Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Presentation

Caricato da

Rajesh DassCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Presentation

Caricato da

Rajesh DassCopyright:

Formati disponibili

VOLATILITY OF SECURITIES TRADED ON BSE AN ANALYTICAL STUDY

BY RAJESH 2491100024 RIMS PROJECT GUIDE PROF. PADMA S RAO RIMS

INTRODUCTION

STOCK MARKET: The stock market is a market in which shares are issued and traded either through exchanges or over-the-counter markets. Also known as the equity market, it is one of the most vital areas of a market economy as it provides companies with access to capital and investors with a slice of ownership in the company and the potential of gains based on the company's future performance.

BSE BSE (Bombay Stock Exchange) is a corporatized and demutualised entity, with a broad shareholder-base which includes two leading global exchanges, Deutsche Bourse and Singapore Exchange as strategic partners. BSE provides an efficient and transparent market for trading in equity, debt instruments, derivatives, mutual funds. It also has a platform for trading in equities of small-andmedium enterprises . Around 5000 companies are listed on BSE making it world's No. 1 exchange in terms of listed members.

STATEMENT OF PROBLEM The Indian securities has always witnessed fluctuation, especially Bombay Stock Exchange (BSE) Sensex have more volatility than the securities traded on the NSE. The study attempts identify the volatility of securities listed in Bombay Stock Exchange with special reference to 10 stocks included in Sensex. Moreover this study helps the potential investors make better investment decision based on calculated beta of 10 shares listed in Bombay Stock Exchange (BSE) Sensex.

METHODOLOGY OBJECTIVES: To study the volatility of selected securities listed in the Bombay Stock Exchange (BSE). To find out how individual stock is performing as compared to market index (Sensex). To offer suggestions to investors for taking better investment decision based on findings of the study.

HYPOTHESIS:

The following Null hypothesis was formulated for the research work. Ho: There is no significant relationship between individual stock price changes and market index (BSE).

PROPOSED TOOLS ALPHA - Alpha represents the forecast of residual return, which we consider the future return of any portfolio. BETA - Beta measures market risk. Beta shows how the price of a security responds to market forces. STANDARD DEVIATION - This is to measure the risk associated with securities. MOVING AVERAGE - Calculates the average of a given data Co-efficient of Correlation: Coefficient of Correlation is a statistical technique, which measures the degree or extent to which two or more variables fluctuate with reference to one another.

RESEARCH DESIGN: TYPE OF STUDY: ANALYTICAL STUDY

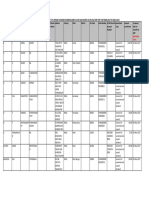

PROPOSED PLAN: Industries that are considered to be leading indicators of stock market will be identified in the first stage. One company from each of the selected industries will be identified for inclusion in the sample in the second stage. The study is to be done selecting different companies of different sectors. The price movements will be observed for period of 3 months. Daily price movements of selected scripts and SENSEX will be observed and closing values will be considered for analysis and comparison.

SAMPLE SIZE: For this study ten companies are being selected. All the companies are the major players in the economy and a part of the Sensex. Three months share prices of different sector stocks. Three month index of BSE.

EXPECTATION: In this research an attempt will be made to analyse the study of volatility of the Equity shares of selected 10 companies traded on BSE. It is expected that the study findings would help to offer suggestions to the investors for taking prudent investment decisions.

REFERENCES

Textbooks: BUSINESS STATISTICS S C GUPTA INVESTMENT SECURITIES PORTFOLIO MANAGEMENTPRASANNA CHANDRA RESEARCH METHODLOGY- C R KOTHARI World Wide Web: www.investorwords.com www.capitalmarket.com www.indianinfoline.com www.bseindia.com.

THANK YOU

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Unclaimed Dividend Data As On 23.9.2016Documento1.775 pagineUnclaimed Dividend Data As On 23.9.2016Swapnilsagar VithalaniNessuna valutazione finora

- Fundraising: StartupsDocumento141 pagineFundraising: StartupsPavan Kumar NNessuna valutazione finora

- A. P 600,000 and P5,500,000: Financial Statement AnalysisDocumento20 pagineA. P 600,000 and P5,500,000: Financial Statement AnalysisDivine Cuasay100% (1)

- Project On Online TradingDocumento81 pagineProject On Online Tradingmupparaju_9100% (1)

- How To Invest in The Philippine Stock Market Final 654A3E338C34F125EF98BBDFB838Documento64 pagineHow To Invest in The Philippine Stock Market Final 654A3E338C34F125EF98BBDFB838Mary Ann Ampo100% (1)

- An Introduction To Value InvestingDocumento36 pagineAn Introduction To Value Investingadib_motiwala100% (2)

- 12 FEB NIFTY FIFTY NSE - National Stock Exchange of India LTDDocumento3 pagine12 FEB NIFTY FIFTY NSE - National Stock Exchange of India LTDAmit KumarNessuna valutazione finora

- What is Equity? Understanding Equity Across Accounting, Real Estate, Investing and StartupsDocumento2 pagineWhat is Equity? Understanding Equity Across Accounting, Real Estate, Investing and StartupsJHERICA SURELLNessuna valutazione finora

- Practices in Financial Accounting Exercise Corporation/EquityDocumento4 paginePractices in Financial Accounting Exercise Corporation/EquityMOHAMAD ASYRAF BIN AZHARNessuna valutazione finora

- Bahria University Midterm Exam QuestionsDocumento3 pagineBahria University Midterm Exam Questionsminza siddiquiNessuna valutazione finora

- Kims HospitalDocumento547 pagineKims Hospitalmanish.wbsNessuna valutazione finora

- Functions and Legal Fram Work of Stock Exchange: (Going On The Right Track)Documento42 pagineFunctions and Legal Fram Work of Stock Exchange: (Going On The Right Track)Rahul SoganiNessuna valutazione finora

- TBChap 007Documento101 pagineTBChap 007wannaflynowNessuna valutazione finora

- Lecture 5Documento47 pagineLecture 5Zixin GuNessuna valutazione finora

- Tutorial Week 3 - Blank - MB 3102 Investment and Capital AnalysisDocumento2 pagineTutorial Week 3 - Blank - MB 3102 Investment and Capital AnalysisMira0% (1)

- Analyzing Effect of Top Five Banks on Indian Stock MarketDocumento21 pagineAnalyzing Effect of Top Five Banks on Indian Stock Marketpappu_k75% (4)

- Note 3Documento37 pagineNote 3Anurag JainNessuna valutazione finora

- Stock Exchange DissertationDocumento5 pagineStock Exchange DissertationPaySomeoneToWriteAPaperForMeUK100% (1)

- SDC Thomson TRX Value ComparisonDocumento10 pagineSDC Thomson TRX Value ComparisonAurino DjamarisNessuna valutazione finora

- DR DIsc - Platinum Equity - Avatar Growth - SirionLabsDocumento1 paginaDR DIsc - Platinum Equity - Avatar Growth - SirionLabsNeelima MaheshwariNessuna valutazione finora

- Gujarat Stock ExchangeDocumento40 pagineGujarat Stock ExchangeSamriddhi RakhechaNessuna valutazione finora

- Wally Considers Adding Income Stocks for Higher DividendsDocumento18 pagineWally Considers Adding Income Stocks for Higher Dividendscathy evangelistaNessuna valutazione finora

- Sbux, Peet, and Pro-Forma Pete-DdrxDocumento12 pagineSbux, Peet, and Pro-Forma Pete-DdrxfcfroicNessuna valutazione finora

- Case Study: Harshad MehtaDocumento4 pagineCase Study: Harshad MehtamehulNessuna valutazione finora

- Capital Market Operations - Lecture 2Documento19 pagineCapital Market Operations - Lecture 2s harsha vardhanNessuna valutazione finora

- Common and Preferred StockDocumento3 pagineCommon and Preferred StockChristianRuizNessuna valutazione finora

- Jurnal Okta PDFDocumento10 pagineJurnal Okta PDFJason JenalNessuna valutazione finora

- Presentation On Preferential Allotment' - by Mahavir LunawatDocumento37 paginePresentation On Preferential Allotment' - by Mahavir LunawatArunachalam SubramanianNessuna valutazione finora

- Precautions of Online TradingDocumento6 paginePrecautions of Online TradingAnkit AgarwalNessuna valutazione finora

- Secondary Equity Market (Stock Market)Documento12 pagineSecondary Equity Market (Stock Market)JagrityTalwarNessuna valutazione finora