Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fdi

Caricato da

sarah x100%(3)Il 100% ha trovato utile questo documento (3 voti)

1K visualizzazioni13 paginea class presentation on Foreign direct investment. it includes types of FDI, its merits and demerits and its determinants

Titolo originale

fdi

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoa class presentation on Foreign direct investment. it includes types of FDI, its merits and demerits and its determinants

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

100%(3)Il 100% ha trovato utile questo documento (3 voti)

1K visualizzazioni13 pagineFdi

Caricato da

sarah xa class presentation on Foreign direct investment. it includes types of FDI, its merits and demerits and its determinants

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 13

FDI………………?

Any form of investment that earns

interest in enterprises which function

outside of the domestic territory of

the investor.

FDI REQUIRES…………..

• a business relationship between a parent

company and its foreign subsidiary

• the parent firm needs to have at least

10% of the ordinary shares of its

foreign affiliates.

• investing firm owns voting power in a

business enterprise operating in a

foreign country.

TYPES OF FDI

1.Outward FDI’s :

• backed by the government against

all types of associated risks.

• subject to tax incentives

2. inward FDI’s :

• Influenced by different economic

factors

3. Vertical Foreign Direct Investment :

takes place when a multinational

corporation owns some shares of a foreign

enterprise, which supplies input for it or

uses the output produced by the MNC.

4. Horizontal foreign direct investments :

when a multinational company carries out

a similar business operation in different

nations.

5. Market-seeking FDI’s :

undertaken to strengthen the

existing market structure or explore

the opportunities of new markets

6. Resource-seeking FDI’s

aimed at factors of production

which have more operational

efficiency than those available in the

home country of the investor.

ADVANTAGES

• Foreign direct investment permits the transfer of

technologies.

• It assists in the promotion of the competition

within the local input market of a country.

• The countries that get foreign direct investment

from another country can also develop the human

capital resources by getting their employees to

receive training on the operations of a particular

business.

• Helps in the creation of new jobs in a particular

country

• As a result of receiving foreign direct

investment from other countries, it has

been possible for the recipient countries

to keep their rates of interest at a lower

level.

• Foreign direct investment can help

Indian companies penetrate foreign

markets and increase the exports.

• Increases tax revenues

• Boost manufacturing sector

• FDI encourages the transfer of

management skills, intellectual property,

and technology.

DISADVANTAGES

• Foreign direct investment may entail high

travel and communications expenses.

• There is a chance that a company may

lose out on its ownership to an overseas

company

• Government has less control over the

functioning of the company that is

functioning as the wholly owned subsidiary

of an overseas company.

• They are unreliable

• Foreign-owned projects are capital-

intensive and labor-efficient. They invest in

machinery and intellectual property, not in

wages. Skilled workers get paid well

above the local norm, all others languish.

Determinants of FDI

1. Size and the growth prospects of the

economy of the country

2. The country having a big market

3. The population of a country

4. Percapita income of the country and their

spending habits

5. The status of the human resources in a

country

6. Availability of natural resources

1. Inexpensive labor force

2. Infrastructural factors

3. Economic policies of the country

Potrebbero piacerti anche

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItDa EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNessuna valutazione finora

- Fdi Types and Benefits To The GlobalizationDocumento13 pagineFdi Types and Benefits To The GlobalizationsitsumitNessuna valutazione finora

- Presented ToDocumento38 paginePresented ToAnoop Raj SrivastvaNessuna valutazione finora

- International BusinessDocumento10 pagineInternational BusinessAishuNessuna valutazione finora

- INB 301 - Chapter 8 - Foreign Direct InvestmentDocumento16 pagineINB 301 - Chapter 8 - Foreign Direct InvestmentS.M. YAMINUR RAHMANNessuna valutazione finora

- Chapter IIIDocumento30 pagineChapter IIIAshantiliduNessuna valutazione finora

- International Business: by Charles W.L. HillDocumento16 pagineInternational Business: by Charles W.L. HillNno 367555Nessuna valutazione finora

- Foreign Direct InvestmentsDocumento26 pagineForeign Direct InvestmentsMary Rica DublonNessuna valutazione finora

- RutuDocumento10 pagineRutuNehal_Mehta_9294Nessuna valutazione finora

- Foreign Direct InvestmentDocumento42 pagineForeign Direct InvestmentVenance NDALICHAKONessuna valutazione finora

- Foreign Direct InvestmentDocumento41 pagineForeign Direct Investmentatul kumarNessuna valutazione finora

- Foreign Investment and Its Necessity: Introductory: Saroj K GhimireDocumento28 pagineForeign Investment and Its Necessity: Introductory: Saroj K GhimireChandra Shekhar PantNessuna valutazione finora

- Understanding Foreign Direct Investment (FDIDocumento10 pagineUnderstanding Foreign Direct Investment (FDINikhil KarwaNessuna valutazione finora

- L-17-19 Foreign Direct InvestmentDocumento28 pagineL-17-19 Foreign Direct InvestmentShubham SinghNessuna valutazione finora

- Foreign Investment, FDI, MNCsDocumento16 pagineForeign Investment, FDI, MNCsAkash PatelNessuna valutazione finora

- Final Project On Fdi in IndiaDocumento66 pagineFinal Project On Fdi in Indiasantosh_boyeNessuna valutazione finora

- Foreign Direct InvestmentDocumento22 pagineForeign Direct InvestmentSagacious Bebo100% (1)

- Unit 2 - Foreign Direct Investment To StsDocumento36 pagineUnit 2 - Foreign Direct Investment To StsK59 TRAN THI THU HANessuna valutazione finora

- Project Report On FDI in RetailDocumento52 pagineProject Report On FDI in Retailprasenjitbiswas4515Nessuna valutazione finora

- L6 - Foreign Direct InvestmentDocumento31 pagineL6 - Foreign Direct InvestmentSarnisha Murugeshwaran (Shazzisha)Nessuna valutazione finora

- International Business Assignment: Foreign Direct InvestmentDocumento8 pagineInternational Business Assignment: Foreign Direct InvestmentpandeyjyotiNessuna valutazione finora

- FDI Benefits for Host CountriesDocumento66 pagineFDI Benefits for Host CountriesVaidyanathan RavichandranNessuna valutazione finora

- Unit 2 - Foreign Direct Investment To StsDocumento36 pagineUnit 2 - Foreign Direct Investment To StsĐặng Thu TrangNessuna valutazione finora

- Session 8 FDI: Foreign direct investment: Ý chính cần nắmDocumento58 pagineSession 8 FDI: Foreign direct investment: Ý chính cần nắmHoàng DuyNessuna valutazione finora

- The Effects of TNCS' Activities0Documento38 pagineThe Effects of TNCS' Activities0Yervant BaghdasarianNessuna valutazione finora

- Foreign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial ManagementDocumento54 pagineForeign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial Managementshankar k.c.Nessuna valutazione finora

- Foreign Direct Investment (Fdi)Documento20 pagineForeign Direct Investment (Fdi)rohanNessuna valutazione finora

- FDI Project ReportDocumento31 pagineFDI Project ReportJasmandeep brar100% (1)

- Trend Analysis of FDI in IndiaDocumento66 pagineTrend Analysis of FDI in IndiaRajat Goyal100% (4)

- Foreign Investment in India: Types, Advantages, Disadvantages and Future OutlookDocumento15 pagineForeign Investment in India: Types, Advantages, Disadvantages and Future OutlookVISHAL MEHTANessuna valutazione finora

- International Business 3Documento45 pagineInternational Business 3Ken TuazonNessuna valutazione finora

- Final Project On FDI and FIIDocumento39 pagineFinal Project On FDI and FIIReetika BhatiaNessuna valutazione finora

- Foreign Direct InvestmentDocumento28 pagineForeign Direct InvestmentTariku KolchaNessuna valutazione finora

- Fdi in IndiaDocumento81 pagineFdi in IndiasuryakantshrotriyaNessuna valutazione finora

- Chapter 4 - Foriegn Direct Investment and Balance of PaymentDocumento48 pagineChapter 4 - Foriegn Direct Investment and Balance of PaymentHay JirenyaaNessuna valutazione finora

- Foreign Direct Investment (Fdi)Documento9 pagineForeign Direct Investment (Fdi)Ankur SahaNessuna valutazione finora

- FDI As A Market Entry Strategy 1Documento35 pagineFDI As A Market Entry Strategy 1jordanNessuna valutazione finora

- International Business: Instructor: Carlos González, PHDDocumento17 pagineInternational Business: Instructor: Carlos González, PHDLuz Del Mar P. MartínezNessuna valutazione finora

- 4. Foreign Direct InvestmentDocumento44 pagine4. Foreign Direct InvestmentNguyen Thi Mai AnhNessuna valutazione finora

- Foreign Direct InvestmentDocumento13 pagineForeign Direct InvestmentGaurav GuptaNessuna valutazione finora

- FDI Guide Explains Types, Factors, Advantages & LimitationsDocumento25 pagineFDI Guide Explains Types, Factors, Advantages & LimitationsSantosh Gunwant PandareNessuna valutazione finora

- FDI in India overviewDocumento23 pagineFDI in India overviewMahbubul Islam KoushickNessuna valutazione finora

- Foreign Direct Investment (FDI)Documento12 pagineForeign Direct Investment (FDI)Benjamin K JaravazaNessuna valutazione finora

- International InvestmentDocumento16 pagineInternational Investmentmisty_nairNessuna valutazione finora

- Materi Binal 7 Foreign Direct InvestmentDocumento27 pagineMateri Binal 7 Foreign Direct InvestmentNicholas ZiaNessuna valutazione finora

- Multinational CorporationsDocumento14 pagineMultinational CorporationsteliumarNessuna valutazione finora

- Types of Foreign Direct Investment: An Overview: Outward FDIDocumento7 pagineTypes of Foreign Direct Investment: An Overview: Outward FDIRitu MakkarNessuna valutazione finora

- Fdi and FiiDocumento19 pagineFdi and FiiManju TripathiNessuna valutazione finora

- Introduction Global Environment - Lect1Documento45 pagineIntroduction Global Environment - Lect1Suvodip SenNessuna valutazione finora

- DDDDDocumento13 pagineDDDDmohamed lahianiNessuna valutazione finora

- Be Module 3Documento34 pagineBe Module 3ssjdxqmqtgNessuna valutazione finora

- DR A K UpadhyayDocumento32 pagineDR A K UpadhyayMinhaz Iqbal HazarikaNessuna valutazione finora

- Detailed Study of Foreign Direct Investment: &its Impact On Various Sectors in IndiaDocumento64 pagineDetailed Study of Foreign Direct Investment: &its Impact On Various Sectors in IndiaSravani RajuNessuna valutazione finora

- What Is Foreign Direct Investment (FDI) ?Documento24 pagineWhat Is Foreign Direct Investment (FDI) ?Rashmi Ranjan PanigrahiNessuna valutazione finora

- Study of Fdi in IndiaDocumento37 pagineStudy of Fdi in Indiadeepakgautam_007Nessuna valutazione finora

- FDI Presentation: Benefits, Objectives & Key FeaturesDocumento6 pagineFDI Presentation: Benefits, Objectives & Key Featuresvaibhav dagadeNessuna valutazione finora

- FDI Corporate Strategy Global ExpansionDocumento15 pagineFDI Corporate Strategy Global ExpansionKshitij TandonNessuna valutazione finora

- Bba - 6 International Business EnvironmentDocumento20 pagineBba - 6 International Business EnvironmentMonan sherajiNessuna valutazione finora

- FDI GuideDocumento28 pagineFDI GuideWilsonNessuna valutazione finora

- Advertising Campaign PlanningDocumento20 pagineAdvertising Campaign Planningsarah x78% (9)

- Loan Syndication and Consortium Finance 1Documento11 pagineLoan Syndication and Consortium Finance 1sarah x89% (9)

- Contstant Elasticity IonDocumento11 pagineContstant Elasticity Ionsarah xNessuna valutazione finora

- Company ManagementDocumento28 pagineCompany Managementsarah x100% (3)

- Elasticity of DemandDocumento18 pagineElasticity of Demandsarah x100% (2)

- A.Arado-HRM-Incentive Plans For Fun TravelDocumento2 pagineA.Arado-HRM-Incentive Plans For Fun TravelAustin Tyler EverhardNessuna valutazione finora

- Fake Job Offers-Sample EmailsDocumento16 pagineFake Job Offers-Sample EmailsAlana PetersonNessuna valutazione finora

- SDM 8 & 9Documento25 pagineSDM 8 & 9Shukla JineshNessuna valutazione finora

- Gartner - Reimaginehr-Global-Key-Takeaways-2020Documento24 pagineGartner - Reimaginehr-Global-Key-Takeaways-2020PedroNessuna valutazione finora

- Administrative Executive Job DescriptionDocumento8 pagineAdministrative Executive Job DescriptionadministrativemanageNessuna valutazione finora

- GO - MsNO.196 Dt24-07-2012cps UploadingDocumento4 pagineGO - MsNO.196 Dt24-07-2012cps UploadingNarasimha SastryNessuna valutazione finora

- Reward StrategiesDocumento35 pagineReward Strategiesamruta.salunke4786100% (6)

- W Rit: The Happy Handwriter® Spiral Refined Finger Movements Free Download. ©bunty Mcdougall, Occupational TherapistDocumento4 pagineW Rit: The Happy Handwriter® Spiral Refined Finger Movements Free Download. ©bunty Mcdougall, Occupational Therapistkelia monizNessuna valutazione finora

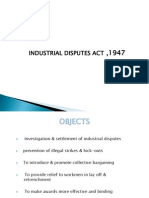

- Industrial Dispute Act 1947Documento32 pagineIndustrial Dispute Act 1947Maithri RameshNessuna valutazione finora

- Labor Law Review Lecture WORDDocumento25 pagineLabor Law Review Lecture WORDAmicus CuriaeNessuna valutazione finora

- Trafford Plc Appeal Vicarious Liability Ex-Employees Injury CaseDocumento2 pagineTrafford Plc Appeal Vicarious Liability Ex-Employees Injury CaseRed HoodNessuna valutazione finora

- Application For HR & Admin DirectorDocumento6 pagineApplication For HR & Admin DirectorNhu Phuong VoNessuna valutazione finora

- Coca Cola (1) FINALDocumento74 pagineCoca Cola (1) FINALAnil Batra100% (1)

- Work Immersion Answer Key TitleDocumento4 pagineWork Immersion Answer Key TitleBright WinNessuna valutazione finora

- 08 Activity 1 8Documento2 pagine08 Activity 1 8Mariz LejerNessuna valutazione finora

- Technostructural Interventions Assess Organizational Structure & TechTITLEHuman Resource Management Interventions Focus on Talent DevelopmentDocumento4 pagineTechnostructural Interventions Assess Organizational Structure & TechTITLEHuman Resource Management Interventions Focus on Talent DevelopmentPriyam BatraNessuna valutazione finora

- Why Your Organization Needs a Knowledge Management StrategyDocumento7 pagineWhy Your Organization Needs a Knowledge Management StrategyKay Rivero100% (1)

- Common HR Error Messages 59f41c201723dd4d02735a0fDocumento10 pagineCommon HR Error Messages 59f41c201723dd4d02735a0fDinkan TalesNessuna valutazione finora

- Money As Debt 2 TranscriptDocumento34 pagineMoney As Debt 2 Transcriptjoedoe1Nessuna valutazione finora

- Biodata OfficersDocumento4 pagineBiodata Officerssrivaghdevi64Nessuna valutazione finora

- When Salaries Are Not SecretDocumento2 pagineWhen Salaries Are Not Secretgollasrinivas100% (1)

- Introduction To MilkfedDocumento30 pagineIntroduction To MilkfedGagan Goel100% (1)

- Manage-Job-Hopping - An Analytical Review-D. PranayaDocumento6 pagineManage-Job-Hopping - An Analytical Review-D. PranayaImpact JournalsNessuna valutazione finora

- (1999) Oshagbemi - Academics and Their Managers A Comparative Study in Job SatisfactionDocumento16 pagine(1999) Oshagbemi - Academics and Their Managers A Comparative Study in Job SatisfactionKodok BodoNessuna valutazione finora

- Bata India's HR Problems: Bata-A Household NameDocumento5 pagineBata India's HR Problems: Bata-A Household NameajayrajvyasNessuna valutazione finora

- Spain Checklist For Tourist VisaDocumento2 pagineSpain Checklist For Tourist VisaNechirvan KoshnowNessuna valutazione finora

- Agra Notes PDFDocumento26 pagineAgra Notes PDFAira AmorosoNessuna valutazione finora

- RA 7277 - Magna Carta for Disabled Persons ActDocumento21 pagineRA 7277 - Magna Carta for Disabled Persons ActOJ CarataoNessuna valutazione finora

- Kenneth E. Hare v. ProPublicaDocumento12 pagineKenneth E. Hare v. ProPublicaKen HareNessuna valutazione finora

- td1 Fill 04 16eDocumento2 paginetd1 Fill 04 16eAlec RichardsonNessuna valutazione finora