Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

400 PPT 10 For Topic 2 Long-Term K Management

Caricato da

Divya_Madisett_788Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

400 PPT 10 For Topic 2 Long-Term K Management

Caricato da

Divya_Madisett_788Copyright:

Formati disponibili

0

TOPIC 2

Long-Term Capital Management

K Structure: Basic Concepts

RWJ_16

2

How should a firm choose its

debtequity ratio?

Define the value (V) of a firm as the sum

of the value of the firms debt (B) and the firms

equity (S): V = B + S

If the goal is to make V as

large as possible, then we

need to pick the D/E ratio

that makes the pie as big as

possible.

Value of the Firm

S B S B S B S B

3

!!!

Note that we defined V as B+S. Can we

define it differently? For e.g., why not ALL

stakeholders, not just owners and creditors?

4

Stockholder Interests

1.Why should shareholders care about maximizing V?

Shouldnt they be interested in strategies that maximize

S not V?

2.The question the manager has to answer is: what B/S

ratio (what K structure) maximizes shareholders value?

As it turns out, changes in K structure increases S if and

only if V increases. To see this, consider the following

example.

5

An all-equity firm consists of 400 shares,

currently priced at $50.

The firm wants to borrow $8,000 at 8%

and use it to buy back 160 shares at $50

each.

How will this restructuring affect V?

e.g. In a world

without taxes

6

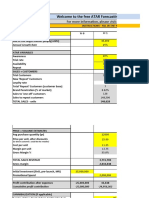

K structure: Current and Proposed

Current

Assets $20,000

Debt $0

Equity $20,000

B/S 0.00

Interest rate n/a

Shares outstanding 400

Share price $50

Proposed

$20,000

$8,000

$12,000

2/3

8%

240

$50

7

EPS and ROE Under Current Structure

in Two States of the World

(What probabilities are associated with these states of the world?)

Recession Expected Expansion

EBI $1,000 $2,000 $3,000

Interest 0 0 0

Net income $1,000 $2,000 $3,000

EPS $2.50 $5.00 $7.50

ROA 5% 10% 15%

ROE 5% 10% 15%

Current Shares Outstanding = 400 shares

8

EPS and ROE Under Proposed Structure

in Same Two States of the World

Recession Expected Expansion

EBI $1,000 $2,000 $3,000

Interest 640 640 640

Net income $360 $1,360 $2,360

EPS $1.50 $5.67 $9.83

ROA 1.8% 6.8% 11.8%

ROE 3.0% 11.3% 19.7%

Proposed Shares Outstanding = 240 shares

9

Financial Leverage and EPS

(2.00)

0.00

2.00

4.00

6.00

8.00

10.00

12.00

1,000 2,000 3,000

E

P

S

Debt

No Debt

Break-even

point :EBI=800

EBI, no taxes

Advantage

to debt

Disadvantage

to debt

10

!!!

Note that leverage increases the risk to

shareholders: if the state turns out recession,

shareholders will suffer a loss under proposed

structure.

11

So,

- which K structure is better? i.e.

- did changing the mix (the ratio) of

equity (S) and debt (B) make S

larger?

- did changing the mix (the ratio) of

equity (S) and debt (B) make V

larger?

12

MM1 __F. Modigliani and M. Miller, The Cost of Capital,

Corporation Finance and the Theory of Investment,

American Economic Review (June 1958)

NO, says MM1. V remains the same under different

B/S values Managers cannot change V by

changing B/S Managers cannot change S by

changing B/S .

MM model (their set of assumptions) + their argument

(homemade leverage) lead to their stunning proposition:

K Structure is Irrelevant

V

levered

= V

unlevered

13

Assumptions of MM Model

Homogeneous Expectations

Homogeneous Business Risk Classes

Perpetual Cash Flows

Perfect Capital Markets:

Perfect competition

Firms and investors can borrow/lend at the same rate

Equal access to all relevant information

No transaction costs

No taxes

No Bankruptcy costs

14

MM key argument: Homemade Leverage

Shareholders can achieve any pattern of payouts they desire with homemade

leverage

An investor can match the desired leverage

ratio: purchase 40 shares of the all-equity

firm using $800 of borrowed funds (at 8%)

and $1,200 of own funds.

The personal debt equity ratio is:

3

2

200 , 1 $

800 $

= =

S

B

15

Homemade Leverage

Long 40 shares of an all-equity firm, using $800 in margin at 8% interest

and $1200 of own funds.

Recession Expected Expansion

EPS of Unlevered Firm $2.50 $5.00 $7.50

Earnings for 40 shares $100 $200 $300

Less interest on $800 (8%) $64 $64 $64

Net Profits $36 $136 $236

ROE (Net Profits / $1,200) 3.0% 11.3% 19.7%

Investor achieves the same ROE as shareholders of

a levered firm.

16

Homemade Un-leverage Argument

A current levered-firm shareholder with a

total of 40 shares can achieve the desired

leverage ratio of zero by selling 16 shares at

$50 a share and using the proceeds to buy

$800 worth of the firms debt. Thus this

shareholder remains fully invested in the firm

with $1,200 invested in the firms equity and

$800 in its debt.

17

Homemade Un-leverage

Long $1200 worth of shares of levered firm, and $800 of its debt .

Recession Expected Expansion

EPS of Levered Firm $1.50 $5.67 $9.83

Earnings for 24 shares $36 $136 $236

Plus interest on $800 (8%) $64 $64 $64

Net Profits $100 $200 $300

ROE (Net Profits / $2,000) 5% 10% 15%

Investor achieves the same ROE as shareholders of

all-equity firm.

18

Hence MM Proposition I

( with No Taxes & No bankruptcy costs)

We can create a levered or unlevered position

by adjusting the trading in our own account

regardless of what management decides.

This homemade leverage suggests that capital

structure is irrelevant in determining the value

of the firm. So,

in a world without taxes, V

L

= V

U

19

MM Proposition II

(with No Taxes & No bankruptcy costs)

Leverage increases the risk and return to

stockholders

R

s

= R

0

+ (B / S

L

) (R

0

- R

B

)

R

B

is the cost of debt

R

s

is the return on (levered) equity (cost of equity)

R

0

is the return on unlevered equity (cost of capital=cost

of equity when debt is 0)

B is the value of debt

S

L

is the value of levered equity

20

MM Proposition II

( with No Taxes & No bankruptcy costs)

Debt-to-equity Ratio

C

o

s

t

o

f

c

a

p

i

t

a

l

:

R

(

%

)

R

0

R

B

S B WACC

R

S B

S

R

S B

B

R

+

+

+

=

) (

0 0 B

L

S

R R

S

B

R R + =

R

B

S

B

21

MM Proposition I

(with Taxes But No bankruptcy costs)

B T V V

C U L

+ =

B R T B R EBIT

B C B

+ ) 1 ( ) (

is rs shareholde & s bondholder to flow cash total The

The present value of this stream of cash flows is V

L

= + B R T B R EBIT

B C B

) 1 ( ) ( Clearly

The present value of the first term is V

U

The present value of the second term is T

C

B

B R T B R T EBIT

B C B C

+ = ) 1 ( ) 1 (

B R BT R B R T EBIT

B C B B C

+ + = ) 1 (

22

MM Proposition II

(with Taxes But No bankruptcy costs)

Start with M&M Proposition I with taxes:

) ( ) 1 (

0 0 B C S

R R T

S

B

R R + =

B T V V

C U L

+ =

Since

B S V

L

+ =

The cash flows from each side of the balance sheet must equal:

B C U B S

BR T R V BR SR + = +

0

B R T R T B S BR SR

B C C B S

+ + = +

0

)] 1 ( [

Divide both sides by S

B C C B S

R T

S

B

R T

S

B

R

S

B

R + + = +

0

)] 1 ( 1 [

B T V B S

C U

+ = +

) 1 (

C U

T B S V + =

Which reduces to

23

MM Propositions I & II

(with Taxes But No bankruptcy costs)

Proposition I (with Corporate Taxes)

Firm value increases with leverage

V

L

= V

U

+ T

C

B

Proposition II (with Corporate Taxes)

Some of the increase in equity risk and return is

offset by the interest tax shield

R

S

= R

0

+ (B/S)(1-T

C

)(R

0

- R

B

)

24

Effect of Financial Leverage

Debt-to-equity

ratio (B/S)

Cost of capital: R

(%)

R

0

R

B

) ( ) 1 (

0 0 B C

L

S

R R T

S

B

R R + =

S

L

L

C B

L

WACC

R

S B

S

T R

S B

B

R

+

+

+

= ) 1 (

) (

0 0 B

L

S

R R

S

B

R R + =

25

Total Cash Flow to Investors

Recession Expected Expansion

EBIT $1,000 $2,000 $3,000

Interest 0 0 0

EBT $1,000 $2,000 $3,000

Taxes (Tc = 35%) $350 $700 $1,050

Total Cash Flow to S/H $650 $1,300 $1,950

Recession Expected Expansion

EBIT $1,000 $2,000 $3,000

Interest ($800 @ 8% ) 640 640 640

EBT $360 $1,360 $2,360

Taxes (Tc = 35%) $126 $476 $826

Total Cash Flow $234+640 $884+$640 $1,534+$640

(to both S/H & B/H): $874 $1,524 $2,174

EBIT(1-Tc)+T

C

R

B

B $650+$224 $1,300+$224 $1,950+$224

$874 $1,524 $2,174

A

l

l

E

q

u

i

t

y

L

e

v

e

r

e

d

26

Total Cash Flow to Stakeholders

The levered firm pays less in taxes than does the all-equity firm.

Thus, V= the sum of the debt plus the equity of the levered firm is

greater than V= equity of the unlevered firm.

This is how cutting the pie differently can make the pie larger. -

the government takes a smaller slice of the pie and by construction,

government is not a stakeholder in the firm!!

S G S G

B

All-equity firm Levered firm

K Structure: Limits to the use

of debt

RWJ_17

28

Example: Company in Distress

Assets BV MV Liabilities BV MV

Cash $200 $200 LT bonds $300

Fixed Asset $400 $0 Equity $300

Total $600 $200 Total $600 $200

What happens if the firm is liquidated today?

$200

$0

29

So, Selfish Strategy 1: Take Risks

Gamble Probability Payoff

Win Big 10% $1,000

Lose Big 90% $0

Cost of investment is $200 (all the firms cash)

Required return is 50%

Expected CF from the Gamble = $1000 0.10 + $0 = $100

NPV = $200 +

$100

(1.50)

NPV = $133

30

Selfish Strategy 1: Take Risks

Expected CF from the Gamble

To Bondholders = $300 0.10 + $0 = $30

To Stockholders = ($1000 $300) 0.10 + $0 = $70

PV of Bonds Without the Gamble = $200

PV of Stocks Without the Gamble = $0

$20 =

$30

(1.50)

PV of Bonds With the Gamble:

$47 =

$70

(1.50)

PV of Stocks With the Gamble:

31

Selfish Strategy 2: Underinvestment

Suppose that this firm has access to a government-

sponsored project that guarantees $350 in one

period.. The cost of investment is $300 (the firm

only has $200 now), so the stockholders will have to

supply an additional $100 to finance the project.

Required return is 10%.

-Should we accept or reject?

NPV = $300 +

$350

(1.10)

NPV = $18.18

32

Selfish Strategy 2: Underinvestment

Expected CF from the government sponsored project:

To Bondholder = $300

To Stockholder = ($350 $300) = $50

PV of Bonds Without the Project = $200

PV of Stocks Without the Project = $0

$272.73 =

$300

(1.10)

PV of Bonds With the Project:

$54.55 =

$50

(1.10)

PV of Stocks With the Project: $100

33

Selfish Strategy 3: Milking the Property

Thru Liquidating dividends

Suppose our firm pays out a $200 dividend to the

shareholders. This leaves the firm insolvent, with

nothing for the bondholders, but plenty for the

former shareholders.

Such tactics often violate bond indentures.

Thru Increasing perquisites to shareholders

and/or management

34

Tax Effects and Financial Distress

There is a trade-off between the tax

advantage of debt and the costs of

financial distress.

It is difficult to express this with a precise

and rigorous formula.

35

Tax Effects and Financial Distress, graphically: The firms

capital structure is optimized where the marginal subsidy to debt

equals the marginal cost.

Debt (B)

Value of firm (V)

0

Present value of tax

shield on debt

Present value of

financial distress costs

Value of firm under

MM with corporate

taxes and debt

V

L

= V

U

+ T

C

B

V = Actual value of firm

B

*

Maximum

firm value

Optimal amount of debt

36

The Pie Revisited

Taxes and bankruptcy costs can be viewed as just

another claim on the cash flows of the firm.

Let G and L stand for payments to the government

and bankruptcy lawyers, respectively.

V

T

= S + B + G + L

The essence of the M&M intuition is

that V

T

depends on the cash flow of the firm;

capital structure just slices the pie.

S

G

B

L

37

Signaling

Investors view debt as a signal of firm value.

Firms with low anticipated profits will take on a low level

of debt.

Firms with high anticipated profits will take on a high

level of debt.

A manager that takes on more debt than is optimal in

order to fool investors will pay the cost in the long

run.

38

Agency Cost of Equity

An individual will work harder for a firm if he is one of the

owners than if he is one of the hired help.

While managers may have motive to partake in perquisites,

they also need opportunity. Free cash flow provides this

opportunity.

The free cash flow hypothesis says that an increase in

dividends should benefit the stockholders by reducing the

ability of managers to pursue wasteful activities.

The free cash flow hypothesis also argues that an increase

in debt will reduce the ability of managers to pursue

wasteful activities more effectively than dividend increases.

39

The Pecking-Order Theory

firms prefer to issue debt rather than equity if

internal financing is insufficient. The order is:

Use internal financing first

Issue debt next,

new equity last

The pecking-order theory is at odds with the tradeoff

theory:

There is no target D/E ratio

Profitable firms use less debt

40

Growth and the Debt-Equity Ratio

Growth implies significant equity financing,

even in a world with low bankruptcy costs.

Thus, high-growth firms will have lower

debt ratios than low-growth firms.

41

Personal Taxes

Dividends face double taxation (firm and

shareholder), which suggests a stockholder

receives the net amount:

(1-T

C

) x (1-T

S

)

Interest payments are only taxed at the individual

level since they are tax deductible by the

corporation, so the bondholder receives:

(1-T

B

)

42

Personal Taxes

If T

S

= T

B

then the firm should be financed

primarily by debt (avoiding double tax).

The firm is indifferent between debt and

equity when:

(1-T

C

) x (1-T

S

) = (1-T

B

)

Valuation and Capital

Budgeting for the Levered

Firm

Three approaches

RWJ_18

44

The Adjusted Present Value (APV) Approach

for valuing projects with leverage

APV = NPV + NPVF

The value of a project to the firm can be thought of as

the value of the project to an unlevered firm (NPV)

plus the present value of the financing side effects

(NPVF).

There are four side effects of financing:

The Tax Subsidy to Debt

The Costs of Issuing New Securities

The Costs of Financial Distress

Subsidies to Debt Financing

45

APV Example

0 1 2 3 4

$1,000 $125 $250 $375 $500

50 . 56 $

) 10 . 1 (

500 $

) 10 . 1 (

375 $

) 10 . 1 (

250 $

) 10 . 1 (

125 $

000 , 1 $

% 10

4 3 2

% 10

=

+ + + + =

NPV

NPV

The unlevered cost of equity is R

0

= 10%:

The project would be rejected by an all-equity firm: NPV < 0.

Consider a project of the Pearson Company. The timing and size

of the incremental after-tax cash flows for an all-equity firm are:

46

APV Example

Now, imagine that the firm finances the project with $600 of

debt at R

B

= 8%.

Pearsons tax rate is 40%, so they have an interest tax shield

worth T

C

BR

B

= .40$600.08 = $19.20 each year.

- The net present value of the project under leverage is:

APV = NPV + NPV

debt tax shield

=

+ =

4

1

) 08 . 1 (

20 . 19 $

50 . 56 $

t

t

APV

09 . 7 $ 59 . 63 50 . 56 $ = + = APV

- So, Pearson should accept the project with debt.

47

The Flow to Equity Approach

for valuing projects with leverage

Discount the cash flow from the project to the

equity holders of the levered firm at the cost of

levered equity capital, R

S

.

There are three steps in the FTE Approach:

Step One: Calculate the levered cash flows (LCFs)

Step Two: Calculate R

S

.

Step Three: Value the levered cash flows at R

S

.

48

Step One: Levered Cash Flows

Since the firm is using $600 of debt (interest-only

loan), the equity holders only have to provide $400

of the initial $1,000 investment.

Thus, CF

0

= $400

Each period, the equity holders must pay interest

expense. The after-tax cost of the interest is:

BR

B

(1 T

C

) = $600.08(1 .40) = $28.80

49

Step One: Levered Cash Flows

$400 $221.20

CF

2

= $250 28.80

$346.20

CF

3

= $375 28.80

$128.80

CF

4

= $500 28.80 600

CF

1

= $125 28.80

$96.20

0 1 2 3 4

50

Step Two: Calculate R

S

) )( 1 (

0 0 B C S

R R T

S

B

R R + =

=

+ + + + =

4

1

4 3 2

) 08 . 1 (

20 . 19

) 10 . 1 (

500 $

) 10 . 1 (

375 $

) 10 . 1 (

250 $

) 10 . 1 (

125 $

t

t

PV

B = $600 when V = $1,007.09 so S = $407.09.

% 77 . 11 ) 08 . 10 )(. 40 . 1 (

09 . 407 $

600 $

10 . = + =

S

R

P V = $943.50 + $63.59 = $1,007.09

B

S

B

V

To calculate the debt to equity ratio, , start with

51

!

This assumes we know the value created by

the project. A more straightforward

assumption is to assume that the ratio is

600/400, based on the amount provided by

each source to fund the project. With these

values, R

S

=11.80%.

52

Step Three: Valuation

Discount the cash flows to equity holders at R

S

=

11.77%

56 . 28 $

) 1177 . 1 (

80 . 128 $

) 1177 . 1 (

20 . 346 $

) 1177 . 1 (

20 . 221 $

) 1177 . 1 (

20 . 96 $

400 $

4 3 2

=

+ + + =

NPV

NPV

0 1 2 3 4

$400 $96.20 $221.20 $346.20 $128.80

53

WACC Method

To find the value of the project, discount the

unlevered cash flows at the weighted average cost of

capital.

Suppose Pearsons target debt to equity ratio is 1.50

) 1 (

C B S WACC

T R

B S

B

R

B S

S

R

+

+

+

=

54

WACC Method

% 58 . 7

) 40 . 1 ( %) 8 ( ) 60 . 0 ( %) 77 . 11 ( ) 40 . 0 (

=

+ =

WACC

WACC

R

R

S

B

= 50 . 1

B S = 5 . 1

60 . 0

5 . 2

5 . 1

5 . 1

5 . 1

= =

+

=

+ S S

S

B S

B

40 . 0 60 . 0 1 = =

+ B S

S

55

WACC Method

To find the value of the project, discount the

unlevered cash flows at the weighted average

cost of capital

4 3 2

) 0758 . 1 (

500 $

) 0758 . 1 (

375 $

) 0758 . 1 (

250 $

) 0758 . 1 (

125 $

000 , 1 $ + + + + = NPV

NPV

7.58%

= $6.68

56

Comparing APV, FTE, & WACC Approaches

All three approaches attempt the same task:

valuation in the presence of debt financing.

Guidelines:

Use WACC or FTE if the firms target debt-to-value

ratio applies to the project over the life of the project.

Use the APV if the projects level of debt is known

over the life of the project.

In the real world, the WACC is, by far, the most

widely used.

57

Comparing APV, FTE, & WACC Approaches

Which approach is best?

Use APV when the level of debt is constant

Use WACC and FTE when the debt ratio is

constant

WACC is by far the most common

FTE is a reasonable choice for a highly levered

firm

58

Capital Budgeting When the Discount Rate Must

Be Estimated

A scale-enhancing project is one where the project is

similar to those of the existing firm.

In the real world, executives would make the

assumption that the business risk of the non-scale-

enhancing project would be about equal to the

business risk of firms already in the business.

No exact formula exists for this. Some executives

might select a discount rate slightly higher on the

assumption that the new project is somewhat riskier

since it is a new entrant.

59

Beta and Leverage

Recall that an asset beta would be of the

form:

2

Market

Asset

) , (

Market UCF Cov

=

60

Beta and Leverage: No Corporate Taxes

In a world without corporate taxes, and with riskless

corporate debt (|

Debt

= 0), it can be shown that the

relationship between the beta of the unlevered firm

and the beta of levered equity is:

Equity Asset

Asset

Equity

=

- In a world without corporate taxes, and with risky

corporate debt, it can be shown that the relationship

between the beta of the unlevered firm and the beta of

levered equity is:

Equity Debt Asset

Asset

Equity

Asset

Debt

+ =

61

Beta and Leverage: With Corporate Taxes

In a world with corporate taxes, and riskless

debt, it can be shown that the relationship

between the beta of the unlevered firm and the

beta of levered equity is:

firm Unlevered Equity

) 1 (

Equity

Debt

1

|

|

.

|

\

|

+ =

C

T

- Since must be more than 1 for a

levered firm, it follows that |

Equity

> |

Unlevered firm

|

|

.

|

\

|

+ ) 1 (

Equity

Debt

1

C

T

62

If the beta of the debt is non-zero, then:

L

C

S

B

T + = ) )( 1 (

Debt firm Unlevered firm Unlevered Equity

Beta and Leverage: With Corporate Taxes

63

Summary

1. The APV formula can be written as:

2. The FTE formula can be written as:

3. The WACC formula can be written as

investment

Initial

debt

of effects

Additional

) 1 (

1

0

+

+

=

= t

t

t

R

UCF

APV

|

|

.

|

\

|

+

=

=

borrowed

Amount

investment

Initial

) 1 (

1 t

t

S

t

R

LCF

FTE

investment

Initial

) 1 (

1

+

=

= t

t

WACC

t

WACC

R

UCF

NPV

64

4 Use the WACC or FTE if the firm's target debt to

value ratio applies to the project over its life.

- WACC is the most commonly used by far.

- FTE has appeal for a firm deeply in debt.

5 The APV method is used if the level of debt is

known over the projects life.

- The APV method is frequently used for special

situations like interest subsidies, LBOs, and leases.

6 The beta of the equity of the firm is positively

related to the leverage of the firm.

Payout

RWJ_19

66

Different Types of Payouts

Many companies pay a regular cash dividend

Public companies often pay quarterly.

Sometimes firms will pay an extra cash dividend.

The extreme case would be a liquidating dividend.

Companies will often declare stock dividends

No cash leaves the firm.

The firm increases the number of shares outstanding.

Some companies declare a dividend in kind

Wrigleys Gum sends a box of chewing gum.

Other companies use stock buybacks

67

Price Behavior

In a perfect world, the stock price will fall by the

amount of the dividend on the ex-dividend date.

$P

$P - div

Ex-

dividend

Date

The price drops

by the amount of

the cash

dividend.

-t

-2 -1 0 +1 +2

68

The Irrelevance of Dividend Policy?

A compelling case can be made that dividend

policy is irrelevant.

Dividend policy will have no impact on the

value of the firm because investors can create

whatever income stream they prefer by using

homemade dividends (i.e. convert shares to

cash at will)

69

Homemade Dividends example

Bianchi Inc. is a $42 stock about to pay a $2 cash dividend.

Bob Investor owns 80 shares and prefers a $3 dividend.

Bobs homemade dividend strategy:

Sell 2 shares ex-dividend

homemade dividends

Cash from dividend $160

Cash from selling stock $80

Total Cash $240

Value of Stock Holdings $40 78 =

$3,120

$3 Dividend

$240

$0

$240

$39 80 =

$3,120

70

Dividend Policy Is Irrelevant

In the above example, Bob Investor began with a

total wealth of $3,360:

share

42 $

shares 80 360 , 3 $ =

240 $

share

39 $

shares 80 360 , 3 $ + =

80 $ 160 $

share

40 $

shares 78 360 , 3 $ + + =

- After a $3 dividend, his total wealth is still $3,360:

- After a $2 dividend and sale of 2 ex-dividend shares, his

total wealth is still $3,360:

71

Personal Taxes, Dividends, and Stock Repurchases

To get the result that dividend policy is irrelevant,

we needed three assumptions:

No taxes

No transactions costs

No uncertainty

In the United States, both cash dividends and capital

gains are (currently) taxed at a maximum rate of 15

percent.

Since capital gains can be deferred, the tax rate on

dividends is greater than the effective rate on capital

gains.

72

Stock Repurchase versus Dividend

$10 = /100,000 $1,000,000

=

Price per share

100,000

=

outstanding Shares

1,000,000 Value of Firm 1,000,000 Value of Firm

1,000,000 Equity 850,000 Assets Other

0 Debt $150,000 Cash

sheet balance Original A.

Equity & Liabilities Assets

Consider a firm that wishes to distribute $100,000 to its

shareholders.

73

Stock Repurchase versus Dividend

$9 = 00,000 $900,000/1 = share per Price

100,000 = g outstandin Shares

900,000 Firm of Value 900,000 Firm of Value

900,000 Equity 850,000 Assets Other

0 Debt $50,000 Cash

dividend cash share per $1 After B.

Equity & s Liabilitie Assets

If they distribute the $100,000 as a cash dividend, the balance

sheet will look like this:

74

Stock Repurchase versus Dividend

Assets Li abilities & Equity

C. After stock repurchase

Cash $50,000 Debt 0

Other Assets 850,000 Equity 900,000

Value of Firm 900,000 Value of Firm 900,000

Shares outstanding = 90,000

Price per share = $900,000 / 90,000 = $10

If they distribute the $100,000 through a stock repurchase, the

balance sheet will look like this:

75

The Clientele Effect

Clienteles for various dividend payout policies

are likely to form in the following way:

Group Stock Type

High Tax Bracket Individuals

Low Tax Bracket Individuals

Tax-Free Institutions

Corporations

Zero-to-Low payout

Low-to-Medium payout

Medium payout

High payout

Once the clienteles have been satisfied, a corporation is

unlikely to create value by changing its dividend policy.

76

What We Know

- Corporations smooth dividends.

- Fewer companies are paying dividends.

- Dividends provide information to the

market.

- Firms should follow a sensible policy:

Do not forgo positive NPV projects just to pay a dividend.

Avoid issuing stock to pay dividends.

Consider share repurchase when there are few better uses for the

cash.

77

What we know

- Aggregate payouts are massive and have

increased over time.

- Dividends are concentrated among a small

number of large, mature firms.

- Managers are reluctant to cut dividends.

- Stock prices react to unanticipated changes

in dividends.

78

Stock Dividends

- Additional shares of stock are distributed instead

of cash Increases the number of outstanding

shares.

- we say Small stock dividend if less than 20 to

25%, otherwise Large stock dividend

If you own 100 shares and the company declared a

10% stock dividend, you would receive an

additional 10 shares.

79

Stock Splits

Stock splits are essentially the same as a stock

dividend except expressed as a ratio

For example, a 2 for 1 stock split is the same as a

100% stock dividend.

Stock price is reduced when the stock splits.

Common explanation for split is to return price

to a more desirable trading range

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Valuation of L.A. Café Restaurant Using 3 ScenariosDocumento4 pagineValuation of L.A. Café Restaurant Using 3 ScenariosCelso Lopez100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Toll Road Financial Model v1-0Documento52 pagineToll Road Financial Model v1-0siby13172100% (3)

- 4831 S2016 PS2 AnswerKeyDocumento9 pagine4831 S2016 PS2 AnswerKeyAmy20160302Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Concerns with DCF analysis for Intermediate Chemicals Group projectDocumento2 pagineConcerns with DCF analysis for Intermediate Chemicals Group projectJia LeNessuna valutazione finora

- Acca f2 Fma Study Text PDF Full View DowDocumento155 pagineAcca f2 Fma Study Text PDF Full View DowAlan CortésNessuna valutazione finora

- 400 Syllabus Spring2013 Sec 05Documento2 pagine400 Syllabus Spring2013 Sec 05Divya_Madisett_788Nessuna valutazione finora

- 400 PPT 10 For Topic 2 Long-Term K ManagementDocumento80 pagine400 PPT 10 For Topic 2 Long-Term K ManagementDivya_Madisett_788Nessuna valutazione finora

- Class 6 Chap 3 The Five ForcesDocumento22 pagineClass 6 Chap 3 The Five ForcesDivya_Madisett_788Nessuna valutazione finora

- Class 5 Chap 2 Create Implement StrategyDocumento19 pagineClass 5 Chap 2 Create Implement StrategyDivya_Madisett_788Nessuna valutazione finora

- Practice 6 - QuestionsDocumento4 paginePractice 6 - QuestionsantialonsoNessuna valutazione finora

- Economic Justification: Measuring Return On Investment (ROI) and Cost Benefit Analysis (CBA)Documento5 pagineEconomic Justification: Measuring Return On Investment (ROI) and Cost Benefit Analysis (CBA)Wisnu1201091Nessuna valutazione finora

- Feasibility Analysis of Business Case Study in Indonesia MinimarketDocumento6 pagineFeasibility Analysis of Business Case Study in Indonesia MinimarketMohsin HaiderNessuna valutazione finora

- Question and Answer - 43Documento30 pagineQuestion and Answer - 43acc-expertNessuna valutazione finora

- Fatima ReyesDocumento26 pagineFatima ReyesNadia Che SafriNessuna valutazione finora

- SD21 APM Sample Answers - Clean - ProofDocumento10 pagineSD21 APM Sample Answers - Clean - ProofCheng Chin HwaNessuna valutazione finora

- CH 6Documento32 pagineCH 6Zead MahmoodNessuna valutazione finora

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Documento27 pagineQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNessuna valutazione finora

- Chapter 12 Risk and Refinements On CB: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento26 pagineChapter 12 Risk and Refinements On CB: © 2012 Pearson Prentice Hall. All Rights ReservedMyra NicdaoNessuna valutazione finora

- Pavement Type Selection For Developing Countries Applying Life Cycle Cost AnalysisDocumento7 paginePavement Type Selection For Developing Countries Applying Life Cycle Cost AnalysisIJAR JOURNALNessuna valutazione finora

- Answers 01 Capital-Budgeting Quizzer-1Documento8 pagineAnswers 01 Capital-Budgeting Quizzer-1Mary Grace MontojoNessuna valutazione finora

- Ch. 5Documento10 pagineCh. 5Abel ZewdeNessuna valutazione finora

- Mergers Acquisitions Valuation With ExcelDocumento4 pagineMergers Acquisitions Valuation With ExcelTazeen Islam0% (1)

- Winter 2010 Midterm With SolutionsDocumento11 pagineWinter 2010 Midterm With Solutionsupload55Nessuna valutazione finora

- Universitas Indonesia Fakultas Ekonomi & Bisnis Department of Accounting Undergraduate ProgramDocumento5 pagineUniversitas Indonesia Fakultas Ekonomi & Bisnis Department of Accounting Undergraduate ProgramYogie YaditraNessuna valutazione finora

- CH 4 Feasibility Study and Business PlanDocumento87 pagineCH 4 Feasibility Study and Business PlanMihretab Bizuayehu (Mera)Nessuna valutazione finora

- 1st Year Honours Syllabus of Finance and BankingDocumento12 pagine1st Year Honours Syllabus of Finance and Bankingjewel7ranaNessuna valutazione finora

- Kajian Kadar Batas Optimum Optimum Cut Off Grade Pada Penambangan Nikel Laterit Dengan Penjualan Dalam Bentuk Material Bijih MentahDocumento6 pagineKajian Kadar Batas Optimum Optimum Cut Off Grade Pada Penambangan Nikel Laterit Dengan Penjualan Dalam Bentuk Material Bijih MentahasmarNessuna valutazione finora

- Foundations in Financial Management (FFM) September 2016 To June 2017Documento10 pagineFoundations in Financial Management (FFM) September 2016 To June 2017Khánh LyNessuna valutazione finora

- The Total Economic Impact of Salesforce B2B CommerceDocumento27 pagineThe Total Economic Impact of Salesforce B2B CommerceVenkata Sundaragiri100% (1)

- ATAR Model 1 1Documento19 pagineATAR Model 1 1Randel Christian AmoraNessuna valutazione finora

- Difference Between NPV and IRR (With Comparison Chart) - Key DifferencesDocumento9 pagineDifference Between NPV and IRR (With Comparison Chart) - Key DifferencessunilsinghmNessuna valutazione finora

- Chapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocumento2 pagineChapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNessuna valutazione finora

- Amendments Ca Final SFM by Aaditya Jain SirDocumento14 pagineAmendments Ca Final SFM by Aaditya Jain SirVijayaNessuna valutazione finora

- Seminar Activity Pack 2015-16 PDFDocumento14 pagineSeminar Activity Pack 2015-16 PDFclova DawkinsNessuna valutazione finora