Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MKT 731 Lecture 3 Fall 2005

Caricato da

Lucas RomeroDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MKT 731 Lecture 3 Fall 2005

Caricato da

Lucas RomeroCopyright:

Formati disponibili

Marketing-Industry Analysis

MKT 731 Fall 2005 Lecture 3 Instructor: Armand Gervais

Web: www.ryerson.ca/~agervais Email: agervais@ryerson.ca Office: Bus 308 Phone: 416-979-5000 Ext. 4215

Lecture 3 Agenda

Questions and Answers Administration Financial Analysis Structural Analysis With Industries Value Chain Video-Lufthansa Dells Value Chain To Dos for next week

Porter 5 Forces Framework

Entry Barriers

Economies of Scale Proprietary Product Differences Brand Identity Switching Costs Capital Requirements Access to Distribution Absolute Cost Advantages - Proprietary learning curve - Access to necessary inputs - Proprietary low-cost product design Government Policy Expected Retaliation

Rivalry Determinants

Industry Growth Fixed (or Storage) Costs/Value Added Intermittent Over-Capacity Product Differences Brand Identity Switching Costs Concentration and Balance Informational Complexity Diversity of Competitors Corporate Stakes Exit Barriers

New Entrants

Threat of New Entrants

Industry Competitors

Bargaining Power of Suppliers

Buying Power of Buyers

Suppliers

Determinants of Supplier Power

Differentiation of Inputs Switching Costs of Suppliers and Firms in the Industry Presence of Substitute Inputs Supplier Concentration Importance of Volume to Supplier Cost Relative to Total Purchases in the Industry Impact of Inputs on Cost or Differentiation Threat of Forward Integration Relative to the Competition Threat of Backward Integration by Firms in the Industry

Intensity of Rivalry

Buyers

Determinants of Buyer Power Bargaining Leverage Price Sensitivity

Threat of Substitutes Buyer Concentration vs. Firm Concentration Buyer Volume Buyer Switching Costs Relative to Firm Switching Costs Buyer Information Ability to Backward Integrate Substitute Products Pull-Through Price/Total Purchases Product Differences Brand Identity Impact on Quality/ Performance Buyer Profits Decision Makers Incentives2

Substitutes

Determinants of Substitutes

Relative Price Performance of Substitutes Switching Costs Buyer Propensity to Substitute

Structural Analysis Within Industries

Competitive Strategies Techniques for Analyzing Industries and Competitors Michael Porter

Dimensions of Competitive Strategy

Strategic options in a given industry: Specialization- Honda Small Engines Brand identification- Volvo is the safe car Push vs pull -pharmaceuticals Channel selection - Dell Product quality - Maytag,Lexus Technological leadership -Sony Vertical integration - Roots Cost position -WestJet Service Virgin, Lufthansa Price policy- Walmart Always lower prices Leverage- GE Relationship to parent GE Relationship to government Oil Companies

4

Strategic Groups

Strategic groups are companies that follow essentially the same strategy Most industries have a few strategic groups Major appliance industry GE broad line, national advertising extensive integration and captive distribution Maytag narrow line high quality high price with limited distribution Strategic groups may differ in product or market approach Firms in the same strategic group tend to have similar market shares and respond similarly to external events or competitive moves in the industry depending on resources and capabilities. Strategic groups can be used as an analytical tool Strategic groups are an intermediate frame of reference between the industry on a whole and the individual firm The profit potential of firms in different strategic groups is often different, quite apart from their implementation abilities, because the five broad competitive forces will not have equal impact on different strategic groups.

Strategic Groups and Mobility Barriers

So far entry barriers have been viewed as industry wide characteristics the deter new firms from entering: Economies of scale, switching costs, access to distribution etc Overall entry barriers depend on the particular strategic group that entrants seek to join- Appliance industry If barriers are caused by production scale economies then the barrier protects those firms with large scale production Entry barriers not only protect firms in a strategic group from entry by firms outside the industry but also provide barriers to shifting strategic position by another strategic group-Mobility Barriers Mobility barriers deter movement of firms from one strategic position to another Mobility barriers provide the first major reason some firms in an industry will be persistently more profitable than others Different strategic groups carry different mobility barriers Without mobility barriers successful firms would be quickly imitated by others Good example is M-Banks trying to compete with ING and PC financial virtual banks

Mobility Barriers and Group Formation

1.

2. 3.

Strategic groups form and change in and industry for a variety of reasons: Firms begin with or develop differences in skills and resources and thus select different strategies Firms goals and risk posture differTechnological changes Banking is a good example Internet and Dell direct model

Strategic Group-Bargaining Power

Strategic group enjoy differing degrees of bargaining power with suppliers or customers HP is in a strategic group in electronic calculators emphasizing high quality and technological leadership focusing on the sophisticated user. This may limit market share but it the buyers are less price sensitive and less powerful than those of a mass market of standardize products Strategic groups will have differing amounts of power vis--vis suppliers and buyers for two reasons: Their strategy may yield them differing degrees of vulnerability to common suppliers or buyers or their strategies may involve dealing with different suppliers or buyers with correspondingly different levels of bargaining power. Computers vs Big Box stores or Dell direct Example Travel agencies that specialize in eco tours

Strategic Groups and Rivalry Among Firms

The existence of multiple strategic groups means that the forces of competitive rivalry are not faced equally by all firms in the industry The presence of several strategic groups will often affect the overall level of rivalry in the industry Rivalry increases due to greater diversity or asymmetry among firms in the industry Differences in strategy and external circumstances mean that firms will have differing preferences about risk taking, time horizon, price levels etc. These differences complicate the process of firms understanding each others intentions Research has shown that industries with complicated strategic maps tend to be more competitive

9

Strategic Groups and Rivalry Among Firms

Four factors determine how strongly strategic groups in an industry will interact: 1. Market interdependence or the extent in which customer targets overlap-Most important

More customers shared the more intense the rivalry

2. 3.

Product differentiation achieved by the groups

differentiation rivalry

The number of strategic groups and their relative size

groups equal size rivalry more likely one group will trigger price war Conversely strategic groups of unequal size will reduce rivalry

4.

The strategic distance among groups, the extent to which strategies diverge The more strategic distance among groups, other things being equal, the more vigorous competitive skirmishing is likely. Firms pursuing different strategies tend to have vastly different ideas on how to compete and other firms have difficulty understanding their behavior The most volatile and competitive industry would be one in which their was several equally balance strategic groups, following different strategies targeting the same customers However, a strategic group that has a large collective share and or targets its efforts to distinct market segments not served by other strategic groups and achieves high product differentiation is likely to me be more insulated from inter group rivalry

10

Strategic Group Mapping and Inter-group Rivalry

Key Strategic Dimension

B A F C

Target Customer Segment

11

Strategic Groups and a Firms Profitability

Underlying determinants of a Firms Profitability: Common Industry Characteristics

1.

Industrywide elements that apply equally to all firms:

Rate of growth, potential for product differentiation, structure of suppliers, aspects of technology etc.

Characteristics of Strategic Group

2. 3. 4. 5.

The height of mobility barriers protecting the firms strategic group The bargaining power of the firms strategic group with customers and suppliers The vulnerability of the firms strategic group to substitute products The exposure of the firms strategic group to rivalry from other groups The degree of competition within the strategic group The scale of the firm relative to others in the group Costs of entry into the group The ability of the firm to execute or implement its chosen strategy in an operational sense

12

Firms Position Within Its Strategic Group

6.

7.

8. 9.

The Value Chain and Competitive Advantage

The Competitive Advantage: Creating and Sustaining Superior Performance C 1985 pp. 33-61

What is Value Chain Analysis

It is a rapid analysis technique that outlines core business activities. It helps you produce a simple working model of a business. It identifies the key steps (links) in each business activity. It shows you how to measure and control your value chains.

14

The Value Chain

Competitive advantage cannot be understood by looking at the firm as a whole. Must understanding many discrete activities a firm performs Each contributes to it relative cost position and creates a basis for differentiation-difficult to match on all dimensions Putting customer analysis and cost analysis together exposed situations in which 20% of a businesses customers accounted for more than 80% or even 100% of its profits The famous 80/20 Rule Influenced by diverse factors like procurement of high quality raw materials efficient assembly, superior sales force, superior product design Value chain is a systematic way to understand a firms competitive advantage Disaggregates the firm activities into small parts Firm gains advantage by performing activities better or cheaper than competitors Advantage is created from the synergies between all activities

15

The Industry Value System

Suppliers not only deliver a product but they influence a firms performance in many other ways. Inputs affect outputs In addition many products pass through the value chains of channels (channel value) on their way to the buyer These channels perform activities that affect the buyer and influence the firms own activities. Package holidays Air component A firms product eventually becomes part of its buyers value chain Suppliers Firm Channel Buyer Value Chains Gaining and understanding competitive advantages depends on understanding not only a firms value chain but how the firms value chain fits in the overall value system Value chains of firms in an industry differ, reflecting their histories, strategies and successes

16

Value Chain

Value is the amount buyers are willing to pay for what a firm provides Creating value for buyers that exceeds the cost of doing so is the goal of any generic strategy The value chain displays total value and consists of value activities and margin Value activities are the physically and technologically distinct activities a firm performs Margin is the difference between total value and costs of performing value activities Value activities employ purchased inputs, Human resources and some form of technology Value activities use and create information like buyer data and performance statistics Value activities may also create assets such as inventory Value Chain divided into two broad types, primary and support activities

17

Porters Value Chain

Porters Value Chain

Firm Infrastructure Human Resource Management

Support Activities

Technology Development Procurement Inbound Logistics Operations Outbound Logistics Sales & Marketing Service

Primary Activities

18

The Value Chain

Primary activities can be divided into five generic categories Support activities support primary activities Dotted lines reflect the fact that procurement, technology development and human resource management can be associated with specific primary activities as well as the entire chain Firm infrastructure supports the entire chain Value activities are therefore discreet building blocks of competitive advantage How each is performed determines costs, value provided to buyers Comparing the value chains of competitors exposes differences that determine competitive advantage Value added analysis (selling price-cost of raw materials) is inferior to value chain because it incorrectly distinguishes raw materials from the many other purchased inputs used in a firms activities and it fails to highlight the linkages between a firm and its suppliers that can reduce cost or enhance differentiation

19

5 Generic Primary Activities

Inbound Logistics -receiving, storing, warehousing, inventory control etc. Operations -machining, packaging assembly maintenance, testing etc Outbound Logistics -storing distributing warehousing of finished product Marketing and Sales -inducing buyers to buy activities like advertising, promotion, sales force, channel relations Service-installation, repair, parts supply and training

20

Support Activities

Procurement function of purchasing inputs used in the firms value chain Improved purchasing practices can strongly affect the cost and quality of purchased inputs. Restaurants Technology development range of activities that can be broadly grouped into efforts to improve the product and the process Telecommunications, office automation Human resource management activities involved in the recruiting, hiring, development and compensation of personnel Cumulative costs of human resource management are rarely understood nor are the tradeoffs in different human resource management costs: Salary compared to cost of recruiting and training due to turnover Call center turnover typically greater than 25% per year HR key to competitive advantage in some industries: Arthur Anderson campus near Chicago Firm infrastructure general management, planning, finance, accounting, government affairs,

21

Activity Types

Within each category of primary and support activities, there are three activity types that play a different role in competitive advantage Direct activities directly involved in creating value for the buyer such as assembly, design or advertising Indirect activities that make it possible to perform direct activities on a continuing basis such as maintenance, scheduling, record keeping Quality Assurance activities that ensure the quality of other activities such as monitoring inspecting testing reviewing etc There are tradeoffs between direct and indirect activities: more spending on maintenance lowers machine costs Quality assurance costs can be very high, Early QC can be more cost effective than later. Examples: autos, video card manufacturing

22

Degree of Disaggregation

At what level should an analyst break up activities? Basic principle is that activities should be isolated and separated that: 1. Have different economics Manufacturing vs. marketing 2. Have a high potential impact of differentiation QC 3. Represent a significant or growing proportion of costs Labour

23

Linkages with the Value Chain

Linkages are relationships between the way one value activity is performed and the cost or performance of another Timing of promotional campaign can influence capacity utilization- Advertising fast food during dinner Linkages can lead to competitive advantage in two ways: optimization and coordination Better material specification or QC can reduce service costs improve quality Improved coordination can reduce inventory, AP, AR Dell, Wal-Mart

24

Linkages among value activities

The same function can be performed in different ways: IE conformance to specifications can be achieved by purchasing high quality inputs or inspection The cost or performance of direct activities is improved by greater efforts in indirect activities better maintenance improves tolerances of machines Activities performed inside the firm reduce the need to demonstrate or service product in field inspection vs after sales service Microwave Quality assurance functions can be performed in different ways Inspect incoming parts vs final goods

25

Vertical Linkages

Linkages between suppliers, channels and buyers Supplier of raw chocolate can supply in a form that reduce costs and handling for both the buyer and supplier Independent ownership of suppliers or channels or a history of an adversary relationship can impede the coordination and joint optimization required to exploit vertical linkages. Car buying experience Dell works with is suppliers in to create a symbiotic relationship-Web orders tied to suppliers Wal-Mart

26

Buyers Value Chain

Understanding households value chains is less intuitive but nevertheless important A car is used for work, shopping, traveling Food is purchased to prepare and eat meals A firms differentiation stems from how its value chain relates to its buyers chain Differentiation derives fundamentally from creating value for the buyer through a firm's impact an the buyers value chain Value is created by the firm for its buyer by lowing the buyers costs or raising the buyers performance Value created by the firm must be perceived by the buyer if the firm is to be rewarded with a premium price Quality, service, installation, Ceiling fan example, software

27

Competitive Scope & the Value Chain

1. 2. 3. 4.

Competitive scope can have a powerful effect on competitive advantage Four dimensions of scope that affect the value chain Segment Scope -product varieties produced and buyers served Microcomputer buyers vs small business buyers Small businesses require less demanding hardware, user friendly software GM value chain can serve different segments compact vs luxury Vertical Scope -extent to which activities are performed in-house instead of outsourced. Air Miles Service Centre Can be products or activities-distribution marketing Geographic Scope -range of regions, countries that a firm competes Industry Scope -range of related industries in which a firm competes with a coordinated strategy. Canon Optics: cameras, photocopiers, video cameras Honda Small engines

28

Value Chain and Industry Struture

Industry structure both shapes the value chain of a firm and is a reflection of the collective value chains of competitors The array of competitor value chains form the basis for many elements of an industry structure Capital requirements in an industry are the result of collective capital required in the chain Similarly, industry product differentiation stems for the way firms products are used in buyers value chain Thus many elements of industry structure can be diagnosed by analyzing the value chains of competitors in an industry

29

Dells Value Chain

Mass Customize WINTEL Windows and Intel standard Moore's Law=processing power double every 18 months =Depreciating inventory 80% of sales from notebooks and desktops 12,000 corporate customers Tried retail channel Get rid of inventory Tried retail channel JIT with suppliers to feed the inbound logistics 96% of procurement is web based No aging inventory built once a customer ordered 52 annual inventory turns with zero finished good inventory Monitor and computer mating during shipping and sent to the customer together Why take a monitor off the truck just to put it on another no value added Love your suppliers Synchronize 50% of sales done through website Love your employees even more Recruit for future Have the capacity to understand the strategy

30

Worldwide PC Shipments

Source:www.clickz.com/stats/sectors/hardware/article.php/5921_3289271#table

31

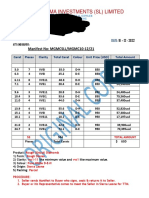

Dell & Competitors Overview

2004 Annual Sales ($mil.) Annual Net Income ($mil.) 44,444 N/A 2,645 N/A 2003 35,404.0 3402.5 2,122.0 (514.8) 2002 31,168.0 4,171.0 1,246.0 (297.7) 2001 31,888.0 6079.5 2,177.0 (1034.0) 2000 25,265.0 9600.6 1,666.0 241.4 GATEWAY IN RED

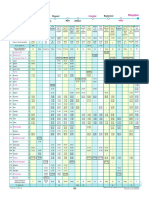

Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2003 (Thousands of Units) 2003 2002 2003 Market 2002 Market Company Shipments Share Shipments Share Growth (%) (%) (%) ---------------------------------------------------------------------Dell 25,302 15.0 20,110 13.2 25.8 Hewlett-Packard 24,230 14.3 21,567 14.2 12.3 IBM 8,608 5.1 7,913 5.2 8.8 Fujitsu/Fujitsu Siemens 6,370 3.8 5,714 3.8 11.5 Toshiba 4,944 2.9 4,233 2.8 16.8 Others 99,402 58.9 92,758 60.9 7.2 Total 168,856 100.0 152,295 100.0 10.9

32

Dell Sales by region and product

Americas Europe Asia/Pacific Total

2003 Sales $ mil. % of total 25,047 71 6,912 19 3,445 10 35,404 100 2003 Sales $ mil. % of total 18,865 53 9,638 27 6,901 20 35,404 100

Desktop computers Notebooks Enterprise systems Total

33

Dell and HP Key Facts

Dell 2003 Sales 35,404.0 ($ mil.) Net Income 2,122.0 ($mil.) Units shipped 25,302 Average $ per unit $1400 Net Profit per unit $84 or 6% HP 2002 Sales 26,133 ($ mil.) 46% of total 1. Units shipped 21,567 Average $ per unit $1211 2002 est. net loss per unit $19.2 or -1.6% HP 2003 Sales est. 33,608.0 ($ mil.) net income 1,167 ($mil.) Units shipped 24,230 Average $ per unit $1387 est. Estimated Net Profit per unit $48 or 3.4%

34

Related Links

http://news.bbc.co.uk/1/hi/business/3169713.stm http://news.bbc.co.uk/1/hi/business/3169407.stm http://www.idctracker.com/newtracker/Pressreleases/jan2004. pdf

35

To Dos for Next

Work on Phase 1 Industry Analysis

Complete the assigned readings Remember no formal class next week I will only be in my office on Tuesday 2-3 p.m.

36

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- ReportDocumento10 pagineReportNeeraj KishoreNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- About Me-1Documento2 pagineAbout Me-1Don't Talking100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- ITC ProjectDocumento54 pagineITC ProjectRahulRaushanNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Abb FZ LLC - Bangalore ItatDocumento23 pagineAbb FZ LLC - Bangalore Itatbharath289Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Seychelles 2010 Article IV Consultation Staff Report IMFDocumento91 pagineSeychelles 2010 Article IV Consultation Staff Report IMFrunawayyyNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Vietnam Construction Cost Review - Q12010Documento9 pagineVietnam Construction Cost Review - Q12010heoconbocthepNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- 26A Via 44 17A 72 46: Mumbai CST Bandra (T) Lokmanya Tilak (T)Documento1 pagina26A Via 44 17A 72 46: Mumbai CST Bandra (T) Lokmanya Tilak (T)sharmarakNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- LumaxDocumento1 paginaLumaxpawan1501Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Agricultural FinanceDocumento43 pagineAgricultural FinancegildesenganioNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- 17 CIR v. Tours SpecialistsDocumento3 pagine17 CIR v. Tours SpecialistsChedeng KumaNessuna valutazione finora

- Imp WebsitesDocumento21 pagineImp WebsitesMeenakshi S. RajpurohitNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- F 1099 ADocumento6 pagineF 1099 AIRS100% (1)

- Aviation Sector PresentationDocumento16 pagineAviation Sector PresentationJitendra GuptaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- HDFC Credit CardDocumento2 pagineHDFC Credit CardraviNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Bing SummaryDocumento3 pagineBing SummarySanta PermatasariNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Lev Aloha Against Waiter ScamsDocumento31 pagineLev Aloha Against Waiter ScamsfedericusxNessuna valutazione finora

- Managerial Remuneration Checklist FinalDocumento4 pagineManagerial Remuneration Checklist FinaldhuvadpratikNessuna valutazione finora

- MarketIntegration 3Documento11 pagineMarketIntegration 3Franz Althea BasabeNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- BASFINE - Banks HomeworkDocumento5 pagineBASFINE - Banks HomeworkDanaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Advertisement: Oleh Masagus Septian Halim Kelas 4KbDocumento21 pagineAdvertisement: Oleh Masagus Septian Halim Kelas 4KbVania ParamithaNessuna valutazione finora

- Role of NgoDocumento26 pagineRole of Ngoziaul haq100% (1)

- Project Report On Various Labour Welfare Activities Done by Jaypee Group and Its Effectiveness (HR)Documento12 pagineProject Report On Various Labour Welfare Activities Done by Jaypee Group and Its Effectiveness (HR)AyushGuptaNessuna valutazione finora

- Channel ManagementDocumento8 pagineChannel Managementsajid bhattiNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Manifest 232Documento2 pagineManifest 232Elev8ted MindNessuna valutazione finora

- My Energy Charging StationDocumento8 pagineMy Energy Charging StationsvabaNessuna valutazione finora

- Economics of Strategy Worksheet 1Documento4 pagineEconomics of Strategy Worksheet 1Matt ParsonsNessuna valutazione finora

- BKSW PDFDocumento3 pagineBKSW PDFyohannestampubolonNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Incorporation of Water Buffalo Into The Canadian Dairy IndustryDocumento20 pagineIncorporation of Water Buffalo Into The Canadian Dairy Industryapi-489282134Nessuna valutazione finora

- TCW MODULE Complete Version 2pdfdocxDocumento188 pagineTCW MODULE Complete Version 2pdfdocxReñer Aquino BystanderNessuna valutazione finora

- Economics MCQS Ebook Download PDFDocumento85 pagineEconomics MCQS Ebook Download PDFMudassarGillani100% (5)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)