Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Vocabulary

Caricato da

Patricia FaneaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting Vocabulary

Caricato da

Patricia FaneaCopyright:

Formati disponibili

Member of the Asscoiated Press .

Aenean commodo ligula eget dolor. Aenean. Aenean commodo ligula eget dolor. Aenhswse. Cejhciebce fcdcdcd.

ILLUSTRATED WEEKLY NEWSPAPER

Est. 1869

Wednesday, November 24, 1892

Price 6d

Accounting vocabulary

Accounting could be defined as the process of collecting, recording, summarising and communicating financial information. Accounts are the record in which this information is recorded.

account a financial record of similar transactions accountant a person who has received professional training in the field of accounting accounting the design and maintenance of a system of financial records and the interpretation of the data contained in them assets money or something of value to a company = active

balance sheet a financial statement listing the assets, liabilities, and net worth of a company =balanta bond a security which indicates the debt of a company to the owner of the bond = obligatiune bookkeepers employees who record the dayto-day transactions of the company in the proper account

depreciate an accounting process which decreases the value of certain fixed assets according to their use. It allows for the firm to recover the cost of their capital over a certain period of time. depreciation the decrease in value of certain fixed assets due to use and wear = amortizare income money which a company or individual receives in the course of doing business

ledger a book containing all the accounts for a company liabilities debts; money which the company owes to another company, a bank, or an individual long term refers to a period of usually ten years or more mortgage a document which gives the title or ownership rights, but not possession of a piece of property to a creditor as guarantee for the payment of a loan; also, the value of a loan

net worth also referred to as owners equity; the difference between the value of the assets of a company and the value of its liabilities outstanding not yet paid receivable money which should be paid to a company during the present business cycle statement a financial report which usually shows totals and balances

turnover cifra de afaceri profit and loss account cont de profit si pierderi consumables - consumabile raw materials materii prime expenditure - cheltuieli costs of production costul de productie

value-added tax - a tax levied to on the assessable profits of companies treasury bill - a short term bond sold by government to cover cash requirements, usually redeemable in 3 months redeemable rambursabil redeemable by installments - rambursabil prin pli ealonate receivables creane

excise = acciz Inland Revenue = Fisc IRS Internal Revenue Service= Fisc financial year an fiscal operating costs costuri de exploatare

Working capital fond de rulment Secured debenture = obligatiune garantata Unsecured loan = obligatiune negarantata Accounts receivable = debitori Accounts payable = creditori Sinking funds = fond de amortizare Called up share capital= capital social atras

Potrebbero piacerti anche

- ACCOUNTING TERMS and Their Definitions: AssetsDocumento8 pagineACCOUNTING TERMS and Their Definitions: AssetsNoby Ann Vargas LobeteNessuna valutazione finora

- Econeng1 Jan10thDocumento14 pagineEconeng1 Jan10thArjan David AlquintoNessuna valutazione finora

- The Balance SheetDocumento101 pagineThe Balance SheethakomoNessuna valutazione finora

- Week 3 SlidesDocumento38 pagineWeek 3 SlidesRogelio ParanNessuna valutazione finora

- Chapter 2Documento22 pagineChapter 2John Edwinson JaraNessuna valutazione finora

- Basic AccountingDocumento45 pagineBasic Accountingmicadeguzman.1313Nessuna valutazione finora

- Nineteen: Short-Term Finance and PlanningDocumento23 pagineNineteen: Short-Term Finance and PlanningKaryn Nathania Hartoyo SMP 9B KarangturiNessuna valutazione finora

- Fundamentals of AccountingDocumento5 pagineFundamentals of AccountingawitakintoNessuna valutazione finora

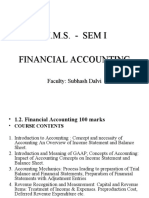

- M.M.S. - Sem I Financial AccountingDocumento71 pagineM.M.S. - Sem I Financial AccountingRajesh Umbarkar100% (1)

- Major Type of AccountsDocumento43 pagineMajor Type of AccountsAngelica Ross de LunaNessuna valutazione finora

- Basic Concepts of Financial Accounting EditedDocumento42 pagineBasic Concepts of Financial Accounting EditedKavitha Kavi KaviNessuna valutazione finora

- Managing The Venture's Financial ResourcesDocumento28 pagineManaging The Venture's Financial ResourcesAnto DNessuna valutazione finora

- 2 Accounting StatementsDocumento50 pagine2 Accounting Statementswanangwa nyasuluNessuna valutazione finora

- Accounting Equation and Double Entry SystemDocumento52 pagineAccounting Equation and Double Entry SystemArmandoNessuna valutazione finora

- Accounting 8Documento60 pagineAccounting 8Marxene Hazel Joy MoranteNessuna valutazione finora

- Chapter 3 (A) -١Documento25 pagineChapter 3 (A) -١Mary Y. GamilNessuna valutazione finora

- Basic Concepts of Financial AccountingDocumento42 pagineBasic Concepts of Financial AccountingKavitha Kavi KaviNessuna valutazione finora

- TERMSDocumento33 pagineTERMSGrecy Mitch L. PatosaNessuna valutazione finora

- Reviewer On Basic AccountingDocumento8 pagineReviewer On Basic AccountingPRINCESS JOY BALAISNessuna valutazione finora

- Finanacial Statements: Balance Sheet & Profit and Loss AccountDocumento26 pagineFinanacial Statements: Balance Sheet & Profit and Loss AccountRichard AustinNessuna valutazione finora

- Financial Accounting - An Introduction: DR Vandana Bhama FORE School of Management, DelhiDocumento30 pagineFinancial Accounting - An Introduction: DR Vandana Bhama FORE School of Management, DelhiShavik BaralNessuna valutazione finora

- Financial AppraisalDocumento54 pagineFinancial AppraisalAarsh SainiNessuna valutazione finora

- Major Accounts: Ana Flor V. CerboDocumento22 pagineMajor Accounts: Ana Flor V. CerboElla yambaoNessuna valutazione finora

- Financial Accounting ppt02Documento31 pagineFinancial Accounting ppt02Bikanair BikanairNessuna valutazione finora

- Lec 10Documento27 pagineLec 10Ritik KumarNessuna valutazione finora

- Accounting and BookkeepingDocumento45 pagineAccounting and BookkeepingMarcel VelascoNessuna valutazione finora

- Glossary Financial AccountingDocumento17 pagineGlossary Financial AccountingSoham DNessuna valutazione finora

- Week 4Documento36 pagineWeek 4Mariah Cielo DaguroNessuna valutazione finora

- Finanacial Statements: Balance Sheet & Profit and Loss AccountDocumento26 pagineFinanacial Statements: Balance Sheet & Profit and Loss AccountAshok SeerviNessuna valutazione finora

- Account TitlesDocumento4 pagineAccount TitlesChristian VelascoNessuna valutazione finora

- Accounting BookDocumento95 pagineAccounting BookHermixoneNessuna valutazione finora

- Accounting and Financial Management in LogisticsDocumento23 pagineAccounting and Financial Management in LogisticsWah KhaingNessuna valutazione finora

- Financial Appraisal: - Adequacy of Rate of Return - Financing PatternDocumento26 pagineFinancial Appraisal: - Adequacy of Rate of Return - Financing PatternTibebu MerideNessuna valutazione finora

- Acconting TermsDocumento3 pagineAcconting TermsTapan Kumar MishraNessuna valutazione finora

- Fundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherDocumento54 pagineFundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherKimberly andrinoNessuna valutazione finora

- Abm01 - Module 4.2Documento25 pagineAbm01 - Module 4.2Love JcwNessuna valutazione finora

- Session 5 - Financial Statement AnalysisDocumento42 pagineSession 5 - Financial Statement AnalysisVaibhav JainNessuna valutazione finora

- BIMTECH PGDM (RM) 2020-22: Financial and Management AccountingDocumento44 pagineBIMTECH PGDM (RM) 2020-22: Financial and Management AccountingShubham DixitNessuna valutazione finora

- Justine Fin-ManDocumento2 pagineJustine Fin-ManJastine CahimtongNessuna valutazione finora

- PNB Class 5Documento56 paginePNB Class 5sunil routNessuna valutazione finora

- Accounting Lec#2Documento20 pagineAccounting Lec#2Ovais ZiaNessuna valutazione finora

- FABM2 - Statement of Financial PositionDocumento36 pagineFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Basic Accounting TermsDocumento4 pagineBasic Accounting TermsBogdan MirceaNessuna valutazione finora

- Accounting Notes Chap 8-11Documento20 pagineAccounting Notes Chap 8-11eemaanzhNessuna valutazione finora

- Chap 1-4Documento11 pagineChap 1-47a4374 hisNessuna valutazione finora

- Types of Major AccountsDocumento37 pagineTypes of Major AccountsJill Alexandra Faye FerrerNessuna valutazione finora

- WCMDocumento12 pagineWCMShariful IslamNessuna valutazione finora

- Five Major Types of AccountsDocumento17 pagineFive Major Types of AccountsCharmie Flor CuetoNessuna valutazione finora

- The Accounting Cycle: Analyze Transactions Journalize and Post During PeriodDocumento9 pagineThe Accounting Cycle: Analyze Transactions Journalize and Post During Periodosogboandrew_9480574Nessuna valutazione finora

- Statement of Financial Position - PPT - Accounts TitlesDocumento23 pagineStatement of Financial Position - PPT - Accounts TitlesMg GarciaNessuna valutazione finora

- Accountancy PPT 1Documento22 pagineAccountancy PPT 1sakshamNessuna valutazione finora

- Basic Concepts of Financial AccountingDocumento107 pagineBasic Concepts of Financial AccountingAnonymous Human100% (1)

- Working Capital Management: Executive Development ProgramDocumento148 pagineWorking Capital Management: Executive Development ProgramsajjukrishNessuna valutazione finora

- Lecture - 2: Financial Reporting and AccountingDocumento41 pagineLecture - 2: Financial Reporting and AccountingMuhammad Waheed SattiNessuna valutazione finora

- The Accounting EquationDocumento5 pagineThe Accounting EquationHuskyNessuna valutazione finora

- Elements of Financial StatementsDocumento6 pagineElements of Financial StatementsAdelina AquinoNessuna valutazione finora

- Financial Accounting and Reporting Study Guide NotesDa EverandFinancial Accounting and Reporting Study Guide NotesValutazione: 1 su 5 stelle1/5 (1)