8) Q4hien05Nessuna valutazione finora

- The Forex MarketDocumento22 pagineThe Forex MarketMrMoney ManNessuna valutazione finora

- International Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auDocumento43 pagineInternational Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auKelvin ChenNessuna valutazione finora

- Practice Set and Solutions #3Documento6 paginePractice Set and Solutions #3ashiq amNessuna valutazione finora

- Case Study ch6Documento3 pagineCase Study ch6shouqNessuna valutazione finora

- FOFch 17Documento48 pagineFOFch 17ferahNessuna valutazione finora

- Parity ExcercisesDocumento6 pagineParity ExcercisesJuan Pablo GarciaNessuna valutazione finora

- MF Tutorial 6Documento29 pagineMF Tutorial 6Hueg Hsien0% (1)

- (Macro) Bank Soal Uas - TutorkuDocumento40 pagine(Macro) Bank Soal Uas - TutorkuDella BianchiNessuna valutazione finora

- F9FM-Session17 d08xsxDocumento16 pagineF9FM-Session17 d08xsxErclanNessuna valutazione finora

- International Parity Relationships ExplainedDocumento45 pagineInternational Parity Relationships ExplainedDr RizwanaNessuna valutazione finora

- INTERNATIONAL FINANCE FORUMULASDocumento17 pagineINTERNATIONAL FINANCE FORUMULASMileth Xiomara Ramirez GomezNessuna valutazione finora

- Tutorial 3 AnswersDocumento6 pagineTutorial 3 AnswersisgodNessuna valutazione finora

- FNCE 4047 Exchange Rate Problems and SolutionsDocumento19 pagineFNCE 4047 Exchange Rate Problems and SolutionsDanial TorabianNessuna valutazione finora

- 02 EconomicsDocumento94 pagine02 EconomicsTecwyn LimNessuna valutazione finora

- 2010-11-23 071132 Best 2Documento3 pagine2010-11-23 071132 Best 2antilazNessuna valutazione finora

- Financial Statement Analysis ToolsDocumento33 pagineFinancial Statement Analysis Toolsmarjannaseri77Nessuna valutazione finora

- International RiskDocumento35 pagineInternational Riskmarjannaseri77Nessuna valutazione finora

- How To Issue SecuritiesDocumento27 pagineHow To Issue Securitiesmarjannaseri770% (1)

- WCMDocumento57 pagineWCMmarjannaseri77Nessuna valutazione finora

- Managing International RisksDocumento24 pagineManaging International Risksmarjannaseri77Nessuna valutazione finora

- Efficient MarketDocumento29 pagineEfficient Marketmarjannaseri77Nessuna valutazione finora

- How To Issue SecuritiesDocumento27 pagineHow To Issue Securitiesmarjannaseri770% (1)

- How To Issue SecuritiesDocumento27 pagineHow To Issue Securitiesmarjannaseri770% (1)

- Efficient MarketDocumento24 pagineEfficient Marketmarjannaseri77Nessuna valutazione finora

- Working Capital MangementDocumento38 pagineWorking Capital Mangementmarjannaseri77Nessuna valutazione finora

- Presentation of ResultsDocumento1 paginaPresentation of Resultsmarjannaseri77Nessuna valutazione finora

- Dividend PolicyDocumento33 pagineDividend Policymarjannaseri77Nessuna valutazione finora

- Writing A Research Paper-FarsiDocumento25 pagineWriting A Research Paper-Farsimarjannaseri77Nessuna valutazione finora

- Islamic FinanceDocumento1 paginaIslamic Financemarjannaseri77Nessuna valutazione finora

- Certified Islamic Finance Professional (Cifp) : Wealth Planning and ManagementDocumento3 pagineCertified Islamic Finance Professional (Cifp) : Wealth Planning and Managementmarjannaseri77Nessuna valutazione finora

- Understanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing ModelDocumento141 pagineUnderstanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing Modelrow rowNessuna valutazione finora

- Ar EdfhcfDocumento45 pagineAr EdfhcfPrasen RajNessuna valutazione finora

- Fraser Ch02Documento87 pagineFraser Ch02jvelauthamNessuna valutazione finora

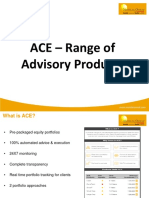

- ACE - Fundtech LargeCap BA-FOTMDocumento16 pagineACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNessuna valutazione finora

- Elements of Financial StatementsDocumento2 pagineElements of Financial StatementsJonathan NavalloNessuna valutazione finora

- Research Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsDocumento11 pagineResearch Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsMehran Arshad100% (1)

- Ifrs Study Material 2021Documento17 pagineIfrs Study Material 2021Sagheer AhmedNessuna valutazione finora

- Pooled Funds 2019 EditionDocumento97 paginePooled Funds 2019 EditionPatrick CuraNessuna valutazione finora

- Venture Capital Handbook Guide to Early FundingDocumento81 pagineVenture Capital Handbook Guide to Early FundingthingsneededforNessuna valutazione finora

- AP Equity 4Documento3 pagineAP Equity 4Mark Michael LegaspiNessuna valutazione finora

- Financial Statements of A CompanyDocumento3 pagineFinancial Statements of A Companytanvi zodapeNessuna valutazione finora

- UFCE - Annex 1 &2Documento8 pagineUFCE - Annex 1 &2Salil NagvekarNessuna valutazione finora

- Chapter 7 Bonds PayableDocumento9 pagineChapter 7 Bonds PayableCarlos arnaldo lavadoNessuna valutazione finora

- FA TableDocumento8 pagineFA TableVy Duong TrieuNessuna valutazione finora

- Stock Market CrashDocumento16 pagineStock Market Crashapi-4616219590% (1)

- SSRN Id1664823Documento37 pagineSSRN Id1664823KaramSoftNessuna valutazione finora

- June 2021Documento21 pagineJune 2021Anjana TimalsinaNessuna valutazione finora

- Calculate Cost of Capital and WACCDocumento4 pagineCalculate Cost of Capital and WACCshazlina_liNessuna valutazione finora

- Chemical Industry AnalysisDocumento4 pagineChemical Industry AnalysisArmyboy 1804Nessuna valutazione finora

- QA-27. Exposure of MNCs To Exchange Rate MovementsDocumento1 paginaQA-27. Exposure of MNCs To Exchange Rate Movementshy_saingheng_7602609Nessuna valutazione finora

- Block ChainDocumento6 pagineBlock ChainRahul NemaNessuna valutazione finora

- PST CL 2015 2023Documento88 paginePST CL 2015 2023Benny MwaloziNessuna valutazione finora

- CFA Level I - Fixed Income: Fundamentals of Credit AnalysisDocumento24 pagineCFA Level I - Fixed Income: Fundamentals of Credit AnalysisAbhishek GuptaNessuna valutazione finora

- 2-5int 2002 Jun QDocumento10 pagine2-5int 2002 Jun Qapi-3728790Nessuna valutazione finora