Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CH 09 Show

Caricato da

Muzafar AliTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CH 09 Show

Caricato da

Muzafar AliCopyright:

Formati disponibili

7 - 1

CHAPTER 7

Bonds and Their Valuation

Key features of bonds

Bond valuation

Measuring yield

Assessing risk

7 - 2

Key Features of a Bond

1. Par value: Face amount; paid

at maturity. Assume $1,000.

2. Coupon interest rate: Stated

interest rate. Multiply by par

value to get dollars of interest.

Generally fixed.

(More)

7 - 3

3. Maturity: Years until bond

must be repaid. Declines.

4. Issue date: Date when bond

was issued.

5. Default risk: Risk that issuer

will not make interest or

principal payments.

7 - 4

How does adding a call provision

affect a bond?

Issuer can refund if rates decline.

That helps the issuer but hurts the

investor.

7 - 5

The basic Bond Valuation Model

( ) ( ) ( )

V

B

=

CF

1 +

K

d

. . . +

M+CF

1 +

K

d

1

n

1

2

2

1

CF

K

d

n

.

0 1 2 N

K

d

%

CF

1

Or INT

CF

n

Or INT

M

CF

2

Or INT

Bonds Value

...

+ +

+

7 - 6

The discount rate (K

d

) is the

opportunity cost of capital, i.e.,

the rate that could be earned on

alternative investments of equal

risk.

k

i

= k

*

+ IP + LP + MRP + DRP

for debt securities.

7 - 7

Whats the value of a 10-year, 10%

coupon bond if K

d

= 10%?

( ) ( )

V

K

B

d

=

$100 $1 , 000

1

1 10 10

. . .

+

$100

1 + K

d

100 100

0 1 2 10

10%

100 + 1,000 V = ?

...

= $90.91 + . . . + $38.55 + $385.54

= $1,000.

+ +

+

1 K +

( ) d

7 - 8

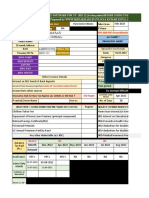

10 10 100 1000

N I/YR PV PMT FV

-1,000

The bond consists of a 10-year, 10%

annuity of $100/year plus a $1,000 lump

sum at t = 10:

$ 614.46

385.54

$1,000.00

PV annuity

PV maturity value

Value of bond

=

=

=

INPUTS

OUTPUT

7 - 9

10 13 100 1000

N I/YR PV PMT FV

-837.21

When k

d

rises, above the coupon rate,

the bonds value falls below par, so it

sells at a discount.

What would happen if expected

inflation rose by 3%, causing k = 13%?

INPUTS

OUTPUT

7 - 10

What would happen if inflation fell, and

k

d

declined to 7%?

10 7 100 1000

N I/YR PV PMT FV

-1,210.71

If coupon rate > k

d

, price rises above

par, and bond sells at a premium.

INPUTS

OUTPUT

7 - 11

Suppose the bond was issued 20

years ago and now has 10 years to

maturity. What would happen to its

value over time if the required rate

of return remained at 10%, or at

13%, or at 7%?

7 - 12

M

Bond Value ($)

Years remaining to Maturity

1,372

1,211

1,000

837

775

30 25 20 15 10 5 0

k

d

= 7%.

k

d

= 13%.

k

d

= 10%.

7 - 13

At maturity, the value of any bond

must equal its par value.

The value of a premium bond would

decrease to $1,000.

The value of a discount bond would

increase to $1,000.

A par bond stays at $1,000 if k

d

remains constant.

7 - 14

Whats yield to maturity?

YTM is the rate of return earned on

a bond held to maturity. Also

called promised yield.

7 - 15

Whats the YTM on a 10-year, 9%

annual coupon, $1,000 par value bond

that sells for $887?

90 90 90

0 1 9 10

k

d

=?

1,000

PV

1

.

.

.

PV

10

PV

M

887 Find k

d

that works!

...

7 - 16

10 -887 90 1000

N I/YR PV PMT FV

10.91

( ) ( ) ( )

V

INT

k

M

k

B

d

N

d

N

=

1 1

1

...

+

INT

1 + k

d

( ) ( ) ( )

887

90

1

1 000

1

1 10 10

=

r k

d d

+

90

1 + k

d

,

Find k

d

+ +

+ +

+ +

+ +k

INPUTS

OUTPUT

...

7 - 17

If coupon rate < k

d

, bond sells at a

discount.

If coupon rate = k

d

, bond sells at its par

value.

If coupon rate > k

d

, bond sells at a

premium.

If k

d

rises, price falls.

Price = par at maturity.

7 - 18

Find YTM if price were $1,134.20.

10 -1134.2 90 1000

N I/YR PV PMT FV

7.08

Sells at a premium. Because

coupon = 9% > k

d

= 7.08%,

bonds value > par.

INPUTS

OUTPUT

7 - 19

Definitions

Current yield =

Capital gains yield =

= YTM = +

Annual coupon pmt

Current price

Change in price

Beginning price

Exp total

return

Exp

Curr yld

Exp cap

gains yld

7 - 20

Find current yield and capital gains

yield for a 9%, 10-year bond when the

bond sells for $887 and YTM = 10.91%.

Current yield =

= 0.1015 = 10.15%.

$90

$887

7 - 21

YTM = Current yield + Capital gains yield.

Cap gains yield = YTM - Current yield

= 10.91% - 10.15%

= 0.76%.

7 - 22

Whats interest rate (or price) risk?

Does a 1-year or 10-year 10% bond

have more risk?

k

d

1-year Change 10-year Change

5% $1,048 $1,386

10% 1,000

4.8%

1,000

38.6%

15% 956

4.4%

749

25.1%

Interest rate risk: Rising k

d

causes

bonds price to fall.

7 - 23

0

500

1,000

1,500

0% 5% 10% 15%

1-year

10-year

k

d

Value

7 - 24

What is reinvestment rate risk?

The risk that CFs will have to be

reinvested in the future at lower rates,

reducing income.

Illustration: Suppose you just won

$500,000 playing the lottery. Youll

invest the money and live off the

interest. You buy a 1-year bond with a

YTM of 10%.

7 - 25

Year 1 income = $50,000. At year-

end get back $500,000 to reinvest.

If rates fall to 3%, income will drop

from $50,000 to $15,000. Had you

bought 30-year bonds, income

would have remained constant.

7 - 26

Long-term bonds: High interest rate

risk, low reinvestment rate risk.

Short-term bonds: Low interest rate

risk, high reinvestment rate risk.

Nothing is riskless!

7 - 27

True or False: All 10-year bonds

have the same price and

reinvestment rate risk.

False! Low coupon bonds have less

reinvestment rate risk but more

price risk than high coupon bonds.

7 - 28

Semiannual Bonds

1. Multiply years by 2 to get periods = 2n.

2. Divide nominal rate by 2 to get periodic

rate = k

d

/2.

3. Divide annual INT by 2 to get PMT =

INT/2.

2n k

d

/2 OK INT/2 OK

N I/YR PV PMT FV

INPUTS

OUTPUT

7 - 29

2(10) 13/2 100/2

20 6.5 50 1000

N I/YR PV PMT FV

-834.72

Find the value of 10-year, 10% coupon,

semiannual bond if k

d

= 13%.

INPUTS

OUTPUT

7 - 30

You could buy, for $1,000, either a 10%,

10-year, annual payment bond or an

equally risky 10%, 10-year semiannual

bond. Which would you prefer?

The semiannual bonds EFF% is:

10.25% > 10% EFF% on annual bond, so buy

semiannual bond.

EFF

i

m

Nom

m

%

.

. = +

|

\

|

.

| = +

|

\

|

.

| = 1 1 1

0 10

2

1 10 25%

2

.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Engineering EconomicsDocumento16 pagineEngineering EconomicsChristine M100% (1)

- New Bvs FormDocumento1 paginaNew Bvs FormTraxex ShyunshinNessuna valutazione finora

- Chapter 29 PDFDocumento11 pagineChapter 29 PDFSangeetha Menon100% (1)

- Prosedur Dan Akibat Hukum Penundaan Kewajiban Pembayaran Utang Perseroan Terbatas (Studi Kasus Putusan Nomor 03/PKPU/2010/PN - Niaga.Sby)Documento5 pagineProsedur Dan Akibat Hukum Penundaan Kewajiban Pembayaran Utang Perseroan Terbatas (Studi Kasus Putusan Nomor 03/PKPU/2010/PN - Niaga.Sby)anindita putriNessuna valutazione finora

- Moody's Certificate in Commercail CreditDocumento8 pagineMoody's Certificate in Commercail CreditExplore with TejuNessuna valutazione finora

- American Wealth PowerDocumento15 pagineAmerican Wealth PowerinprosysNessuna valutazione finora

- Using The Swap To Transform A LiabilityDocumento2 pagineUsing The Swap To Transform A LiabilityThuỷ TrìnhNessuna valutazione finora

- Chapter 18 - Capital Structure DecisionsDocumento19 pagineChapter 18 - Capital Structure DecisionsKazi HasanNessuna valutazione finora

- Facts: Private Respondent Atty. Felipe Lustre Purchased A Toyota Corolla FromDocumento2 pagineFacts: Private Respondent Atty. Felipe Lustre Purchased A Toyota Corolla FromJhenjhen GandaNessuna valutazione finora

- Chapter 07 Positive Accounting TheoryDocumento15 pagineChapter 07 Positive Accounting Theorymehrabshawn75% (4)

- Chapter 11 TQ KP Week 11Documento4 pagineChapter 11 TQ KP Week 11Ahmed El KhateebNessuna valutazione finora

- GEC104 Week16 RoncalADocumento5 pagineGEC104 Week16 RoncalADrei Galanta RoncalNessuna valutazione finora

- Financial Institution and Market Chapter 6Documento23 pagineFinancial Institution and Market Chapter 6Jonathan 24Nessuna valutazione finora

- Third World CountryDocumento3 pagineThird World Countryapi-285429731Nessuna valutazione finora

- TS IT FY 2022-23 Income Tax Software 16.11.2022.Documento37 pagineTS IT FY 2022-23 Income Tax Software 16.11.2022.TestNessuna valutazione finora

- English - SONA 2014Documento23 pagineEnglish - SONA 2014Maree AnnaohjNessuna valutazione finora

- AStudyonAnalysisofStockPricesofSelectedIndustries-research GateDocumento51 pagineAStudyonAnalysisofStockPricesofSelectedIndustries-research GateAvicena Ilham GhifarieNessuna valutazione finora

- Chapter 12Documento25 pagineChapter 12THƯ NGUYỄN ANHNessuna valutazione finora

- A History of The Credit Rating AgenciesDocumento30 pagineA History of The Credit Rating Agenciesrwilson66Nessuna valutazione finora

- Nabard SHG CircularDocumento10 pagineNabard SHG Circularpankaj92Nessuna valutazione finora

- CDP Preparation Template Form 3c.1Documento6 pagineCDP Preparation Template Form 3c.1Princess Hayria B. PiangNessuna valutazione finora

- Cost II Chapter ThreeDocumento106 pagineCost II Chapter Threefekadegebretsadik478729Nessuna valutazione finora

- 395 Midterm 1 Cheat SheetDocumento2 pagine395 Midterm 1 Cheat Sheetchrisjames20036Nessuna valutazione finora

- K ModelDocumento19 pagineK ModelPritchard MatamboNessuna valutazione finora

- BHELDocumento14 pagineBHELMayank Gupta100% (1)

- Corporate Finance: Financial Statements and Cash FlowDocumento27 pagineCorporate Finance: Financial Statements and Cash FlowIBn RefatNessuna valutazione finora

- China Property Sector: Stress Test For Major DevelopersDocumento7 pagineChina Property Sector: Stress Test For Major Developersdohad78Nessuna valutazione finora

- Pennywise - Kotenay Lake, June 12 2012Documento56 paginePennywise - Kotenay Lake, June 12 2012Pennywise PublishingNessuna valutazione finora

- Ratio Analysis of Mahindra N Mahindra LTDDocumento15 pagineRatio Analysis of Mahindra N Mahindra LTDMamta60% (5)

- Ficha 4Documento3 pagineFicha 4Elsa MachadoNessuna valutazione finora