Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Carrefour S.A

Caricato da

Teja_Siva_8909Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Carrefour S.A

Caricato da

Teja_Siva_8909Copyright:

Formati disponibili

6/25/12

Carrefour S.A. (International Business Finance) - Business

Carrefour S.A. (International Business Finance)

Category: Business Autor: people 05 October 2011 Words: 3847 | Pages: 16

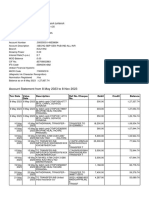

1. Introduction 1.1 Brief In August 2002, the French retail giant Carrefour S.A. was considering alternative currencies for raising (euro) EUR750 million in the Eurobond market. Its investment banks, Morgan Stanley and UBS Warburg, had suggested that Carrefour to consider borrowing in British pound sterling in order to take advantage of a borrowing opportunity in the currency in Carrefour attempt of fund it expansion. This report was commissioned by a junior financial analyst Sikhumbuzo Bhengu in request by Carrefour S.A.s CFO Barry Strydom. The report was requested in order to identify the cost effective currency in which the firm should issue the bond to that currency denominated, and it f turn that foreign currency is effective then the hedging strategy required to hedge exchange rate risk. The report required to be completed and handed in on the 3rd of October 2011. 1.2 Method of investigation This problem solving report is performed on the basis of the information in hand and the report was not been expanded beyond the scope of the data information provided by Carrefour S.A. There is no internet research conducted on the Carrefour S.A. position in the market. It is assumed that the information provided in the case study regarding Carrefour S.A. is true and accurate. The interest rate parity is the main underlying theory that is used in this report. The excel spread sheet is only used and there is no other complex program used. 1.3 Problem definition In the summer of 2002, Carrefour S.A. is seeking to raise 750 million debt financing at a low costs by issuing it bond either in domestic countrys (France) currency or issue foreign currency denominated bond in the Eurobond market. In August 2002, Carrefour S.A.s investment banks (Morgan Stanley and UBS Warburg) had expected that the Carrefour 10-year bonds can be issued at 5.25% in Euros, 5.375% in British pounds, 3.625% in Swiss francs, and 5.5% in U.S. dollars. It is assumed that these bonds are issued at par. Its investment banks also suggested that the British-pound issue appears to provide the lowest cost of funds. 1.4 Objective To examine the borrowing option which provide Carrefour with the lowest cost of funds. To determine the currency risk hedging strategy 2. Data and Methodology All the necessary data was given by Carrefour S.A. and excel was used compute all needed bond payments including the repayment of principal. Excel was also used to compute the forecasted exchange rate...

www.otherpapers.com/print.html?id=13013

1/1

Potrebbero piacerti anche

- Carrefour SA International Business Finance 13013Documento14 pagineCarrefour SA International Business Finance 13013nadiafloreaNessuna valutazione finora

- FX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargDocumento9 pagineFX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargSarvagya JhaNessuna valutazione finora

- Module4 CaseAssignmentDocumento1 paginaModule4 CaseAssignmentDevin Butchko0% (2)

- Carrefour S, ADocumento14 pagineCarrefour S, Aketut_widya67% (3)

- Carrefour S.A.: Ruskin Lisa Crystal WeiDocumento16 pagineCarrefour S.A.: Ruskin Lisa Crystal WeiThái Hoàng NguyênNessuna valutazione finora

- CARREFOUR S.A. Case SolutionDocumento3 pagineCARREFOUR S.A. Case SolutionShubham PalNessuna valutazione finora

- Carrefour Case StudyDocumento3 pagineCarrefour Case StudyChawkiTrabelsiNessuna valutazione finora

- BMA 12e PPT Ch13 16 PDFDocumento68 pagineBMA 12e PPT Ch13 16 PDFLuu ParrondoNessuna valutazione finora

- TN38 Carrefour S ADocumento6 pagineTN38 Carrefour S AFeeling_so_fly100% (2)

- Carrefour S.A.Documento10 pagineCarrefour S.A.sjc1789Nessuna valutazione finora

- Case Analysis - Carnival Cruise LinesDocumento14 pagineCase Analysis - Carnival Cruise LinesArjun ManoharanNessuna valutazione finora

- Zip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)Documento12 pagineZip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)JacksonNessuna valutazione finora

- Dozier Hedging Alternatives GuideDocumento2 pagineDozier Hedging Alternatives Guideacastillo1339Nessuna valutazione finora

- Carrefour - Global Hypermarket ChainDocumento25 pagineCarrefour - Global Hypermarket ChainTuță Cristi FlorinNessuna valutazione finora

- Cash Conversion CycleDocumento7 pagineCash Conversion Cyclebarakkat72Nessuna valutazione finora

- Deluxe Corporation Case StudyDocumento3 pagineDeluxe Corporation Case StudyHEM BANSALNessuna valutazione finora

- Benetton Case StudyDocumento7 pagineBenetton Case StudyNitesh R Shahani0% (1)

- Hedge Using Currency Future, Internal Hedging StrategiesDocumento29 pagineHedge Using Currency Future, Internal Hedging StrategiesRohan DattNessuna valutazione finora

- Purchasing Power Parity & The Big Mac IndexDocumento9 paginePurchasing Power Parity & The Big Mac Indexpriyankshah_bkNessuna valutazione finora

- LoeaDocumento21 pagineLoeahddankerNessuna valutazione finora

- KhoslaDocumento16 pagineKhoslaSaurav BharadwajNessuna valutazione finora

- Emerging Market Carry Trade ChangedDocumento7 pagineEmerging Market Carry Trade ChangedYinghong chen100% (2)

- Case Study ch6Documento3 pagineCase Study ch6shouqNessuna valutazione finora

- Daktronics E Dividend Policy in 2010Documento26 pagineDaktronics E Dividend Policy in 2010IBRAHIM KHANNessuna valutazione finora

- History of Atlas HondaDocumento6 pagineHistory of Atlas HondaAmmar NaumanNessuna valutazione finora

- Eaton Corporation Portfolio Transformation ValuationDocumento1 paginaEaton Corporation Portfolio Transformation ValuationSulaiman AminNessuna valutazione finora

- AssignmetDocumento4 pagineAssignmetHumza SarwarNessuna valutazione finora

- Zespri Final AlternativeDocumento46 pagineZespri Final Alternativeapi-58835638100% (1)

- EADS FX Hedging Strategies ComparisonDocumento8 pagineEADS FX Hedging Strategies ComparisonSarvagya JhaNessuna valutazione finora

- Porters 5 forces analysis of the Kiwi fruit industryDocumento2 paginePorters 5 forces analysis of the Kiwi fruit industryPiyush Agarwal33% (3)

- Case Study On L L BeanDocumento11 pagineCase Study On L L Beanssharma_160328Nessuna valutazione finora

- LOccitane en ProvenceDocumento16 pagineLOccitane en ProvenceGiga KutkhashviliNessuna valutazione finora

- DL 13dect1Documento90 pagineDL 13dect1Kit CheungNessuna valutazione finora

- USTDocumento4 pagineUSTJames JeffersonNessuna valutazione finora

- Firm ValuationDocumento7 pagineFirm ValuationShahadat Hossain50% (2)

- Jet fuel price trends 1990-2011Documento123 pagineJet fuel price trends 1990-2011jk kumar100% (1)

- Case Study-Finance AssignmentDocumento12 pagineCase Study-Finance AssignmentMakshud ManikNessuna valutazione finora

- Dell Working CapitalDocumento7 pagineDell Working CapitalARJUN M KNessuna valutazione finora

- Chapter 5 - Group DisposalsDocumento4 pagineChapter 5 - Group DisposalsSheikh Mass JahNessuna valutazione finora

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Documento6 pagineDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNessuna valutazione finora

- The Walt Disney Company's Yen FinancingDocumento25 pagineThe Walt Disney Company's Yen FinancingAbhishek Prasad100% (2)

- FNCE 6018 Group Project: Hedging at PorscheDocumento2 pagineFNCE 6018 Group Project: Hedging at PorschejorealNessuna valutazione finora

- Hertz QuestionsDocumento1 paginaHertz Questionsianseow0% (1)

- O.M. Scott - Sons CompanyDocumento31 pagineO.M. Scott - Sons Companysultan altamashNessuna valutazione finora

- Should Porsche Hedge Its Foreign Exchange Risk1Documento1 paginaShould Porsche Hedge Its Foreign Exchange Risk1niaz Ali KhanNessuna valutazione finora

- T Cop Y T Cop Y: Bharti Airtel (B)Documento12 pagineT Cop Y T Cop Y: Bharti Airtel (B)Mayank GuptaNessuna valutazione finora

- Carrefour Case Study 2Documento10 pagineCarrefour Case Study 2elsalvador123Nessuna valutazione finora

- Calaveras Vineyards ExhibitsDocumento9 pagineCalaveras Vineyards ExhibitsAbhishek Mani TripathiNessuna valutazione finora

- Charpak Scholarship Q&ADocumento1 paginaCharpak Scholarship Q&AbaahNessuna valutazione finora

- Relative Valuation Notes, Cases and Examples by Rahul KrishnaDocumento44 pagineRelative Valuation Notes, Cases and Examples by Rahul KrishnaSiddhant BanjaraNessuna valutazione finora

- Innocents Abroad: Currencies and International Stock ReturnsDocumento24 pagineInnocents Abroad: Currencies and International Stock ReturnsGragnor PrideNessuna valutazione finora

- Valuing and Acquiring A Business: Hawawini & Viallet 1Documento53 pagineValuing and Acquiring A Business: Hawawini & Viallet 1Kishore ReddyNessuna valutazione finora

- Calculate profitability statements for two hospitals under activity-based pricingDocumento2 pagineCalculate profitability statements for two hospitals under activity-based pricingVishal GoyalNessuna valutazione finora

- SFM Case4 Group7Documento5 pagineSFM Case4 Group7AMAAN LULANIA 22100% (1)

- Finance Zutter CH 1 4 REVIEWDocumento112 pagineFinance Zutter CH 1 4 REVIEWMarjorie PalmaNessuna valutazione finora

- Assignment (Strategic Management) Rabia Zaki - 1935332Documento5 pagineAssignment (Strategic Management) Rabia Zaki - 1935332Rabia ZakiNessuna valutazione finora

- Carrefour S-A.: Source: Case Studies in Finance 5 Edition Tata MC Graw-Hill EditionDocumento8 pagineCarrefour S-A.: Source: Case Studies in Finance 5 Edition Tata MC Graw-Hill EditionVarun ChandelNessuna valutazione finora

- Carrefour S.A.: Permissions@hbsp - Harvard.edu or 617.783.7860Documento10 pagineCarrefour S.A.: Permissions@hbsp - Harvard.edu or 617.783.7860Ayaz Ul HaqNessuna valutazione finora

- Carrefour SADocumento9 pagineCarrefour SAacha0% (1)

- EFC Categories ReportDocumento40 pagineEFC Categories ReportTurcan Ciprian SebastianNessuna valutazione finora

- Carrefour S.ADocumento1 paginaCarrefour S.ATeja_Siva_89090% (1)

- Carrefour Case Study A4Documento5 pagineCarrefour Case Study A4karansurajsinghNessuna valutazione finora

- Mascot: Positive (0.3)Documento19 pagineMascot: Positive (0.3)Teja_Siva_8909Nessuna valutazione finora

- LoadDocumento20 pagineLoadTeja_Siva_8909Nessuna valutazione finora

- JK Cement LTD.: S W N SDocumento5 pagineJK Cement LTD.: S W N STeja_Siva_8909Nessuna valutazione finora

- PayU Recurring Integration V4Documento49 paginePayU Recurring Integration V4Tamal SenNessuna valutazione finora

- Bank StatementDocumento5 pagineBank Statementshahbaz alamNessuna valutazione finora

- Ae113: Midterm Quiz 3 Name: Cherie Lyn Ananayo ID: 20-2007-496 SUBJECT & SCHEDULE: AE113 WSAT 7:30-11:30 SCORE: - DATE: 29/05/21Documento2 pagineAe113: Midterm Quiz 3 Name: Cherie Lyn Ananayo ID: 20-2007-496 SUBJECT & SCHEDULE: AE113 WSAT 7:30-11:30 SCORE: - DATE: 29/05/21Cherie Soriano AnanayoNessuna valutazione finora

- DBG Y9 WT4 GHW4 G LHiDocumento5 pagineDBG Y9 WT4 GHW4 G LHiamit06sarkarNessuna valutazione finora

- Custom Management Checking: You and Wells FargoDocumento4 pagineCustom Management Checking: You and Wells FargoDaniel Avalos100% (1)

- Wise StatementDocumento1 paginaWise StatementSolomonNessuna valutazione finora

- Metropolitan Bank & Trust Company v. CA (194 SCRA 169)Documento5 pagineMetropolitan Bank & Trust Company v. CA (194 SCRA 169)Eric VillaNessuna valutazione finora

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocumento8 pagineToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNessuna valutazione finora

- RCB TC 150922enDocumento9 pagineRCB TC 150922encsyik123junkNessuna valutazione finora

- Ma Si 8 Ms UAIf CDSFBDocumento15 pagineMa Si 8 Ms UAIf CDSFBFiroj Md ShahNessuna valutazione finora

- Uni-statement account overviewDocumento4 pagineUni-statement account overviewlubia83% (6)

- 03 Interchange Pricing Grids Presentation Feb 2012Documento99 pagine03 Interchange Pricing Grids Presentation Feb 201288quiznos88100% (1)

- General Terms and Conditions of South Indian Bank For Credit Facilities PDFDocumento29 pagineGeneral Terms and Conditions of South Indian Bank For Credit Facilities PDFbaba ramdevNessuna valutazione finora

- PDFDocumento2 paginePDFSunil RameshNessuna valutazione finora

- Internship ReportDocumento13 pagineInternship ReportBernard BempongNessuna valutazione finora

- Aaconapps2 03RHDocumento12 pagineAaconapps2 03RHAngelica DizonNessuna valutazione finora

- Payment Confirmation Transaction DetailsDocumento1 paginaPayment Confirmation Transaction DetailsZees Design and BuildNessuna valutazione finora

- Simple Loan Calculator: Option A: Solve For The PAYMENTDocumento3 pagineSimple Loan Calculator: Option A: Solve For The PAYMENTnaresh100939Nessuna valutazione finora

- Evaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Documento32 pagineEvaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Suresh Babu Reddy50% (2)

- TVM Complete TemplateDocumento17 pagineTVM Complete TemplateAlok RajNessuna valutazione finora

- T4 AA Retail PDFDocumento481 pagineT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- Nepalese Banking Crisis ExplainedDocumento5 pagineNepalese Banking Crisis ExplainedChandan SapkotaNessuna valutazione finora

- Ca Doj - Registry - ListDocumento9 pagineCa Doj - Registry - ListcircumventionNessuna valutazione finora

- Currentaccountstatement 18102023-S33iujDocumento4 pagineCurrentaccountstatement 18102023-S33iujjuliaechardhqa85Nessuna valutazione finora

- Murabaha - Application (Trade Finance)Documento72 pagineMurabaha - Application (Trade Finance)Riz Khan100% (2)

- 10th Tamil 2021 Reduced Syllabus Full Guide PENGUIN Publications WWW - Kalvikadal.inDocumento251 pagine10th Tamil 2021 Reduced Syllabus Full Guide PENGUIN Publications WWW - Kalvikadal.inTharunkumarNessuna valutazione finora

- Feb 2022 Operations Acct StatementDocumento24 pagineFeb 2022 Operations Acct StatementNik LedNessuna valutazione finora

- FinanceDocumento18 pagineFinanceMartin DelgadoNessuna valutazione finora

- Share Market ScamDocumento14 pagineShare Market ScamPramod DasadeNessuna valutazione finora

- Santosh - Strategic Alliance - Key Geo Tracker - AtosDocumento159 pagineSantosh - Strategic Alliance - Key Geo Tracker - Atosmayur860Nessuna valutazione finora

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 5 su 5 stelle5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)