Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Informal Risk Capital and Venture Capital

Caricato da

girishvishTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Informal Risk Capital and Venture Capital

Caricato da

girishvishCopyright:

Formati disponibili

Module VII

Criteria for evaluating appropriateness of financing alternatives:

Amount and timing of funds required. Projected company sales and growth. Early stage financing. Development financing. Acquisition financing.

Three types of funding:

Financing the Business

(cont.)

Risk capital markets provide debt and equity to non secure financing situations. Types of risk capital markets:

Informal risk capital market. Venture-capital market. Public-equity market.

All three can be a source of funds for stageone financing.

However, public-equity market is available only for high-potential ventures.

It consists of a virtually invisible group of wealthy investors (business angels). Investments range between $10,000 to $500,000. Provides funding, especially in start-up (firststage) financing. Contains the largest pool of risk capital in the United States.

Table 12.2 - Characteristics of Informal Investors (cont.)

Nature of Venture Capital

A long-term investment discipline, usually occurring over a five-year period. The equity pool is formed from the resources of wealthy limited partners. Found in:

Creation of early-stage companies. Expansion and revitalization of businesses. Financing of leveraged buyouts of existing divisions of

major corporations or privately owned businesses.

Venture capitalist takes an equity participation in each of the investments.

Venture Capital

(cont.)

Venture-Capital Process

Objective of a venture-capital firm - Generation of long-term capital appreciation through debt and equity investments. Criteria for committing to venture:

Strong management team. A unique product and/or market opportunity. Business opportunity must show significant capital

appreciation.

Venture Capital

(cont.)

Venture-capital process can be broken down into four primary stages:

Stage I: Preliminary screening Initial evaluation of the deal. Stage II: Agreement on principal terms - Between entrepreneur and venture capitalist. Stage II: Due diligence - Stage of deal evaluation. Stage IV: Final approval - Document showing the final terms of the deal.

Venture Capital

(cont.)

Locating Venture Capitalists

Venture capitalists tend to specialize either geographically by industry or by size and type of investment. Entrepreneur should approach only those that may have an interest in the investment opportunity. Most venture capital firms belong to the National Venture Capital Association.

Table 12.6 - Guidelines for Dealing with Venture Capitalists (cont.)

Potrebbero piacerti anche

- VENTURE CAPITAL IN INDIA: A HISTORYDocumento10 pagineVENTURE CAPITAL IN INDIA: A HISTORYraveena_jethaniNessuna valutazione finora

- 5 Stages Successful Ventures Life CycleDocumento27 pagine5 Stages Successful Ventures Life CycleRalph Gene Trabasas Flora100% (1)

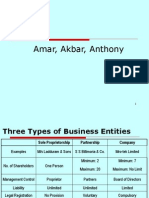

- Forms of Business EntityDocumento20 pagineForms of Business EntityMain Daiictian HuNessuna valutazione finora

- Financial Markets and Institutions OverviewDocumento43 pagineFinancial Markets and Institutions Overviewdhiviraj100% (3)

- Introduction To Corporate Finance - Mcgraw-HillDocumento18 pagineIntroduction To Corporate Finance - Mcgraw-Hilldelifinka100% (2)

- PRACTICE QUESTION-SECURITY LAwDocumento5 paginePRACTICE QUESTION-SECURITY LAwpunugauriNessuna valutazione finora

- External Institutions of Corporate GovernanceDocumento3 pagineExternal Institutions of Corporate GovernanceJolina Ong100% (2)

- Venture CapitalDocumento83 pagineVenture Capitalanu singhNessuna valutazione finora

- Entrepreneurs and Informal InvestorsDocumento25 pagineEntrepreneurs and Informal InvestorsAnam Abdul QayyumNessuna valutazione finora

- VC 131209235045 Phpapp02Documento45 pagineVC 131209235045 Phpapp02rachealllNessuna valutazione finora

- Venture Capital - MithileshDocumento88 pagineVenture Capital - MithileshTejas BamaneNessuna valutazione finora

- A Presentation On Venture CapitalDocumento16 pagineA Presentation On Venture CapitalManash Jyoti Pathak100% (1)

- FPI Guide: Understanding Foreign Portfolio Investment in IndiaDocumento5 pagineFPI Guide: Understanding Foreign Portfolio Investment in IndiaGaurav ShankarNessuna valutazione finora

- 06 Ankit Jain - Current Scenario of Venture CapitalDocumento38 pagine06 Ankit Jain - Current Scenario of Venture CapitalSanjay KashyapNessuna valutazione finora

- CH 14 Foreign Direct InvestmentDocumento53 pagineCH 14 Foreign Direct InvestmentharshaNessuna valutazione finora

- Venture CapitalDocumento71 pagineVenture CapitalSmruti VasavadaNessuna valutazione finora

- Venture CapitalDocumento16 pagineVenture CapitalAditya100% (1)

- Entrepreneurship Chapter 12 - Informal Risk CapitalDocumento3 pagineEntrepreneurship Chapter 12 - Informal Risk CapitalSoledad Perez75% (4)

- A Study of Investment Preferences of InvestorsDocumento8 pagineA Study of Investment Preferences of InvestorsHarshNessuna valutazione finora

- ECONOMIC ENVIRONMENT INTRODUCTIONDocumento22 pagineECONOMIC ENVIRONMENT INTRODUCTIONKavita JainNessuna valutazione finora

- Family VentureDocumento5 pagineFamily VentureAdeem AshrafiNessuna valutazione finora

- Guide-to-Venture-Capital IVA PDFDocumento90 pagineGuide-to-Venture-Capital IVA PDFNaveen AwasthiNessuna valutazione finora

- VC Industry in India Still EmergingDocumento14 pagineVC Industry in India Still EmergingRemy HerbieNessuna valutazione finora

- Primary MarketDocumento27 paginePrimary MarketMrunal Chetan Josih0% (1)

- Company Profile of KBZ BankDocumento6 pagineCompany Profile of KBZ BankKaung Ma Lay100% (1)

- Working Capital AnalysisDocumento20 pagineWorking Capital Analysisaneek100% (1)

- Venture CapitalDocumento24 pagineVenture CapitalDevaraj Devu100% (2)

- Introduction To Mutual Fund and Its Various AspectsDocumento46 pagineIntroduction To Mutual Fund and Its Various AspectsNaazlah SadafNessuna valutazione finora

- Cash ManagementDocumento45 pagineCash ManagementRahul NishadNessuna valutazione finora

- Chapter 7 - The Business Plan: Creating and Starting The VentureDocumento15 pagineChapter 7 - The Business Plan: Creating and Starting The VentureArman100% (2)

- Financial ManagementDocumento49 pagineFinancial ManagementBabasab Patil (Karrisatte)Nessuna valutazione finora

- The Importance of Financial ManagementDocumento3 pagineThe Importance of Financial ManagementDevakiKirupaharanNessuna valutazione finora

- Impact of Investment Banking on India's Economic GrowthDocumento8 pagineImpact of Investment Banking on India's Economic GrowthNeelNessuna valutazione finora

- Chapter No.3 Research Methodology 3.1 IntroductionDocumento15 pagineChapter No.3 Research Methodology 3.1 Introductionpooja shandilyaNessuna valutazione finora

- SM Prime Holdings: A Long-Term InvestmentDocumento4 pagineSM Prime Holdings: A Long-Term InvestmentClaire BarbaNessuna valutazione finora

- Building an organization capable of executing strategyDocumento14 pagineBuilding an organization capable of executing strategyandi ilha100% (1)

- EPPM2033 W5 SEM3 20202021 Licensing, Franchising, FDI and Collaborative VenturesDocumento59 pagineEPPM2033 W5 SEM3 20202021 Licensing, Franchising, FDI and Collaborative VenturesChoo Wei shengNessuna valutazione finora

- Nestlé Financial AnalysisDocumento28 pagineNestlé Financial AnalysisdosNessuna valutazione finora

- Anand RathiDocumento3 pagineAnand RathiShilpa EdarNessuna valutazione finora

- Behavioural Finance & Investment ProcessesDocumento33 pagineBehavioural Finance & Investment ProcessesMoizAliMemonNessuna valutazione finora

- Financing The New VentureDocumento46 pagineFinancing The New Venturearchanasingh22100% (5)

- Product/Service Feasibility AnalysisDocumento14 pagineProduct/Service Feasibility AnalysisAlonnyNessuna valutazione finora

- Wealth ManagementDocumento7 pagineWealth Managementanchit_aswaniNessuna valutazione finora

- Assignment No 1 Competitive Profile MatrixDocumento2 pagineAssignment No 1 Competitive Profile MatrixNuman Rox100% (1)

- The International Monetary System Chapter 11Documento23 pagineThe International Monetary System Chapter 11Ashi GargNessuna valutazione finora

- CB Insights The Future InvestingDocumento26 pagineCB Insights The Future InvestingAlisaNessuna valutazione finora

- FAB Analyst and Investor Day BiosDocumento17 pagineFAB Analyst and Investor Day BioskhuramrajpootNessuna valutazione finora

- Kuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Documento41 pagineKuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Chowdhury Mobarrat Haider AdnanNessuna valutazione finora

- Chapter Questions MKT 1 - 11Documento11 pagineChapter Questions MKT 1 - 11Diego ElizondoNessuna valutazione finora

- Bonus Plan HypothesisDocumento2 pagineBonus Plan HypothesisShamsinaz Mat IsaNessuna valutazione finora

- Module 3 Investment ManagementDocumento17 pagineModule 3 Investment ManagementJennica CruzadoNessuna valutazione finora

- AUDIT BasicDocumento10 pagineAUDIT BasicKingo StreamNessuna valutazione finora

- Helion Ventures Partners Invests in Indian StartupsDocumento4 pagineHelion Ventures Partners Invests in Indian Startupsaimanfatima100% (1)

- What Are The Various Objectives of InvestmentDocumento1 paginaWhat Are The Various Objectives of InvestmentSalil BoranaNessuna valutazione finora

- A Study On Financial Planning and Investment Pattern of Salaried EmployeesDocumento7 pagineA Study On Financial Planning and Investment Pattern of Salaried EmployeesAaron Joshua AguantaNessuna valutazione finora

- Study of Dividend Policy Adopted by Companies: Master of Business AdministrationDocumento125 pagineStudy of Dividend Policy Adopted by Companies: Master of Business AdministrationtechcaresystemNessuna valutazione finora

- Icici Venture Fund Management CompanyDocumento12 pagineIcici Venture Fund Management CompanyRakesh RulzNessuna valutazione finora

- What Do High-Growth Firms in The United States and Europe Teach Policymakers?Documento8 pagineWhat Do High-Growth Firms in The United States and Europe Teach Policymakers?German Marshall Fund of the United StatesNessuna valutazione finora

- Venture Capital in IndiaDocumento32 pagineVenture Capital in IndiasumancallsNessuna valutazione finora

- HDFC Bank StrategyDocumento214 pagineHDFC Bank StrategyMukul Yadav0% (1)

- Opalesque 2011 Singapore RoundtableDocumento25 pagineOpalesque 2011 Singapore RoundtableOpalesque PublicationsNessuna valutazione finora

- Financing The Business: Md. Arafat HossainDocumento25 pagineFinancing The Business: Md. Arafat HossainAhmed Shayer LabibNessuna valutazione finora

- Lecture9_ (MBA-513)Documento25 pagineLecture9_ (MBA-513)Md. Shams SaleheenNessuna valutazione finora

- Informal Risk and Venture CapitalDocumento15 pagineInformal Risk and Venture CapitalZoofi ShanNessuna valutazione finora

- Managing GrowthDocumento18 pagineManaging GrowthgirishvishNessuna valutazione finora

- Business ReportDocumento37 pagineBusiness ReportgirishvishNessuna valutazione finora

- Institutions Supporting EntrepreneursDocumento31 pagineInstitutions Supporting EntrepreneursgirishvishNessuna valutazione finora

- Family BusinessDocumento20 pagineFamily Businessgirishvish100% (1)

- Intro To InnovationDocumento10 pagineIntro To Innovationfnab@hotmail.comNessuna valutazione finora

- Business Planning ProcessDocumento13 pagineBusiness Planning ProcessgirishvishNessuna valutazione finora

- Managing GrowthDocumento11 pagineManaging GrowthgirishvishNessuna valutazione finora

- Creativity and InnovationsDocumento24 pagineCreativity and Innovationsgirishvish100% (1)

- B.N.M Institute of Technology: Department: MBADocumento4 pagineB.N.M Institute of Technology: Department: MBAgirishvishNessuna valutazione finora

- Informal RiskDocumento7 pagineInformal RiskgirishvishNessuna valutazione finora

- EntrepreneurDocumento29 pagineEntrepreneurgirishvishNessuna valutazione finora

- Creativity and InnovationDocumento14 pagineCreativity and InnovationgirishvishNessuna valutazione finora

- Creativity and InnovationDocumento14 pagineCreativity and InnovationgirishvishNessuna valutazione finora

- IBE Structure of IndustriesDocumento24 pagineIBE Structure of IndustriesgirishvishNessuna valutazione finora

- Business Plan OutlineDocumento4 pagineBusiness Plan OutlinemathlanacNessuna valutazione finora

- RecruitmentDocumento20 pagineRecruitmentgirishvishNessuna valutazione finora

- BL InsuranceDocumento15 pagineBL InsurancegirishvishNessuna valutazione finora

- IBE National IncomeDocumento17 pagineIBE National IncomegirishvishNessuna valutazione finora

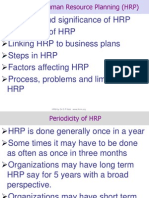

- HR PlanningDocumento19 pagineHR PlanninggirishvishNessuna valutazione finora

- Performance MGTDocumento29 paginePerformance MGTgirishvishNessuna valutazione finora

- Compositions All in OneDocumento1 paginaCompositions All in OneBAZINGA100% (1)

- CFA Society Indonesia Career Guide - WebDocumento31 pagineCFA Society Indonesia Career Guide - Webikram jalilNessuna valutazione finora

- Session4 DueDiligenceDocumento23 pagineSession4 DueDiligenceKanika AhujaNessuna valutazione finora

- A Project ProposalDocumento10 pagineA Project ProposalRam PandeyNessuna valutazione finora

- 2.international FinanceDocumento81 pagine2.international FinanceDhawal RajNessuna valutazione finora

- Porter's 5 forces analysis reveals competition in banking industryDocumento9 paginePorter's 5 forces analysis reveals competition in banking industryYASHASVI SHARMANessuna valutazione finora

- FIN 433 - Exam 1 SlidesDocumento146 pagineFIN 433 - Exam 1 SlidesNayeem MahmudNessuna valutazione finora

- Zakon o Potvrdjivanju ZajmaDocumento41 pagineZakon o Potvrdjivanju ZajmaSlavoljub AleksicNessuna valutazione finora

- Constituents of A Financial SystemDocumento4 pagineConstituents of A Financial SystemDil Shyam D KNessuna valutazione finora

- Symbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Documento24 pagineSymbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Rochak SinglaNessuna valutazione finora

- Primary Dealers and Bond Market Specialists Guidelines 1Documento20 paginePrimary Dealers and Bond Market Specialists Guidelines 1Fuaad DodooNessuna valutazione finora

- Farhat ProjectDocumento49 pagineFarhat ProjectAbdur Rafe Al-AwlakiNessuna valutazione finora

- Income Tax Act Cap 470 Revised 2021-3-1Documento224 pagineIncome Tax Act Cap 470 Revised 2021-3-1danielNessuna valutazione finora

- Prahladrai Dalmia Lions College Of Commerce & Economics: Environmental Management Of Financial ServicesDocumento5 paginePrahladrai Dalmia Lions College Of Commerce & Economics: Environmental Management Of Financial Servicesrahul mehtaNessuna valutazione finora

- Lecture 6 - Alternate Sources of Municipal FinanceDocumento48 pagineLecture 6 - Alternate Sources of Municipal FinancePooja WaybhaseNessuna valutazione finora

- Reid Taylor DRHPDocumento326 pagineReid Taylor DRHPRaghavendra Sattigeri100% (1)

- AIB Capital Company ProfileDocumento16 pagineAIB Capital Company ProfileAlexander BriggsNessuna valutazione finora

- 1 Financial MarketDocumento35 pagine1 Financial MarketSachinGoelNessuna valutazione finora

- Mba Anna University PPT Material For MBFS 2012Documento39 pagineMba Anna University PPT Material For MBFS 2012mail2nsathish67% (3)

- Trust Law EfficiencyDocumento25 pagineTrust Law EfficiencynolienonmeNessuna valutazione finora

- Introduction To Primary Markets 010218Documento4 pagineIntroduction To Primary Markets 010218chee pin wongNessuna valutazione finora

- Investment Test BankDocumento273 pagineInvestment Test BankMarwa Deria.0% (1)

- Chapter 1 Role of Financial Markets and InstitutionsDocumento42 pagineChapter 1 Role of Financial Markets and Institutionschinuuchu100% (2)

- Professional AccountingDocumento35 pagineProfessional AccountinghariNessuna valutazione finora

- GX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFDocumento40 pagineGX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFJyoti KumawatNessuna valutazione finora

- Mutual Fund in NepalDocumento6 pagineMutual Fund in NepalBitaran Jang Maden100% (1)