Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Nanavaty - 21st. Indian Paint Conference

Caricato da

Raja ManiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Nanavaty - 21st. Indian Paint Conference

Caricato da

Raja ManiCopyright:

Formati disponibili

K.P.

Nanavaty

President

Reliance Industries Ltd., Mumbai

Agra, January 18, 2003

21st Indian Paint Conference

Paint Preserve Prosper

Index

Emerging Scenario

Economic Landscape

Paint Industry

overview, applications, structure

Future Prospects

Reliance

Industries Limited

World Chemical Market size 1.6 Trillion USD . . .

Textiles

10%

Petrochemicals

39%

Performance chemicals

16%

Pharmaceutical chemicals

16%

Agrochemicals

11%

Other fine chemicals

1%

Inorganic chemicals

7%

COMMODITIES (56%)

SPECIALTIES (44%)

Source: Chem Systems/ BAG

. . . 3% of which is the global paint industry

Reliance

Industries Limited

Global Economy grows @ 3.4 %

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1

9

7

0

1

9

7

2

1

9

7

4

1

9

7

6

1

9

7

8

1

9

8

0

1

9

8

2

1

9

8

4

1

9

8

6

1

9

8

8

1

9

9

0

1

9

9

2

1

9

9

4

1

9

9

6

1

9

9

8

2

0

0

0

2

0

0

2

0

5

10

15

20

25

30

35

40

$/bbl

Global GDP growth

Crude oil ($/bbl)

1973-75 cycle:

1st Oil Shock

1979-83 cycle:

2nd Oil Shock

1991-92 cycle:

Gulf War

1997:

Asian Crisis

Decade

Global GDP

(in $ trillion)

1970 3

1980 10

1990 21

2000 31

Despite cyclicality, $10 Trillion has been added

to the global GDP each decade

Sept11th01

Reliance

Industries Limited

Dominance by Triad

Source: World Competitiveness Yearbook 2001

0

2

4

6

8

10

GDP

($ Tr.)

Countries

USA W. Europe * Japan China Brazil Mexico Korea India

* Incl. 5 Countries - Germany, UK, France, Italy & Spain

India - 1.45% of global GDP & 13th largest economy

Year - 2000

Global GDP - $ 31 Tr.

Reliance

Industries Limited

Regional GDP share - 2000

USA

32%

Rest of

World

28%

Rest of Asia

Pacific

9%

EU

20%

Japan

8%

UK

3%

Developed Countries account for

61% of Global GDP

But Asias short term response mirror Industrialized

countries even though its share is < 10%

Population

(mn)

% share -

Population

GDP $

Billion

% Share in

global GDP

China * 1261 21% 1254 4.0%

India 1014 17% 480 1.5%

S.Korea 47 1% 457 1.5%

Indonesia 225 4% 153 0.5%

Other S.Asia 359 6% 140 0.4%

Thailand 64 1% 122 0.4%

S'pore 4 0% 92 0.3%

Malaysia 22 0% 89 0.3%

Phillipines 81 1% 75 0.2%

Vietnam 89 1% 31 0.1%

Total Asia 3166 52% 2895 9.2%

Global 6080 31300

Source :- World Bank ; *: China incl. Hongkong

Reliance

Industries Limited

Asian Economy

(growth in %) 1998 1999 2000 2001 2002e

Industrial Economies3.0 3.2 3.5 0.9 1.5

USA 4.3 4.1 3.8 0.3 2.4

Japan -1.2 0.7 2.8 0.3 -0.5

EU 2.9 2.8 3.5 1.6 1.0

Emerging Markets 3.0 4.2 5.9 3.6 4.0

Asia 3.2 6.4 7.0 5.0 5.9

China 7.8 7.1 8.0 7.3 7.5

India 5.8 6.7 5.4 4.1 5.0

Transition economies -0.7 3.7 6.6 5.0 3.9

World 2.7 3.6 4.7 2.2 2.7

e:estimated

Comparative Growth Scenario

but 2002 also marks the beginning of recovery from the

economic slowdown of 2001 - albeit at a slow pace

Last year, the global economy performed below par

triggered by subdued US, Japanese & EU

economies...

Reliance

Industries Limited

With revival of trade, Asian GDP

growth is expected to resume

%

Growth in Asia in tandem with global economic recovery

Real GDP Growth

Merrill Lynch DrKW Morgan Stanley

(in %) 2001 2002

World 1.8 1.7 2.8 3.4 3.0

G7 1.3 1.3 2.4 1.1 2.1

Japan -0.3 -0.7 1.6 0.0 0.7

Asia (ex. Japan) 3.1 5.4 5.6 5.0 5.3

India 5.4 5.4 5.7 5.3 5.1

China 7.5 7.8 8.0 6.8 7.1

Hong Kong 2.3 2.0 3.0 2.1 2.2

Singapore 0.6 3.0 4.3 3.3 3.9

S. Korea 1.0 6.1 5.0 4.3 4.0

Taiwan 1.5 3.4 3.7 2.8 3.8

Source : Dresdner Kleinwort Wasserstein, Merrill Lynch, Morgan Stanley Global Eco Forum

2003 Forecasts

Reliance

Industries Limited

-4

-2

0

2

4

6

8

2002 2003 2004

Benign Intermediate Worst No war

Real US GDP (Annual % Change)

Source: Thomson Datastream, CSIS

However, the possibility of a war with

Iraq poses a major downside risk...

which can drastically reduce economic growth in the US,

& subsequently the world, & can even result in negative

US GDP growth in the worst case scenario

Reliance

Industries Limited

China will overtake US in the global output

India to become he 3rd largest economy in the world ahead of

Japan & Germany

The value of global output would have increased from 30 trillion

dollars to 95 trillion dollars

China will account for 26% of global product

US will remain at the same level of 21%.

The two elephant economies of Asia - China & India would have

increased their global output from only 16 % to 40% by 2025.

Source :

Future New World Economic Order

Asian economic leaders would not be

fast running tigers but stampeding elephants

Mr. Javed Burki - World Bank Expert

( ~next 25 years)

Reliance

Industries Limited

The Indian Economy

Reforms in last decade brought

Paradigm Shift ...

Restrictions to capacity growth removed

Foreign capital flow enhanced

Business-friendly fiscal structure

Liberalized external trade policies

Emphasis on infrastructure development

Market determined exchange rate

Ownership of foreign stocks allowed

Withdrawal of Govt. participation from non-core area

In the offing

Capital a/c convertibility

Patent Bill in line with international norms

and recharged the Indian Economy

Reliance

Industries Limited

Sectoral composition of GDP

A Stable well diversified Economy

GDP (2001) : $ 484 bn

26%

25%

22%

13%

14%

Agriculture Manufacturing Trade etc.

Financing etc. Pub Adm etc

Source: Economic Survey 2001-02

Over the years, the services sector has emerged

as the single largest contributor to GDP

(% of GDP) Agriculture Industry Services

1950-51 to 1959-60 53.7 17.7 28.7

1960-61 to 1969-70 45.8 22.9 31.3

1970-71 to 1979-80 41 25 34

1980-81 to 1989-90 36.5 24.9 38.7

1990-91 to 1999-00 29.2 27 43.8

2001-02 26.3 26.5 47.2

Source:Economic Survey

Changing composition of GDP

Reliance

Industries Limited

Decade of Reforms : 2nd highest

economic growth

Real GDP growth (AARG; 1990-00)

-6 0 6 12

Russia

Italy

Japan

Germany

France

UK

Canada

Mexico

Brazil

US

India

China

% of World GNP at PPP* ($38.8 tr in 2000)

Russi a

2%

Ital y

3%

Japan

8%

Germany

5%

France

3%

UK

3%

Canada

2%

Mexi co

2%

Brazi l

3%

US

22%

Indi a

6%

Chi na

11%

Rest of Worl d

30%

. . . India - 4th Largest economy at USD 1.6 tr.

( PPP basis)

Reliance

Industries Limited

The emerging face of India

Year 2001 2006

Population (mln.) 1012 1087

Population 546 565

<25 years of age

Urbanization (%) 28 31

. A growing country with opportunity

Source: DSP Merrill Lynch

Half the population is below 25 years of age

Young, Mobile, Brand conscious generation

Reliance

Industries Limited

Indian economy today is fundamentally

strong & resilient

Bulging food reserves

Increasing foreign trade with globalisation of the

economy

Comfortable foreign exchange reserves

Soft interest rates

Low inflation

With further reforms, the Indian economy is now at a take-off

stage - planned 8% targeted growth very much feasible

provided reforms are carried out in the right spirit

Reliance

Industries Limited

Per capita income at current prices ($)

98

228

317

494

1

9

7

0

/

7

1

1

9

8

0

/

8

1

1

9

9

0

/

9

1

2

0

0

0

/

0

1

Source:Economic Survey 2001-02, Ministry of Finance,

Govt. of India; FY 2000 forecast by CPMA

Per capita income quadrupled in the

last 2 decades

..with the maximum increase of ~US$ 200 coming in

the last 10 yrs providing additional purchasing power

Per capita income at 1993-94 prices

4000

6000

8000

10000

12000

1

9

8

1

-

8

2

1

9

8

3

-

8

4

1

9

8

5

-

8

6

1

9

8

7

-

8

8

1

9

8

9

-

9

0

1

9

9

1

-

9

2

1

9

9

3

-

9

4

1

9

9

5

-

9

6

1

9

9

7

-

9

8

1

9

9

9

-

2

0

0

0

Reliance

Industries Limited

Consumer goods, (esp. the durables) registered

double digit growth in the post reform era . . .

Consumer Durables: High double Digit Growth

2.0

3.0

6.0

3.0

7.0

-0.1

10.0

12.0

23.0

27.0

18.0

6.0

-1

4

9

14

19

24

A

i

r

c

o

n

d

i

t

i

o

n

e

r

T

V

P

a

s

s

e

n

g

e

r

c

a

r

s

M

o

t

o

r

c

y

c

l

e

s

C

o

m

m

e

r

c

i

a

l

v

e

h

i

c

l

e

s

W

r

i

s

t

w

a

t

c

h

e

s

(

%

)

1989-93 1993-01

Source: CII/ASCON

. . . and have been the prime mover for

economic growth

Reliance

Industries Limited

Investments in highways to fuel growth . .

+ + e`

BANGALORE

_

CHENNAI

Surat

Vadodara

Ahmedabad Bypass

MUMBAI

Vijayawada

_

Eluru

Bhubaneshwar

Varanasi

Sikandara

:

:

KOLKATA

DELHI

Barwa Adda

Panagarh

Amer

Manor

Krishnagiri

Jagatpur

Jaipur Bypass Ph.II

Neelamangala

Nellore Bypass

Dharwad

Hathipali

Vishakhapatnam

Khurda

Agra

Pune

Kokhraj

Allahabad bypass

Kolaghat

Bhadrak

Palasa

Nellore

Katraj

Wather

Hubli

Pallikonda

Ph.I

Chittorgarh

Himmatnagar

Chiloda

Jaipur

Etawah

Gowthami

Sira

_:

Palanpur

PORBANDAR

Rajkot

`

Udaipur

Kanpur

Siliguri

SILCHAR

Samakhiali

Shivpuri

Guwahati

Purnea

Muzaffarpur

Gorakhpur

Lucknow

l

l:

._

.

l

. l :

_

Islampur

KANYAKUMARI

l

Madurai

l

Kurnool

l

Hyderabad

l

Lakhnadon

l

:

Jhansi

.

.

SRINAGAR

Dindigul

Karur

.

Jammu

Jalandhar

Gwalior

Nagpur

Salem

Kochi

_l

Thrissur

Coimbatore

Dankuni-NH-2/NH-6 Near Kolkata

LEGEND:

Under Implementation

Already Completed

Project Preparation Taken Up

Balance for Award

N. H. Number

S

E

N

W

Status as on August 31, 2002

Total length(km)

Completed Total till date (km)

Under Implementation

Financial (Rs. Crs.)

Contracts to be awarded

GQ

5,846

1,159*

95

15,951

1,688

6,286

136

4

4,551

(Handia)

. . . through multiplier effect on the economy

Reliance

Industries Limited

Soft interest rate regime expected to

continue...

Interest rates - Softening

16.5

14.75

14.0

12.5

12.25

11.5 11.5 11.5

10

11

12

13

14

15

16

17

1

9

9

5

-

9

6

1

9

9

6

-

9

7

1

9

9

7

-

9

8

1

9

9

8

-

9

9

1

9

9

9

-

0

0

2

0

0

0

-

0

1

2

0

0

1

-

0

2

2

0

0

2

-

0

3

% p.a

Nominal PLR

Source: Economic Survey, 2001-02

The ET ,Dec 23rd 02

. . . boosting housing demand & creating a conducive

environment for industrial growth & demand for paints

(in Million) 1991 2001

%

change

Urban

Population 218 291 33%

Urban

Housing

shortage 46 62 35%

Source: National Inst of Urban Affairs

Urban Profile of India

Reliance

Industries Limited

Housing sector given top priority by

the Govt...

Current shortage of dwelling units : 20 mn

Govt. targets Housing for All by end of Xth Plan

Golden Jubilee Rural Housing Finance Scheme coverage increased from

1.7 lakh to 2.25 lakh units

Indira Awas Yojana allocation increased by 13% to Rs 1725 crs.

Housing finance disbursement increased by 35% after 28% rise in 02

Corporate space absorption likely to go up by 50% in 03

which is likely to boost demand for construction

and associated sectors incl. paints

Reliance

Industries Limited

The Indian Opportunity

Increasingly affluent middle class

Middle Class Households(2001-02) (million no.)

32.8

40

13

7.5

6.7

Low Income

Lower middle income

Middle income

Upper income

High income

71%

73%

85%

5%

Own PC

Own vehicle

75% have an annual household income

between $1000 and $3000

Middle Class Monetory profile

Own flat/house

Own colour TV

Reliance

Industries Limited

The Indian Opportunity

Growing disposable incomes

2001

1.6

32

60

62

44

Million

Households

Million

People

8

10

110

85

14

8

Million

Households

Million

People

58 The Rich

The Consuming Class

The Climbers

The Aspiring

The Destitute

2010

62

Reliance

Industries Limited

Growth in telecom sector will have

profound multiplier effect...

Cellular & Fixed Line subscribers Ringing in Better

Times !

3.6

6

19

33

40

66

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

2

0

0

1

2

0

0

2

2

0

0

5

mn no.s Cel l ul ar subscri bers

Fi xed l i ne networks

Source: NASSCOM

...on the economy in sustaining high growth in the

future

Reliance

Industries Limited

Average penetration levels in India are way

below global averages in sectors like IT,

telecom & consumer electronics . . .

Penetration per 1000 Population

210

75

225

60

3

20

100

22

125

0

50

100

150

200

250

World 2001 India 2001 India 2008 Target

TV Computers Fixed telephones

Source:Dept of Information Technology, Govt of India

. . . pointer to Indias immense growth potential

Reliance

Industries Limited

As normalcy returns in the economic

environment, outlook for the Indian economy

is bright

(Real GDP growth in %) 2003 2004

World Bank 5.6 5.8

Asian Develeopment Bank 6 6.3

IMF 5.7 6

Merrill Lynch 5.7 5.8

DrKW 5.3 4.7

Morgan Stanley 5.1 5.8

Source:Respective Economic Outlook Forecasts

Growth Forecasts for India

The overall quantum of economic activities

& the demand situation in the country is forecasted

to improve implying a better year for different

sectors of the economy incl. paints

Reliance

Industries Limited

WTO is providing market access across the

globe for Indian manufacturers...

Increased market access to erstwhile inaccessible overseas

markets

Exposure to global industry best practices & latest

technology

Competition with global giants would make the Indian

producers more price & quality conscious

Low quality producers will perish with availability of cheap,

high quality imports

..& an opportunity to speed up domestic reforms to

become globally competitive which nations like

China are pursuing

Reliance

Industries Limited

The Indian Paint Industry

Demand for paints in the Asia Pacific is predicted to

rise from the current level of 7.9 MMT to 11.1 MMT

by 2005.

1860

825

410

620

106

200

116

218

86

278

290

2486

-400

100

600

1100

1600

2100

2600

C

h

i

n

a

J

a

p

a

n

S

K

o

r

e

a

T

a

i

w

a

n

I

n

d

i

a

P

a

k

i

s

t

a

n

I

n

d

o

n

e

s

i

a

M

a

l

a

y

s

i

a

P

h

i

l

i

p

p

i

n

e

s

S

i

n

g

a

p

o

r

e

T

h

a

i

l

a

n

d

A

u

s

t

r

a

l

i

a

(000 MT) 2000 2005

Rest of Oceania 46

Northeast Asia 5705 8300

Southeast Asia 994 1200

Indian sub-continent 794 1200

Oceania 336 370

ASIA PACIFIC 7829 11100

on the back of significant demand growth

in NE Asia & Indian sub-continent

Source:Asian Chemical News, Nov, 2002

Reliance

Industries Limited

Per Capita Paint Consumption (Kgs)

0.6

2.9

4.0

8.8

15.0

19.0

22.0

24.5

26.8

1.6

0

5

10

15

20

25

30

I

n

d

i

a

C

h

i

n

a

T

h

a

i

l

a

n

d

S

E

A

s

i

a

M

a

l

a

y

s

i

a

G

l

o

b

a

l

A

v

e

r

a

g

e

G

e

r

m

a

n

y

D

e

v

e

l

o

p

e

d

W

o

r

l

d

U

S

A

S

i

n

g

a

p

o

r

e

At 0.55 Kgs, annual per capita consumption of

paints in India is way below the global average of 15

kgs & SE Asian average of 4 kgs..

an indicator of the paint industrys tremendous

future growth potential, capable of sustaining a

10% CARG in the period 2003-06 Reliance

Industries Limited

Even if per capita paint consumption in India

reaches the current SE Asian average of 4 kgs from

the current level of 0.55 kgs...

Current @ 0.55 kgs Future @ 4 kgs

Population (million nos.) 1027 1108*

Total paint consumption (MT) 564850 4432000

Addl paint consumption

when per capita

consumption is 4 kgs (MT)

3867150

Per cent increase in total

paint consumption 685%

*population no. for the year 2007

Per capita paint consumption in India

Impact of increase in per capita paint consumption in India

it would translate to a ~700% increase in paint

consumption - an achievable target in view of high

growth in end-user sectors

Reliance

Industries Limited

Paint Industry : Burning Issues

Housing prime mover - How to create more

housing ?

Shabby building exteriors - Is legislation making

exterior maintenance mandatory the solution ?

Customized R&D for meeting needs of countries

like India

Need for introspection!

Reliance

Industries Limited

New Paradigms

for the coming Decade

Issues & Strategies

Issues Strategies

Scale Consolidation

WTO Globalisation

Investment Asset Renewal

Technology Innovation

Man Power Training

Market Aspirations Total Solution Provider

Reliance

Industries Limited

Thank You!

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Equipment Maintenance and Measuring Equipment ProcedureDocumento2 pagineEquipment Maintenance and Measuring Equipment ProcedureRaja Mani100% (1)

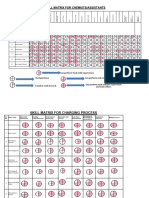

- Skill Matrix For ChemistsDocumento9 pagineSkill Matrix For ChemistsRaja ManiNessuna valutazione finora

- Is ISO 9004 A Path To Business ExcellencDocumento20 pagineIs ISO 9004 A Path To Business ExcellencRaja ManiNessuna valutazione finora

- Competence, Training and Awareness-ProcedureDocumento2 pagineCompetence, Training and Awareness-ProcedureRaja ManiNessuna valutazione finora

- Introduction - Energy GuideDocumento13 pagineIntroduction - Energy GuideRaja ManiNessuna valutazione finora

- DM Water CostingDocumento1 paginaDM Water CostingRaja ManiNessuna valutazione finora

- ELECTRICTY - Rate ScheduleDocumento41 pagineELECTRICTY - Rate ScheduleRaja ManiNessuna valutazione finora

- Incident Brief Detail of Surat Fire IncidentDocumento3 pagineIncident Brief Detail of Surat Fire IncidentRaja ManiNessuna valutazione finora

- Flow Meter - BROILDocumento2 pagineFlow Meter - BROILRaja ManiNessuna valutazione finora

- An ISO 9001 Co.: Delta Cooling Towers P. LTDDocumento25 pagineAn ISO 9001 Co.: Delta Cooling Towers P. LTDRaja ManiNessuna valutazione finora

- Panel Accessories Price List 01nov2019Documento44 paginePanel Accessories Price List 01nov2019Raja ManiNessuna valutazione finora

- Tankcal (Version 1)Documento8 pagineTankcal (Version 1)Raja ManiNessuna valutazione finora

- Baliga Technical DataDocumento10 pagineBaliga Technical DataRaja ManiNessuna valutazione finora

- Accredited ConsultantsDocumento195 pagineAccredited ConsultantsRaja Mani100% (1)

- Lean & Environment Case Study: Columbia Paint & CoatingsDocumento21 pagineLean & Environment Case Study: Columbia Paint & CoatingsRaja ManiNessuna valutazione finora

- Panel Accessories Price List 01nov2019Documento44 paginePanel Accessories Price List 01nov2019Raja ManiNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Bradford Snell The Street Car ConspiracyDocumento4 pagineBradford Snell The Street Car ConspiracyDaniel DavarNessuna valutazione finora

- Ans Mini Case 2 - A171 - LecturerDocumento14 pagineAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Business Level StrategyDocumento28 pagineBusiness Level StrategyMohammad Raihanul HasanNessuna valutazione finora

- Respond To Business OpportunitiesDocumento21 pagineRespond To Business OpportunitiesRissabelle CoscaNessuna valutazione finora

- PGM-199 R1Documento5 paginePGM-199 R1Faraz Ali Khan0% (1)

- Fundraising Blueprint Plan TemplateDocumento3 pagineFundraising Blueprint Plan Templateoxade21Nessuna valutazione finora

- Ch.10 - The Statement of Cash Flows - MHDocumento59 pagineCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- Jack Daniel'sDocumento17 pagineJack Daniel'sIon TarlevNessuna valutazione finora

- Woolf Prompt WritingDocumento1 paginaWoolf Prompt Writingapi-2089824930% (1)

- Magazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheDocumento5 pagineMagazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheRush YuviencoNessuna valutazione finora

- Spisak Parfema NEWDocumento1 paginaSpisak Parfema NEWDouglas CoxNessuna valutazione finora

- Tourism PolicyDocumento6 pagineTourism Policylanoox0% (1)

- Masan Group CorporationDocumento31 pagineMasan Group Corporationhồ nam longNessuna valutazione finora

- Diebold Case StudyDocumento2 pagineDiebold Case StudySagnik Debnath67% (3)

- Harish NatarajanDocumento10 pagineHarish NatarajanbananiacorpNessuna valutazione finora

- FM 8th Edition Chapter 12 - Risk and ReturnDocumento20 pagineFM 8th Edition Chapter 12 - Risk and ReturnKa Io ChaoNessuna valutazione finora

- EnglishtoMath##1Documento8 pagineEnglishtoMath##1zubairNessuna valutazione finora

- Question Bank Volume 2 QDocumento231 pagineQuestion Bank Volume 2 QCecilia Mfene Sekubuwane100% (1)

- International Marketing - ChinaDocumento10 pagineInternational Marketing - ChinaNaijalegendNessuna valutazione finora

- Break Even Point ExplanationDocumento2 pagineBreak Even Point ExplanationEdgar IbarraNessuna valutazione finora

- Short AnswerDocumento4 pagineShort AnswerMichiko Kyung-soonNessuna valutazione finora

- Donner Company 2Documento6 pagineDonner Company 2Nuno Saraiva0% (1)

- Case Study-1 SHEENADocumento2 pagineCase Study-1 SHEENARushikesh Dandagwhal100% (1)

- Influence of Celebrity Endoresement On Consumer Prefeference For Glo NigeriaDocumento8 pagineInfluence of Celebrity Endoresement On Consumer Prefeference For Glo NigeriaBraym Mate'sunNessuna valutazione finora

- English Listening MaterialsDocumento3 pagineEnglish Listening MaterialsVita NovitasariNessuna valutazione finora

- Gat PreparationDocumento21 pagineGat PreparationHAFIZ IMRAN AKHTERNessuna valutazione finora

- Brand Licensing PDFDocumento3 pagineBrand Licensing PDFalberto micheliniNessuna valutazione finora

- 8508Documento10 pagine8508Danyal ChaudharyNessuna valutazione finora

- SOLAS - Verified Gross Mass (VGM)Documento2 pagineSOLAS - Verified Gross Mass (VGM)Mary Joy Dela MasaNessuna valutazione finora