Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ica 7

Caricato da

farahamaliay8877Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ica 7

Caricato da

farahamaliay8877Copyright:

Formati disponibili

Competitive Advantage

A. Tony Prasetiantono

Faculty of Economics Gadjah Mada University

Absolute, Comparative, and Competitive Advantage

Absolute Advantage: Adam Smith (1776) Comparative Advantage: David Ricardo (1840). Productivity is enhanced if each country specializes in those goods for which it has lowest opportunity cost. The result of such a system is a more efficient global use of resources, greater output and consumption, and lower prices.

Comparative Advantage

What determines the goods for which a country has a comparative advantage? Eli Heckscher and Bertil Ohlin pointed to the correspondence between a countrys factor endowmentsthat is, how much land, labor and capital it hasand the factor intensity of the goods it produces.

Development and the Theory of International Trade

Products that require much land and relatively little labor (such as wheat) should be produced by those countries with high ratios of land to labor; while those goods that have higher labor requirements (such as inexpensive clothing) should be produced by countries with high ratios of labor to land and labor to capital. Capital intensive goods, such as jet aircraft, should be produced in those countries that have accumulated significant amounts of capital goods.

Terms of Trade

A countrys terms of trade (TOT) are measured by comparing an index of the prices of its export goods to an index of the prices of its import goods. This ratio, Px/Pm, known as the net barter terms of trade.

The Prebisch-Singer Thesis

Raul Prebisch (Argentina) suggested in 1950s that the prices of primary exports of the poor countries were deteriorating as the result of trade, while prices of the manufactured products of the industrialized countries were either constant or increasing. Developing countries were suffering from worsening living standards and also becoming stuck in a pattern of producing and exporting primary goods, which would keep them poor. Similar findings were reported by Hans Singer.

The Infant Industry Argument

Alexander Hamilton used the infant industry argument that new industries cannot compete internationally in their early stages. It could therefore be acceptable to protect the industry temporarily until it matured. However, protection brings inefficiencies, which are usually politically expedient.

Import Substitution

Import Substitution: government promotion of industrial development by restricting imports is referred to as a strategy.

What Determines Exchange Rates?

Purchasing power parity (PPP) Big Mac index (The Economist magazine) Inflation rate Balance of payments International reserve Psychology

Export-Orientation

Export orientation (or export promotion) advocates suggest that a dollar earned from exports is more valuable than a dollar saved through importing.

Competitive Advantage Defined (1)

When a firm earns a higher rate of economic profit than the average rate of economic profit of other firms competing within the same market, the firm has a competitive advantage in that market. Competitive advantage requires a firm to create value to outperform competitors.

Competitive Advantage Defined (2)

Whether a firm has competitive advantage or disadvantage depends on whether the firm is more or less successful than rivals at creating and delivering economic value. A firm that can create and deliver more economic value than its competitors can simultaneously earn higher profits and offer higher net benefits to consumers than its competitors can.

Competitive Advantage, Consumer Surplus and Value Creation

Market: Supply and Demand Curves Maximum willingness to pay for the product Equilibrium Consumer Surplus Case: Mercedes-Benz Vs. Japanese Lexus, Infiniti, and Acura Value Created = Consumer Surplus + Producers Profit

Value Creation and Michael Porters Value Chain

Porter distinguishes between 5 primary activities and 4 support activities. Five primary activities are (1) inbound logistics, (2) production operations, (3) outbound logistics, (4) marketing and sales, and (5) service. Four support activities are: (1) firm infrastructure, e.g. finance, accounting, legal; (2) human resources management; (3) technology development; (4) procurement.

Cost Advantage (1)

A firm with a cost advantage creates more value than its competitors by offering products that have a lower cost. The firm can achieve benefit by exploiting economies of scale to lower average costs relative to rivals. The firm automates processes that are better performed, hires fewer skilled workers, purchases less expensive components. Yamahas cost advantage over Steinway & Sons, is a good example of this.

Cost Advantage at Cemex (1)

Mexicos Cemex is the 3rd largest cement manufacturer in the world behind Frances Lafarge and Switzerlands Holcim. Cemex now operates worldwide, claiming market leadership in Mexico, Egypt, Spain, the Philippines, and a number of Latin American markets. In 2000, it posted annual revenues of US$5.6 billion.

Cost Advantage at Cemex (2)

By exploiting economies of scale, increasing automation, and exploiting information technology, Cemex has maintained the low costs and flexibility necessary to markedly outperform its rivals in these markets. However, Cemex is not without problems. It is saddled with debt, mainly from its many acquisitions. (In Indonesia: they have 25% shares in Semen Gresik Group).

Cost Advantage (2)

A firm may offer a product that is qualitatively different from its rivals. Many people continue to use the U.S. Postal Service rather than private delivery services, such as Federal Express, because the cost savings are worth the lower quality for some services.

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Paper - Policy Against Child Sex TraffickingDocumento9 paginePaper - Policy Against Child Sex Traffickingfarahamaliay8877Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Strategic Positioning For Competitive Advantage: A. Tony Prasetiantono Week 11Documento21 pagineStrategic Positioning For Competitive Advantage: A. Tony Prasetiantono Week 11farahamaliay8877Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Ica 10Documento13 pagineIca 10farahamaliay8877Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Ica 12Documento15 pagineIca 12farahamaliay8877Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Ica 6Documento26 pagineIca 6farahamaliay8877Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Ica 9Documento9 pagineIca 9farahamaliay8877Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Ica 5Documento16 pagineIca 5farahamaliay8877Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- ICA 4bDocumento8 pagineICA 4bfarahamaliay8877Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- ICA 3bDocumento11 pagineICA 3bfarahamaliay8877Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- ICA 4aDocumento7 pagineICA 4afarahamaliay8877Nessuna valutazione finora

- ICA 3aDocumento13 pagineICA 3afarahamaliay8877Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Industry and Competitive Analysis: A. Tony Prasetiantono Week 2Documento22 pagineIndustry and Competitive Analysis: A. Tony Prasetiantono Week 2farahamaliay8877Nessuna valutazione finora

- Ica 1Documento11 pagineIca 1farahamaliay8877Nessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Nandurbar District S.E. (CGPA) Nov 2013Documento336 pagineNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- DLL LayoutDocumento4 pagineDLL LayoutMarife GuadalupeNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- PHD Thesis - Table of ContentsDocumento13 paginePHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Present Continuous WorkshopDocumento5 paginePresent Continuous WorkshopPaula Camila Castelblanco (Jenni y Paula)Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Effect of Added Sodium Sulphate On Colour Strength and Dye Fixation of Digital Printed Cellulosic FabricsDocumento21 pagineEffect of Added Sodium Sulphate On Colour Strength and Dye Fixation of Digital Printed Cellulosic FabricsSumaiya AltafNessuna valutazione finora

- Charles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsDocumento20 pagineCharles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsRizki AuliaNessuna valutazione finora

- Government by Algorithm - Artificial Intelligence in Federal Administrative AgenciesDocumento122 pagineGovernment by Algorithm - Artificial Intelligence in Federal Administrative AgenciesRone Eleandro dos SantosNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- CGP Module 1 FinalDocumento19 pagineCGP Module 1 Finaljohn lexter emberadorNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Different Types of Classrooms in An Architecture FacultyDocumento21 pagineDifferent Types of Classrooms in An Architecture FacultyLisseth GrandaNessuna valutazione finora

- De Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Documento106 pagineDe Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Mai PhanNessuna valutazione finora

- ED Tox PGS.2021Documento4 pagineED Tox PGS.2021Jm uniteNessuna valutazione finora

- International Covenant On Economic Social and Cultural ReportDocumento19 pagineInternational Covenant On Economic Social and Cultural ReportLD MontzNessuna valutazione finora

- DLP No. 10 - Literary and Academic WritingDocumento2 pagineDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- Grafton Business Services 2023Documento61 pagineGrafton Business Services 2023Vigh ZsoltNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Diane Mediano CareerinfographicDocumento1 paginaDiane Mediano Careerinfographicapi-344393975Nessuna valutazione finora

- Ollie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Documento2 pagineOllie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Scribd Government DocsNessuna valutazione finora

- Scientific Errors in The QuranDocumento32 pagineScientific Errors in The QuranjibranqqNessuna valutazione finora

- EMI - Module 1 Downloadable Packet - Fall 2021Documento34 pagineEMI - Module 1 Downloadable Packet - Fall 2021Eucarlos MartinsNessuna valutazione finora

- ISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCDocumento2 pagineISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCdevaprNessuna valutazione finora

- Mooting ExampleDocumento35 pagineMooting Exampleluziro tenNessuna valutazione finora

- Deadlands - Dime Novel 02 - Independence Day PDFDocumento35 pagineDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliNessuna valutazione finora

- Sarcini: Caiet de PracticaDocumento3 pagineSarcini: Caiet de PracticaGeorgian CristinaNessuna valutazione finora

- Trenching Shoring SafetyDocumento29 pagineTrenching Shoring SafetyMullapudi Satish KumarNessuna valutazione finora

- Gastric Emptying PresentationDocumento8 pagineGastric Emptying Presentationrahul2kNessuna valutazione finora

- Florida v. DunnDocumento9 pagineFlorida v. DunnJustice2Nessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Final Module in Human BehaviorDocumento60 pagineFinal Module in Human BehaviorNarag Krizza50% (2)

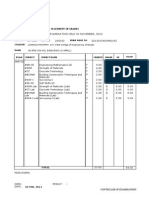

- 2024 01 31 StatementDocumento4 pagine2024 01 31 StatementAlex NeziNessuna valutazione finora

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDocumento2 pagineTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiNessuna valutazione finora

- QTP Common FunctionsDocumento55 pagineQTP Common FunctionsAnkur TiwariNessuna valutazione finora

- Assessment NCM 101Documento1 paginaAssessment NCM 101Lorainne Angel U. MolinaNessuna valutazione finora