Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

29 (2) - 07 NPC V Province of Quezon

Caricato da

Bernz Velo TumaruDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

29 (2) - 07 NPC V Province of Quezon

Caricato da

Bernz Velo TumaruCopyright:

Formati disponibili

Obligations and Contracts

July 15, 2009 NATIONAL POWER CORPORATION (PETITIONER) VS. PROVINCE OF QUEZON AND MUNICPALITY OF PAGBILAO (RESPONDENTS) GR. NO. 171586 Facts: Petitioner NPC entered in to Energy Conversion Agreement with Mirant Corp. to generate electricity in its coal-fired thermal plant, stipulating among others a build-operate-transfer arrangement after 25 years and that NPC will pay for all the tax liabilities that the government may impose on the former. Later on, in a letter dated March 2, 2000, the Municipality of Pagbilao assessed Mirants real property taxes on the power plant and its machineries in the total amount of P1,538,076,000.00 for the period of 1997 to 2000. The Municipality of Pagbilao furnished the NPC a copy of the assessment letter. The NPC objected to the assessment against Mirant on the claim that it (the NPC) is entitled to the tax exemptions provided in Section 234, paragraphs (c) and (e) of the Local Government Code. To protect its interest, NPC filed a petition before the Local Board of Assessment Appeal, who however dismissed the petition. Aggrieved, NPC filed an appeal with the Central Board of Assessment Appeals who, however, affirmed the dismissal of the petition before the LBAA. An appeal before the Court of Tax Appeals met with a similar fate. Issue: WON NPC is the proper party in interest? WON the municipality of Pagbilao can impose a real estate tax on the Mirant Property despite the ECA with NPC? Held: First: No. The tax assessment is directed to Mirants property only and petitioner has failed to prove that it has direct interest or ownership of those properties under the ECA. For it to be a proper party to contest the tax assessment, it should have a legal interest that is actual and material, direct and immediate, not simply contingent or expectant. In the present case, the NPC is neither the owner, nor the possessor or user of the property taxed. No interest on its part thus justifies any tax liability on its part other than its voluntary contractual undertaking. Under this legal situation, only Mirant as the contractual obligor, not the local government unit, can enforce the tax liability that the NPC contractually assumed; the NPC does not have the legal interest that the law and jurisprudence require to give it personality to protest the tax imposed by law on Mirant. Second: Yes. Although NPC assumed responsibility for the taxes due on the power plant and its machineries, this agreement, however is only binding on both NPC and Mirant and not to third parties. Therefore, its assumption of the tax liability of Mirant does not automatically grant tax exemption to the properties in question. By law, the tax liability rests on Mirant based on its ownership, use, and possession of the plant and its machineries. To reiterate, only the parties to the ECA agreement can exact and demand the enforcement of the rights and obligations it established only Mirant can demand compliance from the NPC for the payment of the real property tax the NPC assumed to pay. The local government units as third parties to the ECA, cannot demand payment from the NPC. Corollarily, the local government units can neither be compelled to recognize the protest of a tax assessment from the NPC, an entity against whom it cannot enforce the tax liability. Court: All we declare is that the stipulation is entirely between the NPC and Mirant, and does not bind third persons who are not privy to the contract between these parties. We say this pursuant to the principle of relativity of contracts under Article 1311 of the Civil Code which postulates that contracts take effect only between the parties, their assigns and heirs. (Rule on relativity of contracts). An exception to the rule on relativity of contracts is provided under the same Article 1311 as follows: If the contract should contain some stipulation in favor of a third person, he may demand its fulfillment provided he communicated his acceptance to the obligor before its revocation. A mere incidental benefit or interest of a person is not sufficient. The contracting parties must have clearly and deliberately conferred a favor upon a third person. The respondents however, do not fall within the exception, as they are neither conferred any express benefit nor was there any implied benefit it can receive from the ECA.

Bernz Velo Tumaru

Potrebbero piacerti anche

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemDa EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNessuna valutazione finora

- 174 NAPOCOR V Province of QuezonDocumento5 pagine174 NAPOCOR V Province of Quezonav783Nessuna valutazione finora

- NPC vs. QuezonDocumento11 pagineNPC vs. QuezonSjaneyNessuna valutazione finora

- NPC V Prov of QCDocumento10 pagineNPC V Prov of QCShane FulguerasNessuna valutazione finora

- National Power Corporation Vs Province of Quezon and Municipality of Pagbilao DigestDocumento2 pagineNational Power Corporation Vs Province of Quezon and Municipality of Pagbilao DigestNic NalpenNessuna valutazione finora

- Republic Vs KidapawanDocumento3 pagineRepublic Vs KidapawanJep Echon TilosNessuna valutazione finora

- Remedies On Real Property TaxationDocumento41 pagineRemedies On Real Property TaxationJacel Anne DomingoNessuna valutazione finora

- NPC Vs QuezonDocumento9 pagineNPC Vs QuezonJane CuizonNessuna valutazione finora

- Digest TaxDocumento36 pagineDigest TaxharveypugongNessuna valutazione finora

- Case Taxation Second BatchDocumento3 pagineCase Taxation Second BatchChristopher Jan DotimasNessuna valutazione finora

- Real Property Case DigestsDocumento45 pagineReal Property Case DigestsKristine Jay Perez-CabusogNessuna valutazione finora

- Philippine Telegraph & Telephone Corp.: Petitioner RespondentDocumento60 paginePhilippine Telegraph & Telephone Corp.: Petitioner RespondentRobynne LopezNessuna valutazione finora

- Villanueva V City of IloiloDocumento48 pagineVillanueva V City of Iloiloamun dinNessuna valutazione finora

- The National Government, Which Historically Merely Delegated To Local Governments The Power To TaxDocumento37 pagineThe National Government, Which Historically Merely Delegated To Local Governments The Power To Taxlleiryc7Nessuna valutazione finora

- National Power Corporation vs. Province of Quezon G.R. No. 171586 January 25, 2010Documento2 pagineNational Power Corporation vs. Province of Quezon G.R. No. 171586 January 25, 2010luckyNessuna valutazione finora

- Tax Digests For Local Government TaxDocumento8 pagineTax Digests For Local Government TaxGeoanne Battad BeringuelaNessuna valutazione finora

- HIL - Tax Digests1Documento7 pagineHIL - Tax Digests1cookiehilaryNessuna valutazione finora

- Bacani and Matoto Vs National Coconut CorporationDocumento90 pagineBacani and Matoto Vs National Coconut CorporationPJ JavierNessuna valutazione finora

- Tax DigestDocumento18 pagineTax DigestMhayBinuyaJuanzonNessuna valutazione finora

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Documento2 pagine08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNessuna valutazione finora

- PT&T Vs SmartDocumento2 paginePT&T Vs Smartjimmie alforque100% (2)

- City of Iriga Vs CASURECODocumento2 pagineCity of Iriga Vs CASURECOGarp BarrocaNessuna valutazione finora

- CIR Vs Lingayen ElectricDocumento2 pagineCIR Vs Lingayen ElectricRobert Quiambao100% (2)

- Napocor Vs Province of QuezonDocumento11 pagineNapocor Vs Province of QuezonJedAdrianNessuna valutazione finora

- City of Iriga Vs CASURECODocumento2 pagineCity of Iriga Vs CASURECOYani Ramos100% (1)

- Tax1 Assigned CasesDocumento5 pagineTax1 Assigned CasesflorencemanulatNessuna valutazione finora

- CIR Vs GOTAMCO, GR NO L-31092, FEB 27, 1987Documento6 pagineCIR Vs GOTAMCO, GR NO L-31092, FEB 27, 1987KidMonkey2299Nessuna valutazione finora

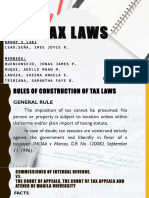

- Group 5 Tax LawsDocumento122 pagineGroup 5 Tax LawsAngeliqueGiselleCNessuna valutazione finora

- Admin Case Digest Compilation - Paolo JavierDocumento90 pagineAdmin Case Digest Compilation - Paolo JavierPJ JavierNessuna valutazione finora

- PLDT Vs City of Davao, G.R. No. 143867. August 22, (2001) FactsDocumento24 paginePLDT Vs City of Davao, G.R. No. 143867. August 22, (2001) FactsFinserglen Choclit LopezNessuna valutazione finora

- PLDT Vs City of Davao, G.R. No. 143867. August 22, (2001) FactsDocumento13 paginePLDT Vs City of Davao, G.R. No. 143867. August 22, (2001) FactsfinserglenNessuna valutazione finora

- First, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction OverDocumento2 pagineFirst, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction Overhigoremso giensdksNessuna valutazione finora

- Deutsche Bank Ag Manila Branch VS CirDocumento4 pagineDeutsche Bank Ag Manila Branch VS CirJen DeeNessuna valutazione finora

- Tax Doctrines Rev.Documento10 pagineTax Doctrines Rev.freak20Nessuna valutazione finora

- Manila Electric V Province of LagunaDocumento12 pagineManila Electric V Province of LagunamehNessuna valutazione finora

- Iloilo V SmartDocumento2 pagineIloilo V SmartCzar Ian AgbayaniNessuna valutazione finora

- Taxation 2 Case DigestDocumento27 pagineTaxation 2 Case DigestThalia SalvadorNessuna valutazione finora

- Napocor Vs City CabanatuanDocumento2 pagineNapocor Vs City Cabanatuanhime mejNessuna valutazione finora

- Case Digest in TAXATionDocumento7 pagineCase Digest in TAXATionanthonyjohntarreNessuna valutazione finora

- Pepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Documento42 paginePepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Celine GarciaNessuna valutazione finora

- CIR v. Lingayen GulfDocumento7 pagineCIR v. Lingayen Gulfliz kawiNessuna valutazione finora

- Case Digest Compendium: Saturday, January 27, 2007Documento14 pagineCase Digest Compendium: Saturday, January 27, 2007Mandy CayangaoNessuna valutazione finora

- Phil Geothermal V CIR GR 154028 July 29, 2005Documento1 paginaPhil Geothermal V CIR GR 154028 July 29, 2005katentom-1Nessuna valutazione finora

- Taxation Cases 2Documento29 pagineTaxation Cases 2Claudine SumalinogNessuna valutazione finora

- Lealda Electric Co. vs. CIR (G.R. No. L-16428 April 30, 1963) - 3Documento3 pagineLealda Electric Co. vs. CIR (G.R. No. L-16428 April 30, 1963) - 3Amir Nazri Kaibing100% (1)

- Napocor VS City of CabanatuanDocumento3 pagineNapocor VS City of CabanatuanbelleferiesebelsaNessuna valutazione finora

- Tax Review CasesDocumento20 pagineTax Review CasesNeri DelfinNessuna valutazione finora

- CIR v. Gotamco & Sons, GR No. 31092, 27 Feb. 1987, 148 SCRA 36Documento3 pagineCIR v. Gotamco & Sons, GR No. 31092, 27 Feb. 1987, 148 SCRA 36Dom ValdezNessuna valutazione finora

- 05 Napocor Vs QuezonDocumento2 pagine05 Napocor Vs QuezonGreg PascuaNessuna valutazione finora

- City of Iloilo v. Smart Comm - G.R. No. 167260Documento6 pagineCity of Iloilo v. Smart Comm - G.R. No. 167260Ash SatoshiNessuna valutazione finora

- Tax Rev Midterms CoverageDocumento11 pagineTax Rev Midterms CoverageRegi Mabilangan ArceoNessuna valutazione finora

- NPC v. City of Cabanatuan, GR No. 149110, April 9, 2003Documento4 pagineNPC v. City of Cabanatuan, GR No. 149110, April 9, 2003Judy Anne RamirezNessuna valutazione finora

- Light Rail Manila vs. Caloocan CityDocumento2 pagineLight Rail Manila vs. Caloocan CityEllaine BernardinoNessuna valutazione finora

- NAPOCOR vs. Province of QuezonDocumento16 pagineNAPOCOR vs. Province of QuezonJay GeeNessuna valutazione finora

- NPC Vs City of CabanatuanDocumento1 paginaNPC Vs City of CabanatuanEdmund DiazNessuna valutazione finora

- Refund CTW Put X Only Not Present Evidence To ProveDocumento7 pagineRefund CTW Put X Only Not Present Evidence To ProveRegina CoeliNessuna valutazione finora

- CIR vs. GotamcoDocumento3 pagineCIR vs. GotamcoAyra CadigalNessuna valutazione finora

- 14 CIR v. Gotamco & SonsDocumento3 pagine14 CIR v. Gotamco & SonsLean Gela MirandaNessuna valutazione finora

- CombinedDocumento242 pagineCombinedLord AumarNessuna valutazione finora

- Basilan Estates v. CIRDocumento14 pagineBasilan Estates v. CIRBernz Velo TumaruNessuna valutazione finora

- 36-01 Clarin vs. RulonaDocumento1 pagina36-01 Clarin vs. RulonaBernz Velo TumaruNessuna valutazione finora

- Santos V NLRC, G.R. No. 115795. March 6, 1998Documento3 pagineSantos V NLRC, G.R. No. 115795. March 6, 1998Bernz Velo Tumaru100% (1)

- 2-08 Chavez Vs PEADocumento1 pagina2-08 Chavez Vs PEABernz Velo TumaruNessuna valutazione finora

- Zaragoza vs. CADocumento7 pagineZaragoza vs. CABernz Velo TumaruNessuna valutazione finora

- 06-03 Great Asian Sales Center Vs CADocumento2 pagine06-03 Great Asian Sales Center Vs CABernz Velo TumaruNessuna valutazione finora

- Aid For TradeDocumento6 pagineAid For TradeRajasekhar AllamNessuna valutazione finora

- Consumer BehaviorDocumento18 pagineConsumer Behaviormayur6790Nessuna valutazione finora

- Industrialisation in RajasthanDocumento4 pagineIndustrialisation in RajasthanEditor IJTSRDNessuna valutazione finora

- Court of Tax Appeals First Division: Republic of The Philippines Quezon CityDocumento2 pagineCourt of Tax Appeals First Division: Republic of The Philippines Quezon CityPaulNessuna valutazione finora

- Tender Waiver Form 2015Documento6 pagineTender Waiver Form 2015ahtin618Nessuna valutazione finora

- 8531Documento9 pagine8531Mudassar SaqiNessuna valutazione finora

- Health Mitra PamphletDocumento2 pagineHealth Mitra Pamphletharshavardhanak23Nessuna valutazione finora

- Reverse InnovationDocumento12 pagineReverse InnovationPrasanjeet Bhattacharjee0% (1)

- Biznis Plan MLIN EngDocumento16 pagineBiznis Plan MLIN EngBoris ZecNessuna valutazione finora

- CompiledProgram Sept16Documento64 pagineCompiledProgram Sept16Obafemi KitchingNessuna valutazione finora

- Gross Domestic ProductDocumento3 pagineGross Domestic ProductAbeer WarraichNessuna valutazione finora

- Finance Crypto AssignmentDocumento8 pagineFinance Crypto AssignmentPromise GapareNessuna valutazione finora

- Contingent Liabilities For Philippines, by Tarun DasDocumento62 pagineContingent Liabilities For Philippines, by Tarun DasProfessor Tarun DasNessuna valutazione finora

- DELIVERY Transfer of Risk and Transfer of TitleDocumento2 pagineDELIVERY Transfer of Risk and Transfer of TitleLesterNessuna valutazione finora

- Business ResearchDocumento8 pagineBusiness ResearchDhrumil GadariaNessuna valutazione finora

- 9 Ekonomi Kesehatan MateriDocumento51 pagine9 Ekonomi Kesehatan MaterialyunusNessuna valutazione finora

- Airbus A3XX: Developing The World's Largest Commercial JetDocumento31 pagineAirbus A3XX: Developing The World's Largest Commercial JetRishi Bajaj100% (1)

- Case AnalysisDocumento3 pagineCase AnalysisAnurag KhandelwalNessuna valutazione finora

- Transcript Regarding Investors' Conference Call (Company Update)Documento25 pagineTranscript Regarding Investors' Conference Call (Company Update)Shyam SunderNessuna valutazione finora

- SaleDocumento1 paginaSaleMegan HerreraNessuna valutazione finora

- ToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...Documento14 pagineToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...PalawanBaliNessuna valutazione finora

- Day Trading StrategiesDocumento3 pagineDay Trading Strategiesswetha reddy100% (2)

- SWOT AnalysisDocumento12 pagineSWOT AnalysisSam LaiNessuna valutazione finora

- Postpaid Monthly Statement: This Month's SummaryDocumento8 paginePostpaid Monthly Statement: This Month's SummaryAVINASH KUMBARNessuna valutazione finora

- Ethiopia Profile Enhanced Final 7th October 2021Documento6 pagineEthiopia Profile Enhanced Final 7th October 2021sarra TPINessuna valutazione finora

- Registration of PropertyDocumento13 pagineRegistration of PropertyambonulanNessuna valutazione finora

- 200400: Company Accounting Topic 3: Accounting For Company Income TaxDocumento15 pagine200400: Company Accounting Topic 3: Accounting For Company Income TaxEhtesham HaqueNessuna valutazione finora

- HR PoliciesDocumento129 pagineHR PoliciesAjeet ThounaojamNessuna valutazione finora

- Textile Ministry of IndiaDocumento290 pagineTextile Ministry of IndiaSrujan KumarNessuna valutazione finora

- China in Africa Research ProposalDocumento20 pagineChina in Africa Research ProposalFrancky VincentNessuna valutazione finora