Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity Valuation

Caricato da

Shailesh RathodTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity Valuation

Caricato da

Shailesh RathodCopyright:

Formati disponibili

Prepared by

Ken Hartviksen

INTRODUCTION TO

CORPORATE FINANCE

Laurence Booth W. Sean Cleary

Chapter 7 Equity Valuation

CHAPTER 7

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 3

Lecture Agenda

Learning Objectives

Important Terms

The Nature of Equity Securities

Valuation of Equities

Preferred Share Valuation

Dividend Discount Model

Using Multiples to Value Shares

Summary and Conclusions

Concept Review Questions

CHAPTER 7 Equity Valuation 7 - 4

Learning Objectives

Understand the basic characteristics of

equity securities

How these securities are valued

Some of the major factors that affect

stock prices

Understand the sensitivity of the

valuation estimate to the input values

used

How to relate valuation models to

commonly used ratios or multiples

CHAPTER 7 Equity Valuation 7 - 5

Important Chapter Terms

Common share

Constant growth DDM

Dividend discount model

Equity securities

Market value to EBIT ratio

Market value to EBITDA

ratio

Market-to-book ratio

Preferred share

Price-earnings ratio

Price-to-cash-flow ratio

Price-to-sales ratio

Relative valuation

Sustainable growth rate

The Nature of Equities

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 7

Equity Securities

Introduction

Equities represent ownership claims on businesses

Despite having residual claims to earnings after tax

and to assets upon dissolution equities offer the

prospect for participation in the growth and

profitability of the business.

Equity securities can be valued based on

approaches using the present value of expected

future dividend stream.

CHAPTER 7 Equity Valuation 7 - 8

Equity Securities

Nature of these Securities

Equity Securities

Include preferred and common shares

Represent ownership claims on the underlying entity

Usually have no specified maturity date, and since the

underlying entity has a life separate and apart from

its owners, equities are treated as investments with

infinite life

Equities may pay dividends from after-tax earnings at

the discretion of the board of directors

CHAPTER 7 Equity Valuation 7 - 9

Equity Securities

Common Shares

According to the Canada Business Corporations Act (CBCA)

corporations must have at least one share class with the

following rights:

Rights to residual earnings after-tax (after all legal obligations to

other claimants have been satisfied)

Rights to residual assets upon dissolution/liquidation

Exert control over the corporation through voting rights to elect

board of directors, accept financial statements, appoint auditors

and approve major issues such as takeovers and corporate

restructuring.

Equities with the foregoing characteristics are typically called

Common Shares

CHAPTER 7 Equity Valuation 7 - 10

Equity Securities

Preferred Shares

Have some preference over the common share class

Usually have the following characteristics:

A fixed annual dividend (not legally enforceable by shareholders

if not declared)

Have prior claim to dividends and assets upon

dissolution/liquidation over and above the common shares

Non-voting except if dividends are seriously in arrears

No maturity date

Often have a cumulative feature (dividends in arrears must be

paid before common shareholders can receive dividends)

Often called a fixed income investment because the regular

annual dividend is fixed (set) at the time the shares are originally

issued.

Valuation of Equities

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 12

Valuation of Equity Securities

Risk-Premium Approach

Valuation of equities can follow a discounted cash

flow approach

The discount rate used reflects current level of

interest rates (based on the risk-free rate) plus a risk

premium

This relationship is expressed as:

Premium Risk RF+ = k

[ 7-1]

CHAPTER 7 Equity Valuation 7 - 13

Valuation of Equity Securities

Risk-Premium Approach

The risk-free rate is

equal to the real rate of

return plus expected

inflation (Fisher

Equation)

The risk premium is

based on an estimate of

the risk associated with

the security.

Equation 7-1 can be

described graphically as

follows:

Premium Risk RF+ = k [ 7-1]

Risk of Equity

Security M

Required

Return (%)

RF

Risk

Required

return on

Equity

Security (M)

Risk

Premium

Real Return

Expected Inflation Rate

Preferred Share Valuation

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 15

Preferred Share Valuation

Cash Flow Pattern for a Straight Preferred Share

0 1 2 3

D

p

D

p

D

p

D

p

D

p

7-1 FIGURE

Preferred shares can be viewed as perpetuities because of the

nature of the dividend stream they offer.

A perpetuity is an infinite series of equal and periodic cash flows.

CHAPTER 7 Equity Valuation 7 - 16

Preferred Share Valuation

Value of a Perpetuity

P

ps

is the market price (or present value)

D

p

is the annual dividend amount

k

p

is the required rate of return investors demand (or discount rate)

p

p

ps

k

D

P =

[ 7-2]

CHAPTER 7 Equity Valuation 7 - 17

Determine the market price of a $100 par value preferred share

that pays dividend based on a 7 percent dividend rate when

investors require a return of 10 percent on the investment.

What happens to the market price if interest rates rise and

investors now require a 12 percent rate of return on the

investment?

Preferred Share Valuation

Value of a Perpetuity - Example

00 . 70 $

10 . 0

00 . 7 $

10 . 0

100 $ 07 .

= =

= =

p

p

ps

k

D

P

[ 7-2]

33 . 58 $

12 . 0

00 . 7 $

12 . 0

100 $ 07 .

= =

= =

p

p

ps

k

D

P

[ 7-2]

CHAPTER 7 Equity Valuation 7 - 18

What happens to the market price if interest rates fall and

investors now require a 7 percent rate of return on the

investment?

Like bonds, when the required return is equal to the preferred

dividend rate, the preferred will be priced to equal its par value.

Preferred Share Valuation

Value of a Perpetuity Example

00 . 100 $

07 . 0

00 . 7 $

07 . 0

100 $ 07 .

= =

= =

p

p

ps

k

D

P

[ 7-2]

CHAPTER 7 Equity Valuation 7 - 19

The preferred share valuation equation can be modified to solve

for the investors required rate of return.

Remember, for market traded preferred shares, the stock price

will be observable (known) and so too will the annual dividend,

so this type of calculation is very common.

Preferred Share Valuation

Estimating the Required Rate of Return

ps

p

p

P

D

k =

[ 7-3]

CHAPTER 7 Equity Valuation 7 - 20

Assuming the previous 7%, $100 par value preferred share is

currently trading for $57.25, what is the implied market-

demanded required return?

You knew that the share was trading for less than its par value,

so even before trying to solve for the answer, you should have

known that investors were requiring a higher rate of return than

7%.

Preferred Share Valuation

Estimating the Required Rate of Return An Example

% 22 . 12

25 . 57 $

00 . 7 $

25 . 57 $

100 $ 07 .

= =

= =

ps

p

p

P

D

k

[ 7-3]

Valuation of Common Stock

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 22

Common Share Valuation

Discount Models

All discount valuation models estimate the current economic value of

any security as the sum of the discounted (present) value of all

promised future cash flows.

The current value is therefore a function of the timing, magnitude and

riskiness of all future cash flows:

=

+

=

+

+ +

+

+

+

=

n

i

i

i

n

n

k

Flow Cash

k

Flow Cash

k

Flow Cash

k

Flow Cash

V

1

2

2

1

1

0

) 1 (

) 1 (

...

) 1 ( ) 1 (

CHAPTER 7 Equity Valuation 7 - 23

Common Share Valuation

Discount Models

In the case of common stock the cash flows of a going-concern

business are expected to go on in perpetuity (forever).

The purchaser exchanges the price she/he paid for the investment at

time 0 with a possible series of future cash flows.

Risk is factored into the equation through k (investors required return)

=

+

=

+

+ +

+

+

+

=

o

o

o

1

2

2

1

1

0

) 1 (

) 1 (

...

) 1 ( ) 1 (

i

i

i

k

Flow Cash

k

Flow Cash

k

Flow Cash

k

Flow Cash

V

CHAPTER 7 Equity Valuation 7 - 24

Common Share Valuation

Discount Models

The formula can be illustrated graphically as follows:

=

+

=

+

+ +

+

+

+

=

o

o

o

1

2

2

1

1

0

) 1 (

) 1 (

...

) 1 ( ) 1 (

i

i

i

k

Flow Cash

k

Flow Cash

k

Flow Cash

k

Flow Cash

V

V

0

= Market Price Paid $

CF

1

CF

2

CF

3

CF

0

1 2 3

CHAPTER 7 Equity Valuation 7 - 25

Common Share Valuation

Discount Models

Remember, the amount and timing of future dividends (if that is the

cash flow you are using) is highly uncertain for most businesses

because dividends are not fixed obligation of the firm, but rather are

declared at the discretion of the board of directors, when, and if the firm

is profitable, and doesnt have other uses for the cash.

=

+

=

+

+ +

+

+

+

=

o

o

o

1

2

2

1

1

0

) 1 (

) 1 (

...

) 1 ( ) 1 (

i

i

i

k

Flow Cash

k

Flow Cash

k

Flow Cash

k

Flow Cash

V

CHAPTER 7 Equity Valuation 7 - 26

Common Share Valuation using DDM

The Basic Dividend Discount Model Intrinsic Value Estimate

The DDM says the intrinsic value or inherent

economic worth of the stock is equal to the sum of the

present value of all future dividends to be received.

n

c

n

c c

k

D

k

D

k

D

P

) 1 (

...

) 1 ( ) 1 (

2

2

1

1

0

+

+ +

+

+

+

=

[ 7-4]

CHAPTER 7 Equity Valuation 7 - 27

Common Share Valuation using DDM

Fundamental Analysts and the Basic Dividend Discount Model

Security analysts that use the DDM model are called

FUNDAMENTAL ANALYSTS because they base the estimate of

inherent worth on the economic fundamentals of the stock.

Once they have estimated the inherent worth, they compare their

estimate with the actual stock price in the market to determine

whether the stock is UNDER, OVER, or FAIRLY valued.

=

+

=

+

+ +

+

+

+

=

o

o

o

1

2

2

1

1

0

) 1 ( ) 1 (

...

) 1 ( ) 1 (

t

t

c

t

c c c

k

D

k

D

k

D

k

D

P

[ 7-5]

CHAPTER 7 Equity Valuation 7 - 28

Common Share Valuation using DDM

The Constant Growth DDM

When the firms dividends are growing at a slow, constant rate,

and reasonably can be expected to do so for the foreseeable

future, we use the constant growth dividend discount model.

Which can be simplified by multiplying D

0

by a factor of

(1+g)/(1+k

c

) every period to get:

o

o

) 1 (

) 1 (

...

) 1 (

) 1 (

) 1 (

) 1 (

0

2

2

0

1

1

0

0

c c c

k

g D

k

g D

k

g D

P

+

+

+ +

+

+

+

+

+

= [ 7-6]

g k

D

g k

g D

P

c c

=

+

=

1 0

0

) 1 (

[ 7-7]

CHAPTER 7 Equity Valuation 7 - 29

Common Share Valuation using DDM

Estimating the Required Rate of Return

The Constant Growth DDM can be reorganized to solve for the

investors required return

This formula can be decomposed into two components,

demonstrating that equity investors receive two forms of prospective

income from their investment, dividends and capital gains.

g

P

D

k

c

+ =

0

1

[ 7-8]

| | | | | | Yield Gain Capital Yield Dividend Current

0

1

+ = +

(

= g

P

D

k

c

CHAPTER 7 Equity Valuation 7 - 30

Common Share Valuation using DDM

Estimating the Value of Growth Opportunities

Assuming the firm has no profitable growth opportunities g should be

equal to 0, and D

1

=EPS

1

The Constant Growth DDM reduces to:

Therefore, the share price of any constant growth common stock is

made up of two components:

The no-growth components and

The present value of growth opportunities

This can be expressed as:

(See the following slide)

c

k

EPS

P

1

0

=

[ 7-9]

CHAPTER 7 Equity Valuation 7 - 31

Constant Growth DDM Two Components

Estimating the Value of Growth Opportunities

Decomposing the constant-growth DDM into its two

components gives us an analytical tool to examine the two

sources of current value of the firm.

| | | | ies opportunit growth of value present component growth no

PVGO

k

EPS

P

c

+ =

+ =

1

0

[ 7-10]

CHAPTER 7 Equity Valuation 7 - 32

The Constant Growth DDM

Examining the Importance of the Growth Assumption

The formula assumes that the growth rate will remain the same in period 1

through infinity.

This is a very long period of time

It assumes a compound growth rate

...

3 2 1 o

g g g g = = = =

g k

D

P

c

=

1

0

[ 7-7]

Time

Earnings

5% growth

rate

CHAPTER 7 Equity Valuation 7 - 33

The Constant Growth DDM

Examining the Importance of the Growth Assumption

The formula assumes that the growth rate will remain the same

in period 1 through infinity.

This is a very long period of time

Because of compounding over time, small changes in g will have

dramatic effects on the estimated stock value today.

If g is assumed to be greater than k

c

a non-sense answer would

result. In practice this could never happen because no company

can continue to grow at compound rates of return to infinity at a rate

that exceeds the long-term rate of growth in the economy.

g k

D

P

c

=

1

0

[ 7-7]

CHAPTER 7 Equity Valuation 7 - 34

The Constant Growth DDM

Examining the Inputs of the Constant Growth DDM

The formula predicts stock price increases if:

D

1

is increased

g is increased

k

c

is decreased

Conversely, the formula predicts stock price increases if:

D

1

is decreased

g is decreased

k

c

is increased

g k

D

P

c

=

1

0

[ 7-7]

CHAPTER 7 Equity Valuation 7 - 35

Common Share Valuation using DDM

Estimating DDM Inputs Sustainable Growth

Sustainable growth can be estimated using the following

equation:

Where: b = the firms earnings retention ratio

= (1 firms dividend payout ratio)

and

ROE = firms return on common equity

= net profit/common equity

ROE b g =

[ 7-11]

Clearly, the value of the firm will rise if the firm retains and

reinvests its profits at a rate of return (ROE) greater than k

c

Under such conditions, g increases more than k

c

CHAPTER 7 Equity Valuation 7 - 36

Common Share Valuation using DDM

Estimating DDM Inputs Sustainable Growth

Decomposing ROE using the DuPont system allows managers

to see how they can increase the value of the firm:

increase the profit margin on sales

Increase the turnover rate on sales

Leverage the firm using less equity and more debt (although use of

more debt implies higher risk and the benefits may be offset by a higher

k

c

)

ROE b g =

[ 7-11]

Ratio Leverage Ratio Turnover Margin Profit Net

Equity

Assets Total

Assets Total

Sales

Sales

income Net

ROE

=

=

[ 7-12]

CHAPTER 7 Equity Valuation 7 - 37

Common Share Valuation using DDM

The Multiple Stage Growth Version of the DDM

Firms with earnings that

are growing rapidly (more

rapid than the general rate

of economic expansion)

require another approach.

Remember, no firms

growth in earnings can

exceed the general rate of

economic expansion

foreverat some point,

earnings growth will fall.

...

5 4 3 2 1 o

g g g g g g = = = = > >

Time

Earnings

g

1

= 50%

g

2

= 30%

g

3

= g

4

= g

=4%

CHAPTER 7 Equity Valuation 7 - 38

Multiple Stage Growth Version of DDM

The Cash Flow Pattern for Multiple Stage Growth in Dividends

t

c

t t

c c

k

P D

k

D

k

D

P

) 1 (

...

) 1 ( ) 1 (

2

2

1

1

0

+

+

+ +

+

+

+

=

[ 7-13]

7-2 FIGURE

0 1 2 t t +1

D

1

D

2

D

t

D

t+1

Growth rate long-term growth rate (g) Growth rate = g from t to

g k

D

P

c

t

t

=

+1

CHAPTER 7 Equity Valuation 7 - 39

Multiple Stage Growth Version of DDM

Using Multiple Stage Growth Version of the DDM

Predict each dividend during the high growth years

Predict the first dividend during the constant growth years

Discount the individual dividends to the present and sum together with

the price at time t when the constant growth model is used.

The following is the formula you would use for two years of high

earnings growth followed by a constant growth in years three through

infinity.

2

2

2

2

1

1

2

3 2 1 0

2

2 1 0

1

1 0

0

) 1 ( ) 1 ( ) 1 (

) 1 (

) 1 )( 1 )( 1 (

) 1 (

) 1 )( 1 (

) 1 (

) 1 (

c c c

c

c

c c

k

P

k

D

k

D

k

g k

g g g D

k

g g D

k

g D

P

+

+

+

+

+

=

+

+ + +

+

+

+ +

+

+

+

=

CHAPTER 7 Equity Valuation 7 - 40

Example of Two-stage DDM

Using a Spreadsheet Modeling Approach

Forecast Assumptions:

Investors required return = k = 10.9%

Most recent dividend per share = D

0

= $0.25

Growth rate in first year = g

1

=14.8%

Growth rate in second year= g

2

= 10%

Growth rate in years three through infinity = g

3-

= 5%

Time

Dividend / Price

Calculation

Dividend

/Price

Present

Value

Factor

Present

Value

1 $0.25 X (1+.148) = $0.29 0.901713 $0.26

2 $0.287 X (1+.1) = $0.32 0.813087 $0.26

2 P(2) = D(3)/ (.109 - .05) = $5.62 0.813087 $4.57

Intrinsic Value Estimate = $5.08

08 . 5 $

) 109 . 1 (

62 . 5 $

) 109 . 1 (

32 . 0 $

) 109 . 1 (

29 . 0 $

) 109 . 1 (

05 . 109 .

) 05 . 1 )( 1 . 1 )( 148 . 1 ( 25 . 0 $

) 109 . 1 (

) 1 . 1 )( 148 . 1 ( 25 . 0 $

) 109 . 1 (

) 148 . 1 ( 25 . 0 $

) 1 ( ) 1 ( ) 1 (

2 2

2 2 1

2

2

2 1

0

= + + =

+

+

+

+

+

=

+

+

+

+

+

=

c c c

k

P

k

D

k

D

P

CHAPTER 7 Equity Valuation 7 - 41

Constant Growth DDM

Limitations of the DDM

The Model predictions are highly sensitive to changes in

g and k

c

Not helpful in valuing non-dividend paying firms.

g k

D

P

c

=

1

0

[ 7-7]

CHAPTER 7 Equity Valuation 7 - 42

Constant Growth DDM

Best Application of the Constant Growth DDM

Use of the Model is best suited to:

Firms that pay dividends based on a stable dividend

payout history that are likely to maintain that practice

into the future

Are growing at a steady and sustainable rate.

This model works for large corporations in mature

industries such as banks and utility companies.

Using Multiples to Value Shares

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 44

Using Multiples to Value Shares

The Basic Approach

Relative valuation approaches estimate the value of

common shares by comparing market prices of

similar companies, relative to some variable such

as:

Earnings

EBITDA

Cash flow

Book value

Sales

The challenge is finding the right comparator!

CHAPTER 7 Equity Valuation 7 - 45

Using Multiples to Value Shares

The Price-earnings (P/E) Ratio

Also known as the price-earnings multiple

The ratio tells you how many times projected annual earnings (per

share) the share is currently trading

If you buy a company that is trading 10 times projected earnings, it

will take 10 years of those earnings to recover your investment.

If you buy a company trading 100 times projected earnings, it will

take 100 years of those earnings to simply recover your investment

(not including any time value of money or return on your

investment).

1

0

1

1 0

E

P

EPS

ratio P/E Justified EPS Estimated

=

= P

[ 7-13]

CHAPTER 7 Equity Valuation 7 - 46

Using Multiples to Value Shares

P/E Multiples Over Time

Figure 7 3 illustrates the aggregate P/E ratios for the

S&P/TSX from 1956 through 2005.

This figure is based on trailing multiples (ie. Using actual

earnings per share rather than forecast)

The volatility of these aggregate multiples is driven by the

volatility of corporate earnings.

Falling earnings can result in skyrocketing P/E ratios that are not a

reflection of the increasing value of stock (in fact, the market price of

the stock could be falling), but rather, the fact that earnings have

dropped dramatically, in relation to the stock price

This phenomenon should be expected since one years earnings

can fall, but a stock price (according to the DDM approach) is a

function of many years of forecast cash flows

(See Figure 7 -3 on the next slide)

CHAPTER 7 Equity Valuation 7 - 47

P/E Multiples

The S&P/TSX Composite P/E

7-3 FIGURE

CHAPTER 7 Equity Valuation 7 - 48

P/E Multiples

Implementing the P/E Ratio Approach

Estimate EPS

1

using:

Historical earnings data

Projected trends

Use of analyst estimates

Estimate justifiable P/E ratio using where appropriate:

Industry average

Range of P/Es

Subjectively adjusted industry averages based on risk

assessment

Obtain corroborating estimates based on:

Economic, industry and company fundamentals, and/or

Relate P/E to the fundamentals in the DDM

CHAPTER 7 Equity Valuation 7 - 49

P/E Multiples

Relating the P/E Multiple to Fundamentals in the DDM

Given the constant growth DDM

Divide both sides by expected earnings per share, you get Equation

7-15

Notice that D

1

/EPS

1

is the expected dividend payout ratio at time 1.

Equation 7-15 indicates:

The higher the expected payout ratio, the higher the P/E

The higher the expected growth rate, g, the higher the P/E

The higher the required rate of return, k

c

, the lower the P/E

g k

D

P

c

=

1

0

[ 7-7]

g k

EPS

D

E

P

EPS

P

c

= =

1

1

1

0

[ 7-15]

CHAPTER 7 Equity Valuation 7 - 50

Using P/E Multiples to Value Shares

Limitations of P/E Ratios

P/Es are uninformative when companies have negative (or very

small) earnings

The volatility in earnings creates great volatility in P/Es throughout

the business cycle.

Given the foregoing problems, analysts normally use smoothed or

normalized estimates of earnings for the forecast year, as well as

using a variety of different approaches to develop a range of

potential values for the stock.

(The issues compromising P/Es are illustrated in Table 7 -1 on the following slides)

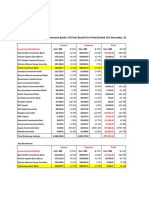

CHAPTER 7 Equity Valuation 7 - 51

Limitations of P/E Ratios

Examples in the Forest Industry

Company Price 2006

EPS

Forecast

EPS

P/E P/E

Forecast

Yield TSX

Symbol

Abitibi 2.72 -0.30 0.12 nm 22.67 0.00 A

Canfor 11.13 -0.27 0.47 nm 23.68 0.00 CFP

Cascades 11.54 0.71 0.60 16.25 19.23 1.39 CAS

Canfor Pulp 11.56 1.38 1.20 8.38 9.63 7.51 CFX.UN

Catalyst 3.22 -0.07 0.03 nm nm 0.00 CTL

Fraser Papers 7.01 -1.35 -0.41 nm nm 0.00 FPS

International 6.6 0.26 0.53 25.38 12.45 0.00 IFPA

Mercer 9.69 -0.07 0.14 nm 54.35 0.00 MERC

Norbord 8.41 0.74 0.40 10.24 18.95 4.76 NBD

PRT 11.2 0.69 0.70 16.23 16.00 9.38 PRT.UN

SFK Pulp 4.14 0.64 0.82 6.47 5.05 4.19 SFK.UN

Tembec 1.43 -2.00 -1.11 nm nm 0.00 TBC

TimberWest Forest 14.07 0.01 -0.27 nm nm 7.65 TWF.UN

West Fraser Timber 37.45 0.94 2.35 39.84 15.94 1.50 WFT

Note: nm = note meaningf ul

Source: RBC Dominion Securities Inc., Foundations Research Report, September 2006.

Table 7-1 P/E Ratios in the Paper and Forest Products Sector

Large

number

of firms

with

negative

earnings

CHAPTER 7 Equity Valuation 7 - 52

Limitations of P/E Ratios

Examples in the Forest Industry

Company Price 2006

EPS

Forecast

EPS

P/E P/E

Forecast

Yield TSX

Symbol

Abitibi 2.72 -0.30 0.12 nm 22.67 0.00 A

Canfor 11.13 -0.27 0.47 nm 23.68 0.00 CFP

Cascades 11.54 0.71 0.60 16.25 19.23 1.39 CAS

Canfor Pulp 11.56 1.38 1.20 8.38 9.63 7.51 CFX.UN

Catalyst 3.22 -0.07 0.03 nm nm 0.00 CTL

Fraser Papers 7.01 -1.35 -0.41 nm nm 0.00 FPS

International 6.6 0.26 0.53 25.38 12.45 0.00 IFPA

Mercer 9.69 -0.07 0.14 nm 54.35 0.00 MERC

Norbord 8.41 0.74 0.40 10.24 18.95 4.76 NBD

PRT 11.2 0.69 0.70 16.23 16.00 9.38 PRT.UN

SFK Pulp 4.14 0.64 0.82 6.47 5.05 4.19 SFK.UN

Tembec 1.43 -2.00 -1.11 nm nm 0.00 TBC

TimberWest Forest 14.07 0.01 -0.27 nm nm 7.65 TWF.UN

West Fraser Timber 37.45 0.94 2.35 39.84 15.94 1.50 WFT

Note: nm = note meaningf ul

Source: RBC Dominion Securities Inc., Foundations Research Report, September 2006.

Table 7-1 P/E Ratios in the Paper and Forest Products Sector

P/E ratio

is highly

variable

across the

industry

there is no

average

or

consistent

pattern.

CHAPTER 7 Equity Valuation 7 - 53

Limitations of P/E Ratios

Examples in the Forest Industry

Company Price 2006

EPS

Forecast

EPS

P/E P/E

Forecast

Yield TSX

Symbol

Abitibi 2.72 -0.30 0.12 nm 22.67 0.00 A

Canfor 11.13 -0.27 0.47 nm 23.68 0.00 CFP

Cascades 11.54 0.71 0.60 16.25 19.23 1.39 CAS

Canfor Pulp 11.56 1.38 1.20 8.38 9.63 7.51 CFX.UN

Catalyst 3.22 -0.07 0.03 nm nm 0.00 CTL

Fraser Papers 7.01 -1.35 -0.41 nm nm 0.00 FPS

International 6.6 0.26 0.53 25.38 12.45 0.00 IFPA

Mercer 9.69 -0.07 0.14 nm 54.35 0.00 MERC

Norbord 8.41 0.74 0.40 10.24 18.95 4.76 NBD

PRT 11.2 0.69 0.70 16.23 16.00 9.38 PRT.UN

SFK Pulp 4.14 0.64 0.82 6.47 5.05 4.19 SFK.UN

Tembec 1.43 -2.00 -1.11 nm nm 0.00 TBC

TimberWest Forest 14.07 0.01 -0.27 nm nm 7.65 TWF.UN

West Fraser Timber 37.45 0.94 2.35 39.84 15.94 1.50 WFT

Note: nm = note meaningf ul

Source: RBC Dominion Securities Inc., Foundations Research Report, September 2006.

Table 7-1 P/E Ratios in the Paper and Forest Products Sector

Data mixes

normal

corporations

with Income

Trust

structures.

Income

Trusts have

more stable

earnings, so

their P/E

ratios are

more stable.

CHAPTER 7 Equity Valuation 7 - 54

Other Multiples or Relative Value Ratios

Market-to-book (M/B) ratio

Price-to-sales (P/S) ratio

Price-to-cash-flow (P/CF) ratio

Market value to EBIT ratio

Market value to EBITDA ratio

CHAPTER 7 Equity Valuation 7 - 55

Market-to-Book Ratio

Multiply justifiable M/B ratio times the firms book value per share to get an

estimate of intrinsic value

Advantages

Book values provide a relatively stable, intuitive measure of value relative to

market values

Eliminates problems associated with P/E multiples because book values are

rarely negative and are not volatile

Disdvantages

Book values may be sensitive to accounting standards

Book values may be uninformative for companies with few fixed assets

M/B ratio fell out of favour in the 1980s and 90s because high rates of

inflation distorted book values

Share per Value Book

Share per Price Market

/ = ratio B M

CHAPTER 7 Equity Valuation 7 - 56

Price-to-Sales (P/S) Ratio

Multiply justifiable P/S ratio times the firms sales per share to

get an estimate of intrinsic value

Advantages

Sales are relatively insensitive to accounting decisions and are

never negative

Sales are not as volatile as earnings

Sales provide useful information about corporate decisions such

as product pricing

Disadvantages

Sales do not provide information about expenses and profit

margins which are key determinants of corporate performance.

CHAPTER 7 Equity Valuation 7 - 57

Price-to-Cash-Flow (P/CF) Ratio

Cash Flow is estimated as Net Income + Depreciation and

Amortization + Deferred Taxes

Multiply justifiable P/CF ratio times the firms cash flow per

share to get an estimate of intrinsic value

Advantages

Reduces accounting concerns regarding earnings measurement

CHAPTER 7 Equity Valuation 7 - 58

Market Value to EBIT or EBITDA

Multiply justifiable ratio times the firms forecast EBIT or

EBITDA per share to get an estimate of intrinsic value

Use Market Value of both Debt and Equity reflecting the fact

that EBIT or EBITDA represents income available to satisfy

the claims of both debt and equity holders

Advantages

Using EBIT and EBITDA instead of net income eliminates

volatility caused by EPS

(A Forecast Income Statement that could be used with EBIT and EBITDA ratios is

illustrated in Table 7 -2 on the following slide)

CHAPTER 7 Equity Valuation 7 - 59

EBIT and EBITDA Ratios

Examples using Forecast Income Statement

Sales Volume 1 million units

Unit price $10 $10 million

Variable costs 5.0

Fixed cash costs 1.7

EBITDA 3.3

Depreciation 0.8

EBIT 2.5

Interest 0.5

EBT 2.0

Income Tax @ 50 percent 1.0

Net Income 1.0

Dividends 0.5

Book value of equity 5.0

Book value of debt 5.0

Table 7-2 Forecast Income Statement

3.3

MV

=

+

=

EBITDA

Equity Debt MV

ratio EBITDA

2.5

MV

=

+

=

EBIT

Equity Debt MV

ratio EBIT

CHAPTER 7 Equity Valuation 7 - 60

Using Multiples to Value Shares

Concluding Remarks

Use of comparative multiples is a popular approach

to valuing stock

Despite apparent simplicity of generating the ratios,

consideration of the accounting, volatility and other

issues affecting the usefulness of these approaches.

CHAPTER 7 Equity Valuation 7 - 61

Summary and Conclusions

In this chapter you have learned:

Basic approaches to valuing preferred

and common shares including:

Dividend discount models

Relative valuation models

The importance of recognizing the

sensitivity of the valuation process to

assumptions regarding input variables

such as growth rates, discount rates

and general market conditions.

Concept Review Questions

Equity Valuation

CHAPTER 7 Equity Valuation 7 - 63

Concept Review Question 1

Preferred Shares Versus Bonds

In what ways are preferred shares different from

bonds?

CHAPTER 7 Equity Valuation 7 - 64

Copyright

Copyright 2007 John Wiley & Sons

Canada, Ltd. All rights reserved.

Reproduction or translation of this work

beyond that permitted by Access

Copyright (the Canadian copyright

licensing agency) is unlawful. Requests

for further information should be

addressed to the Permissions

Department, John Wiley & Sons Canada,

Ltd. The purchaser may make back-up

copies for his or her own use only and

not for distribution or resale. The author

and the publisher assume no

responsibility for errors, omissions, or

damages caused by the use of these files

or programs or from the use of the

information contained herein.

Potrebbero piacerti anche

- CH 06Documento73 pagineCH 06Sarang AdgokarNessuna valutazione finora

- BUSI 353 S18 Assignment 3 All RevenueDocumento5 pagineBUSI 353 S18 Assignment 3 All RevenueTanNessuna valutazione finora

- BUSI 353 S18 Assignment 6 SOLUTIONDocumento4 pagineBUSI 353 S18 Assignment 6 SOLUTIONTanNessuna valutazione finora

- BUSI 353 Assignment #5 General Instructions For All AssignmentsDocumento3 pagineBUSI 353 Assignment #5 General Instructions For All AssignmentsTanNessuna valutazione finora

- Mod08 - 09 10 09Documento37 pagineMod08 - 09 10 09Alex100% (1)

- ENG 111 Final SolutionsDocumento12 pagineENG 111 Final SolutionsDerek EstrellaNessuna valutazione finora

- BUSI 353 S18 Assignment 4 SOLUTIONDocumento2 pagineBUSI 353 S18 Assignment 4 SOLUTIONTanNessuna valutazione finora

- Corporate Finance: Laurence Booth - W. Sean ClearyDocumento136 pagineCorporate Finance: Laurence Booth - W. Sean Clearyatif41Nessuna valutazione finora

- Solutions BD3 SM24 GEDocumento4 pagineSolutions BD3 SM24 GEAgnes ChewNessuna valutazione finora

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocumento5 pagineBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANessuna valutazione finora

- Model Question Paper Business EconomicsDocumento20 pagineModel Question Paper Business EconomicsDaniel VincentNessuna valutazione finora

- Mock Midterm 2019-1Documento8 pagineMock Midterm 2019-1xsnoweyxNessuna valutazione finora

- Case Scenarios For Taxation Exams ACCT 3050 by RC (2020)Documento5 pagineCase Scenarios For Taxation Exams ACCT 3050 by RC (2020)TashaNessuna valutazione finora

- Fae3e SM ch04 060914Documento23 pagineFae3e SM ch04 060914JarkeeNessuna valutazione finora

- Exercise Problems - 485 Fixed Income 2021Documento18 pagineExercise Problems - 485 Fixed Income 2021Nguyen hong LinhNessuna valutazione finora

- Understanding Financial StatementsDocumento10 pagineUnderstanding Financial StatementsNguyet NguyenNessuna valutazione finora

- Chapter 04 - Mutual Funds and Other Investment CompaniesDocumento58 pagineChapter 04 - Mutual Funds and Other Investment CompaniesAmadou JallohNessuna valutazione finora

- Chapter 6 Discounted Cash Flow ValuationDocumento27 pagineChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Capital BudgetingDocumento3 pagineCapital BudgetingMikz PolzzNessuna valutazione finora

- CH 3Documento13 pagineCH 3Madyoka Raimbek100% (1)

- Chapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Documento62 pagineChapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Mohammad Salim Hossain0% (1)

- Fm202 Exam Questions 2013Documento12 pagineFm202 Exam Questions 2013Grace VersoniNessuna valutazione finora

- Practice Test MidtermDocumento6 paginePractice Test Midtermrjhuff41Nessuna valutazione finora

- Chapter 019Documento14 pagineChapter 019mallumainhunmailNessuna valutazione finora

- Ratio Analysis: Important FormulaDocumento4 pagineRatio Analysis: Important FormulaHarsh Vardhan KatnaNessuna valutazione finora

- Fixed Income QuestionsDocumento1 paginaFixed Income QuestionsAbhishek Garg0% (2)

- Ch. 3,4,5,6 - Study PlanDocumento185 pagineCh. 3,4,5,6 - Study PlanIslamNessuna valutazione finora

- Quiz 2 - QUESTIONSDocumento18 pagineQuiz 2 - QUESTIONSNaseer Ahmad AziziNessuna valutazione finora

- OPT SolutionDocumento52 pagineOPT SolutionbocfetNessuna valutazione finora

- 4th Sem PapersDocumento10 pagine4th Sem PapersAkash ChatterjeeNessuna valutazione finora

- BD3 SM17Documento3 pagineBD3 SM17Nguyễn Bành100% (1)

- Chapter 9Documento18 pagineChapter 9Rubén ZúñigaNessuna valutazione finora

- Introduction to Accounting and Business FundamentalsDocumento147 pagineIntroduction to Accounting and Business Fundamentalsannie100% (1)

- Ingredients of Finance Interviews: - HR - Finance Concepts - Puzzles - Stress Test & Attitude QuestionsDocumento6 pagineIngredients of Finance Interviews: - HR - Finance Concepts - Puzzles - Stress Test & Attitude QuestionsShine NagpalNessuna valutazione finora

- Chapter 12Documento25 pagineChapter 12Muhammad Umair KhalidNessuna valutazione finora

- BKM Solution Chapter 4Documento8 pagineBKM Solution Chapter 4minibodNessuna valutazione finora

- KPMG Prodegree EBrochureDocumento6 pagineKPMG Prodegree EBrochurerajiv559Nessuna valutazione finora

- CAPM TheoryDocumento11 pagineCAPM TheoryNishakdasNessuna valutazione finora

- EBIT-EPS analysis for financing plan decisionsDocumento6 pagineEBIT-EPS analysis for financing plan decisionsSthephany GranadosNessuna valutazione finora

- Rose Mwaniki CVDocumento10 pagineRose Mwaniki CVHamid RazaNessuna valutazione finora

- BUSI 353 S18 Assignment 5 SOLUTIONDocumento5 pagineBUSI 353 S18 Assignment 5 SOLUTIONTan100% (2)

- Accrual Accounting and ValuationDocumento49 pagineAccrual Accounting and ValuationSonyaTanSiYing100% (1)

- Discounted Cash Flow (DCF) Definition - InvestopediaDocumento2 pagineDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532Nessuna valutazione finora

- AC2091 Financial Reporting: Session 4Documento40 pagineAC2091 Financial Reporting: Session 4NadiaIssabellaNessuna valutazione finora

- Hillier Model 3Documento19 pagineHillier Model 3kavyaambekarNessuna valutazione finora

- Aicpa 040212far SimDocumento118 pagineAicpa 040212far SimHanabusa Kawaii IdouNessuna valutazione finora

- Free Cash Flow Valuation: Wacc FCFF VDocumento6 pagineFree Cash Flow Valuation: Wacc FCFF VRam IyerNessuna valutazione finora

- Risk Management Solution Chapters Seven-EightDocumento9 pagineRisk Management Solution Chapters Seven-EightBombitaNessuna valutazione finora

- Chapter 2Documento17 pagineChapter 2jinny6061100% (1)

- frm指定教材 risk management & derivativesDocumento1.192 paginefrm指定教材 risk management & derivativeszeno490Nessuna valutazione finora

- Monitor & Control TPM ProjectsDocumento40 pagineMonitor & Control TPM ProjectsGulzaibNessuna valutazione finora

- Ion - Why Is It Necessary - How It WorksDocumento7 pagineIon - Why Is It Necessary - How It WorksPankaj D. DaniNessuna valutazione finora

- Spring03 Final SolutionDocumento14 pagineSpring03 Final SolutionrgrtNessuna valutazione finora

- Week 7 Workshop Solutions - Long-Term Debt MarketsDocumento3 pagineWeek 7 Workshop Solutions - Long-Term Debt MarketsMengdi ZhangNessuna valutazione finora

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKDa EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNessuna valutazione finora

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsDa EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNessuna valutazione finora

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsDa EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNessuna valutazione finora

- The Four Walls: Live Like the Wind, Free, Without HindrancesDa EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesValutazione: 5 su 5 stelle5/5 (1)

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Article About ITC in ForbesDocumento11 pagineArticle About ITC in ForbesShailesh RathodNessuna valutazione finora

- Partnership Formation and LiabilityDocumento6 paginePartnership Formation and LiabilityShailesh RathodNessuna valutazione finora

- SEBI: The Purpose, Objective and Functions of SEBIDocumento10 pagineSEBI: The Purpose, Objective and Functions of SEBIShailesh RathodNessuna valutazione finora

- Training and Development Program For Apple IncDocumento22 pagineTraining and Development Program For Apple IncMarcela GrebenisanNessuna valutazione finora

- Managing Conflicts in OrganizationsDocumento309 pagineManaging Conflicts in OrganizationsRishi100% (3)

- Business Plan - Tour Company (JST)Documento26 pagineBusiness Plan - Tour Company (JST)Adrian Keys81% (67)

- SEBI: The Purpose, Objective and Functions of SEBIDocumento10 pagineSEBI: The Purpose, Objective and Functions of SEBIShailesh RathodNessuna valutazione finora

- SAARC Jamshed Iqbal M.com. EconomicsDocumento14 pagineSAARC Jamshed Iqbal M.com. EconomicssiddhantkamdarNessuna valutazione finora

- Consumer Buying Decision ProcessDocumento23 pagineConsumer Buying Decision Processapi-372849775% (8)

- Accounting For AmalgamationsDocumento40 pagineAccounting For AmalgamationsKamal Kannan GNessuna valutazione finora

- Final Project ReportDocumento14 pagineFinal Project ReportShailesh RathodNessuna valutazione finora

- After Graduation in CommerceDocumento1 paginaAfter Graduation in CommerceShailesh RathodNessuna valutazione finora

- Selfless ServiceDocumento20 pagineSelfless ServiceShailesh RathodNessuna valutazione finora

- SAARC Jamshed Iqbal M.com. EconomicsDocumento14 pagineSAARC Jamshed Iqbal M.com. EconomicssiddhantkamdarNessuna valutazione finora

- SSC ResultDocumento2 pagineSSC ResultShailesh RathodNessuna valutazione finora

- ConsumersDocumento63 pagineConsumersVijayuduGnanamkondaNessuna valutazione finora

- ISO 9000 - ImplementationDocumento29 pagineISO 9000 - ImplementationMahloyal FazalNessuna valutazione finora

- Full Issue PDFDocumento44 pagineFull Issue PDFShailesh RathodNessuna valutazione finora

- TYBMS Sem 5 Question BankDocumento6 pagineTYBMS Sem 5 Question BankShailesh RathodNessuna valutazione finora

- Consumer Behaviour - IntroductionDocumento10 pagineConsumer Behaviour - IntroductionruchierichNessuna valutazione finora

- ConsumersDocumento63 pagineConsumersVijayuduGnanamkondaNessuna valutazione finora

- TYBMS Sem 5 Question BankDocumento6 pagineTYBMS Sem 5 Question BankShailesh RathodNessuna valutazione finora

- JitDocumento5 pagineJitShailesh RathodNessuna valutazione finora

- ISO and International StandardizationDocumento20 pagineISO and International StandardizationShailesh RathodNessuna valutazione finora

- Case MotoDocumento44 pagineCase MotoShailesh RathodNessuna valutazione finora

- SAM Questionnaire 2009Documento77 pagineSAM Questionnaire 2009Shailesh RathodNessuna valutazione finora

- Human Resource Management Notes..Documento40 pagineHuman Resource Management Notes..Shailesh RathodNessuna valutazione finora

- Central BankDocumento24 pagineCentral BankShailesh RathodNessuna valutazione finora

- TYBMS Sem 5 Question BankDocumento6 pagineTYBMS Sem 5 Question BankShailesh RathodNessuna valutazione finora

- 05-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesDocumento10 pagine05-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesThanh ThùyNessuna valutazione finora

- Pro PerDocumento47 paginePro Perxlrider530Nessuna valutazione finora

- Aarti Brochure 2009Documento4 pagineAarti Brochure 2009Sabari MarketingNessuna valutazione finora

- Facebook Rankwave LawsuitDocumento11 pagineFacebook Rankwave LawsuitTechCrunchNessuna valutazione finora

- Bredol SepesifikasiDocumento2 pagineBredol SepesifikasiAhmad ArifNessuna valutazione finora

- CRIMPRO-Rule 112 Section 4 - Cruz Vs CruzDocumento1 paginaCRIMPRO-Rule 112 Section 4 - Cruz Vs CruzDSB LawNessuna valutazione finora

- Deed of Absolute SaleDocumento2 pagineDeed of Absolute SaleDEXTER ARGONCILLONessuna valutazione finora

- Legal Considerations for Maternal and Child NursesDocumento6 pagineLegal Considerations for Maternal and Child NursesA C100% (2)

- Government of India Directorate General of Civil Aviation Central Examination OrganisationDocumento1 paginaGovernment of India Directorate General of Civil Aviation Central Examination OrganisationsubharansuNessuna valutazione finora

- MGT101 - Financial Accounting - Solved - Final Term Paper - 02Documento12 pagineMGT101 - Financial Accounting - Solved - Final Term Paper - 02Ahmad SheikhNessuna valutazione finora

- Social Implications in The Hound of The BaskervillesDocumento8 pagineSocial Implications in The Hound of The BaskervillesDaffodilNessuna valutazione finora

- Kenyan Brokerage & Investment Banking Financial Results 2009Documento83 pagineKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNessuna valutazione finora

- GOMs-50-Revenue DivisionsDocumento4 pagineGOMs-50-Revenue Divisionsabhilash gaddeNessuna valutazione finora

- (Share) Chocozip - 202312FreePlanner - Line - MonoDocumento10 pagine(Share) Chocozip - 202312FreePlanner - Line - Mono8tj2gcjj9bNessuna valutazione finora

- OpenSAP Signavio1 Week 1 Unit 1 Intro PresentationDocumento8 pagineOpenSAP Signavio1 Week 1 Unit 1 Intro PresentationMoyin OluwaNessuna valutazione finora

- Human Rights Victim's Claim Application Form and FAQsDocumento23 pagineHuman Rights Victim's Claim Application Form and FAQsTon RiveraNessuna valutazione finora

- Community Participation and Institutional Experiences in School Education: School Development and Monitoring Committees in KarnatakaDocumento28 pagineCommunity Participation and Institutional Experiences in School Education: School Development and Monitoring Committees in KarnatakaOxfamNessuna valutazione finora

- Badges of Dummy StatusDocumento3 pagineBadges of Dummy StatusPamela DeniseNessuna valutazione finora

- Ex Parte Motion To Release Bail SAMPLEDocumento2 pagineEx Parte Motion To Release Bail SAMPLEweddanever.cornelNessuna valutazione finora

- Ong Yong vs. TiuDocumento21 pagineOng Yong vs. TiuZen DanielNessuna valutazione finora

- Eddie BurksDocumento11 pagineEddie BurksDave van BladelNessuna valutazione finora

- IMUX 2000s Reference Manual 12-12-13Documento70 pagineIMUX 2000s Reference Manual 12-12-13Glauco TorresNessuna valutazione finora

- Cyber Crime and Security: Student:Jalba Ion Group:1804Documento20 pagineCyber Crime and Security: Student:Jalba Ion Group:1804Jalba IonNessuna valutazione finora

- Investment in Cambodia Prepared by Chan BonnivoitDocumento64 pagineInvestment in Cambodia Prepared by Chan BonnivoitMr. Chan Bonnivoit100% (2)

- BP 22 NotesDocumento2 pagineBP 22 NotesBay Ariel Sto TomasNessuna valutazione finora

- TOTO Anthology PDFDocumento6 pagineTOTO Anthology PDFDominique Marquer30% (60)

- PEOPLE v. ESCOBER - Robbery with Homicide; Acquittal and ConvictionDocumento3 paginePEOPLE v. ESCOBER - Robbery with Homicide; Acquittal and ConvictionAaron Cade CarinoNessuna valutazione finora

- Universal Banking in IndiaDocumento6 pagineUniversal Banking in IndiaashwanidusadhNessuna valutazione finora

- Barangay Tax Code Sample PDFDocumento14 pagineBarangay Tax Code Sample PDFSusan Carbajal100% (2)

- Answer To Exercises-Capital BudgetingDocumento18 pagineAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)